Nippon Telegraph and Telephone Corporation (NTT Group) and Chunghwa Telecom dominate the telecom landscapes in Japan and Taiwan, respectively. Both companies operate as integrated telecommunications service providers, offering comprehensive suites of services to consumers and enterprise clients. The companies are primarily engaged in providing a wide range of telecom services, including fixed line communication services, mobile phone services, and internet and data services.

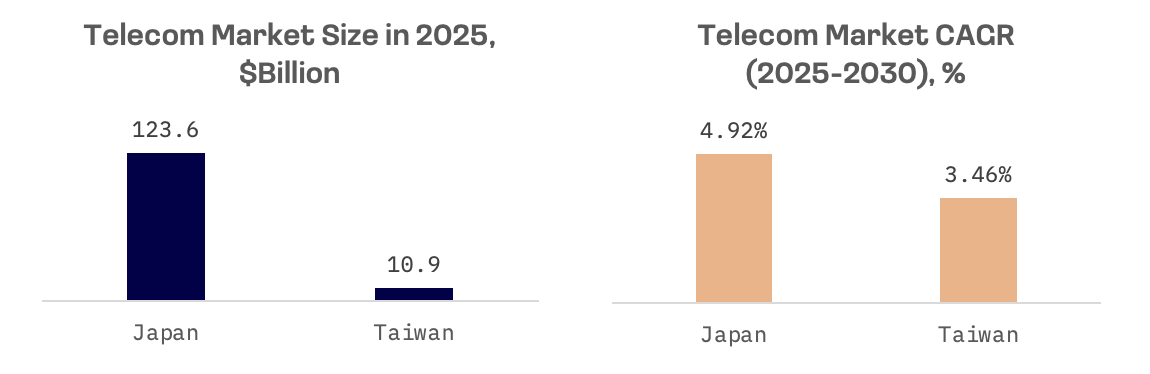

Japan and Taiwan both feature highly advanced and competitive telecom sectors, driven by robust 5G deployment and digital transformation initiatives. Japan operates a significantly larger and more mature market, with strong emphasis on fibre optic infrastructure and global leadership in 5G deployment. Taiwan, though smaller in scale, maintains exceptionally high broadband penetration across both fixed and mobile networks and capitalises on its deep information and communication technology (ICT) manufacturing capabilities to drive advancements in areas such as Open RAN and data centre infrastructure, with growing focus on bolstering network resilience.

NTT and Chunghwa Telecom, both formerly state owned, have transitioned to private ownership but still maintain significant government ties. As of March 31, 2025, Japan’s Ministry of Finance held a 32.25% stake in NTT, while Taiwan’s Ministry of Transportation and Communications remained Chunghwa Telecom’s largest shareholder with a 35.29% stake. Despite these substantial government stakes, both companies are publicly listed entities, balancing state ownership with the demands of private shareholders.

NTT Group operates as the market leader in Japan and maintains a significant global footprint through a network of subsidiaries – including NTT DATA, NTT Communications and NTT DOCOMO – operating in more than 190 countries across North America, Europe, Asia and Oceania. NTT Group stands as the fourth largest telecommunications company by revenue worldwide. Meanwhile, Chunghwa Telecom stands as Taiwan’s largest integrated telecom provider, with operations largely concentrated in the domestic market. While it maintains a modest international presence, primarily in enterprise solutions and network services, its primary market and focus remain Taiwan.

NTT Group operates a highly diversified structure with distinct subsidiaries specialising in various areas. Beyond traditional telecom, the company has strong ventures in:

- Global IT Services: NTT DATA Group is a major global IT service and consulting company.

- Urban Solutions: Real estate and urban development.

- Energy: Renewable energy creation and distribution.

- Research and Development: Extensive R&D at the holding company level, alongside subsidiary specific R&D.

While Chunghwa Telecom also invests in emerging technologies such as Internet of Things (IoT) and AI for its enterprise clients, its diversification strategy remains centred on strengthening its core ICT and network service offerings. Unlike NTT Group, which has expanded into adjacent sectors including real estate and energy, Chunghwa’s expansion has been more measured and closely aligned with its telecommunications foundation.

With market capitalisations of $91 billion and $33.7 billion, respectively, NTT Group and Chunghwa Telecom are constituents of the JAKOTA Blue Chip Index:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| NTT Group | 9432.TSE | Blue Chip 150 | 91B |

| Chunghwa Telecom | 2412.TW | Blue Chip 150 | 33.7B |

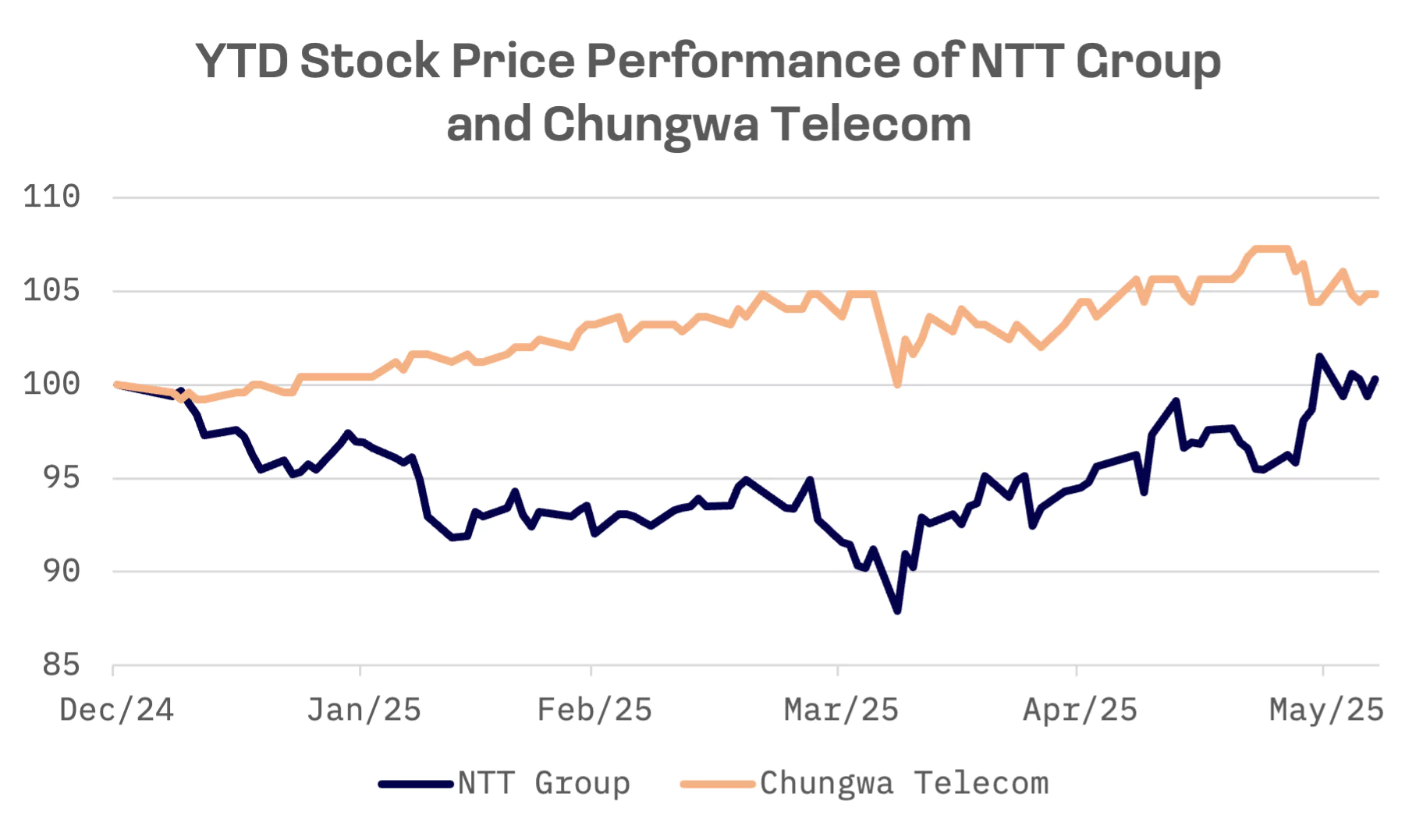

Chunghwa Telecom outperformed NTT Group in year-to-date stock performance, buoyed by steadier price action and a more sustained upward trend. As of early June 2025, NTT Group’s share price had effectively returned to levels seen at the end of 2024, following a period of volatility.

Not surprisingly, Chunghwa Telecom trades at significantly higher valuation multiples than NTT Group. Its elevated EV/Sales, EV/EBITDA and P/E ratios indicate that investors are assigning a premium to the company.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| NTT Group | 1.63x | 6.46x | 13.24x |

| Chunghwa Telecom | 4.31x | 11.14x | 26.86x |

Nippon Telegraph and Telephone (NTT Group)

NTT Group operates through five core business segments.

The Regional Communications segment, led by NTT East and NTT West, provides fixed line and local communication services in Japan. These units operate under the NTT Law, which mandates universal service coverage and requires them to lease unused optical fibre (dark fibre) to other carriers at regulated rates.

The Long Distance and International Communications segment is driven by NTT Communications, which provides a broad range of global services.

Mobile Communications is provided by NTT Docomo, Japan’s leading mobile operator.

The Data and System Integration segment, led by publicly traded NTT Data Group (9613.TSE, JAKOTA Blue Chip 150 Index constituent), offers end-to-end IT services, including system integration, cloud solutions and data centres. NTT Group recently announced that it will take NTT Data Group private in a deal worth more than ¥2.37 trillion ($16 billion), aiming to tighten control and accelerate growth in its overseas operations.

The Other segment includes diversified businesses such as real estate, through NTT Urban Solutions, and energy, via NTT Anode Energy.

NTT Group: Key Financial Indicators, ¥ billion

| Fiscal Q4 2024 ending 03/31/25 | Y/Y change, % | |

| Revenue | 3,660 | -0.07% |

| EBITDA | 762.23 | -10.91% |

| Net income | 149.33 | -44.37% |

NTT Group’s diversified portfolio provides a crucial hedge against market volatility, with strong performance in high value, digital driven segments such as Smart Life, Enterprise Solutions, Data Centres and AI helping to offset the structural decline in legacy voice and regional fixed line services.

NTT is ramping up investment in AI and data infrastructure, committing ¥8 trillion ($59 billion) over five years through fiscal 2027 to fuel growth in areas including data centres and AI. The group is allocating more than $3.6 billion annually to R&D, underscoring its ambition to lead in next generation technologies.

NTT Group’s fiscal 2025 outlook reflects the financial impact of its “New Value Creation & Sustainability 2027 Powered by IOWN” strategy, which prioritises long term innovation over near term profitability. The company is accelerating investments in strategic growth areas such as IOWN infrastructure, 6G, AI and data centres.

For fiscal 2025, operating revenue is projected to rise 2.5% year-over-year. However, operating profit is expected to decline 14.2%, with net profit attributable to NTT Group forecast to fall 21.8%. Despite this anticipated contraction, NTT plans to raise its annual dividend to ¥5.3 per share, marking a 15th consecutive year of increases, and authorised share buybacks of up to ¥200 billion.

Chunghwa Telecom

Chunghwa Telecom’s core operations span mobile, fixed line, broadband and enterprise ICT services, with growing focus on emerging technologies. Its mobile division features a 5G NR network launched in mid 2020, while its fixed line business includes domestic and international voice and leased line services. In broadband and internet, the company offers high speed access and multimedia on demand IPTV services.

A key growth engine is Chunghwa’s ICT business, which serves enterprise clients with a suite of solutions in big data, cybersecurity, cloud computing and Internet Data Centre (IDC) services. The company is also accelerating its push into next generation technologies, including IoT and AI. In January 2022, Chunghwa restructured its organisation into customer facing groups – Consumer, Enterprise and International – and technical units to streamline operations and enhance responsiveness.

Chunghwa Telecom remains the dominant integrated telecom provider in Taiwan, holding leadership across Public Switched Telephone Network (PSTN), mobile and broadband segments. As of December 2024, it commanded the largest market share in mobile subscribers (38%) and revenue (40.4%), with a 5G subscriber share of 38.8%. This reflects a deliberate shift toward premium users, with a 42.7% increase in average monthly spending observed when customers upgraded from 4G to 5G, despite a modest decline in overall subscriber numbers. The strategy mirrors global trends in mature telecom markets, where operators focus on ARPU growth and service monetisation over pure volume expansion.

Beyond mobile, Chunghwa leads Taiwan’s fixed broadband market with 4.4 million households and a 62.6% share, and it dominated the domestic IDC space with a more than 70% market share by year end 2024.

Chunghwa Telecom’s total revenues increased 1.6% to NT$55.81 billion in the first quarter of 2025. The reported earnings per share (EPS) was NT$0.38, aligning with consensus estimates, although quarterly revenue of NT$1.85 billion was below analysts’ expectations of NT$56.11 billion.

Chunghwa Telecom: Key Financial Indicators, NT$ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 55.81B | 1.57% |

| EBITDA | 21.39B | 3.15% |

| Net income | 9.80B | 4.34% |

Chunghwa Telecom is focusing its 2025 strategy towards stable growth, digital transformation and sustainability, with a forward looking investment approach. For 2025, the company forecasts revenue growth of 1.2% to 1.6%, driven by continued momentum in mobile communications, broadband access, data services and emerging technology businesses. Operating expenses are expected to rise 2.4%, reflecting increased investment in infrastructure, talent, network resilience, cybersecurity and rising electricity costs.

Capital expenditures are set to climb by NT$3.37 billion to NT$32.36 billion, as Chunghwa ramps up development of AI powered internet data centres, constructs new submarine cables and continues its nationwide 5G rollout. The guidance underscores management’s focus on long term capacity expansion amid near term cost challenges.

Chunghwa Telecom follows a more pragmatic, evolutionary growth strategy, optimising existing strengths and expanding into adjacent high growth areas. This approach targets stable, predictable growth. Conversely, NTT Group is on a transformative path, making massive, long term bets on foundational technologies like IOWN, 6G and advanced AI. NTT Group is accepting short term profit pressures as a necessary cost for potential long term, industry leading positions. This difference in strategic ambition shapes their respective long term market outlooks.