Japan and South Korea, global powerhouses in car manufacturing, have cultivated robust tire manufacturing industries. This natural synergy stems from their close ties to automakers, shared technological advances and strong access to domestic and international markets.

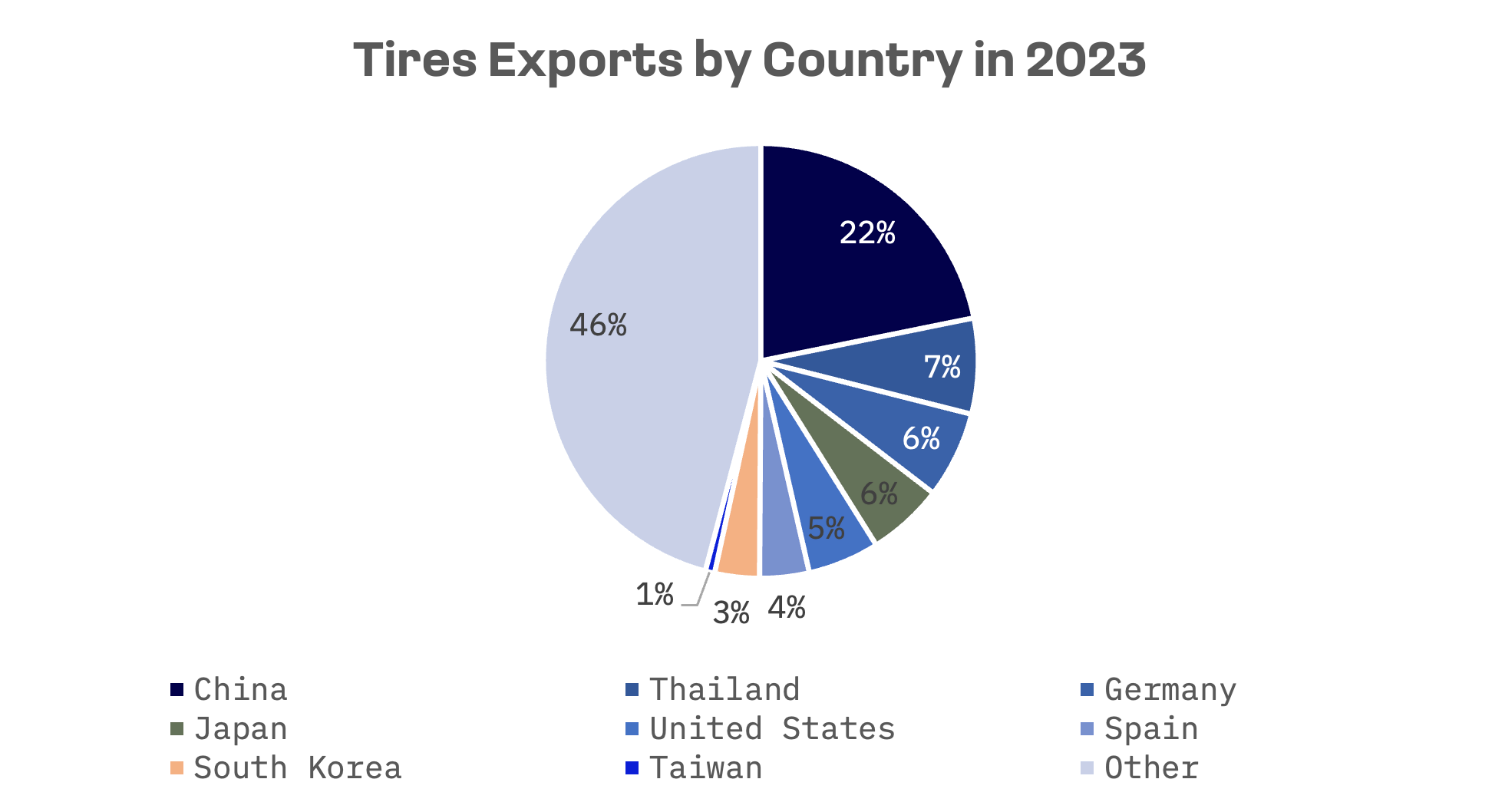

The global tire industry, valued at approximately $280 billion, saw world exports reach an estimated $97.8 billion in 2023. The Jakota countries command about 10% of market share, with Japan and South Korea ranking fourth and seventh globally, recording $5.5 billion and $3.2 billion in exports respectively.

Japan

The Japanese tire market distinguishes itself through intensive research and development, producing advances in sustainable and eco friendly tire technologies. Japanese manufacturers lead in innovations such as run flat and fuel efficient tires, enhancing both safety and environmental performance. The country maintains a global manufacturing presence while serving diverse markets worldwide.

Japanese tire makers are swiftly adapting to electric vehicle demand by developing EV specific tires. Their expansion efforts target the Asia Pacific region and emerging markets where demand continues to surge. These manufacturers are also advancing material innovations to reduce CO2 emissions, highlighting their environmental commitments.

Major Japanese tire makers:

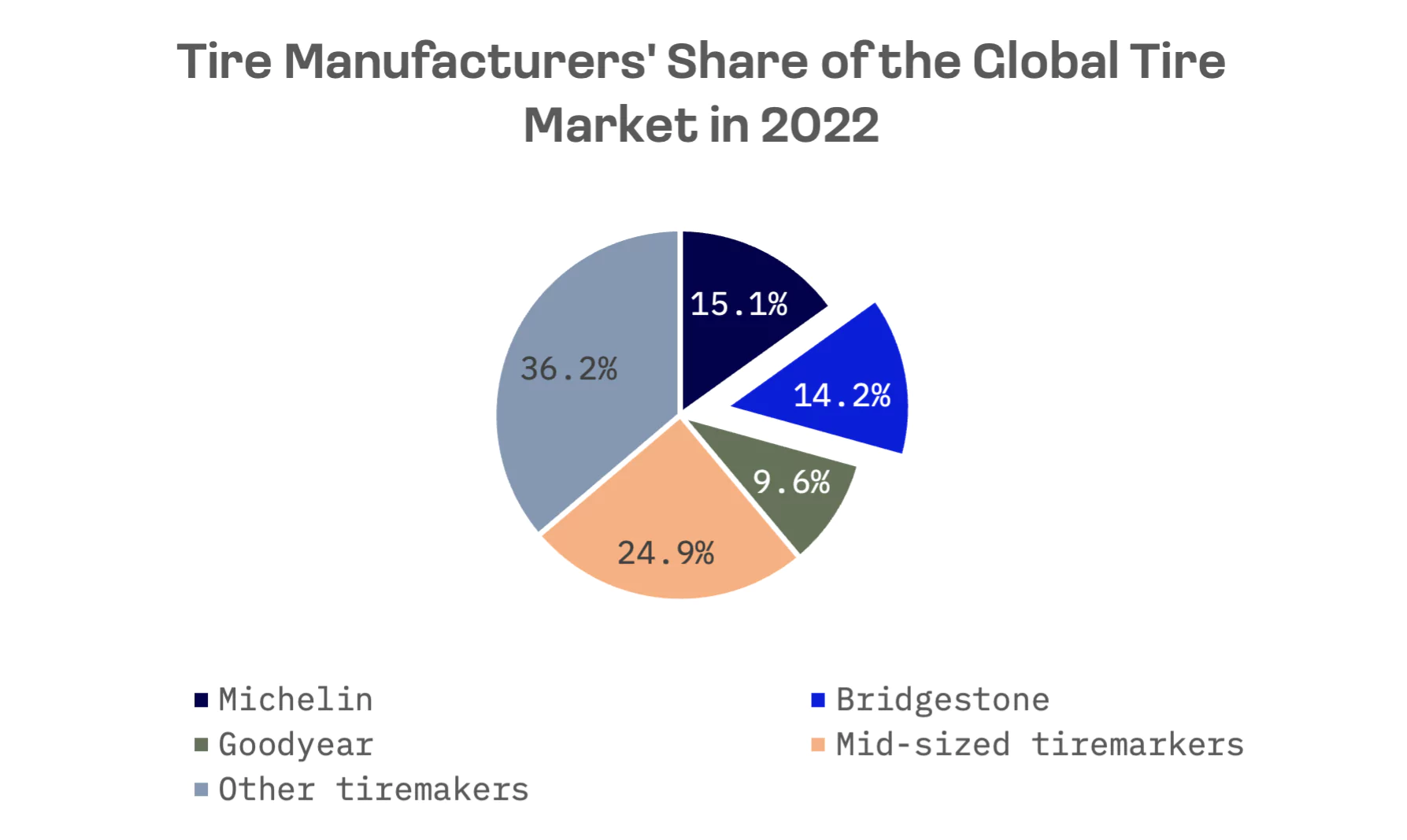

- Bridgestone, the world’s second largest tire manufacturer by revenue, known for high quality products and innovation in sustainable tire technologies.

- Yokohama Rubber, known for passenger and performance tires, as well as heavy duty applications.

- Sumitomo Rubber Industries, which offers a wide range of tires under the Falken and Dunlop brands.

- Toyo Tire, focused on high performance tires for both consumer and commercial vehicles.

South Korea

South Korea’s tire industry has emerged as a global force through strategic partnerships with automakers like Hyundai and Kia. South Korean manufacturers specialise in electric vehicle tires and smart tires with IoT integration, meeting modern automotive demands. They have expanded production to Europe, North America and Southeast Asia, strengthening their global presence. Their growth stems from increasing market share in the U.S. and Europe, where they target the premium segment.

The country’s major players:

- Hankook Tire & Technology, ranking among the top 10 global tire manufacturers, known for high quality and innovation.

- Kumho Tire, which focuses on passenger and commercial vehicle tires, with strong OEM ties.

Taiwan

Taiwan’s tire industry concentrates on exports to the U.S. and Europe, key markets for premium tires. Manufacturers are embracing automation and smart manufacturing to enhance efficiency and streamline production processes. The sector’s growth comes from specialty tires for motorcycles and ATVs, while manufacturers strengthen partnerships with global automotive brands through OEM contracts.

Leading Taiwanese companies:

- Cheng Shin Rubber, among the top 10 global tire makers, with a strong focus on both automotive and bicycle tires.

- Nankang Rubber Tire, which produces a range of products catering to diverse markets.

All companies mentioned are publicly traded, each with a market capitalisation exceeding $1 billion, except Kumho Tire. Bridgestone remains the sole constituent of the JAKOTA Blue Chip 150 Index, with a market capitalisation of $23.7 billion.

| Company Name | Country | Ticker | JAKOTA Index | Market Cap, USD |

| Bridgestone | Japan | 5108.TSE | Blue Chip 150 | 23.7B |

| Cheng Shin Rubber | Taiwan | 2105.TW | Mid and Small Cap 2000 | 5.2B |

| Hankook Tire & Technology | Korea | 161390.KO | Mid and Small Cap 2000 | 3.4B |

| The Yokohama Rubber | Japan | 5101.TSE | Mid and Small Cap 2000 | 3.1B |

| Sumitomo Rubber Industries | Japan | 5110.TSE | Mid and Small Cap 2000 | 3.0B |

| Toyo Tire | Japan | 5105.TSE | Mid and Small Cap 2000 | 2.4B |

| Nankang Rubber Tire | Taiwan | 2101.TW | Mid and Small Cap 2000 | 1.2B |

| Kumho Tire | Korea | 073240.KO | Mid and Small Cap 2000 | 0.9B |

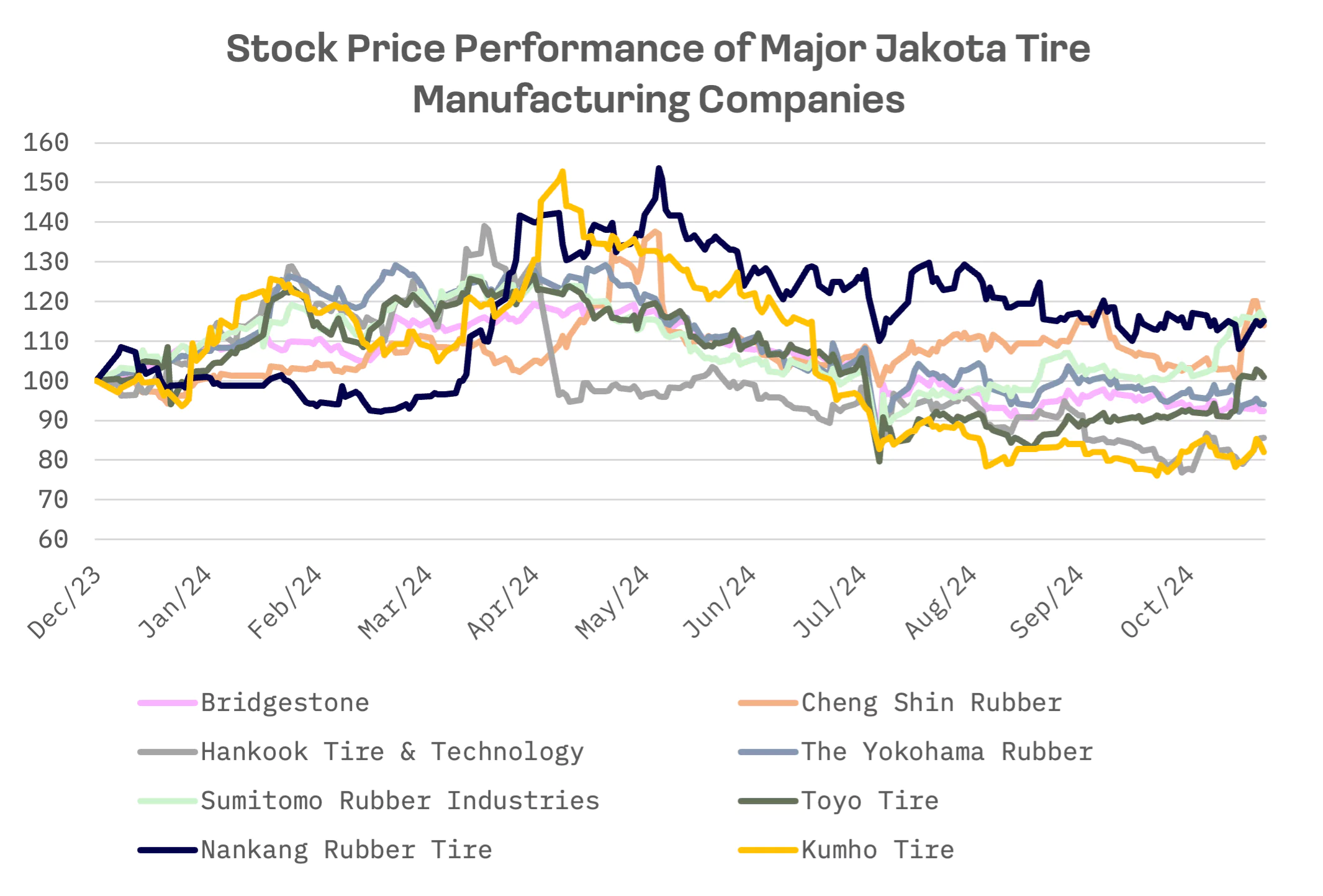

The first half of 2024 demonstrated largely positive movement for tire manufacturing stocks, with most companies showing growth during this period. However, the situation shifted in June, leading to a broad decline by mid-November. The downturn reflects slower than expected electric vehicle market growth and cooling auto industry demand.

Taiwanese tire makers outperformed the Jakota peers, maintaining year-to-date gains despite the broader downturn. This resilience reflects Taiwan’s stronger stock market performance compared with Korean and Japanese markets in 2024, along with more diversified portfolios. Cheng Shin Rubber, for instance, leads in bicycle tire manufacturing.

Nankang Rubber Tire and Cheng Shin Rubber, both Taiwanese companies, command the highest EV/Sales and EV/EBITDA ratios, suggesting premium valuations. South Korea’s Hankook Tire & Technology trades at the lowest multiples but lacks a P/E ratio due to negative earnings. Japan’s Bridgestone, the biggest tire player in Asia, trades near median multiples within the peer group.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Bridgestone | 0.86x | 4.44x | 11.84x |

| Cheng Shin Rubber | 1.83x | 8.34x | 25.22x |

| Hankook Tire & Technology | 0.33x | 1.01x | N/A |

| The Yokohama Rubber | 0.76x | 4.03x | 5.90x |

| Sumitomo Rubber Industries | 0.52x | 4.93x | 33.62x |

| Toyo Tire | 0.70x | 3.88x | 5.24x |

| Nankang Rubber Tire | 3.85x | 12.81x | 12.43x |

| Kumho Tire | 0.74x | 3.58x | N/A |

| AVERAGE | 1.20x | 5.38x | 15.71x |

| MEDIAN | 0.75x | 4.23x | 12.14x |

Bridgestone

During its last earnings call, Bridgestone outlined its financial performance and strategic direction in the face of a complex global market. Bridgestone posted revenue of ¥2,176.8 billion for Q2 FY2024, though adjusted operating income fell to ¥229.2 billion.

The profit decline stemmed from lower sales volumes and weakened Latin American performance. The company faces challenges from tariff increases and import surges in North America. In Brazil, competition from low cost imports poses a challenge, while the truck and bus (TB) segment is also under pressure from inexpensive foreign products.

The company maintains its focus on premium tires and commercial B2B solutions while pursuing cost reductions to counter import competition. It plans to emphasise its Firestone brand in the U.S. and streamline European operations around fleet services and quality upgrades, targeting a 10% profit margin by 2026. Despite market pressures, Bridgestone’s efforts to combat import competition and develop new sales channels are expected to boost profitability, particularly in the passenger tire segment.

Cheng Shin Rubber

Cheng Shin Rubber reported steady financial performance in Q3 2024, with revenue flat at NT$25.5 billion year-over-year. Net income rose 18% to NT$2.33 billion, driven by improved profitability. Profit margins strengthened to 9.1% from 7.8% in the third quarter of 2023, reflecting stronger cost management and higher margin product sales. Earnings per share (EPS) climbed to NT$0.72, up from NT$0.61 in the same period last year, underscoring the company’s continued progress in operational efficiency.

Hankook Tire & Technology

Hankook Tire & Technology shares remained under pressure following their May decline. The company recently announced a ₩1.73 trillion ($1.3 billion) investment to acquire control of Hanon Systems, the world’s second largest automotive thermal management supplier.

The board approved plans to acquire a 25% stake in Hanon Systems from Hahn & Company, a Korean private equity firm, and purchase 65.12 million newly issued shares, raising its stake to 50.5% and securing management rights. This follows Hankook’s 2015 acquisition of a 19.5% stake for ₩1.08 trillion, bringing total investment to 2.8 trillion won.

Investors responded negatively to the Hanon Systems deal amid profitability concerns. Hanon Systems, focused on EV thermal management solutions, saw a 50.1% year-over-year drop in second quarter operating profit, raising questions about the deal’s timing. A militant union at Hanon adds to Hankook’s challenges.

Meanwhile, Hankook Tire & Technology financial results were positive, demonstrating growth in both sales and profitability.

Hankook Tire & Technology: Key financial indicators, ₩ billion

| 3 months ended on 9/30/2023 | 3 months ended on 9/30/2024 | Y/Y change, % | |

| Total Revenue | 2,340 | 2,435 | 4.1% |

| EBITDA | 396 | 470 | 18.7% |

The tire manufacturing sectors in Japan, Korea and Taiwan remain crucial to the global market, driven by innovation, quality standards and strategic positioning. These nations are key players in the evolution of tire production, continuously adapting to market shifts and environmental concerns, maintaining their influence in the global automotive industry.