Last week’s Jakota markets:

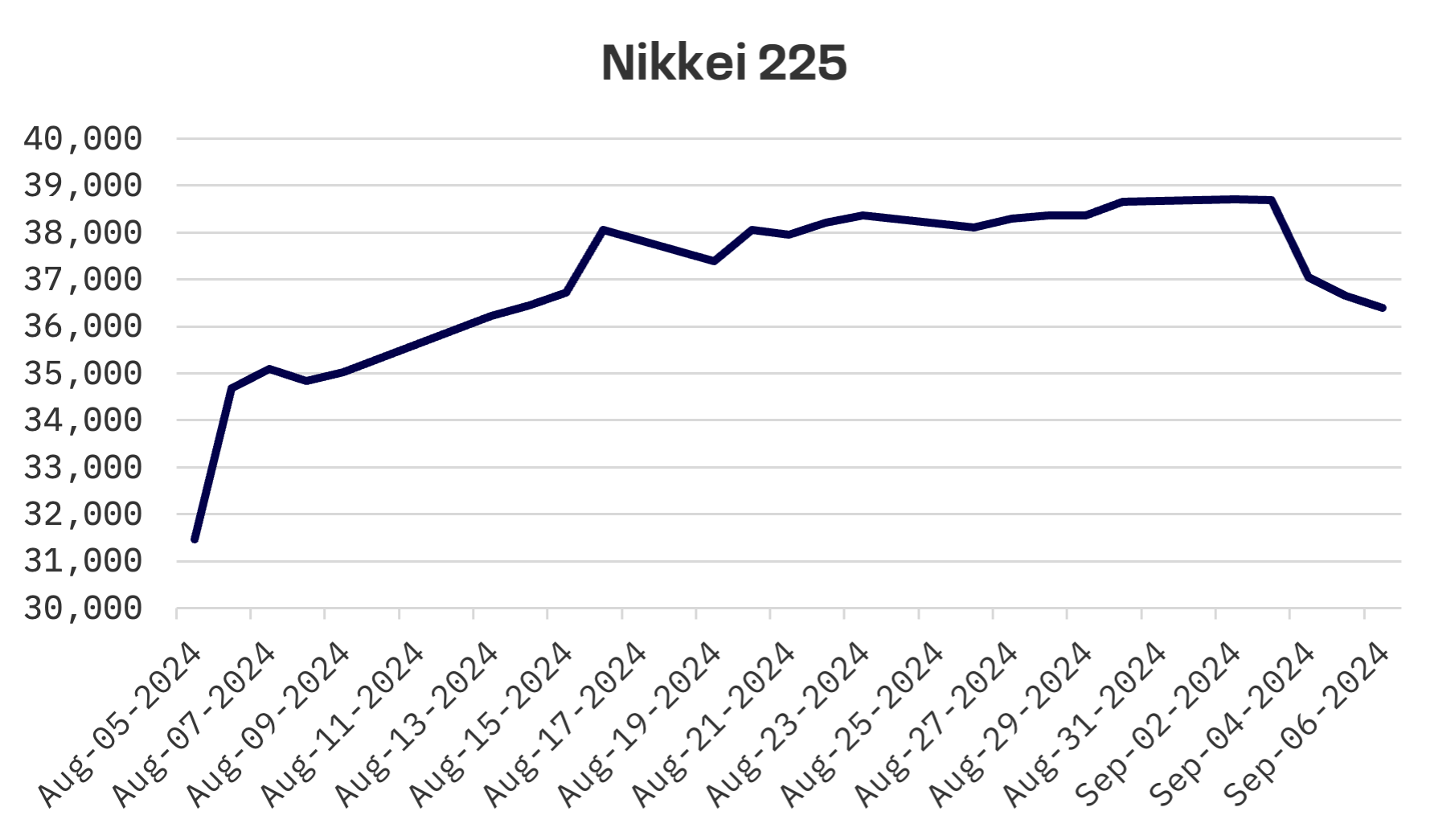

- Japan’s Nikkei 225 Index plunged 5.8% as semiconductor stocks faltered and the yen surged against the dollar

- South Korea’s KOSPI tumbled 4.9% amid growing U.S. recession fears and tepid domestic economic data

- Taiwan’s TAIEX dropped 3.9%, with a midweek rout followed by a modest tech driven recovery

- The JAKOTA Blue Chip 150 Index retreated 4.1%, with Kao Corporation emerging as a rare bright spot

Japan

The Japanese stock market took a hit this week, with the Nikkei 225 Index sliding 5.8%. A midweek selloff in semiconductor stocks, triggered by weakness in U.S. markets, weighed heavily on the index. The strengthening yen added pressure on the nation’s export reliant companies.

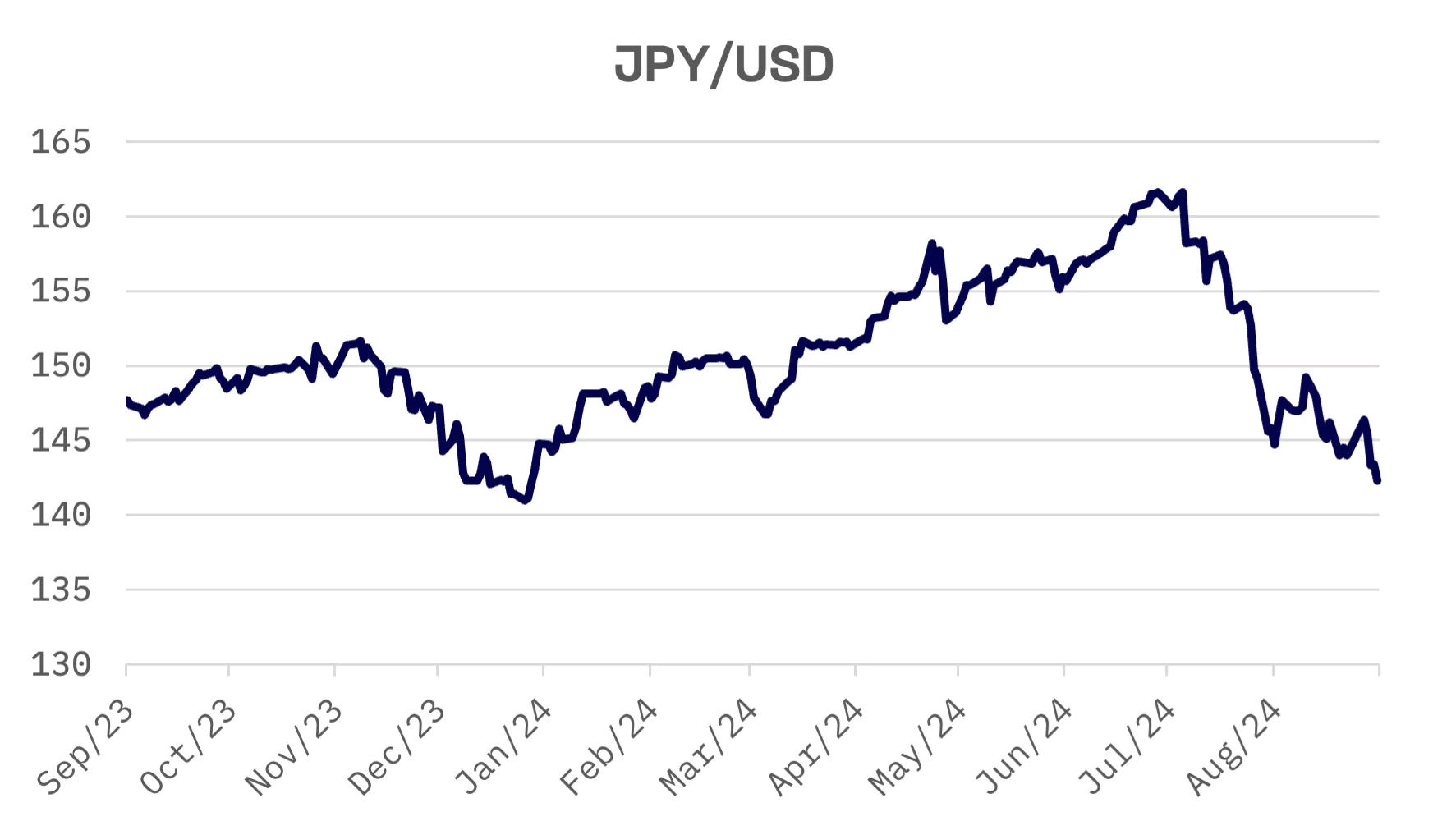

The yen climbed to around 142 against the U.S. dollar, up from 145 yen at the end of the previous week. This surge came amid expectations of narrowing interest rate differentials between Japan and the U.S. Investors are betting on further rate hikes by the Bank of Japan this year, while anticipating a rate cut by the U.S. Federal Reserve in September.

The yield on the 10-year Japanese government bond dropped to 0.86% from 0.90% the prior week. Weak U.S. economic data stoked recession fears, prompting investors to seek safe haven assets and boosting demand for Japanese government bonds. This bond rally occurred despite a 0.4% year-on-year rise in Japan’s inflation adjusted wages for July, supported by pay hikes and summer bonuses. The wage increase marked the second consecutive monthly rise, reinforcing expectations of further rate hikes by the Bank of Japan this year.

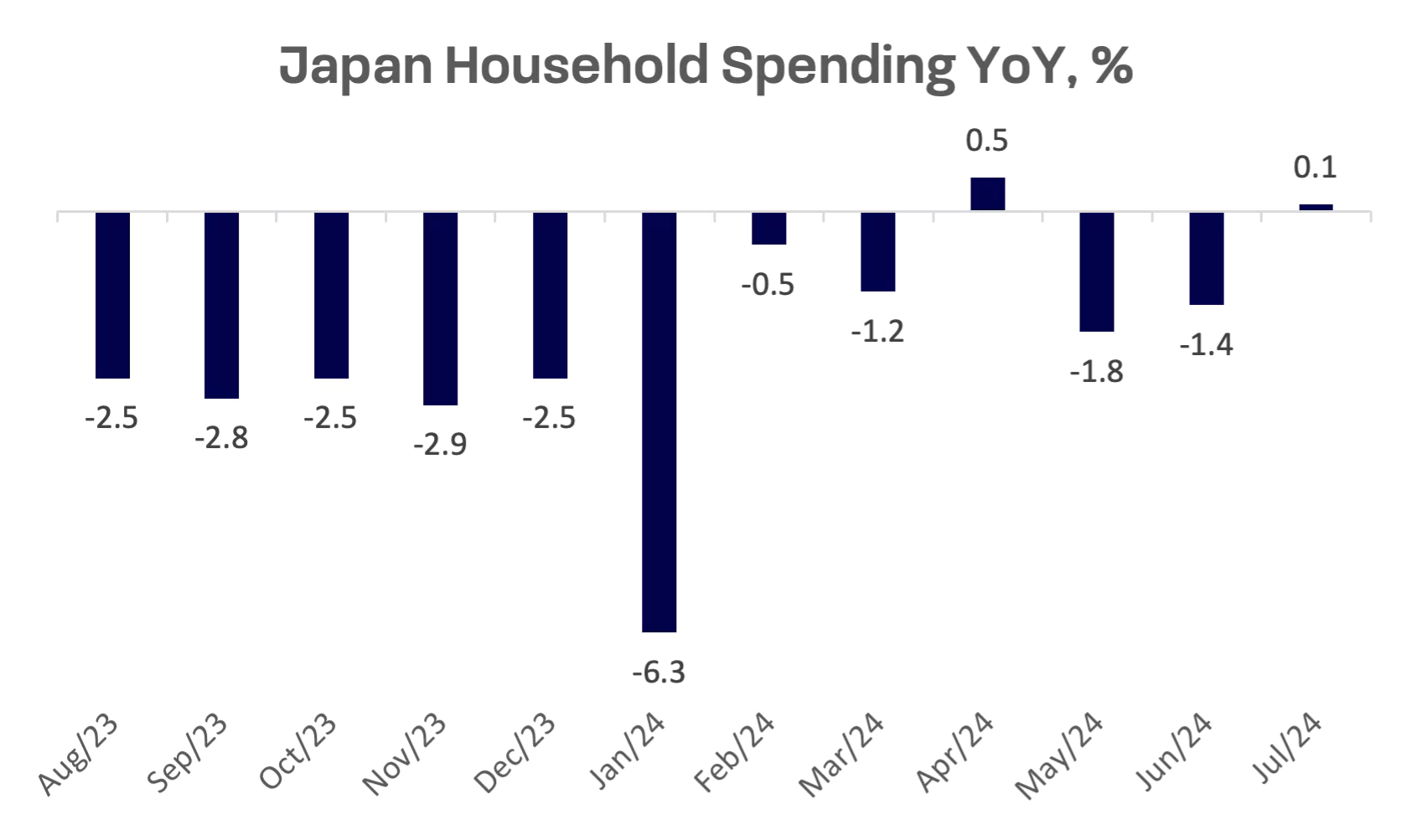

However, household spending remained tepid, inching up just 0.1% in July despite income growth. The central bank continues to target 2% inflation, accompanied by wage growth, and has signalled it will adjust monetary policy if economic conditions meet expectations.

Bank of Japan Board Member Hajime Takata reaffirmed this stance but cautioned that fluctuations in financial markets, driven by differing global monetary policies, require close monitoring. He emphasized the need for careful assessment at each policy meeting to gauge the effects of market movements on the economy and inflation.

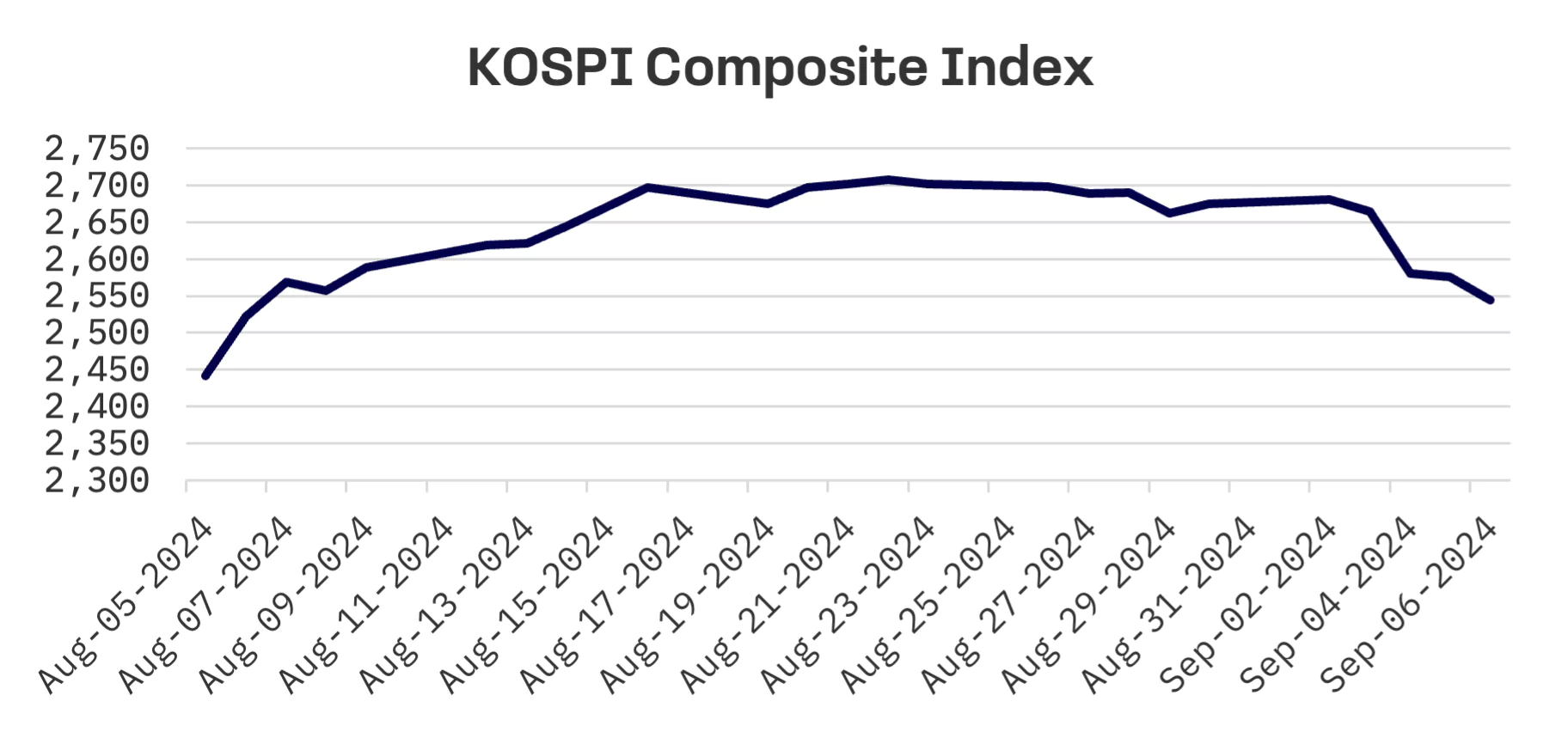

South Korea

The Korean stock market experienced a sharp decline this week, with the KOSPI Index shedding 4.9%. The index closed lower for four consecutive sessions, pressured by growing fears of a U.S. recession.

After starting the week with gains on hopes of a U.S. rate cut, the market reversed course as caution grew ahead of key U.S. data. By Wednesday, shares hit a one month low, with diminished expectations for aggressive Fed action adding pressure. Losses extended through Thursday and Friday amid heightened concerns of a U.S. slowdown, despite the Korean won strengthening against the dollar.

South Korea’s GDP growth slowed to 2.3% year-over-year in the April-June period, down from 3.3% in the previous quarter, as weaker domestic consumption and reduced private sector investment weighed on the economy. This slowdown has heightened expectations for a potential rate cut next month.

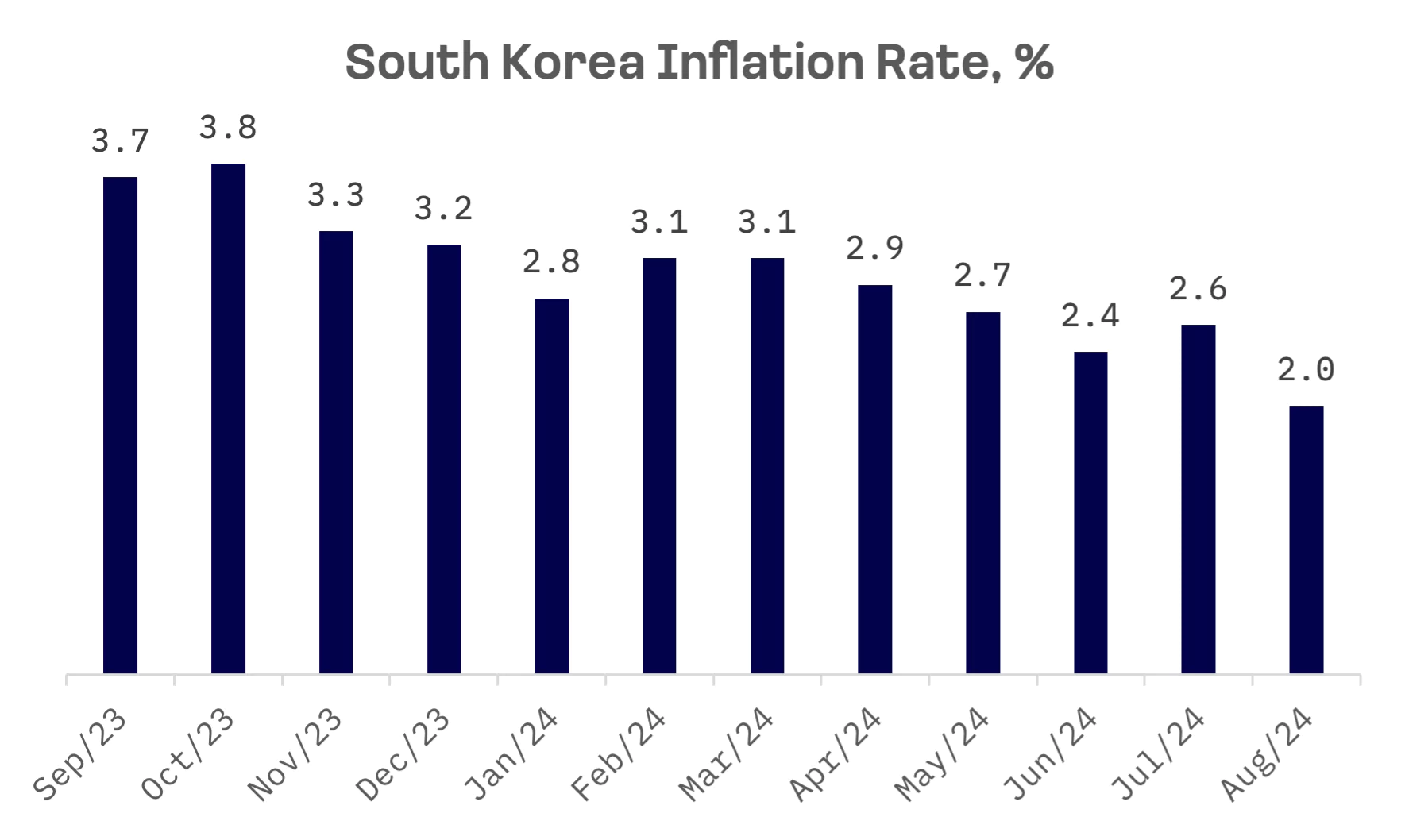

Additionally, South Korea’s inflation eased to the government’s 2.0% target in August, marking the slowest rise in over three years and intensifying pressure on the Bank of Korea (BOK) to shift toward monetary easing.

The economic deceleration has fuelled speculation that the central bank may have missed its window to cut interest rates, as calls from the presidential office grow louder, urging the BOK to lower rates to stimulate domestic demand.

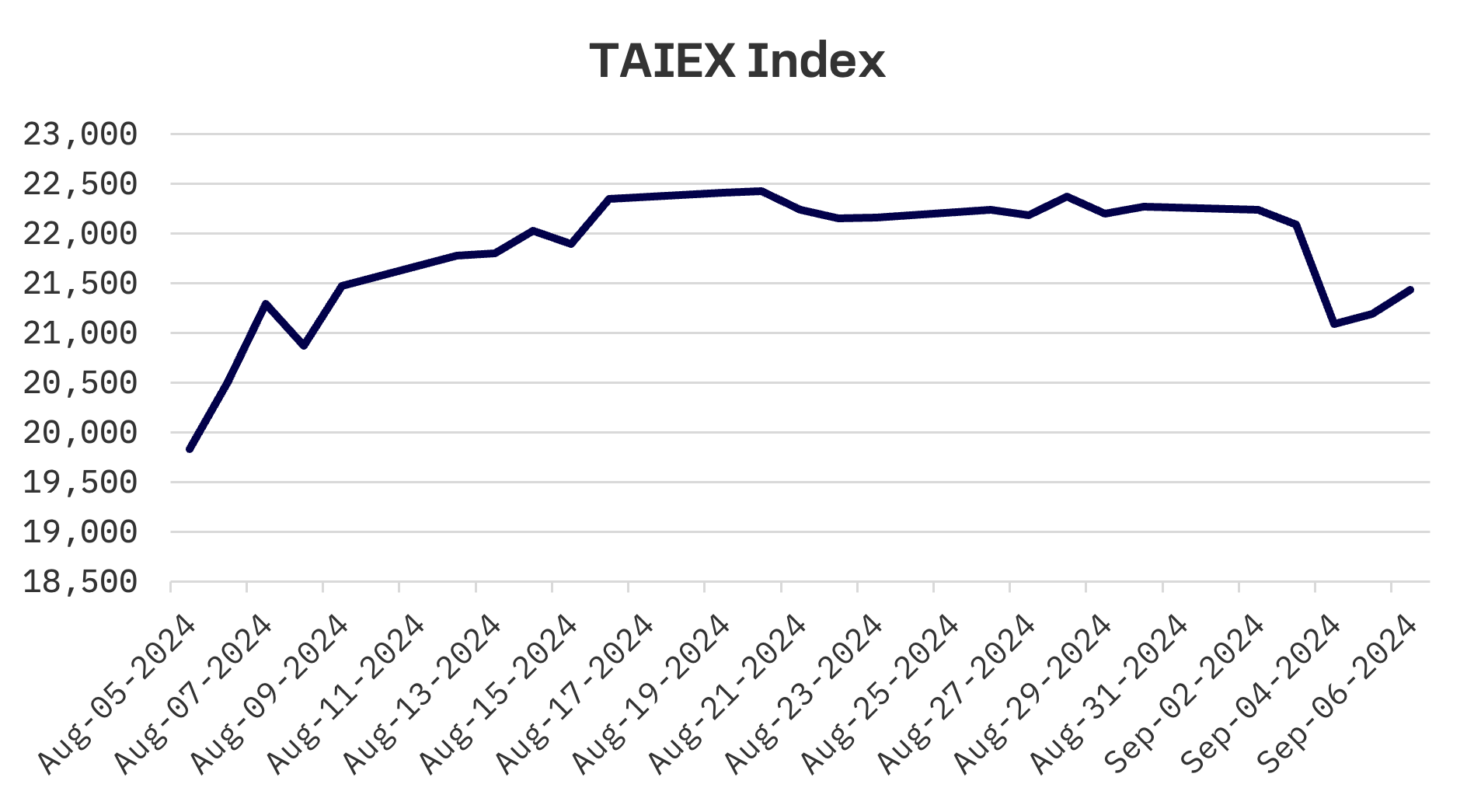

Taiwan

Taiwanese shares, in line with other Jakota markets, experienced a sharp decline this week, with the TAIEX Index dropping 3.9%.

Taiwan’s stock market saw a dramatic decline on Wednesday, with the TAIEX Index plummeting nearly 1,000 points. This significant selloff was largely attributed to a downturn in U.S. markets, driven by concerns about a potential hard landing for the American economy. The selloff was exacerbated by a sharp drop in Nvidia Corp.’s shares, following news of an antitrust investigation by the U.S. Department of Justice.

However, the market showed some recovery on Thursday and Friday, with the index rebounding by over 240 points. This rebound was primarily fuelled by a resurgence in large cap tech stocks, which had been heavily affected by the earlier decline.

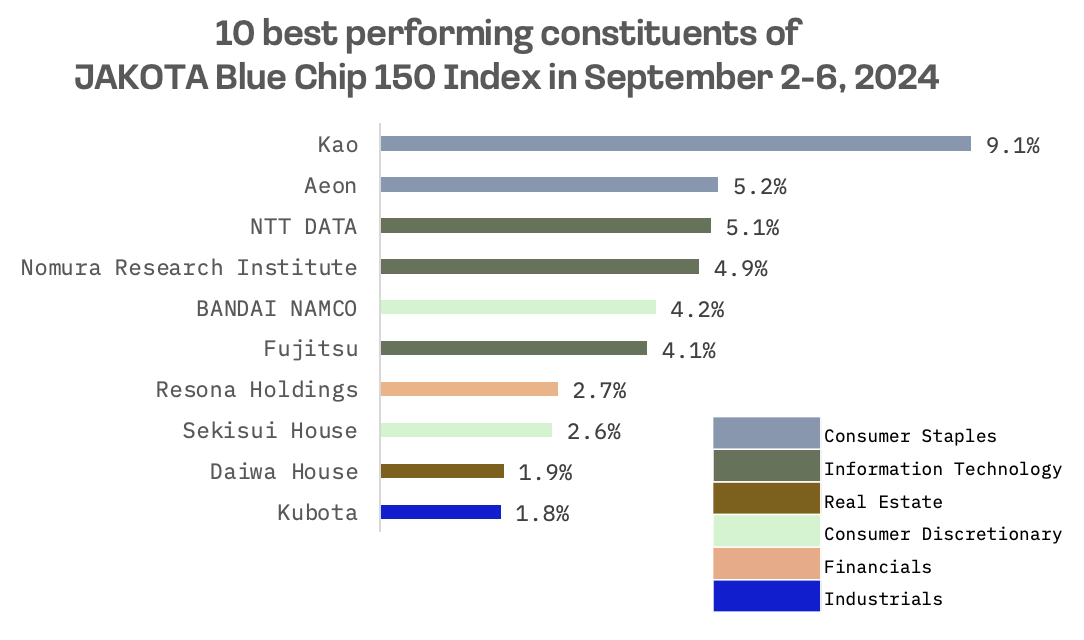

JAKOTA Blue Chip 150 Index

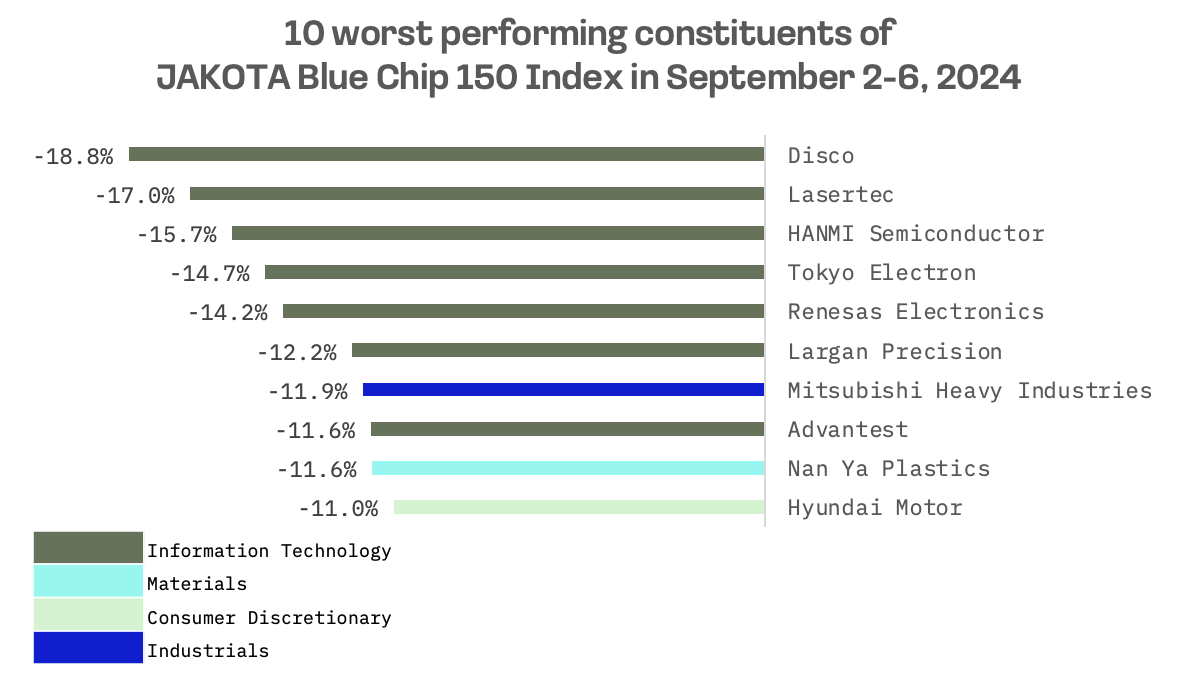

The JAKOTA Blue Chip 150 Index fell by 4.1% this week. Out of a pool of 150 constituents, only 28 stocks posted gains.

Kao Corporation, a Japanese global chemical and cosmetics company, emerged as the top performing stock this week. The stock surged over 9% following Mitsubishi UFJ Morgan Stanley Securities’ decision to raise its target price from ¥7,900 to ¥8,400. The securities firm highlighted that the impacts of ongoing restructuring and sustained price increases are expected to drive significant business performance growth starting next fiscal year.

Japanese and Korean semiconductor companies, including Disco, Lasertec and HANMI Semiconductor, were among the worst performers on the JAKOTA Blue Chip 150 Index. Their shares struggled amid a broader selloff in semiconductor stocks, exacerbated by weakness in the U.S. market. Japanese semiconductor companies faced additional headwinds as the yen strengthened, impacting their export oriented businesses.