Last week’s Jakota markets:

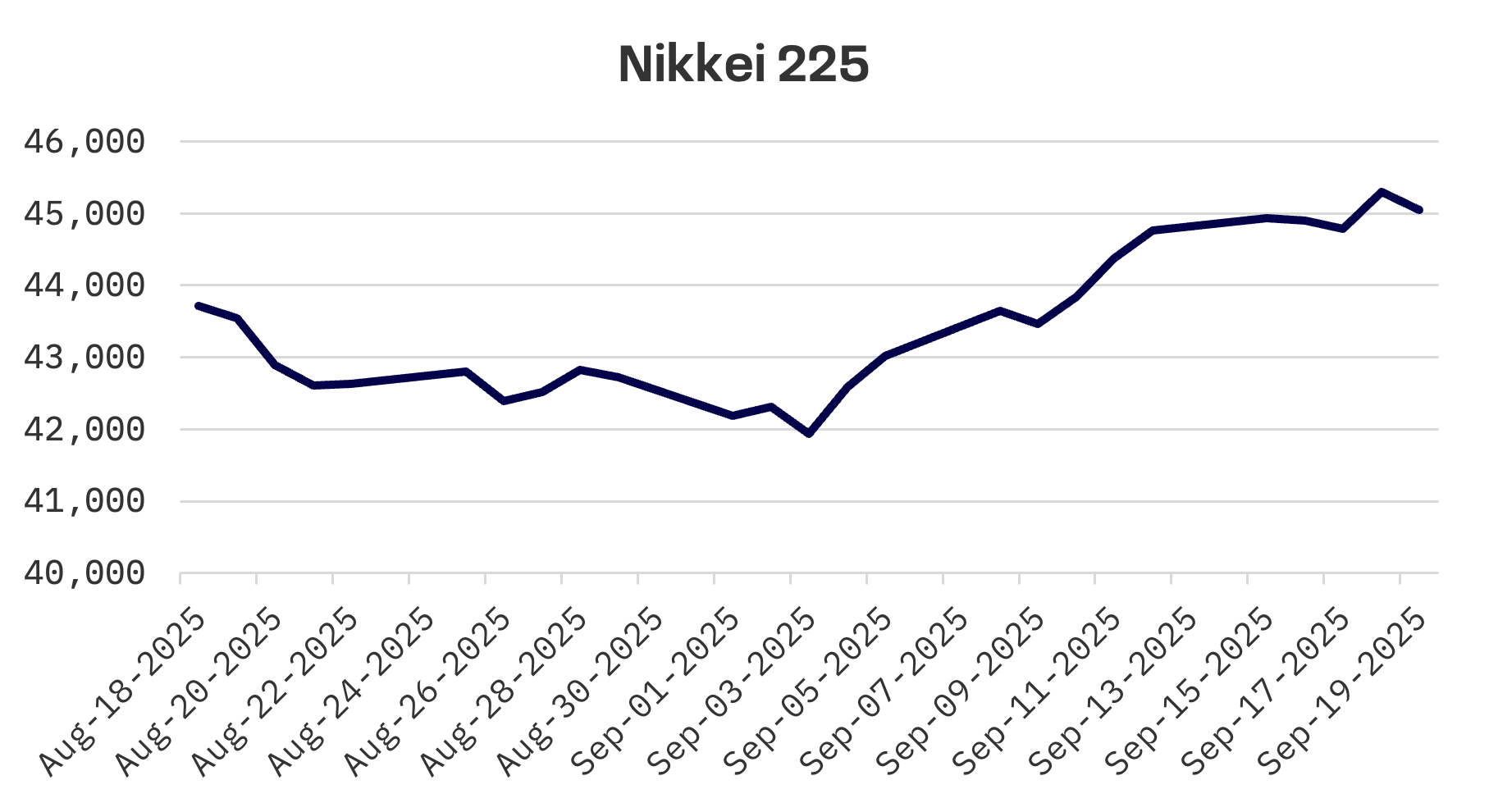

- Japan’s Nikkei 225 Index rose 0.6% as the BoJ signalled policy normalisation by accelerating asset sales, while two board members voted for rate hikes under Governor Ueda’s leadership

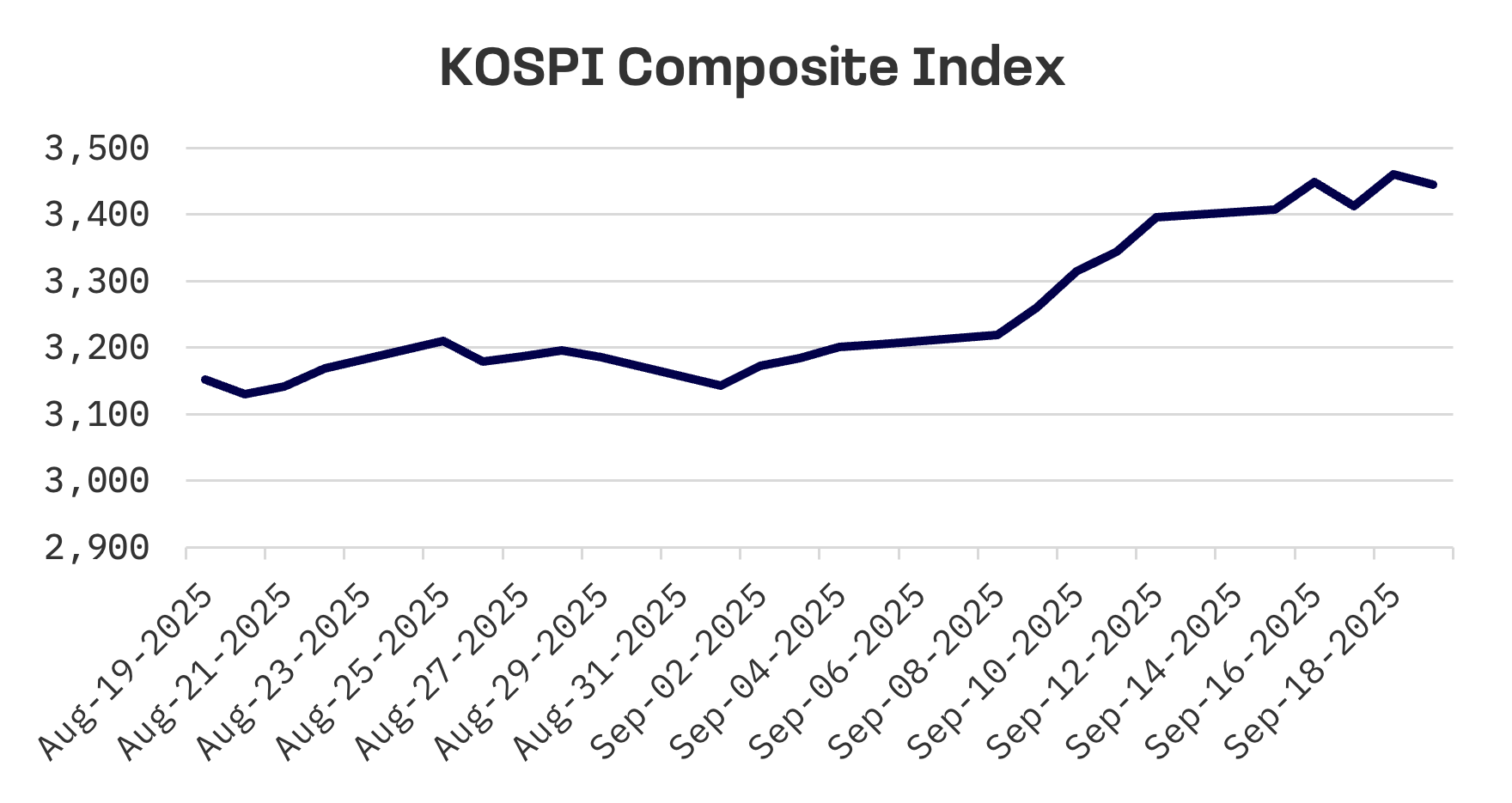

- South Korea’s KOSPI climbed 1.5% following the Federal Reserve’s rate cut, though sentiment was tempered by President Trump’s threats of higher tariffs on semiconductors and pharmaceuticals

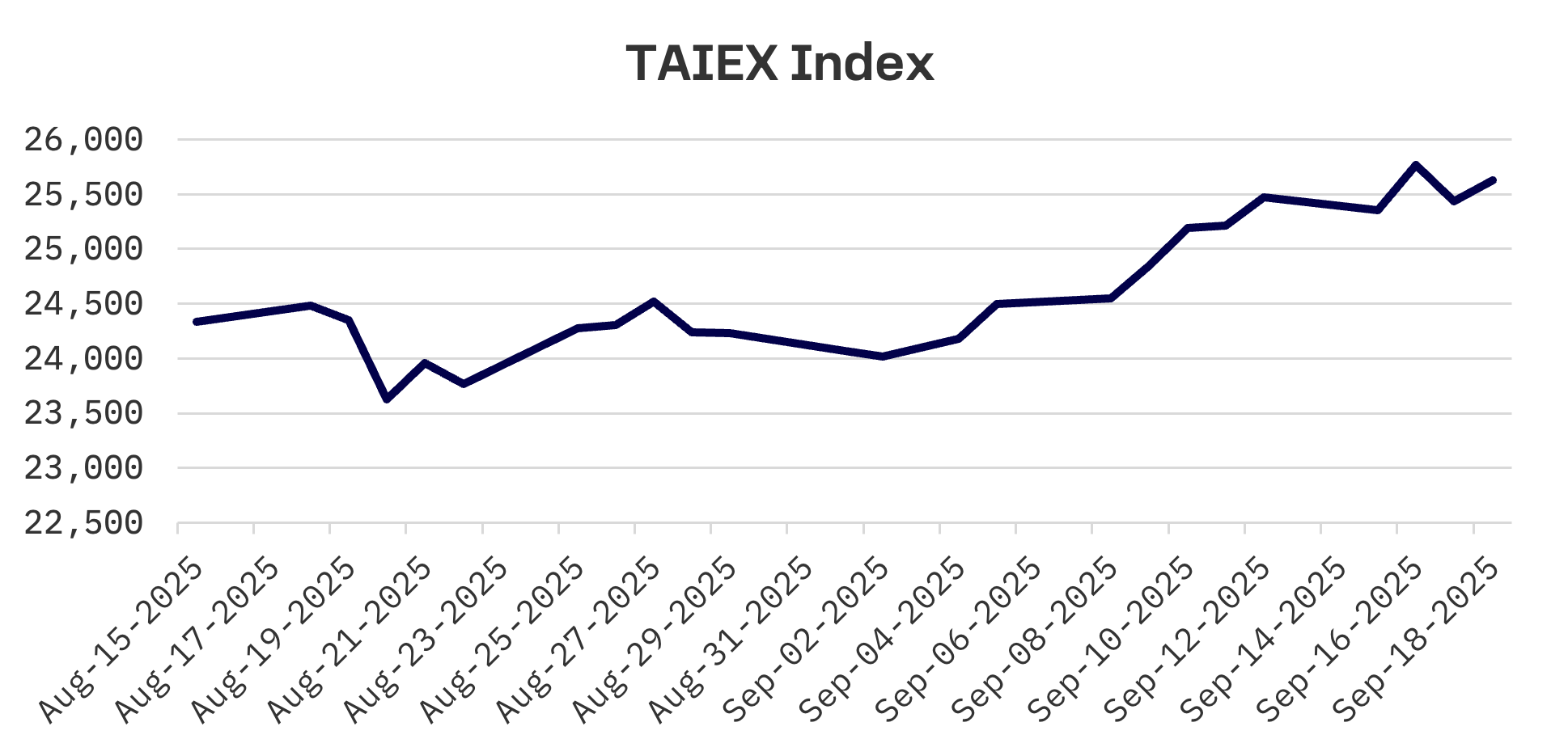

- Taiwan’s TAIEX index advanced 1.6% amid continued investor appetite for TSMC and tech heavyweights, buoyed by sustained AI optimism

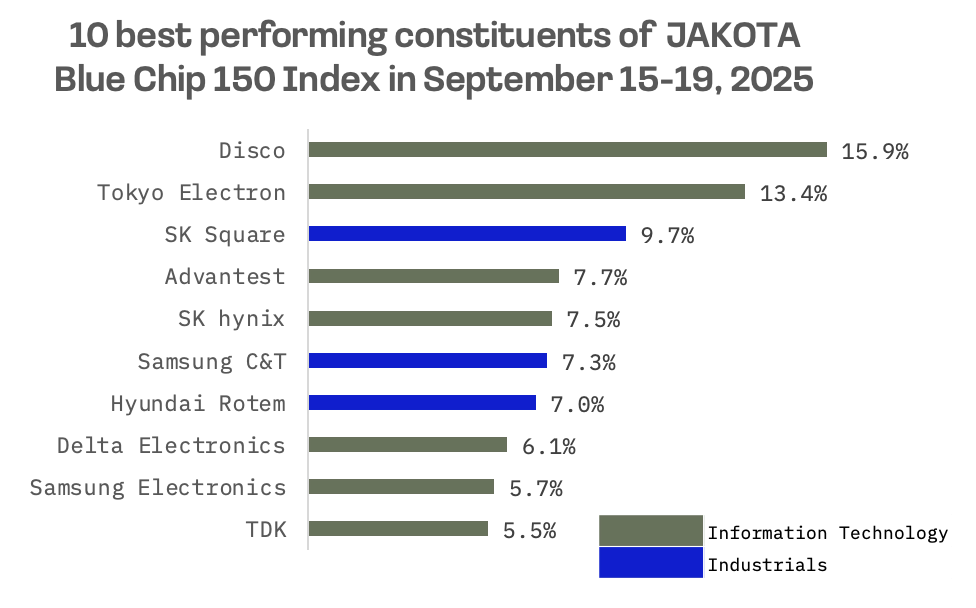

- The JAKOTA Blue Chip 150 Index gained 0.3% with tech stocks dominating the top performers, led by Japanese semiconductor equipment makers Disco and Tokyo Electron

Japan

Japan’s stock market posted modest gains this week, with the Nikkei 225 advancing 0.6%. The Bank of Japan (BoJ) surprised investors by announcing plans to accelerate the sale of its exchange traded fund and real estate investment trust holdings, a move markets interpreted as signalling a shift towards policy normalisation.

The central bank held its benchmark rate steady at 0.5% as expected, amid domestic political tensions and global trade uncertainty. In a notable development, two board members voted to raise rates for the first time under Governor Kazuo Ueda’s leadership. The BoJ reiterated that it would tighten policy if growth and inflation develop in line with its forecasts – a statement markets viewed as hawkish, suggesting the possibility of a rate increase later this year.

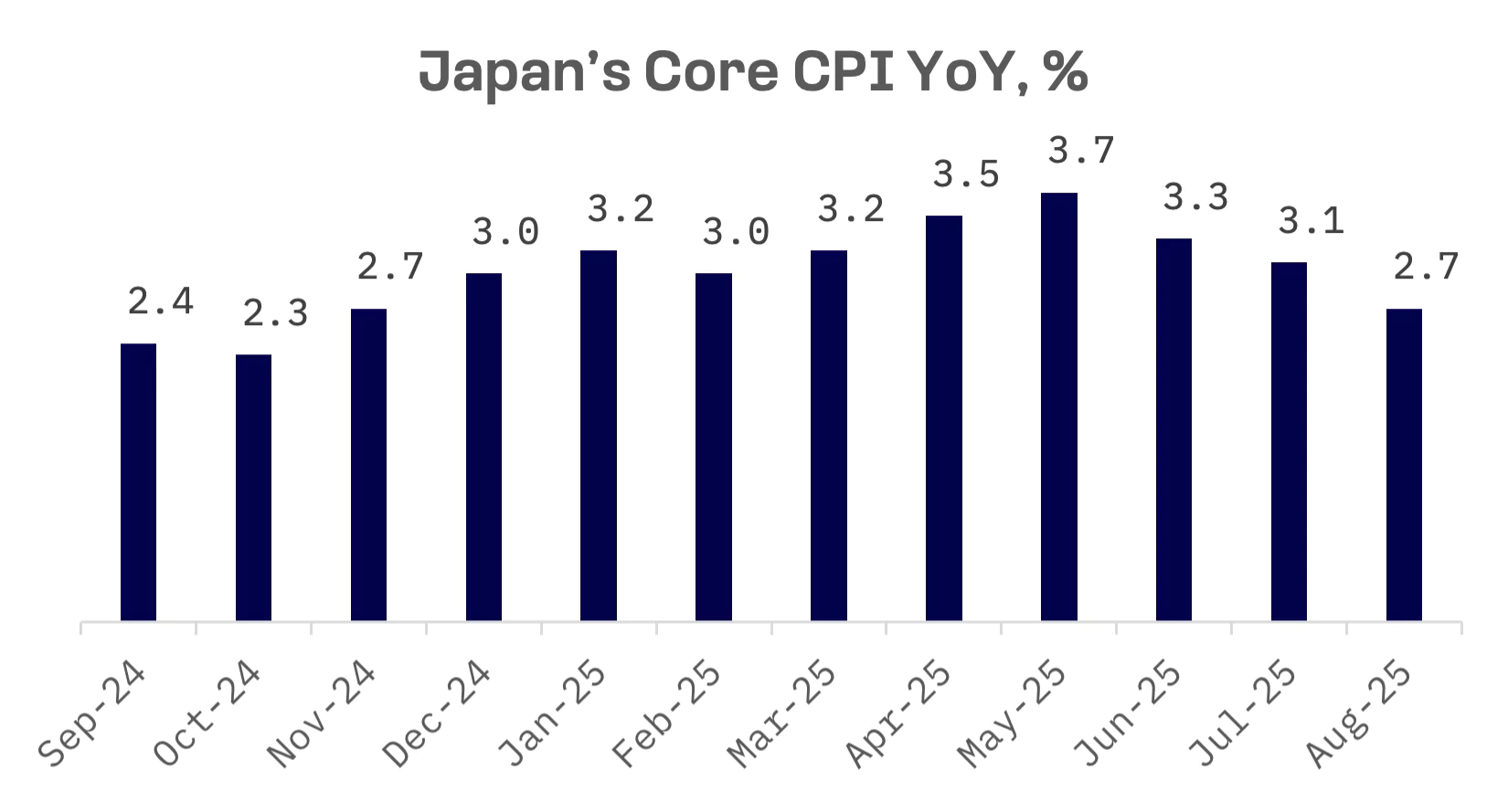

Japan’s core consumer prices rose 2.7% year-over-year in August, matching forecasts and decelerating from July’s 3.1% pace. While inflation remains above the BoJ’s 2% target, supporting the case for higher rates, Governor Ueda has maintained a cautious approach, noting that underlying price growth has yet to align consistently with the target.

Export data showed resilience, with shipments declining just 0.1% in August from a year earlier, a smaller drop than the 1.9% decline economists had forecast. The improvement came as the impact of U.S. tariffs eased following the late July trade agreement with Washington.

South Korea

South Korean stocks rallied this week, with the KOSPI Index climbing 1.5% following the Federal Reserve’s first interest rate cut of the year. However, sentiment was dampened by President Donald Trump’s suggestion that tariffs on semiconductors and pharmaceuticals could exceed the 25% duty on automobiles, arguing that chipmakers and drug companies enjoy “bigger margins.”

In a significant policy reversal, South Korea abandoned plans to tighten capital gains taxes on large shareholders, maintaining the ₩5 billion ($3.6 million) threshold after facing investor backlash and concerns over market impact. The decision marks a retreat from the Lee Jae-myung administration’s late July tax blueprint, which proposed lowering the threshold to ₩1 billion as part of a broader tax overhaul.

Taiwan

Taiwan’s stock market gained ground this week, with the TAIEX index rising 1.6% following the Fed’s rate cut. Investors continued buying shares of Taiwan Semiconductor (TSMC) and other tech heavyweights, reflecting sustained optimism about AI developments.

Taiwan’s central bank bucked the Federal Reserve’s lead on Thursday, keeping its benchmark rate unchanged despite the Fed’s 25 basis point reduction a day earlier. The Central Bank of the Republic of China (Taiwan) held policy steady for the sixth consecutive quarter, as expected, with officials citing uncertainty from U.S. tariff measures.

The central bank raised its 2025 GDP growth forecast to 4.55% and projected 2.68% expansion in 2026. The upgrade follows strong global demand for emerging technologies such as AI and increased private investment, which helped drive a 6.75% gain in the first half of the year.

JAKOTA Blue Chip 150 Index

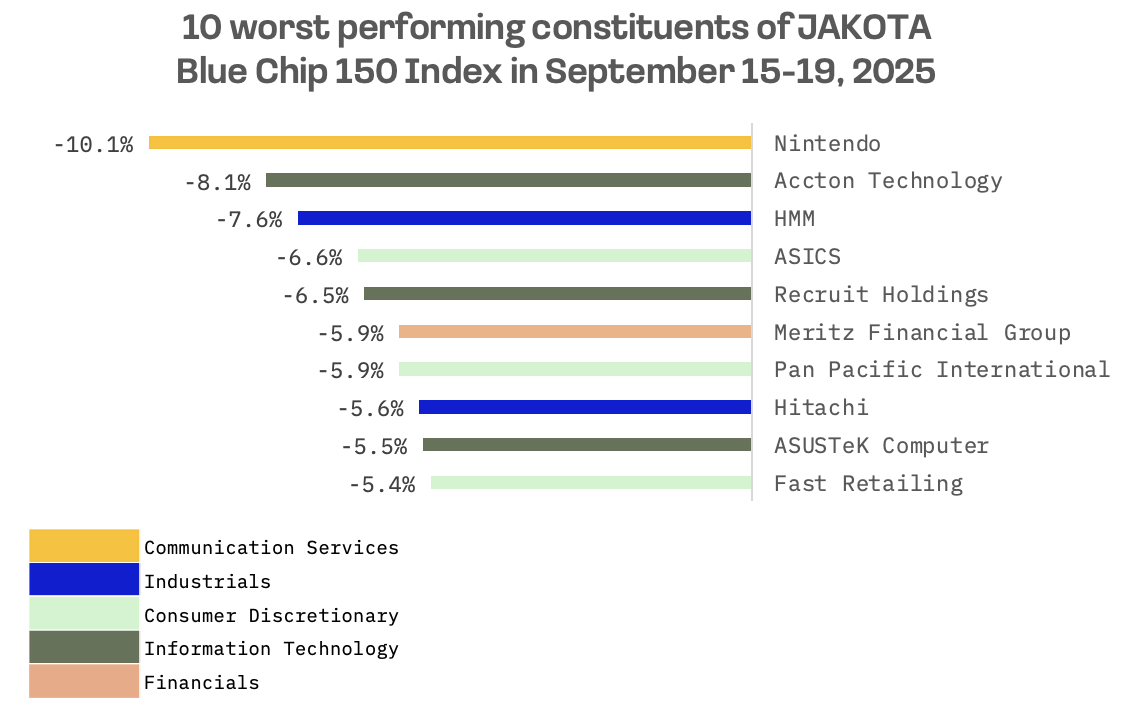

The JAKOTA Blue Chip 150 Index edged higher by 0.3% this week, with 58 of its 150 constituents posting gains.

Tech companies dominated the week’s top performers, with all 10 best performing stocks in the index coming from the tech sector amid a global tech stock rally. Two Japanese semiconductor manufacturing equipment giants – Disco and Tokyo Electron – surged more than 10% each on strong demand for semiconductor equipment, particularly for AI and advanced manufacturing applications.

Nintendo emerged as the index’s worst performer after Wedbush downgraded the Japanese video game giant to “neutral.” The wealth management and brokerage firm said much of the positive outlook is already reflected in the stock price, leaving limited near term upside potential.

Profit taking also weighed on Nintendo shares following recent gains, with some investors concerned that future growth could face constraints. Despite high expectations surrounding the Switch 2 console and Nintendo’s recent successes, any developments that fall short of elevated projections can trigger selloffs.