2024 proved to be a banner year for major initial public offerings (IPOs) across the Jakota markets, with 10 offerings exceeding $100 million in transaction volume. Two offerings stood out: Tokyo Metro and HD Hyundai Marine Solution set records as the largest in recent years for the Japanese and Korean markets, respectively.

| Issuer | Ticker | Exchange | Total Transaction Value, USD (Historical Rate) | First Day Return, % | Public Offerings Offer Date | Primary Industry |

| Tokyo Metro | 9023.TSE | TSE | 2,280.92M | 44.92% | October 23, 2024 | Rail Transportation |

| Rigaku Holdings Corporation | 268A.TSE | TSE | 738.84M | (10.32%) | October 25, 2024 | Machinery and Supplies and Components: Industrial |

| HD Hyundai Marine Solution | 443060.KO | KOSE | 536.32M | 96.52% | May 9, 2024 | Machinery and Equipment: Construction and Heavy Transportation |

| Shift Up Corporation | 462870.KO | KOSE | 315.30M | 18.33% | July 11, 2024 | Interactive Home Entertainment |

| Timee | 215A.TSE | TSE | 304.83M | 13.79% | July 26, 2024 | Human Resource and Employment Services |

| Trial Holdings | 141A.TSE | TSE | 294.56M | 29.41% | March 21, 2024 | Consumer Staples Merchandise Retail |

| Caliway Biopharmaceuticals | 6919.TW | TWSE | 214.85M | 43.61% | October 2, 2024 | Pharmaceuticals |

| Sanil Electric | 062040.KO | KOSE | 192.04M | 43.43% | July 29, 2024 | Electrical Components and Equipment: Heavy |

| Astroscale Holdings | 186A.TSE | TSE | 152.68M | 61.76% | June 5, 2024 | Aerospace and Defense |

| Intermestic | 262A.TSE | TSE | 116.86M | 21.53% | October 18, 2024 | Other Specialty Retail |

Source: Capital IQ.

Tokyo Metro

Tokyo Metro, one of Japan’s largest passenger railway operators, debuted on October 23, 2024, raising ¥348.6 billion ($2.3 billion). The shares were priced at ¥1,200, at the top of their range, marking Japan’s largest IPO since 2018 and signalling robust investor confidence in the company’s established presence and growth potential.

Following the IPO, the company expanded internationally by joining a consortium to operate London’s Elizabeth line, its first overseas venture. Tokyo Metro is pursuing growth through mergers and acquisitions, targeting opportunities in real estate and distribution.

Rigaku Holdings Corporation

Rigaku Holdings Corporation, a leader in scientific instruments with a focus on X ray technologies, raised ¥112.3 billion in its IPO on October 25, 2024. Despite strong market interest, its shares, priced at ¥1,260, dropped 10% on their first trading day.

Post-IPO, Rigaku has emphasised its semiconductor business, rebranding a key subsidiary as Rigaku Semiconductor Instruments and expanding globally with a new facility in Cleveland, Ohio.

HD Hyundai Marine Solution

South Korea’s HD Hyundai Marine Solution, a top independent vessel aftermarket provider, completed its IPO on May 9, 2024, raising ₩742.3 billion. Priced at ₩83,400 per share, the stock nearly doubled on its debut, posting the highest first day return among the top 10 IPOs of 2024 in the Jakota markets.

The company has since secured strategic investments to enhance its maritime data analytics platform and is pursuing dominance in the global ship repair market, driven by rising demand for LNG carrier retrofitting and stricter environmental regulations.

Shift Up Corporation

Shift Up Corporation, the South Korean developer of hit game Goddess of Victory: Nikke and PlayStation 5 exclusive Stellar Blade, raised ₩435 billion in its July 11, 2024, IPO. Shares surged 49% in initial trading but settled with an 18% gain on the first day. Institutional investors oversubscribed nearly 226 times the allocated shares, while the general offering was oversubscribed by more than 341 times, underscoring investor confidence in its innovative game portfolio.

The company is developing a new cross-platform game, codenamed “Witches,” and exploring sequels and PC expansions for Stellar Blade. The IPO has solidified Shift Up’s position as a major player in South Korea’s gaming sector.

Timee

Japan’s on demand job platform Timee Inc. raised ¥46.8 billion ($307 million) during its IPO on July 26, 2024, with shares priced at ¥1,450. The company’s service addresses labor market gaps by offering spot work, connecting employers with workers seeking short term jobs at specific times and locations. The stock rose as much as 28% on its first trading day.

Timee is expanding its services into hotels, nursing care and manufacturing, while exploring potential acquisitions to strengthen its market position.

Trial Holdings

Japanese discount retailer Trial Holdings raised ¥44.6 billion in its IPO on March 21, 2024. The stock, with an initial value of ¥1,700 per share, opened at ¥2,215, up 30%.

The company plans to use the proceeds to expand its store network, logistics infrastructure and technology driven retail solutions.

Caliway Biopharmaceuticals

Taiwan’s Caliway Biopharmaceuticals raised NT$6.4 billion on October 2, 2024, the largest biotech IPO in the nation’s history. Valued at nearly $3 billion, Caliway is advancing its flagship product, CBL-514, an injectable treatment for subcutaneous fat reduction, with global Phase 3 trials planned for mid-2025.

Sanil Electric

South Korea’s Sanil Electric, which specialises in power converters, raised ₩266 billion on July 29, 2024. The company is expanding production capacity and exploring vehicle to grid (V2G) technologies to support renewable energy advancement.

Astroscale Holdings

Japanese space company Astroscale Holdings Inc., which offers commercial services for space debris removal, raised ¥21.2 billion in its June 5, 2024, IPO. The company has since achieved a milestone in its Astroscale-Japan (ADRAS-J) mission and partnered with the U.K. Space Agency to develop innovative cleanup technologies.

Post-listing, Astroscale has advanced its on orbit servicing technologies and expanded globally. The company completed the rendezvous phase of its Active Debris Removal by ADRAS-J mission and initiated proximity approach to a large piece of debris. Astroscale is also advancing its Cleaning Outer Space Missions through Innovative Capture (COSMIC), in collaboration with the U.K. Space Agency.

Intermestic

Japanese eyewear maker Intermestic Inc. raised ¥17.16 billion ($116.09 million) in its IPO on October 18, 2024.

After its IPO, Intermestic has concentrated on expanding its product portfolio and reinforcing its market position. The company reported strong sales growth in December 2024, driven by successful launches such as the ‘Zoff | Sanrio Characters’ collection. Strategic collaborations and new product offerings have significantly boosted its sales performance, further cementing its standing in the eyewear market.

The top 10 IPOs in the Jakota markets underscore the diverse range of companies seeking public capital. While first day returns varied significantly, investor sentiment towards new listings remained positive overall.

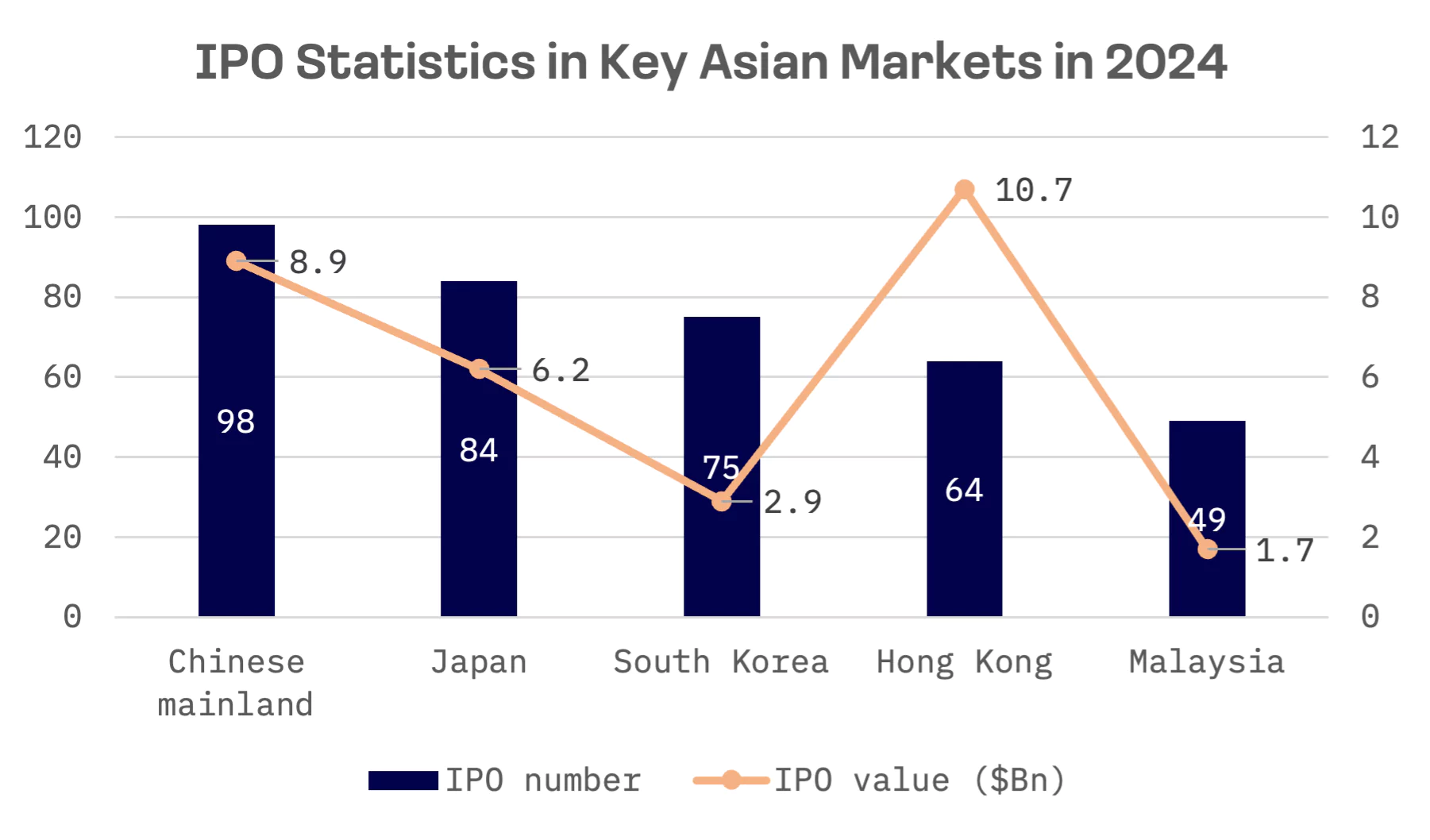

Among key Asian markets, Japan and South Korea rank third and second in total IPO numbers, trailing only mainland China. In terms of value, both markets lag behind mainland China and Hong Kong.

EY research shows that IPO returns in South Korea underperformed other Asian markets as the broader South Korean market faced significant pressure throughout 2024.

Note: IPO return represents year-to-date (YTD) change in common share pricing of newly listed companies, weighted by market capitalisation, compared to their offer prices at the time of listings.

In conclusion, the year marked a pivotal period for IPO markets in Japan, South Korea and Taiwan, with several high profile listings setting new regional benchmarks. The performance of these IPOs will serve as a key indicator of broader economic health across the Asia Pacific region as investors closely monitor shifting trends in these dynamic markets.