Last week’s Jakota markets:

- Japan’s Nikkei 225 Index rallied 5.1% on Takaichi’s LDP leadership victory, but coalition partner Komeito’s withdrawal clouded the political outlook

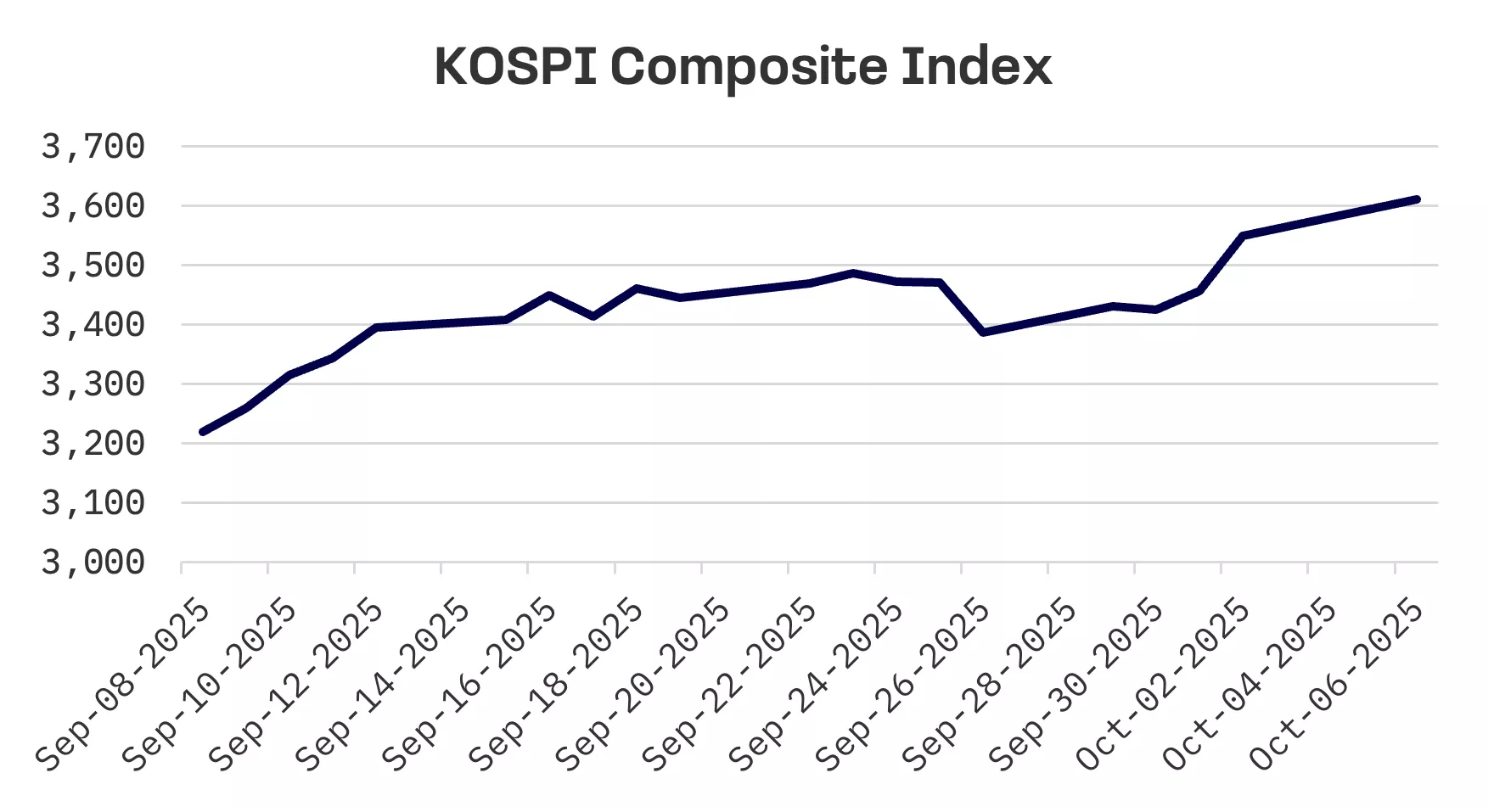

- South Korea’s KOSPI jumped 1.7% to a record high above 3,600, powered by semiconductor giants Samsung and SK Hynix after the Chuseok holiday

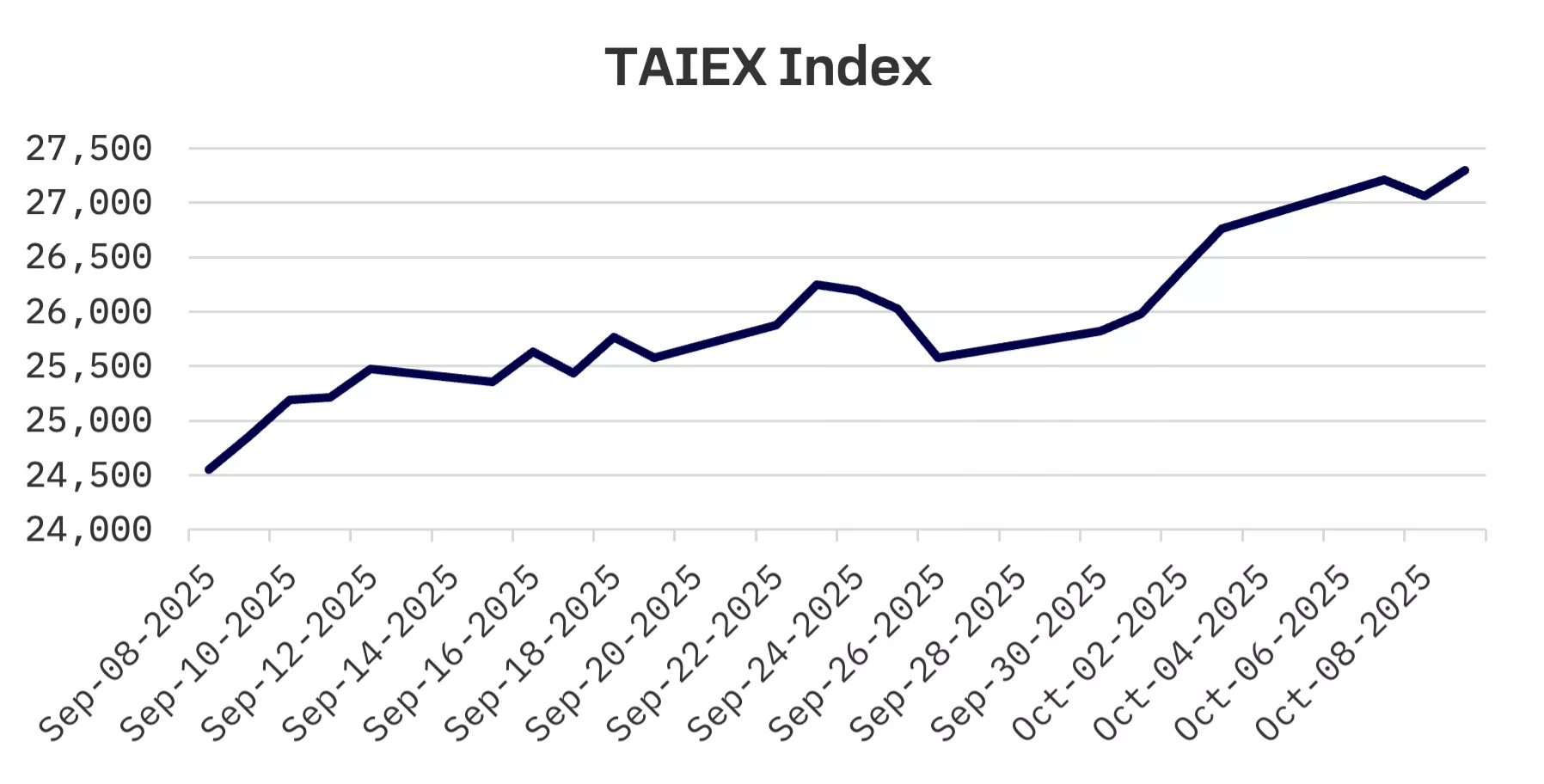

- Taiwan’s TAIEX index climbed 2% to close above 27,000, riding momentum from the AMD-OpenAI collaboration announcement

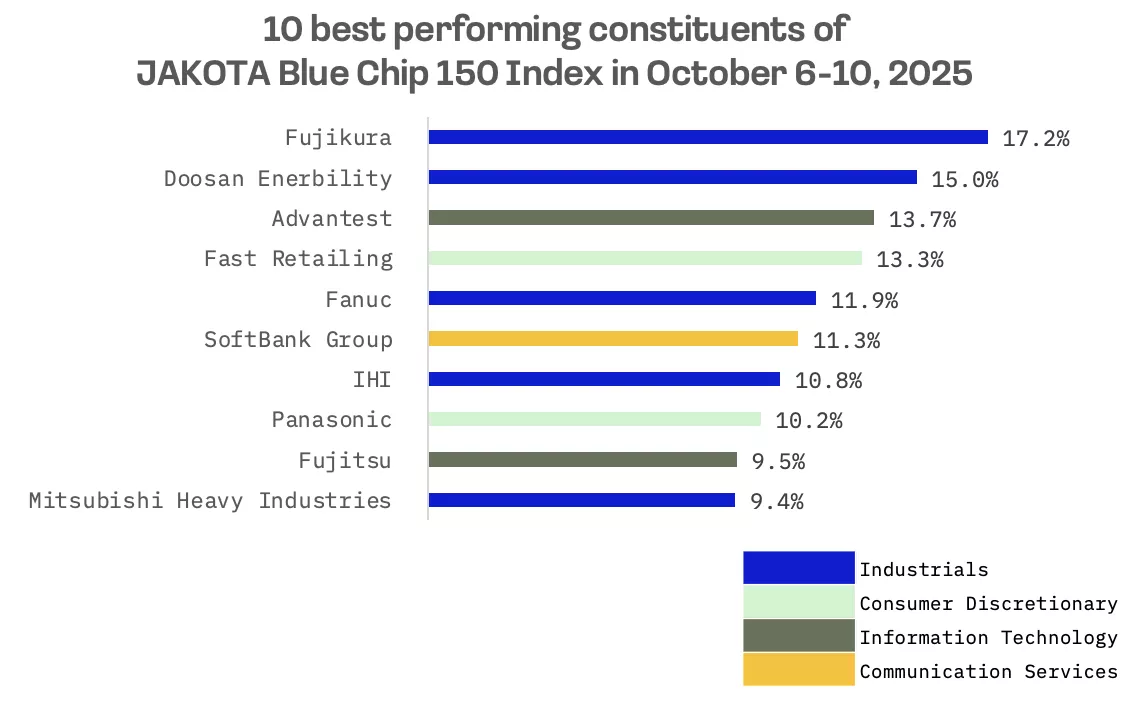

- The JAKOTA Blue Chip 150 Index rose 0.2%, led by Japanese fibre optic maker Fujikura’s 17% surge on OpenAI investment news

Japan

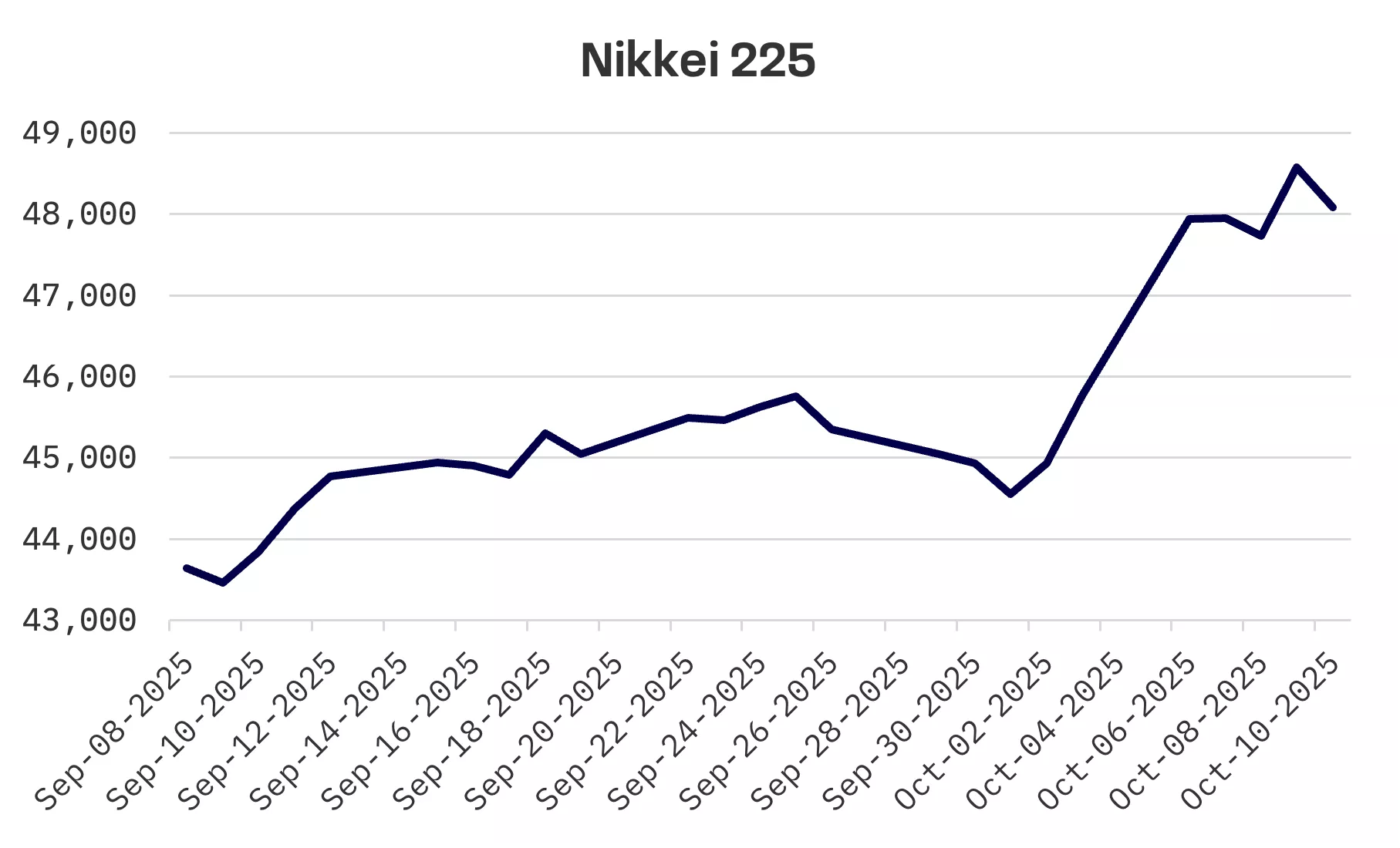

Japan’s stock market surged this week, with the Nikkei 225 advancing 5.1% as investors welcomed Sanae Takaichi’s victory in the Liberal Democratic Party leadership contest. Market participants bet that her administration would pursue expansionary fiscal policies while maintaining the Bank of Japan’s (BoJ) ultra accommodative monetary stance.

The optimism proved short lived. After Friday’s close, the Komeito party – the LDP’s longtime coalition partner – announced it was abandoning the alliance, citing disagreements over policy direction and the government’s response to a political funding scandal. The bombshell development cast doubt on Takaichi’s prospects of becoming prime minister and fuelled speculation that she might call a snap election to secure a mandate.

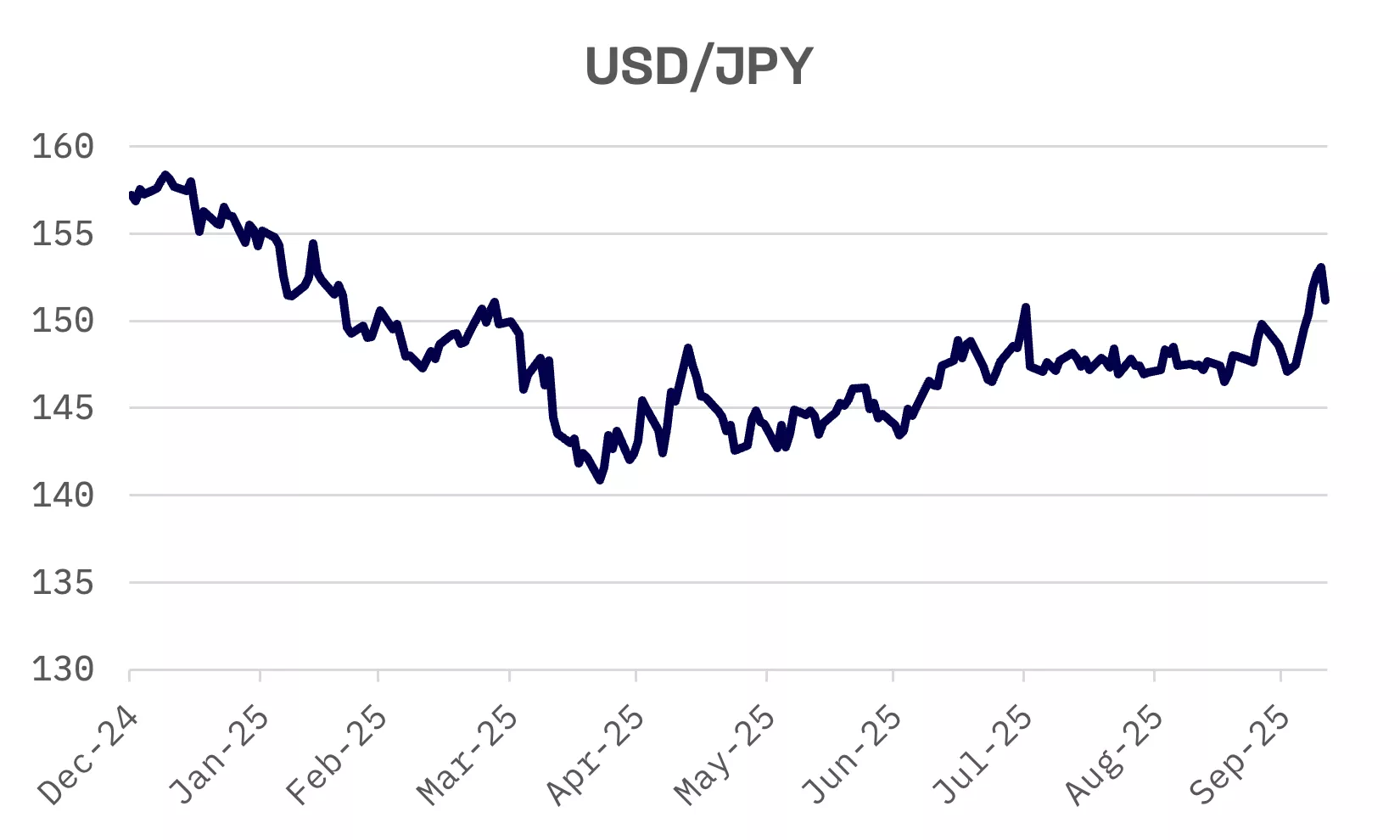

The yen weakened sharply, sliding to around ¥152.8 against the dollar from roughly ¥147.5 a week earlier. Takaichi declined to share her views on potential interest rate increases, prompting traders to pare back bets on near term monetary tightening by the BoJ and adding further pressure on the currency.

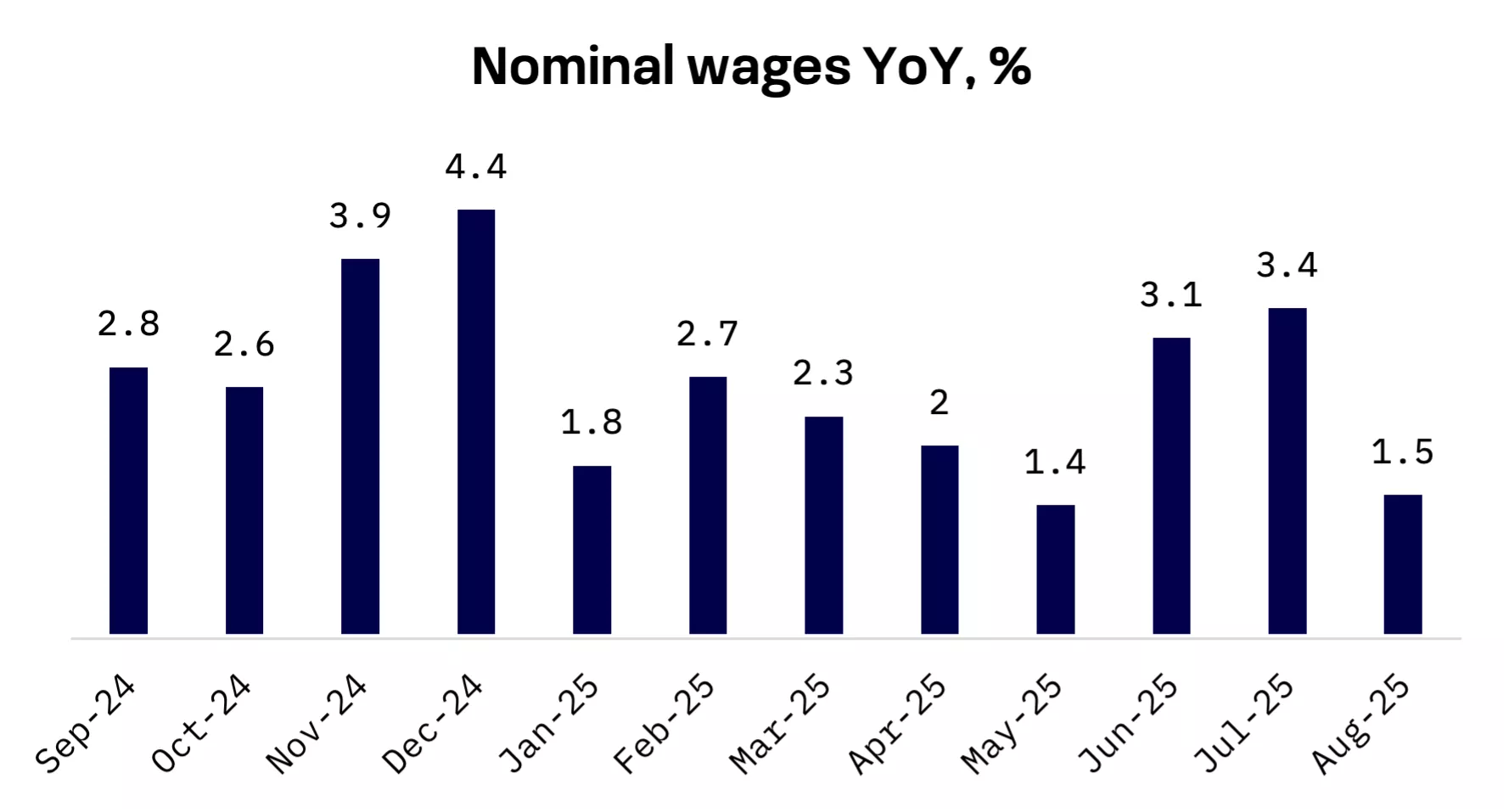

Economic data painted a mixed picture. Wage growth decelerated more than expected in August, with nominal average wages rising just 1.5% from a year earlier – below market expectations for a 2.7% gain and down from a revised 3.4% increase in July. Real wages contracted for an eighth month straight, highlighting the ongoing squeeze on Japanese households’ purchasing power.

Consumer spending, however, showed unexpected resilience. Household expenditures rose 2.3% from a year earlier, nearly doubling forecasts for 1.2% growth and accelerating from July’s 1.4% gain.

South Korea

South Korean stocks roared back from a weeklong Chuseok holiday break, with the KOSPI jumping 1.7% on Friday to close above 3,600 for the first time on record. Samsung Electronics and SK hynix powered the advance.

The technology heavy index benefitted from a global semiconductor rally that unfolded while Korean markets were closed. Sentiment received an additional boost from reports that Samsung was working to restore partnerships with U.S. chipmakers Qualcomm and Intel. SK hynix shares gained after Washington approved Nvidia Corp.’s sale of advanced chips for AI projects in the United Arab Emirates (UAE), a development that benefits the Korean company as a key Nvidia supplier.

On the diplomatic front, South Korean Finance Minister Koo Yoon-cheol is set to meet U.S. Treasury Secretary Scott Bessent in Washington this month, the Ministry of Economy and Finance said. The talks come as both nations seek to break a deadlock in tariff negotiations that have snagged over details of Seoul’s promised $350 billion U.S. investment package.

Taiwan

Taiwanese stocks extended their rally in a holiday shortened week, with the TAIEX climbing 2% to finish above 27,000. The electronics sector led gains following news of a collaboration between AI chipmaker AMD and AI developer OpenAI.

JAKOTA Blue Chip 150 Index

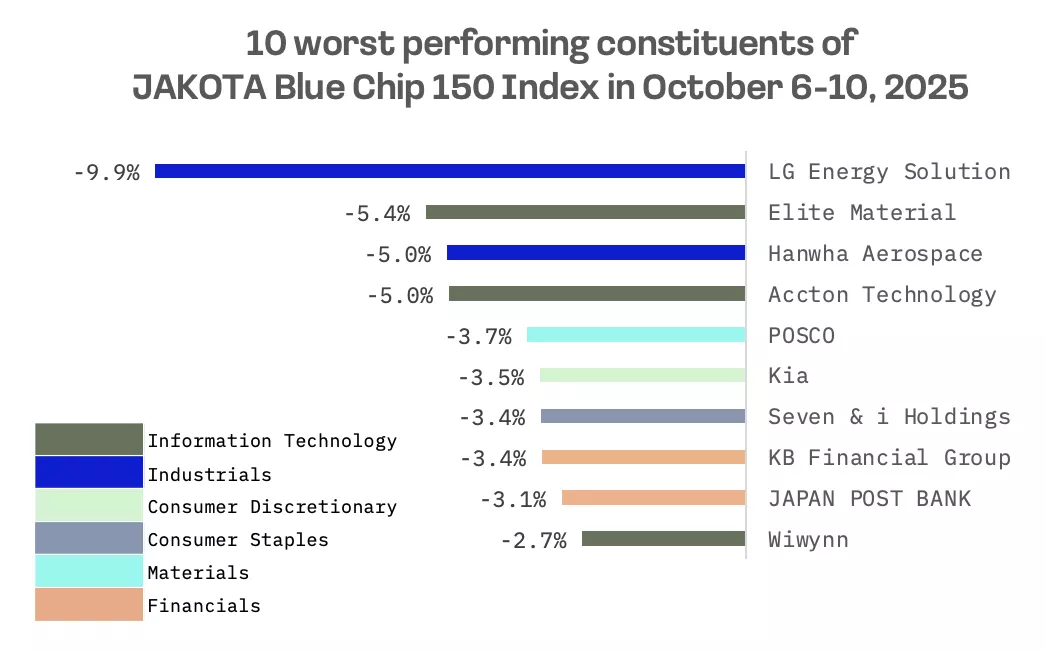

The JAKOTA Blue Chip 150 Index edged up 0.2% for the week, with 97 of its 150 constituents posting gains.

Fujikura, a Japanese electrical equipment manufacturer known for its high density fibre optic cables used in AI and data centre applications, topped the index with a 17% surge. The stock rallied on news that OpenAI was investing alongside AMD in large scale data centre development.

LG Energy Solution, a South Korean manufacturer of lithium ion batteries for the automotive industry, led the losses on the JAKOTA Blue Chip 150 Index this week. The company’s sharp drop this week was not driven by any business or financial deterioration but by a technical anomaly related to the options expiration timing.

South Korea’s extended Chuseok holiday (October 3-9) forced the monthly futures and options expiration to occur roughly a week earlier than its typical second Thursday schedule, creating confusion among some traders. The calendar shift triggered automated buying by liquidity providers in after hours trading on October 2, artificially inflating the stock price. When markets reopened post holiday, shares snapped back to their appropriate level as the distortion unwound.