Last week’s Jakota markets:

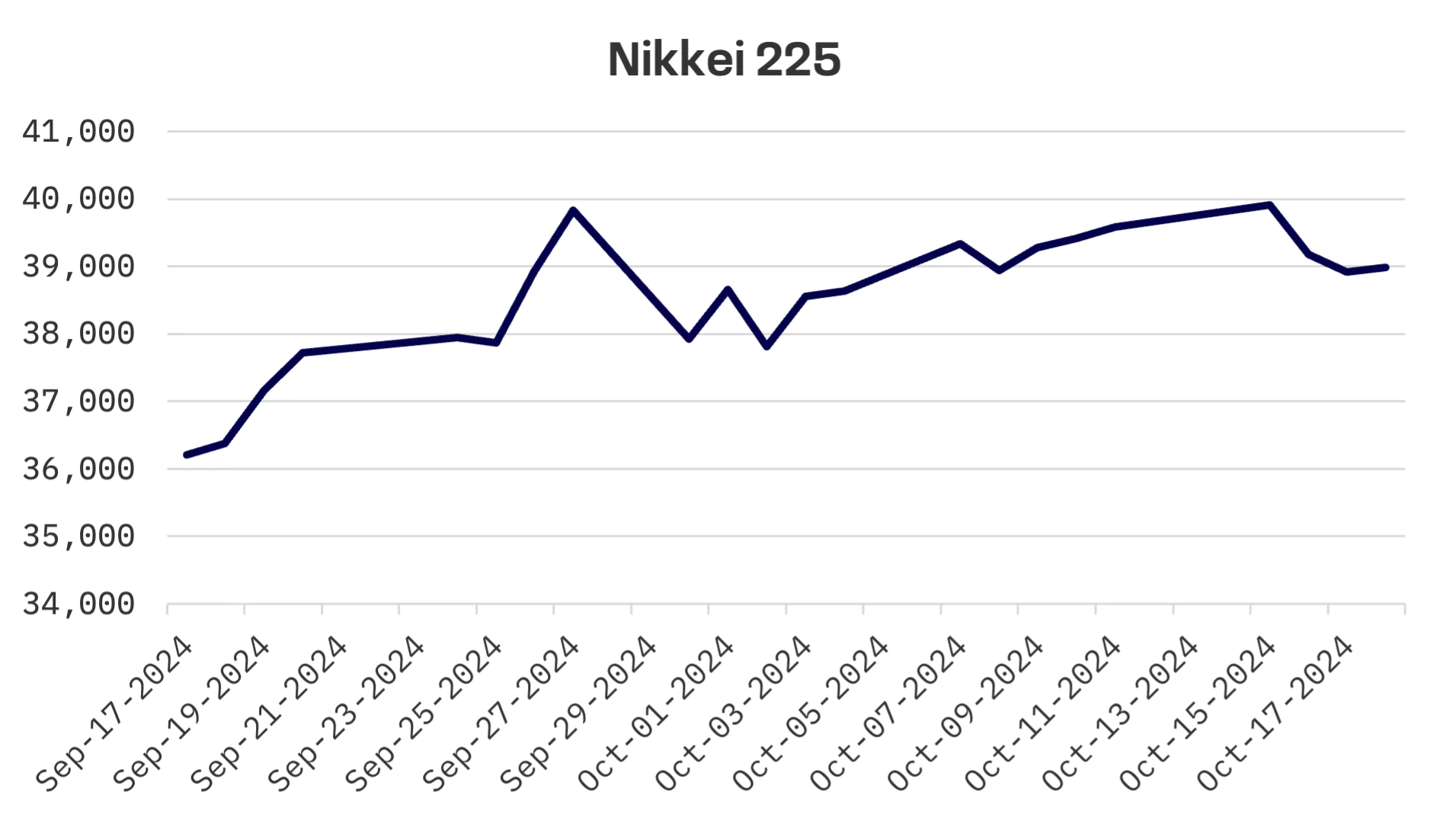

- Japan’s Nikkei 225 Index fell 1.6%, as softer inflation data sparked speculation about potential BoJ policy pauses

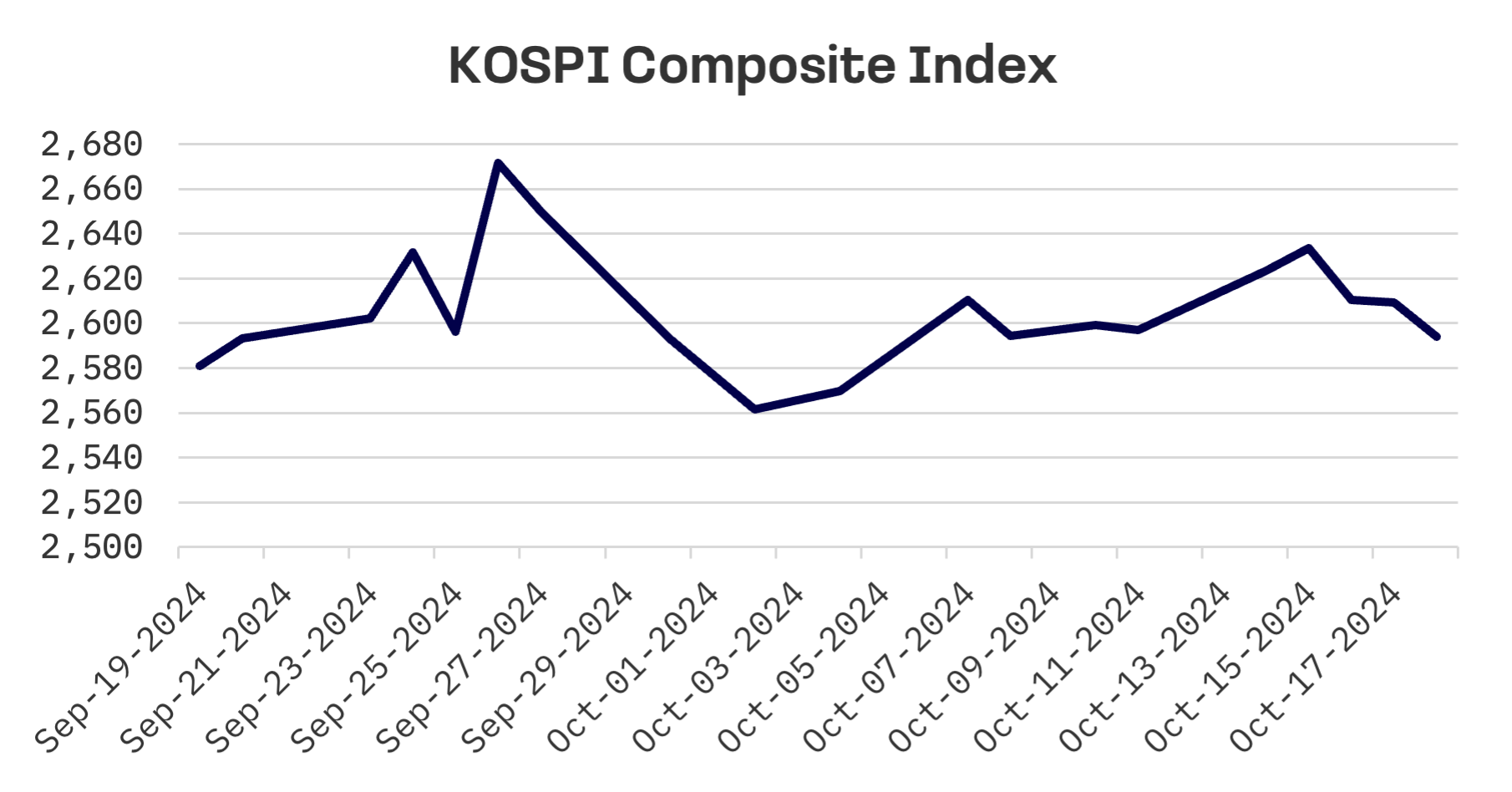

- South Korea’s KOSPI edged down 0.1%, despite early gains, as foreign investors sold off tech and battery stocks

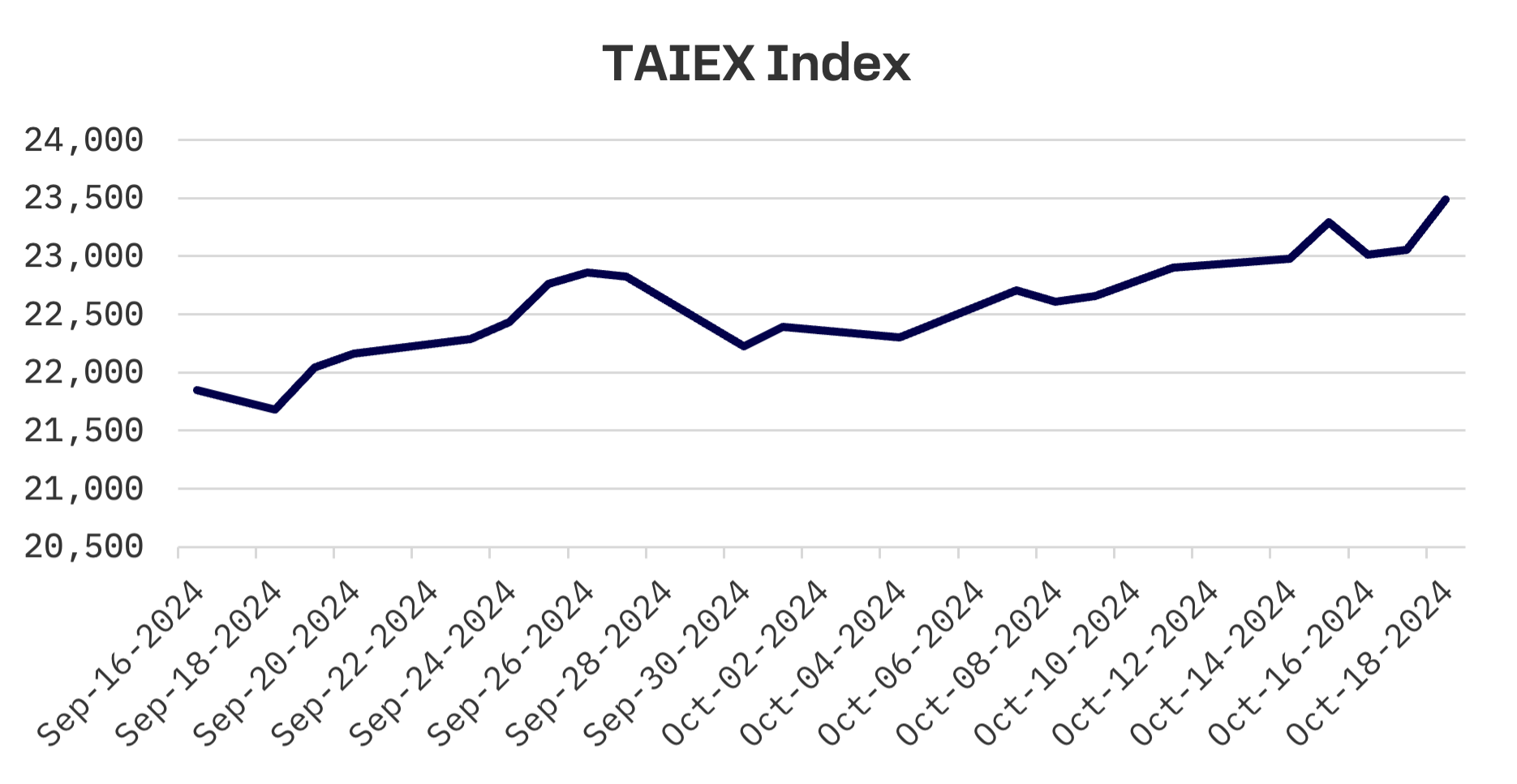

- Taiwan’s TAIEX index outperformed with a 2.6% gain, driven by TSMC’s record profits and optimistic sales forecast

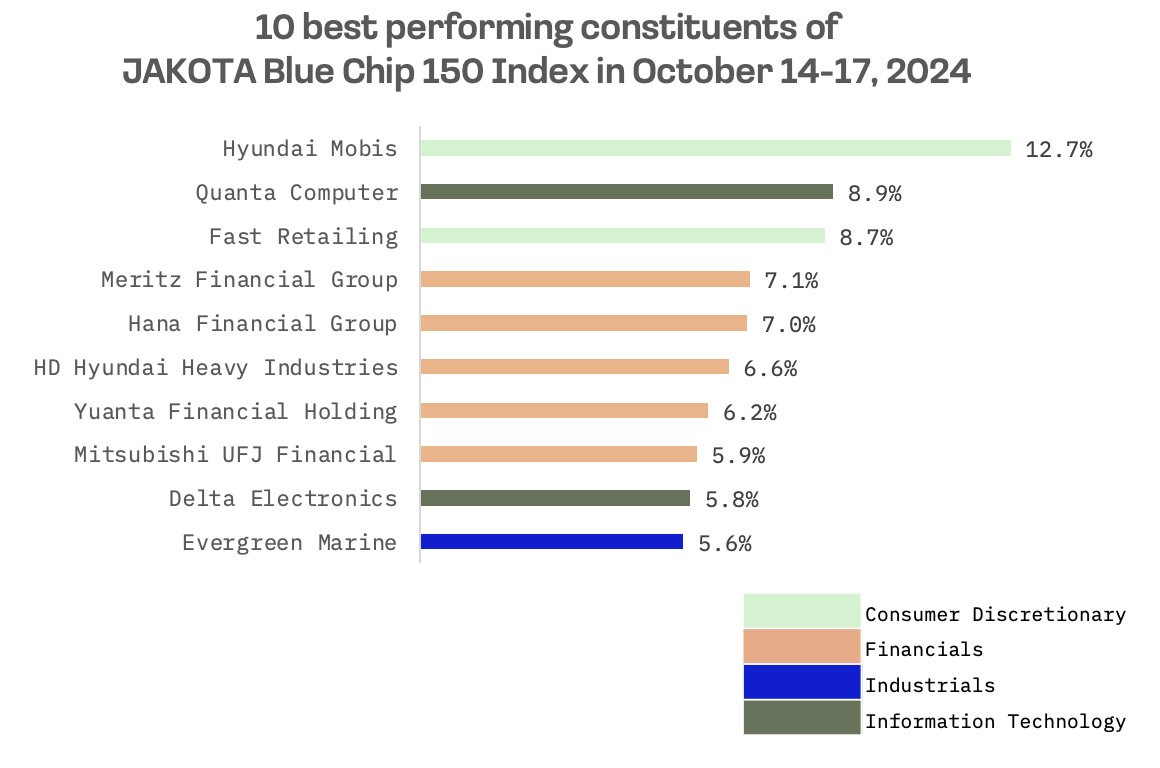

- The JAKOTA Blue Chip 150 Index retreated 0.7%, showcasing stark contrasts between top and bottom performers

Japan

Japan’s stock markets declined last week, with the Nikkei 225 Index falling 1.6%. Softer than expected domestic inflation in September fuelled speculation that the Bank of Japan might pause further interest rate hikes for the rest of the year.

Bank of Japan (BoJ) officials recently indicated that conditions for starting monetary policy normalisation are in place. BoJ Board Member Seiji Adachi noted the wide range of items seeing price increases. However, he emphasised that rate hikes should proceed gradually, warning against abrupt policy shifts amid uncertainties in the global economic outlook and domestic wage growth.

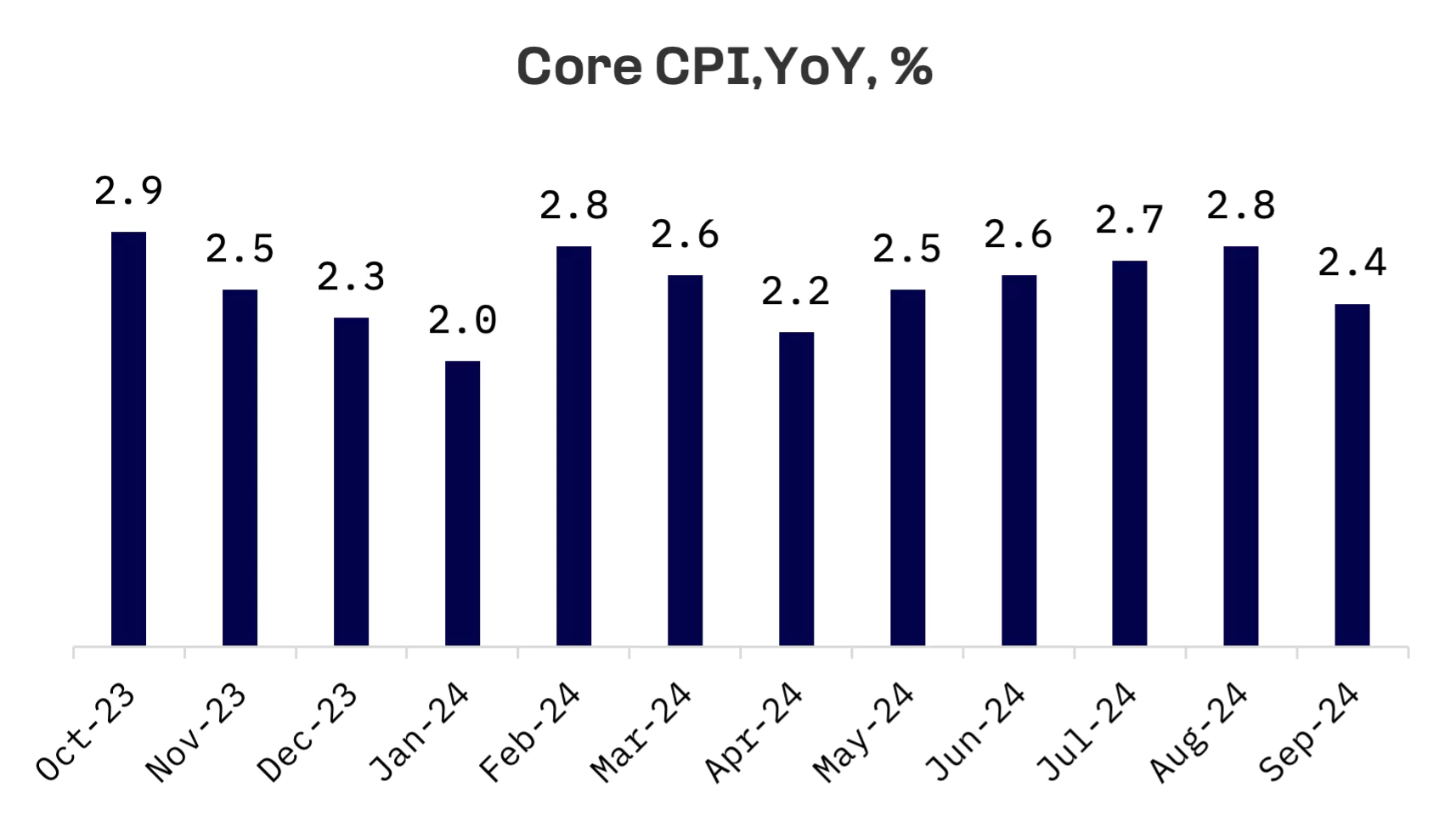

Japan’s core consumer price index (CPI), which excludes fresh food but includes energy products, rose 2.4% year-over-year in September, down from 2.8% in August. This cooling in inflation aligns with expectations following the reinstatement of electricity and gas subsidies.

In addition, Japan’s exports fell 1.7% in September, the first decline in 10 months, driven by weak demand from China. Imports rose 2.1%.

South Korea

South Korea’s stock market also dipped, with the KOSPI Index declining 0.1% this week. The market saw gains early in the week, driven by advances in tech stocks and foreign buying. However, the trend reversed midweek as tech stocks retreated amid earnings concerns. Foreign investors continued selling large cap tech and battery stocks through Friday.

Despite the market downturn, South Korea’s exports of information and communication technology (ICT) products surged for the eleventh consecutive month in September, fuelled by record semiconductor sales, according to data released on Monday. Outbound shipments of ICT goods reached $22.4 billion, a 24% increase from $18.04 billion a year earlier, according to the Ministry of Science and ICT.

Taiwan

Taiwan’s stock market bucked the regional trend, with the TAIEX climbing 2.6%. The rally was led by Taiwan Semiconductor Manufacturing Co. (TSMC), which reported record high net profit for the third quarter and raised its 2024 sales growth forecast to nearly 30%.

TSMC Chairman and CEO C.C. Wei stated that the ongoing boom driven by the AI era is expected to see chips used in tech devices, including graphics processing units (GPUs), AI accelerators and AI servers, account for approximately 15% of total sales in 2024. Given these favourable conditions, Wei projected TSMC’s 2025 sales to grow nearly 30% year-over-year, up from the previous estimate of 24-26%.

JAKOTA Blue Chip 150 Index

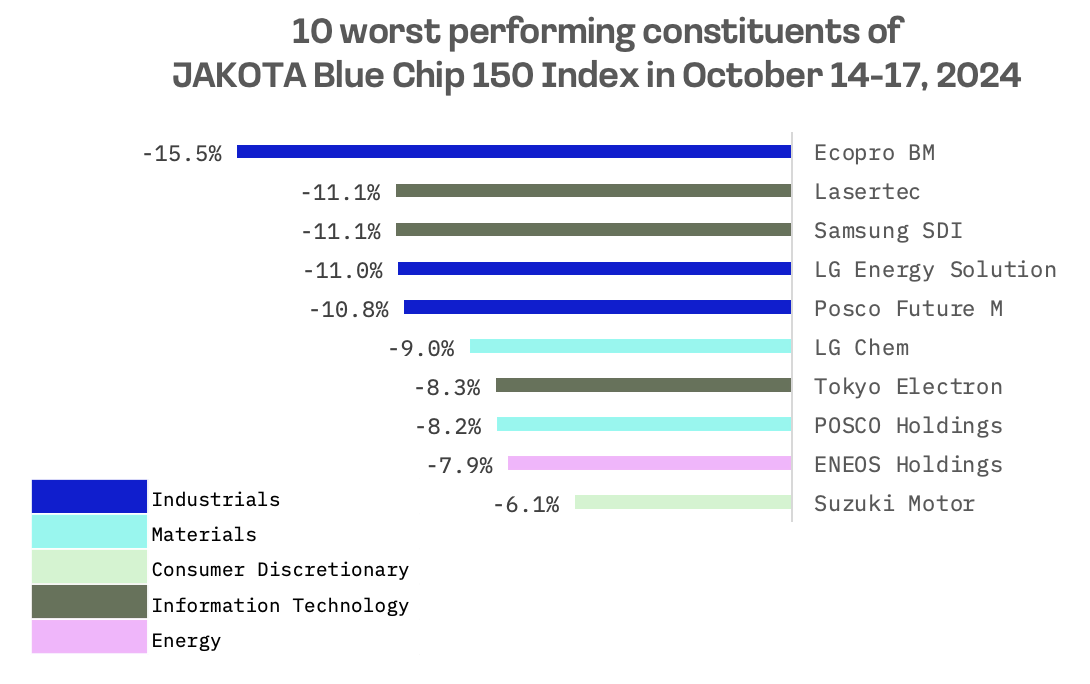

The JAKOTA Blue Chip 150 Index declined 0.7% for the week, with 62 out of 150 constituents posting gains.

Hyundai Mobis, a South Korean car parts company, was the top performing stock, gaining 12.7%. The company is expanding its electrification business by establishing a new production hub for key electric vehicle components in Europe. On October 16, Hyundai Mobis announced an investment agreement with the Slovak government to build a new plant for producing PE systems in Novaky and expand its existing facility in Zilina to produce electric vehicle braking systems. This will be its third such facility in the region, following plants in the Czech Republic and Spain.

EcoPro BM, a South Korean secondary battery materials producer, was the worst performer on the JAKOTA Blue Chip 150 Index this week, reinforcing its reputation as one of the index’s most volatile components. The stock plunged 15.5%, a stark reversal from its 5.6% gain the previous week. This sharp decline followed KB Securities’ decision to lower its target price for EcoPro BM from ₩270,000 to ₩210,000, citing expectations that the company’s third quarter performance would fall short of market consensus.