Last week’s Jakota markets:

- Japan’s Nikkei 225 struggled against global market pressures, ending the week slightly lower by 0.36% despite a strong start influenced by positive Nvidia earnings

- South Korea’s KOSPI ended the week with a loss of 1.4%, reversing gains as global economic data led to profit-taking

- Taiwan’s TAIEX surged by 1.4%, spurred by Nvidia’s earnings impact and strong investor interest in AI technologies

- The JAKOTA Blue Chip 150 Index saw a slight decline of 0.4%, with standout performances from MS&AD Insurance offset by losses in materials and industrials

Japan

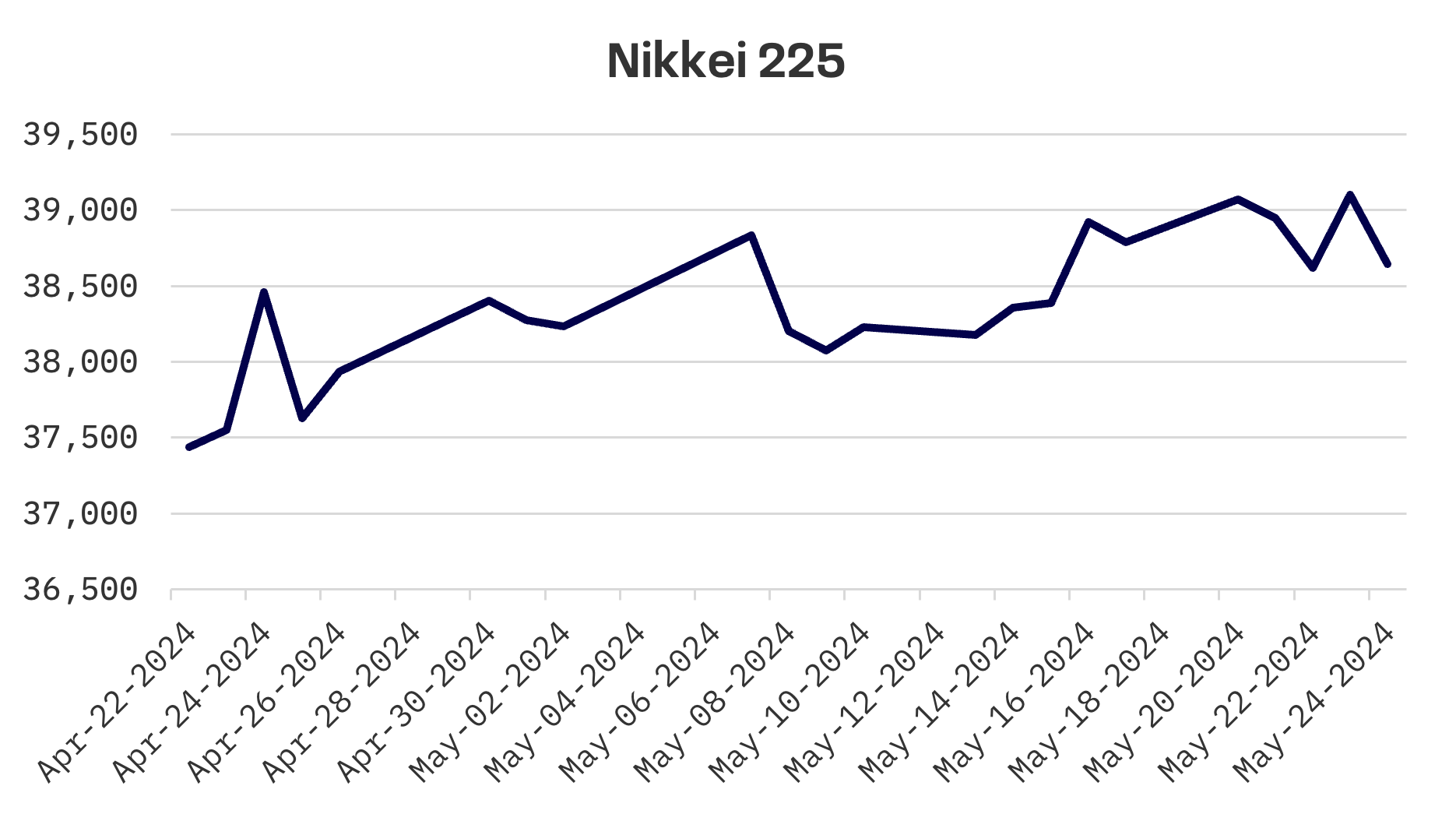

The Nikkei 225 Index closed the week slightly lower, down by 0.36%. The week began on a positive note, driven by upbeat economic data releases and strong earnings from Nvidia Corp., which lifted Japanese tech stocks. However, these gains were negated by Friday’s drop, influenced by U.S. economic data that dampened hopes for a near-term interest rate cut by the Federal Reserve.

The Bank of Japan (BoJ) recently shifted to a more hawkish policy in an attempt to bolster the yen, which continues to languish near 24-year lows. Despite these efforts, the currency struggled, ending the week around JPY 157 against the USD. This persistent weakness raises concerns about its impact on Japan’s emerging inflation and wage growth prospects. Additionally, robust U.S. economic data and hawkish minutes from the Federal Reserve’s latest policy meeting have further strengthened the U.S. dollar, countering the effects of any potential interventions by Japanese authorities aimed at supporting the yen.

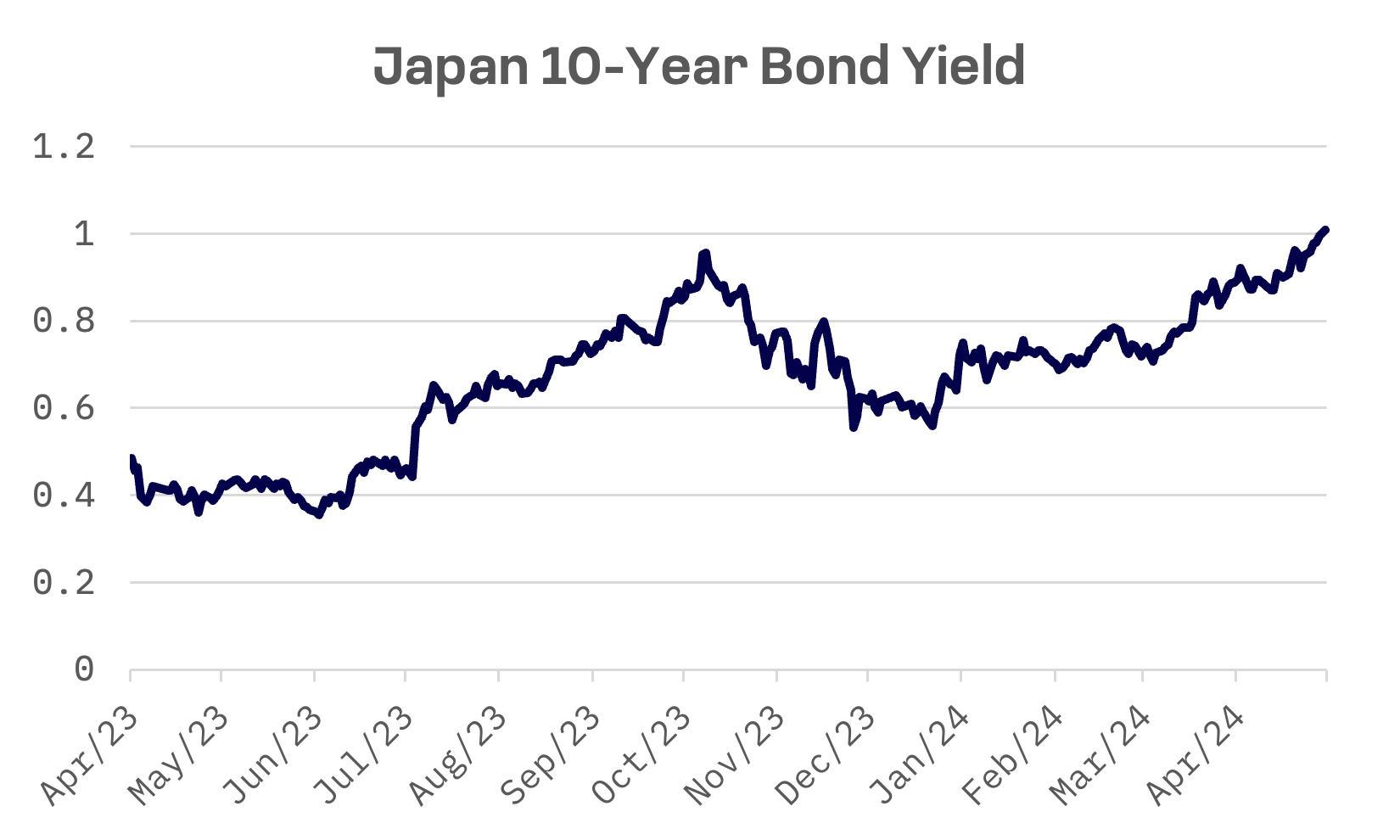

Japanese government bond yields have risen steadily, with the 10-year yields climbing more than 25 basis points since the end of March. This increase followed the BoJ’s first rate hike since 2007 and was fuelled by speculation about further tightening and a possible reduction in the government’s bond purchase program, pushing yields to 1.0% mid-week.

Flash economic data released during the week indicated a rebound in Japanese manufacturing for May, with the PMI increasing to 50.5 from 49.6 in April, marking the first expansion in over a year. The services PMI dipped slightly to 53.6 from 54.3, though it remained in expansion territory.

South Korea

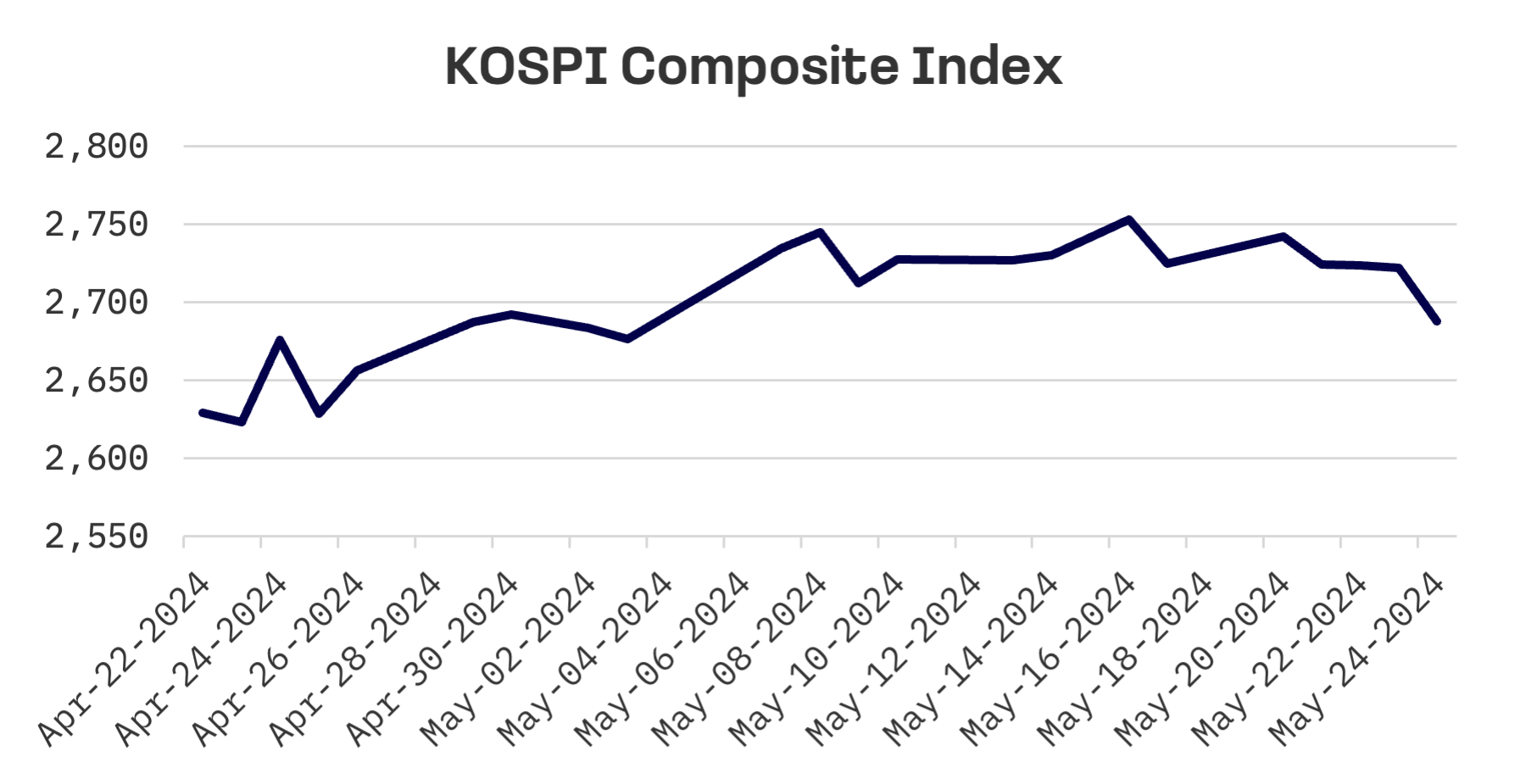

The Korean stock market experienced its second consecutive week of declines, with the KOSPI index falling by 1.4%. The week started on a high note with gains in chip and auto sectors lifting the index, but these early gains did not hold. Despite relatively stable performance mid-week, the final trading session saw all of the week’s gains erased.

In a widely expected decision, the Bank of Korea (BOK) held its policy rate steady at 3.5% for the 11th consecutive session, citing persistent inflation and a stronger than expected economic outlook.

Additionally, South Korea is considering a partial lift of its short-selling ban in June, ahead of the full removal scheduled for July.

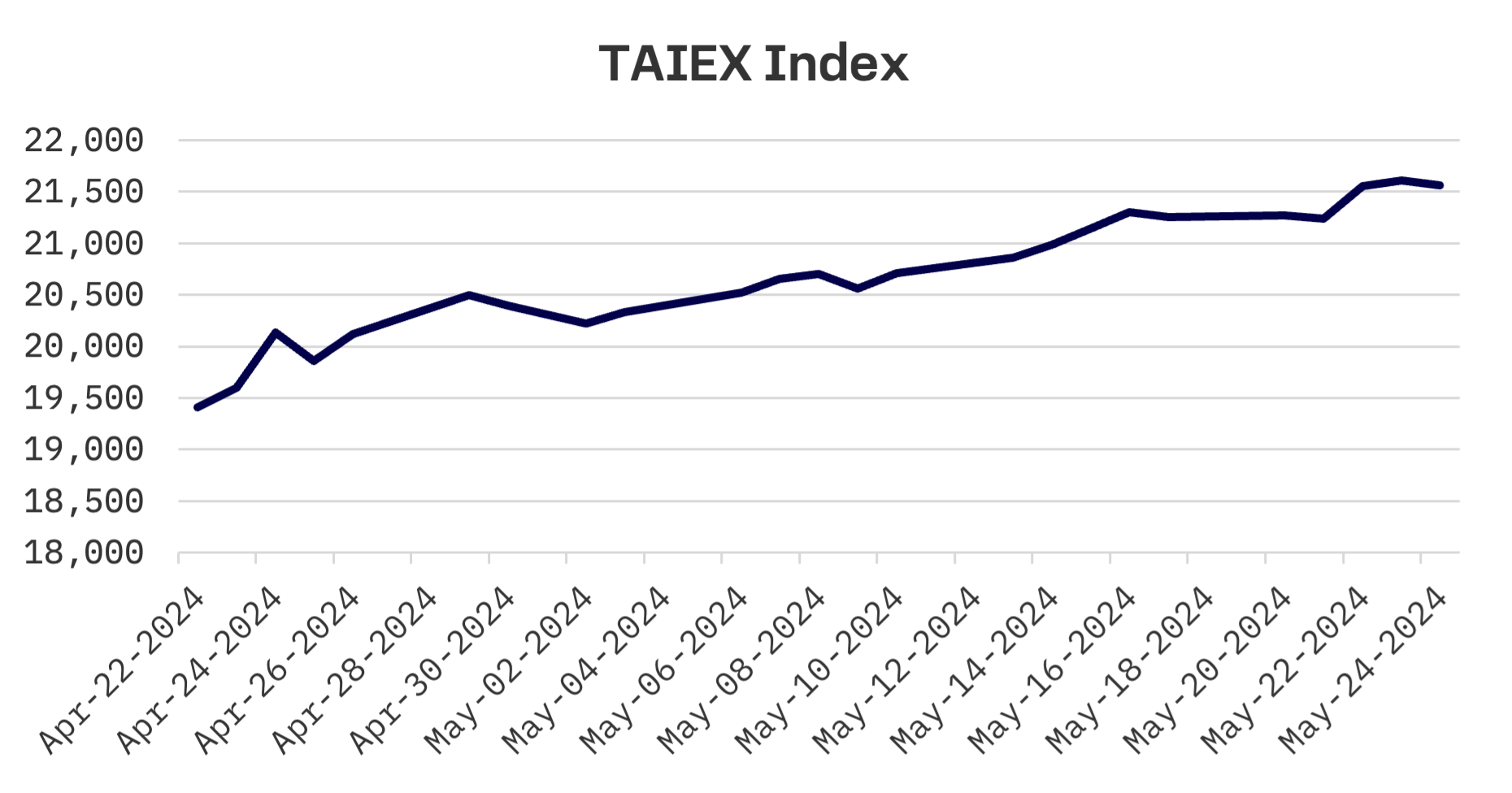

Taiwan

Taiwan’s TAIEX index was the standout among the Jakota markets, gaining 1.4% for the week. On Thursday, shares closed at a new high as investors scrambled to buy shares of contract chipmaker Taiwan Semiconductor Manufacturing (TSMC) and other AI-related stocks. The buying spree was driven by investor optimism following the strong first-quarter earnings report from U.S.-based AI chip designer Nvidia Corp., which exceeded consensus estimates.

On the economic data front, Taiwan saw a significant uplift in market sentiment following the release of various datasets. Export orders for April soared by over 10 percent, outpacing earlier estimates from the Ministry of Economic Affairs (MOEA), largely driven by robust global demand for emerging technologies, particularly in AI development.

Moreover, the Taiwan Institute of Economic Research (TIER) reported a modest improvement in business sentiment within the local manufacturing sector for April. This came despite the ongoing global economic slowdown. The TIER’s composite index, which gauges the mood among manufacturers, increased by 0.35 points from the previous month to 98.67.

According to the Directorate General of Budget, Accounting and Statistics (DGBAS), Taiwan’s unemployment rate in April fell to its lowest level for the month since 2000, dropping to 3.36%, reflecting strong domestic demand in the post-COVID-19 recovery phase.

JAKOTA Blue Chip 150 Index

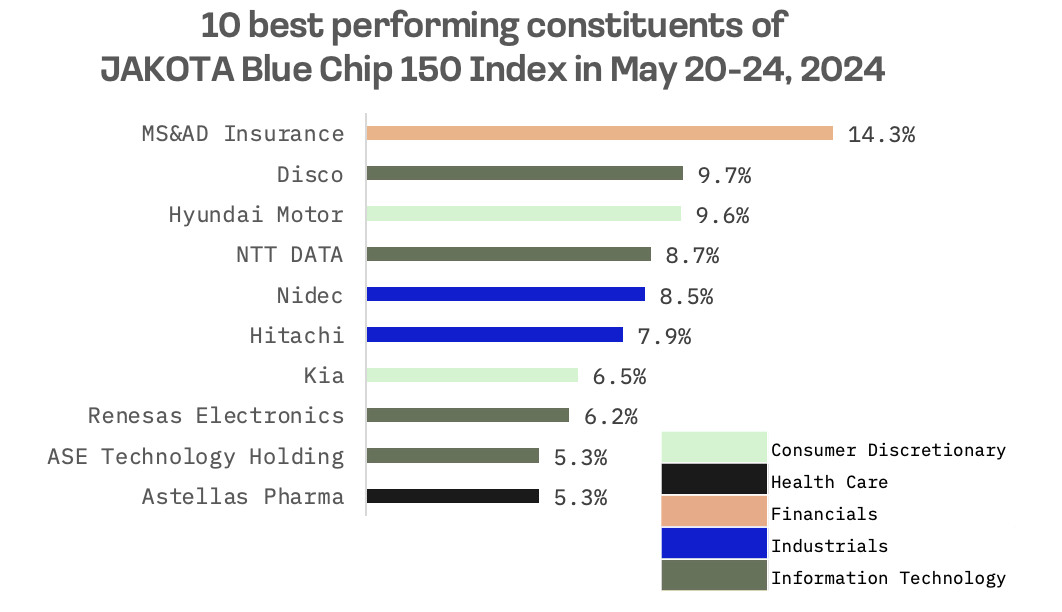

The JAKOTA Blue Chip 150 Index fell slightly by 0.4% this week. Out of 150 constituents, 62 stocks showed positive trends.

MS&AD Insurance, one of the world’s largest non-life insurers, stood out as the week’s top performer in the JAKOTA Blue Chip 150 Index, with an impressive gain of 14.3%. The company reported robust financial results for the fiscal year 2024 on Monday, with revenue rising by 23% and net income surging by 129% compared to the previous fiscal year.

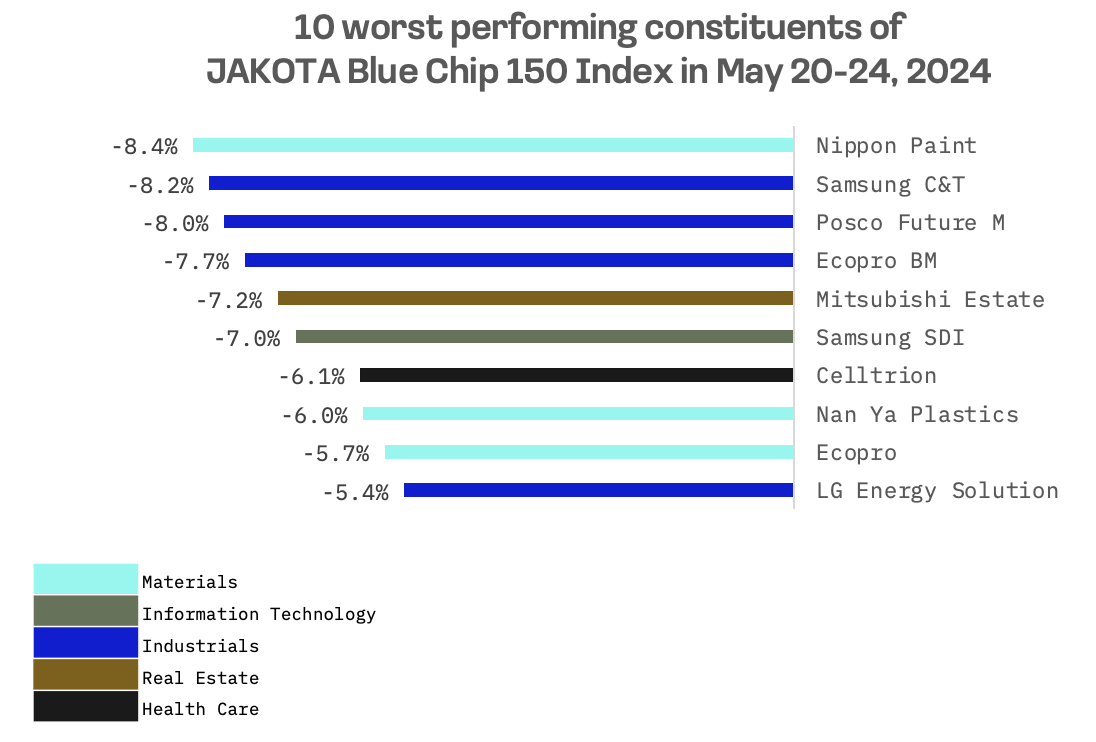

This week, the top losers in the JAKOTA Blue Chip 150 Index were predominantly represented by companies from the materials and industrials sectors.

Nippon Paint led the decliners, with its shares falling 8.4% over the week. The company’s first-quarter financial results, released on May 15th, showed a 10.6% increase in revenue and a 15.9% rise in operating profit, initially well-received by investors, leading to more than a 5% increase in stock price. However, this optimism faded quickly, and despite the positive financial results, the stock experienced a significant downturn by week’s end.