Last week’s Jakota markets:

- Japan’s Nikkei 225 Index managed a 1.5% increase despite significant economic headwinds and a lacklustre yen, finding support in global rate cut prospects

- South Korea’s KOSPI Index ended the week slightly lower by 0.1%, with early gains erased by investor caution ahead of key U.S. economic data

- Taiwan’s TAIEX Index led with a 2.7% gain, boosted by strong performances in the electronics sector and favourable U.S. market influences, despite a Friday dip

- The JAKOTA Blue Chip 150 Index saw a general upturn of 1.4%, highlighted by a strong recovery in Sony Group’s stock despite last week’s financial concerns

Japan

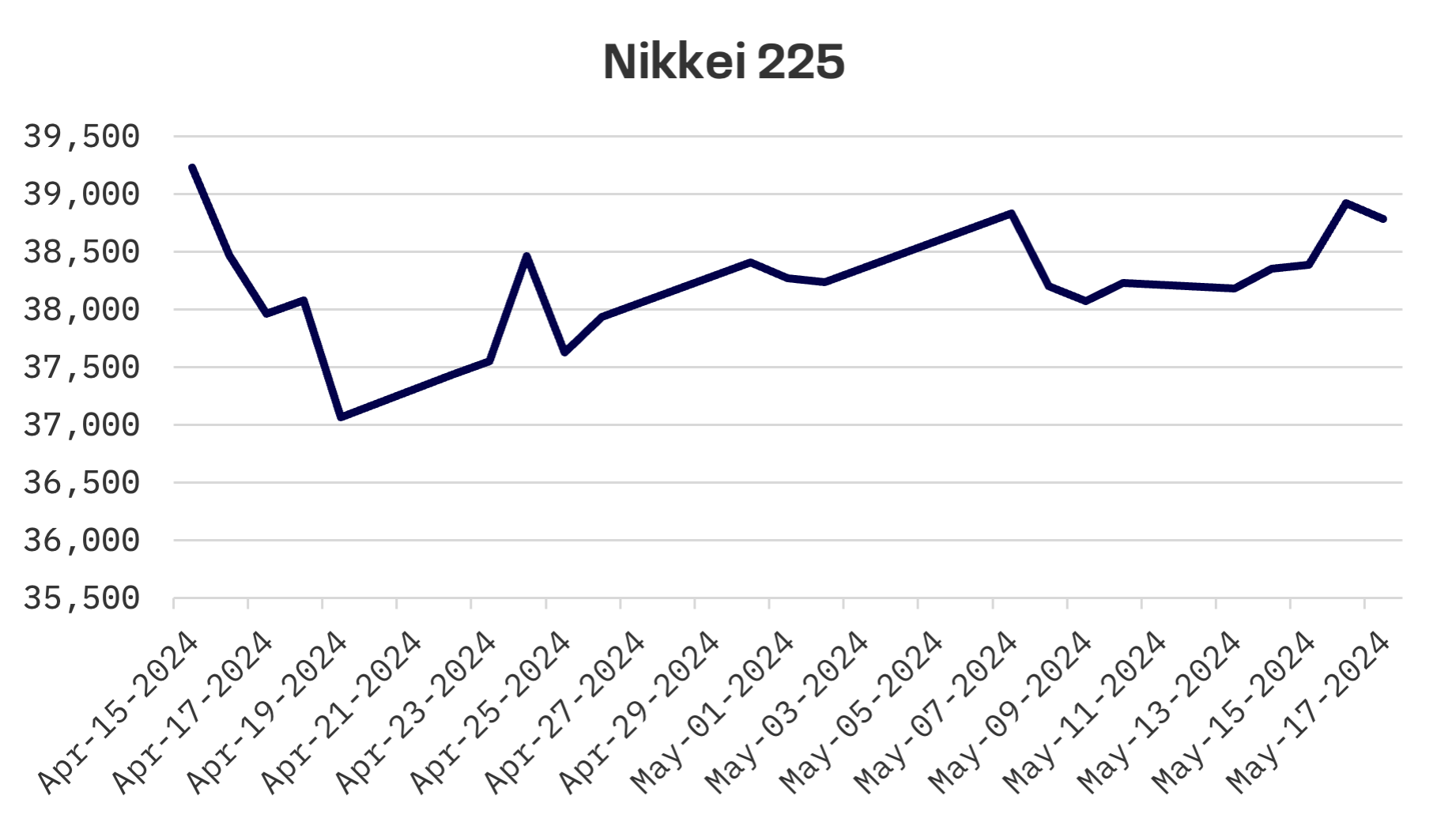

The Nikkei 225 Index closed the week up 1.5%, despite a backdrop of economic downturn and a yen that remained weak but stable, shaped by market expectations of potential U.S. interest rate cuts.

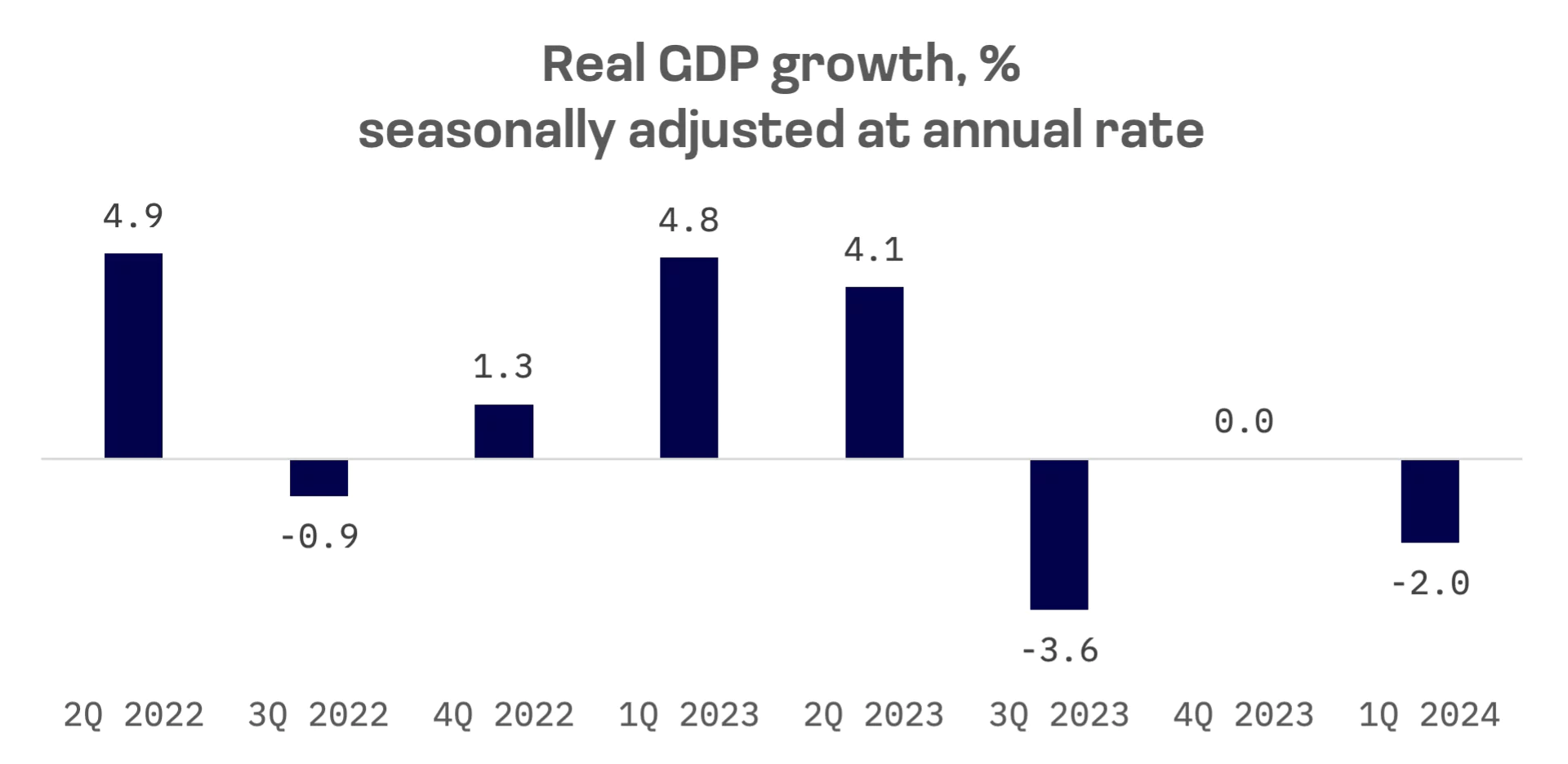

The Japanese economy contracted by an annualised 2.0% in the first quarter, a sharper decline than anticipated, partly due to the January earthquake in the Noto Peninsula and disruptions in auto production. While public demand and private inventories lent some support, capital expenditure and external demand remained weak.

The yen was relatively stable, ending the week in the high-JPY 155 range against the USD. This stability is tied to expectations that the U.S. Federal Reserve may cut interest rates twice this year, which could narrow the interest rate differential with Japan and potentially support the yen. Despite its low levels, the yen showed signs of resilience, buoyed by speculation of intervention by Japanese authorities in the forex markets.

South Korea

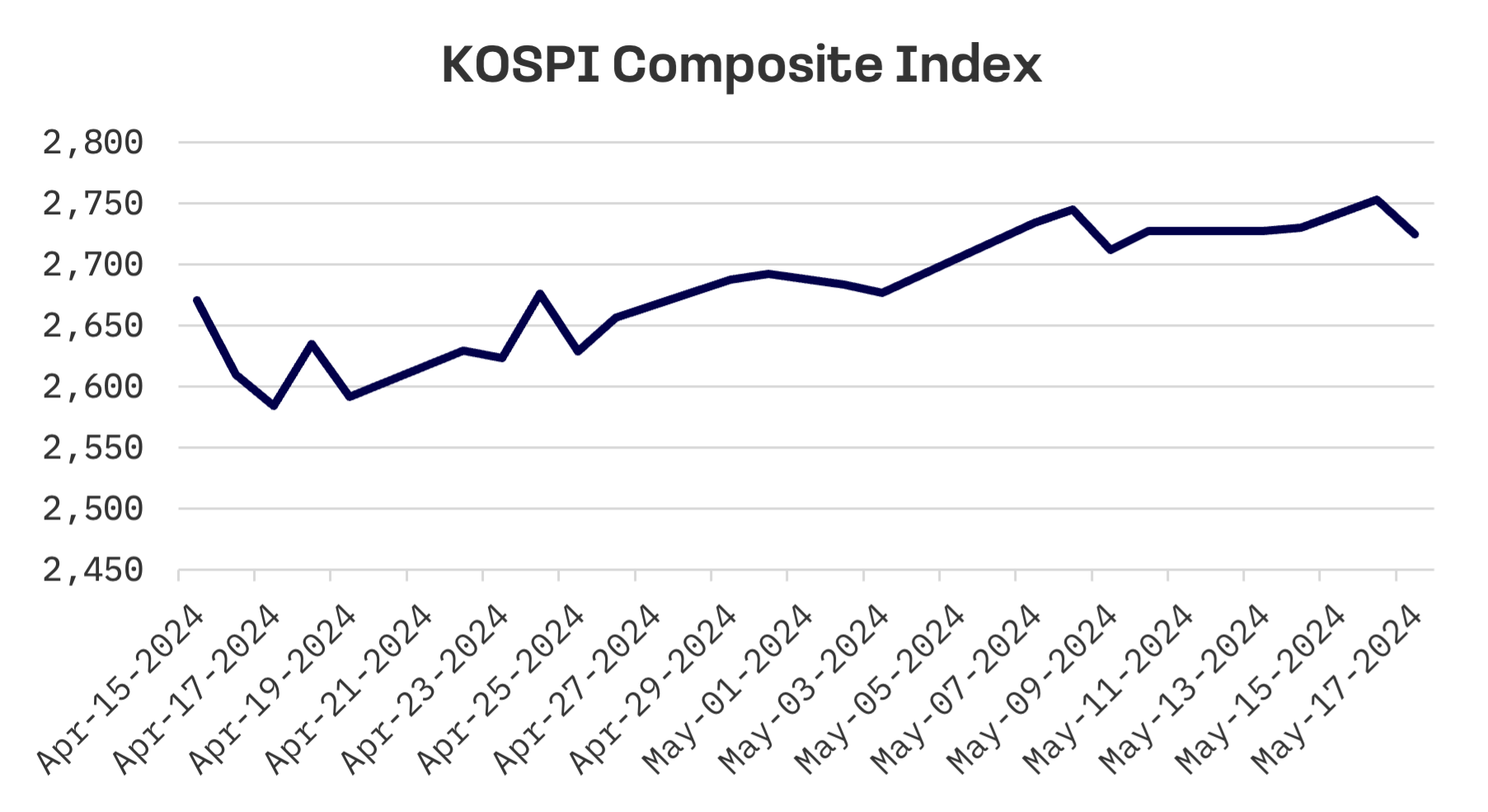

The South Korean stock market’s three-week rally came to an end, with the KOSPI index slightly down by 0.1%.

The fluctuation in stock prices was influenced by expectations surrounding U.S. inflation data, which is anticipated to affect the Federal Reserve’s upcoming rate decisions. While the market started the week flat, it briefly rebounded by nearly 1% on Thursday amid optimism about potential U.S. rate cuts, only to retreat on Friday as investors took profits.

Economic indicators were more positive: South Korea added over 200,000 jobs in April, bolstered by a significant increase in manufacturing employment linked to strong export growth. Exports in April rose 13.8% to $56.3 billion, with a notable 54.5% surge in semiconductor sales, underscoring the country’s leading export sector, according to customs data.

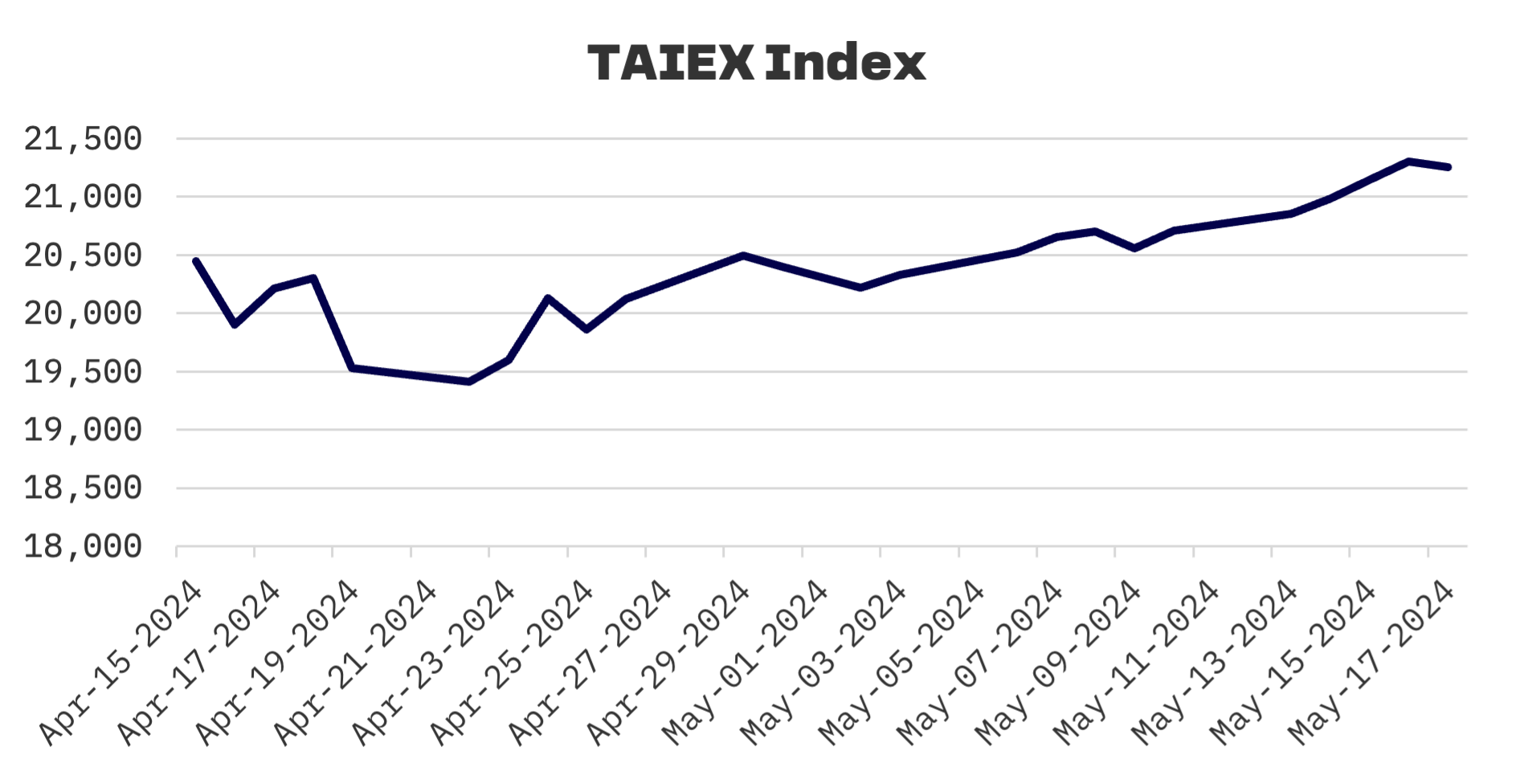

Taiwan

Taiwan’s TAIEX index outperformed other Jakota markets, rising 2.7%. The market grew over five consecutive sessions, extending from last week into this week, but faced a downturn on Friday due to selling pressure in the electronics sector, reflecting losses in U.S. tech stocks.

On Thursday, the market reached a new high, closing above the 21,300-point mark, driven largely by gains in the electronics sector. Shares of Taiwan Semiconductor Manufacturing (TSMC) reached new heights following the company’s strong April sales report.

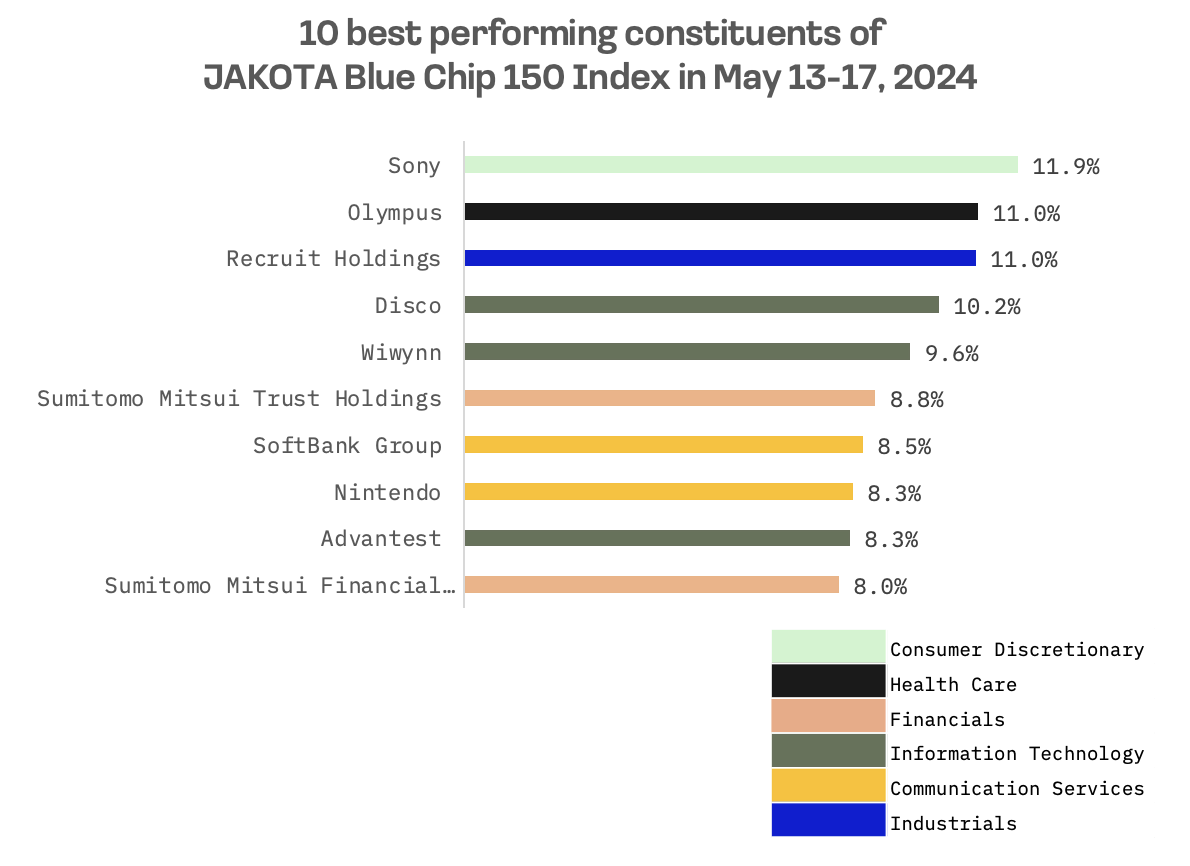

JAKOTA Blue Chip 150 Index

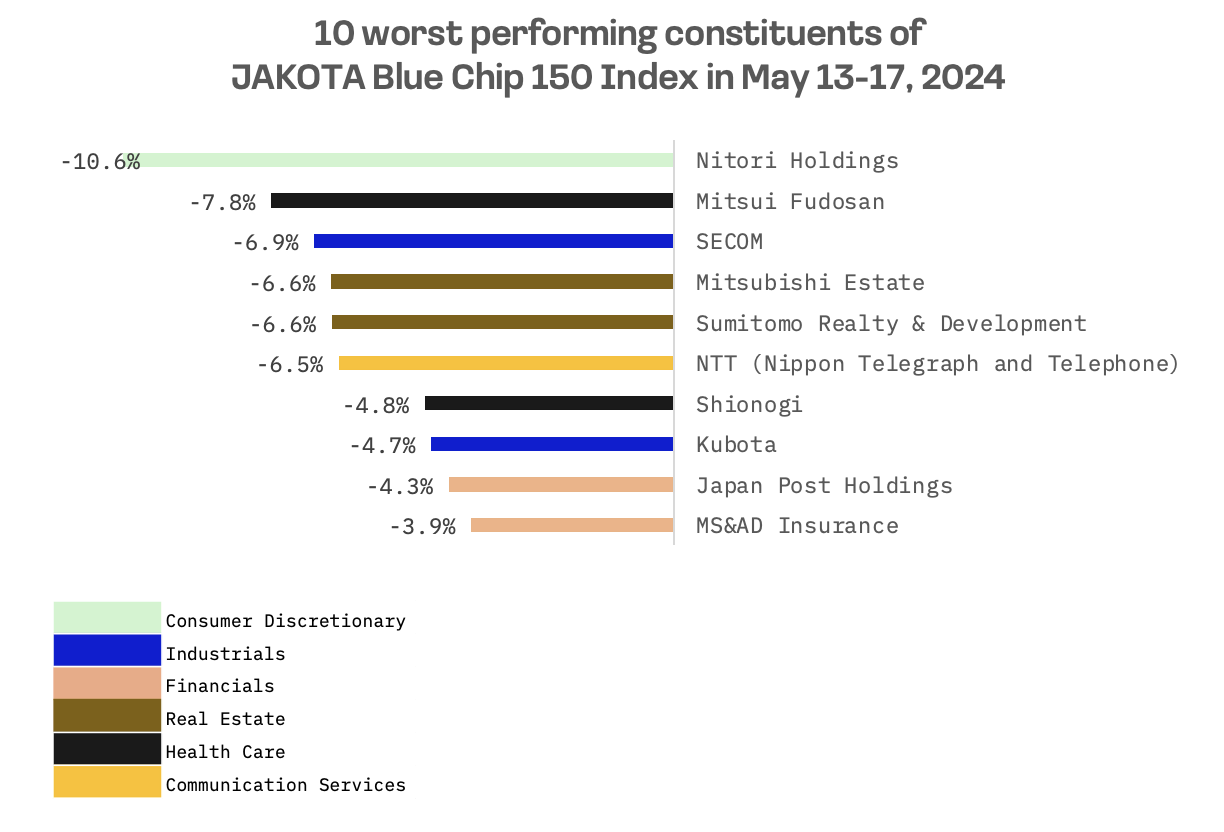

The JAKOTA Blue Chip 150 Index rose by 1.4% over the week. Out of 150 companies, 83 recorded gains.

Sony Group, which faced a sharp decline last week due to financing concerns related to its proposed acquisition of Paramount Global, rebounded strongly. The company’s shares surged nearly 12%, underpinned by a significant jump in profit driven by its Gaming and Movie divisions. Sony reported a 34% increase in net profit year-over-year, supported by record-high consolidated sales and operating income for fiscal 2023. Notable growth was also seen in its Music and Pictures segments, while the Imaging & Sensing Solutions segment benefitted from robust demand for mobile image sensors and favourable exchange rates.

Conversely, Nitori Holdings, a Japanese furniture and home accessories retail company, saw its shares tumble more than 10% following the announcement of disappointing financial results for fiscal 2024, which fell short of forecasts. While the company projected a recovery for fiscal 2025, the anticipated profit levels did not meet market expectations, adding downward pressure on its stock price.