Last week’s JAKOTA markets:

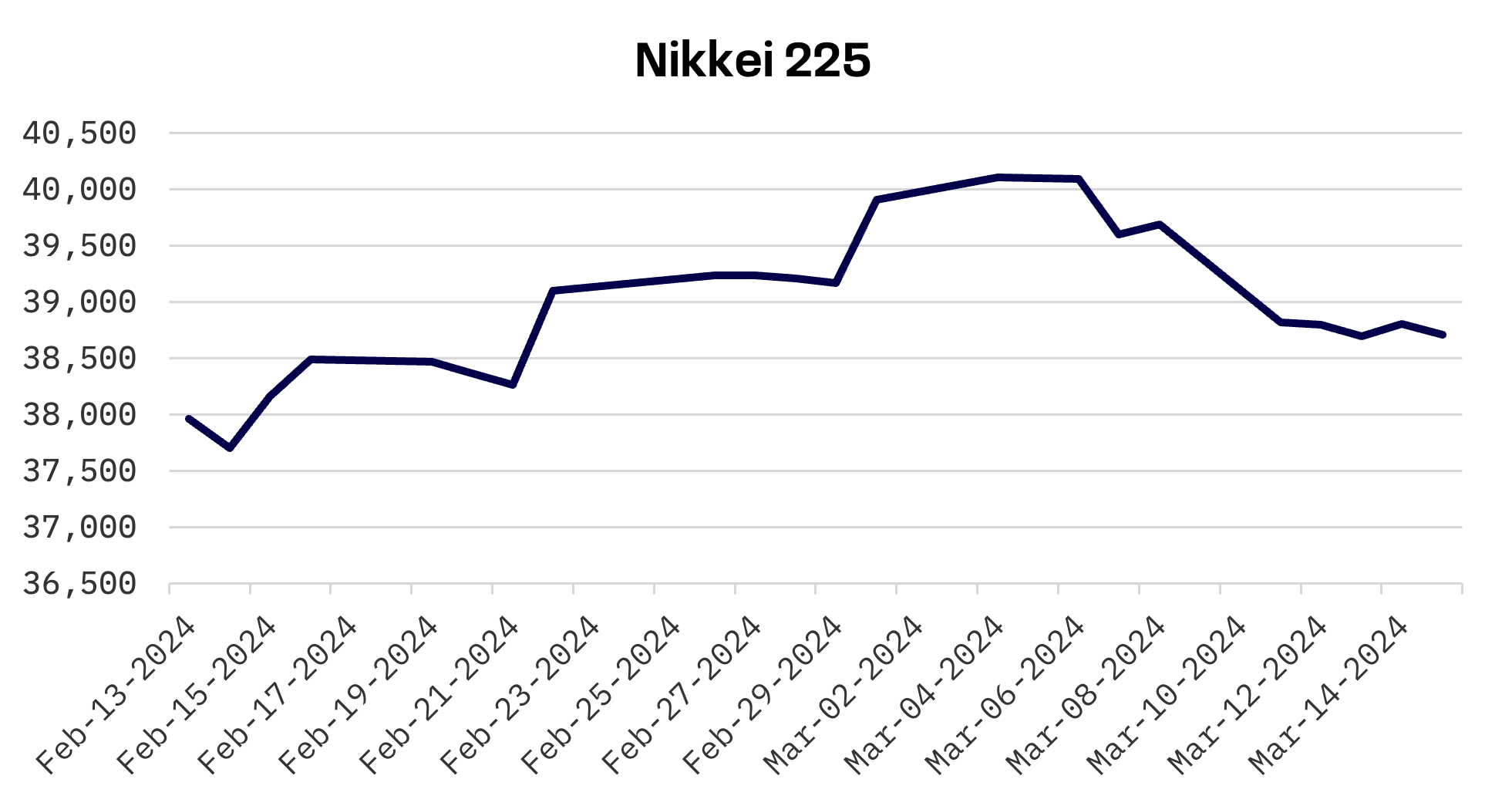

- The Nikkei 225 Index in Japan falls by 2.5%, as investor sentiment wavers over anticipated changes to the Bank of Japan’s negative interest rate policy amid wage inflation discussions

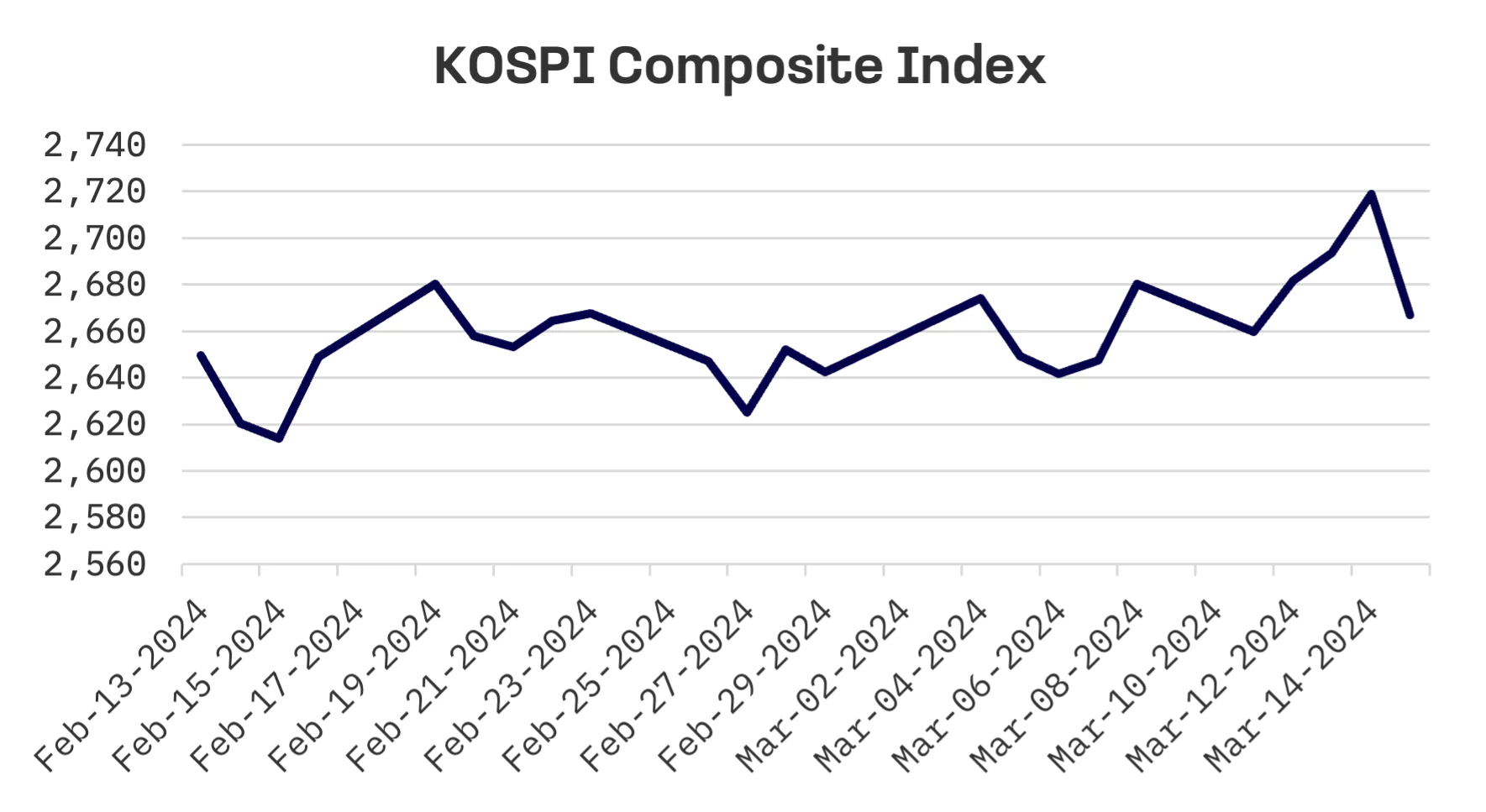

- South Korea’s KOSPI index dips 0.5% after initially reaching a two-year high, influenced by global reaction to U.S. inflation figures and the Bank of Korea’s steadfast monetary stance

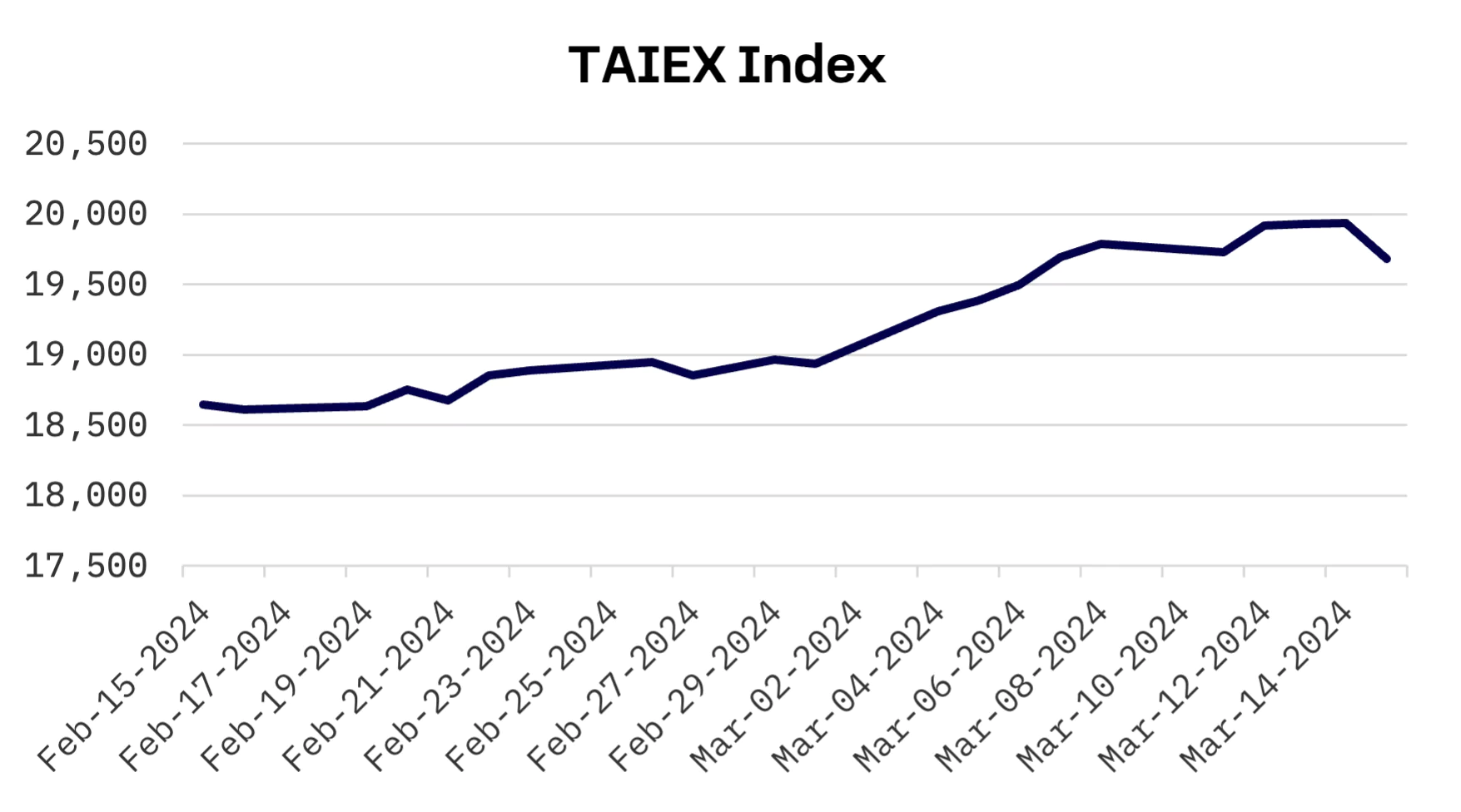

- Taiwan’s TAIEX index mirrors South Korea’s pattern, with a week of gains wiped out by Friday’s drop, closing down by 0.5% despite strong performances from key tech stocks

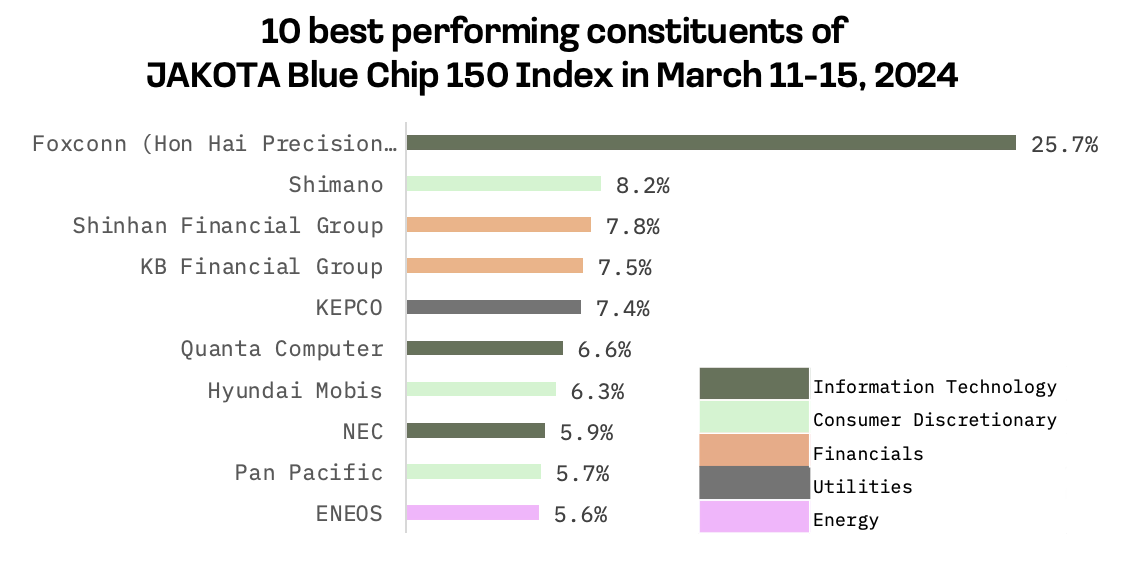

- The JAKOTA Blue Chip 150 Index’s 3.1% retreat highlights the contrasting fortunes of AI-driven growth and traditional sector volatility

Japan

The Japanese stock market concluded the week lower than the previous period, with the Nikkei 225 Index recording a 2.5% loss. The speculation around the Bank of Japan (BoJ) potentially ending its negative interest rate policy has intensified following announcements of the most substantial average wage increases for labor union members since the early 1990s.

The BoJ has indicated that any shift in monetary policy will be closely tied to achieving its 2% inflation target, necessitating parallel inflation and wage growth. The growing consensus among economists suggested a potential interest rate hike as soon as March – which came to fruition on 19th March, according to this recent article in Bloomberg.

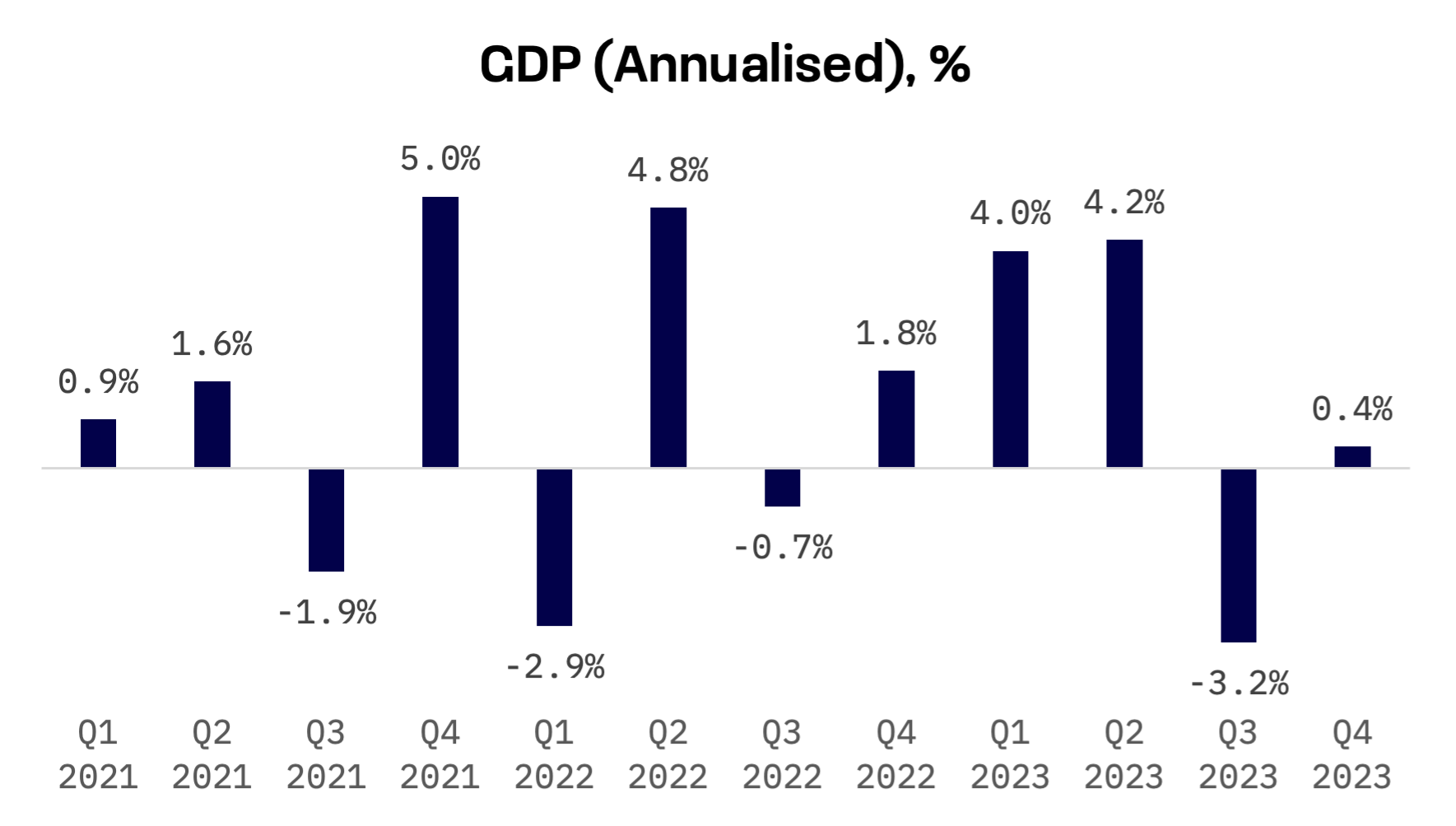

BoJ Governor Kazuo Ueda articulated a cautious perspective on Japan’s economic trajectory, observing that despite a moderate recovery, some indicators point to persistent vulnerabilities. Data released early in the week highlighted that Japan narrowly escaped a technical recession in the last quarter of 2023, traditionally defined by two successive quarters of contraction.

The country’s Gross Domestic Product (GDP) for the fourth quarter showed a slight increase of 0.1%, a revision from the initially reported 0.1% contraction. Annually, this adjustment reflects a growth of 0.4%, marking a reversal from the previously noted 0.4% decline.

South Korea

South Korea’s KOSPI index fell by 0.5% over a week. The index reached a near two-year peak mid-week, buoyed by substantial gains in financial, automotive and other blue chips. However, the momentum reversed on Friday, with the KOSPI closing nearly 2% lower. This downturn was precipitated by global investors’ decision to secure profits in response to the release of U.S. inflation figures that exceeded expectations.

Meanwhile, on Thursday, the Bank of Korea (BOK) reiterated its commitment to a restrictive monetary policy stance on Thursday, citing the risk of destabilizing market confidence and the high household debt levels. While acknowledging a mild slowdown in core inflation, the BOK pointed out significant domestic and international uncertainties in its monetary policy report.

Taiwan

In Taiwan, the TAIEX index dipped by 0.5%, following a pattern similar to South Korea’s, with gains between Tuesday and Thursday overshadowed by a Friday drop in response to the U.S. inflation figures. Noteworthy were the movements in Foxconn (Hon Hai Precision Industry) and Taiwan Semiconductor (TSMC) shares, which initially drove the market higher, along with selected financial and traditional economy stocks.

Yang Chin-long, Governor of the Central Bank of the Republic of China (Taiwan), on Thursday, stated that Taiwan’s consumer price index (CPI) might exceed a 2% increase this year should the anticipated hikes in electricity rates occur. He explained that such rate adjustments are likely to prompt businesses to elevate their prices in response to the higher operational costs tied to increased electricity expenses. The central bank has been enforcing a stringent monetary policy to mitigate the impact of rising consumer prices. However, Yang expressed concerns about the potential difficulty in curbing inflation if it continues to exceed the 2% threshold into 2024.

JAKOTA Blue Chip 150 Index

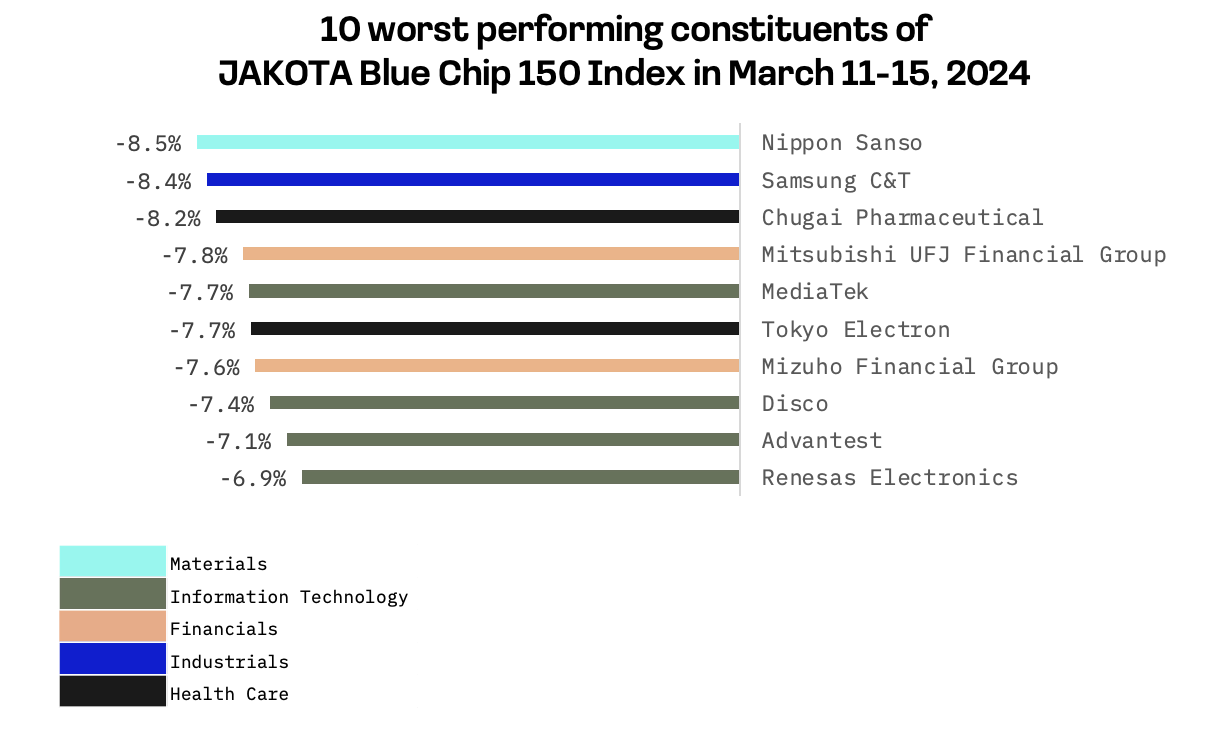

The JAKOTA Blue Chip 150 Index recorded a 3.1% decrease this week, largely due to the poor performance of several large-cap stocks. Of its 150 constituents, only 47 showed positive trends.

Foxconn (Hon Hai Precision Industry), a Taiwanese multinational electronics contract manufacturer, experienced its most substantial intraday stock jump in over three years, with shares increasing by more than 25%. This surge followed the company’s announcement of anticipated strong growth in its AI hardware sales for the year. Chairman Young Liu, in an earnings call on Thursday, shared that Foxconn expects a 40% growth in its AI server business, aiming to capture a 40% market share. This optimistic outlook is backed by two consecutive quarters of strong profit growth, where AI hardware sales have successfully compensated for the weaker demand in iPhone and consumer electronics sectors.

Nippon Sanso, a Japanese multinational industrial gas manufacturer, faced the steepest decline in the JAKOTA Blue Chip 150 Index this week. This downturn contrasts sharply with the previous week’s performance when the stock surged by 13%, propelled by its role in supplying semiconductor gases and a favourable assessment from CLSA Securities. However, this week’s shift towards profit-taking resulted in a notable decrease in the company’s stock performance.