Last week’s Jakota markets:

- Japan’s Nikkei 225 jumped 2.6% amid historic yen weakness, while Tokyo inflation data fueled BOJ policy speculation

- South Korea’s KOSPI advanced 0.5%, as the government weighed tax incentives to boost dividends and address the “Korea Discount”

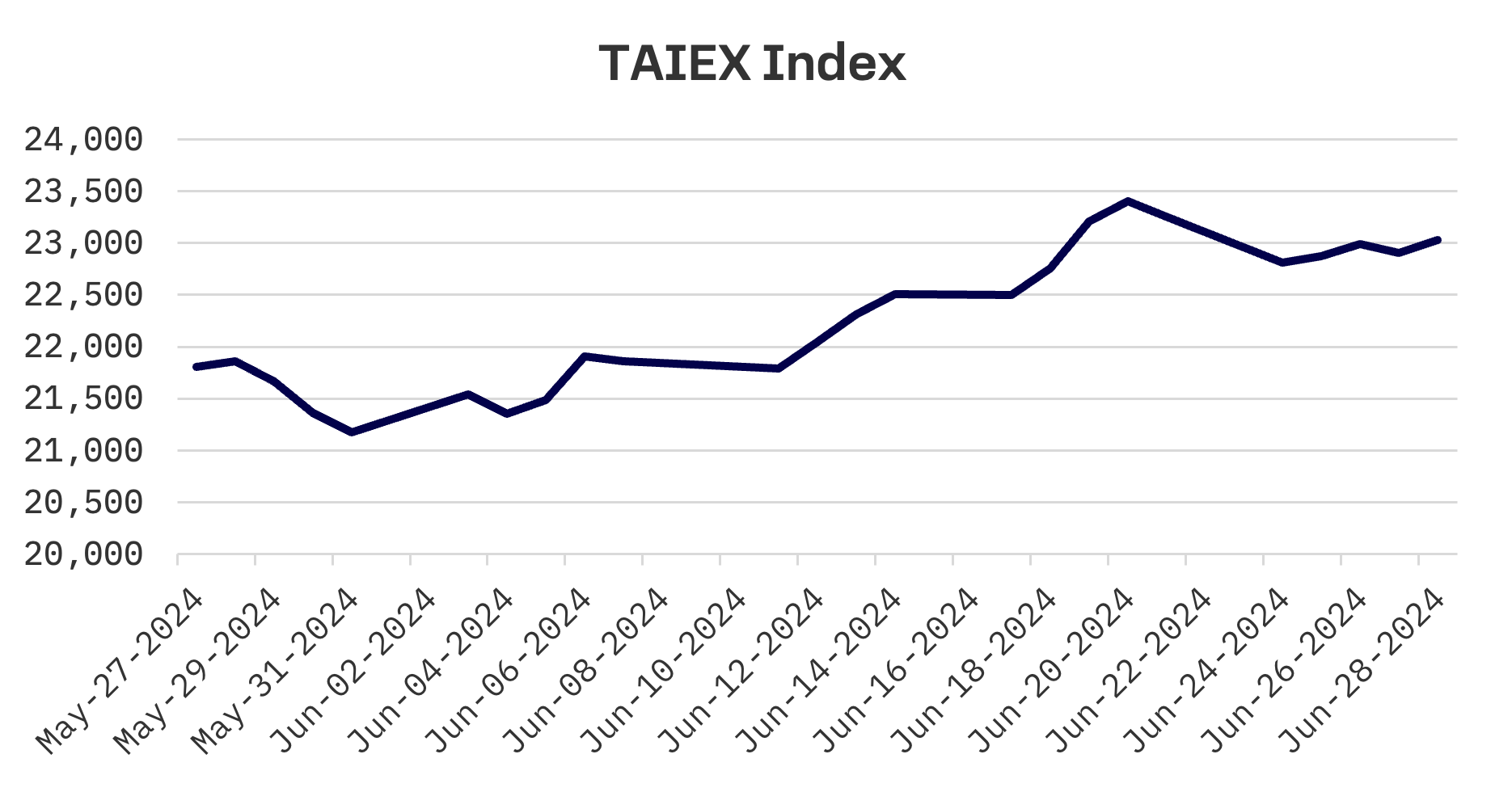

- Taiwan’s TAIEX slipped 1.0% for the week but maintained its position as the top performer in 2024 with a 28% half-year gain

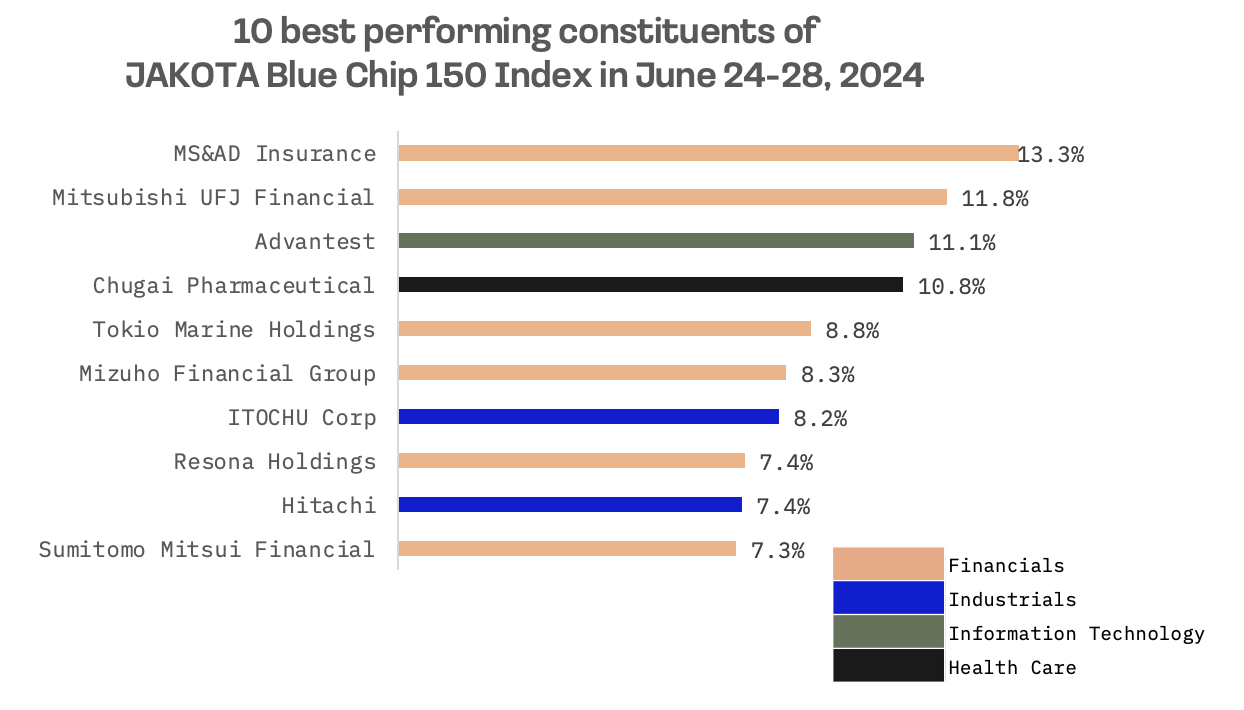

- The JAKOTA Blue Chip 150 Index rose 1.5%, with financial stocks, particularly Japanese non-life insurers, leading the gains

Japan

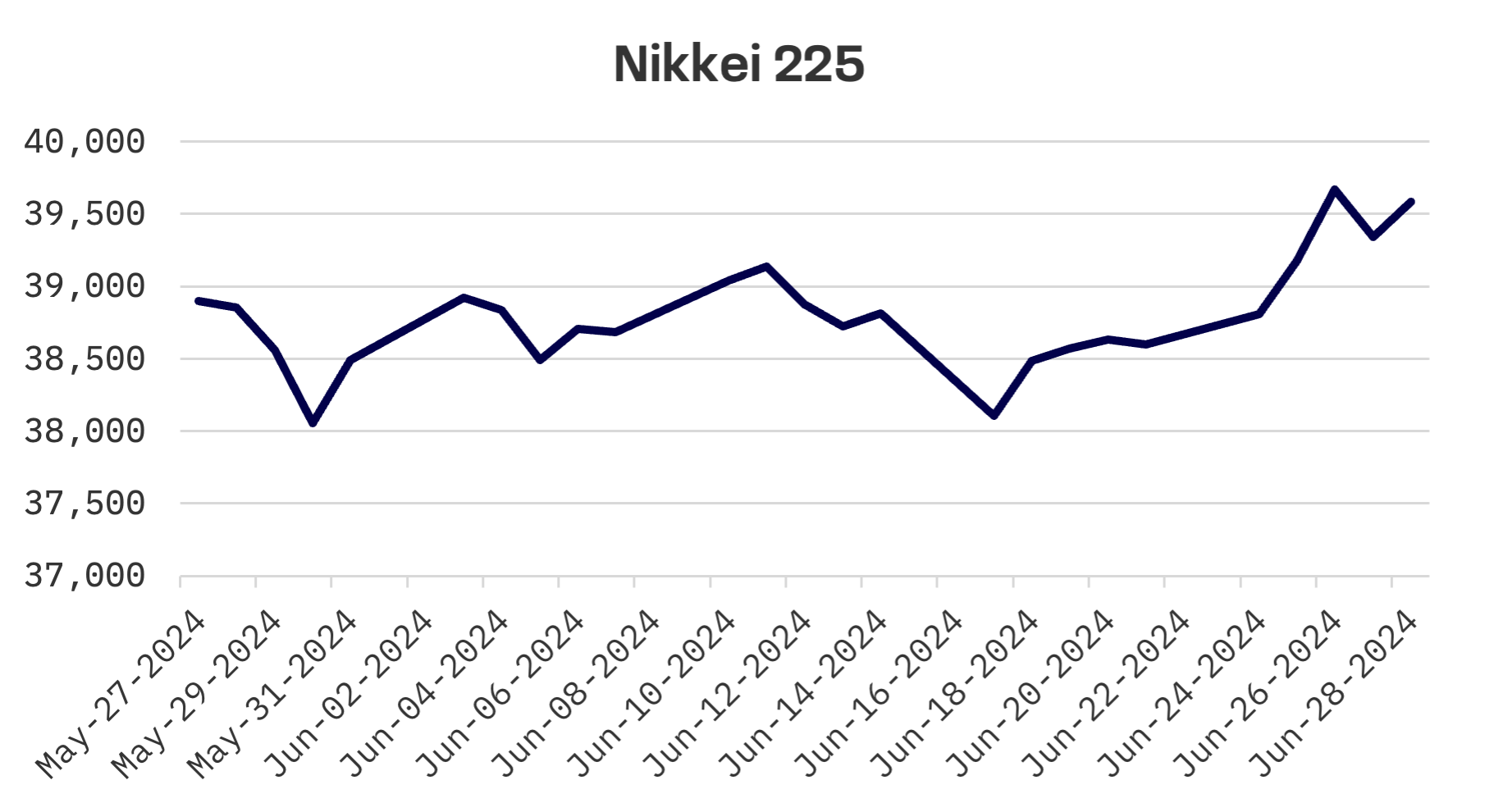

Japan’s stock market advanced this week, with the Nikkei 225 Index climbing 2.6% as the yen’s historic weakness continued to bolster export-heavy industries. The Japanese currency touched a 38-year low, breaching ¥160 against the dollar on Thursday, prompting a 1% drop in the Nikkei and breaking its upward trend.

Despite expectations of intervention to stem the yen’s decline, driven by the wide U.S.-Japan interest rate gap, authorities limited their response to verbal warnings. Finance Minister Shunichi Suzuki reiterated that excessive currency volatility is undesirable, assuring appropriate action if needed.

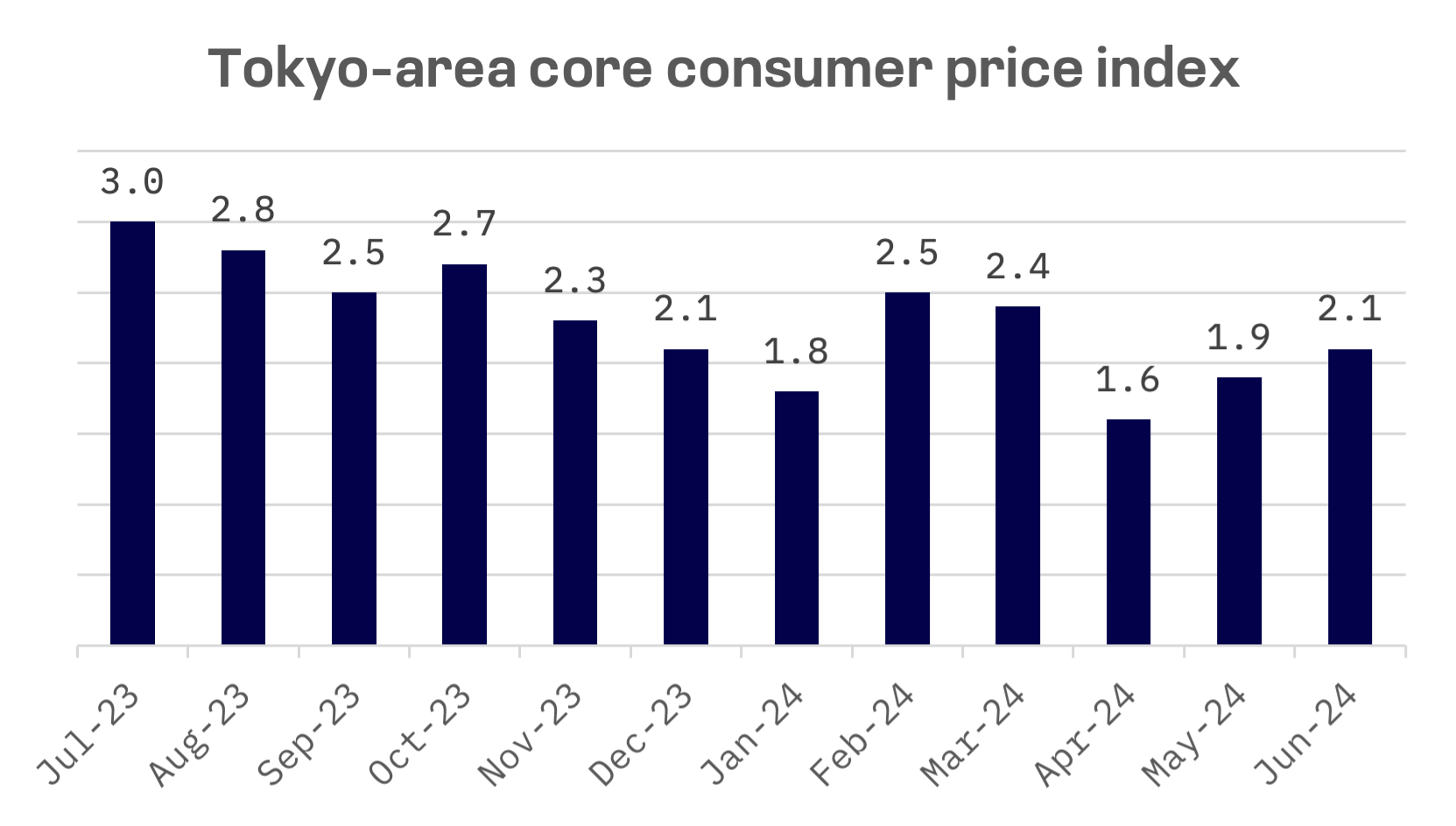

On the economic data front, investors focused on Tokyo’s June core consumer price index, which showed a year-on-year inflation increase of 2.1%, beating expectations and accelerating from May’s 1.9%. This rise, primarily driven by services inflation, fuelled speculation about potential Bank of Japan policy normalization, as the central bank targets a sustainable 2.0% inflation rate.

Retail sales and industrial production in May also exceeded forecasts.

South Korea

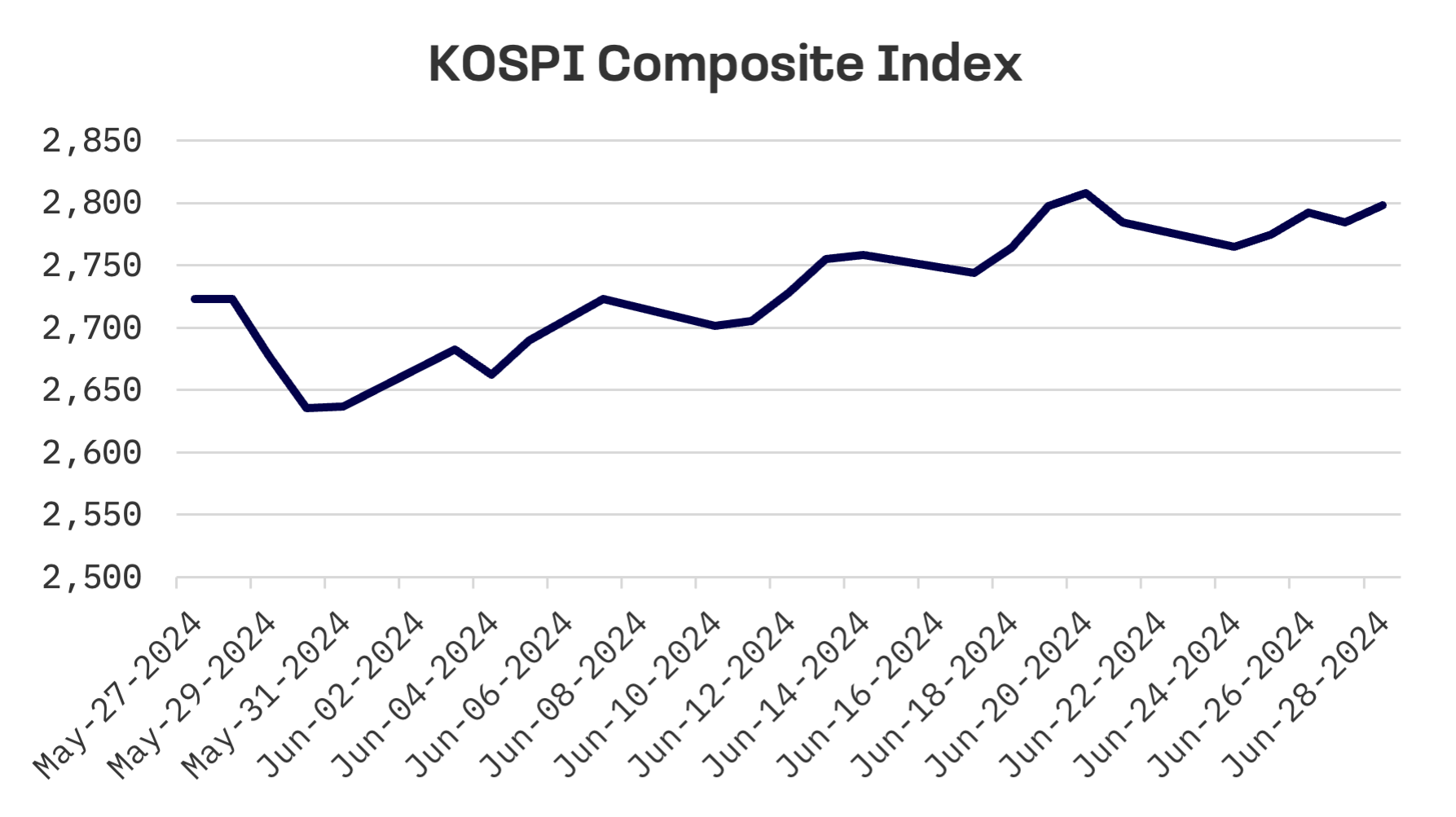

The KOSPI Composite Index rose 0.5% this week, its fourth consecutive weekly gain. For the quarter, the index advanced 1.86%, closing at 2797.82, driven by gains in auto and technology stocks.

The South Korean government is considering significant tax relief to stimulate domestic dividends and promote shareholder value disclosure. The Ministry of Economy and Finance plans to reduce income tax rates by up to 20% for shareholders of listed companies that increase dividends and participate in value enhancement disclosures. Additionally, these companies would receive tax deductions equivalent to their dividend increase. This initiative, part of the government’s annual tax reform plan, aims to address the “Korea Discount” phenomenon, where Korean stocks trade at lower valuations compared to global peers.

Taiwan

Taiwan’s stock market contracted this week, with the TAIEX index declining 1.0%. However, in the first half of 2024, the TAIEX surged over 28%, outperforming other JAKOTA markets, buoyed by robust AI-related tech stocks.

Manufacturing sector sentiment improved for the sixth consecutive month in May, according to the Taiwan Institute of Economic Research (TIER). Emerging technologies stimulated global demand and bolstered Taiwanese exports, driving the improvement. TIER’s data showed the composite index measuring business sentiment among local manufacturers rose 1.07 points from April to 99.73 in May.

JAKOTA Blue Chip 150 Index

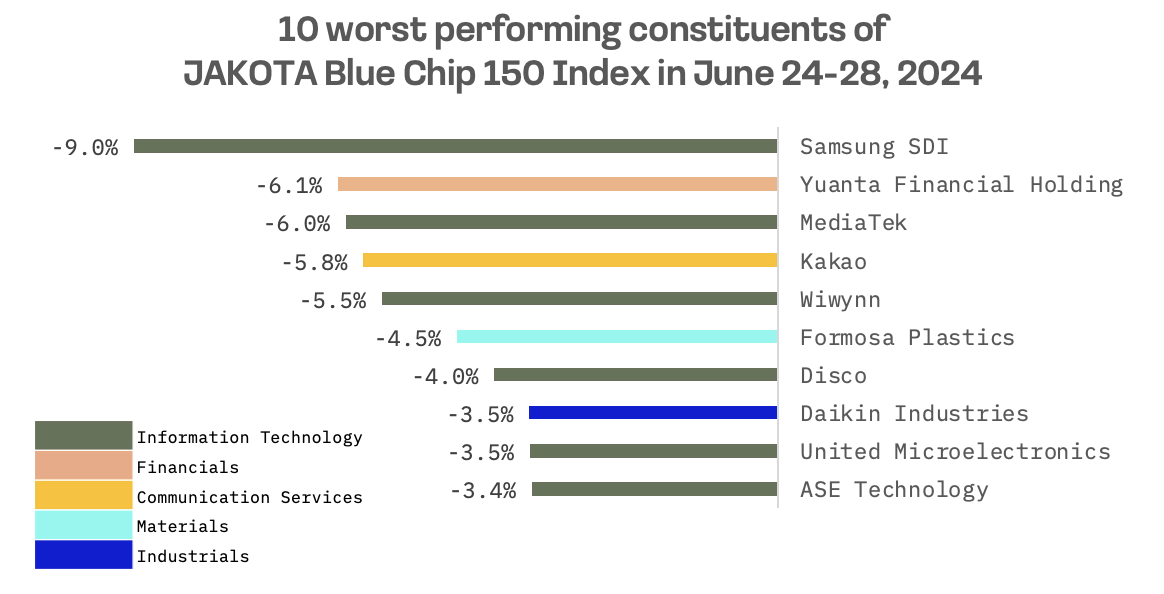

The JAKOTA Blue Chip 150 Index climbed 1.5% this week, with 99 of 150 constituents showing positive price trends.

Financial stocks, particularly non-life insurers like MS&AD Insurance and Tokio Marine Holdings, dominated the top performers of the JAKOTA Blue Chip 150 Index this week. MS&AD Insurance led gains, rising 13.3%. The surge followed reports that the Non-Life Insurance Rating Organization of Japan plans to raise the reference net rate for automobile insurance premiums by an average of 5.7%. This adjustment, expected to influence premiums starting in 2026, marks the third consecutive year of increases. Investors flocked to non-life insurance stocks, anticipating a favorable impact on future earnings.

Samsung SDI, a Korean secondary battery maker, emerged as the worst performer among the index constituents, with declining profitability attributed to sluggish electric vehicle sales in Europe.