Last week’s Jakota markets:

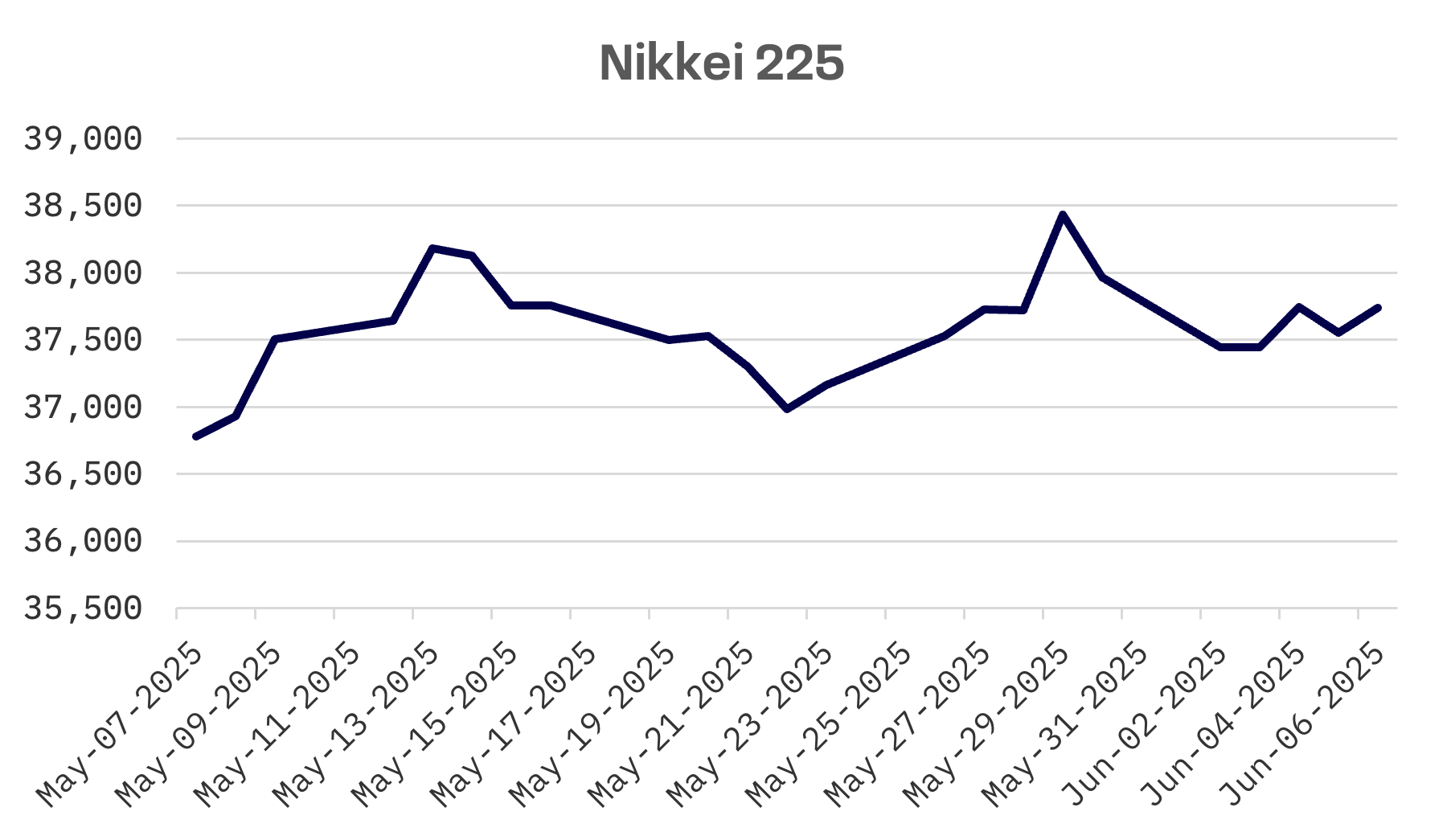

- Japan’s Nikkei 225 Index fell 0.59% as U.S.-Japan trade talks stalled, while the BoJ maintained its gradual tightening stance despite weak wage and spending data

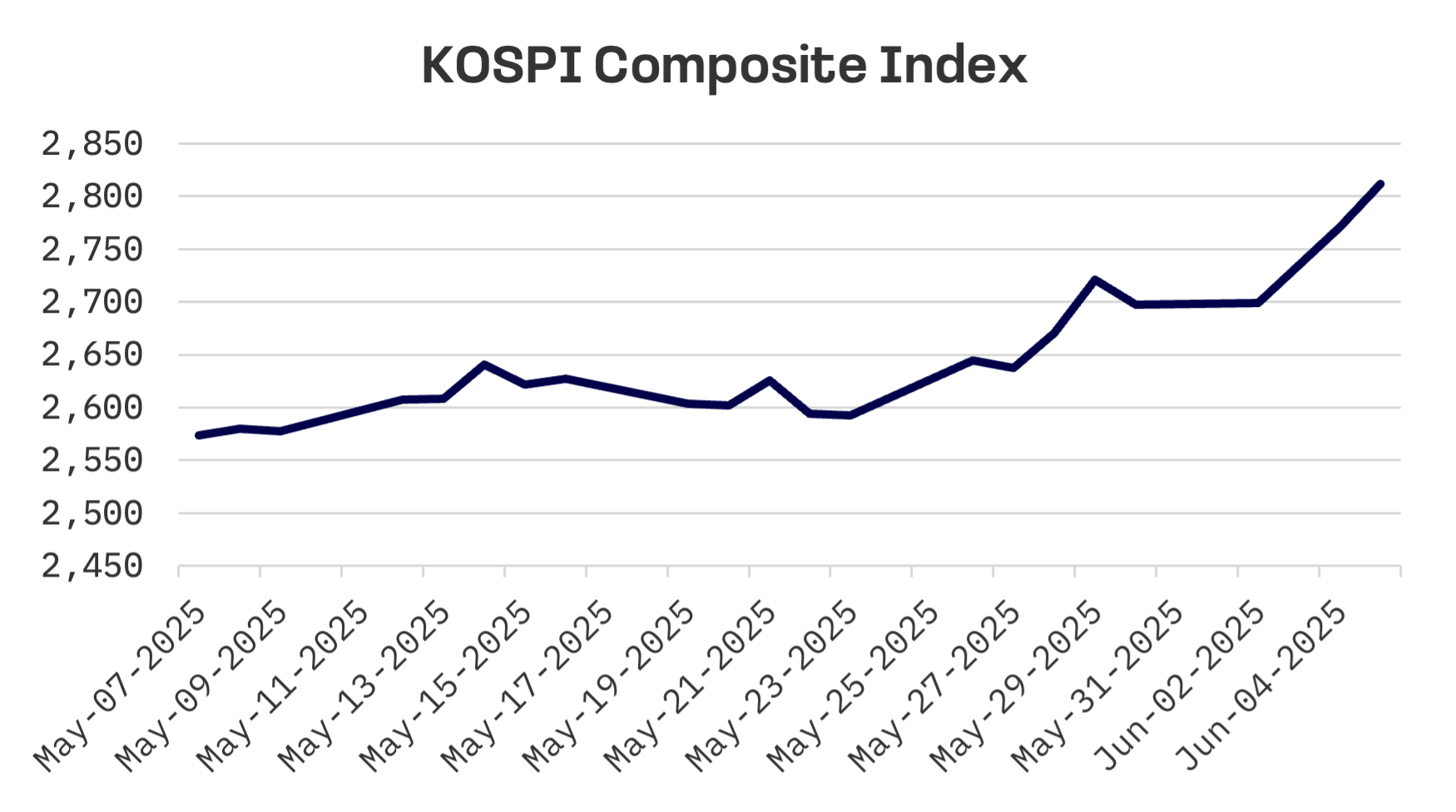

- South Korea’s KOSPI soared 4.2% as foreign investors poured ₩1.96 trillion into equities following President Lee Jae-myung’s election victory and promises of fiscal stimulus

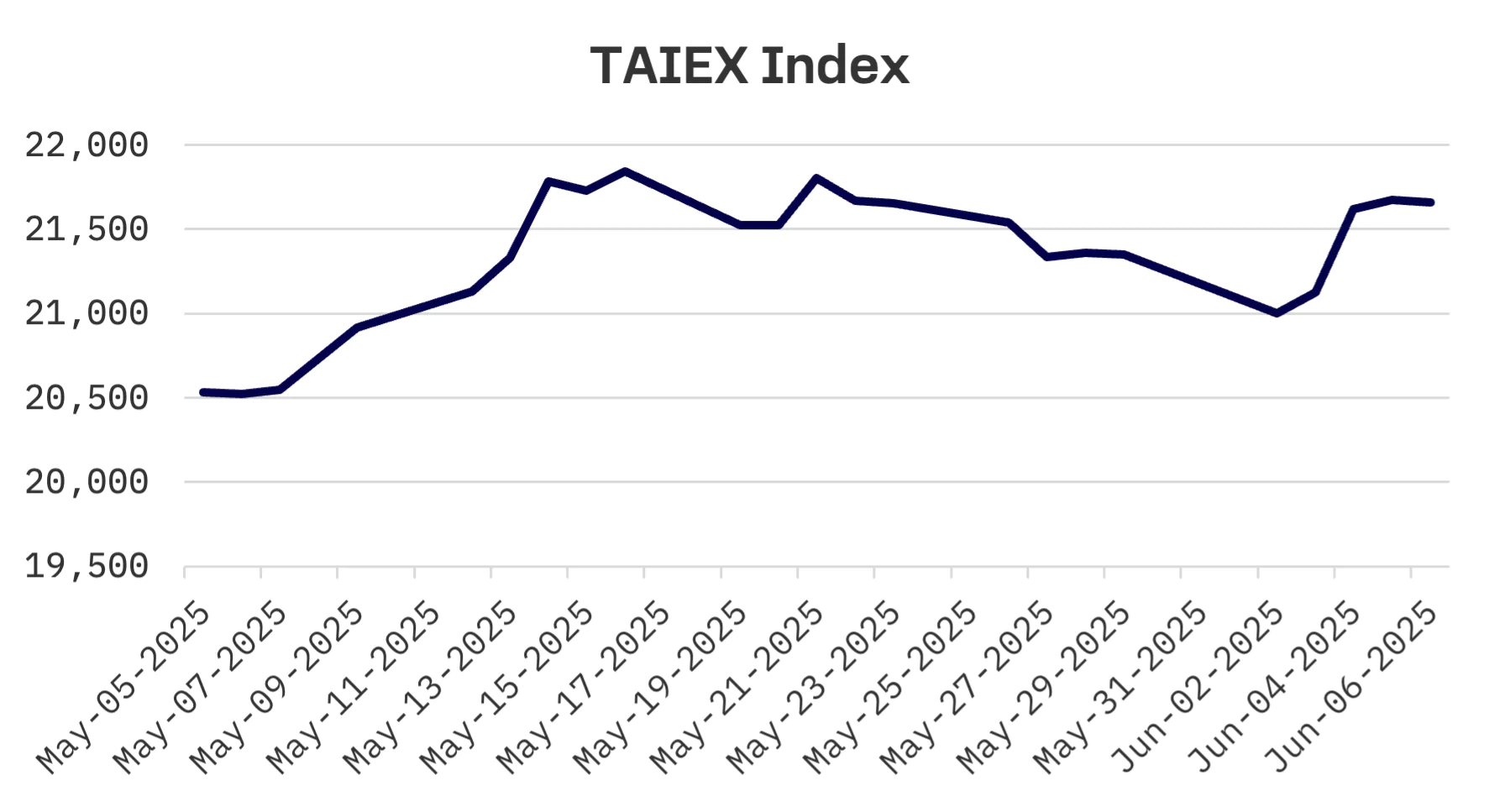

- Taiwan’s TAIEX climbed 1.5% on semiconductor sector strength, supported by easing inflationary pressures that hit four year lows

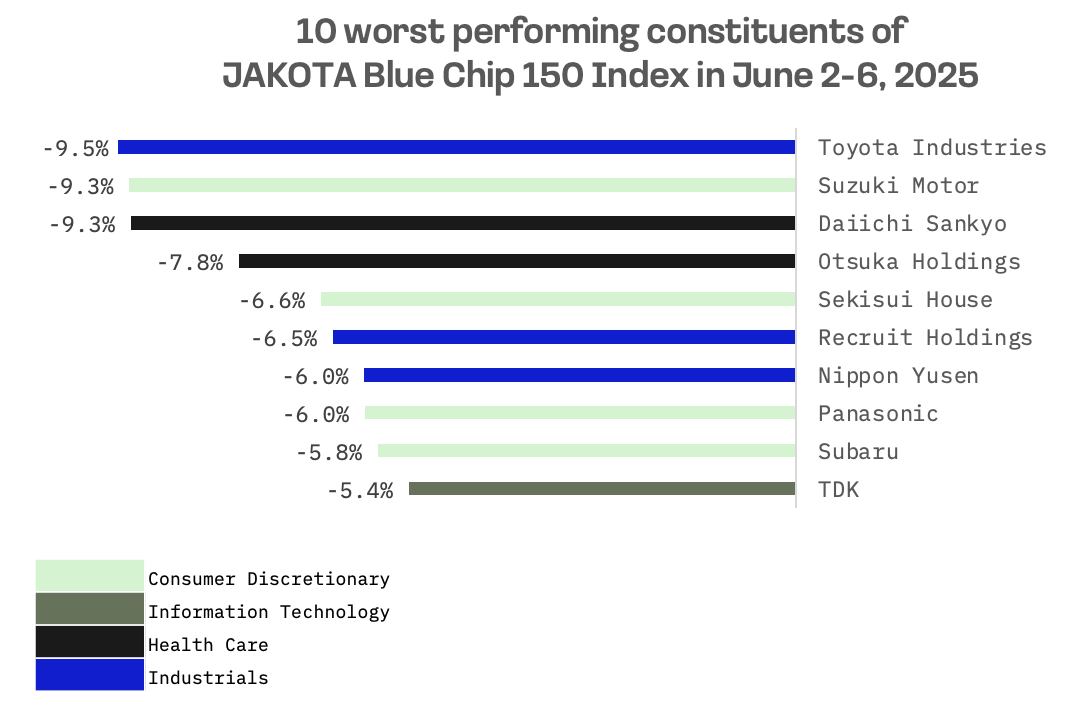

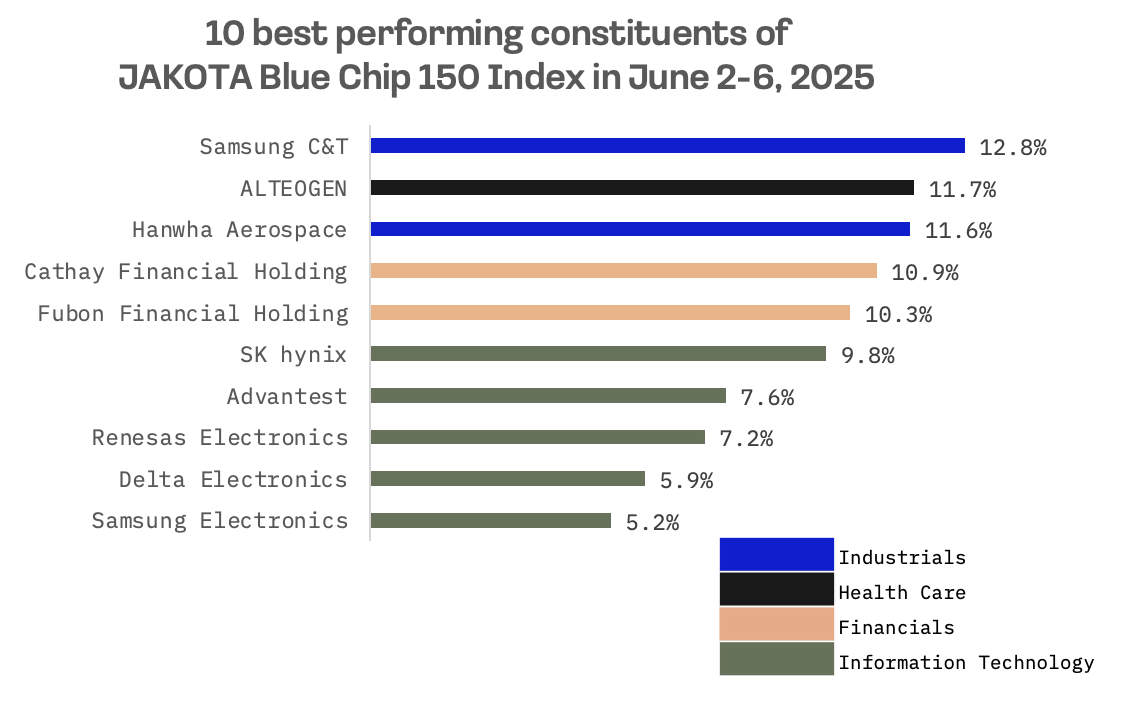

- The JAKOTA Blue Chip 150 Index edged up just 0.1%, with Samsung C&T leading gains on regulatory reform hopes and Toyota Industries tumbling on privatisation news

Japan

Japan’s stock market retreated over the week, with the Nikkei 225 falling 0.59% as U.S.-Japan trade negotiations failed to produce a breakthrough. Although no agreement was reached, the talks laid groundwork for a potential deal that could be announced at the Group of Seven (G7) summit in June.

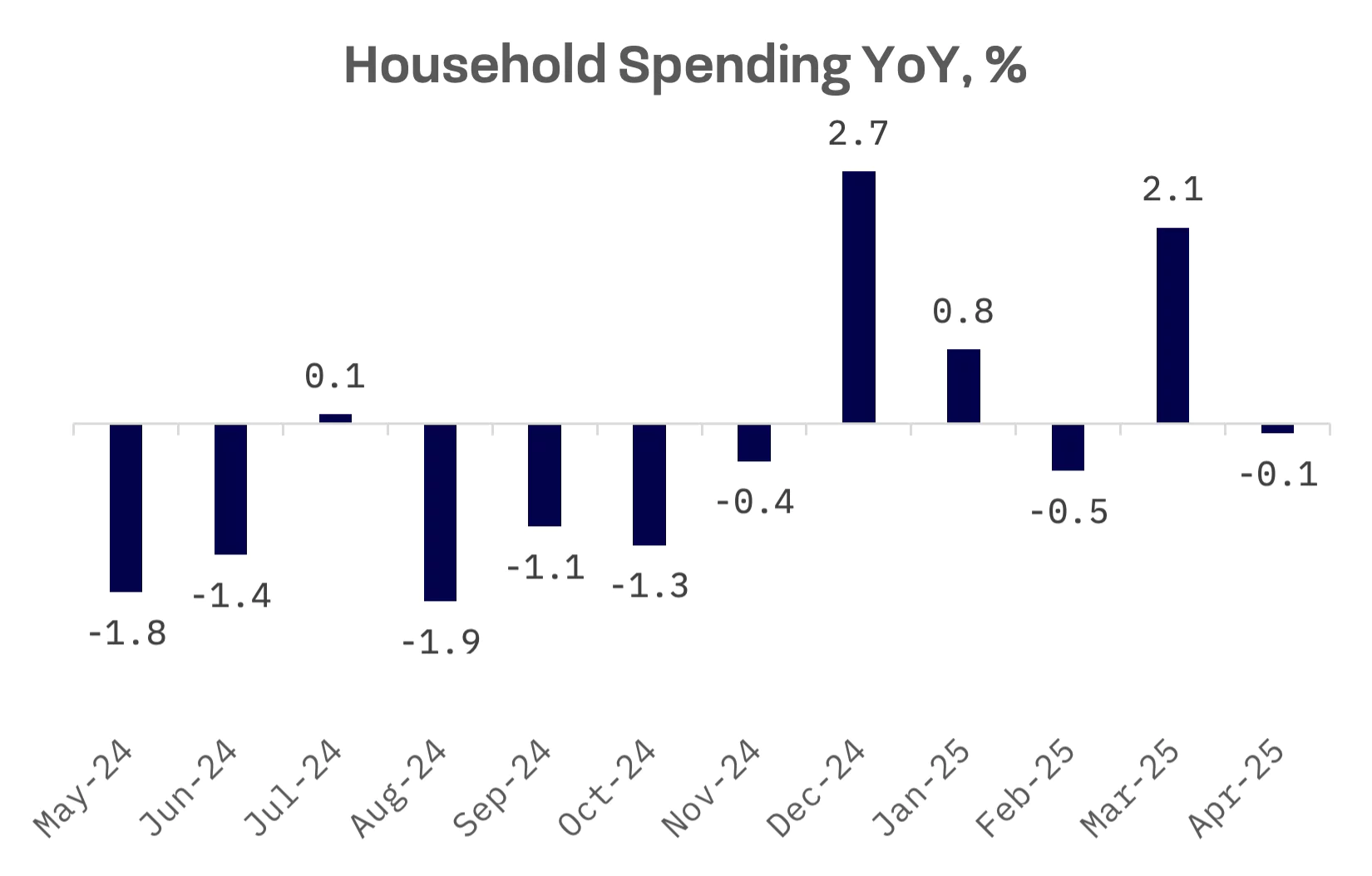

Economic data painted a mixed picture. Real wages, adjusted for inflation, dropped 1.8% in April from the previous year – worse than economists had expected – as rising prices continued to outstrip pay increases. Household spending declined 0.1% year-over-year in April, reversing March’s 2.1% gain and missing consensus forecasts for a 1.4% rise.

Despite the softer data, the Bank of Japan (BoJ) stuck to its assessment that the economy remains on a moderate recovery track. The central bank reiterated its readiness to raise interest rates further if its growth and inflation projections prove accurate, reinforcing market expectations for a gradual tightening cycle.

South Korea

South Korea’s stock market surged during a holiday shortened trading week, with the KOSPI index jumping 4.2% as post election euphoria drove foreign investors back into Korean assets. Markets were closed on June 3 for the presidential election and on June 6 for Memorial Day.

The rally reflected growing investor confidence in newly elected President Lee Jae-myung’s economic agenda, which is expected to emphasise fiscal stimulus and pro-market reforms. The Korean won strengthened to a seven month high as risk appetite returned.

Analysts said the policy environment, combined with a weaker dollar and stronger won, has created favourable conditions for Korean equities. However, expectations of expansive fiscal spending triggered a sharp selloff in government bonds, with yields climbing as markets prepared for increased debt issuance and higher government spending.

Foreign investors demonstrated their renewed appetite for Korean stocks, recording their largest net purchases of the year on Wednesday, the day after the presidential vote, buying ₩1.05 trillion worth of local equities. The buying spree continued on Thursday with an additional ₩916 billion in net inflows.

The Organization for Economic Cooperation and Development (OECD) tempered the optimism by cutting South Korea’s 2025 growth forecast to 1.0% from 1.5%, citing escalating global trade tensions. The June 3 downgrade reflected mounting concerns over U.S. tariff uncertainty, which the OECD said would likely weigh on exports and dampen business investment. Still, reduced domestic political uncertainty and projected increases in real wages are expected to support a recovery in private consumption beginning late next year.

Taiwan

Taiwan’s stock market advanced this week, with the TAIEX gaining 1.5% on strength in semiconductor and electronics shares that lifted market sentiment.

Taiwan’s consumer price index (CPI) rose 1.55% in May from a year earlier – the slowest pace in more than four years – as declining food and energy prices helped ease inflationary pressures, according to the Directorate General of Budget, Accounting and Statistics (DGBAS).

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index remained essentially flat for the week, edging up 0.1%. Among the index’s 150 constituents, 72 stocks posted gains.

Samsung C&T, a South Korean construction and engineering company, surged 14.2% to become the top performer on the JAKOTA Blue Chip 150 Index. The rally was tied to expectations surrounding President Lee Jae-myung’s push for Commercial Act reforms. Samsung C&T, widely viewed as the de facto holding company within Samsung Group’s structure, gained on growing expectations that President Lee will mandate the retirement of treasury shares held by Korean holding companies. During his campaign, Lee pledged to establish a system requiring listed companies to cancel their treasury shares “in principle,” with the goal of returning value to shareholders and boosting the domestic stock market.

Toyota Industries, the world’s largest forklift manufacturer, was the index’s worst performer after Toyota Motor announced plans to take the company private in a ¥4.7 trillion ($33 billion) buyout – one of Japan’s largest ever take private transactions and a significant step towards unwinding traditional cross shareholdings.

The deal includes a ¥3.7 trillion ($26 billion) tender offer at ¥16,300 per share, an 11% discount to Toyota Industries’ ¥18,400 closing price before the announcement. The companies said the transaction would allow Toyota Industries to pursue longer term strategic objectives outside the constraints of public markets.

A new holding structure will be created to execute the transaction, with Toyota Fudosan, the group’s real estate arm, contributing ¥180 billion and Toyota Motor Chairman Akio Toyoda investing ¥1 billion. Toyota Motor will also provide ¥700 billion through non voting preferred shares.

The deal comes as Japanese regulators and investors pressure conglomerates to streamline operations and improve governance by reducing cross shareholdings.