Last week’s Jakota markets:

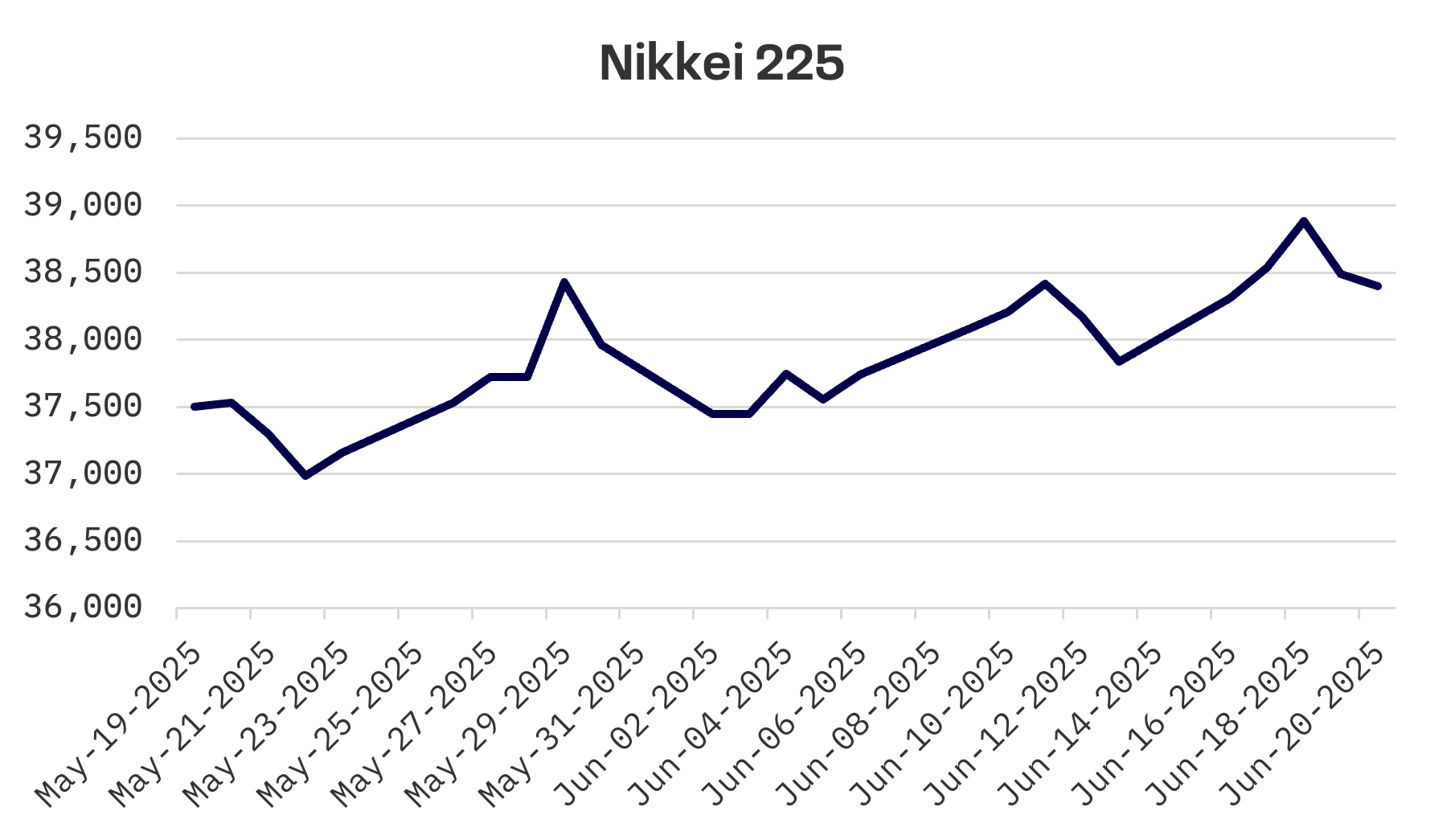

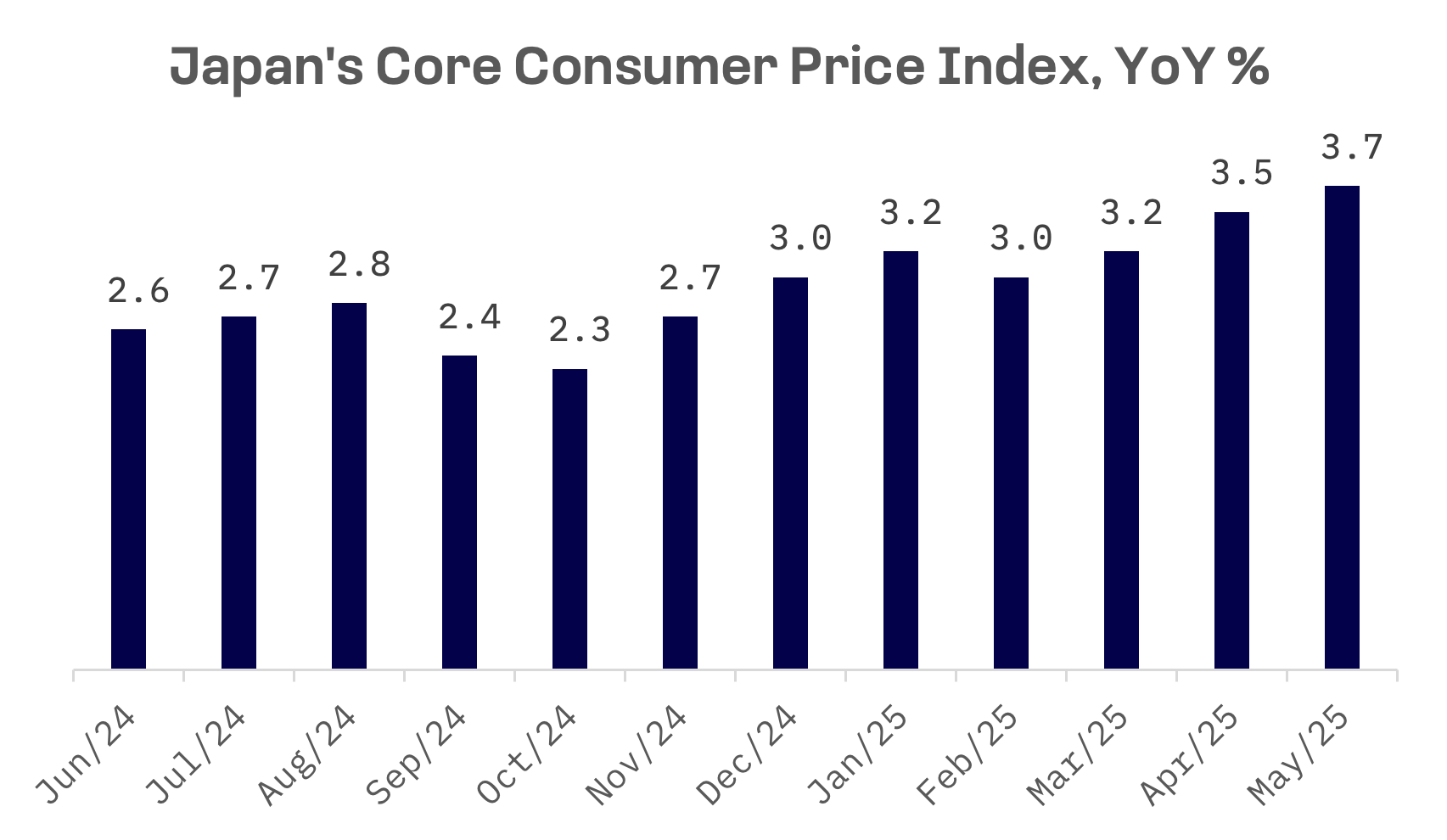

- Japan’s Nikkei 225 Index advanced 1.5% ahead of the BoJ’s monetary policy decision, as core inflation accelerated to 3.7% and U.S.-Japan tariff talks stalled at the G7 summit

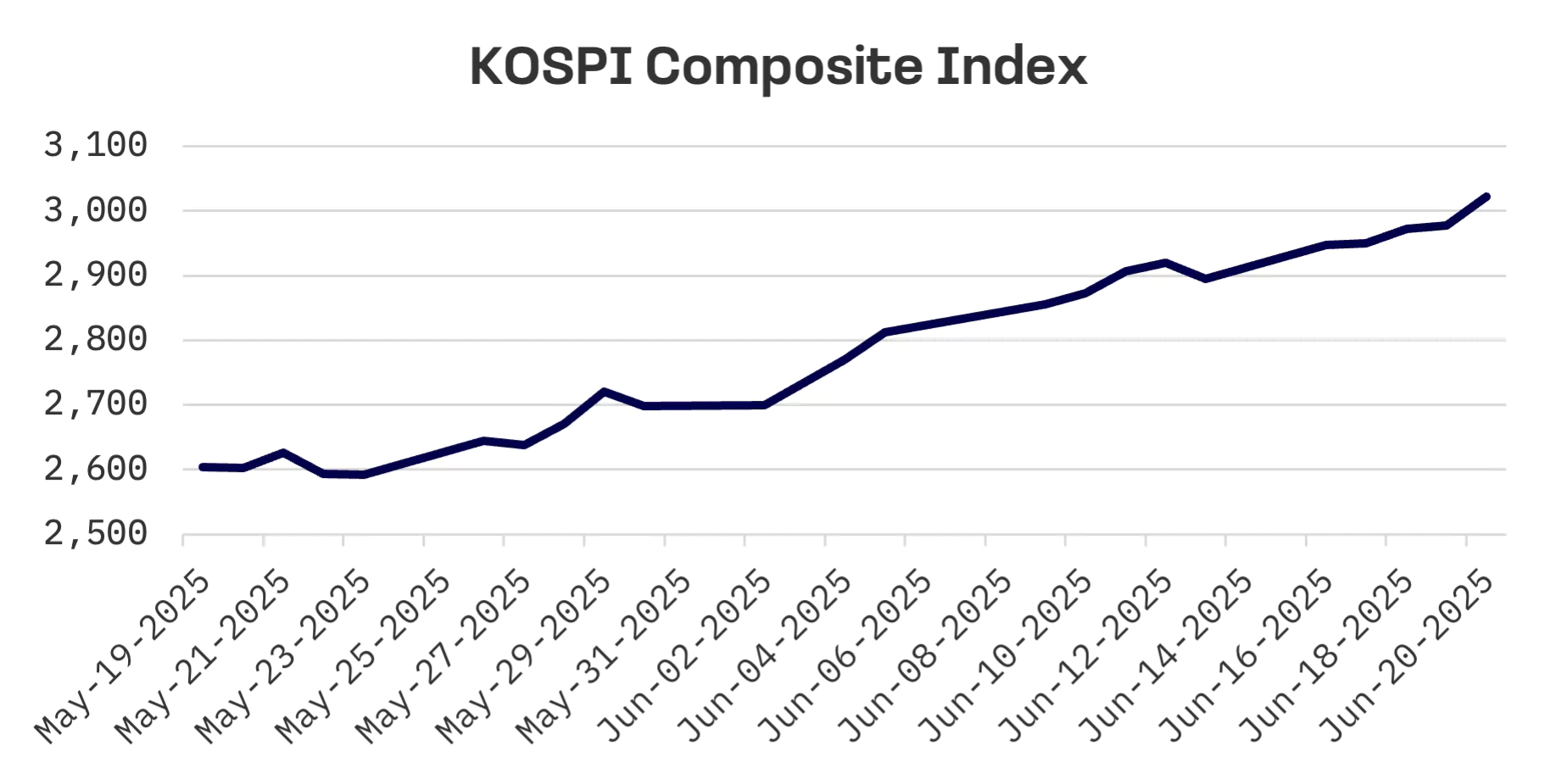

- South Korea’s KOSPI Index jumped 4.4% to breach the 3,000 point threshold, driven by expectations around Seoul’s massive fiscal stimulus and AI infrastructure investments

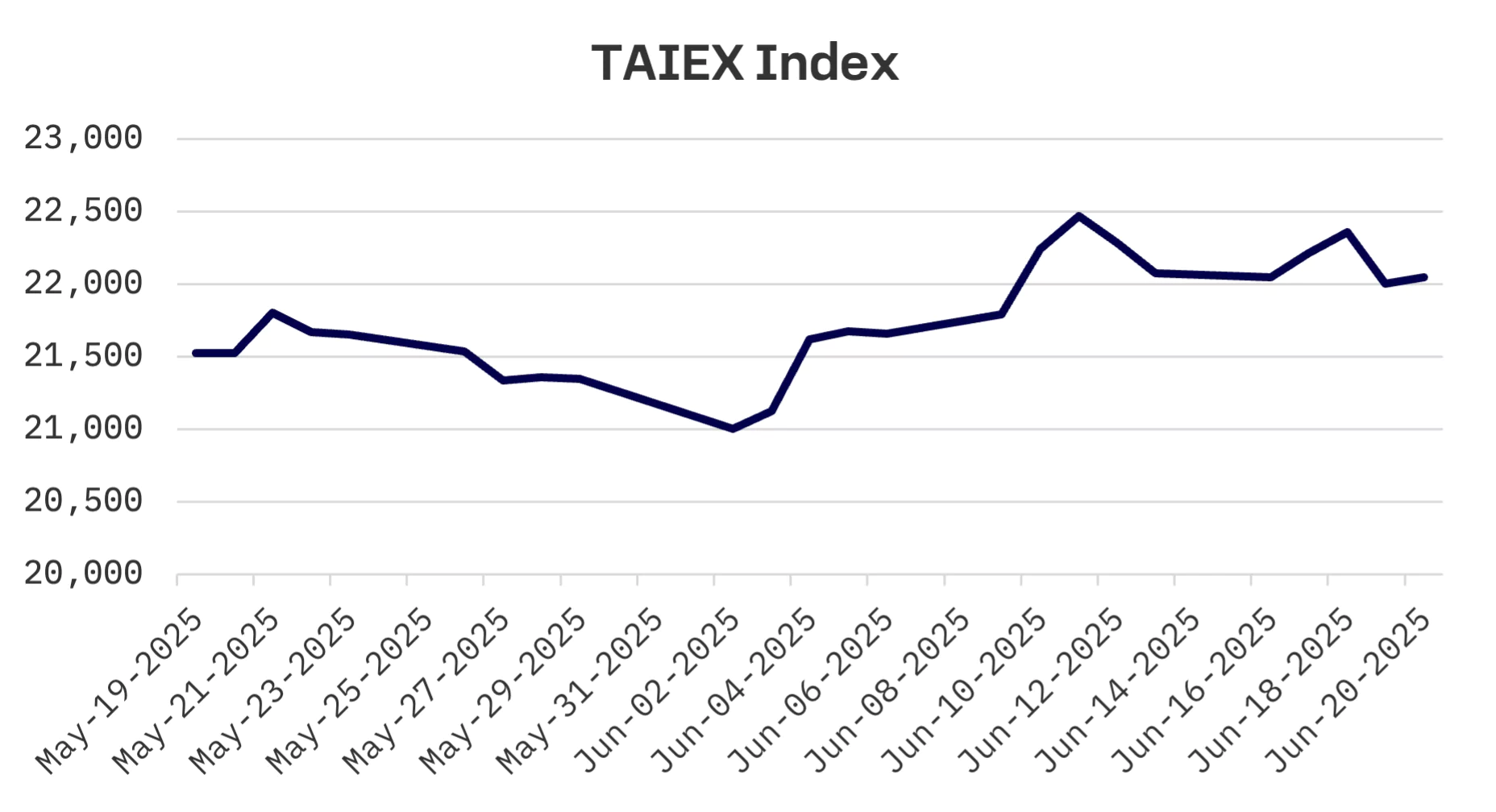

- Taiwan’s TAIEX dipped 0.1% as Iran-Israel tensions and hawkish Fed signals dampened investor appetite, with the central bank keeping rates unchanged for a fifth straight quarter

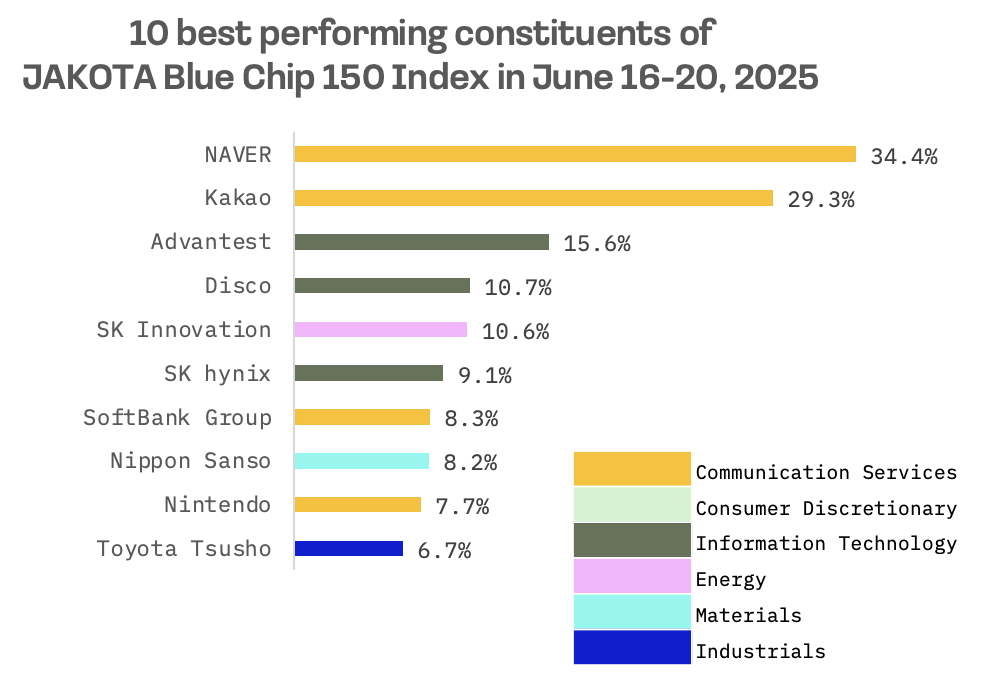

- The JAKOTA Blue Chip 150 Index edged up 0.1%, with AI focused stocks Naver and Kakao leading rallies of 34% and 29% respectively

Japan

Japan’s stock market advanced this week, with the Nikkei 225 climbing 1.5% as investors focused on the Bank of Japan’s (BoJ) June 16-17 monetary policy meeting despite escalating geopolitical tensions in the Middle East.

The BoJ kept its policy rate unchanged at 0.5%, as widely expected, and signalled it would slow the pace of Japanese government bond (JGB) purchase tapering beginning in April 2026. The decision, while anticipated, reflects caution about potential market disruption following a sharp rise in JGB yields in late May amid concerns the central bank was tightening monetary policy too aggressively. The 10 year JGB yield rose to 1.42% from 1.40% the previous week.

The U.S. and Japan failed to reach a tariff agreement at the Group of Seven (G7) summit, contrary to some expectations. The U.S. is scheduled to reinstate higher reciprocal tariffs on July 9, increasing levies on Japanese imports to 24% from 10%. Japan’s chief trade negotiator, Ryosei Akazawa, stressed that the date isn’t a hard deadline, emphasising that both sides must protect core national interests. He noted Japan’s priority is safeguarding the profitability of its key automotive sector.

On the economic front, Japan’s core consumer price index accelerated to 3.7% year-over-year in May, exceeding the consensus estimate of 3.6% and April’s 3.5% increase. The acceleration was driven largely by rising prices for non fresh food items, particularly a sharp increase in rice costs.

South Korea

South Korean stocks extended their winning streak to four consecutive weeks, with the KOSPI Index surging 4.4%. On Friday, the benchmark topped the 3,000 point mark for the first time in more than three years, buoyed by increased global financial market liquidity and expectations that the Lee Jae-myung government’s fiscal policy, including a ₩20.2 trillion supplementary budget plan, will stimulate economic growth.

South Korea’s new administration on Thursday unveiled a ₩20.2 trillion ($14.6 billion) supplementary budget designed to boost domestic demand. The plan’s centerpiece is a universal cash handout program worth ₩10.3 trillion, offering vouchers ranging from ₩150,000 to ₩500,000 per citizen. Additional measures include ₩2.7 trillion in support for the construction sector — particularly social infrastructure projects — as well as targeted investments in AI and aid for small and medium sized enterprises.

President Lee Jae-myung pledged full scale support for South Korea’s AI industry on Friday, positioning it as the country’s next key growth engine. Speaking at a groundbreaking ceremony for a new AI data center in Ulsan, Lee emphasised the strategic importance of the facility, which is being developed jointly by SK Group and Amazon Web Services. Once completed, the center will be the largest of its kind in South Korea and serve as a cornerstone of Lee’s “AI highway” initiative.

Taiwan

Taiwan’s stock market declined this week, with the TAIEX falling 0.1% as investor sentiment was dampened by escalating tensions between Israel and Iran, alongside signals from the U.S. Federal Reserve suggesting it isn’t rushing to ease interest rates.

The Central Bank of the Republic of China (Taiwan) held its key interest rates steady on Thursday following its quarterly policy meeting, marking the fifth consecutive quarter of unchanged policy. The decision aligned with market expectations, particularly after the U.S. Federal Reserve opted to maintain its own policy stance for a fourth straight meeting just one day earlier.

JAKOTA Blue Chip 150 Index

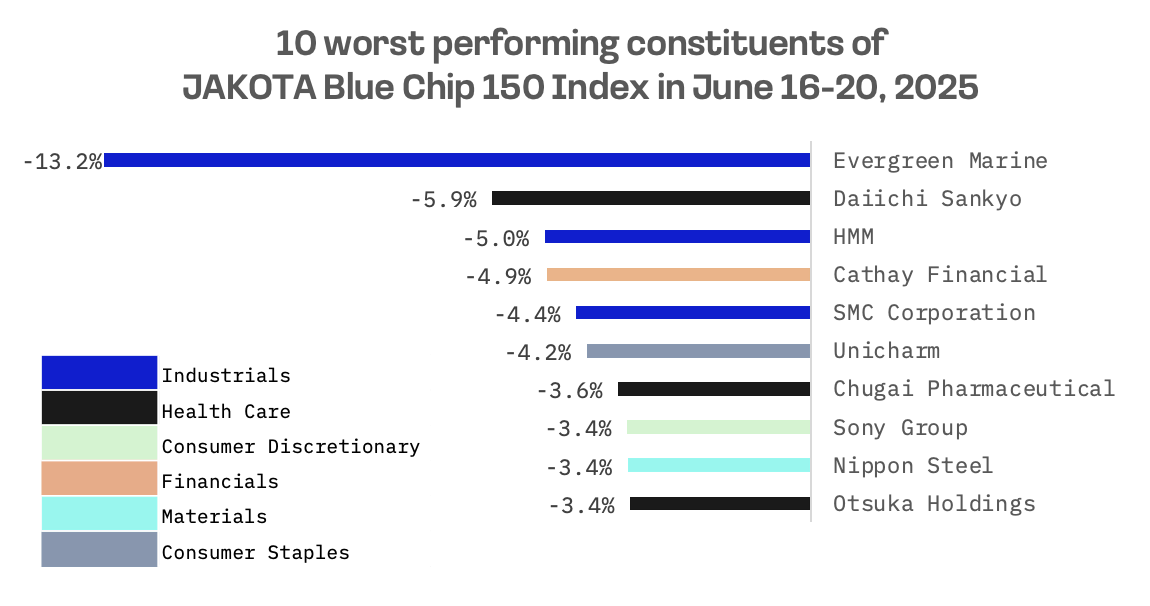

The JAKOTA Blue Chip 150 Index posted modest gains this week, rising 0.1%. Of the index’s 150 constituents, 88 stocks advanced.

Naver surged 34% this week, leading gains on the JAKOTA Blue Chip 150 Index, as investor enthusiasm around Seoul’s massive AI investment plan and a bullish outlook from JPMorgan boosted sentiment. The rally extends the South Korean search giant’s momentum amid mounting expectations about its role in the nation’s tech driven growth strategy.

Kakao climbed 29%, ranking second on the index, after South Korea’s SK Group announced plans to invest roughly ₩7 trillion ($5.11 billion) in a hyperscale AI data center in Ulsan, in partnership with Amazon Web Services. The AI data center, which will be the country’s largest, will break ground in September and be fully operational with 100 megawatts of capacity by 2029, according to the Ministry of Science and ICT. Shares of SK Innovation and SK Hynix rose 10.6% and 9.1%, respectively, on the news.

Evergreen Marine, a Taiwanese container transportation and shipping company, tumbled 13.2% this week, posting the steepest decline in the JAKOTA Blue Chip 150 Index. The stock went ex-dividend on June 19 following its earlier announcement of a NT$32.50 per share cash payout — roughly 13% of its share price. The stock’s decline was largely in line with expectations, as prices typically adjust downward by the dividend amount on the ex-dividend date.