Last week’s Jakota markets:

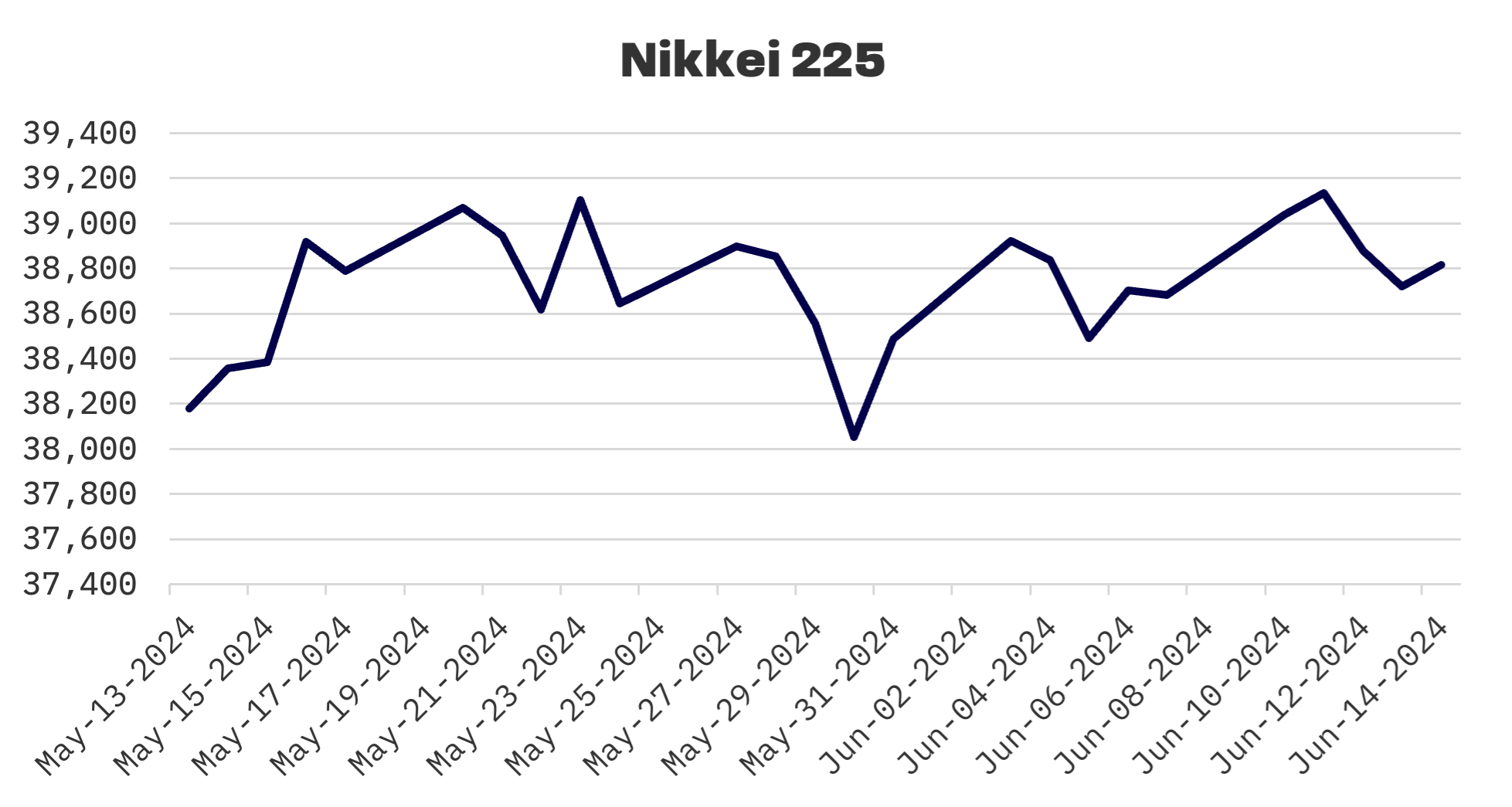

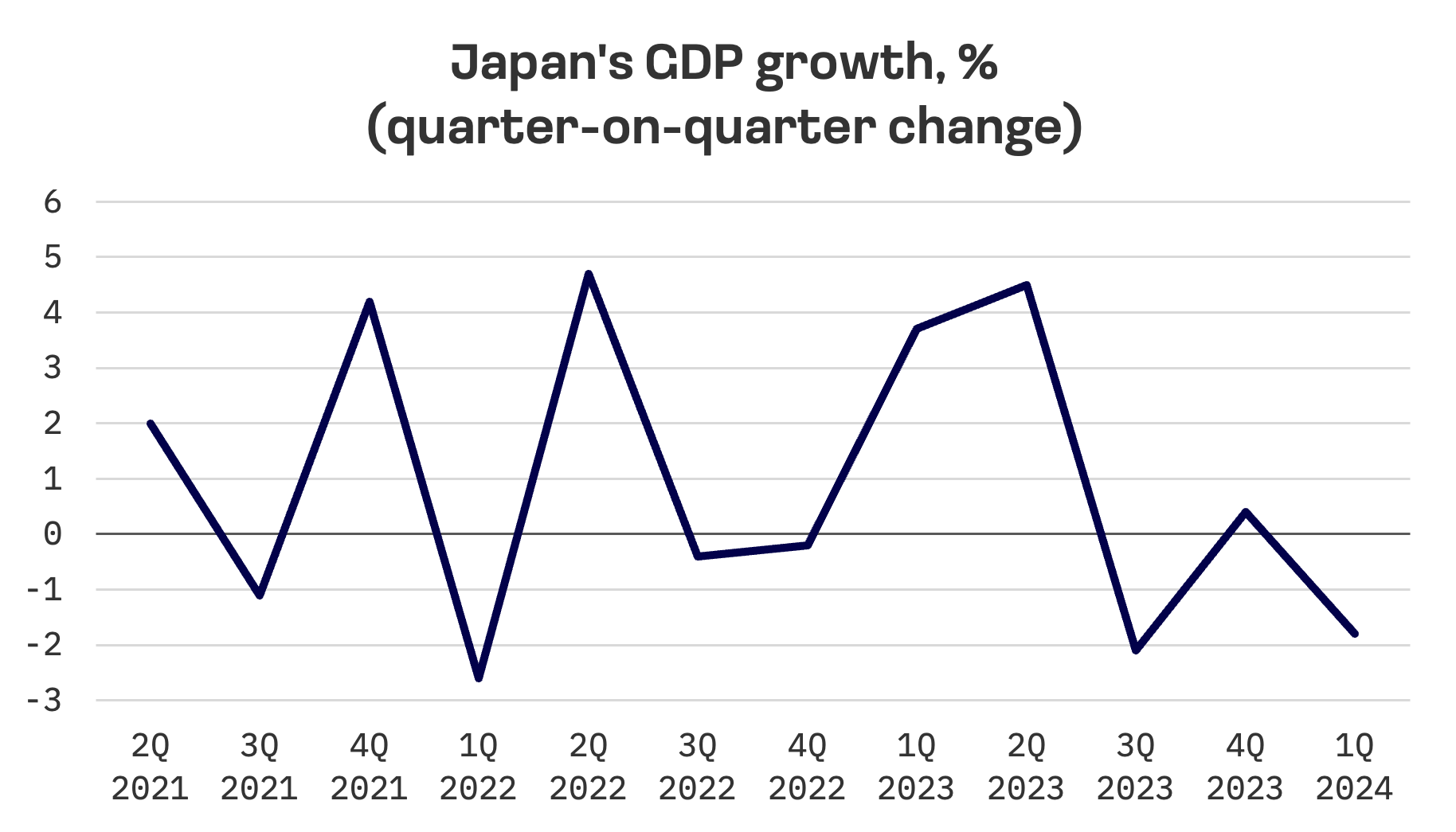

- Japan’s Nikkei 225 Index managed a modest 0.3% gain amid the Bank of Japan’s dovish stance, despite a 1.8% contraction in first quarter GDP and higher producer prices

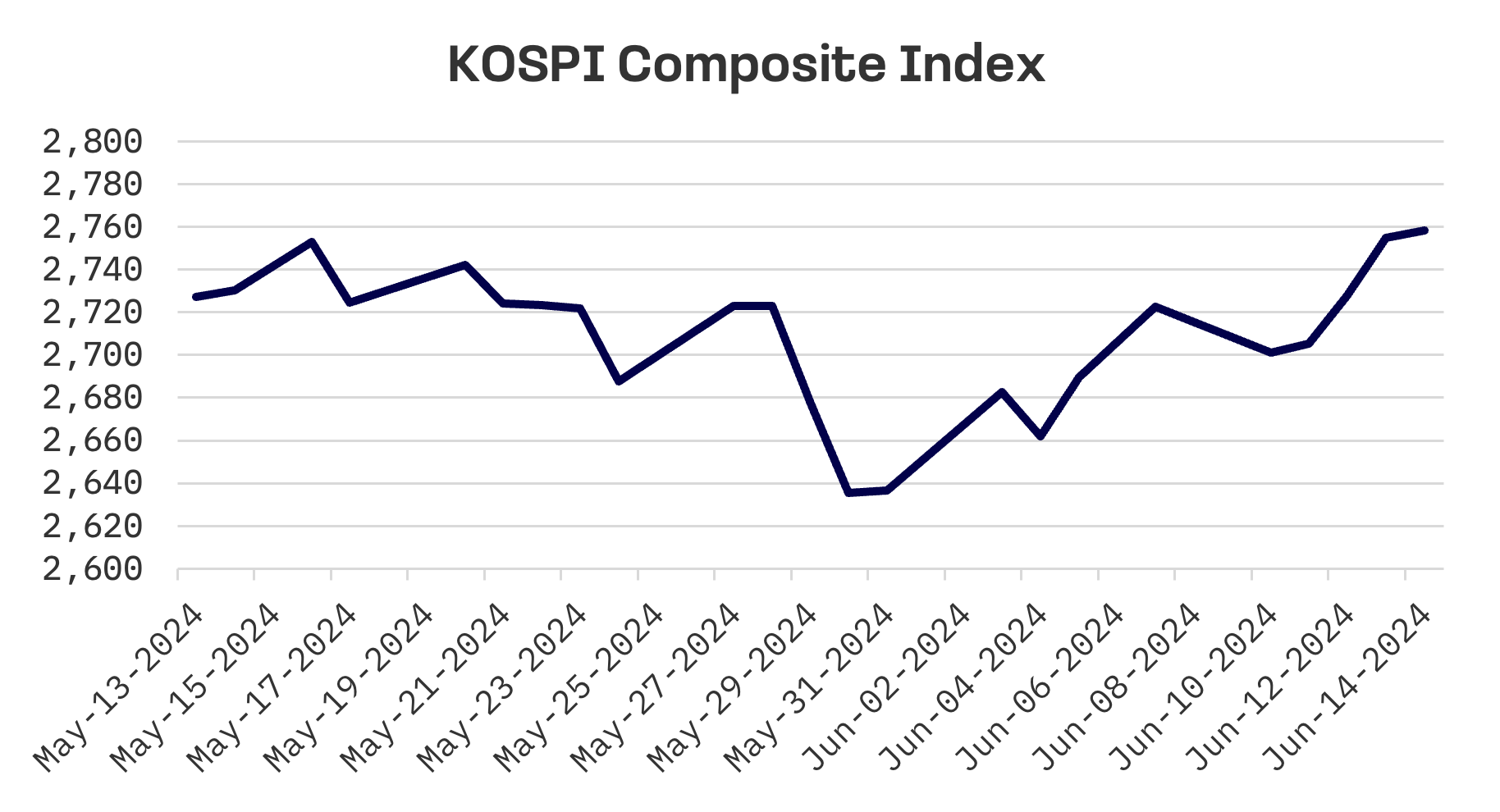

- South Korea’s KOSPI added 2.2%, approaching an annual high, bolstered by U.S. market gains and an extended short selling ban

- Taiwan’s TAIEX index outperformed, rising 3.0% to a historic high, propelled by tech stocks and an improved economic outlook

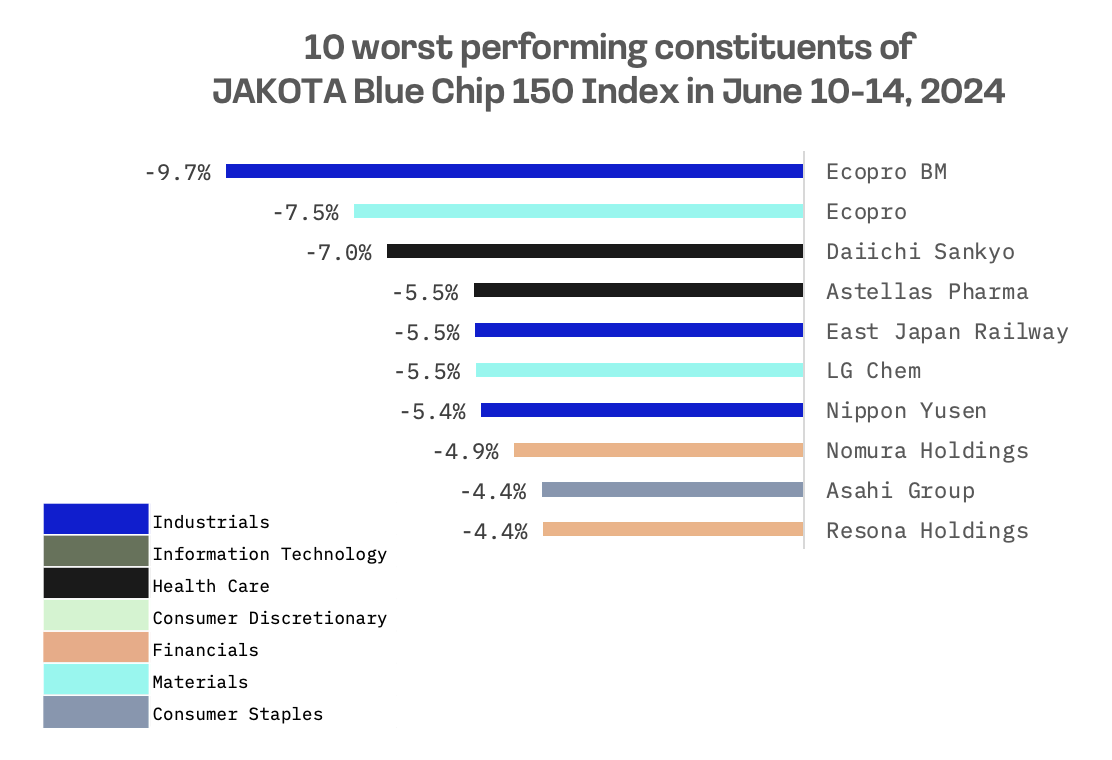

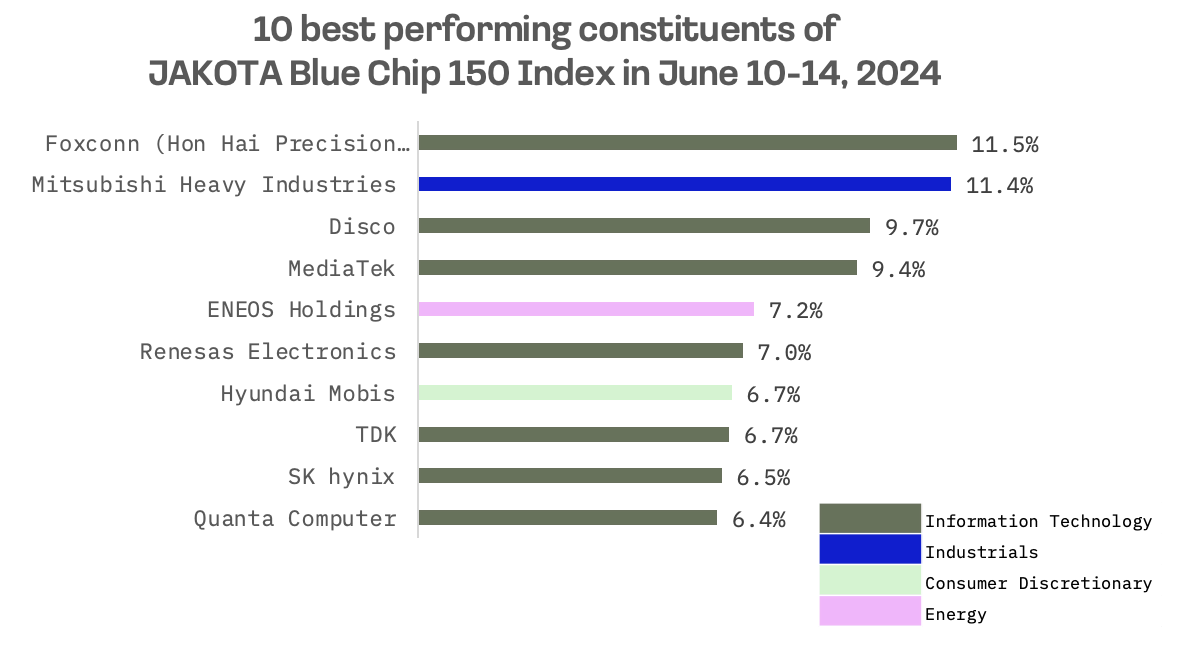

- The JAKOTA Blue Chip 150 Index fell 0.6%, with Foxconn emerging as the top performer and Korean battery stocks Ecopro and Ecopro BM experiencing a reversal of fortune

Japan

Japan’s stock market posted modest gains this week, with the Nikkei 225 Index rising 0.3%. The index hit a monthly high on Tuesday but faced pressure in the latter half of the week. The Bank of Japan’s dovish stance at its June meeting supported equities and helped the Nikkei 225 close in positive territory.

The central bank maintained its monetary policy and plans to scale back Japanese government bond purchases gradually over the next one to two years, detailing the tapering plan at its July meeting. This decision surprised markets, which had anticipated an immediate reduction in the bank’s substantial bond-buying program, and reaffirmed expectations of a gradual pace of monetary normalisation.

Japan’s revised first quarter GDP data showed a contraction of 1.8% on an annualised basis, slightly less severe than the initial 2.0% estimate, primarily due to an upward revision in private inventories. The weakness was largely attributed to the economic impact of the January earthquake on the Noto Peninsula and temporary auto production suspensions.

Additionally, the Bank of Japan reported that producer prices rose 2.4% year-over-year in May, exceeding market expectations of a 2.0% increase, driven by higher renewable energy surcharges.

South Korea

South Korea’s KOSPI added 2.2% this week, nearing a new annual high as U.S. stock markets continued to gain. The Federal Open Market Committee’s indication of potential rate cuts within the year and flat U.S. consumer prices in May helped ease investor sentiment.

South Korea’s financial regulator, the Financial Services Commission (FSC), announced a 10 month extension of the blanket stock short selling ban until the end of March 2025.

FSC Vice Chairman Kim So-young stated, “If short sales resume now without a comprehensive monitoring system in place, there is a risk that large scale illegal short selling will occur again.”

Taiwan

Taiwan’s TAIEX index was the top performer among the Jakota markets, rising 3.0% and reaching a new historic high above 22,500 points on Friday.

Investors were relieved to see easing inflationary pressures in the U.S., as indicated by a cooler than expected Consumer Price Index (CPI) for May. This prompted them to buy large tech stocks, including Apple suppliers Taiwan Semiconductor (TSMC) and Hon Hai Precision Industry, amid optimism that Apple would benefit from its efforts in AI development.

The Taiwan Central Bank raised its 2024 GDP growth forecast to 3.77% from the previous 3.22% estimate made in March. The bank noted that the export oriented local economy has benefitted from growing global demand for emerging technologies such as AI development.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index fell 0.6% this week, with only 59 out of 150 constituents showing positive price trends.

Taiwanese iPhone assembler Foxconn (Hon Hai Precision Industry) emerged as the top performer in the JAKOTA Blue Chip 150 Index this week, gaining 11.5%. The surge followed Apple’s shares reaching a record high on Tuesday after the company’s highly anticipated entry into AI development. The announcement confirmed that Apple’s flagship products, including the iPhone, iPad, and Mac, will integrate advanced AI applications, potentially stimulating consumer upgrades and benefiting Apple’s suppliers.

Korean secondary battery related stocks Ecopro and its subsidiary Ecopro BM, known for their volatility within the index, experienced a reversal of fortune. Last week’s top performers found themselves at the bottom of the index, with Ecopro BM seeing the largest decline of 9.7%. The sharp drop in stock prices was influenced by news that Blue Run Ventures (BRV), Ecopro BM’s second largest shareholder, had engaged in after hours block deals.