Last week’s Jakota markets:

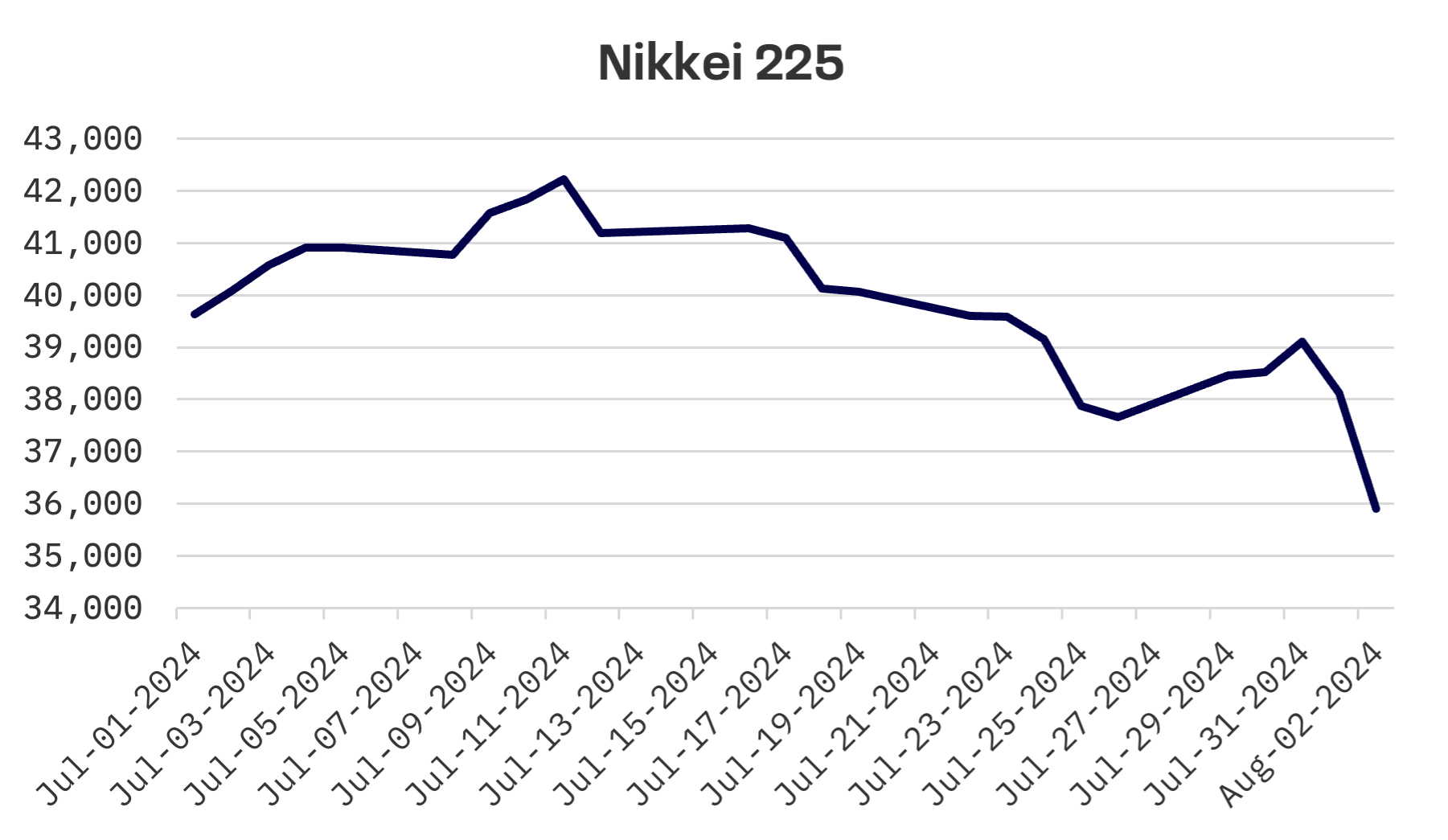

- Japan’s Nikkei 225 Index plunged 4.7%, reeling from the Bank of Japan’s unexpected hawkish shift relating to short term interest rates and disappointing U.S. economic data

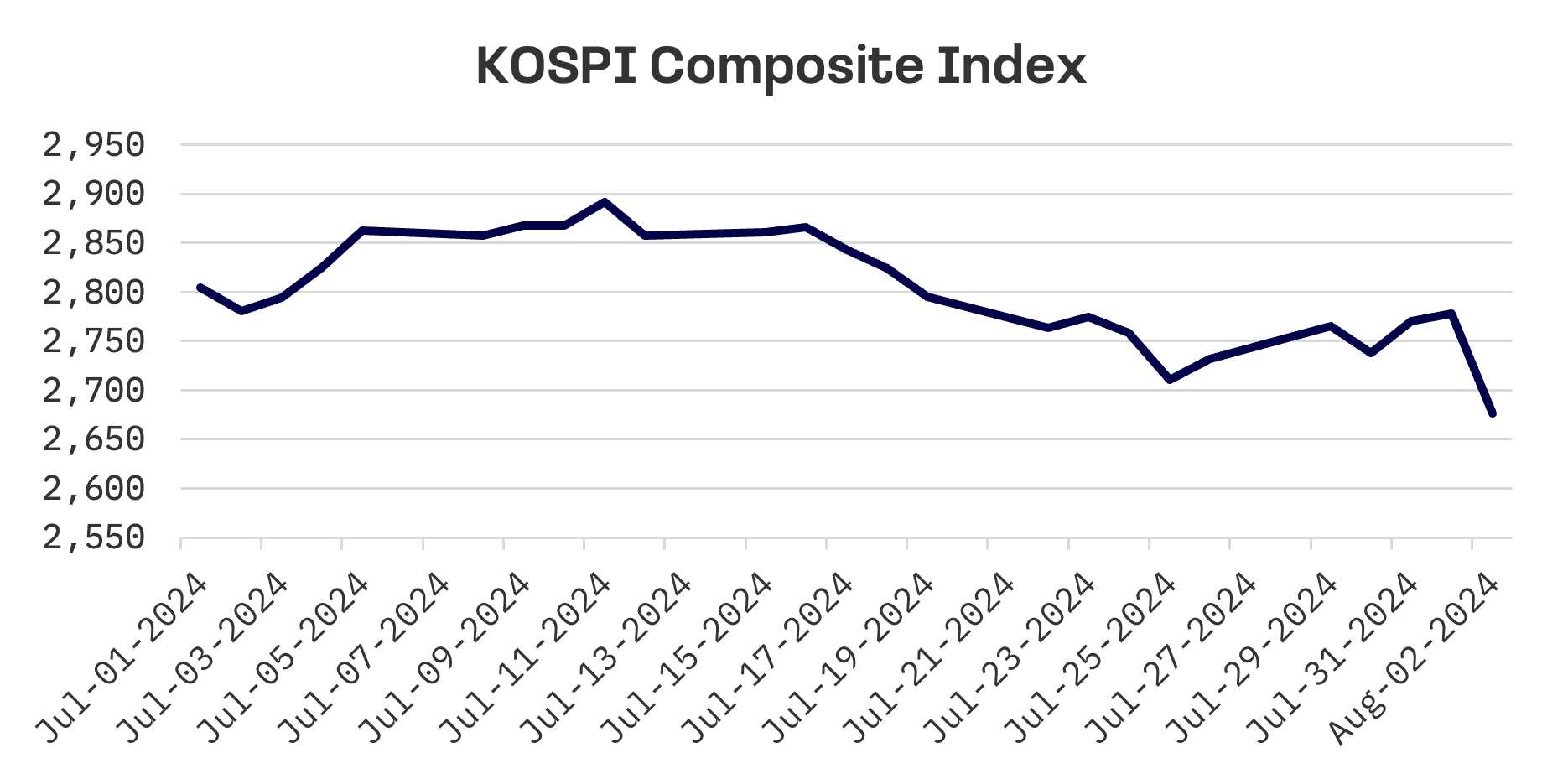

- South Korea’s KOSPI fell 2.0%, marking its fourth consecutive weekly loss, despite strong export performance in semiconductors

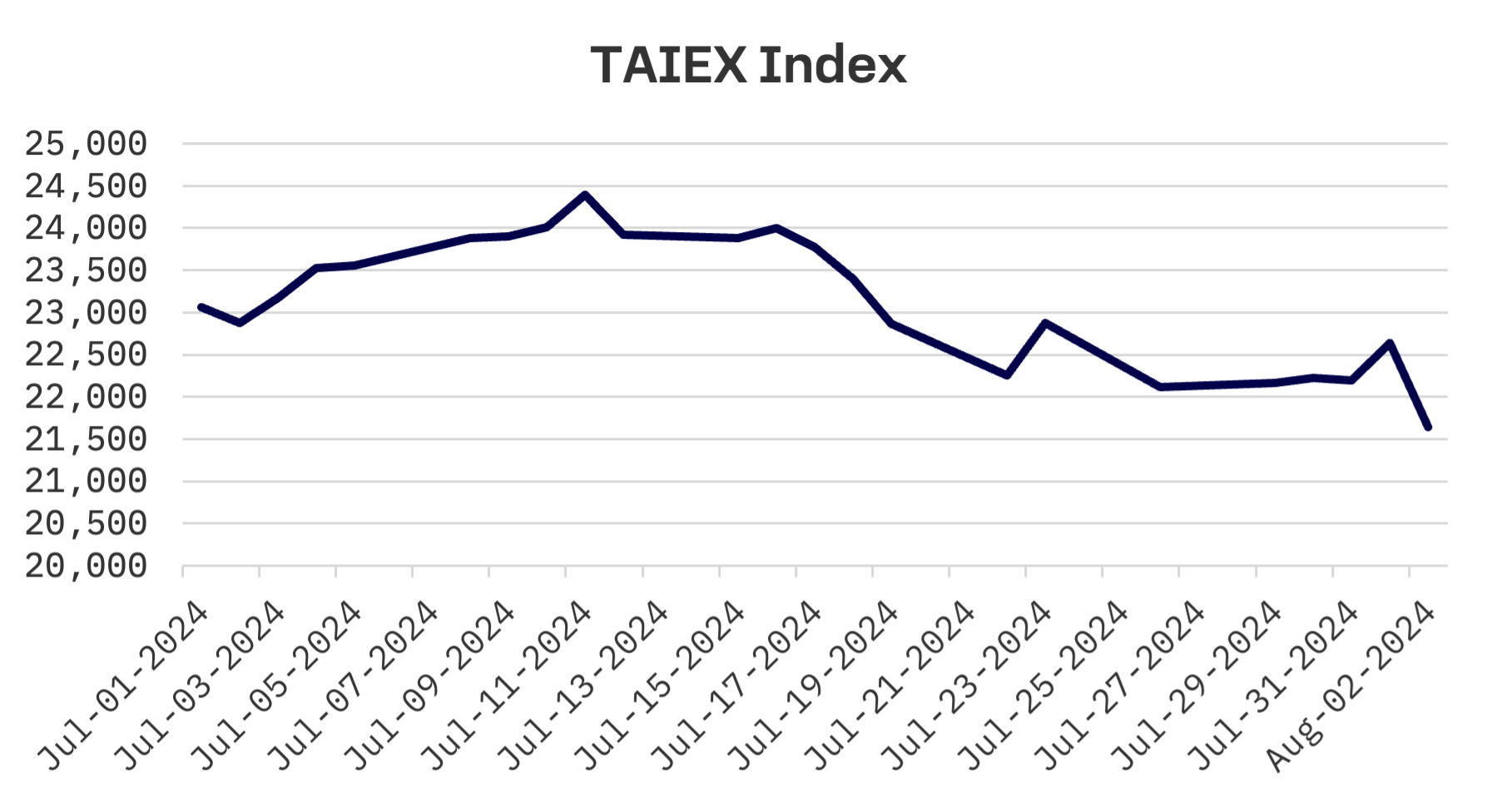

- Taiwan’s TAIEX index dropped 2.2%, with Friday seeing its steepest point decline in history, driven by concerns over the U.S. economy

- The JAKOTA Blue Chip 150 Index declined 2.4%, with only 26 out of 150 stocks showing positive trends, highlighting widespread market weakness

Japan

The Japanese stock market experienced a significant downturn last week, with the Nikkei 225 Index dropping 4.7%, driven by the Bank of Japan’s hawkish shift. On Friday, disappointing U.S. macroeconomic data further eroded investor confidence, leading to one of the largest single day drops in the Nikkei’s history – paralleling the severe falls of March 2020 amid the onset of the coronavirus pandemic and the October 1987 “Black Monday” crash.

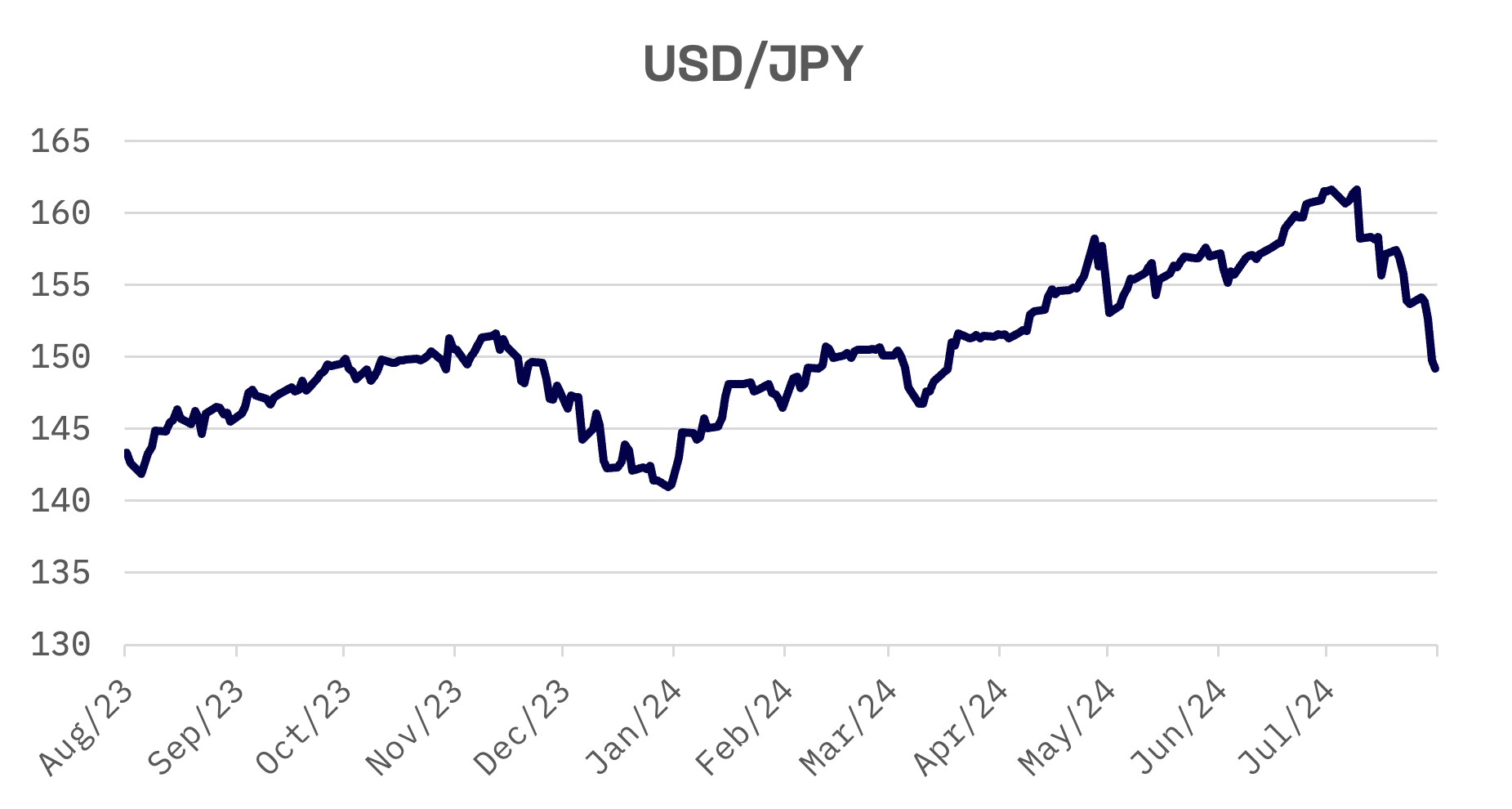

The yen’s resurgence continued to pressure earnings forecasts for Japan’s export driven firms. The currency appreciated to about ¥149 per dollar, up from around ¥154 the previous week.

At its July meeting, the Bank of Japan (BoJ) raised its key short-term interest rate to approximately 0.25% from the previous range of 0% to 0.1%. This marked the BoJ’s second rate hike of the year, following its exit from a negative interest rate policy in March, and occurred sooner than many investors had anticipated.

The BoJ also unveiled a plan to decrease its monthly outright purchases of Japanese Government Bonds to about ¥3 trillion by the first quarter of 2026. These purchases will be reduced by around ¥400 billion each calendar quarter, a strategy announced in June. Unlike the rate hike, this tapering of bond purchases was anticipated, as the BoJ had announced this strategy in June, promising to provide specifics at the July meeting.

In its quarterly outlook, the BoJ revised its core inflation forecast for fiscal year 2024 downward to 2.5% from 2.8% projected in April. It also slightly reduced its growth outlook to 0.6% from 0.8%.

South Korea

The Korean stock market retreated last week, with the KOSPI Composite Index dropping 2.0%, marking its fourth consecutive weekly loss. Until Friday, market dynamics were generally positive, spurred by signals from the Federal Reserve indicating potential rate cuts. However, on Friday, Seoul shares plummeted by more than 3.5%, breaching the 2,700 level for the first time in almost two months, as data stoked concerns about the U.S. economy. U.S. data showed unemployment claims hit the highest in almost a year and manufacturing shrank.

Meanwhile, South Korea’s exports extended their year-on-year gains for the tenth consecutive month in July, driven by robust semiconductor performance. Outbound shipments rose 13.9% year-on-year to $57.4 billion last month, according to the Ministry of Trade, Industry and Energy.

Taiwan

The Taiwan stock market was no exception among Jakota markets, also experiencing a decline, with the TAIEX Index falling 2.2% last week. On Friday, the TAIEX registered its steepest point drop in history as sharp declines in high cap electronics shares reflected concerns over the U.S. economy and disappointing earnings reports from major U.S. tech companies.

On the economic front, Taiwan’s GDP grew by approximately 5.09% year-on-year in the second quarter of 2024, slightly below the earlier forecast of 5.18% made in May, according to preliminary government data.

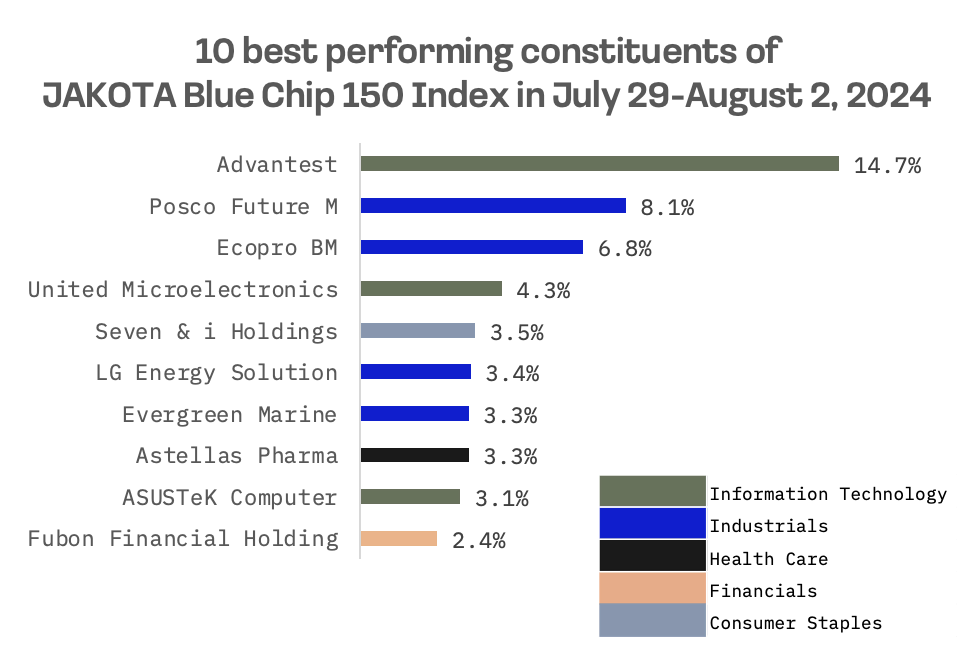

JAKOTA Blue Chip 150 Index

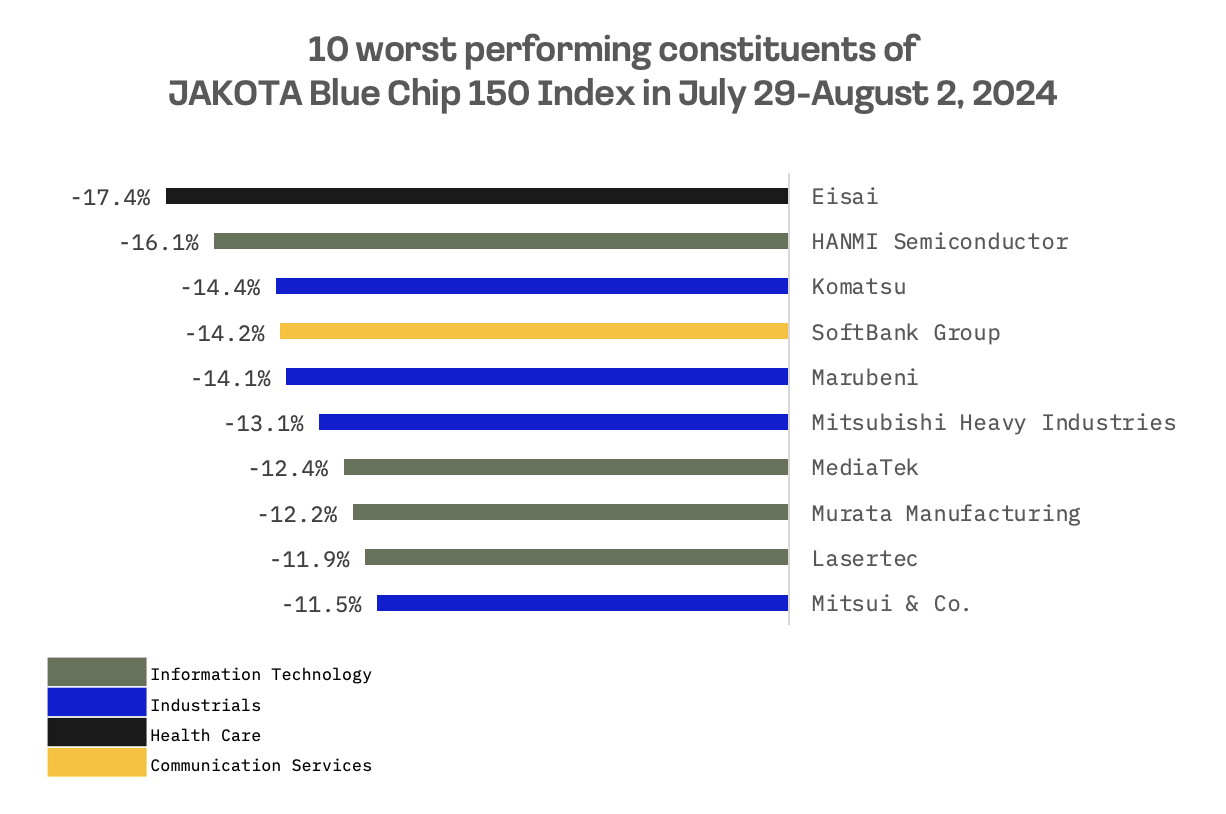

The JAKOTA Blue Chip 150 Index fell by 2.4% last week. On Friday, the Index plummeted by 5.2%, marking the steepest drop in its history. Out of 150 constituents, only 26 stocks exhibited positive price trends.

Advantest, a manufacturer of automatic test equipment for the semiconductor industry, emerged as the top performing stock. The company’s consolidated net profit for the first quarter (April-June) of the fiscal year ending March 2025 surged to ¥23.8 billion, 2.6 times higher than the same period last year. Advantest revised its full year net profit forecast upward by 56.7% from the previous forecast of ¥67 billion to ¥105 billion (compared to ¥62.2 billion in the previous period).

Eisai, the Japanese pharmaceutical company, led the decline among JAKOTA Blue Chips 150 constituents. Shares fell more than 17% following the European authorities’ surprise rejection of its Alzheimer’s drug last week. “The benefits of treatment are not large enough to outweigh the risks associated with Leqembi,” said the European Medicines Agency (EMA) in an opinion issued on July 25. Leqembi can have side effects, such as headache and swelling in areas of the brain.

The decision complicates Eisai’s efforts to distribute the breakthrough drug developed with Boston based Biogen. Eisai stated it was “extremely disappointed” by the EMA’s negative opinion and will seek a re-examination of the decision. The drug has been approved in the U.S., Japan, China, South Korea, Hong Kong and Israel; it is being marketed in the U.S., Japan and China. The rejection came as a surprise to investors expecting Europe to follow these other markets.