Last week’s Jakota markets:

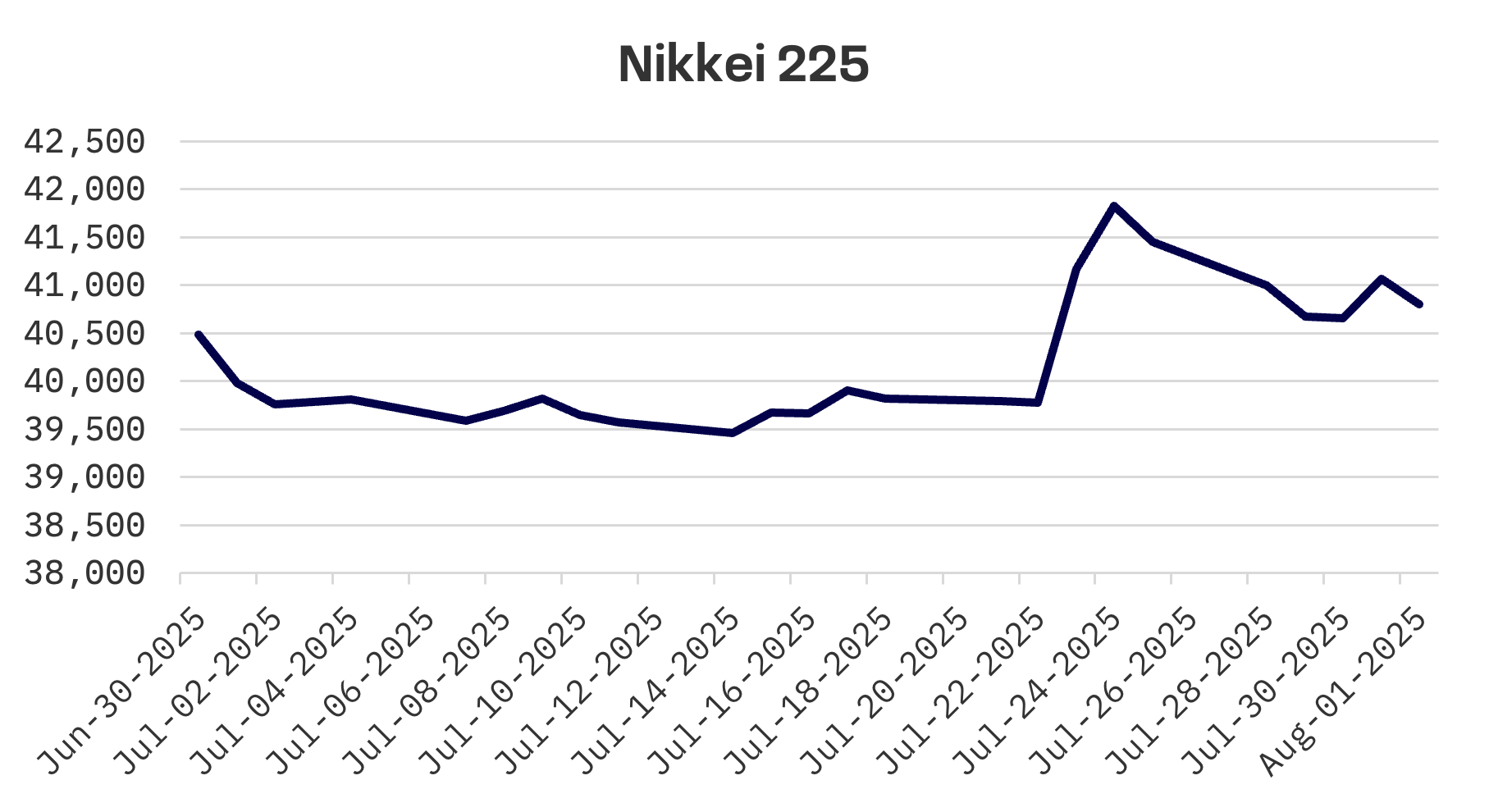

- Japan’s Nikkei 225 Index dropped 1.6% as tech selloffs outweighed positive economic data, while the yen weakened past ¥150 against the dollar

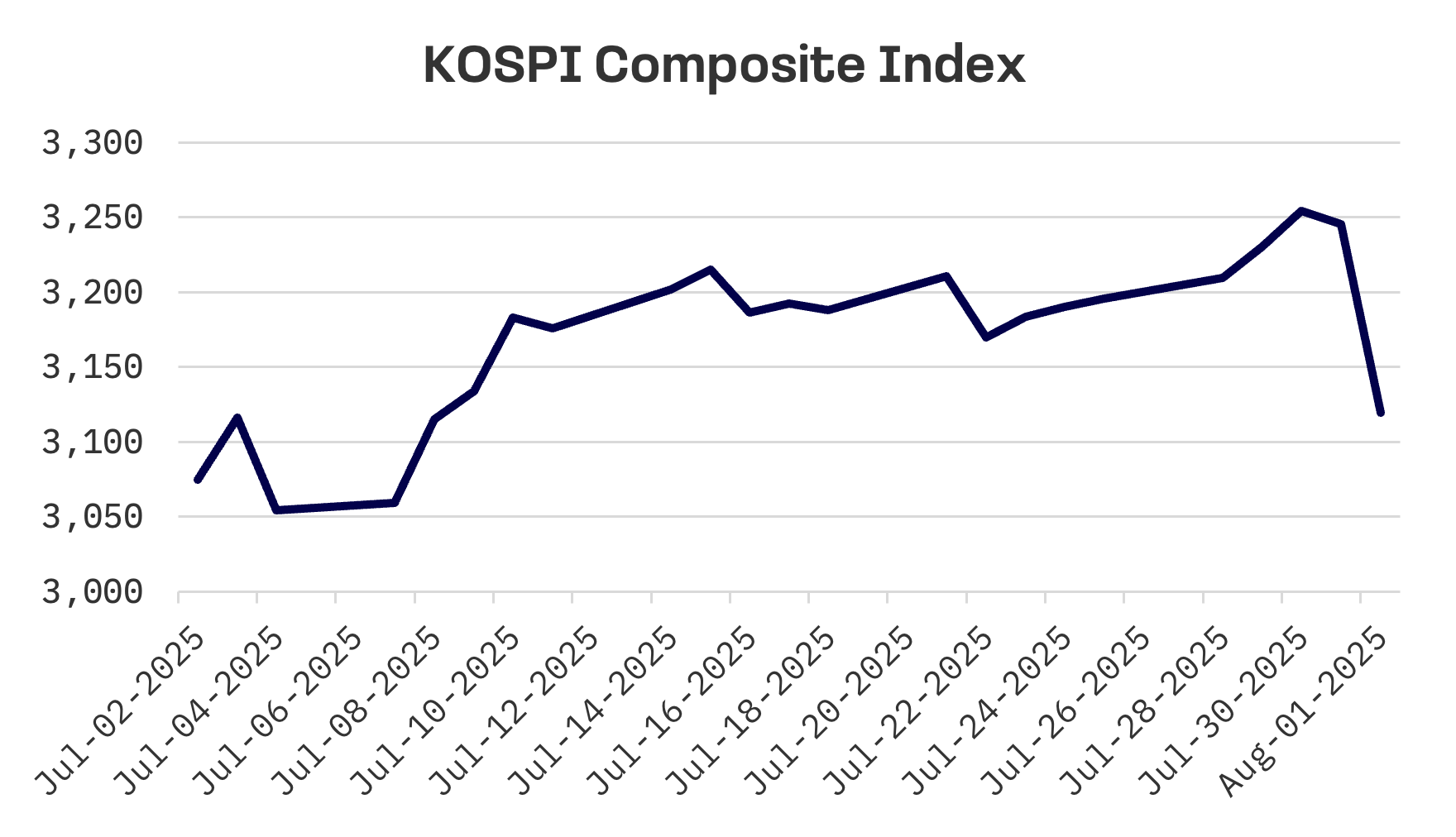

- South Korea’s KOSPI Index suffered a 2.4% decline after new tax policies dampened investor enthusiasm despite securing reduced U.S. tariffs

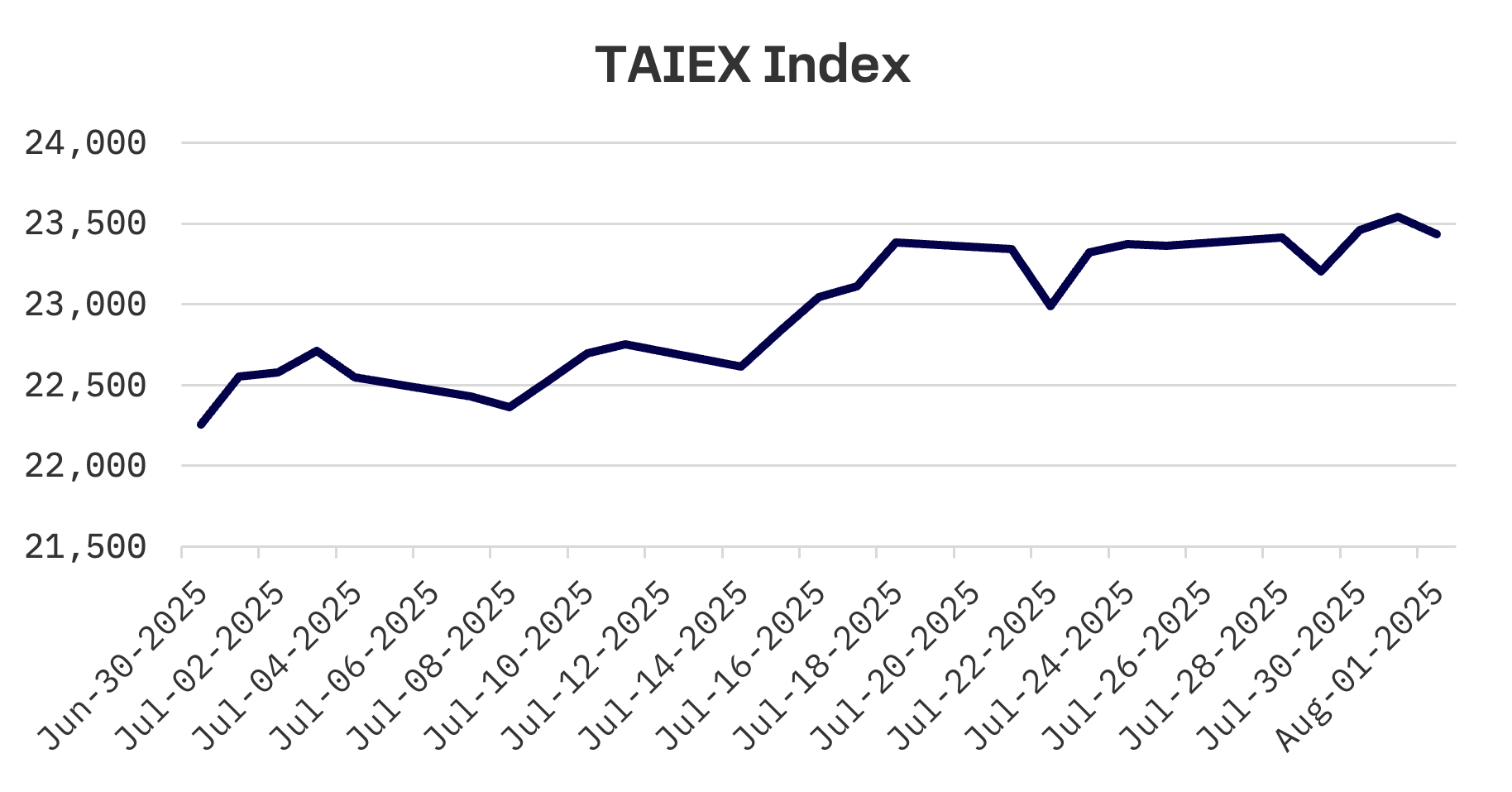

- Taiwan’s TAIEX Index bucked regional weakness with a 0.3% gain, shrugging off steeper 20% U.S. tariffs as officials characterised the measure as provisional

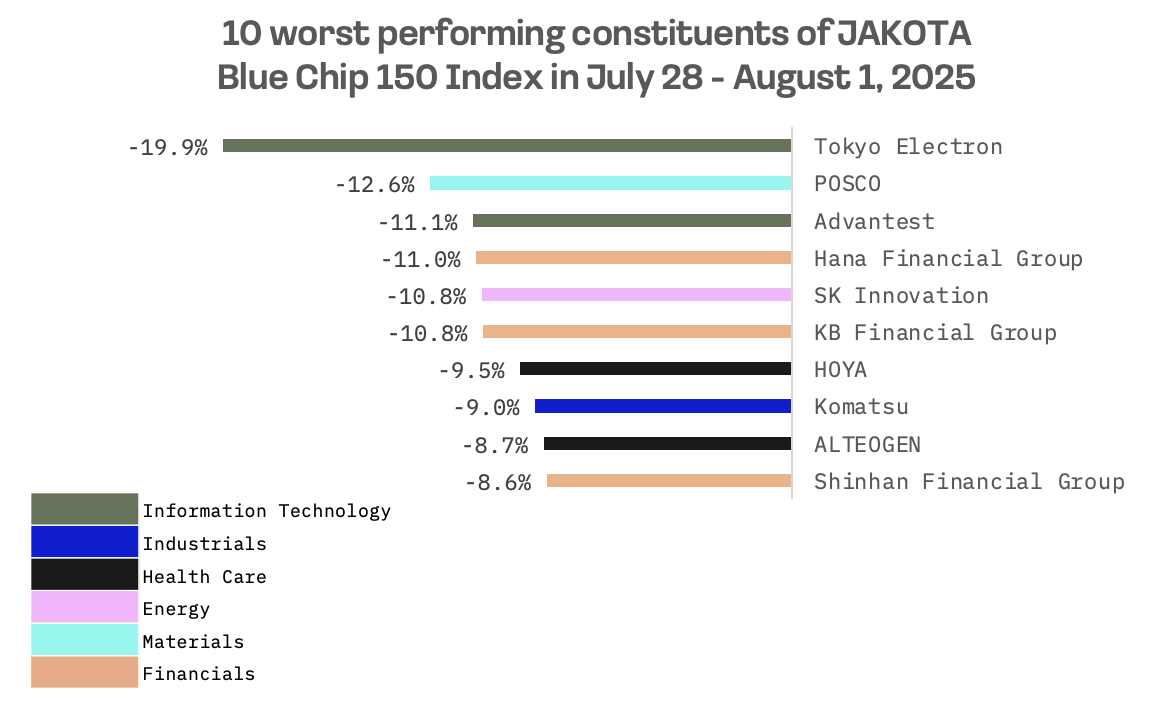

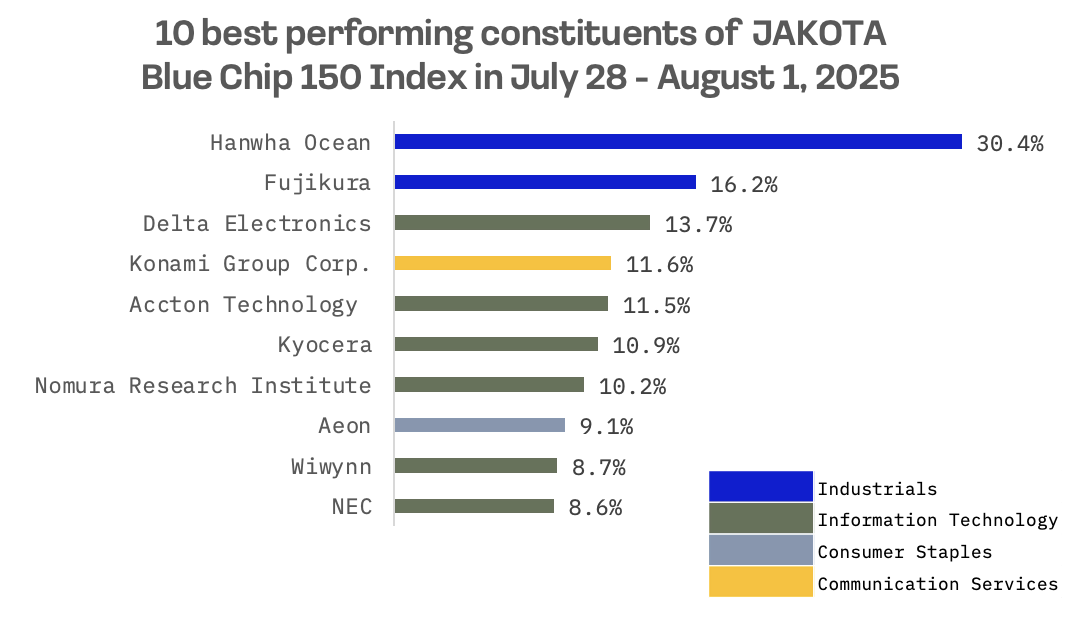

- The JAKOTA Blue Chip 150 Index slipped 2.1%, with shipbuilder Hanwha Ocean surging 30% and semiconductor equipment maker Tokyo Electron leading declines

Japan

Japan’s stock market retreated this week, with the Nikkei 225 falling 1.6% as technology shares led declines following disappointing earnings results. Rising global trade tensions further weighed on investor sentiment across the market.

The yen continued its slide, weakening past the ¥150 mark against the dollar to hover near four month lows. The currency’s decline prompted Finance Minister Katsunobu Kato to express concern over volatility and reiterate the government’s preference for exchange rates that move in a stable manner aligned with economic fundamentals.

The Bank of Japan (BoJ) held its benchmark interest rate steady at 0.5% following its July 30-31 policy meeting, while raising inflation expectations in its quarterly outlook. The central bank now projects core consumer prices will rise 2.7% in fiscal 2025, up from its April estimate of 2.2%, citing continued upward pressure from food costs. CPI forecasts for fiscal 2026 and 2027 were also revised modestly higher.

The BoJ upgraded its real GDP growth forecast to 0.6% for fiscal 2025, slightly above its earlier 0.5% projection. While flagging geopolitical and trade policy uncertainty as key risks, the central bank acknowledged constructive developments, including a bilateral agreement between Japan and the U.S..

Governor Kazuo Ueda noted that confidence in the bank’s outlook had strengthened, fuelling investor speculation about a potential rate increase later this year. The BoJ reaffirmed that if economic activity and inflation develop as projected, it will continue raising rates and gradually adjusting monetary accommodation.

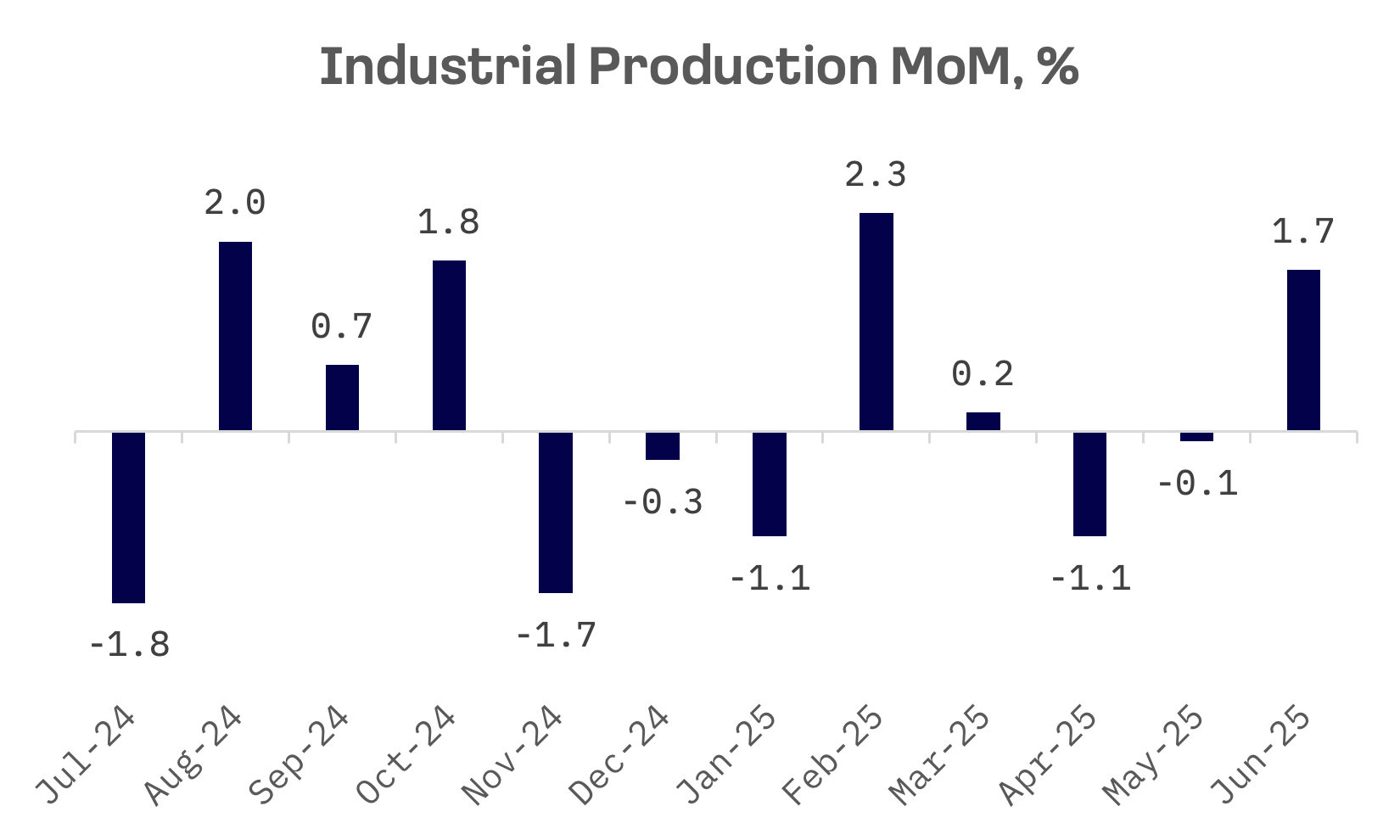

Economic data painted a brighter picture, with industrial production climbing 1.7% in June from the previous month, defying expectations for a 0.6% decline and rebounding from May’s 0.1% drop. Retail sales rose 2% year-over-year, slightly beating forecasts of 1.8% growth and following May’s 1.9% increase.

South Korea

South Korean stocks tumbled this week, with the KOSPI Index plunging 2.4%. Despite a trade agreement with the U.S. that reduced tariffs from 25% to 15%, investor sentiment soured after the government announced sweeping tax reforms aimed at boosting revenue from corporations and individual investors.

The tax overhaul, unveiled on Friday, includes raising the top corporate tax rate from 24% to 25% and tightening capital gains rules by lowering the threshold for large shareholders to ₩1 billion from the current ₩5 billion. The announcement triggered heavy selling by foreign investors, even as officials continue promoting a KOSPI 5,000 target – conflicting policy signals that have raised doubts about the government’s commitment to market friendly policies.

The recent U.S.-South Korea trade agreement has created winners and losers across Korean industries, with shipbuilders emerging as clear beneficiaries. Central to the deal is South Korea’s $150 billion shipbuilding fund, designed to strengthen the U.S. shipbuilding sector through infrastructure investment, workforce development and supply chain expansion. Automakers, steelmakers and semiconductor companies, however, face a more challenging outlook.

Taiwan

Taiwan’s stock market edged higher this week, with the TAIEX gaining 0.3%, even as the U.S. imposed a 20% tariff on Taiwan’s imports – steeper than the 15% rate facing competitors Japan and South Korea. While the higher duty initially raised concerns about local exporters’ competitiveness, investor sentiment stabilised after officials characterised the measure as provisional with negotiations ongoing.

Taiwan’s Purchasing Managers’ Index declined for a second consecutive month in July, weighed down by weaker new orders and manufacturing output amid ongoing tariff uncertainty.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index fell 2.1% this week, with 70 of its 150 constituents posting gains.

Hanwha Ocean emerged as the index’s top performer, with shares surging more than 30% – their highest level since July 2015 – after President Donald Trump announced a blanket 15% tariff on South Korean exports to the U.S.

The rally reflected expectations that the South Korean shipbuilder will benefit from potential expansion at its Philly Shipyard in Philadelphia, which it acquired last year. The company is viewed as playing a central role in U.S. efforts to revitalise domestic shipbuilding.

Hanwha Ocean also reported strong second quarter results, with operating profit of ₩371.7 billion ($266.7 million), a 43.6% increase from the previous quarter and a sharp turnaround from a ₩10 billion loss a year earlier. Revenue climbed 4.8% quarter-over-quarter to ₩3.3 trillion, supported by solid commercial and offshore sales.

The company announced ₩353.6 billion in new orders on July 29 and unveiled several initiatives under a 2023 competitiveness program aimed at fending off rising competition from Chinese shipbuilders.

Tokyo Electron, a Japanese semiconductor production equipment manufacturer, was the index’s worst performer after the company sharply cut its full year operating profit forecast on July 31, citing sluggish demand from Chinese chipmakers.

The company now expects operating profit of ¥570 billion ($3.83 billion) for fiscal 2026, down from a previous projection of ¥727 billion.

The downgrade came as first quarter revenue fell 1% year-over-year to ¥549.6 billion, while operating profit dropped 12.7% to ¥144.7 billion. Tokyo Electron also trimmed its dividend forecast, lowering the expected payout to ¥485 per share from 618 yen.