Last week’s Jakota markets:

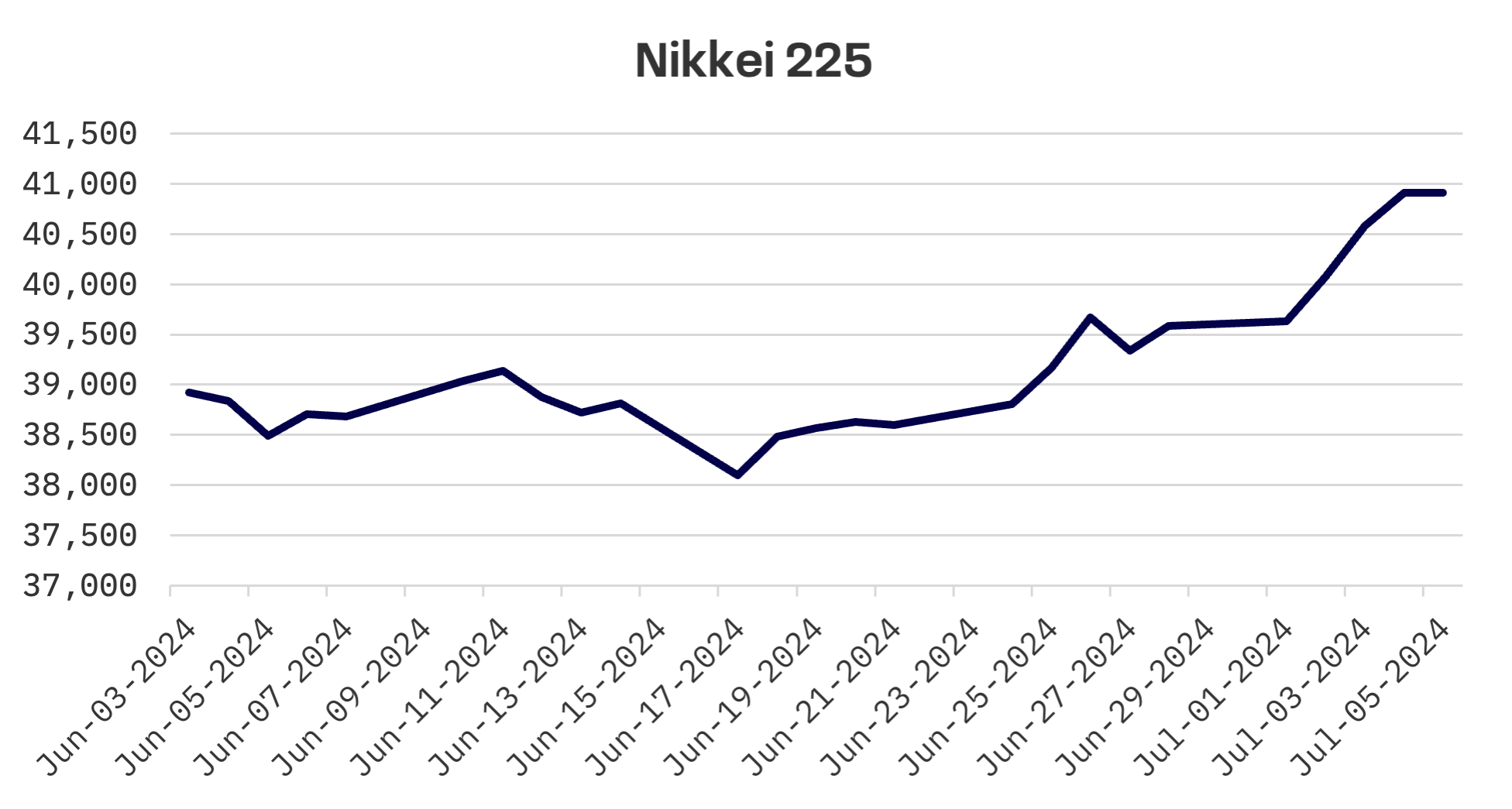

- Japan’s Nikkei 225 Index hit record highs with a 3.4% jump, shrugging off weak GDP revision and consumer spending data

- South Korea’s KOSPI climbed 2.3%, marking five weeks of gains, as the government raised its 2024 growth forecast to 2.6%

- Taiwan’s TAIEX index matched South Korea’s 2.3% gain, buoyed by potential U.S. monetary easing despite slowing manufacturing growth

- The JAKOTA Blue Chip 150 Index rallied 3.5%, with Mitsubishi Heavy Industries surging 11.5% on geopolitical considerations

Japan

Japan’s stock market rallied this week, with the Nikkei 225 Index surging 3.4% to all-time highs. The gains were fuelled by heavy buying of technology and export-oriented shares, benefitting from the yen’s historic weakness.

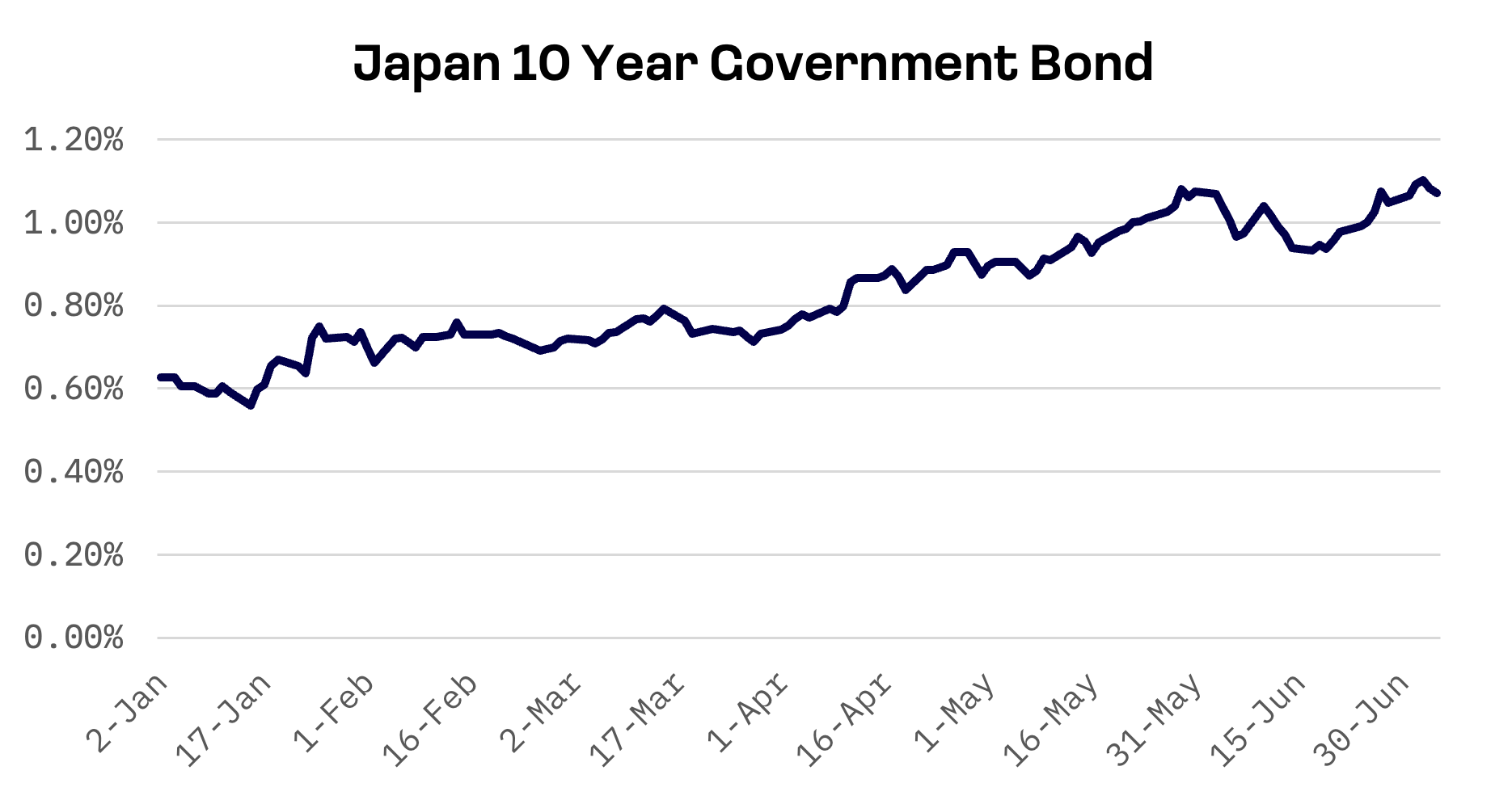

The yield on Japan’s 10-year government bonds touched 1.1%, its highest since 2011, before easing in line with U.S. Treasury yields later in the week.

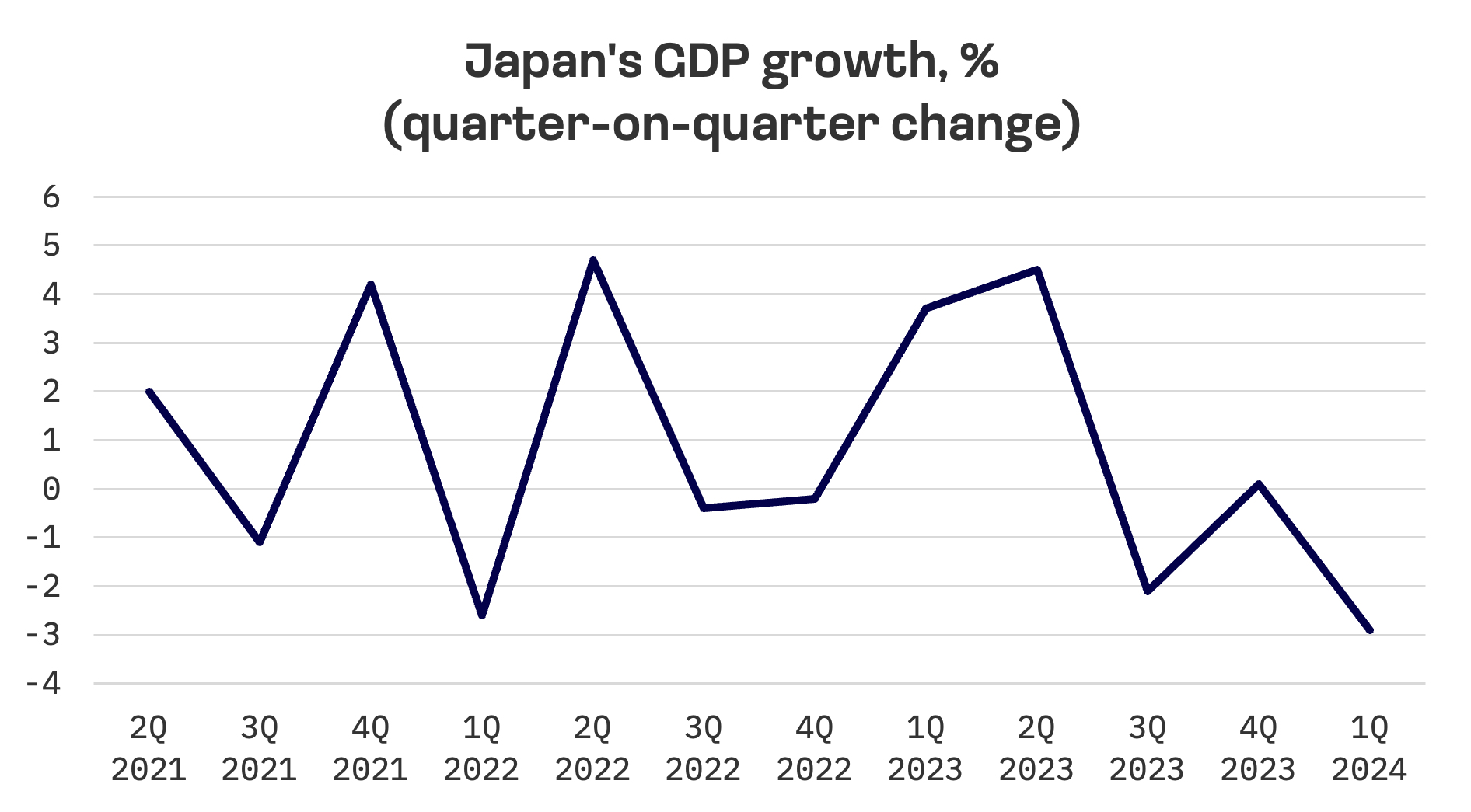

Japan’s economy contracted more sharply than initially estimated in the first quarter, falling 2.9% year-over-year compared to the initial 1.8% drop in GDP. The government attributed the revision to corrections in construction orders.

Household spending fell 1.8% year-over-year in May, significantly below the consensus estimate of a 0.1% increase. Month-over-month, consumer spending dropped 0.3%, against expectations of a 0.5% rise. The weak yen dampened spending, particularly on overseas package tours. Concurrently, rising prices led to a 3.1% decline in food expenditures compared to the previous year.

South Korea

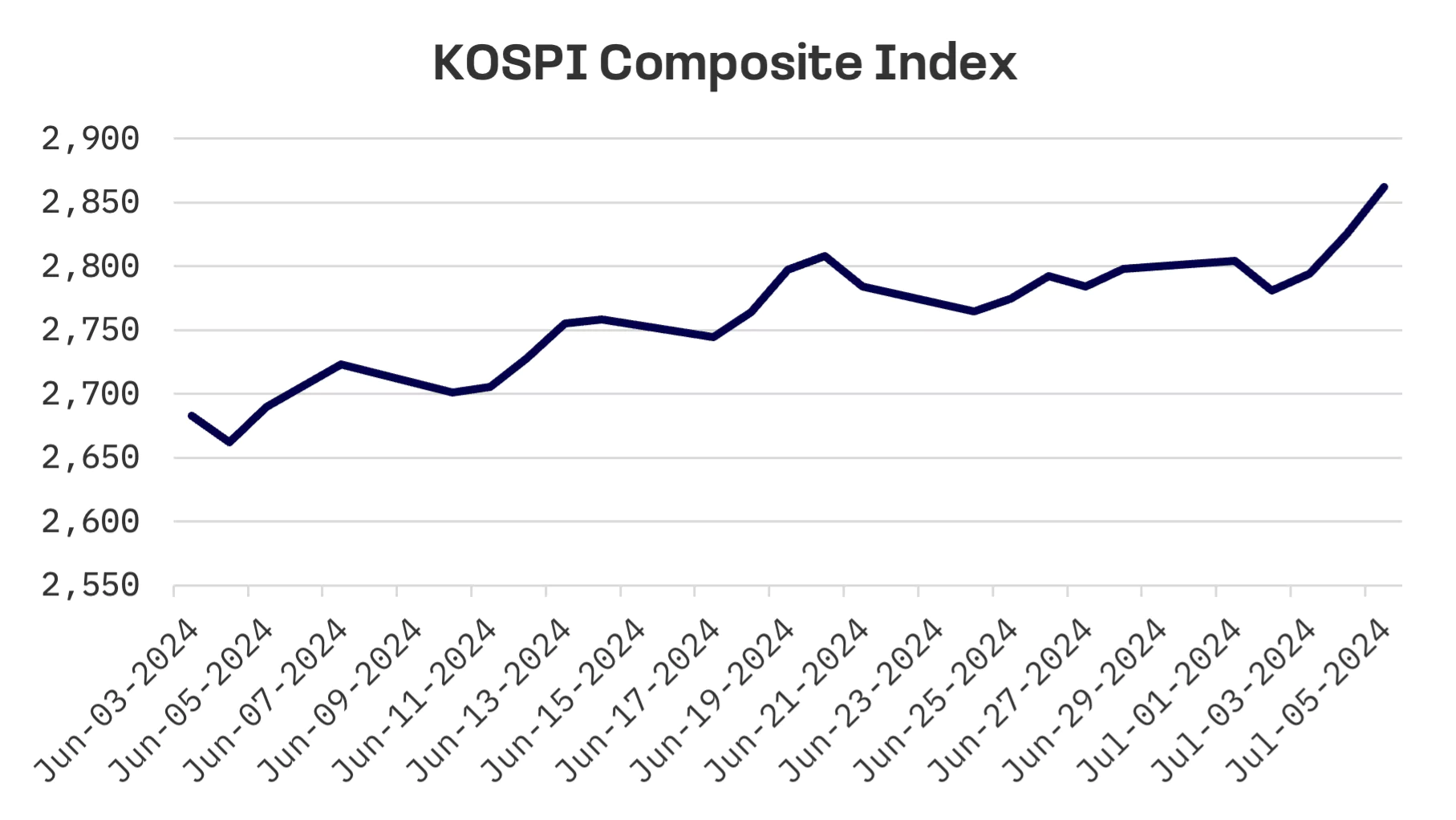

The KOSPI Composite Index rose 2.3%, marking its fifth consecutive week of gains. Investors were buoyed by Federal Reserve Chief Jerome Powell’s comments suggesting possible rate cuts and softer U.S. labour market data.

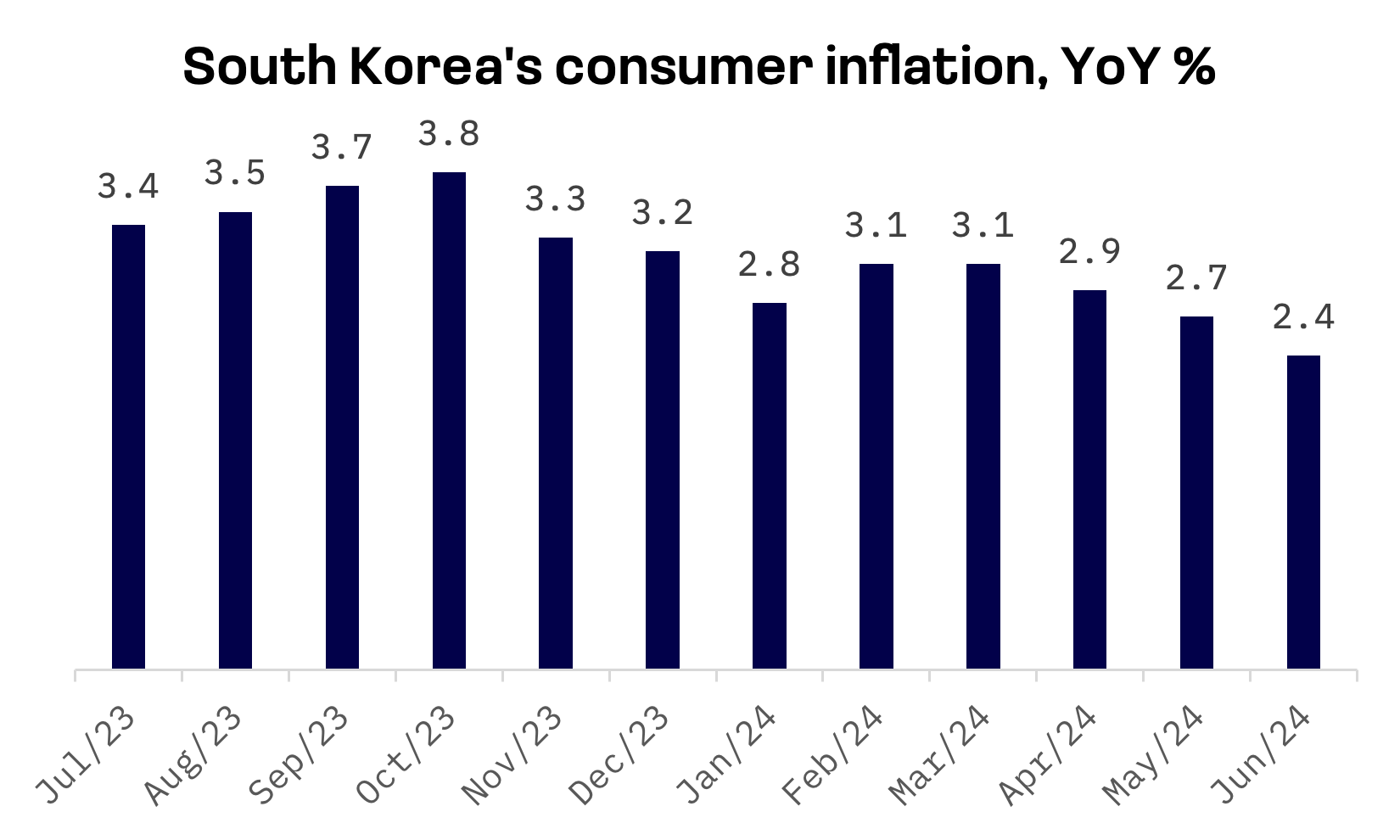

South Korea’s headline inflation remained in the 2% range for the third straight month in June, raising expectations for sub-3% inflation in the latter half of the year.

The Korean government raised its 2024 economic growth forecast to 2.6%, up 0.4 percentage points from its January projection, citing robust exports and a global economic rebound. The Ministry of Economy and Finance stated, “The recovery in exports is anticipated to strengthen in the latter half of the year, supported by the gradual expansion of the global economy and the vigorous semiconductor sector.”

Taiwan

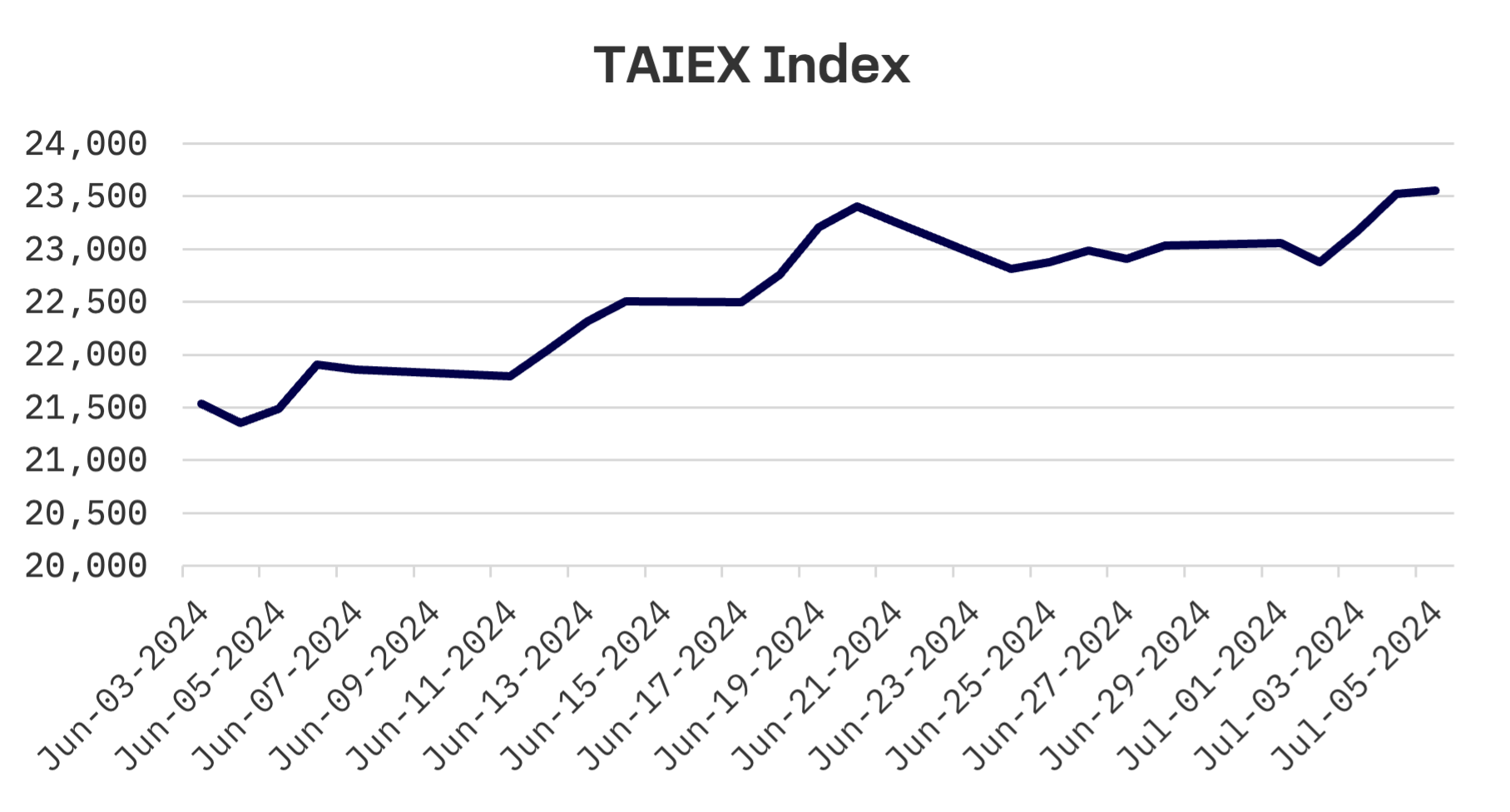

Taiwan’s TAIEX index jumped 2.3%, driven by expectations of potential Federal Reserve rate cuts as early as September.

The Chung-Hua Institution for Economic Research (CIER) reported that Taiwan’s manufacturing sector continued to grow in June, albeit at a slower pace. The purchasing managers’ index (PMI) stood at 53.7%, marking the second consecutive month of expansion. The moderated growth was influenced by renewed geopolitical risks and logistical challenges in shipping, according to CIER.

JAKOTA Blue Chip 150 Index

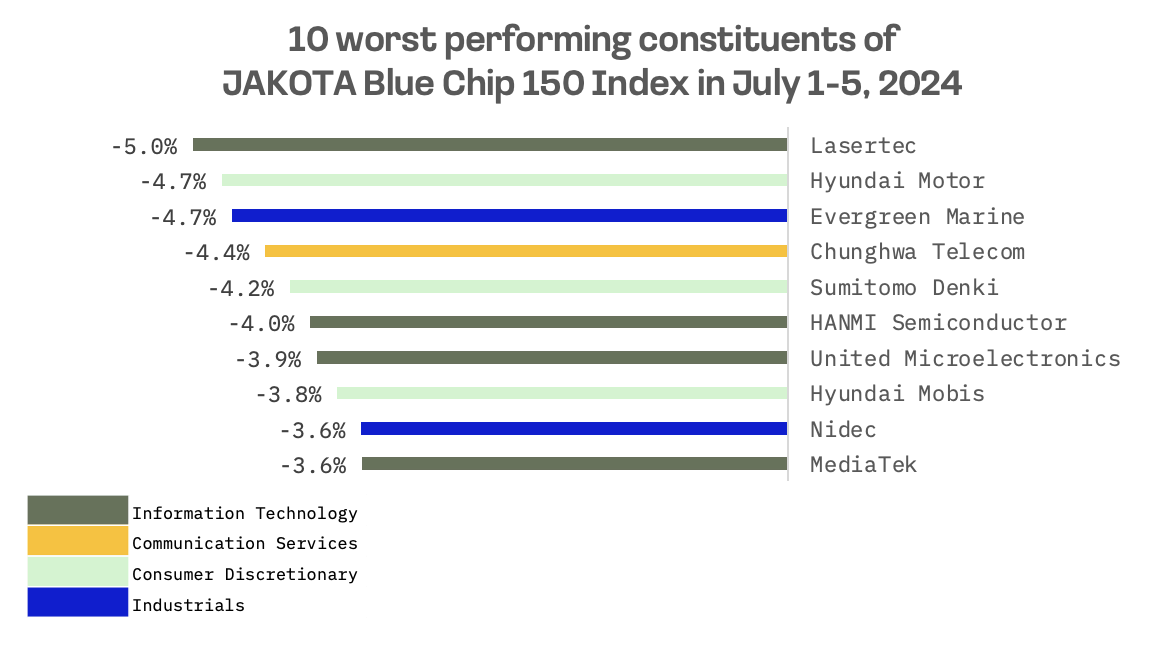

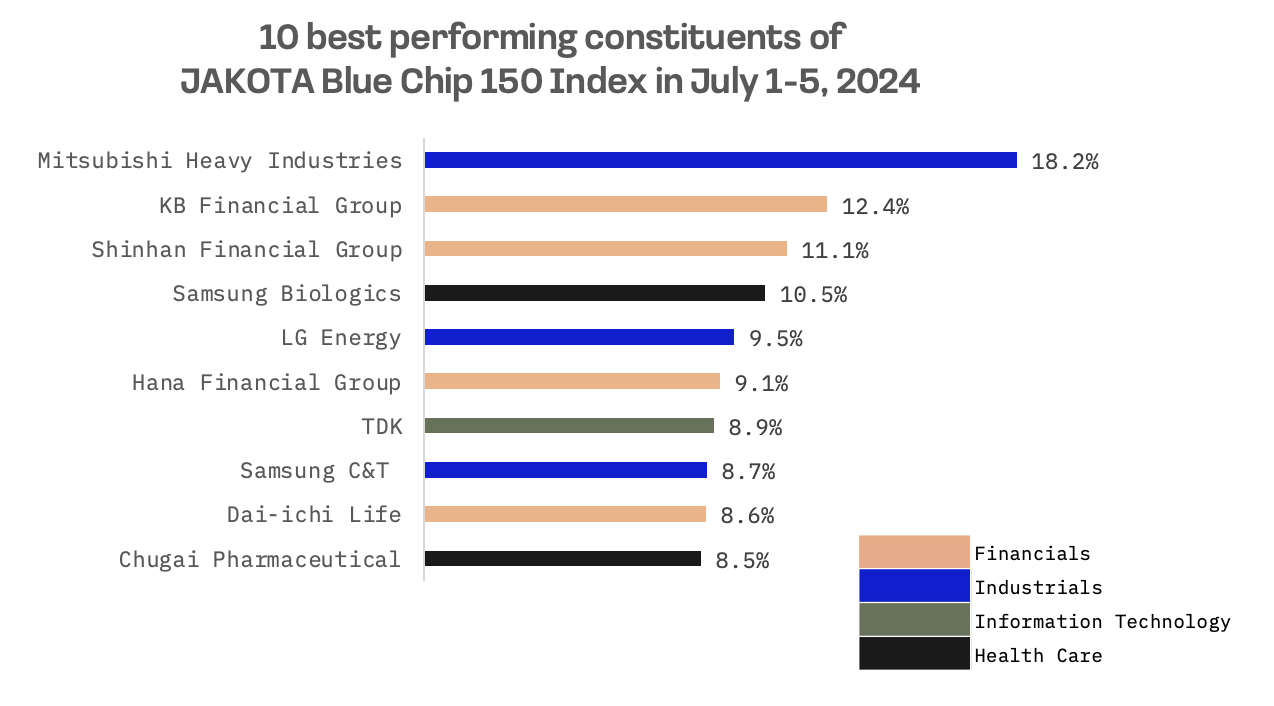

The JAKOTA Blue Chip 150 Index climbed 3.5% this week, with 121 of 150 constituents posting gains.

Mitsubishi Heavy Industries, a Japanese defense contractor, led gains with an 11.5% increase. Shares hit record highs amid speculation about increased military spending by U.S. allies if former President Donald Trump wins a second term.

An analyst noted, “The government’s defense program is centered on longer-range missiles and underwater launch technology, which aligns well with Mitsubishi Heavy Industries’ technological capabilities.”

Lasertec, a Japanese manufacturer of inspection and measurement equipment, was the index’s worst performer. A major Japanese securities firm maintained a neutral rating on Lasertec while cutting its target price from ¥43,000 to ¥32,000.