Last week’s JAKOTA markets:

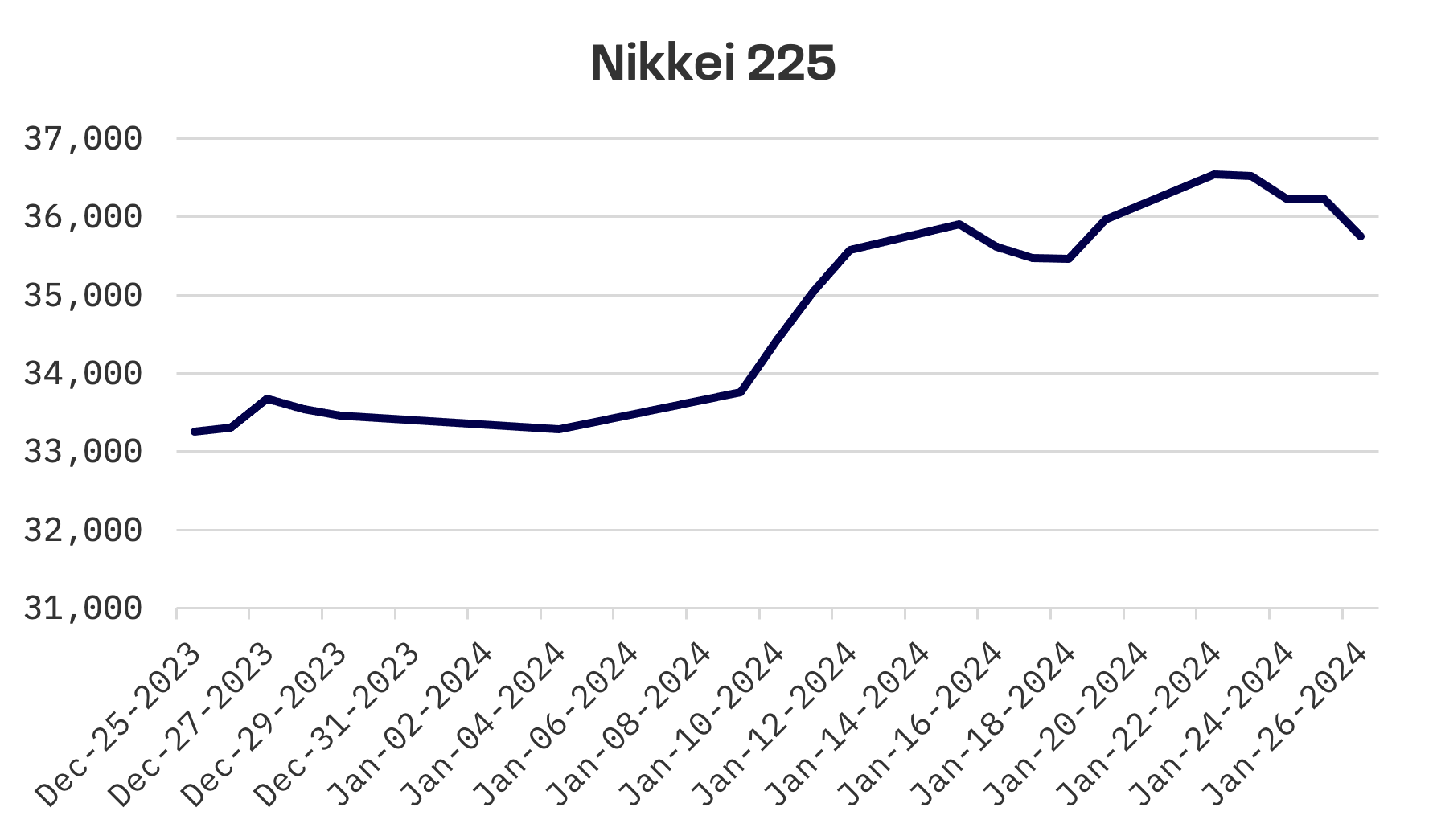

- Japan’s Nikkei 225 Index dipped 0.6%, amid BoJ Governor Ueda’s hints at potential policy shifts, countered by lower-than-expected Tokyo inflation data

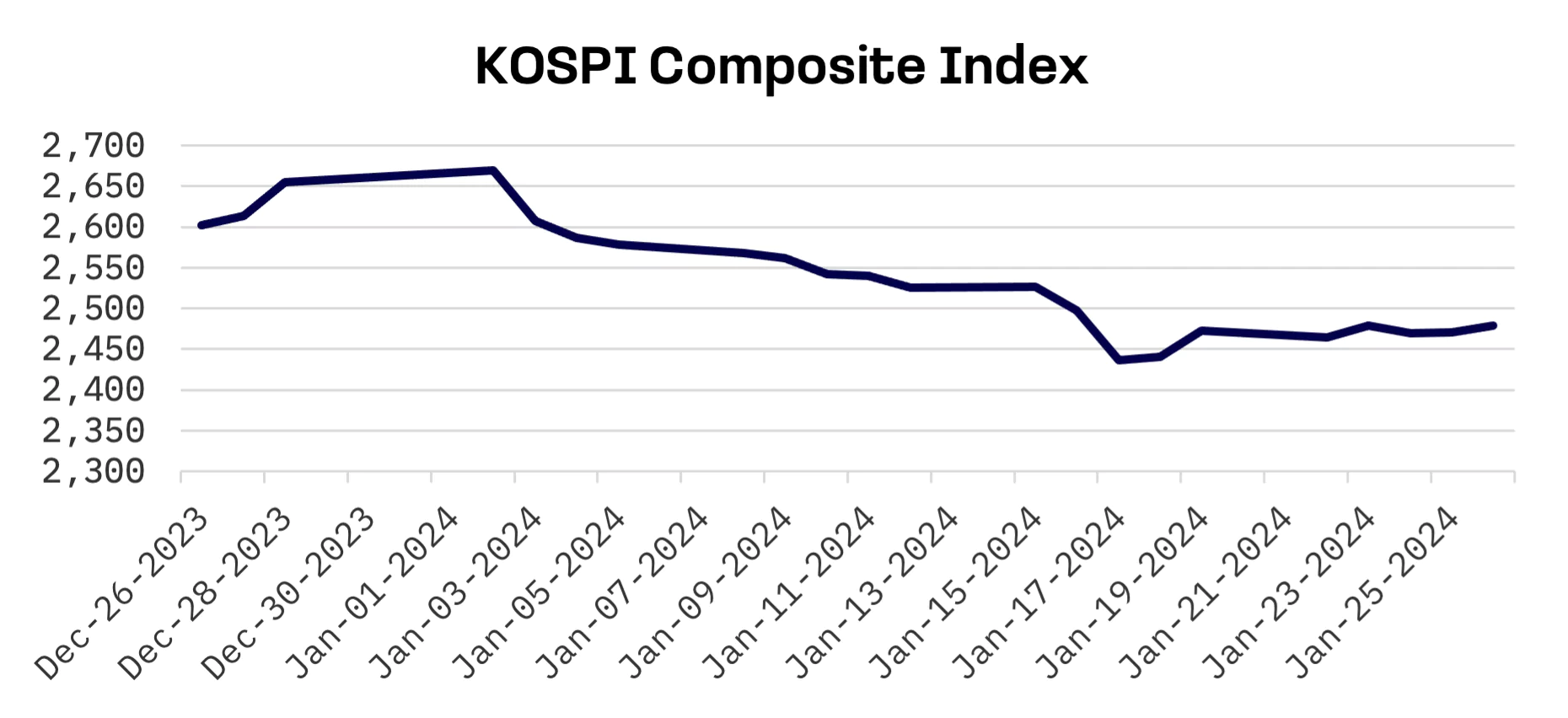

- South Korea’s KOSPI reversed its downward trend, gaining 0.24% thanks to optimistic consumer and business sentiment and a strong performance in the tech sector

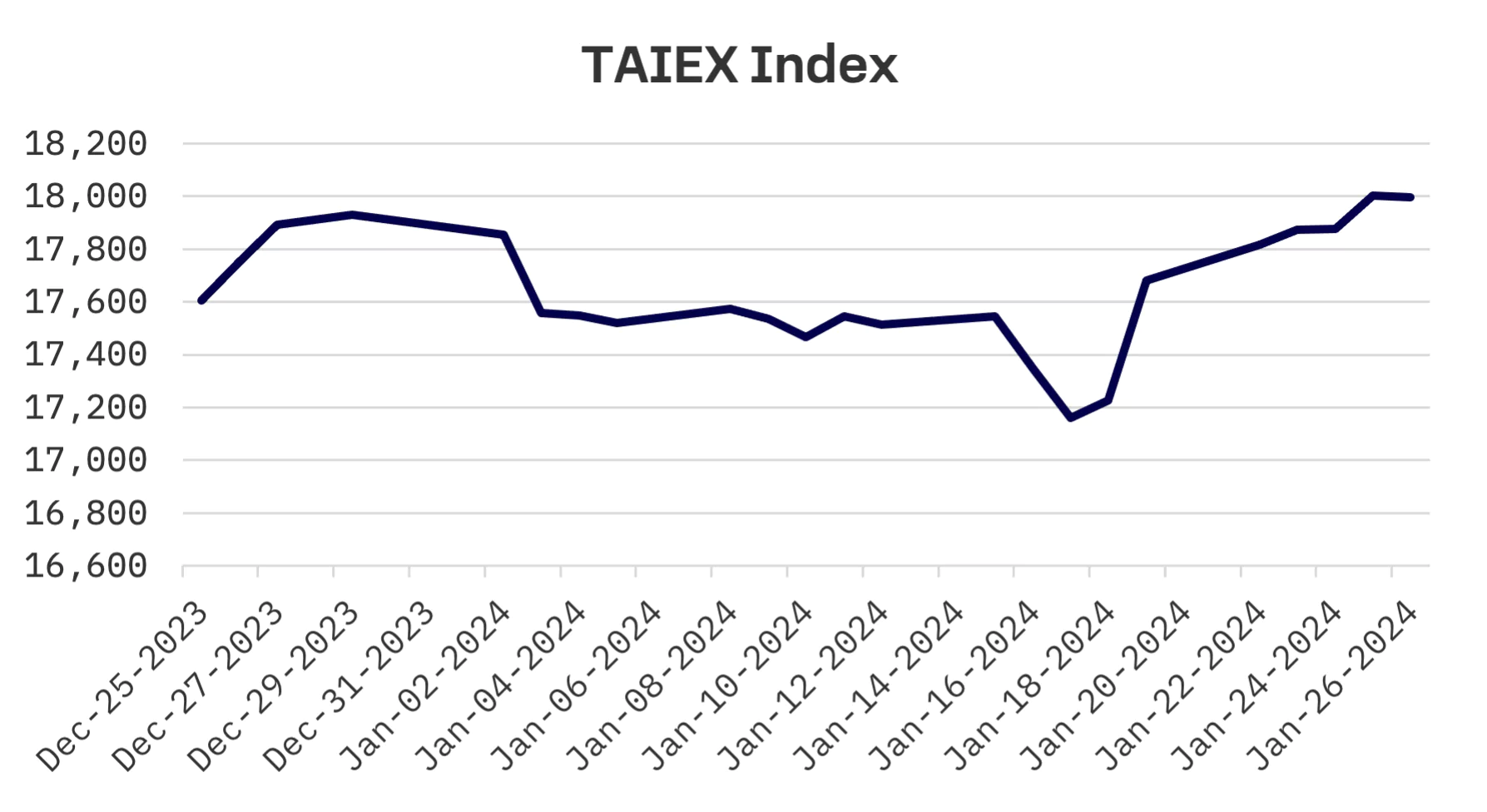

- Taiwan’s TAIEX index led the JAKOTA markets with a 1.8% gain, driven by strong investor interest in TSMC and a rally in U.S. tech stocks

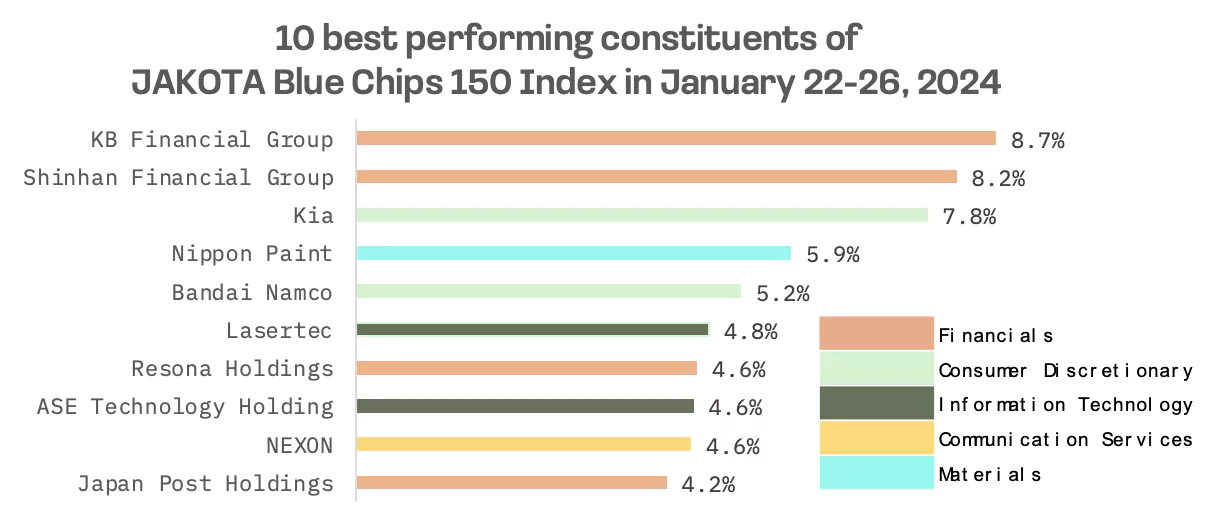

- The JAKOTA Blue Chip 150 Index registered a marginal 0.1% drop, with financial stocks in Korea making gains while other sectors showed varied performances

Japan

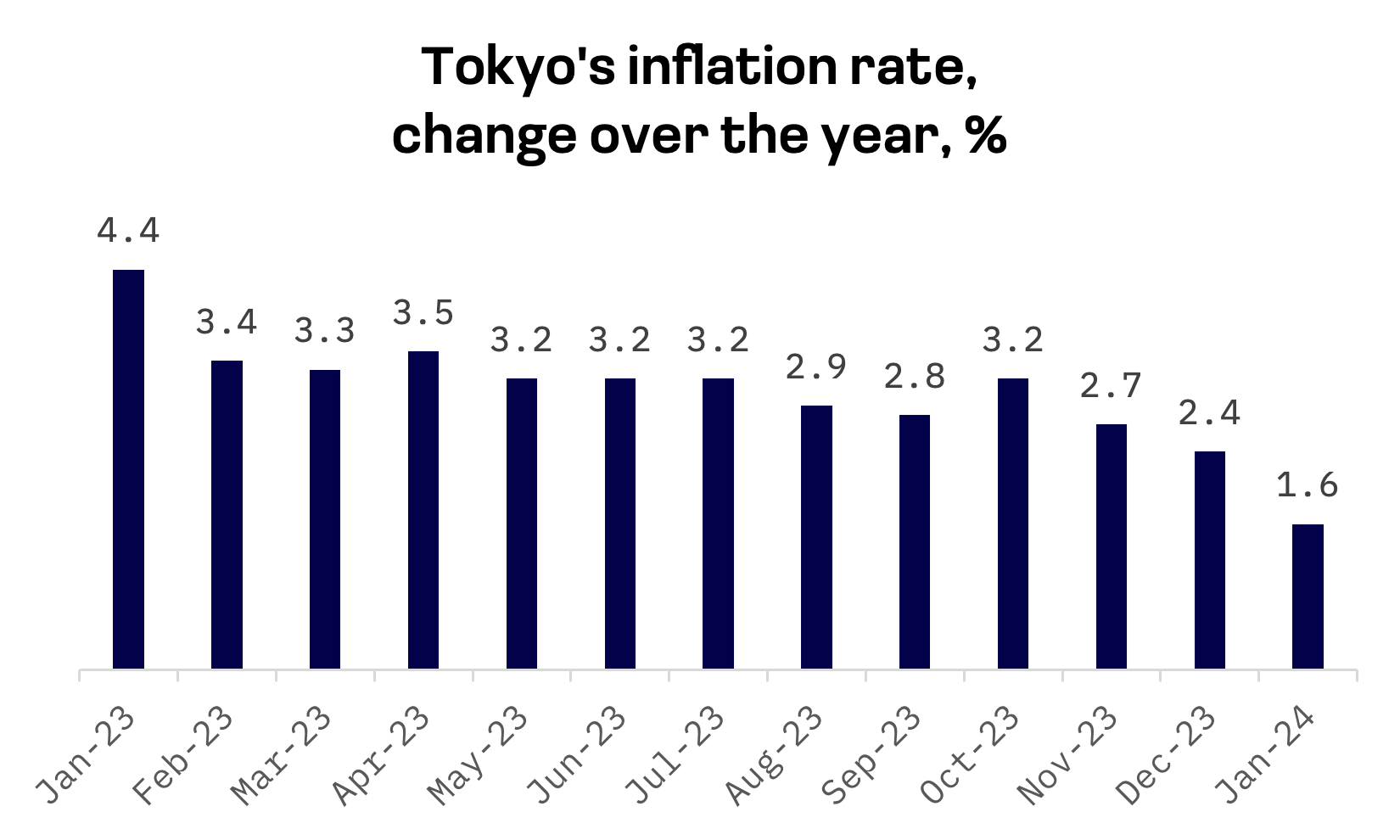

Japan’s stock markets faced a downturn this week, with the Nikkei 225 Index declining by 0.6%. Despite the Bank of Japan (BoJ) maintaining its highly accommodative monetary policy, Governor Kazuo Ueda’s remarks signaling progress towards sustained inflation stirred speculation about potential policy adjustments. However, optimism was tempered by a Tokyo-area inflation report falling below projections, hinting at slower national price trends.

In its mid-January meeting, the BoJ kept its key short-term interest rate target at -0.1% and affirmed its commitment to yield curve control, capping 10-year Japanese Government Bond (JGB) yields at 1.0%. The bank downwardly revised its consumer inflation forecast for fiscal 2024 to 2.4% from the 2.8% projection made in October 2023, attributing this to the recent dip in crude oil prices. Still, the BoJ noted a moderate increase in medium to long-term inflation expectations, suggesting a cautious approach toward its 2.0% inflation target.

Governor Ueda indicated the growing likelihood of meeting the inflation target, a key condition for any potential shifts in monetary policy. The central bank is monitoring the emergence of a positive wage-inflation cycle before deciding on its stimulus continuation.

January’s inflation rate in Tokyo, a precursor to national trends, dipped to 1.6%, a decrease from December’s 2.4%.

Amid speculation about Japan’s negative interest rate policy, the yield on the 10-year JGB edged up to 0.71%. The yen also strengthened slightly, moving to the high-JPY 147 range from around JPY 148 the previous week.

South Korea

In South Korea, the KOSPI Composite Index rebounded, closing 0.24% higher, ending a three-week losing streak. This resurgence was fueled by improved consumer sentiment, attributed to moderating inflation, a rebound in exports and expectations of a pause in the Federal Reserve’s rate hikes.

The technology and battery sectors in South Korea’s stock market experienced notable gains this week, propelled by the robust performance of the U.S. economy, which outpaced expectations with a surge of 3.3% in the fourth quarter of 2023. Additionally, impressive earnings performances from leading automotive companies, including Hyundai Motor and Kia, were pivotal. The strong demand these companies encountered throughout 2023 significantly bolstered their stock prices, contributing to the KOSPI Composite Index closing in positive territory.

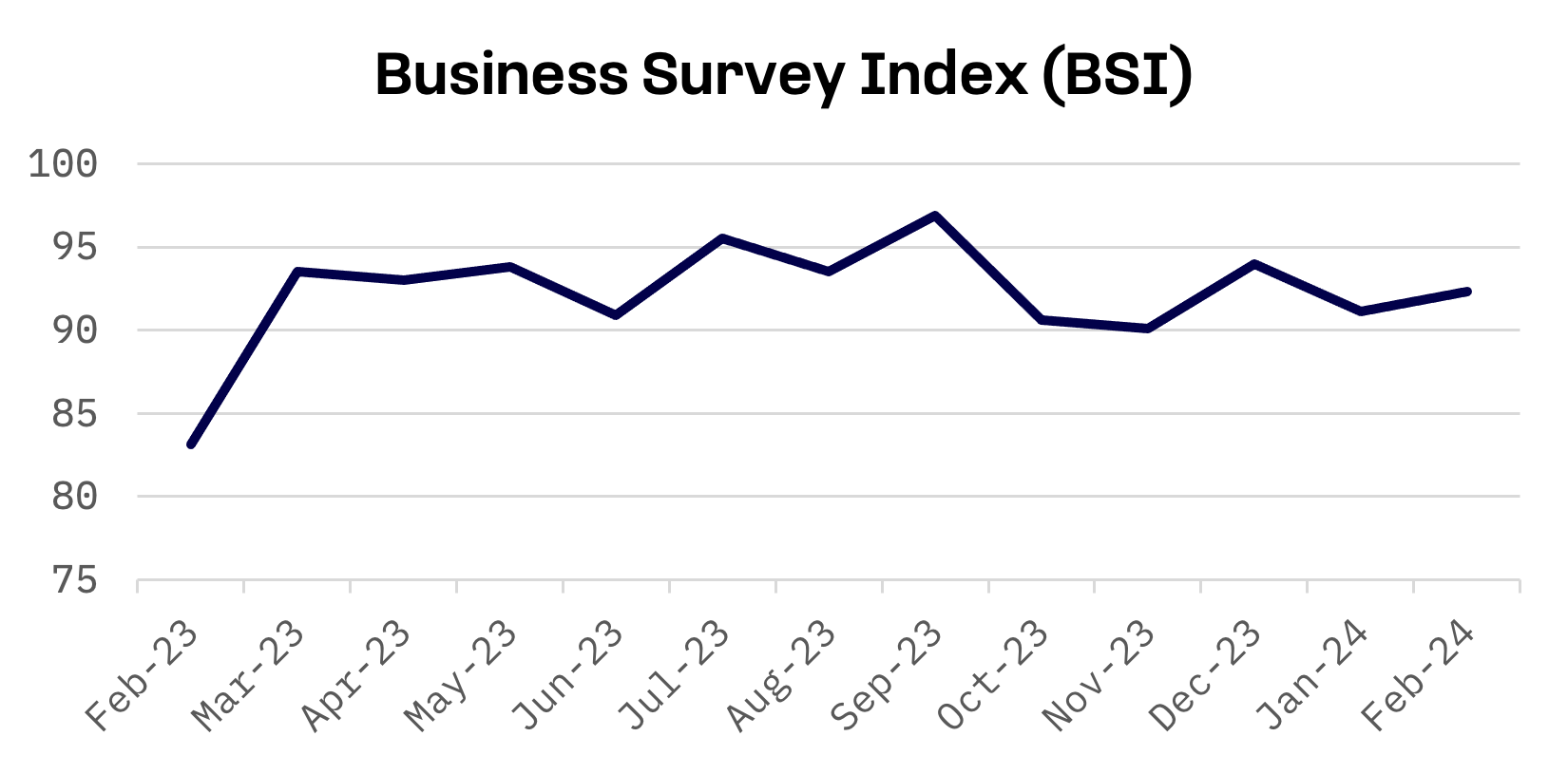

South Korea’s business sentiment continues to exhibit a cautious outlook for February, as indicated by a recent poll. The Business Survey Index (BSI) for the country’s top 600 companies by sales showed a modest improvement, rising by 1.2 points from the previous month to reach 92.3. However, the index still remains below the 100-point mark, signifying that pessimists outnumber optimists among South Korean businesses. This sentiment is largely driven by ongoing concerns over a global economic slowdown.

In addition to this cautious business outlook, there is an observable shift among South Korean investors who are increasingly expanding their investment portfolios to include shares in the U.S. and Japanese markets. This trend highlights growing dissatisfaction with the sluggish performance of South Korean equities. Data released by the Korea Securities Depository on January 23 reveals a significant increase in trading activity, with the month-to-date trading volume of U.S. shares by local retail investors experiencing a notable surge of 32.5% compared to the same period in the previous year.

Taiwan

Taiwan’s stock market showed the strongest growth among the JAKOTA markets, with the TAIEX index climbing 1.8%. The surge was primarily driven by robust investor interest in Taiwan Semiconductor Manufacturing Co. (TSMC), particularly mirroring a rally in U.S. tech stocks.

This week’s macroeconomic data releases have significantly bolstered business sentiment in Taiwan. The country’s unemployment rate has dropped to its lowest level in 23 years, signaling a stable job market. The Directorate General of Budget, Accounting, and Statistics (DGBAS) reported that the unemployment rate fell for the fourth consecutive month in December, decreasing by 0.01% from the previous month to 3.33%. Furthermore, the annual unemployment rate for 2023 was recorded at 3.48%, the lowest since 2000.

The Chung-Hua Institution for Economic Research (CIER) revised its GDP growth forecast for Taiwan for 2024, attributing the adjustment to a resurgence in private investment. The CIER now projects a GDP growth of 3.10% for the year, an increase of 0.07 percentage points from its earlier estimate in October. This updated forecast reflects a significant improvement in economic fundamentals, especially when compared to the 1.41% growth projected for 2023. The earlier period was characterised by weakened global demand, which adversely impacted Taiwan’s export-oriented economy, leading to a downturn in exports and a consequent dampening of investment intentions among companies.

JAKOTA Blue Chip 150 Index

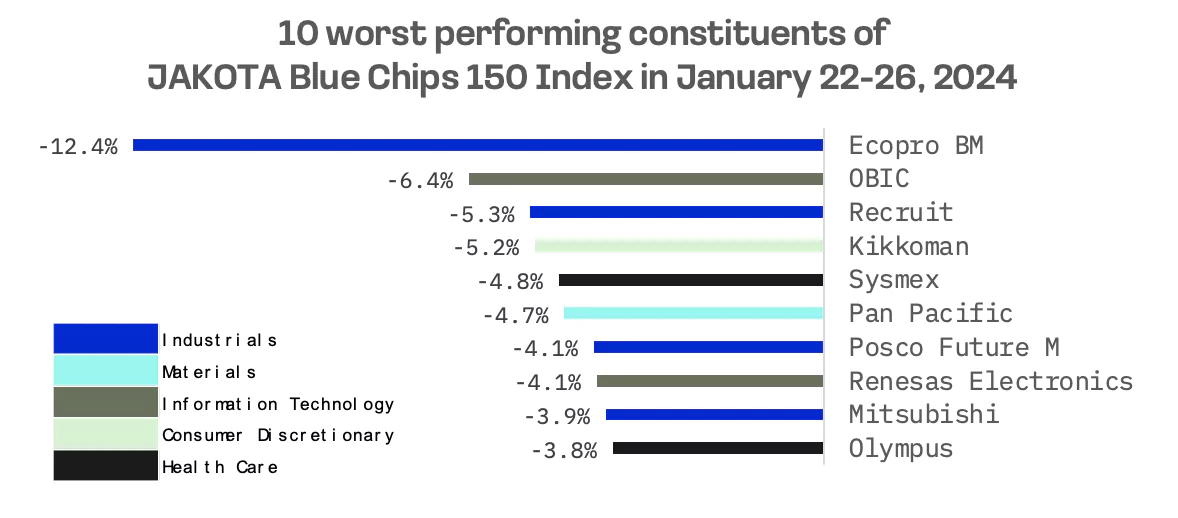

The JAKOTA Blue Chip 150 Index saw a marginal decline of 0.1%, with 69 of its 150 constituents showing positive price trends.

The top-performing stocks this week are KB Financial Group and Shinhan Financial Group with finance shares leading the gains in Korea. Investor sentiment in the region was positively influenced by the all-time high performance of U.S. shares and the recovery of stocks that had previously faced significant setbacks.

Ecopro BM, a battery materials manufacturer, confirmed its position as one of the most volatile shares in the JAKOTA Blue Chip 150 index. The company’s shares witnessed a sharp decline of over 12%, as securities firms continued to criticise Ecopro BM. Samsung Securities revised its target stock price for Ecopro BM downwards from 280,000 won to 250,000 won, citing the company’s operating loss in the fourth quarter of last year.