Last week’s Jakota markets:

- Japan’s Nikkei 225 Index jumped 3.9%, weathering yen appreciation as core CPI rose to 3.0% and the BoJ executed its first rate hike since 2008

- South Korea’s KOSPI advanced 0.5%, despite the BOK’s growth forecast cut to 1.6-1.7% for 2025 amid political uncertainty

- Taiwan’s TAIEX added 1.6% before the Lunar New Year break, supported by a 24 year low in unemployment and delayed U.S. tariffs

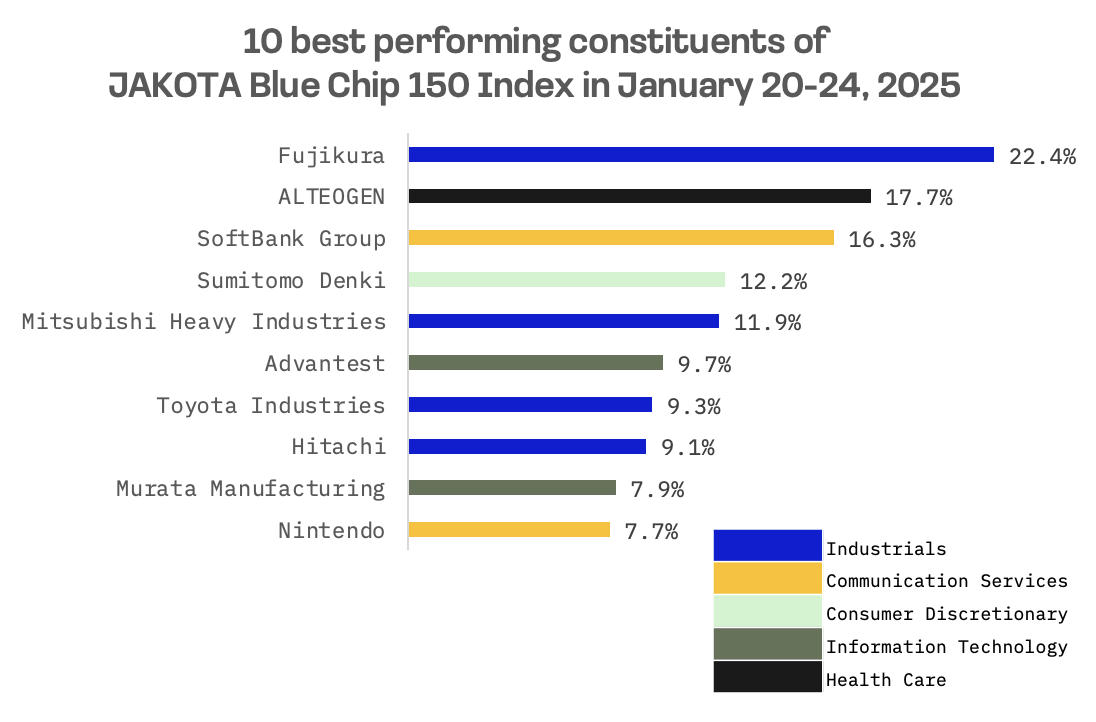

- The JAKOTA Blue Chip 150 Index climbed 3%, led by Fujikura’s all time high following the $500 billion Stargate AI infrastructure project announcement

Japan

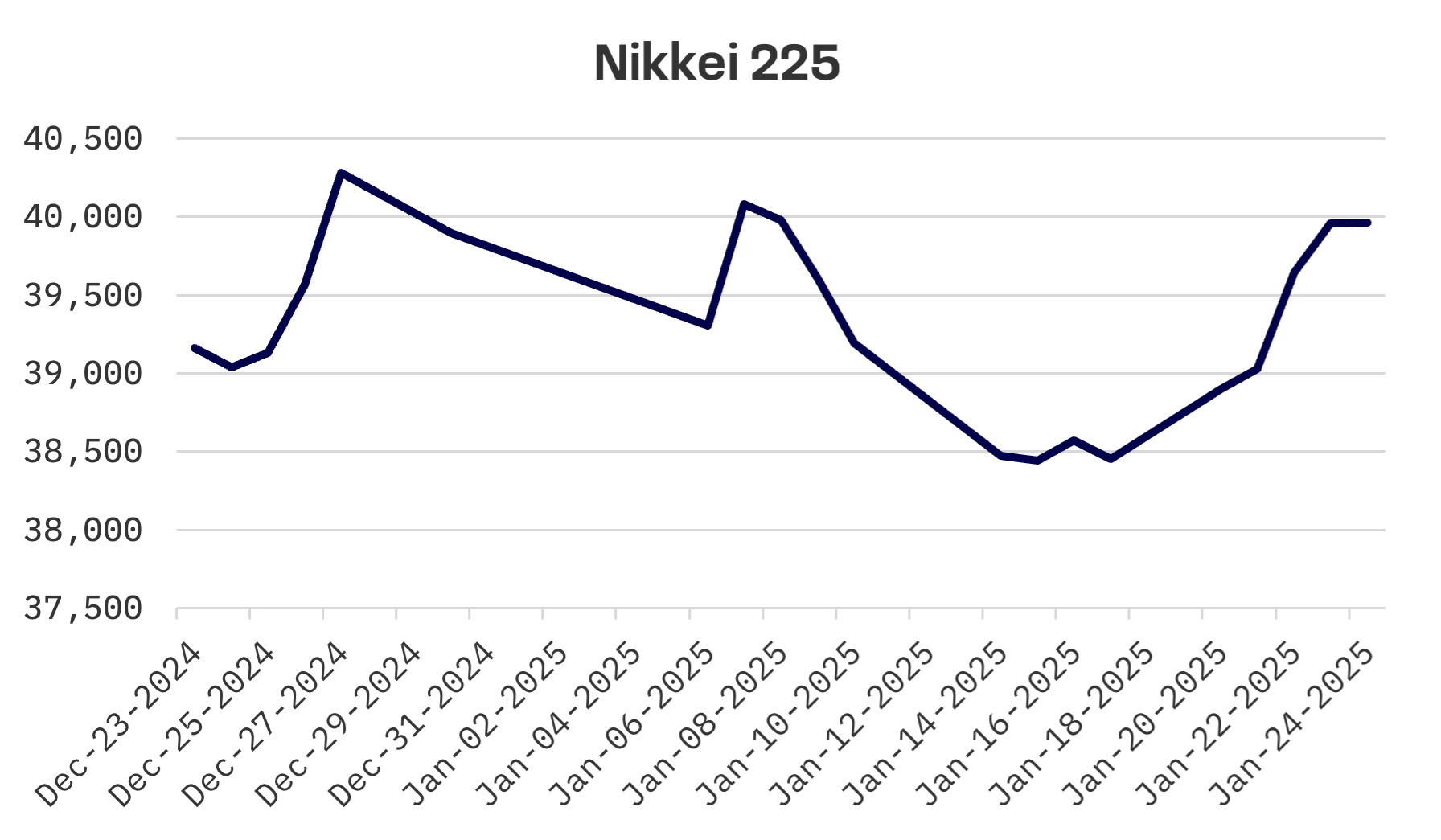

Japanese stocks rallied this week, with the Nikkei 225 Index advancing 3.9%, shrugging off headwinds from a stronger yen. The gains came after U.S. President Donald Trump postponed the implementation of new tariffs on his first day in office. The yen’s strength was underpinned by hawkish signals from the Bank of Japan and statements from Japan’s finance minister indicating the government’s readiness to implement currency stabilising measures.

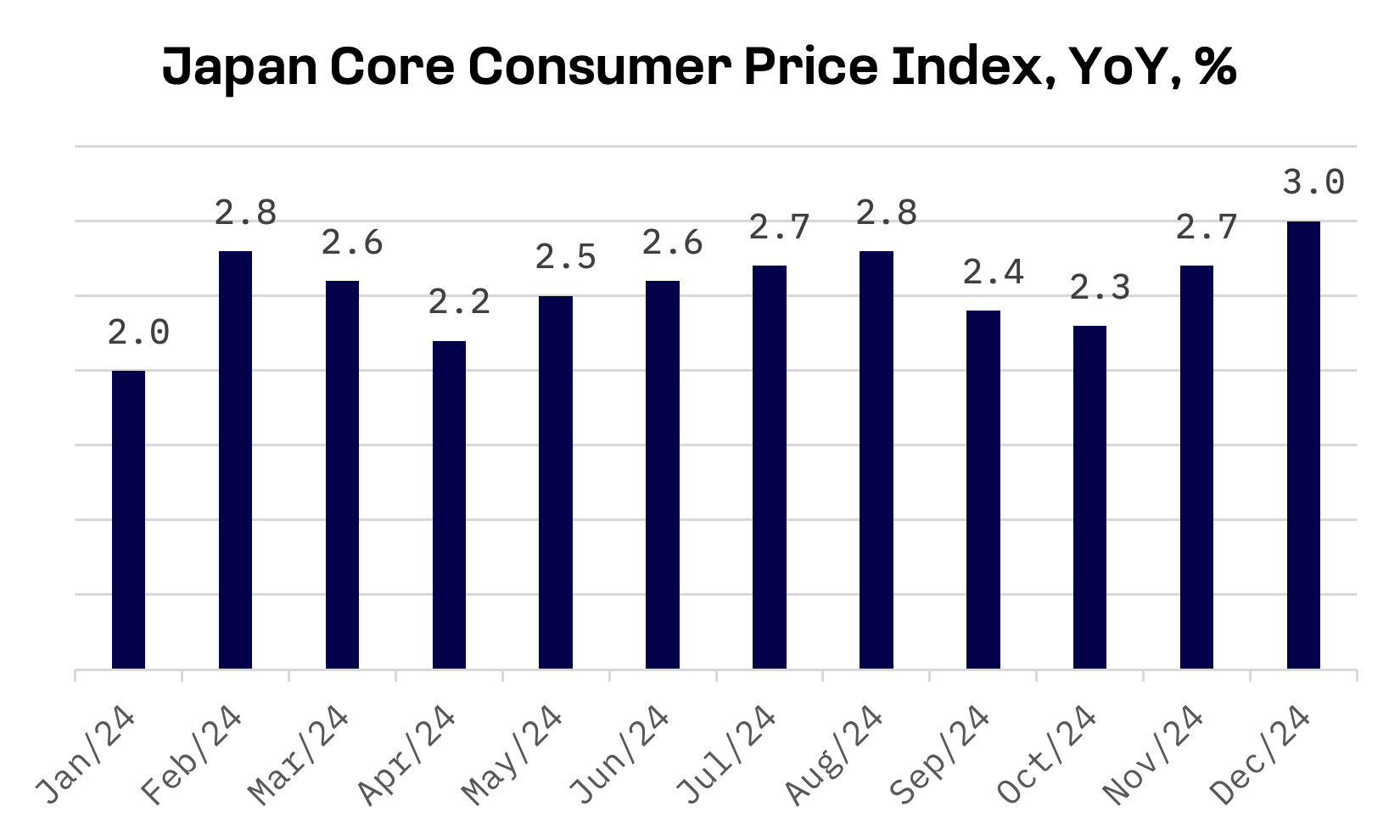

In a significant monetary policy shift, the Bank of Japan (BoJ) raised its policy rate by 0.25 percentage points to 0.5%, marking the highest level since the 2008 financial crisis. The widely anticipated move was coupled with an upward revision of the central bank’s inflation forecast for fiscal year 2025, with all measures now expected to exceed the 2% target. The bank cited improving wage growth prospects and indicated a bias toward further tightening, leading market participants to speculate about additional rate increases in the latter half of 2025.

Recent inflation data reinforced expectations for continued monetary policy normalisation. Japan’s core consumer price index (CPI) increased 3% year-over-year in December 2024, matching analysts’ forecasts and accelerating from November’s 2.7% rise.

South Korea

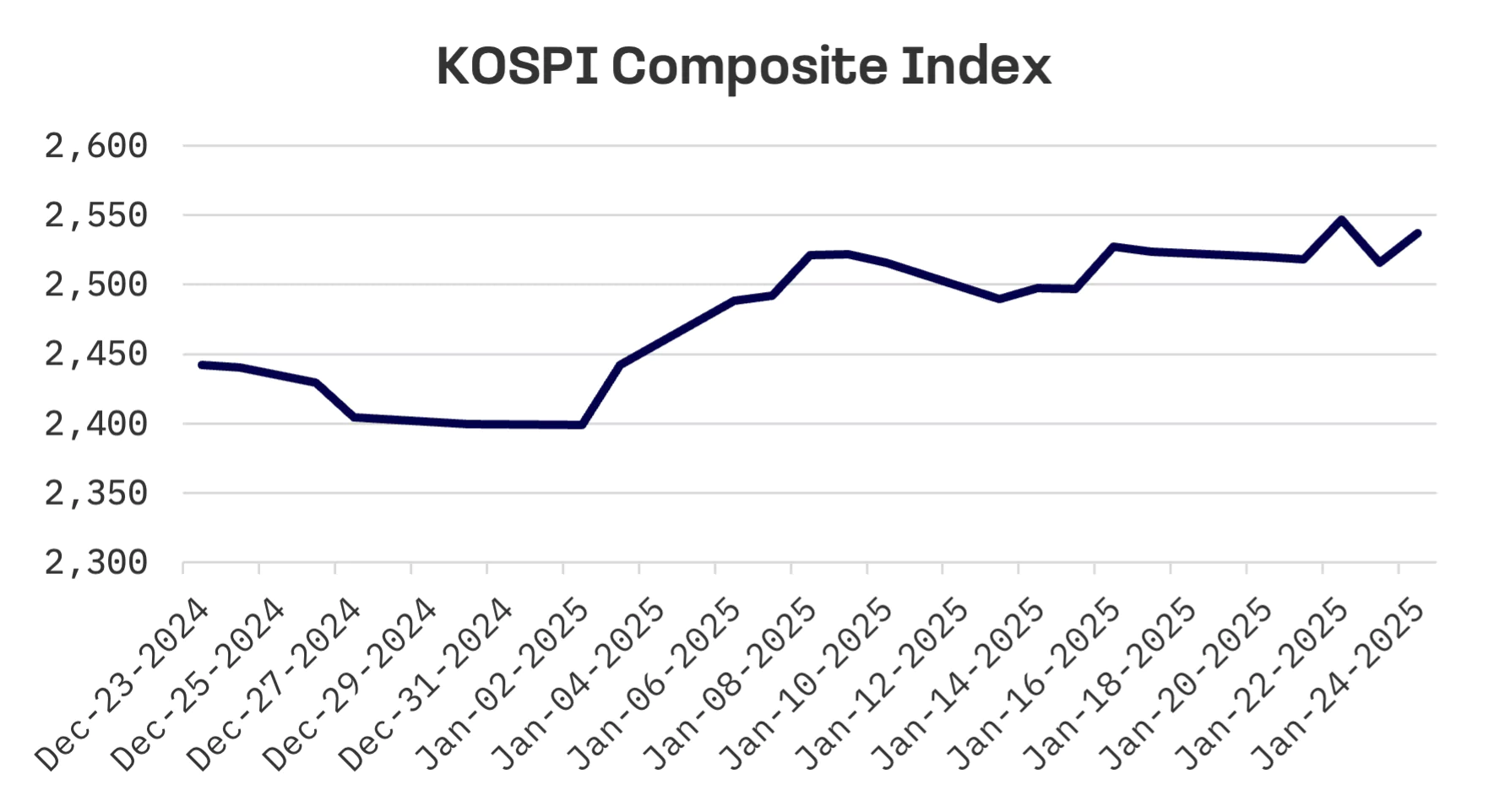

South Korea’s KOSPI index edged up 0.5% this week, benefitting from reduced U.S. tariff concerns and President Trump’s advocacy for interest rate cuts.

However, the Bank of Korea (BOK) cast a shadow over market sentiment by lowering its 2025 economic growth projection to 1.6-1.7% from its previous estimate of 1.9% in November. The revised forecast falls below the government’s recent projection of 1.8%. The central bank attributed the downgrade to political uncertainty following a martial law declaration and mounting U.S. trade protectionism.

Taiwan

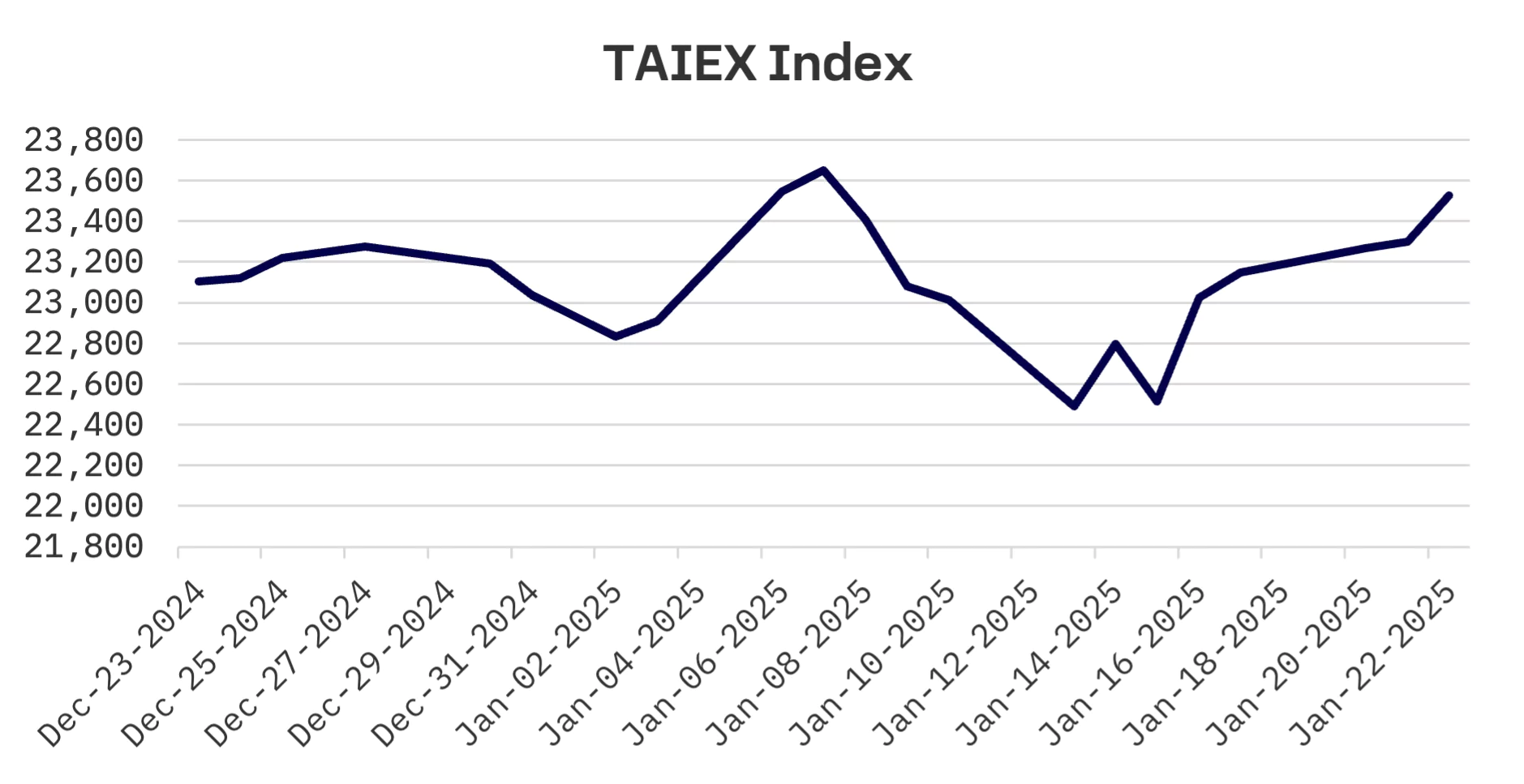

The TAIEX index gained 1.6% during the abbreviated trading week ahead of the Lunar New Year holiday, with markets closing Thursday and Friday. The advance followed Trump’s tariff delay announcement.

Taiwan’s unemployment rate reached a 24 year low of 3.38% in 2024, according to the Directorate General of Budget, Accounting and Statistics (DGBAS). The data showed a 0.1 percentage point decline from the previous year, as unemployment fell to levels not seen since 2000, when it stood at 2.99%. The number of unemployed individuals decreased by 9,000 year-over-year to 406,000.

JAKOTA Blue Chip 150 Index

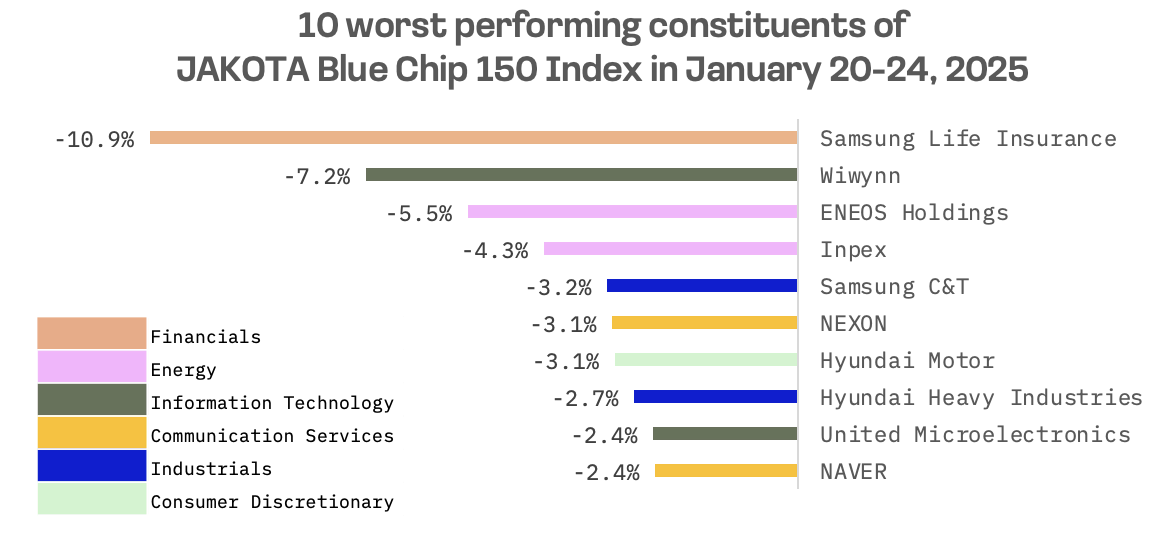

The JAKOTA Blue Chip 150 Index rose 3% this week, with 121 of its 150 constituents advancing.

Fujikura, a Japanese manufacturer specialising in electrical and optical cable products, emerged as the top performer on the JAKOTA Blue Chip 150 Index, reaching an all time high of ¥7,482. The surge followed the announcement of the Stargate project, a joint venture between SoftBank Group, OpenAI, Oracle and investment firm MGX. The initiative, unveiled by Donald Trump on Tuesday, plans to invest up to $500 billion in AI related infrastructure, including data centres, across the U.S. over the coming years.

As a key supplier of optical fibre cables and components essential for AI driven data centers, Fujikura has become a focal point for investors betting on growing demand for high speed, high capacity data transmission infrastructure.

Samsung Life Insurance, a South Korean insurance company and Samsung Group subsidiary, landed at the bottom of the index.

One of South Korea’s largest securities firms forecasts the insurer will post a fourth quarter net profit of ₩178 billion, marking a 60.1% year-over-year decline and falling short of market expectations. The report cited weak insurance and investment profits, with insurance losses expected due to changes in actuarial assumptions and a worsening forecast to actual gap. Investment profits are projected to remain subdued, driven by valuation losses on marketable securities. The securities firm emphasised the need for Samsung Life to establish a clear strategy for improving capital ratios and enhancing shareholder returns.