Last week’s JAKOTA markets:

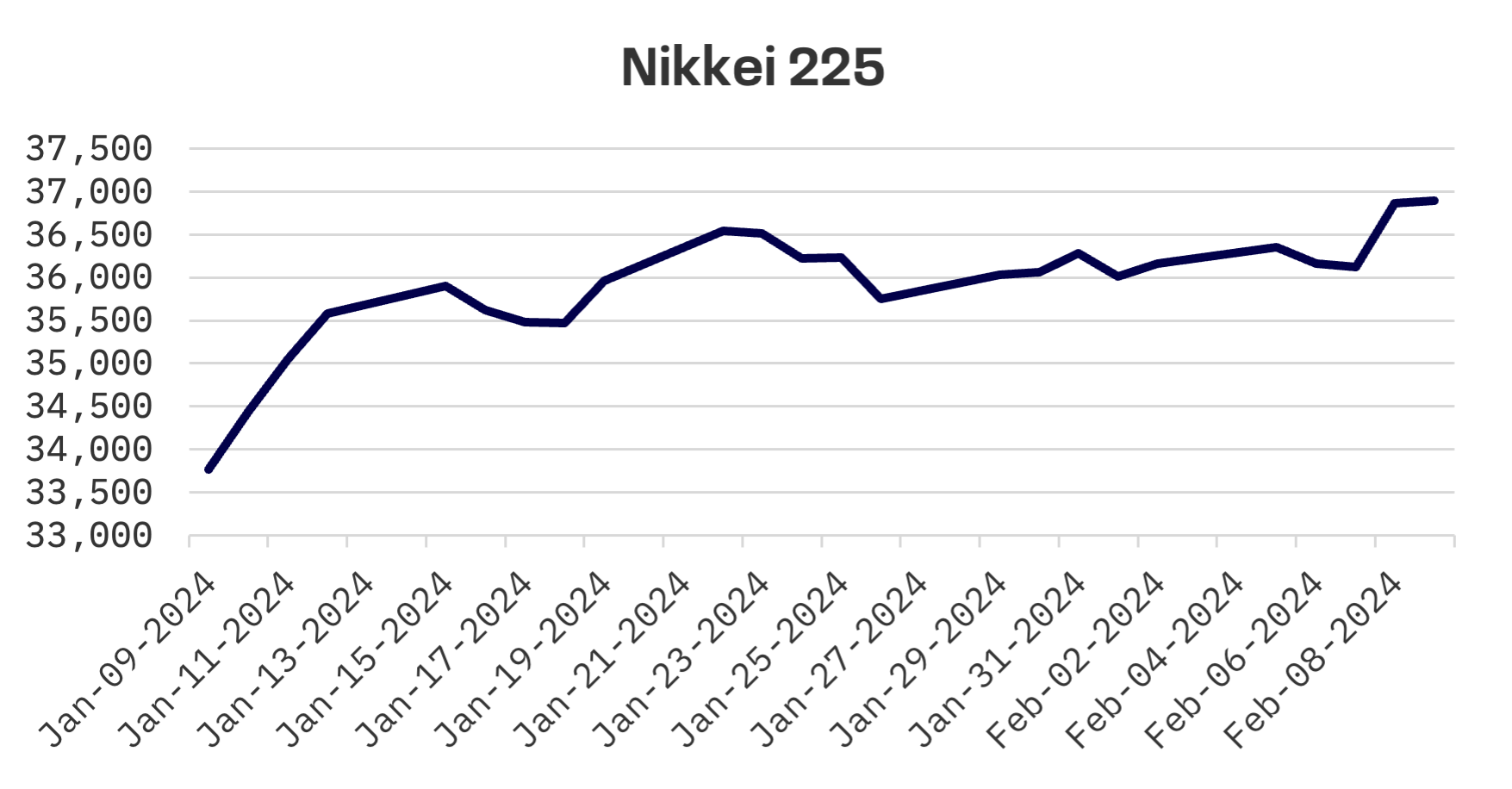

- The Japanese stock market recorded a significant 2.0% rise, with foreign investments reaching near-record levels and the Nikkei 225 hitting a historic high amidst evolving monetary policies

- South Korea’s KOSPI index edged up by 0.2%, rebounding from early pressures thanks to foreign investment and optimistic economic surplus data

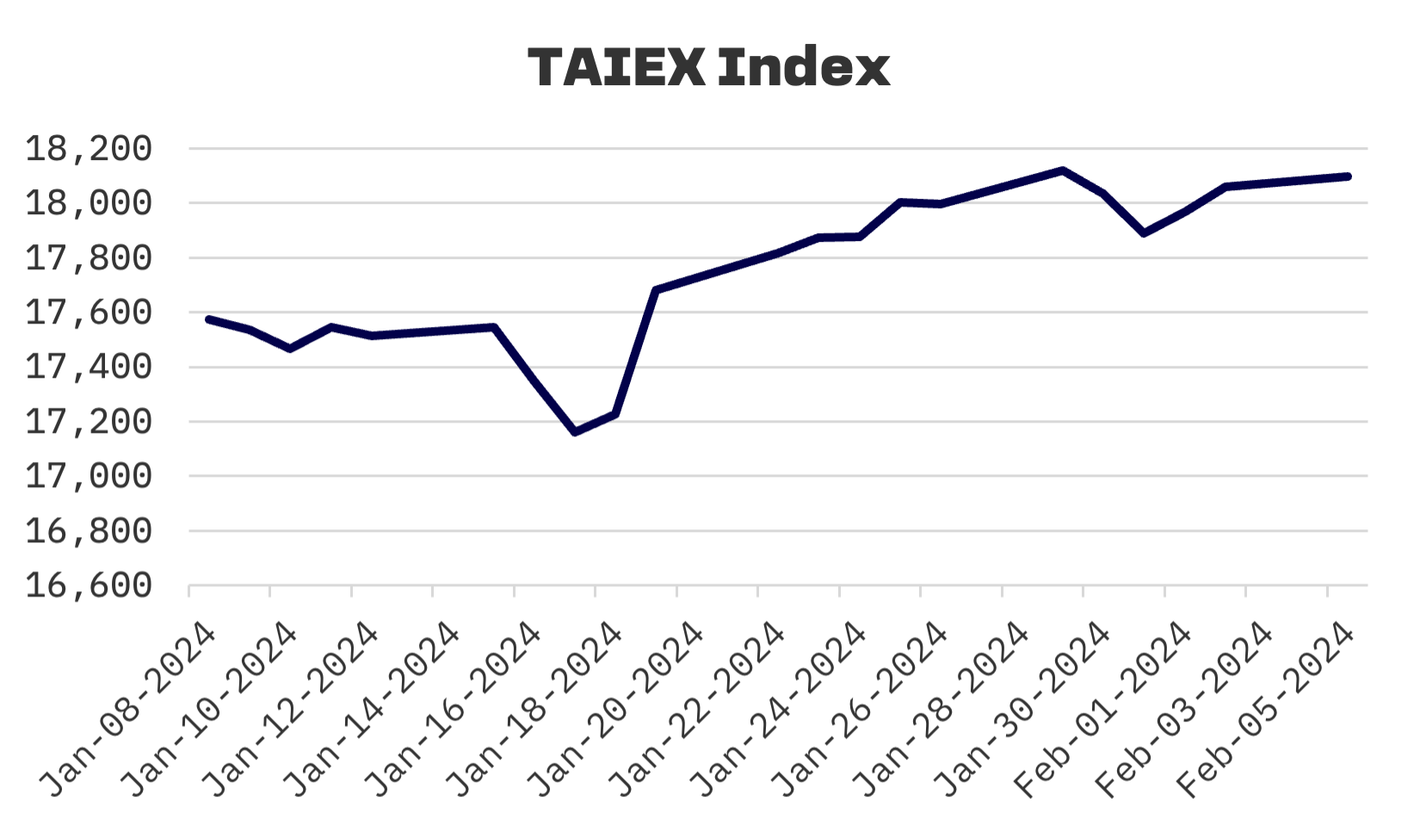

- Taiwan’s stock market, limited to a single day of trading due to the Lunar New Year holiday, saw a slight increase of 0.2%, largely driven by TSMC’s upbeat sales forecast

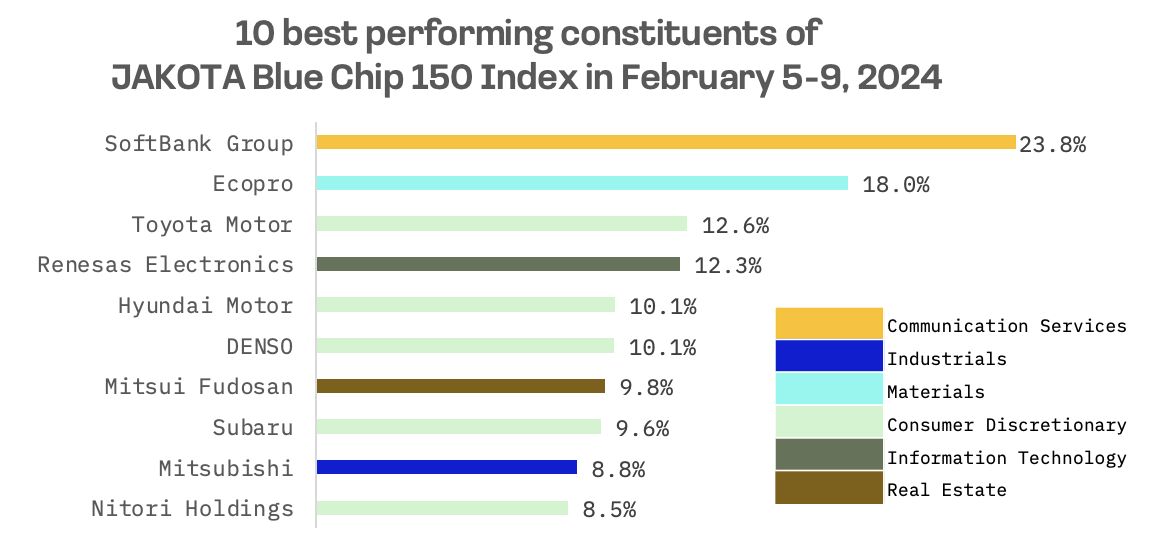

- SoftBank Group and EcoPro led the gains in the JAKOTA Blue Chip 150 Index, which rose by 1.0%, despite KDDI facing challenges after announcing a major investment in Lawson

Japan

The Japanese stock markets saw gains this past week, with the Nikkei 225 Index climbing 2.0%, reaching a 34-year high, bolstered by a weak yen. However, this enthusiasm was curbed by adjusted expectations for a March rate cut by the U.S. Federal Reserve.

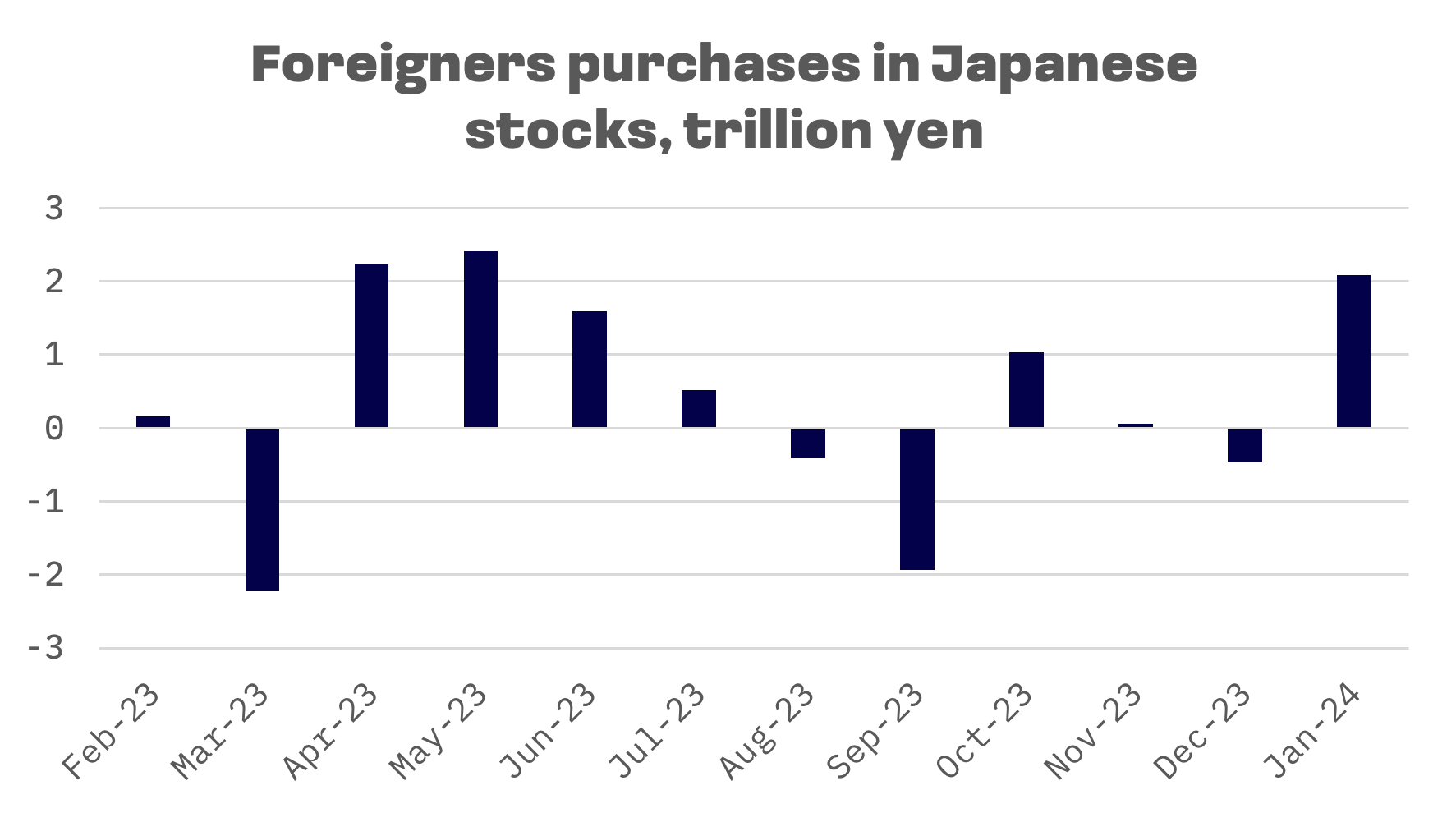

Foreign investors poured a net total of ¥2.07 trillion ($13.4 billion) into Japanese stocks in January, marking the seventh highest monthly influx on record. This influx, spurred by strong earnings and corporate strategies to improve price-to-book ratios, positively influenced market sentiment. Additionally, the Bank of Japan’s (BoJ) stance on monetary policy continuity, post-negative interest rate regime exit, further buoyed confidence.

Economic data, however, painted a mixed picture. The BoJ’s 2% inflation target remains a challenge, as evidenced by nominal wage growth of 1.0% year-on-year in December, missing forecasts and real wages falling 1.9% year-on-year. Household spending in December also contracted more than expected, down 2.5% year-on-year, indicating weak private demand. Meanwhile, the yield on the 10-year Japanese government bond edged up to 0.72% from 0.68%, reflecting the BoJ’s commitment to keeping financial conditions accommodative.

However, other economic indicators create a mixed view. The BoJ’s goal of a 2% inflation target, aligned with wage growth, remains elusive. In December, nominal wages rose by 1.0% year-on-year, missing consensus estimates and showing only a slight improvement from November’s 0.7% growth. After adjusting for inflation, real wages declined by 1.9% year-on-year in the final month of 2023. Household spending in December also contracted by 2.5% year-on-year, a sharper decline than expected and worsening from a 2.9% decrease the previous month, reflective of subdued growth in private demand. The 10-year Japanese government bond yield rose to 0.72% from 0.68%, reflecting the BoJ’s commitment to keeping financial conditions accommodative.

South Korea

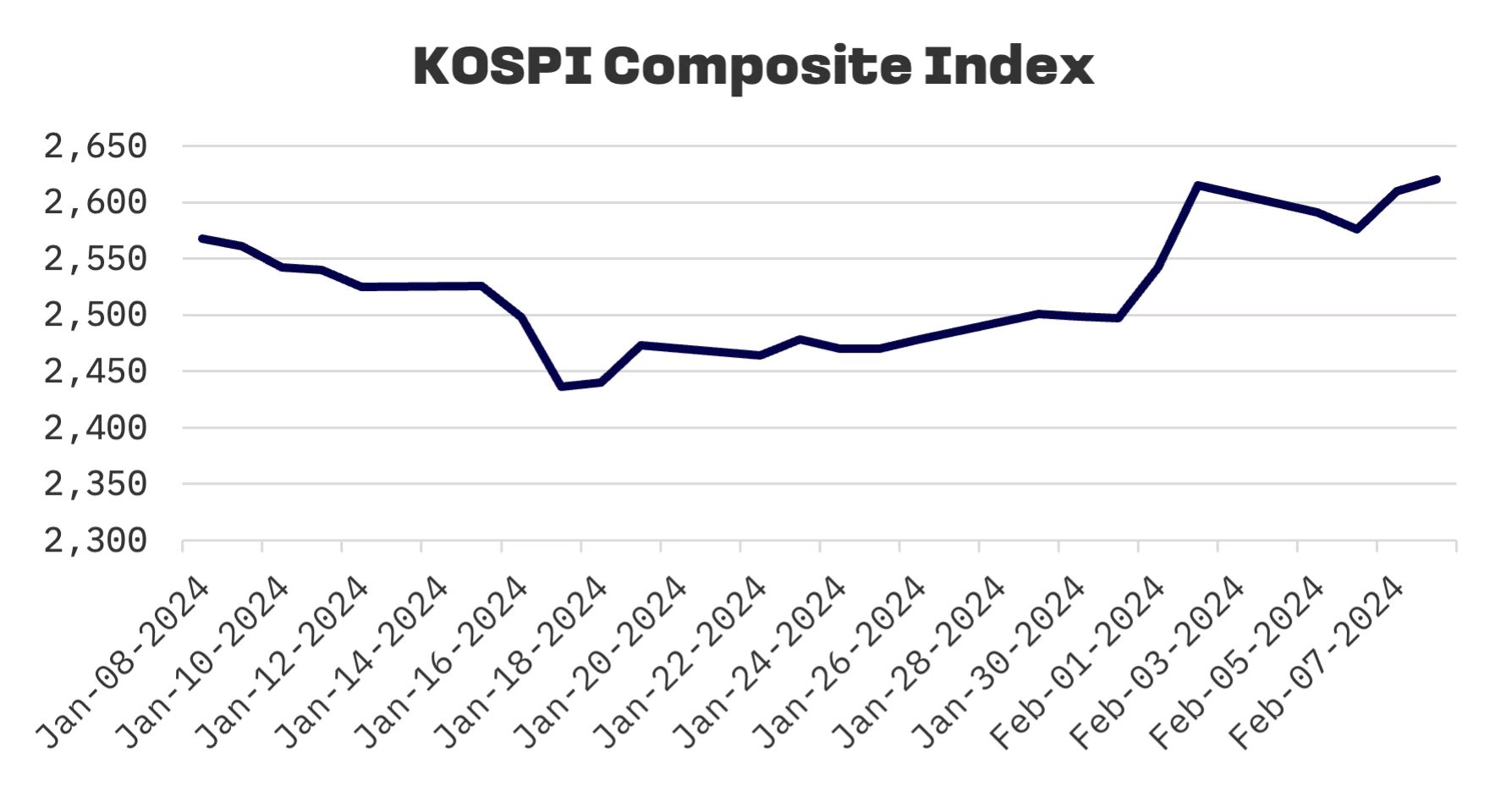

The KOSPI index in South Korea reported a slight increase of 0.2% this week. Early profit-taking and concerns over U.S. interest rates, sparked by comments from the Federal Reserve chair, initially pressured Korean stocks. Yet, the market rebounded in the latter half of the week, energised by Wall Street’s performance and growing optimism about potential U.S. rate cuts, despite a shortened trading week due to the Korean New Year holiday.

Foreign investment played a pivotal role in the recent KOSPI rally, with offshore investors buying ₩5 trillion (US$3.75 billion) worth of shares between January 29th and February 8th, as reported by the Korea Exchange.

The country’s economic data remained robust, with an eighth consecutive month of current account surpluses in December, driven by an increased trade surplus and higher dividends from abroad. According to central bank data released on Wednesday, the surplus reached US$7.41 billion, up from the previous month’s $3.89 billion.

Taiwan

With the Taiwanese stock market closed for the Lunar New Year holiday, only one day of trading took place this week, witnessing a modest 0.2% increase. The day’s trading was predominantly uplifted by TSMC shares, which climbed by 1.7%. The optimism around TSMC was sparked by its optimistic sales growth forecast of 21-26% for 2024, issued in mid-January, which exceeded market expectations.

JAKOTA Blue Chip 150 Index

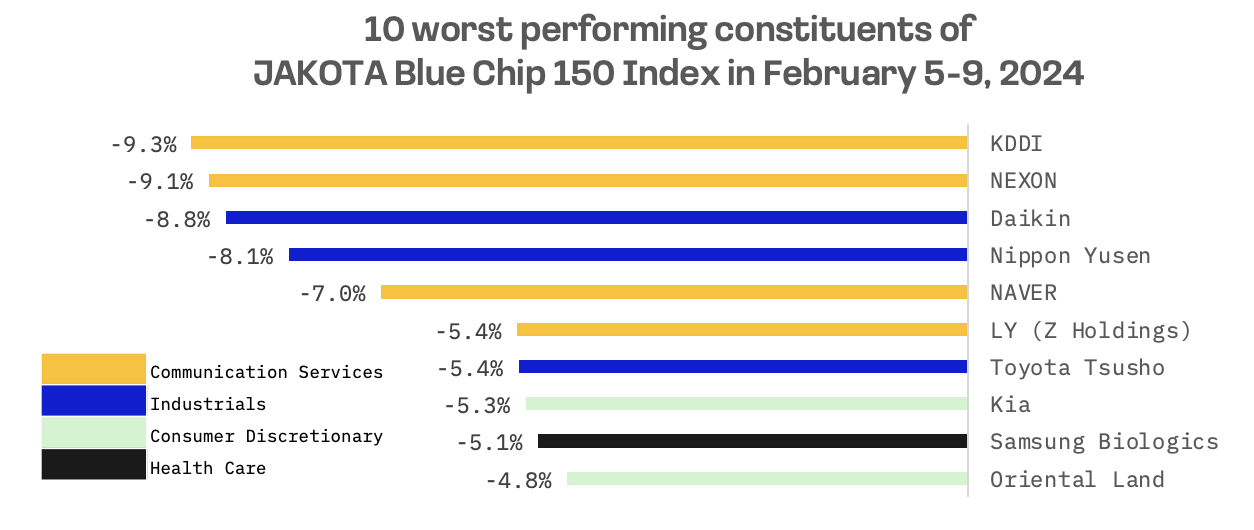

The JAKOTA Blue Chip 150 Index advanced by 1.0%, with 73 of its 150 constituents posting gains.

This week’s top performers in the JAKOTA Blue Chip 150 Index included SoftBank Group, a diversified holding company with significant telecommunications operations through its subsidiary “SoftBank.” The group’s stock price surged following an announcement of its first profit in five quarters, further buoyed by an impressive 55% increase in the shares of Arm Holdings. SoftBank holds a 90% stake in Arm Holdings, a British technology firm whose stock soared on Thursday after projecting quarterly sales and profits that surpassed Wall Street’s forecasts.

Ecopro, known for manufacturing core materials and components for air pollution control, also saw its stock price climb after announcing a 5-to-1 stock split. In addition, the company announced moving the listing of its subsidiary, Ecopro BM, from KOSDAQ to KOSPI.

On the downside, KDDI, a Japanese telecommunications provider, was this week’s least successful stock in the index. The company’s shares declined after it disclosed plans to enhance its stake in Lawson, one of Japan’s largest convenience store chains. KDDI intends to invest ¥496.50 billion ($3.34 billion) in this venture, aiming for an equal 50% ownership with Mitsubishi. Currently, KDDI possesses a 2.1% stake, while Mitsubishi holds 50.1%.