Last week’s Jakota markets:

- Japan’s Nikkei 225 dropped 1% as the yen strengthened to ¥150 against the dollar, while GDP data showed economy expanded 2.8% annualised in Q4 2024, potentially hastening BoJ tightening

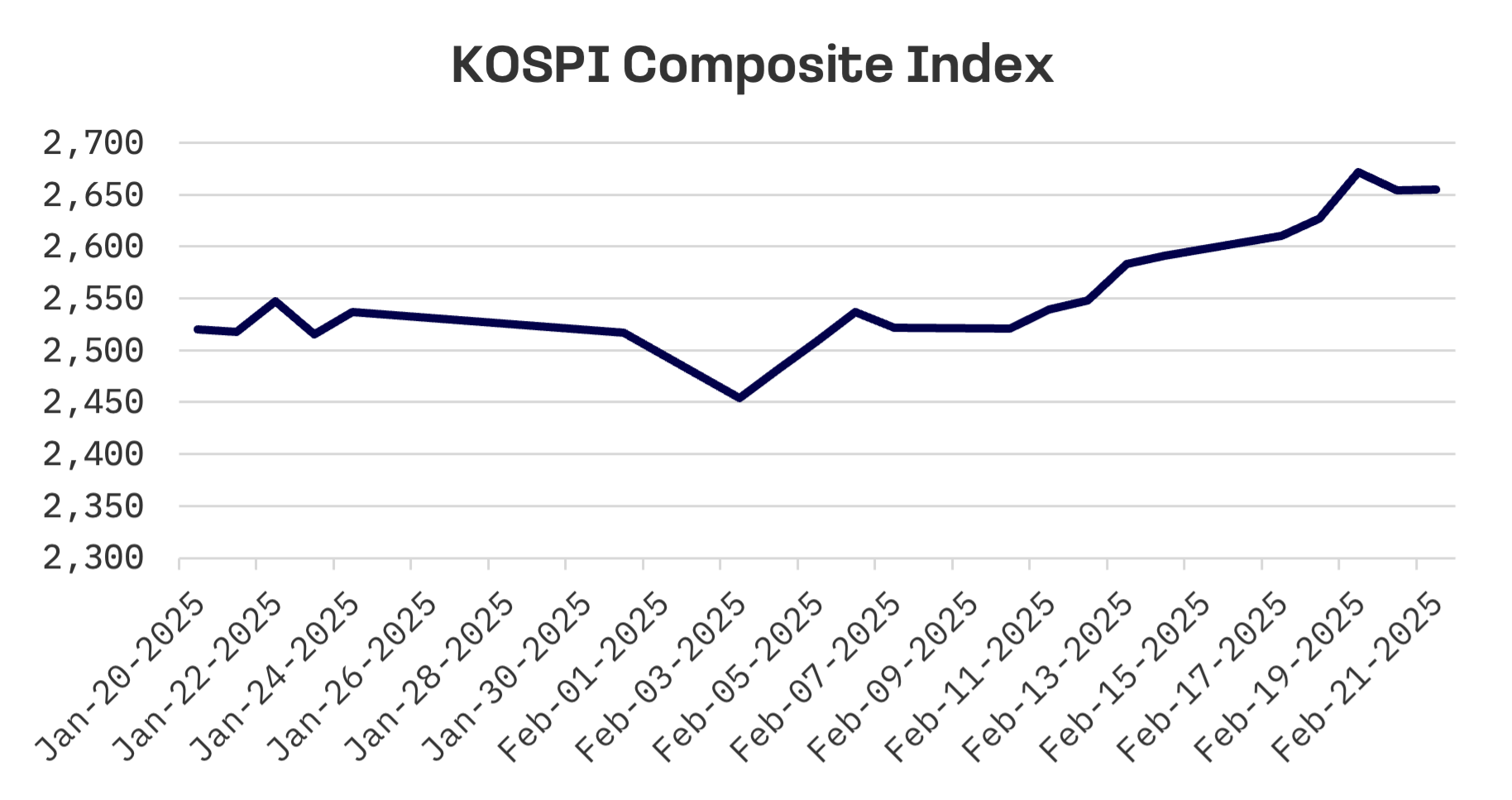

- South Korea’s KOSPI surged 2.5% to eight month highs as investors piled into defense and technology sectors, while the FSS governor advocated for unrestricted shortselling

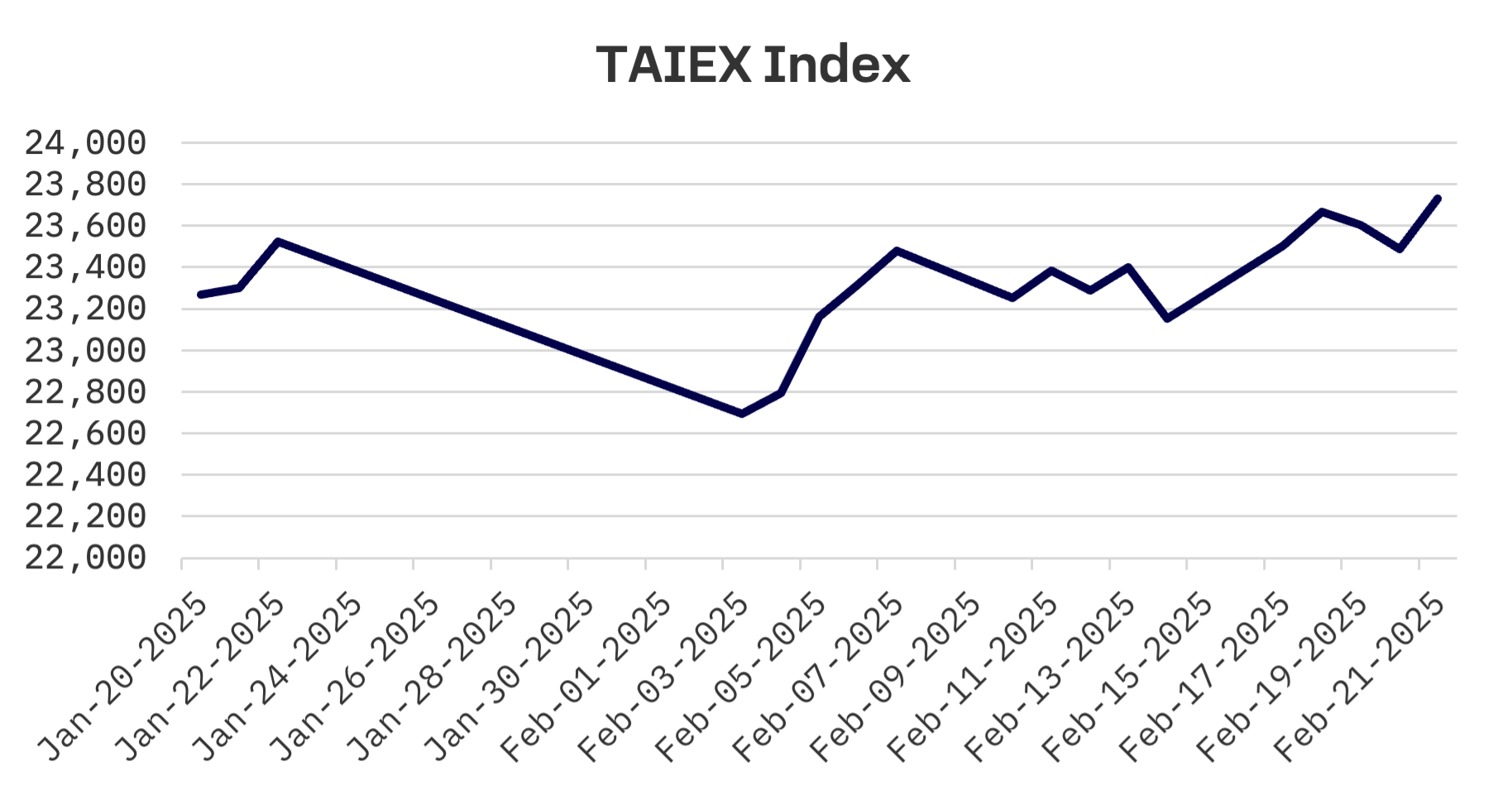

- Taiwan’s TAIEX index climbed 2.5%, buoyed by Taiwan Semiconductor’s technical rebound as investors assessed potential impacts from Trump’s ‘Made in America’ initiative

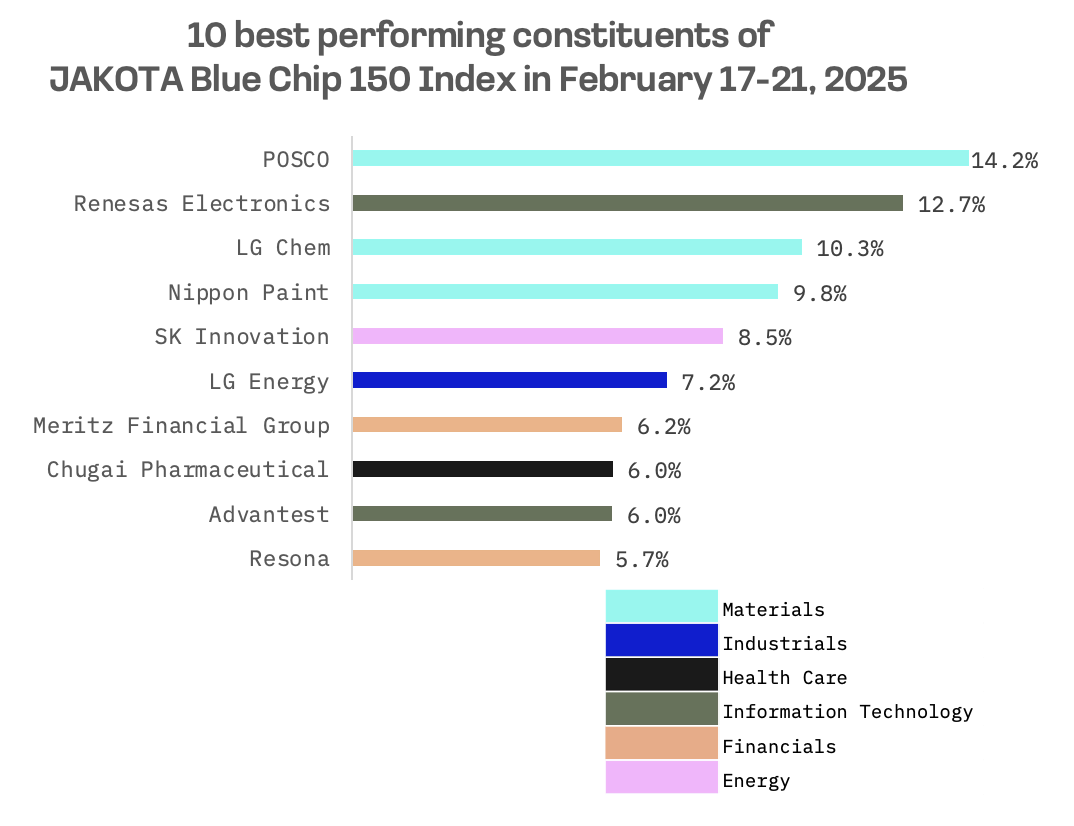

- The JAKOTA Blue Chip 150 Index increased 0.8%, featuring POSCO’s strong performance after new Chinese steel tariffs and HD Hyundai’s 10% tumble on rising cost concerns

Japan

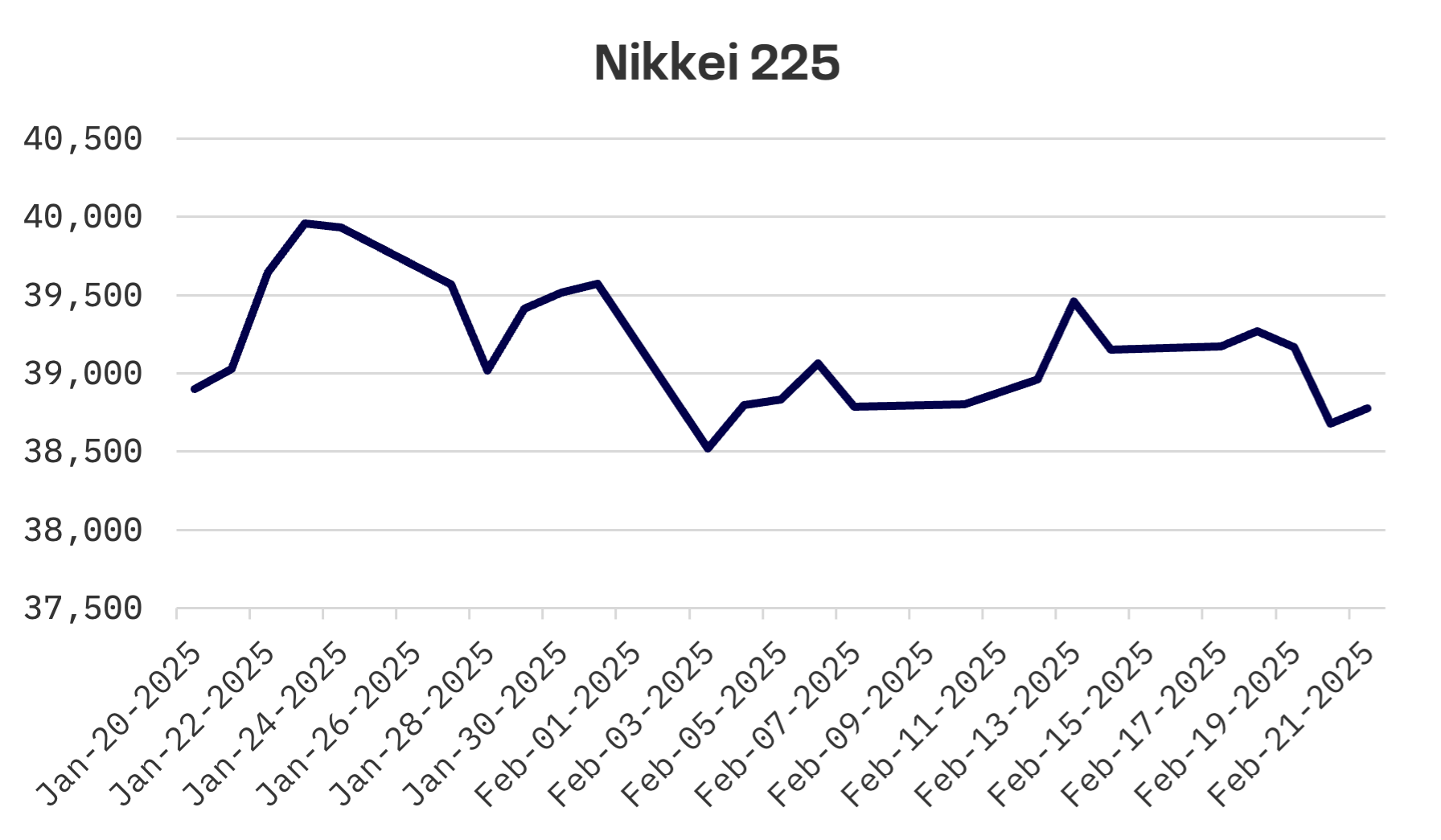

Japan’s stock market retreated this week, with the Nikkei 225 shedding 1% as a stronger yen and climbing Japanese government bond (JGB) yields dampened investor sentiment. Looming tariff threats from U.S. President Donald Trump further unsettled market participants.

The yen appreciated to approximately ¥150 per dollar from roughly ¥152 the previous week, as inflation figures that exceeded expectations prompted speculation about a potentially more hawkish stance from the Bank of Japan (BoJ) regarding interest rate increases.

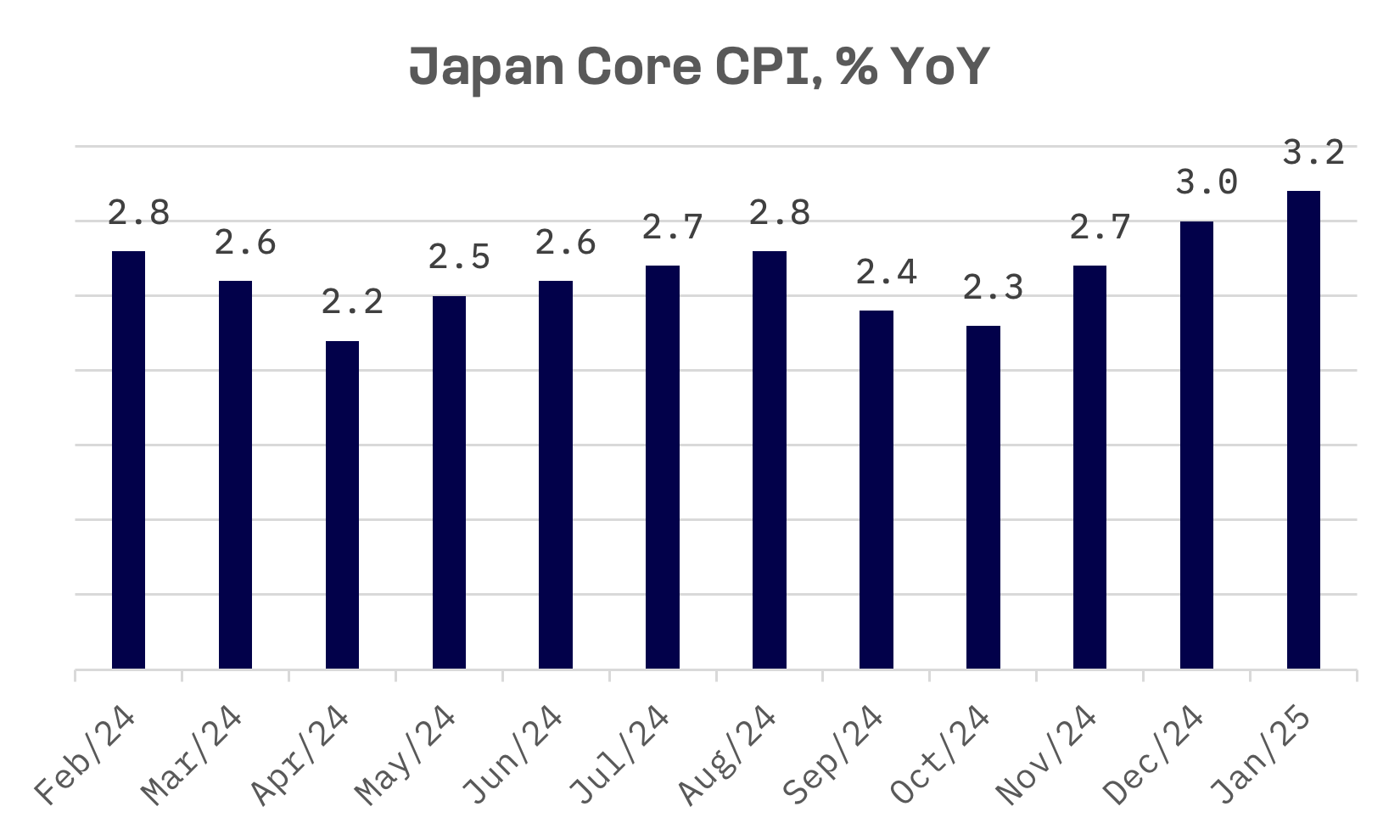

Japan’s inflation surged to 4% in January year-over-year, marking the highest level since January 2023. Japan’s core consumer prices jumped 3.2% in January from a year earlier, surpassing economists’ projections of 3.1% and accelerating from December’s 3% increase, primarily due to escalating rice and energy costs.

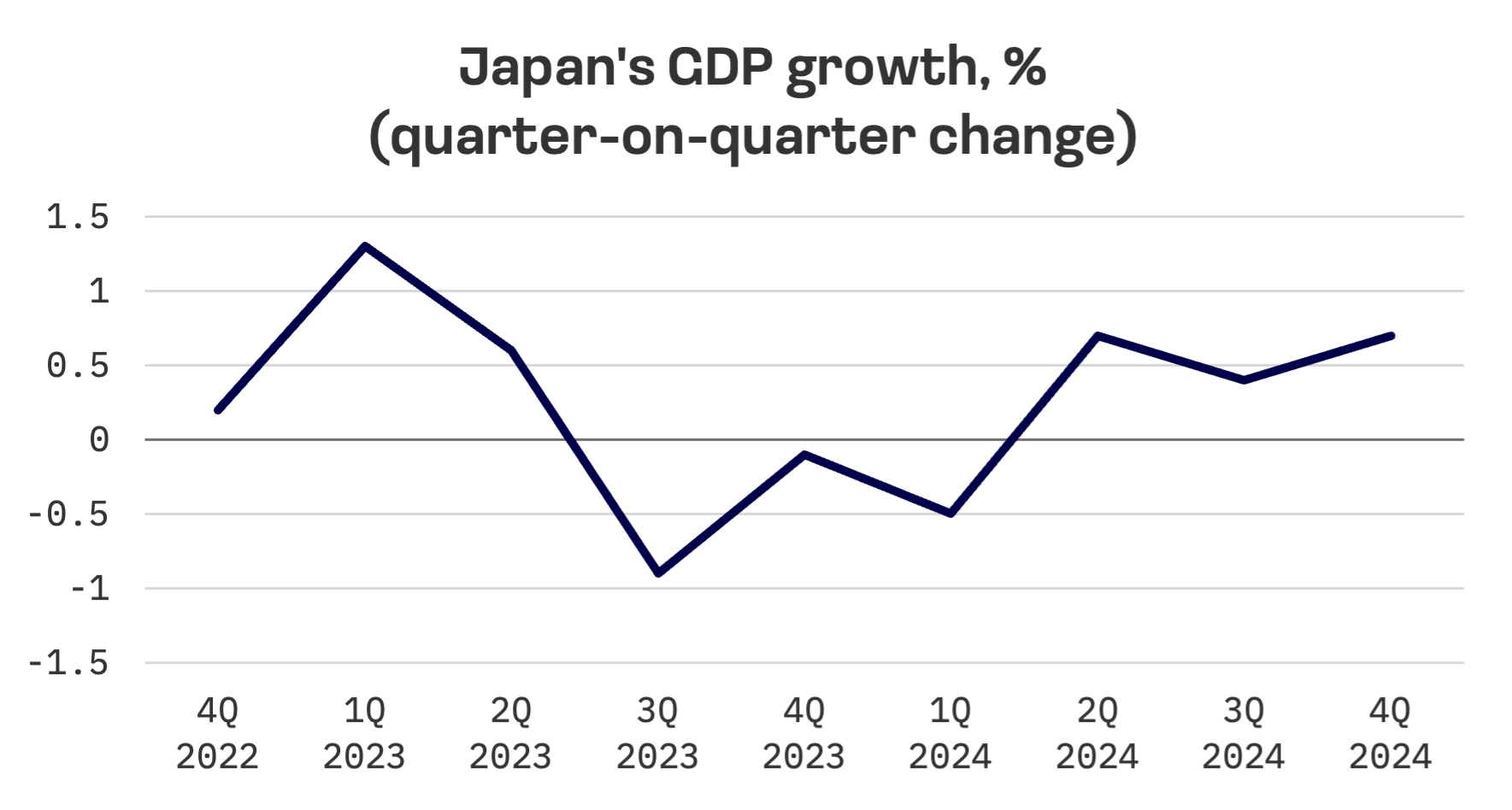

GDP data revealed that Japan’s economy expanded at a 2.8% annualised basis in the fourth quarter of 2024. This robust growth strengthened the case for monetary tightening, with quarterly GDP growth reaching 0.7%, outpacing the consensus estimate of 0.3% and improving upon the previous quarter’s 0.4% expansion.

South Korea

South Korea’s equities continued their upward trajectory this week, with the KOSPI advancing 2.5% to reach its highest level since September 2024. Trading volumes hit an eight month peak as investors flocked to defense, nuclear energy, shipbuilding and robotics stocks. Meanwhile, the credit default swap (CDS) premium for South Korean foreign exchange stabilisation bonds with five year maturities declined to levels not seen since before martial law was imposed.

Lee Bok-hyun, governor of South Korea’s Financial Supervisory Service (FSS), advocated this week for an unrestricted approach to shortselling when the practice resumes next month. He underscored the importance of implementing a comprehensive restart.

“We understand concerns about reinstating shortselling, particularly regarding so called zombie companies, but we also need to explore ways to curb market volatility and bolster trust among foreign investors and institutions,” he told reporters.

Taiwan

Taiwan’s equity market rallied this week, with the TAIEX index gaining 2.5%, propelled by a technical rebound in shares of Taiwan Semiconductor (TSMC). The upswing helped the broader market recover from the previous week’s downturn.

Market participants continued evaluating the possibilities of TSMC acquiring a stake in Intel Corp.’s wafer fabrication facilities and how the company might address U.S. President Donald Trump’s ‘Made in America’ manufacturing initiative. The appreciation in Taiwan Semiconductor’s share price indicates that some investors expect a period of negotiation before potential semiconductor tariffs might be implemented.

JAKOTA Blue Chip 150 Index

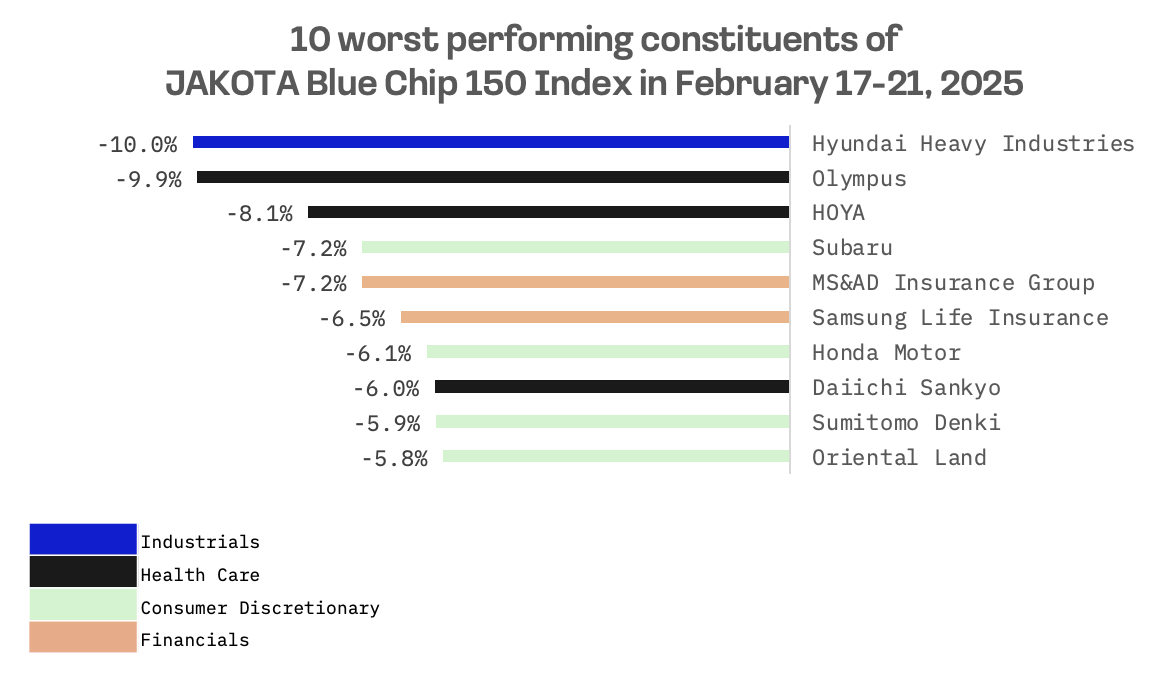

The JAKOTA Blue Chip 150 Index rose 0.8% this week, with 71 of its 150 constituent stocks registering gains.

POSCO Holdings, a South Korean steel manufacturer, emerged as the index’s top performer following its earnings report. The company benefitted after South Korea’s industry ministry announced on Thursday a provisional decision to levy tariffs of up to 38% on Chinese steel plate imports, following an investigation into alleged dumping of these materials used in shipbuilding and construction.

Meanwhile, HD Hyundai Heavy Industries, the world’s largest shipbuilding company, ranked as the worst performer on the JAKOTA Blue Chip 150 Index this week, plunging 10% amid escalating concerns about production costs in the wake of South Korea’s tariff implementation on Chinese steel.