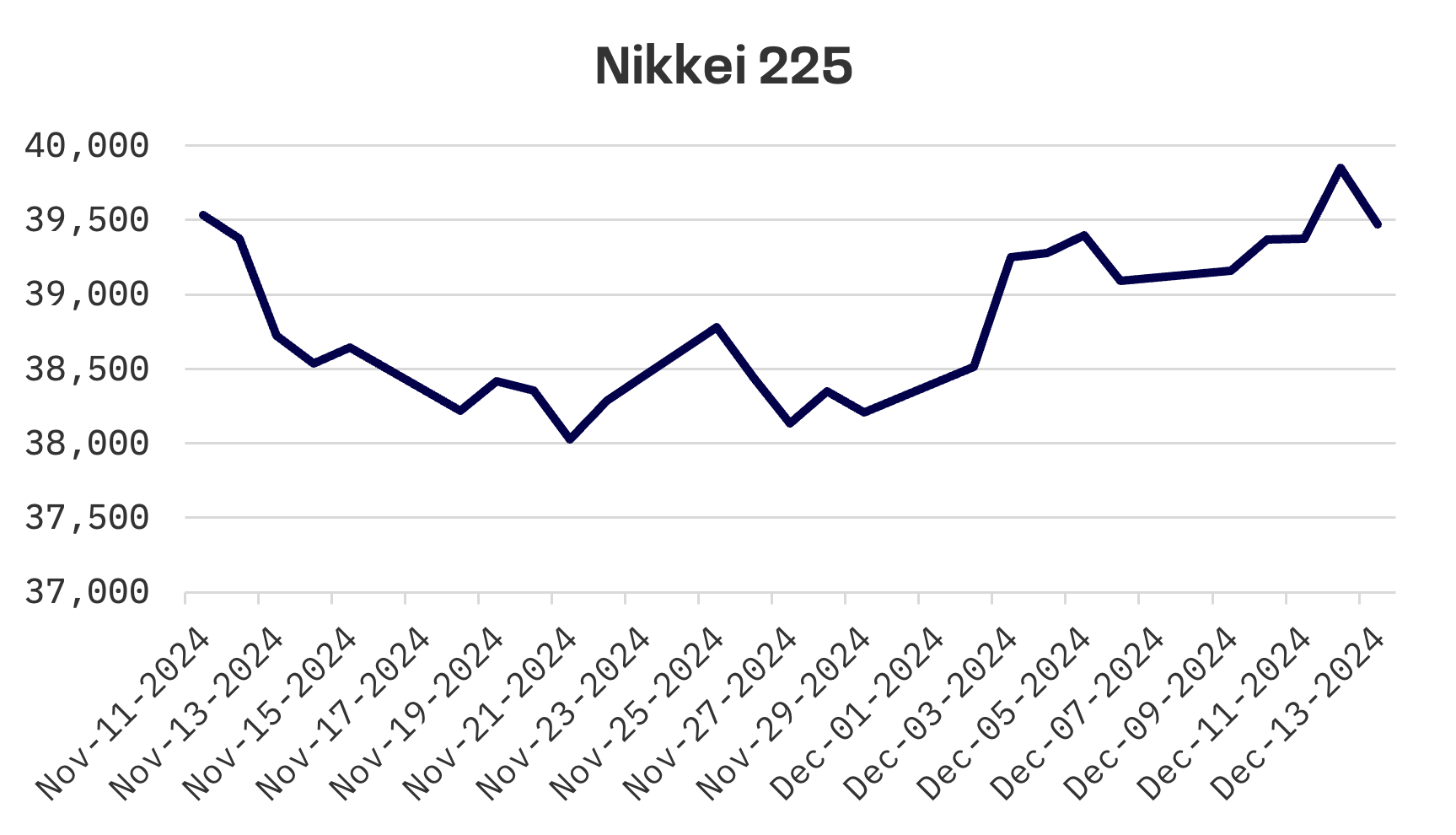

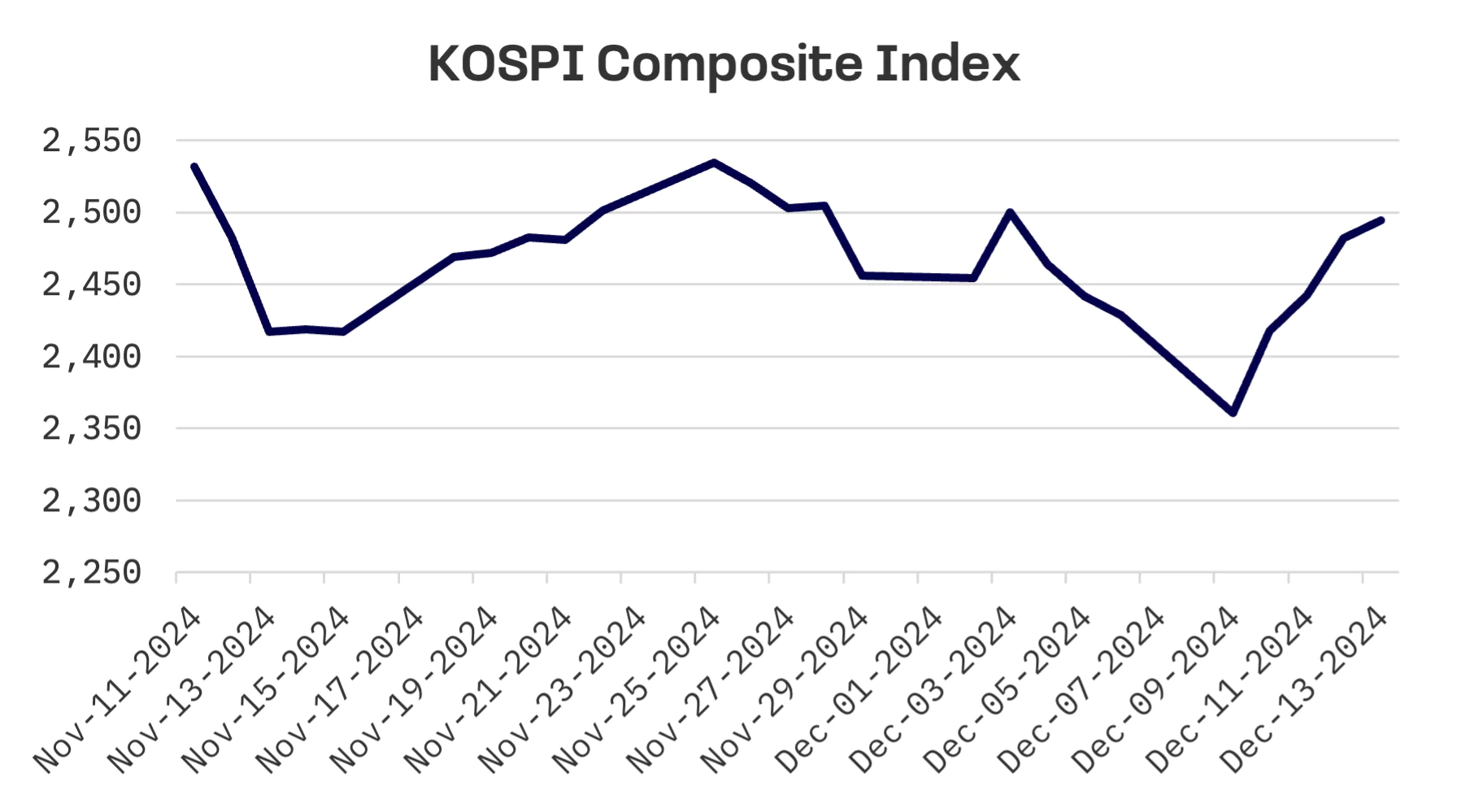

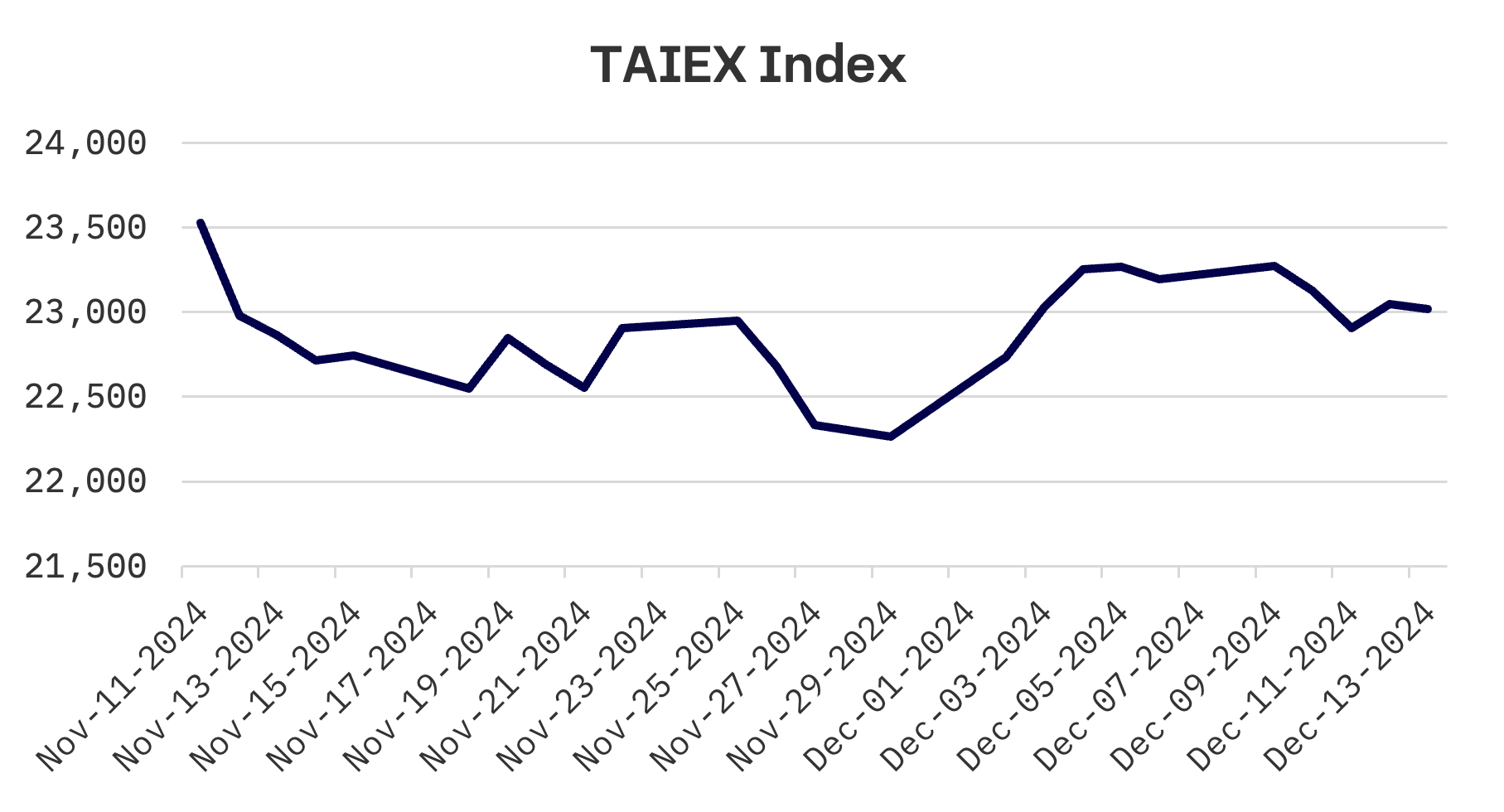

Last week’s Jakota markets:

- Japan’s Nikkei 225 Index rose 1%, supported by China’s fiscal stimulus and speculation about BoJ’s rate hike delay

- South Korea’s KOSPI surged 2.7%, recovering from political turmoil as President Yoon’s impeachment vote brought clarity to markets

- Taiwan’s TAIEX fell 0.7%, retreating from previous week’s gains amid cooling investor sentiment

- The JAKOTA Blue Chip 150 Index climbed 1.3%, with shipbuilding stocks benefitting from Trump administration cooperation hopes

Japan

Japan’s stock market advanced modestly this week, with the Nikkei 225 Index rising 1%. The market drew support from China’s announcement of expansionary fiscal measures and monetary easing. The Japanese yen weakened to around ¥153 against the dollar from ¥150 the previous week, as speculation mounted that the Bank of Japan (BoJ) might delay an interest rate increase at its December 18-19 meeting.

Market expectations have shifted toward a potential 25 basis point rate increase at the central bank’s January meeting rather than December. The postponement would allow policymakers to evaluate additional inflation data, the quarterly economic outlook and feedback from the regional manager meeting. The BoJ maintains that rate decisions will hinge on its assessment of economic conditions, inflation trends and wage growth.

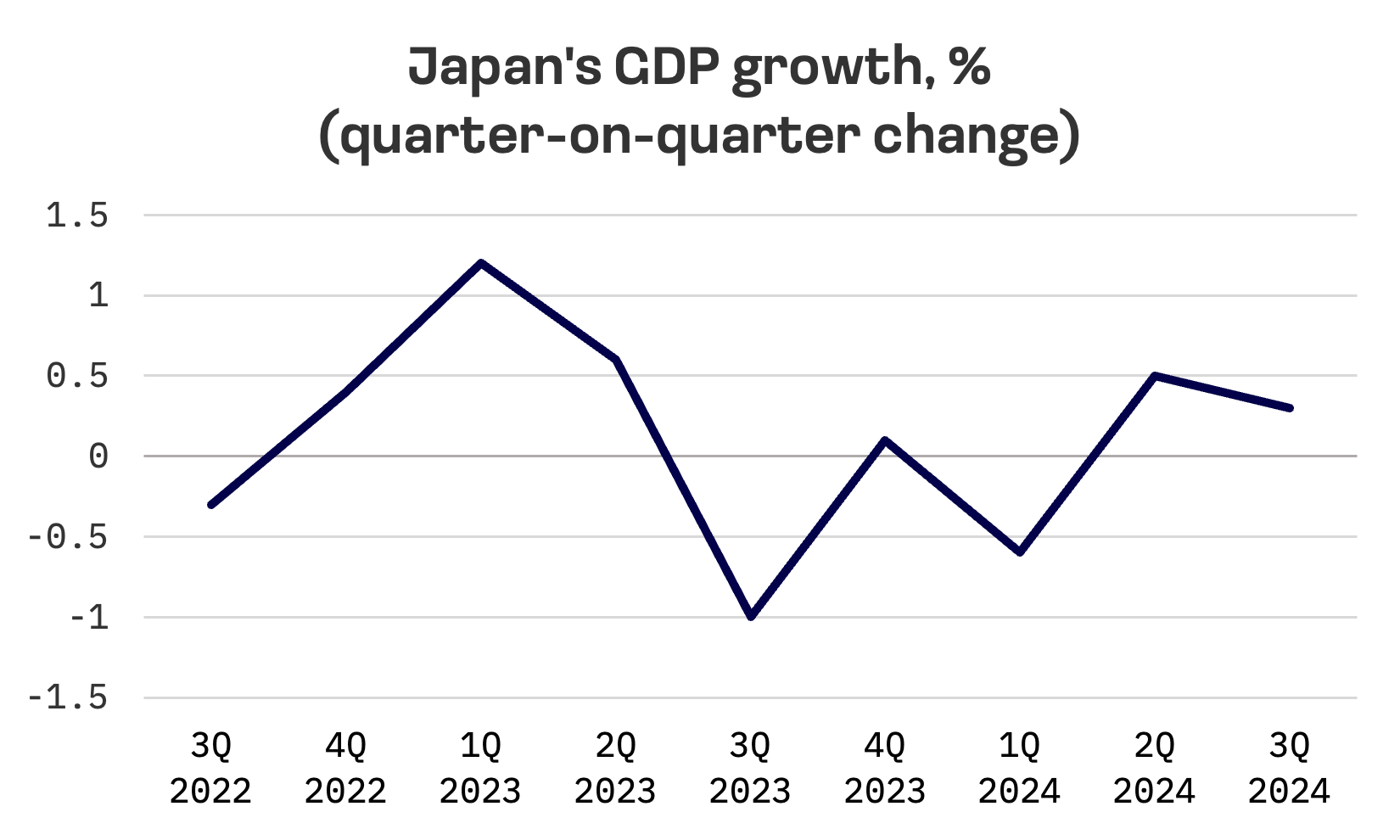

Japan’s economy showed signs of strength, with third quarter GDP growing 0.3% from the previous quarter, exceeding both preliminary estimates and market forecasts of 0.2%.

Adding to signs of resilience, the BoJ’s Tankan survey revealed improved sentiment among large manufacturers in the fourth quarter, with more firms optimistic than pessimistic about business conditions.

South Korea

South Korean markets recovered from Monday’s sharp 3% decline, which was triggered by political upheaval surrounding President Yoon Suk Yeol’s martial law controversy and an initial failed impeachment attempt.

The KOSPI Index gained 5.7% between Tuesday and Thursday, ending the week up 2.7%, as investigations into Yoon’s actions progressed and optimism grew over a resolution to the crisis ahead of another impeachment vote.

South Korea’s parliament voted on Saturday to impeach President Yoon over his martial law decree, temporarily suspending him from office. The National Assembly passed the motion with 204 votes in favor, 85 against, three abstentions and eight invalid votes out of 300 lawmakers. The impeachment is expected to ease market uncertainty after weeks of political tension.

Meanwhile, the three major credit rating agencies – Moody’s, Fitch and S&P – maintained South Korea’s stable credit rating. During virtual meetings with Finance Minister Choi Sang-mok, the agencies expressed confidence in the country’s economic fundamentals, indicating that the presidential impeachment hasn’t undermined South Korea’s financial position.

Taiwan

Taiwan’s stock market declined 0.7% this week as investor enthusiasm waned following last week’s gains.

JAKOTA Blue Chip 150 Index

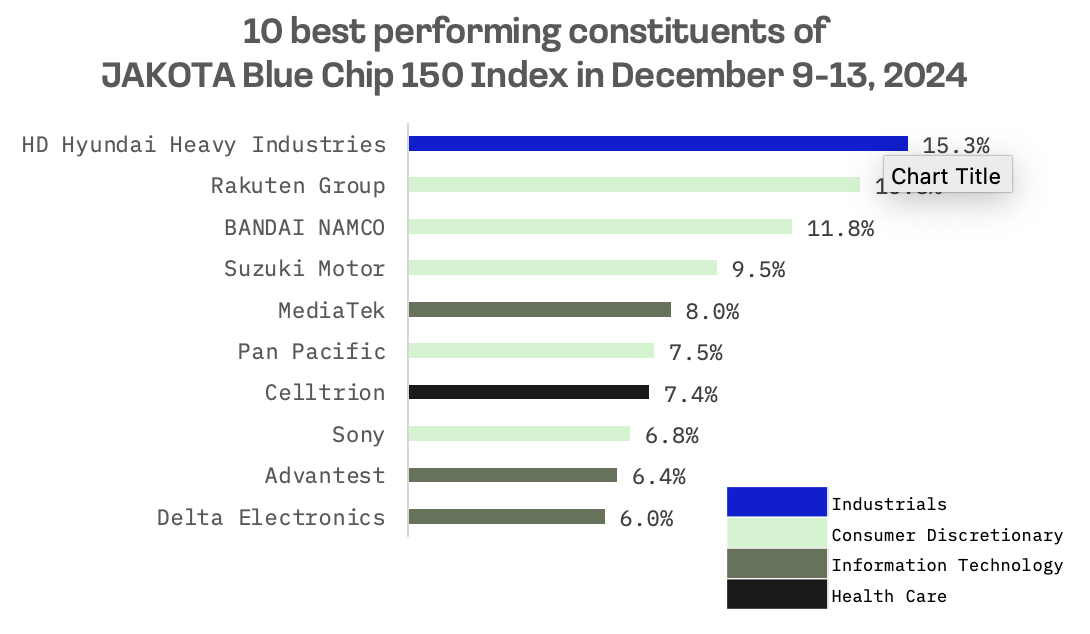

The JAKOTA Blue Chip 150 Index advanced 1.3% this week, with 85 of its 150 constituents posting gains.

HD Hyundai Heavy Industries, the world’s largest shipbuilding company from South Korea, emerged as the top performer of the JAKOTA Blue Chip 150 Index this week. Shipbuilding stocks, which had been hit hard by the martial law situation, rebounded as investors took advantage of lower prices. Analysts attribute the recovery to improving prospects for ship order shares and potential benefits from the rising exchange rate.

The sector surged in November on expectations that the Donald Trump administration would strengthen cooperation with domestic companies, following President elect Trump’s direct request for collaboration from President Yoon Seok-yeol.

Daiichi Sankyo, the Japanese pharmaceutical giant, was the index’s worst performer following the death of Toshinori Agatsuma, widely regarded as the scientific trailblazer behind the company’s groundbreaking antibody drug conjugate (ADC) technology. Agatsuma, who served as head of research at Daiichi Sankyo, led the development of ADC technology that resulted in the creation of Enhertu, the company’s blockbuster breast cancer drug.