Last week’s Jakota markets:

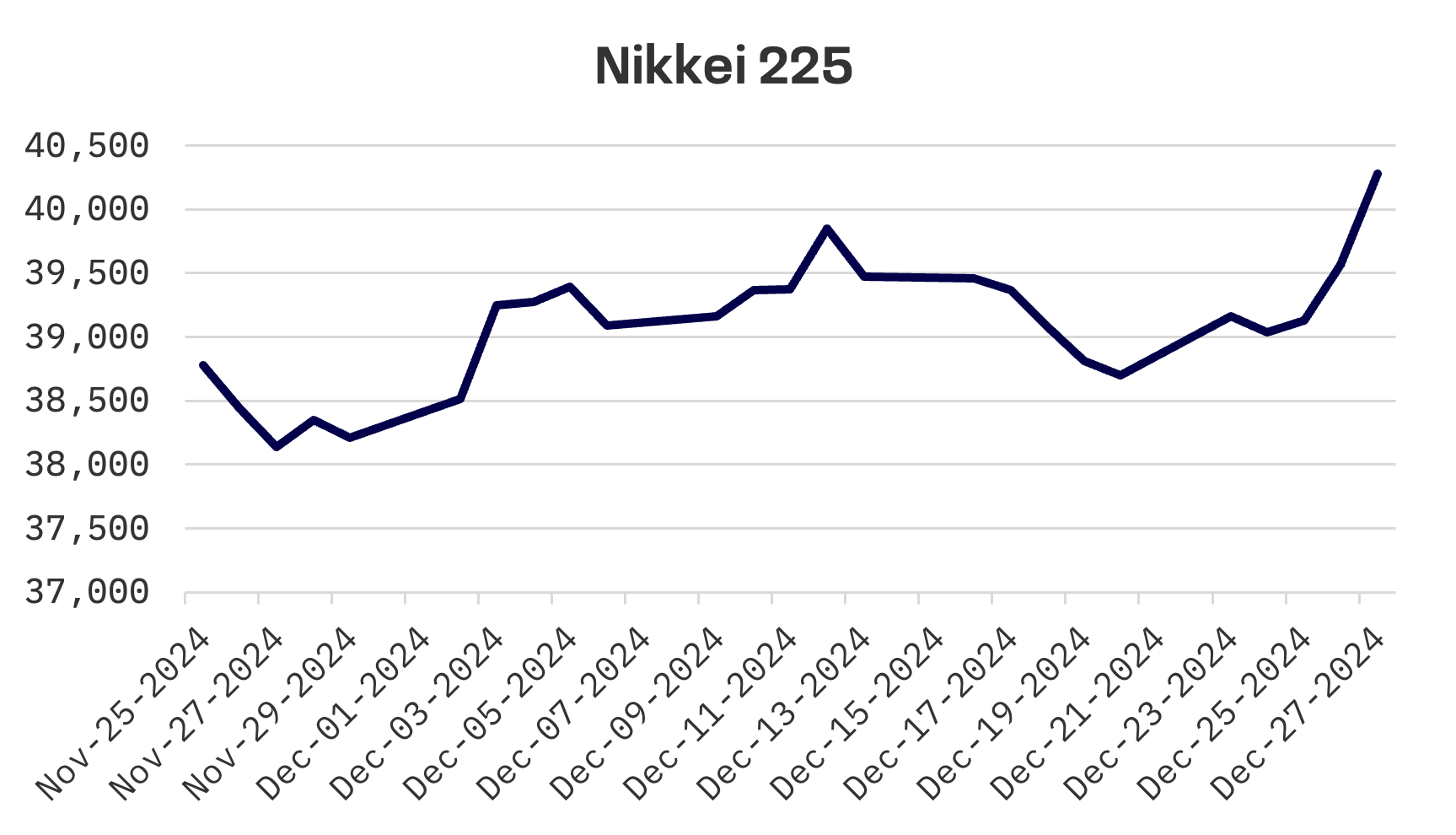

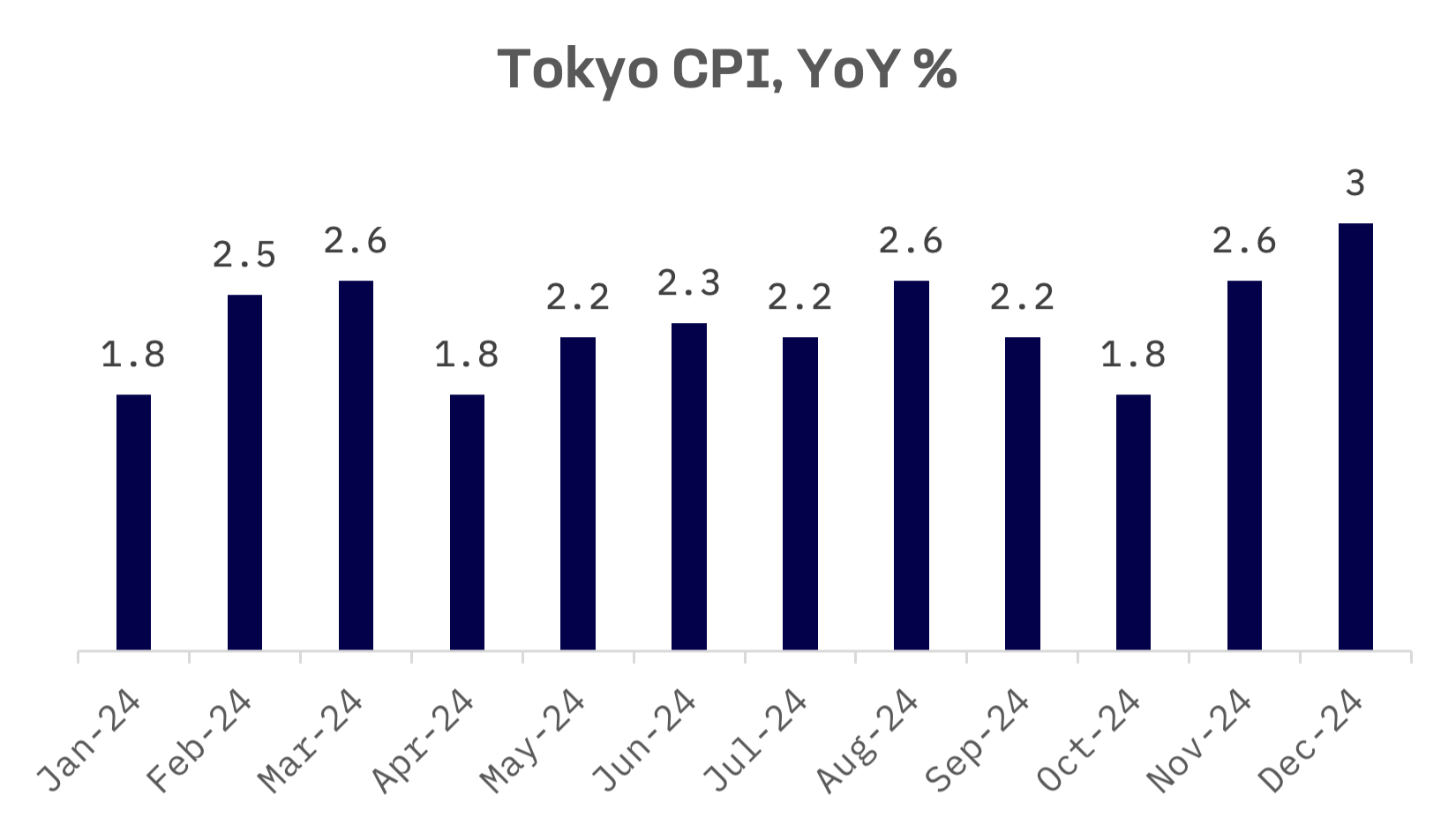

- Japan’s Nikkei 225 surged 4.08%, as a weaker yen boosted exporters’ outlook, while Tokyo inflation accelerated to 3% year-over-year in December

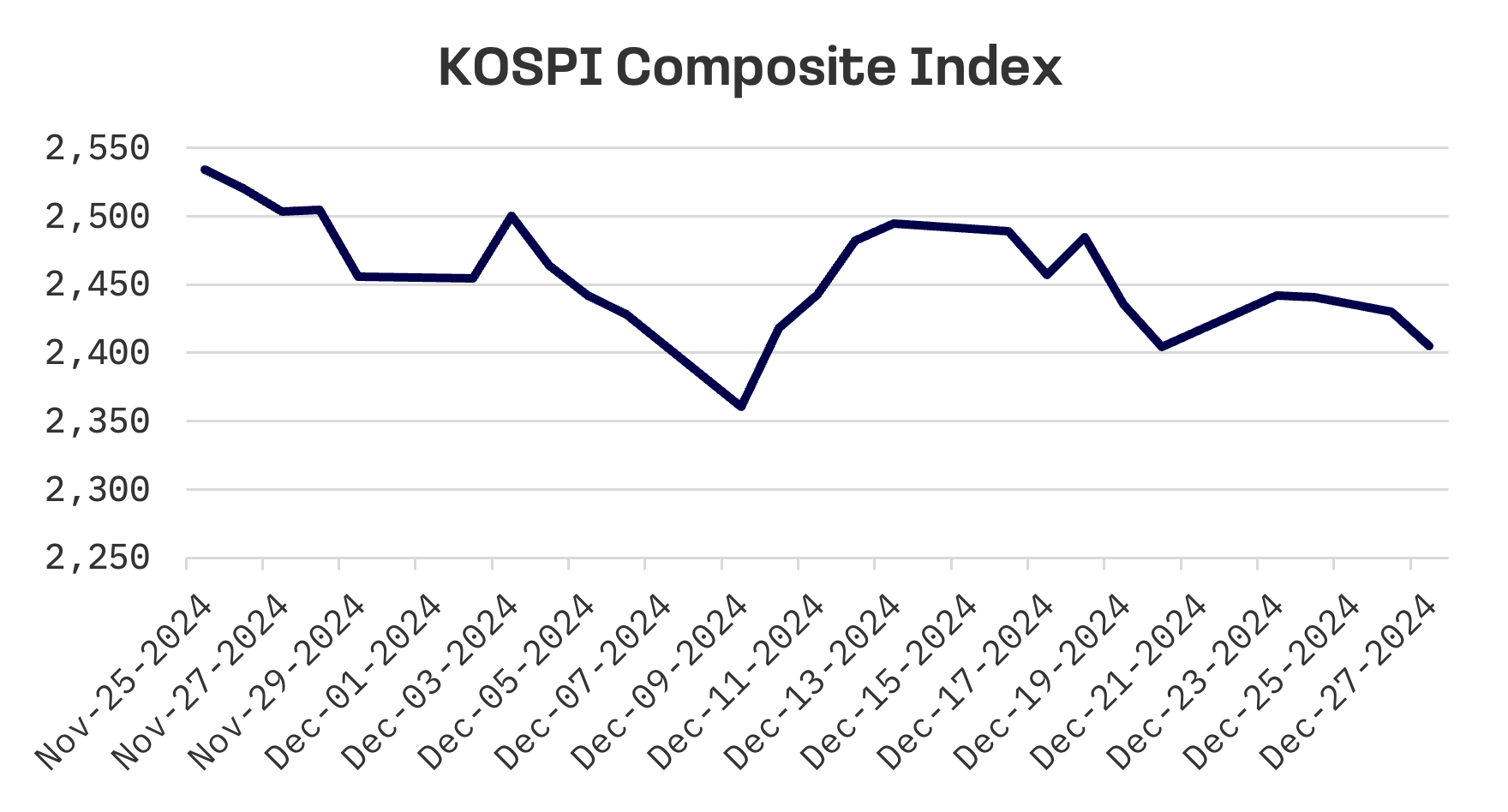

- South Korea’s market stagnated, remaining negative at -2.1% in December amid political chaos, with the KOSPI heading for its ninth straight monthly decline and the won falling to ₩1,467.5 per dollar

- Taiwan’s TAIEX jumped 3.4%, primarily driven by Monday’s 2.6% rally in tech stocks following U.S. market strength

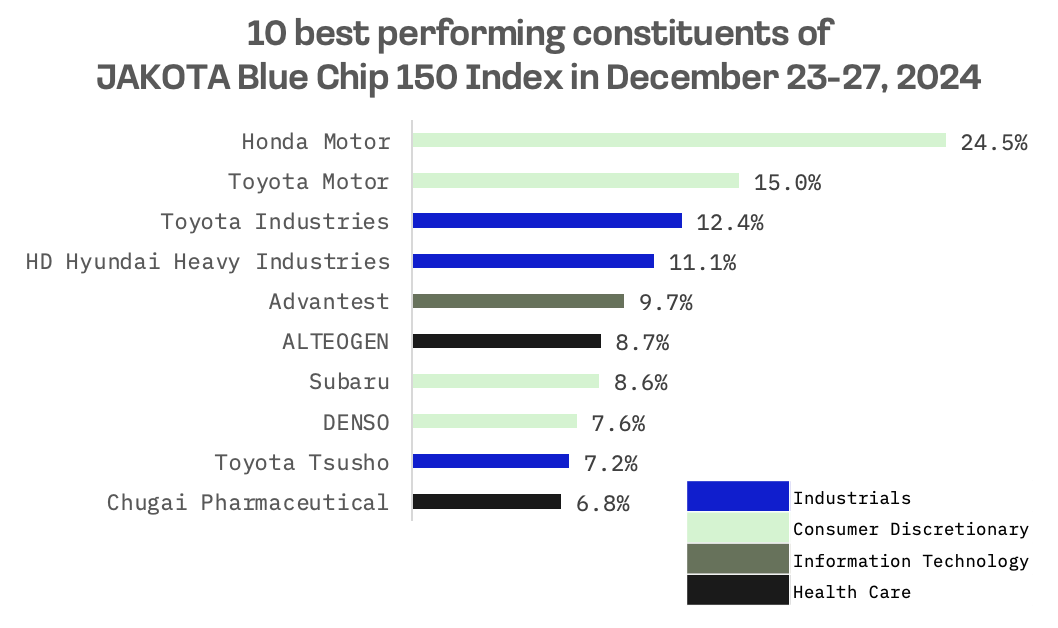

- The JAKOTA Blue Chip 150 Index climbed 3.2%, highlighted by Honda Motor’s 24.5% surge on Nissan merger talks, while South Korean stocks lagged

Japan

Japan’s stock market advanced this week, with the Nikkei 225 rising 4.08%, supported by a weakening yen. The currency’s depreciation boosted profit outlooks for the country’s export oriented sectors, even as it traded near five month lows against the backdrop of the Bank of Japan (BoJ)’s cautious tone.

BoJ Governor Kazuo Ueda indicated that further monetary tightening could be warranted if economic conditions improve as expected, while emphasising that policy adjustments would depend on economic activity, price trends and financial conditions. He underscored the importance of maintaining accommodative policy to support growth while keeping inflation near the central bank’s 2% target.

The country’s industrial production fell 2.3% in November, dipping from October’s 2.8% increase and beating expectations of a 3.5% decline. Retail sales showed strength, growing 1.8% from a year earlier, surpassing forecasts and accelerating from October’s 0.1% gain.

The Tokyo area consumer price index (CPI) rose 3% year-over-year in December, exceeding expectations and accelerating from November’s 2.6% increase.

Core CPI, which strips out volatile food and energy prices, increased 2.4% from the previous year, up from November’s 2.2% rise. The Tokyo data, considered a leading indicator for nationwide trends, continues to run above the central bank’s 2% target.

South Korea

South Korea’s stock market stagnated this week, with the KOSPI index heading for its ninth consecutive monthly decline in 2024. December’s performance remains negative at -2.1%, as political upheaval continues to dampen investor confidence.

The nation’s parliament voted Friday to remove acting President Han Duck-soo, a mere two weeks after President Yoon Suk Yeol’s impeachment following an unsuccessful attempt to declare martial law.

The South Korean won plunged to its weakest level in nearly 16 years on Friday, trading at ₩1,467.5 per U.S. dollar amid the deepening political crisis. This marks the lowest level since March 13, 2009, when it traded at ₩1,483.5 in the aftermath of the global financial crisis.

The country has narrowed its export value gap with Japan to a record low of $20.2 billion this year, though export prospects remain dim due to mounting political, trade and social challenges.

Business sentiment dropped to a four year low, reflecting uncertainties following President Yoon’s brief martial law declaration and growth concerns, according to a central bank survey released on Friday.

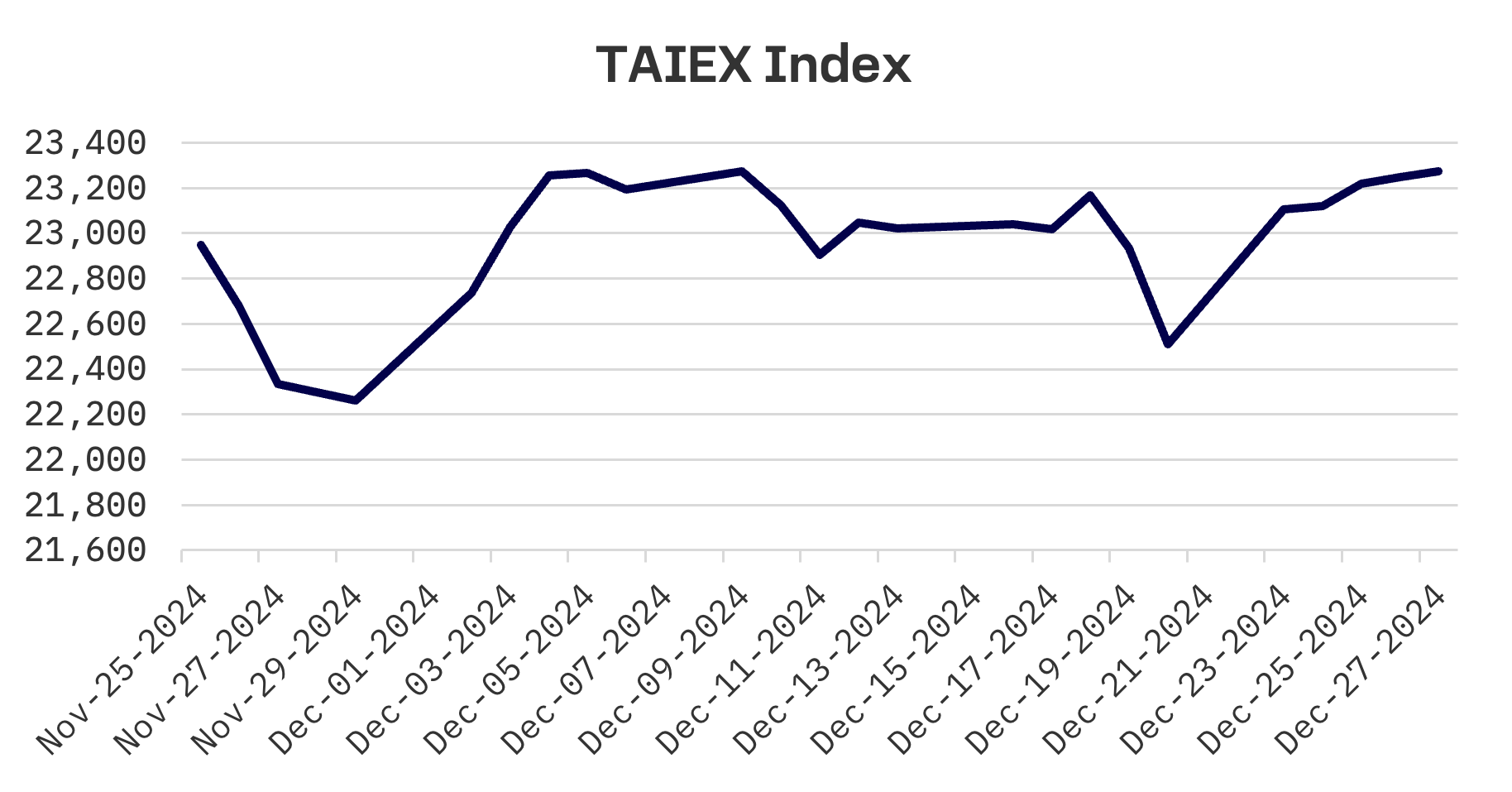

Taiwan

Taiwan’s stock market rose this week, with the TAIEX Index climbing 3.4%. The gains were concentrated on Monday, when the index jumped 2.6%, following strong U.S. market performance. The electronics sector led the gains, with Taiwan Semiconductor (TSMC) spearheading the rally.

The country’s economic indicators flashed a third consecutive “yellow-red” light in November, signalling a moderately hot economy and slight improvement from October, the National Development Council reported. The composite index of economic indicators rose two points to 34, remaining within the “yellow-red” range of 32 to 37.

Manufacturing sentiment improved in November, breaking a five month declining streak, according to the Taiwan Institute of Economic Research (TIER).

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index gained 3.2% this week, with 128 of 150 constituents advancing.

Honda Motor, a Japanese automotive conglomerate, topped the index’s performers, surging 24.5% following merger discussions with Nissan.

The companies announced on Monday that they are exploring a merger by 2026, with Mitsubishi Motors — 34% owned by Nissan — potentially joining. The combined entity could be valued above $50 billion, potentially creating the world’s third largest automaker by sales behind Toyota Motor and Volkswagen. The move comes as both Honda and Nissan face intensifying competition in China, particularly from the rapidly growing electric vehicle sector.

The companies aim for combined sales of ¥30 trillion through the merger, their chief executives said on Monday. They plan to conclude negotiations by June 2025 and establish a holding company by August 2026, when both firms would delist.

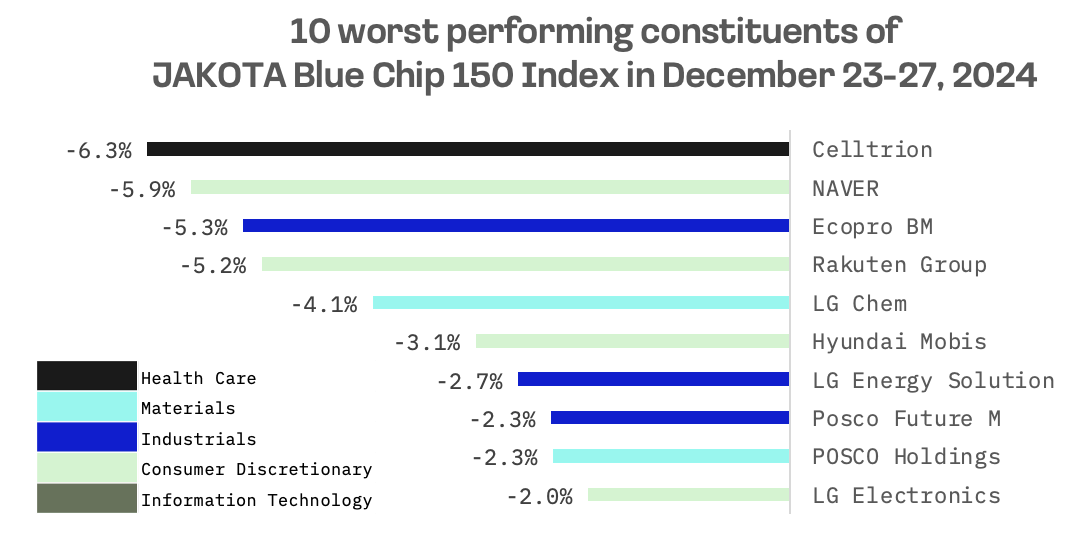

Not surprisingly, the top 10 worst-performing stocks of the week are heavily dominated by South Korean companies, including Celltrion, a Korean biopharmaceutical firm, which dropped by 6.3%.