Last week’s Jakota markets:

- Japan’s Nikkei 225 advanced 1.7%, buoyed by a weakening yen that boosted export sector prospects, while base wages hit a 32 year high

- South Korea’s KOSPI fell 1.1% amid political turbulence following President Yoon’s martial law declaration, though officials moved quickly to calm market concerns

- Taiwan’s TAIEX emerged as the strongest performer with a 4.2% surge, led by a robust rebound in TSMC and the broader electronics sector

- The JAKOTA Blue Chip 150 Index climbed 1.7%, featuring ALTEOGEN’s surge thanks to licensing deals while Korean financial stocks faced pressure from political uncertainty

Japan

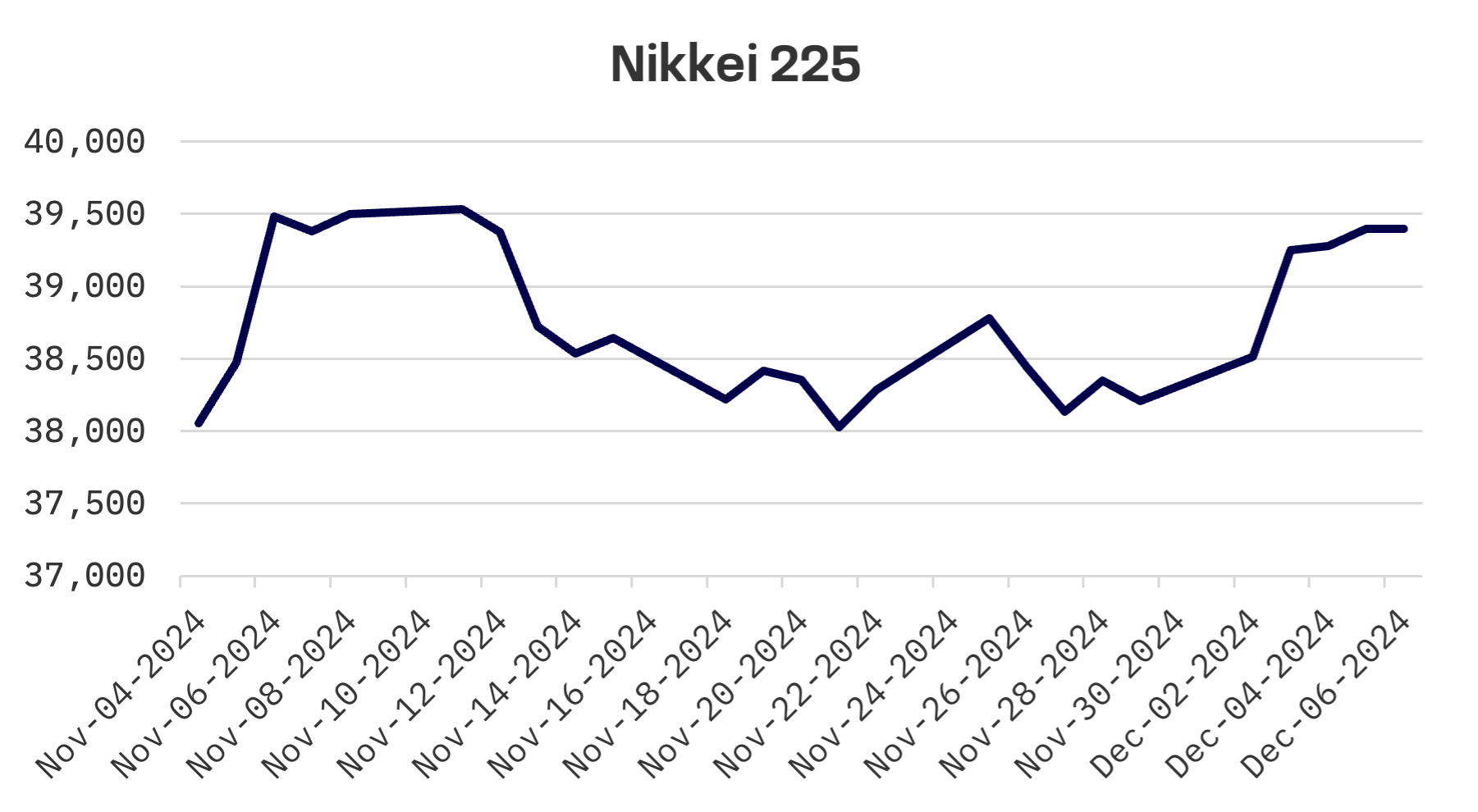

The Nikkei 225 gained 1.7% over the week, supported by a weakening yen that enhanced profit prospects for the country’s export sectors. The Japanese currency declined from the high ¥149 per dollar range at the prior week’s close to the mid ¥150 range against the U.S. dollar.

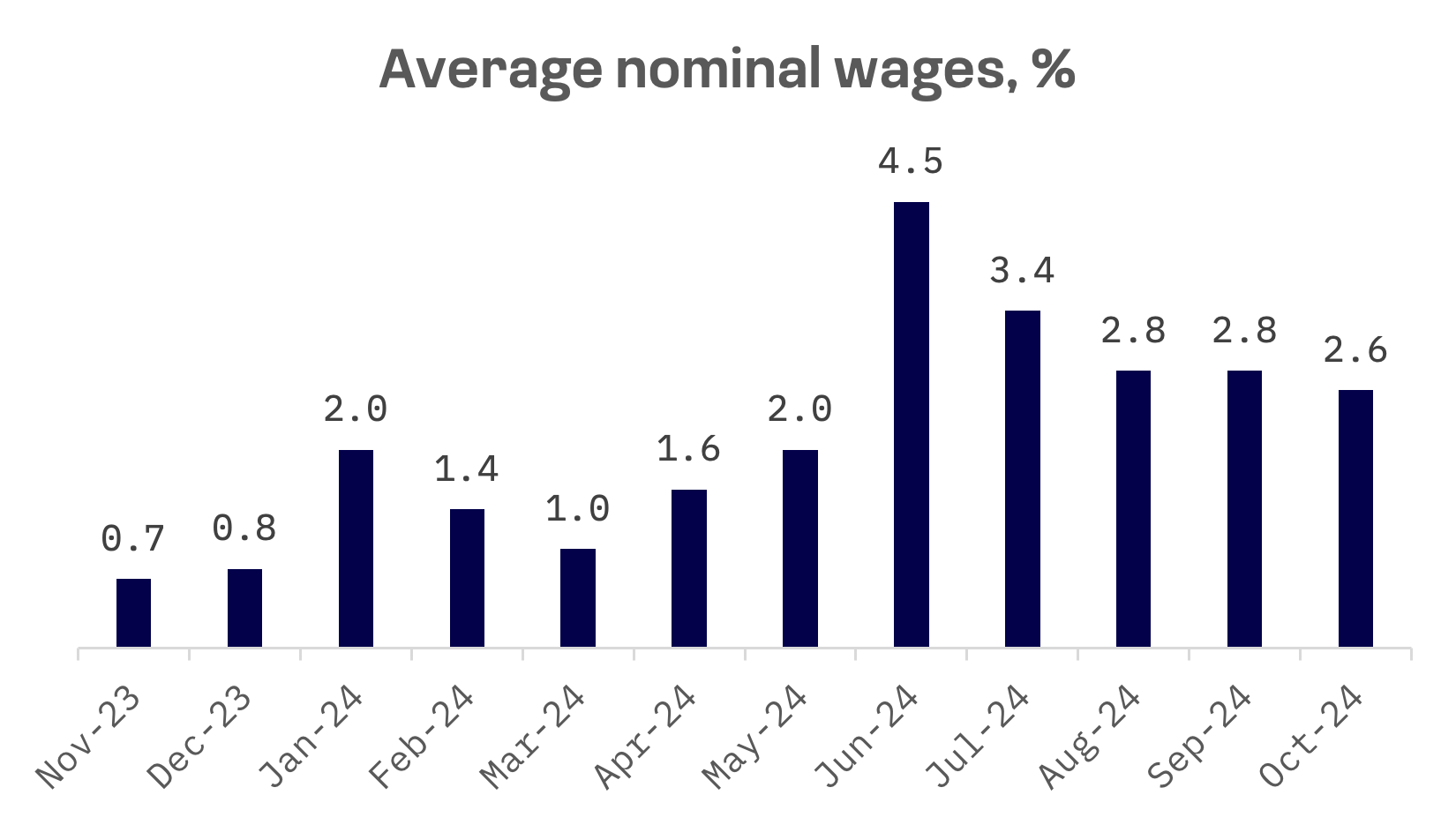

Bank of Japan (BoJ) board member Toyoaki Nakamura emphasised that interest rate decisions will depend on incoming data, particularly wage and economic growth trends. Market observers remain split on whether the central bank will implement a 25 basis point rate increase in December or delay until January.

BoJ Governor Kazuo Ueda indicated that 2025 wage trends and their influence on service prices will be crucial factors, suggesting January as a more likely timing for a rate increase. Ueda also cited uncertainties in U.S. economic policy, including potential tariff impositions, as reasons to avoid premature action.

Japanese base salaries recorded their fastest increase in 32 years this October, providing a boost to real wages after two months of decline and strengthening the case for a potential rate increase. Average nominal wages rose 2.6%, adding context to the central bank’s December 19 policy review.

Household spending, however, fell 1.3% from a year earlier, marking its third consecutive monthly decline and indicating persistent pressure on consumer sentiment.

South Korea

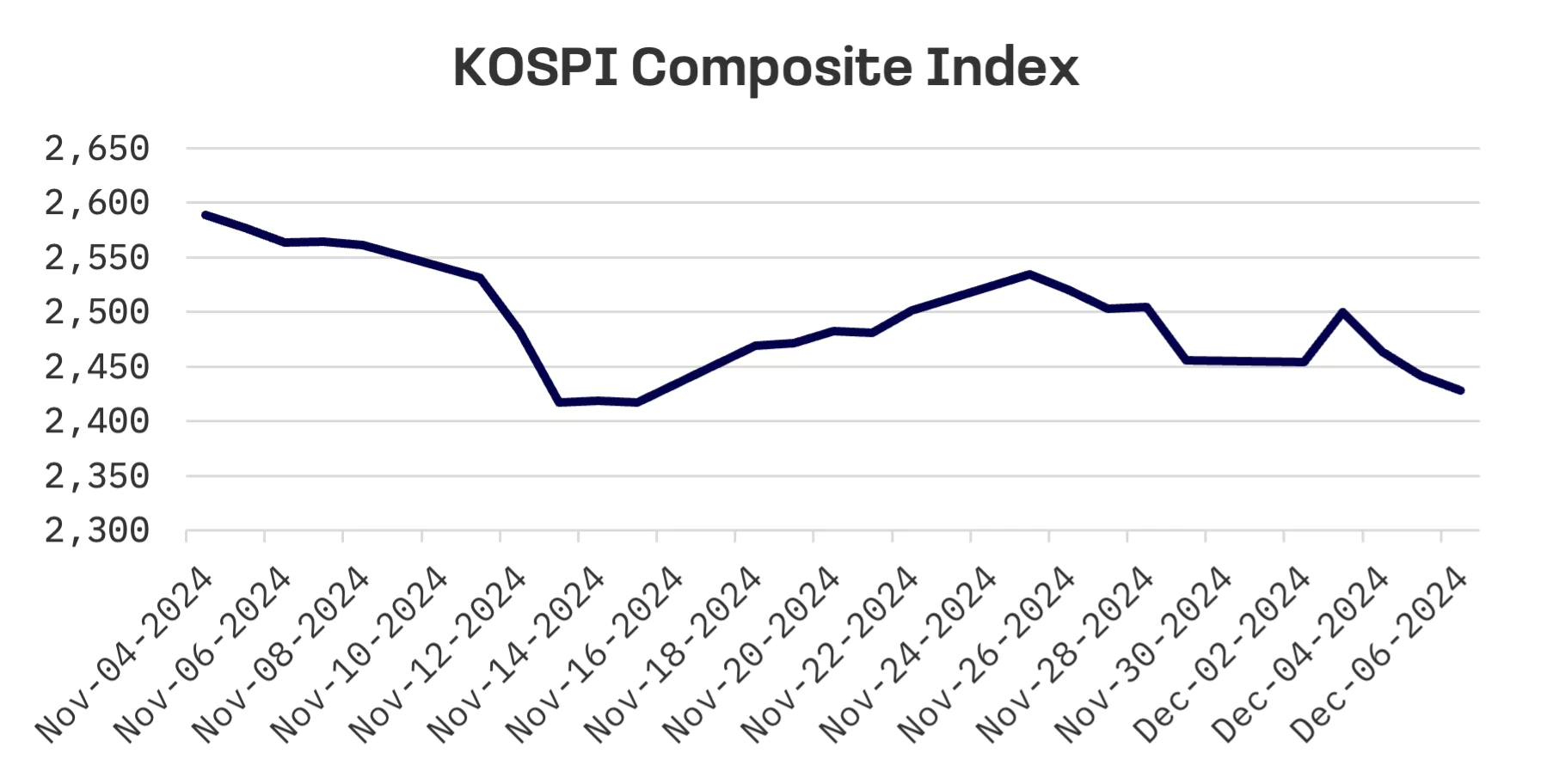

South Korean President Yoon Suk Yeol’s unexpected declaration of martial law rattled domestic politics and financial markets, pushing the KOSPI Index down 1.1% for the week.

The declaration, evoking memories of the nation’s military rule era, prompted opposition lawmakers led by the Democratic Party to file an impeachment motion. The motion, which required a two thirds majority in the 300 member National Assembly, ultimately failed after Mr. Yoon’s ruling party boycotted the vote, preventing the necessary quorum.

Finance Minister Choi Sang-mok sought to calm markets on Friday, stating that the failed martial law attempt would have limited impact on the economy and financial markets. Choi dismissed recession concerns for next year as overblown and assured that financial authorities and the Bank of Korea (BOK) stand ready to provide unlimited liquidity support if market volatility increases. Choi predicted a slight moderation in economic growth, but emphasised that it would not fall below the country’s potential growth rate.

BOK Governor Rhee Chang-yong echoed these sentiments, stating that the political uncertainty would have minimal effect on Asia’s fourth largest economy. Rhee credited prompt intervention by financial authorities, including liquidity injections, for containing the crisis’s impact.

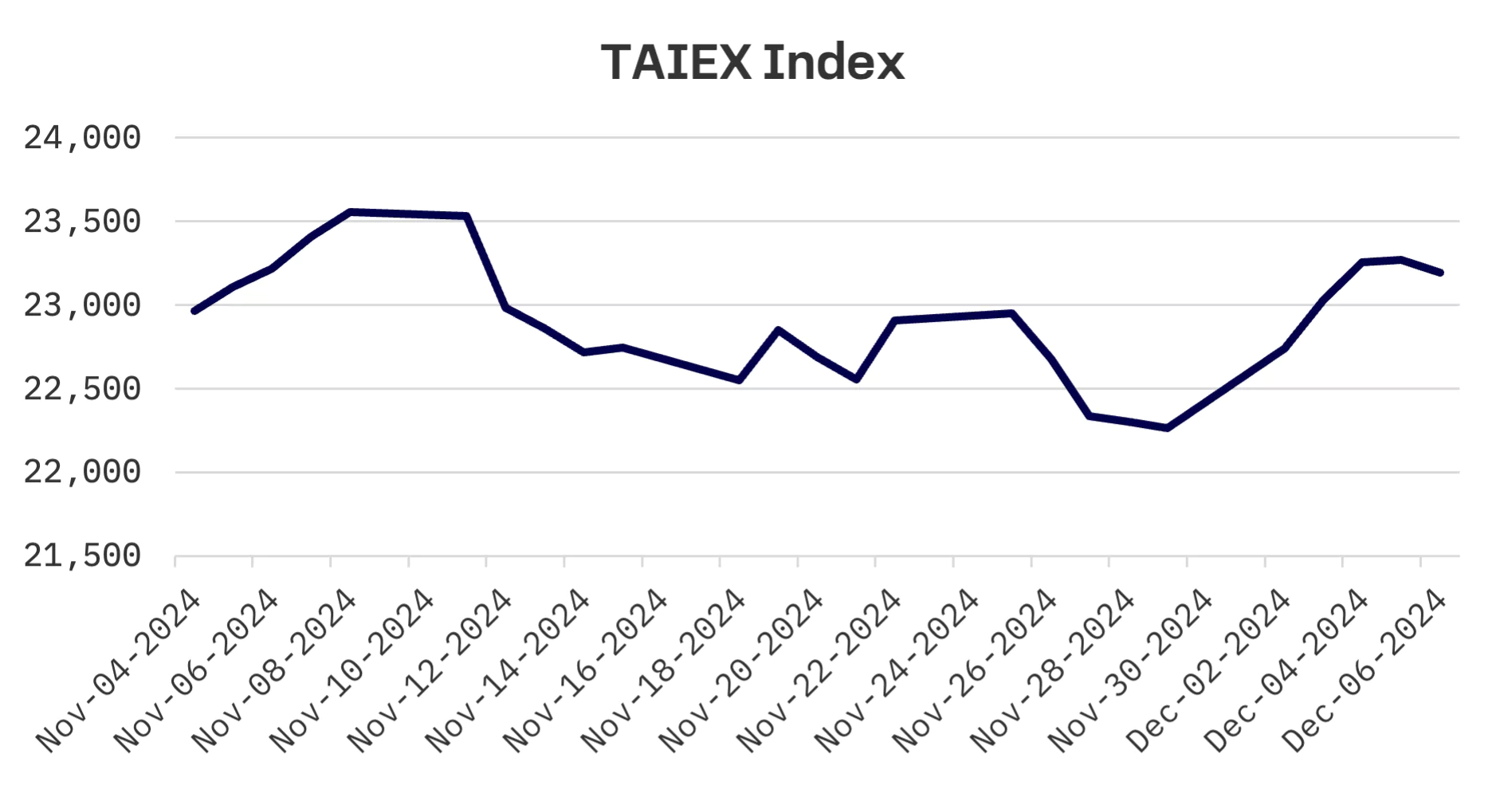

Taiwan

Taiwan’s TAIEX Index surged 4.2% this week, driven by a rally in the electronics sector. This helped the broader market recover from last week’s slump. Taiwan Semiconductor (TSMC) saw a significant rebound, with buying interest spreading to other major technology stocks.

JAKOTA Blue Chip Index

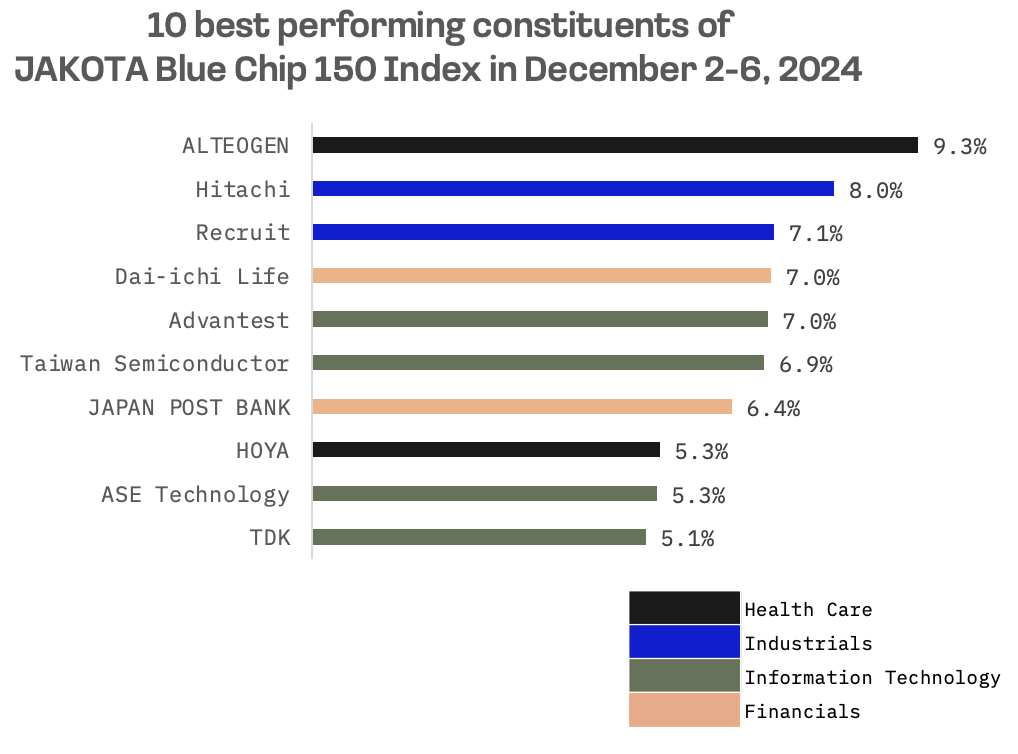

The JAKOTA Blue Chip 150 Index advanced 1.7% this week, with 102 of its 150 constituents posting gains.

ALTEOGEN, a Korean biotech company specialising in long-acting biobetters, proprietary antibody drug conjugates, and antibody biosimilars, stood out as the week’s top performer, emerging as one of the most volatile stocks in the index over last month. On December 3, the company disclosed that it had received $20 million (approximately ₩28 billion) from Daiichi Sankyo as a technology licensing fee for its proprietary hyaluronidase, ALT-B4. The payment follows the agreement signed between the two companies on November 8.

ALTEOGEN shares had previously rallied on news of a $300 million partnership with Daiichi Sankyo to develop a subcutaneous version of cancer treatment Enhertu, co-developed with AstraZeneca. The stock later declined after a Goldman Sachs note raised concerns about potential patent infringement of Halozyme’s ENHANZE patents, particularly regarding MSD’s development of a subcutaneous version of the immunotherapy drug Keytruda.

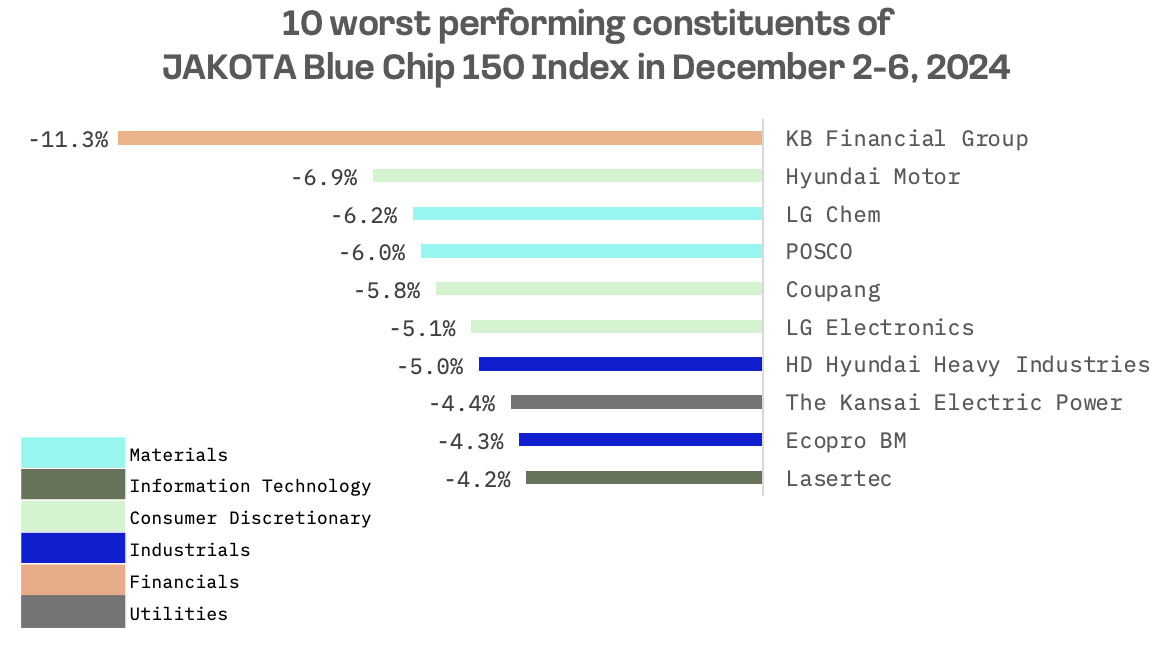

Amid the political turmoil, Korean companies emerged as the worst performers on the JAKOTA Blue Chip 150 Index, with financial stocks proving particularly vulnerable. KB Financial Group, South Korea’s largest bank, recorded the index’s steepest decline, reflecting heightened market sensitivity to the political crisis.

Adding to the pressure, growing skepticism over South Korea’s “Corporate Value Enhancement Plan” weighed heavily on bank stocks. The initiative, a cornerstone of the government’s strategy to address prolonged stock market undervaluation, failed to calm investor concerns, leading to an intensifying selloff in the financial sector.