Last week’s JAKOTA markets:

- Japan’s Nikkei 225 edges up, bolstered by the Bank of Japan’s dovish monetary approach.

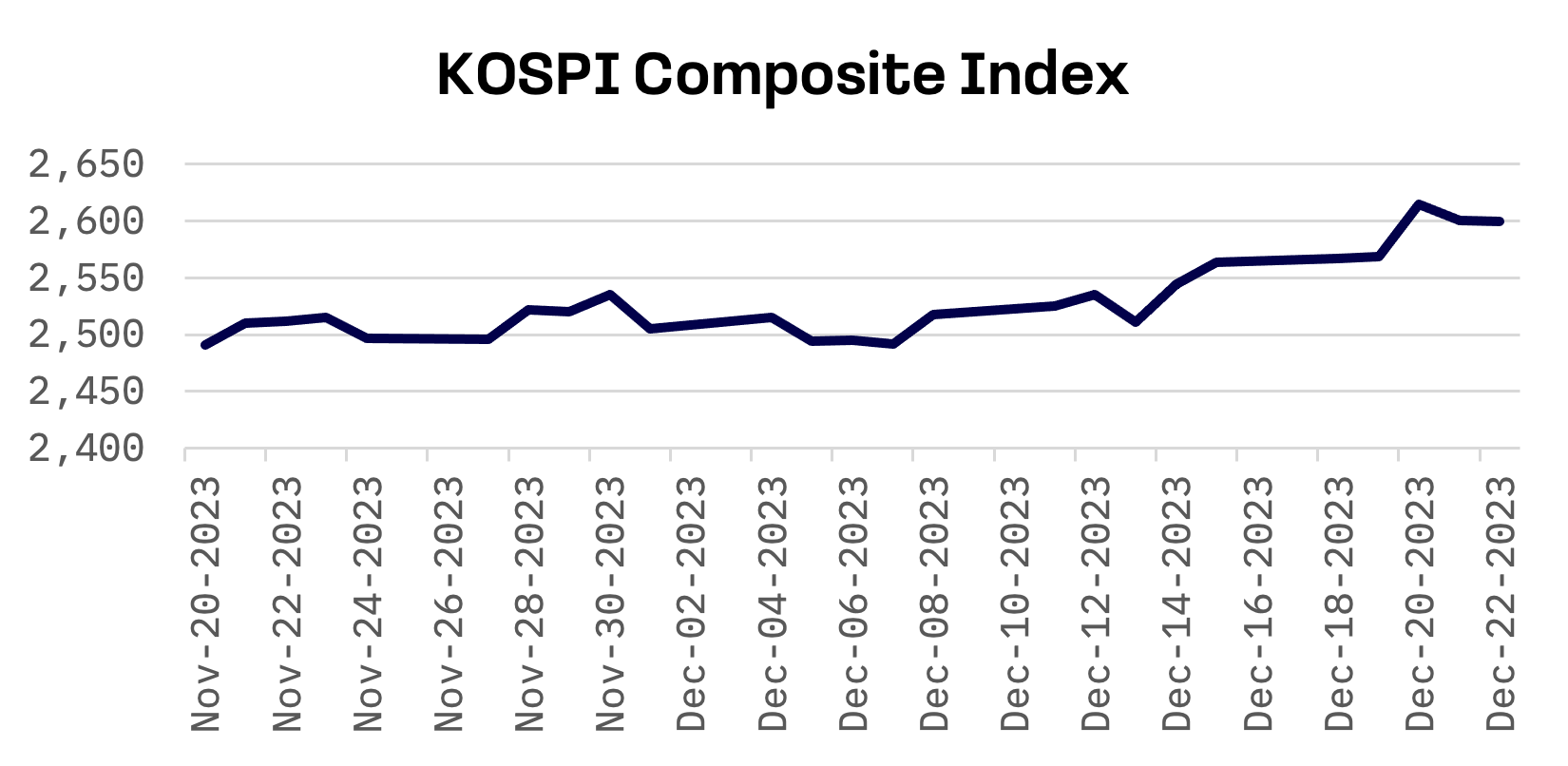

- South Korea’s KOSPI extends its growth streak to eight weeks, amidst expectations of moderated inflation.

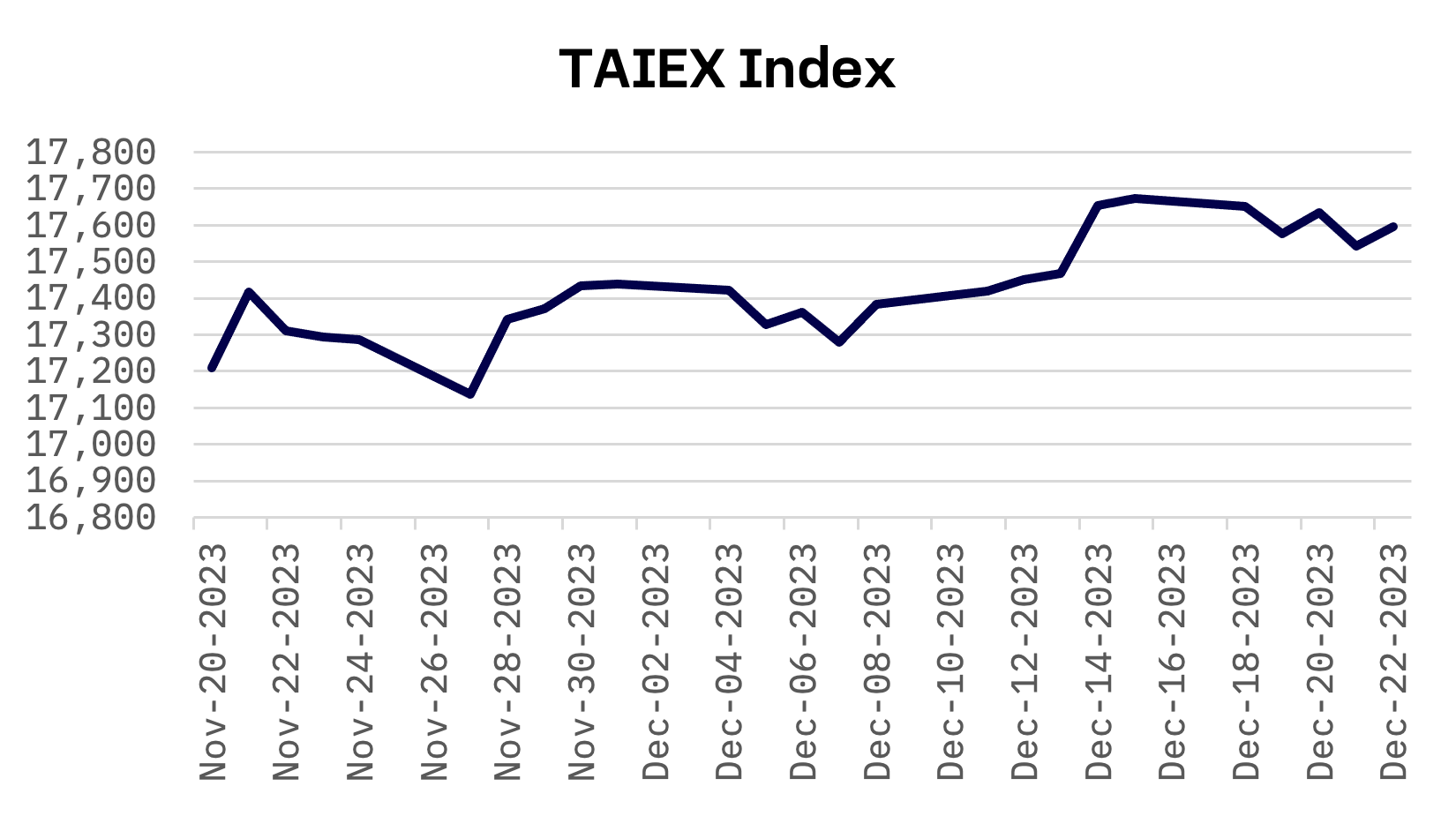

- Taiwan’s TAIEX experiences a slight decline, influenced by tech stock sell-offs and a dip in smartphone shipments.

- The financial landscape was characterised by central bank policy actions, inflation trends in South Korea, Japan’s shipping sector performance, and the impact of China’s gaming regulations on Nexon.

Japan

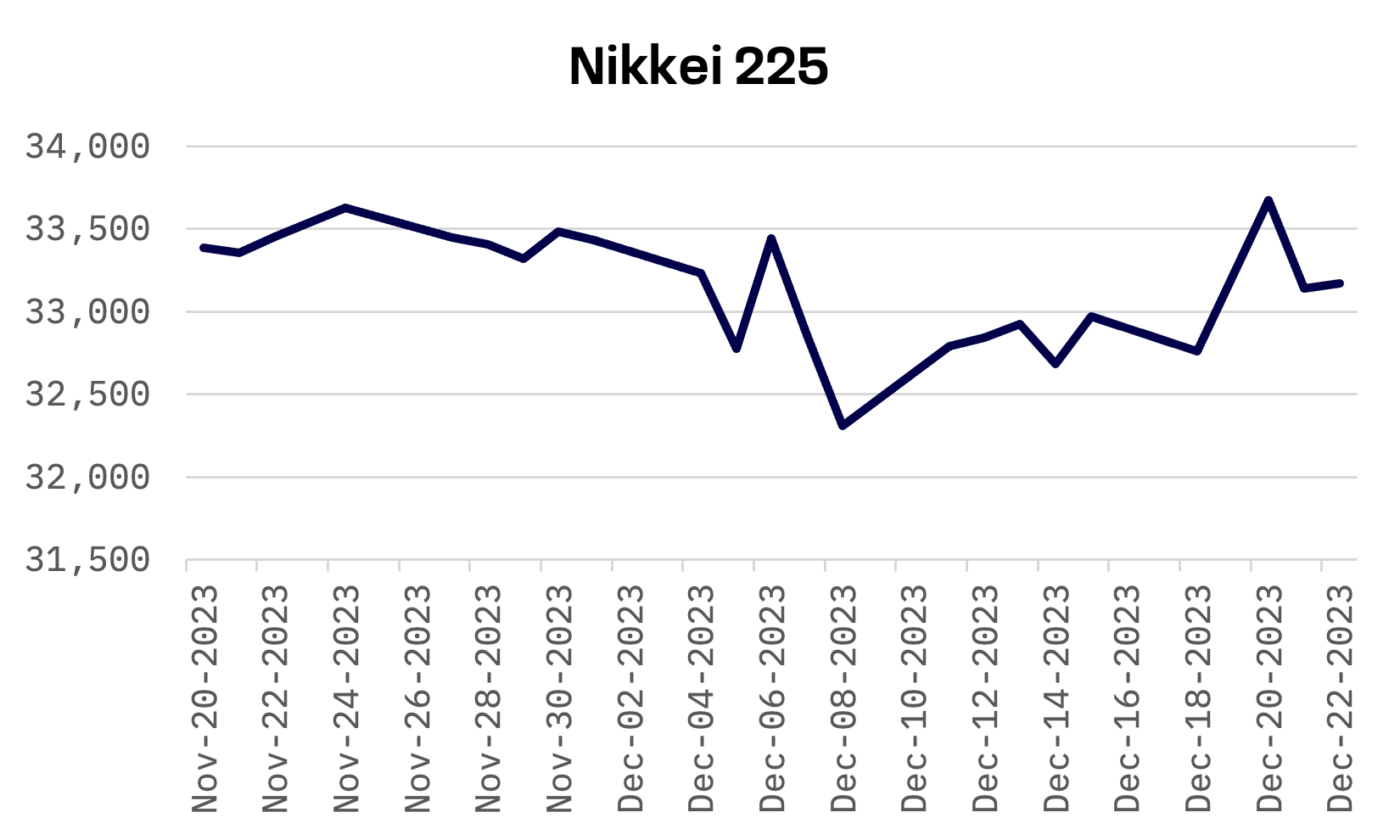

The Nikkei 225 Index in Japan witnessed a modest 0.6% increase this week, supported by the Bank of Japan’s (BoJ) dovish monetary policy. During its December meeting, the BoJ maintained its highly accommodative stance, including forward guidance, while refraining from hinting at any potential policy changes in 2024.

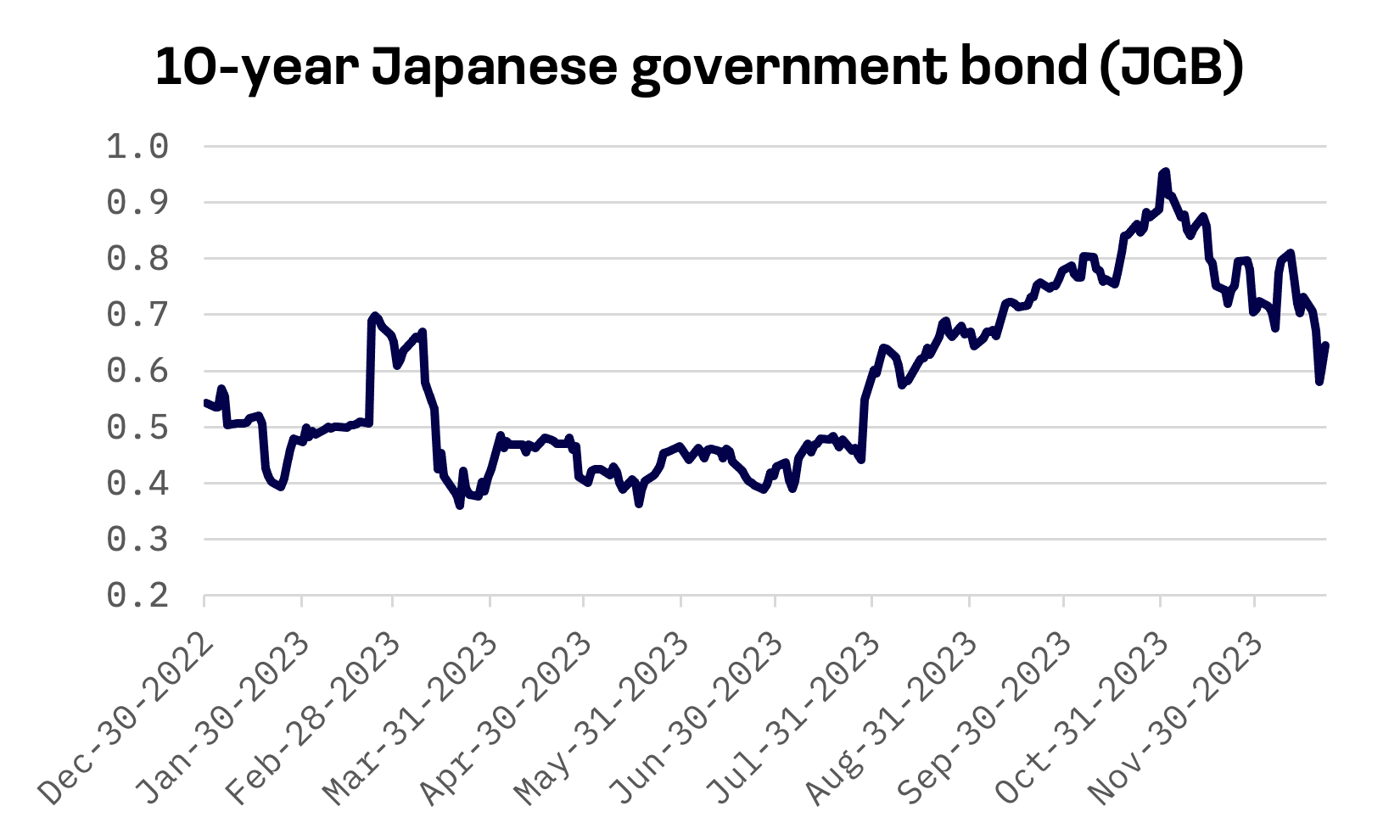

The yield on the 10-year Japanese government bond (JGB) declined from 0.73% to 0.65%, a response to the dovish stance maintained by the Bank of Japan (BoJ). In its December meeting, the BoJ adhered to market expectations by keeping its key short-term interest rate target steady at -0.1%. Furthermore, the central bank reaffirmed its commitment to continue its yield curve control policy, maintaining the upper bound of 1.0% for 10-year JGB yields.

Earlier in the month, remarks from BoJ officials had fueled investor speculation about a potential early shift in the bank’s ultra-accommodative monetary policy. This speculation included the possibility of removing the negative interest rate policy soon after any changes in yield curve control.

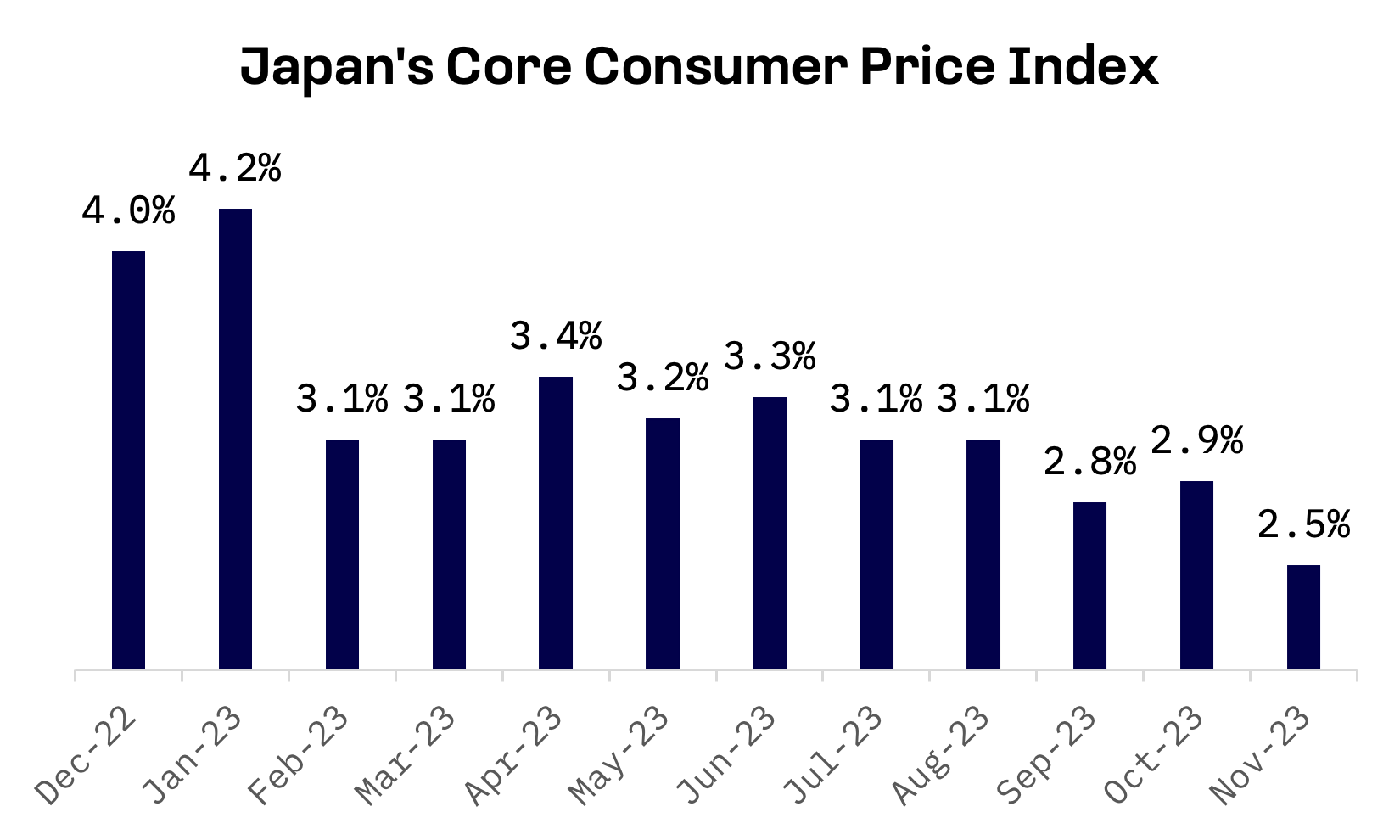

However, BoJ Governor Kazuo Ueda’s recent comments appeared to temper expectations of an imminent interest rate hike. He made no direct references to upcoming policy changes in the next year, instead emphasising the need to assess whether inflation is sustainably approaching the BoJ’s 2% target. Ueda highlighted the complexities in formulating an exit strategy from the current policy, citing the current lack of sustained inflationary conditions in the economy.

Later in the week, data showed that Japan’s core consumer price index increased by 2.5% year-on-year in November, a notable decrease from the 2.9% recorded in the previous month. This figure marks the most subdued inflation rate since July 2022, suggesting a softening of cost-push inflationary pressures. This trend indicates an easing of immediate price pressures, potentially giving the Bank of Japan more leeway before it needs to consider scaling back its extensive monetary stimulus.

South Korea

The KOSPI Composite Index in South Korea rose by 1.4%, marking eight consecutive weeks of growth. This positive trend was influenced by the anticipated U.S. Federal Reserve rate cuts and general market optimism.

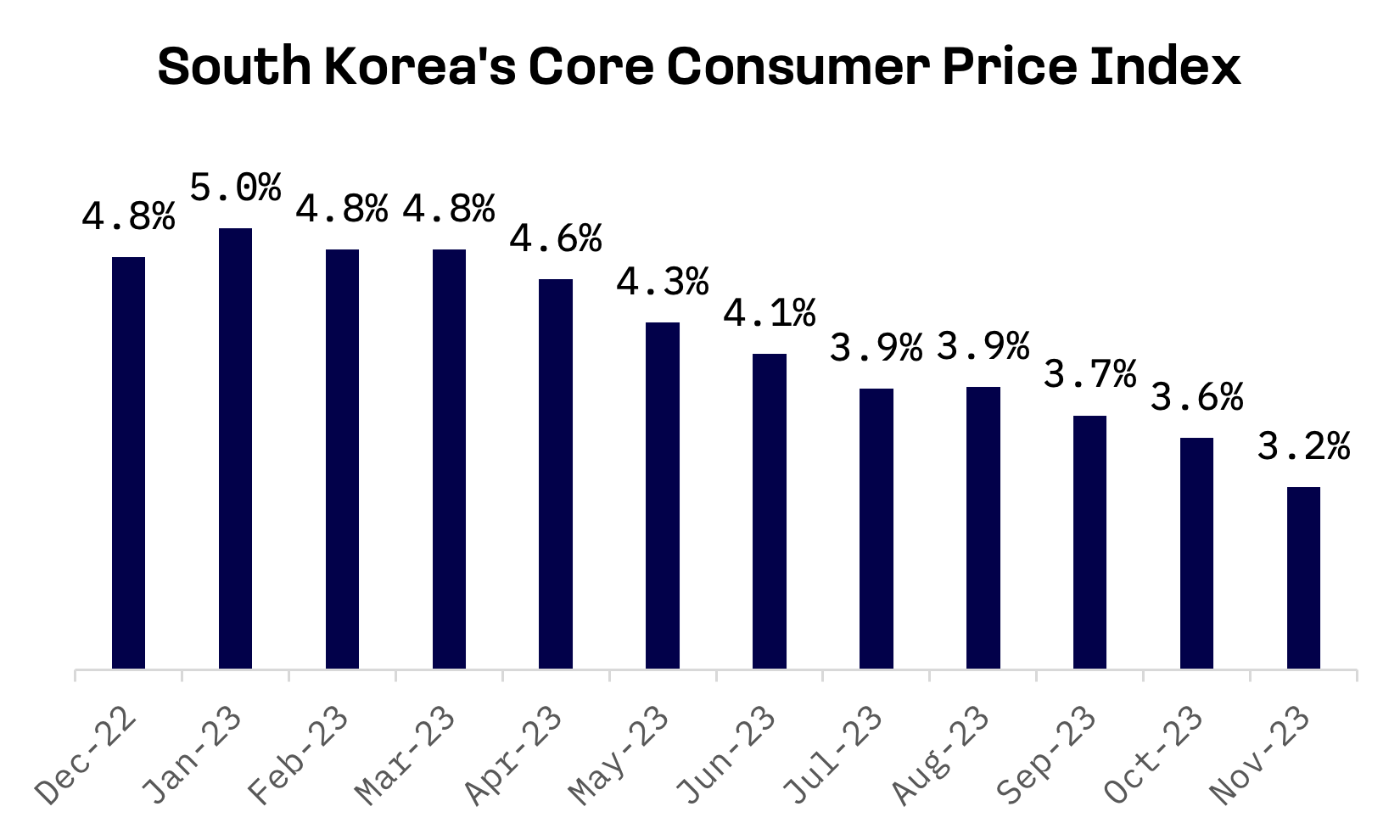

The Bank of Korea (BOK) on Wednesday projected that South Korea’s inflation rate is expected to continue its downward trajectory, with the aim of reaching around 2% in the latter part of the coming year. However, the central bank anticipates that this descent will be more gradual than initially expected.

According to the BOK’s report, the recent decline in consumer prices in South Korea, Asia’s fourth-largest economy, is not expected to replicate the sharp decrease seen in November. This significant drop was largely due to falling oil prices and lower costs for agricultural products.

The report stated, “November’s inflation posted a significant drop due to a decline in oil prices and agricultural products, but such a sharp deceleration is unlikely down the road.” It added that consumer prices in December are expected to either mirror November’s levels or show a slower rate of decline. The central bank foresees this moderated rate of inflation continuing, with the goal of achieving the 2% target later in the year ahead.

Taiwan

Contrasting with its regional counterparts, Taiwan’s TAIEX index fell by 0.4%, as investors cashed in on recent gains in large-cap tech stocks.

Taiwan’s smartphone market witnessed a downturn, as recent statistics from the U.S.-based International Data Corp (IDC) indicated a decline in local smartphone shipments. In the third quarter, shipments fell by 3.1% compared to the same period last year, totaling 1.26 million units. IDC, in its Thursday release, attributed this decrease primarily to subdued consumer demand, noting that many consumers are postponing their phone replacements.

This week, Taiwan’s central bank issued a statement defending its prolonged policies of low interest and exchange rates. The bank clarified that its statutory operational objectives do not require it to transfer surplus earnings to the treasury. As a result, it emphasised that its current monetary policies are not designed with the intention of facilitating such transfers.

Additionally, the central bank addressed the factors contributing to the recent surge in inflation in Taiwan. It attributed the increase primarily to external factors, specifically the escalation of international raw material prices due to the COVID-19 pandemic and the ongoing Russia-Ukraine conflict. The bank stressed that these global developments, rather than its domestic monetary policies, are the key drivers behind the inflationary pressures facing the country.

JAKOTA Blue Chip 150 Index

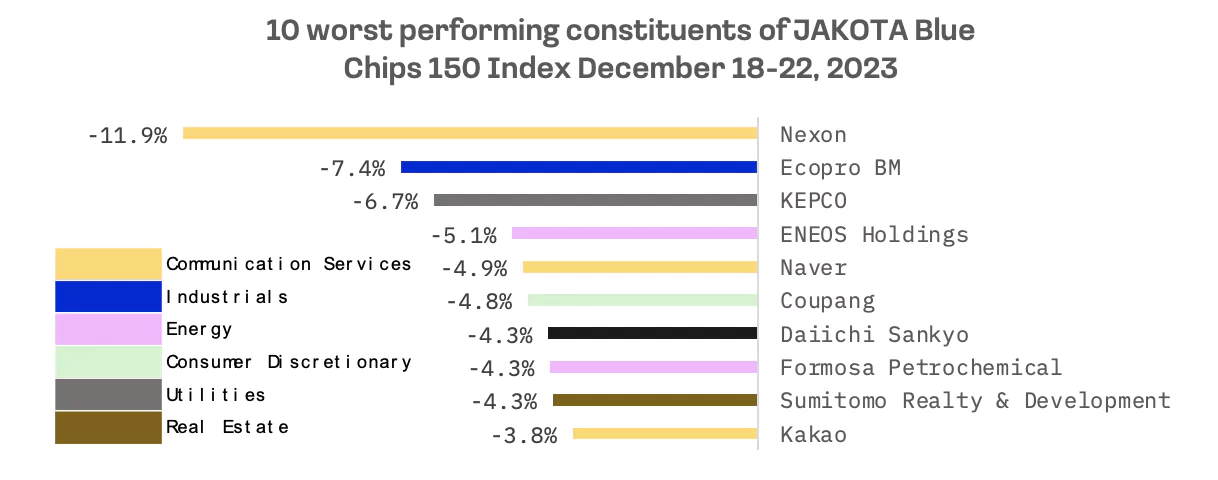

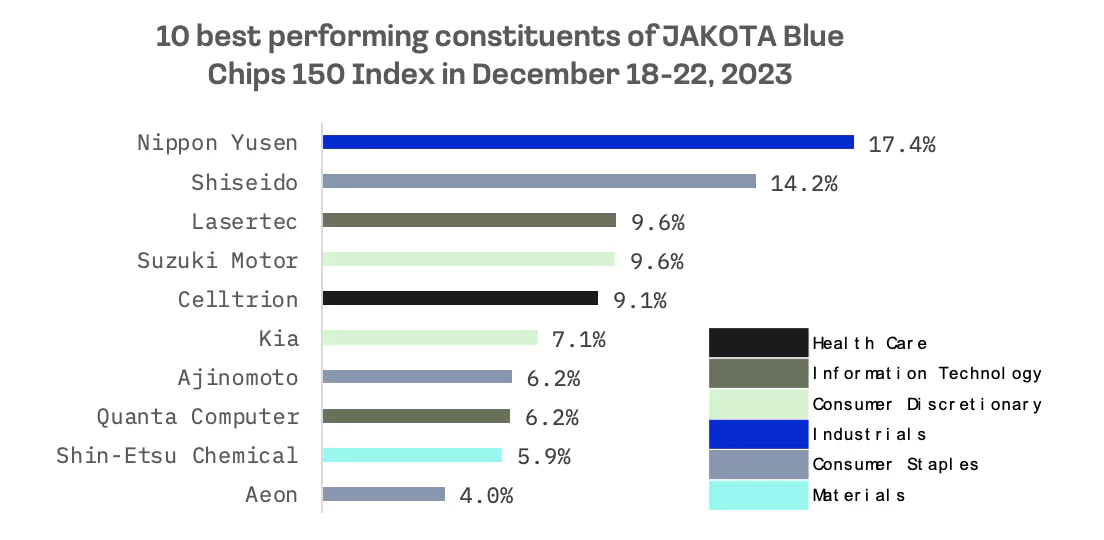

The JAKOTA Blue Chip 150 Index saw a modest increase of 0.35%, reaching 118.36. Of the 149 constituents (following the delisting of Toshiba on Wednesday after 74 years on the Tokyo exchange), 69 stocks showed positive trends.

Nippon Yusen, a shipping and logistics company, emerged as the top performer in the JAKOTA Blue Chip Index this week. The company’s robust performance, in tandem with other Japanese shipping firms like K Line and Mitsui O.S.K. Lines (both part of the JAKOTA Mid and Small Cap 2000 Index), was particularly notable. This success comes amid increasing geopolitical risks in the Middle East, which are posing operational challenges for major European shipping companies. These difficulties are expected to potentially drive up shipping costs in the future, creating a favorable environment for Japan’s shipping sector.

On the other hand, Nexon, a video game publisher, saw its stock price fall sharply, dropping nearly 12%. This decline came after the Chinese government introduced policies aimed at tightening the management of online games. Given Nexon’s substantial presence in the Chinese online gaming market, these regulatory changes are expected to have significant negative implications for the company.