Last week’s Jakota markets:

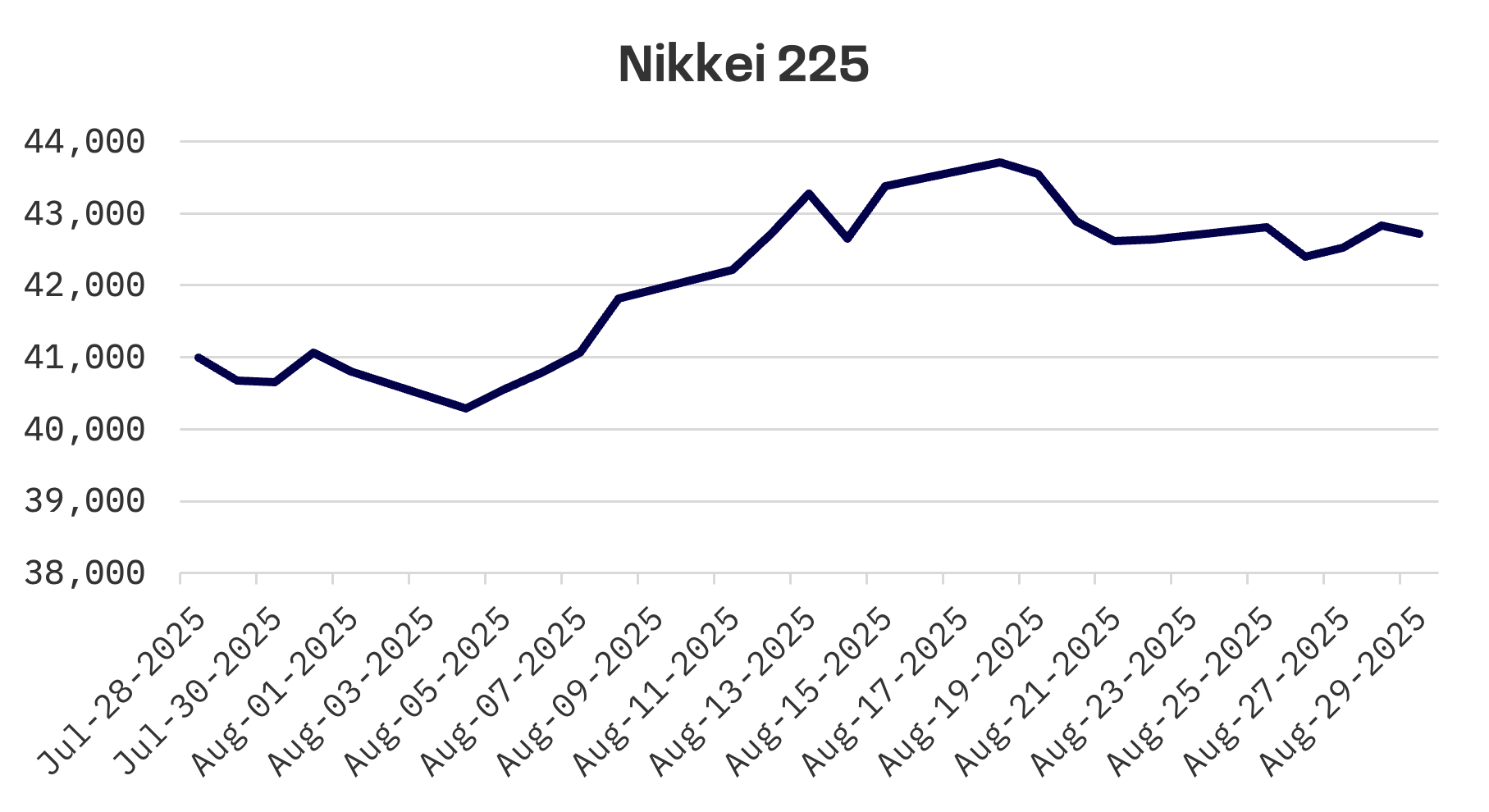

- Japan’s Nikkei 225 Index inched higher by 0.2% amid institutional rebalancing, while bond yields reached 17 year peaks as markets bet on BoJ tightening following hawkish Governor Ueda comments

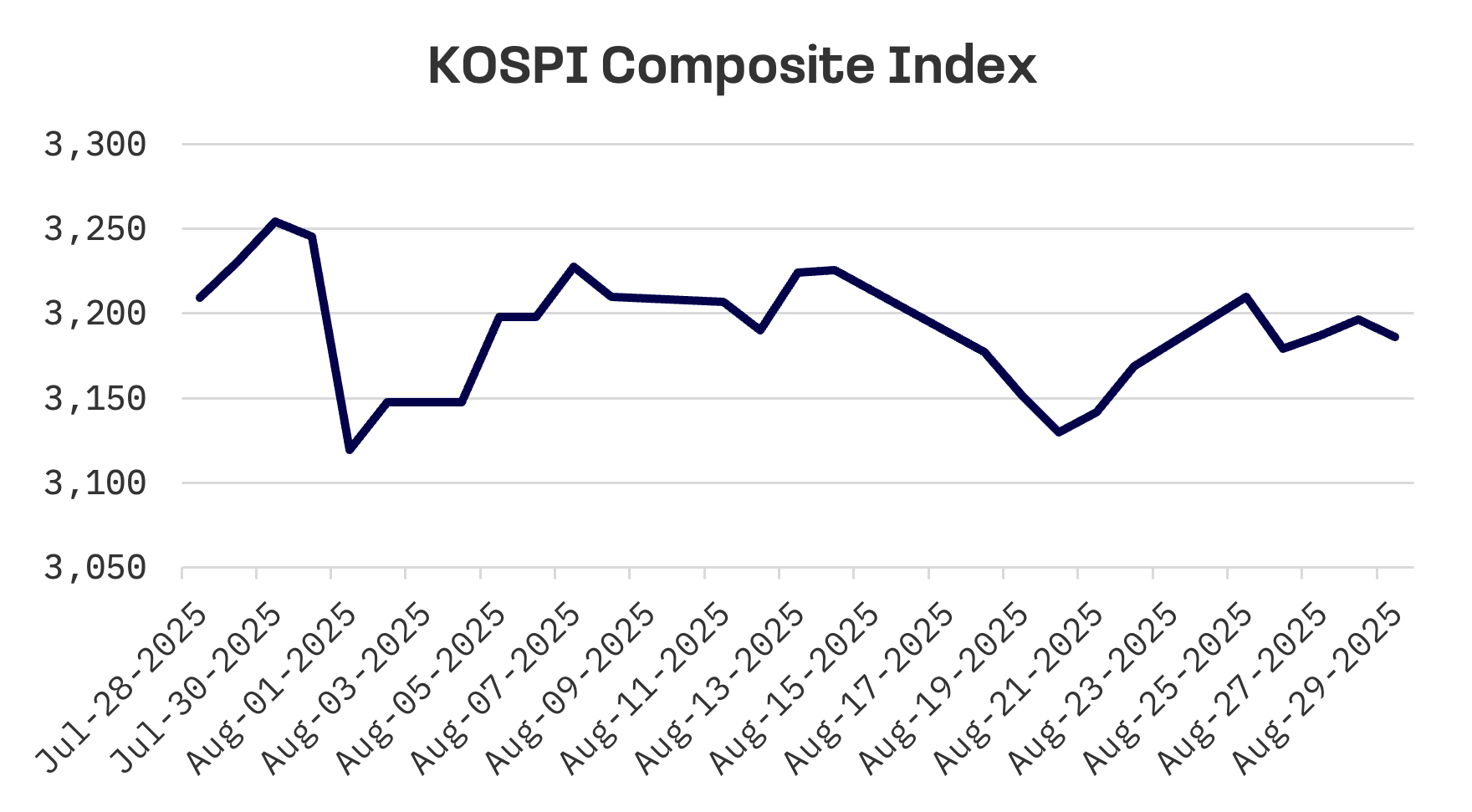

- South Korea’s KOSPI climbed 0.5% on renewed investor confidence from central bank optimism, though officials warned of slowing global growth and persistent household debt risks

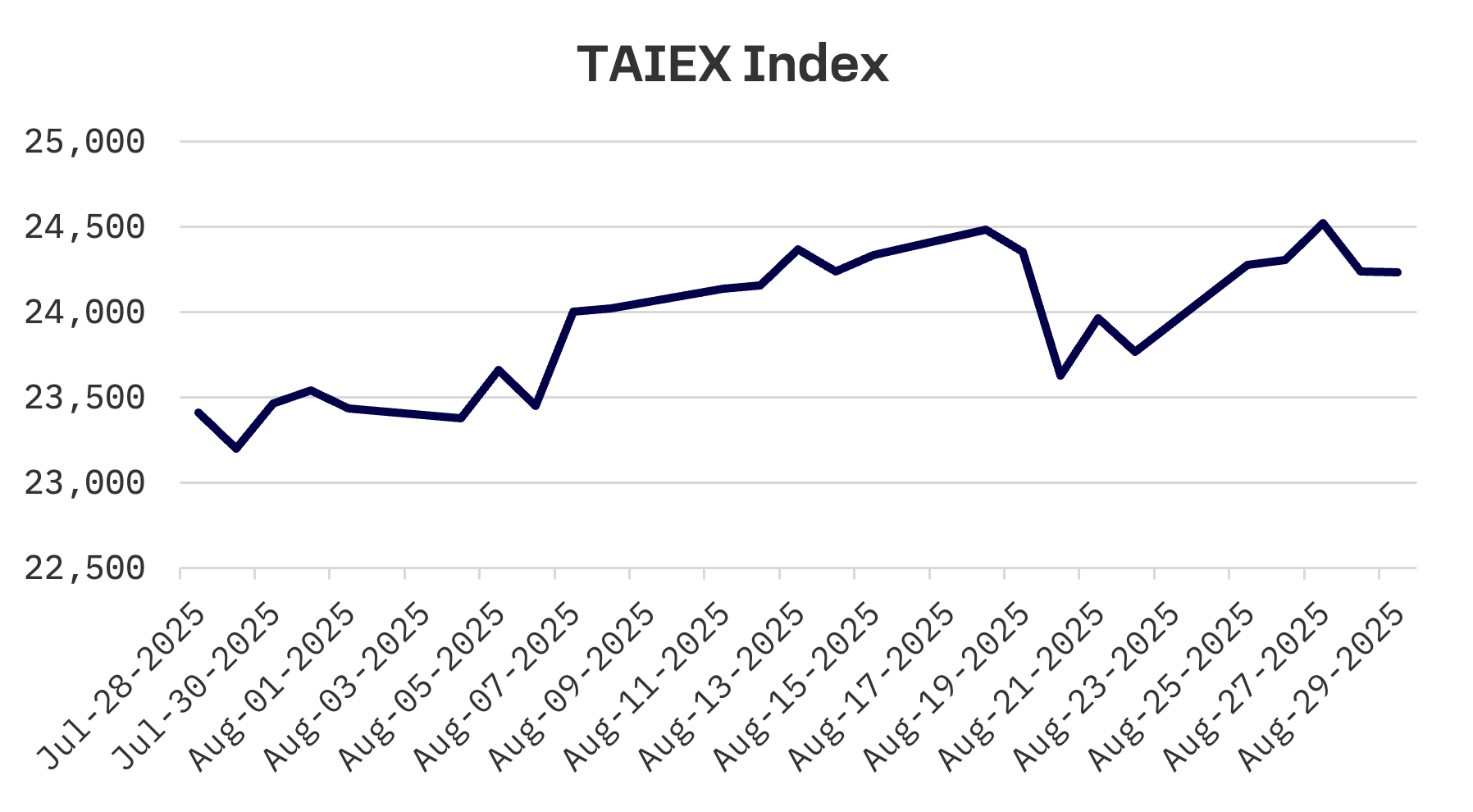

- Taiwan’s TAIEX surged 2.3% to lead regional gains ahead of Nvidia’s earnings release, as the chipmaker’s better than expected results eased AI rally sustainability concerns

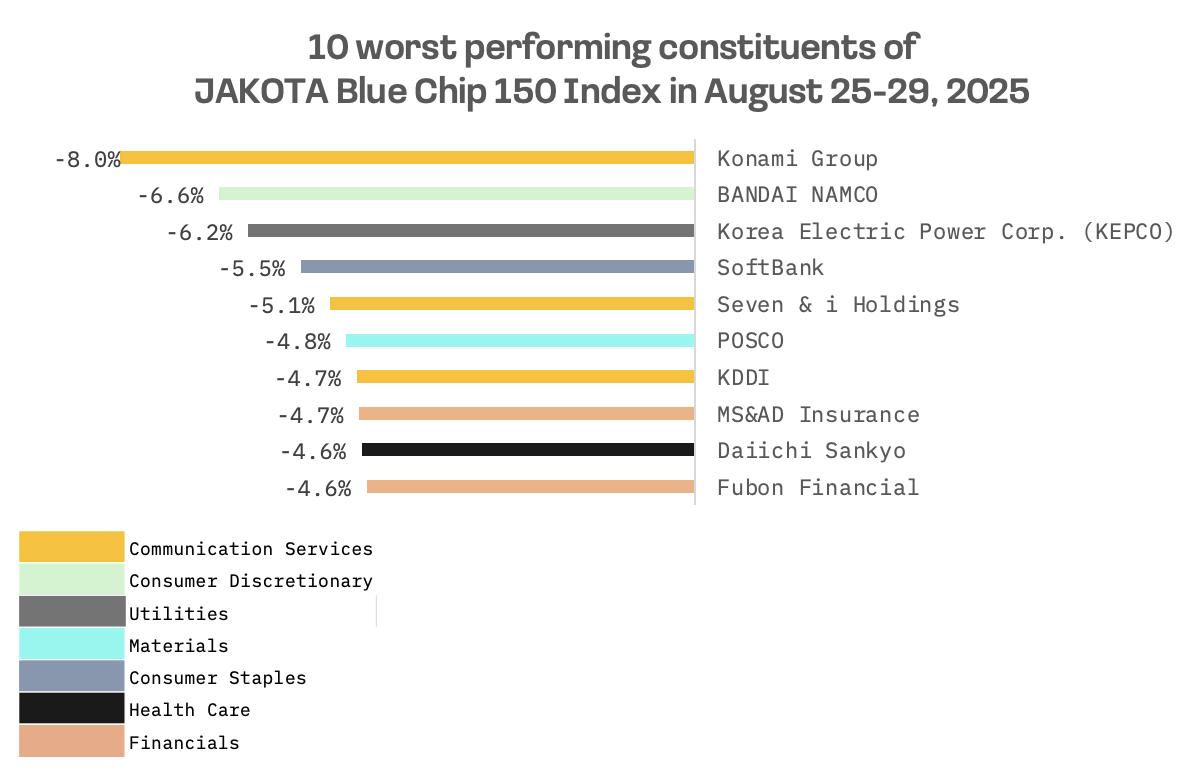

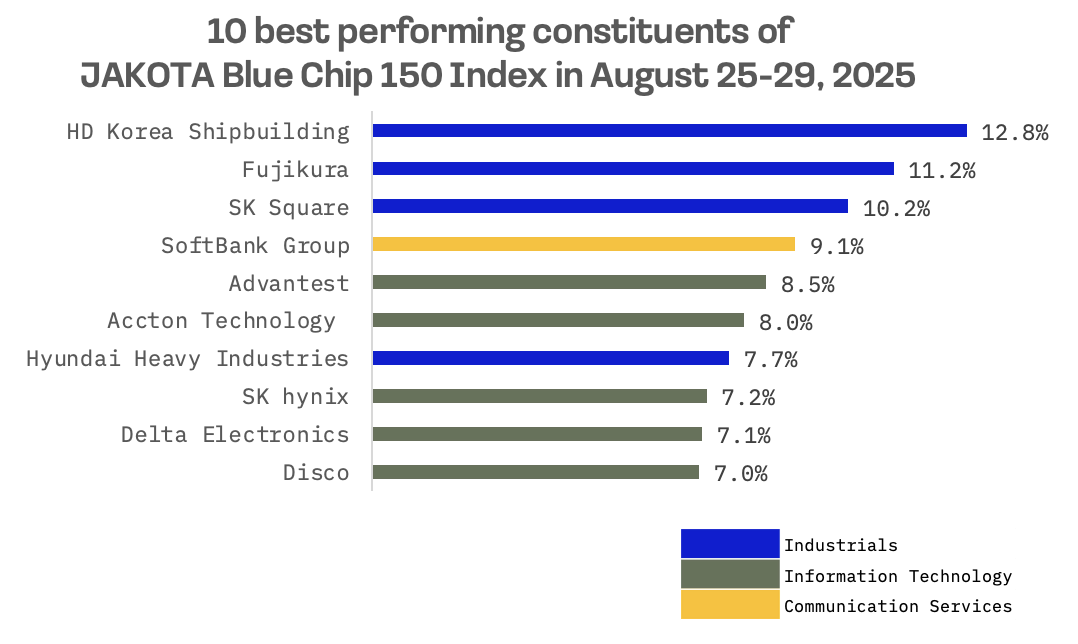

- The JAKOTA Blue Chip 150 Index rose 0.5% with shipbuilding giant HD Korea Shipbuilding soaring 12.8% on merger news and Konami tumbling on mixed game reviews

Japan

Japan’s stock market edged higher this week, with the Nikkei 225 rising 0.2% as institutional investors engaged in month end profit taking and portfolio rebalancing. However, lingering trade tensions dampened investor sentiment after Japan’s chief negotiator Ryosei Akazawa abruptly cancelled a scheduled trip to Washington, leaving key issues unresolved in ongoing U.S.-Japan trade negotiations.

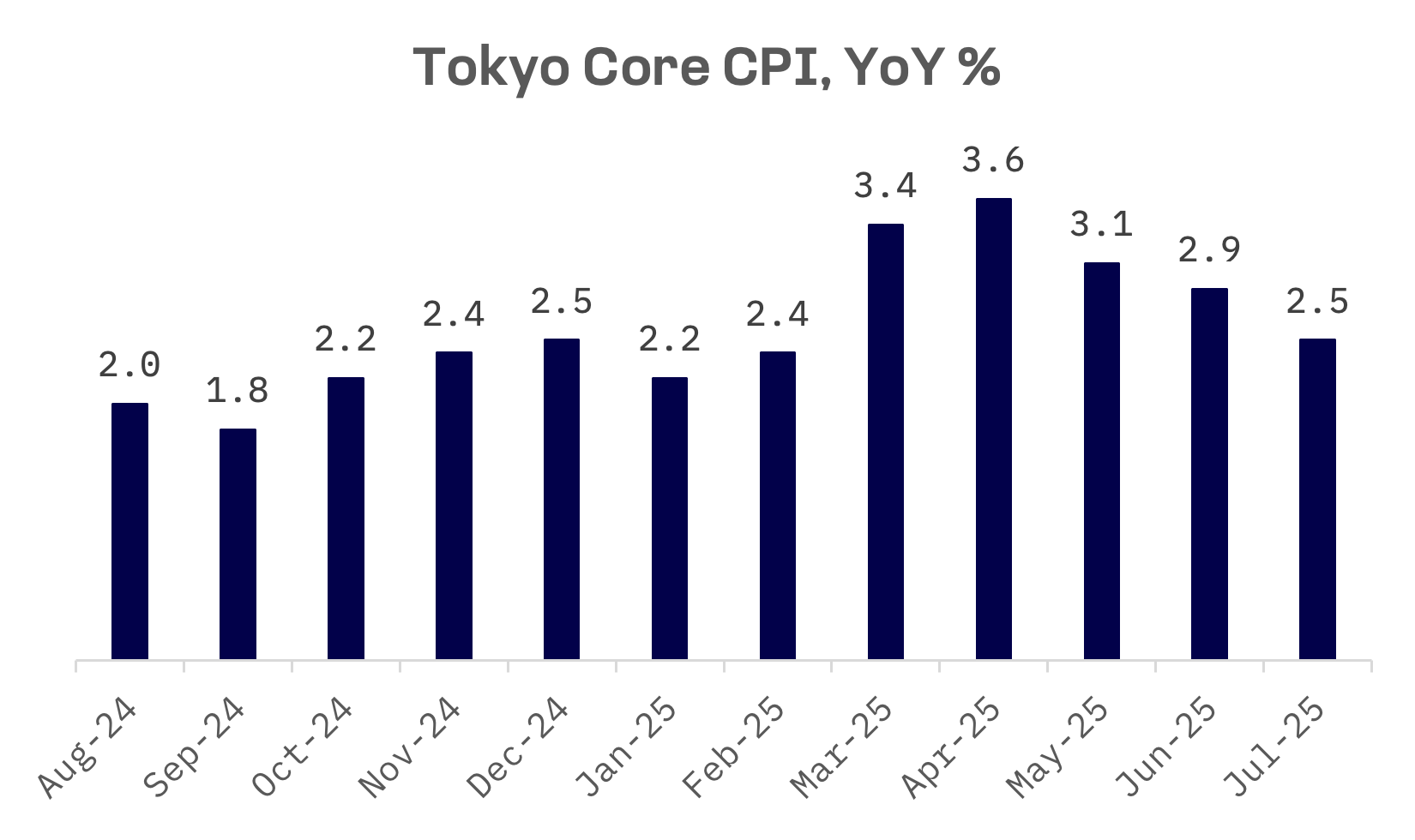

Government bond yields continued their march higher, with the benchmark 10 year Japanese government bond (JGB) yield hovering near 1.61% – its highest level in 17 years. Growing market expectations that the Bank of Japan (BoJ) is moving closer to raising short term interest rates gained momentum as Tokyo inflation remained above the central bank’s 2% target and unemployment unexpectedly declined.

Speaking at the Federal Reserve’s Jackson Hole symposium, BoJ Governor Kazuo Ueda signalled that a tightening labour market should drive wage growth, suggesting conditions for another rate hike are materialising.

Economic data reinforced the central bank’s hawkish tilt. Tokyo’s core consumer prices rose 2.5% year-over-year in August, though the pace marked a third consecutive month of decelerating growth.

Meanwhile, Japan’s unemployment rate unexpectedly dropped to 2.3% in July – the lowest reading since December 2019.

South Korea

South Korea’s stock market advanced this week, with the KOSPI Index adding 0.5% after investor confidence received a boost from the Bank of Korea (BOK)’s better than expected economic outlook.

The BOK left its base rate unchanged at 2.5%, citing stable inflation conditions and persistent uncertainty surrounding the growth outlook. Central bank officials highlighted risks stemming from rising housing prices and elevated household debt levels, while acknowledging that global economic expansion is likely to decelerate.

Policymakers noted that South Korea’s economic recovery has been underpinned by rebounding domestic consumption and robust semiconductor exports. However, they cautioned that export momentum could weaken as the impact of U.S. tariffs becomes more widespread. Officials projected inflation to remain near 2% due to subdued demand and stable oil prices. While the monetary policy board has maintained its current stance since implementing a rate cut in May, it reiterated its readiness to ease policy further should downside risks to economic growth intensify.

Taiwan

Taiwan’s stock market delivered the Jakota region’s strongest performance, with the TAIEX surging 2.3% as investors positioned ahead of chipmaker Nvidia’s quarterly earnings release on Wednesday. The world’s most valuable company reported financial results that exceeded FactSet consensus estimates. Although Nvidia shares declined on Thursday following the earnings announcement, the upbeat numbers helped allay concerns about the sustainability of the AI driven rally that has propelled major indexes to record levels this year.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index gained 0.5% for the week, with 54 of its 150 constituent stocks posting advances.

HD Korea Shipbuilding & Offshore Engineering (HD KSOE), a South Korean shipbuilding company and subholding entity of HD Hyundai, emerged as the index’s top performer with shares soaring 12.8%. The rally followed announcements that HD Hyundai Heavy Industries and HD Hyundai Mipo plan to merge into a single entity.

HD KSOE said it will combine affiliates HD Hyundai Heavy Industries (HHI) and HD Hyundai Mipo Dockyard (HMD) as part of a restructuring plan aimed at boosting global competitiveness. The consolidation comes as South Korea seeks to expand its presence in shipbuilding and defence sectors, with momentum building around the U.S. “Make American Shipbuilding Great Again” initiative.

The boards of all three companies approved the merger proposal on August 27, with HHI and HMD scheduled to complete their combination in December, pending shareholder and regulatory approvals.

“This restructuring aims to maximise both quantitative and qualitative synergies, expand and diversify markets, and secure a decisive competitive edge in the fiercely contested global market through the preemptive development of advanced technologies,” the companies said in a joint statement.

At the opposite end of the performance spectrum, Konami Group, a Japanese multinational entertainment company and video game developer, ranked as the worst performer among JAKOTA Blue Chip 150 constituents following the release of its highly anticipated video game “Metal Gear Solid Delta: Snake Eater,” which garnered mixed critical reception.

The remake of the 2004 classic received praise for its faithful recreation of the original but faced criticism for technical issues, particularly when played on Sony’s PlayStation 5 Pro console. Konami acknowledged the problems and committed to releasing a software patch to address the issues.