Last week’s Jakota markets:

- Japan’s Nikkei 225 Index climbed 0.8%, buoyed by BoJ Governor Ueda’s reaffirmation of monetary policy normalisation amid accelerating core inflation

- South Korea’s KOSPI ticked up 0.2%, while the won hit a five month high following the central bank’s decision to maintain interest rates

- Taiwan’s TAIEX index slipped 0.9%, reflecting caution ahead of Fed Chair Powell’s Jackson Hole speech despite robust export orders

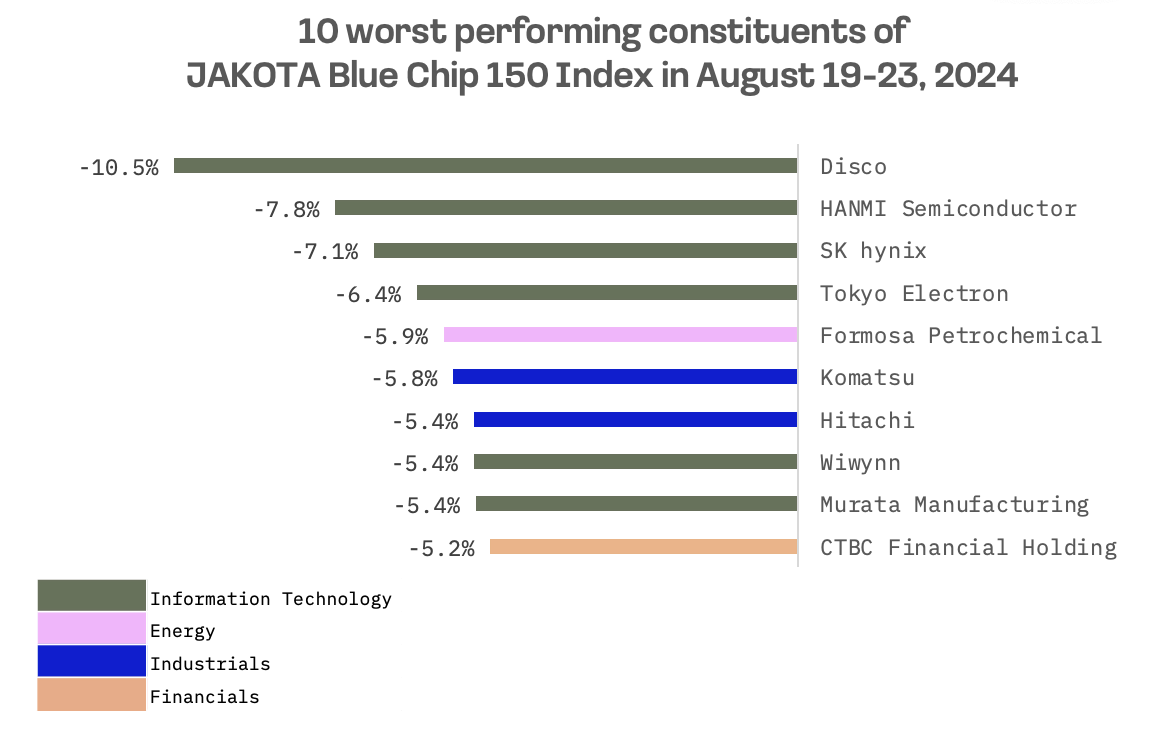

- The JAKOTA Blue Chip 150 Index advanced 1.2%, led by Seven & i Holdings’ 16% surge on acquisition news, while semiconductor stocks faced pressure

Japan

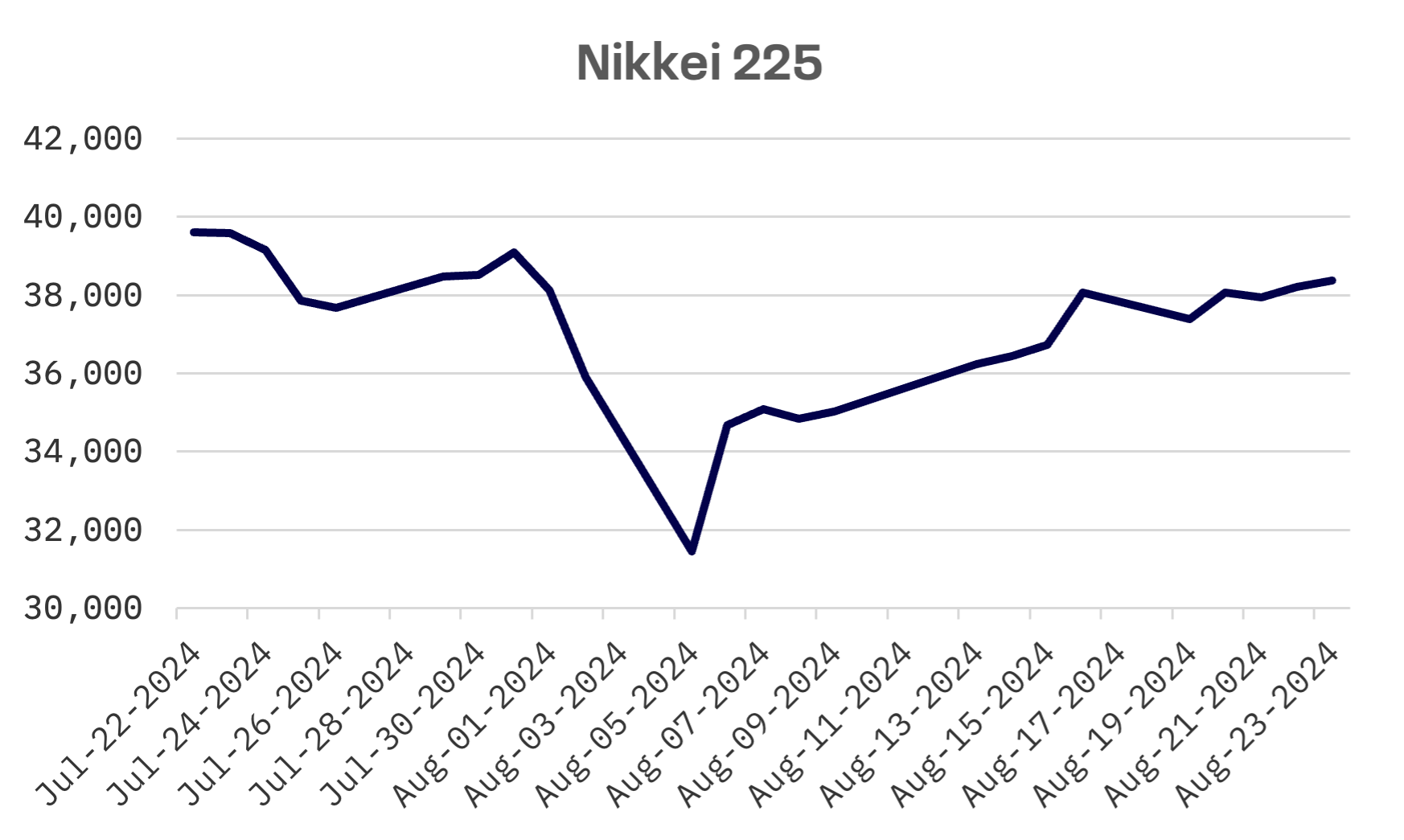

The Nikkei 225 Index inched up 0.8% this week, as Bank of Japan (BoJ) Governor Kazuo Ueda reaffirmed the central bank’s commitment to normalising monetary policy. Mr. Ueda emphasised that the BOJ would proceed with tightening as confidence grows in the economy’s ability to achieve stable 2% inflation.

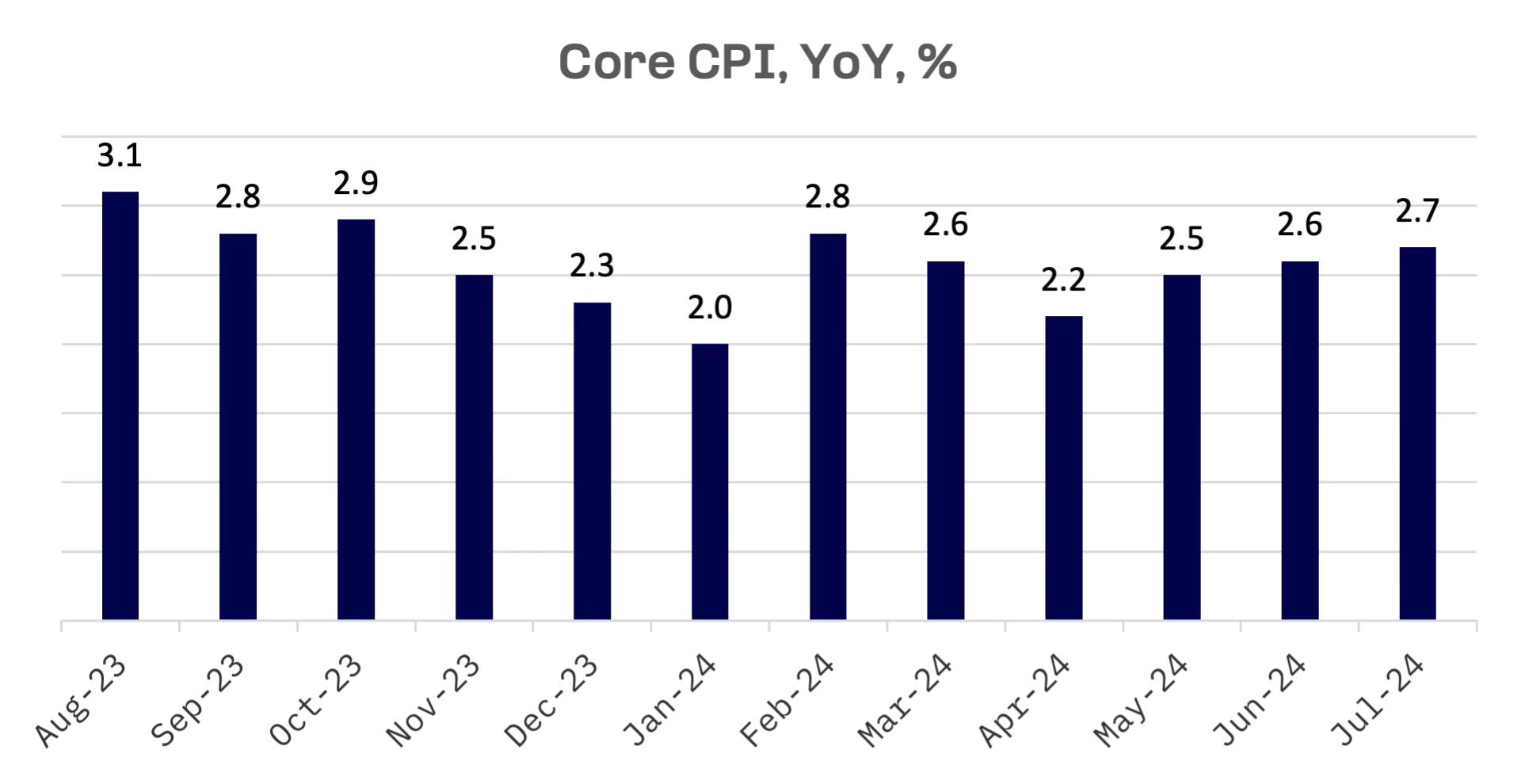

Core consumer price inflation accelerated for the third consecutive month in July, reaching 2.7% year-on-year, up from 2.6% in June, further supporting the BOJ’s hawkish stance this year.

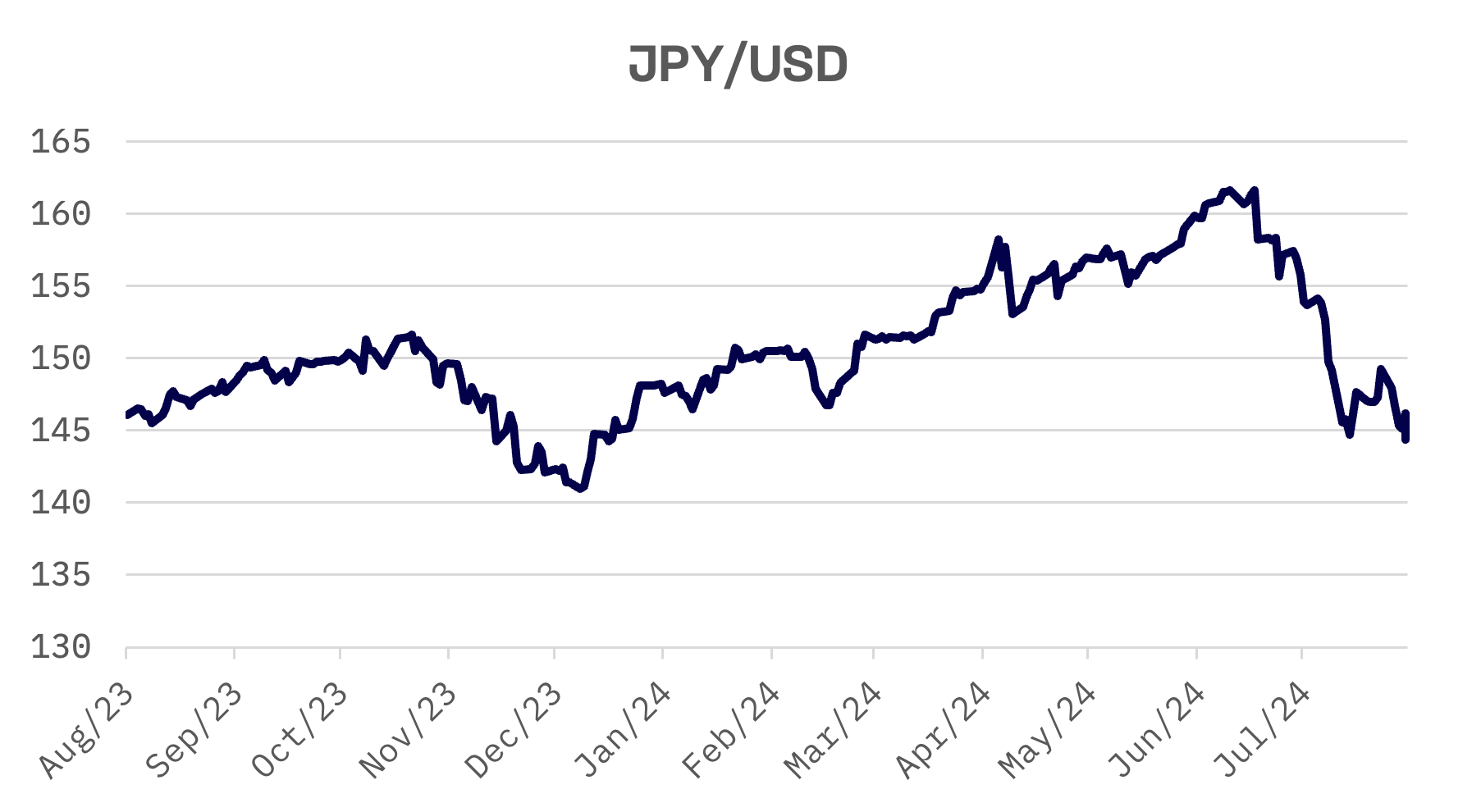

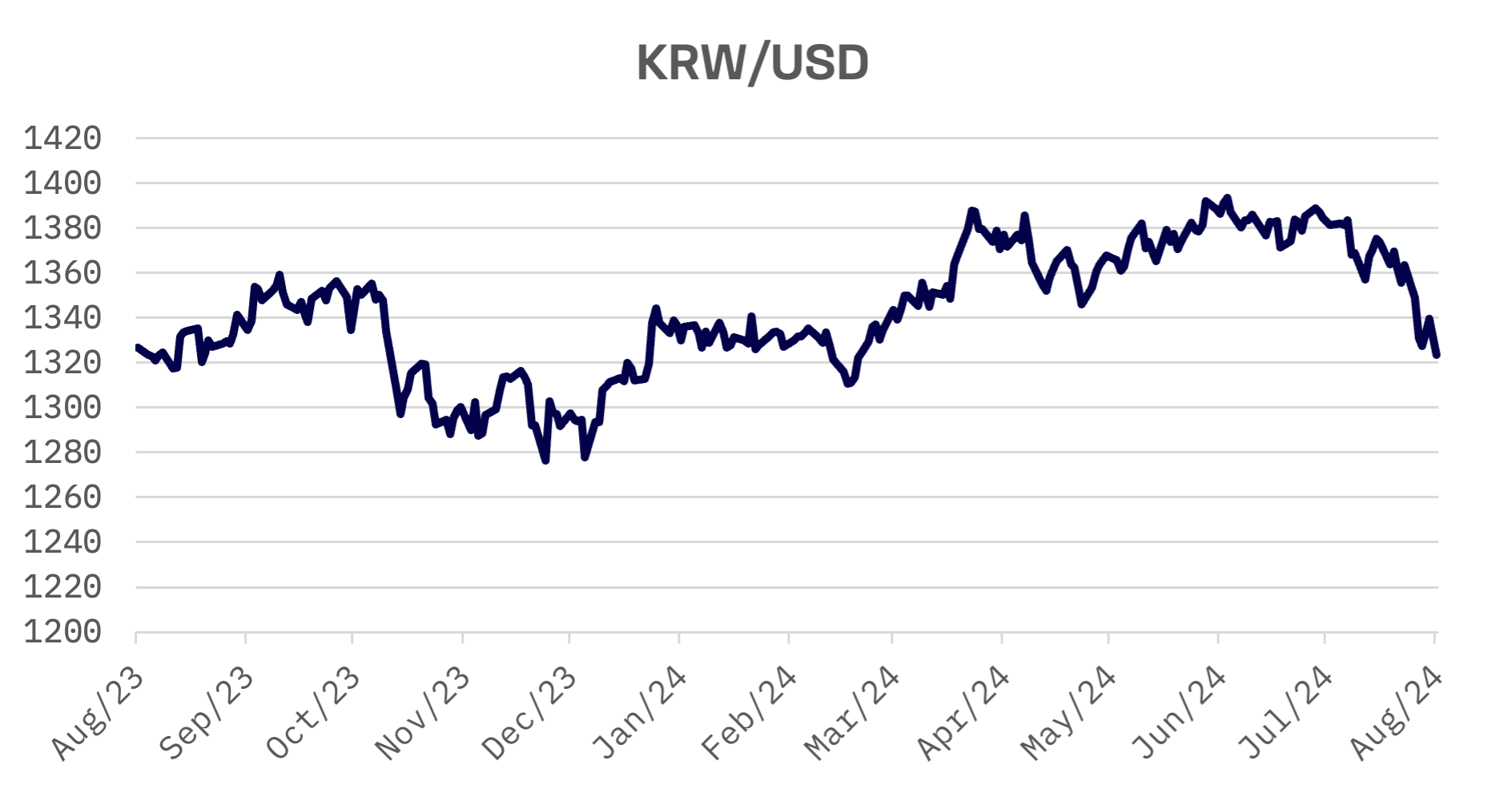

The yen strengthened to the upper ¥145 per dollar level, climbing from around ¥148 at last week’s close, influenced by diverging monetary policy expectations between Japan and the U.S.

Japanese stocks experienced a sharp sell off in early August following the BOJ’s second interest rate hike of the year in late July. The downturn was primarily fueled by renewed U.S. growth concerns.

In a parliamentary hearing on Friday, Mr. Ueda reiterated the central bank’s readiness to adjust monetary policy if economic and price developments align with forecasts. He noted that while Japan’s stock market had rebounded from significantly undervalued levels, market instability persists.

Mr. Ueda emphasised the need for close monitoring of sharp yen movements, which could impact the BOJ’s median inflation forecasts, underscoring the urgency of the situation.

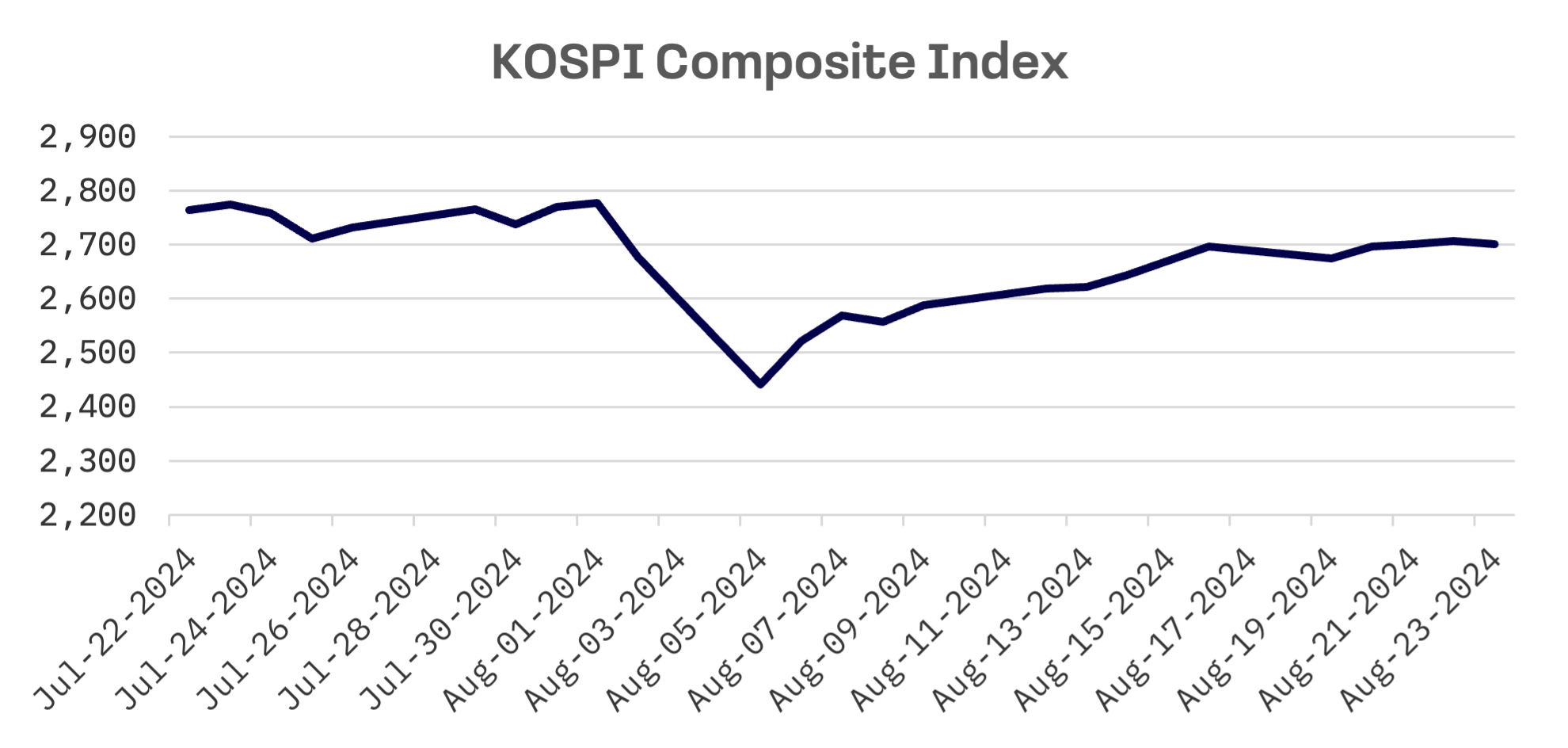

South Korea

The KOSPI Index nudged up 0.2% this week as investors awaited further signals on U.S. interest rate policy. The Bank of Korea (BoK) maintained its key rate at 3.5% for the 13th consecutive session, citing concerns over soaring home prices. The decision was widely anticipated, and market participants continued to adopt a wait and see stance.

BOK Governor Rhee Chang-yong hinted at a potential rate cut within the next three months, given expectations of easing inflation amid a slowdown in South Korea’s economy. “We are approaching a point where conditions for a rate cut may be met based solely on price trends,” Mr. Rhee told reporters. He expressed increased confidence that inflation is trending toward the 2% target.

The South Korean won surged to a five month high, reaching its strongest level since March 15, following the BOK’s decision to keep its policy interest rate unchanged, despite the U.S. Federal Reserve’s anticipated move to lower borrowing costs.

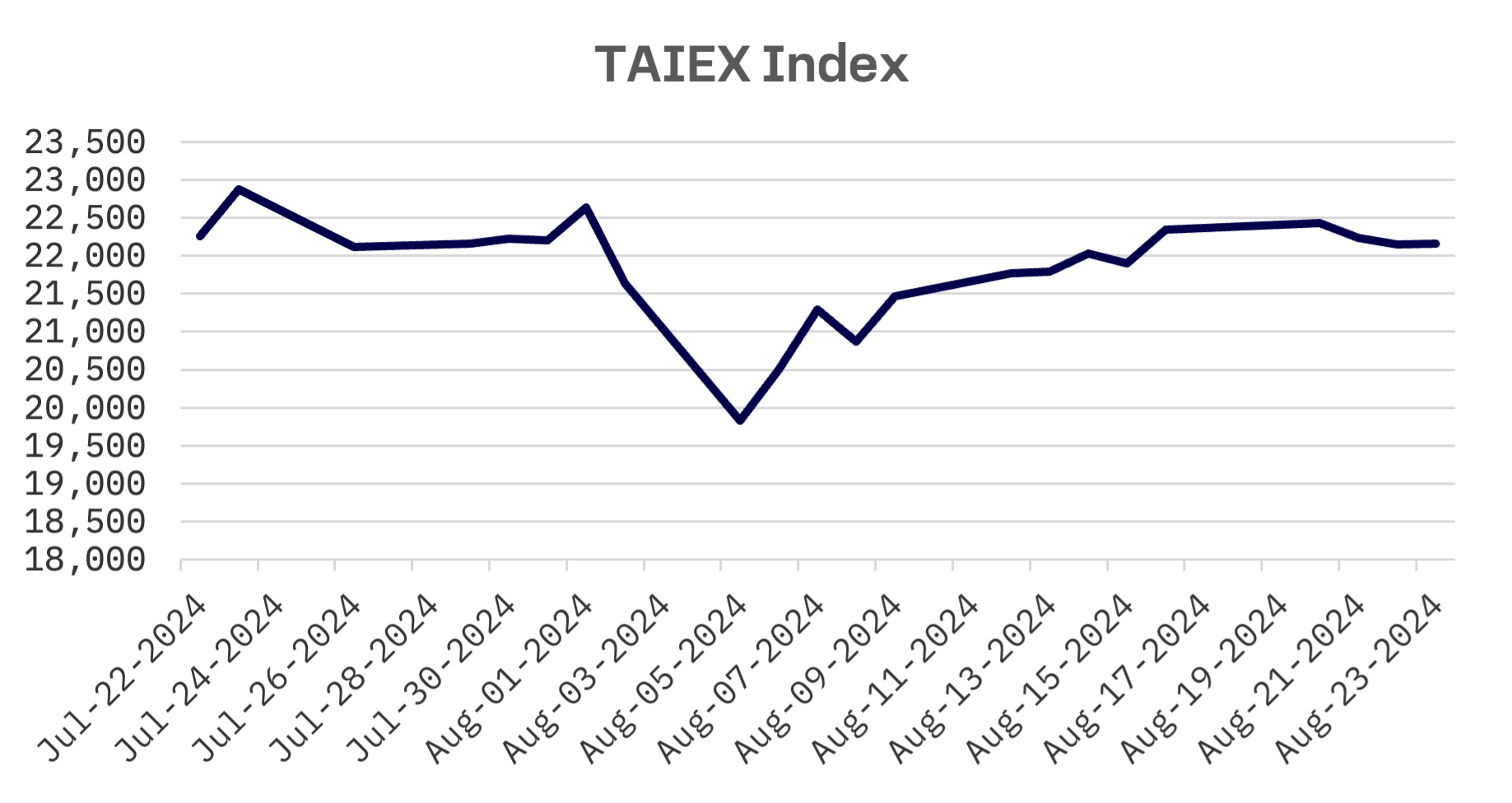

Taiwan

Taiwan shares bucked the trend in other Jakota markets, with the TAIEX index dipping 0.9%. This decline reflected cautious sentiment ahead of U.S. Federal Reserve Chair Jerome Powell’s speech, which happened on Friday 23rd August at the annual economic policy symposium in Jackson Hole.

Taiwan’s export orders increased nearly 5% year-on-year in July, driven by robust demand for emerging technologies, including AI applications and high performance computing (HPC) devices, according to the Ministry of Economic Affairs.

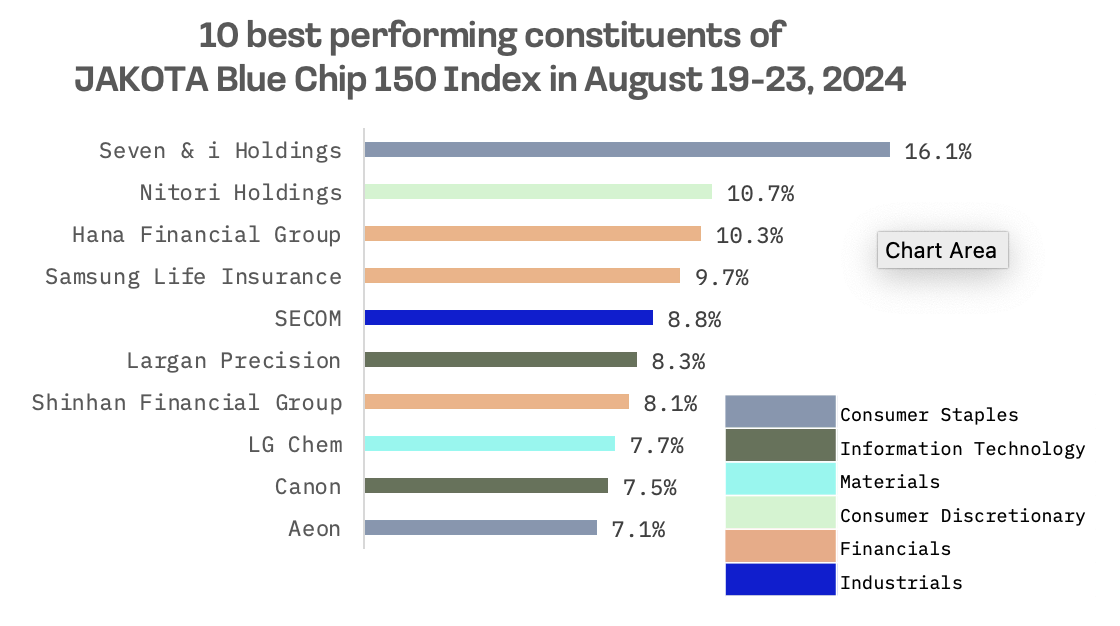

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index added 1.2% this week, with half of its 150 constituents posting gains.

Seven & i Holdings, a Japanese diversified retail holdings company, led the gainers, surging more than 16% following news that Canada’s Alimentation Couche-Tard had made a “friendly, non-binding proposal” to acquire the Japanese company. If completed, this unsolicited approach would mark the largest foreign acquisition of a Japanese company, though it is expected to face regulatory scrutiny in both the U.S. and Japan.

Formosa Petrochemical, a Taiwanese energy company specialising in crude oil refining and the marketing of petroleum and petrochemical products, led the decliners among JAKOTA Blue Chip 150 constituents, posting a 4.7% drop after MSCI decided to remove it from its MSCI Global Standard Indexes.

Semiconductor stocks, including Disco, HANMI Semiconductor and SK Hynix, faced selling pressure this week, driven by headwinds from the U.S. SOX Index, which fell more than 3% between Monday and Thursday.