Last week’s Jakota markets:

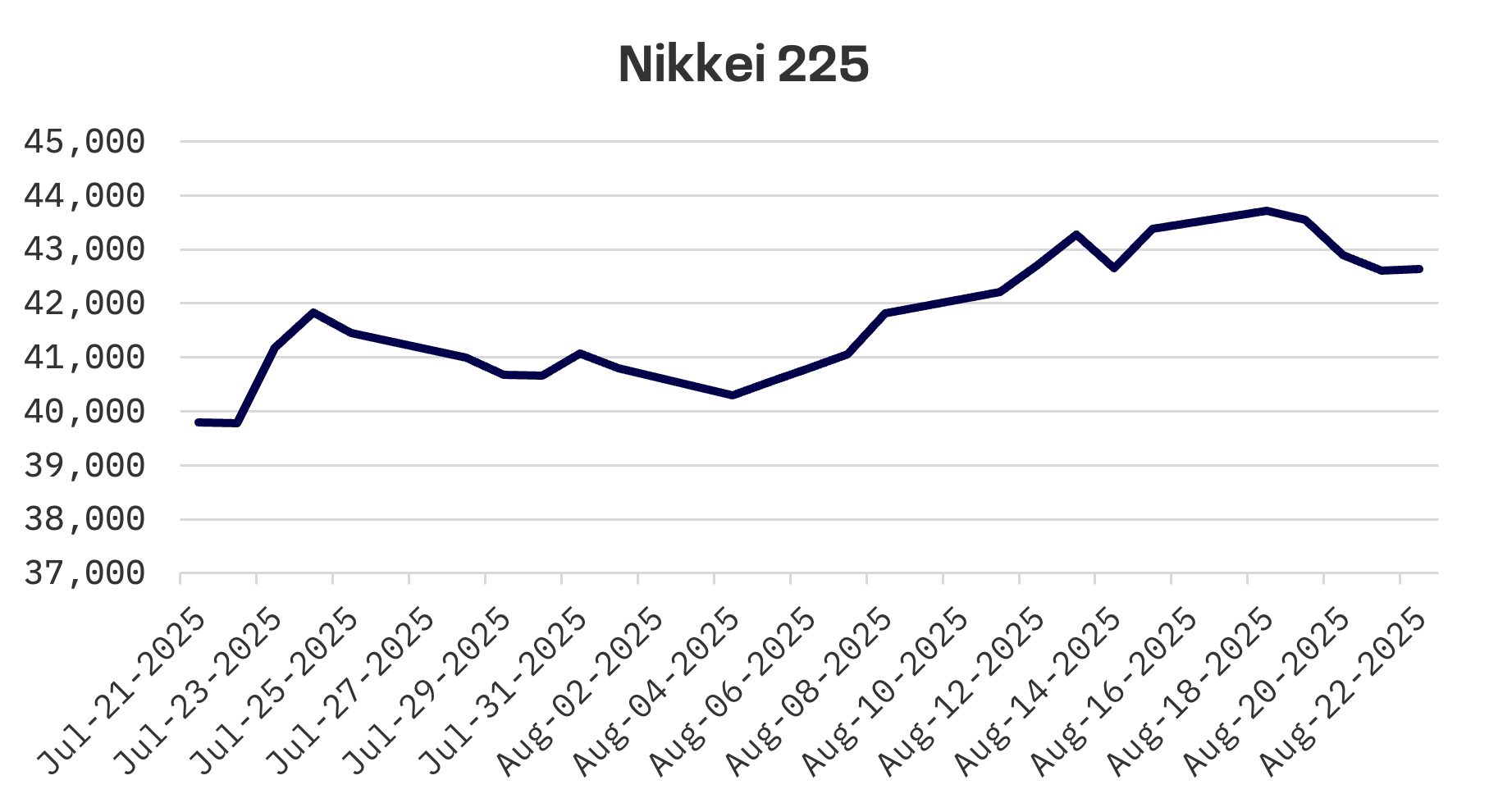

- Japan’s Nikkei 225 Index fell 1.7% as investors retreated from risk assets amid global tech selloff and rising bond yields fuelled expectations of potential BoJ policy tightening

- South Korea’s KOSPI declined 0.3% on persistent global uncertainties and AI bubble concerns, while the government slashed its 2025 growth forecast to just 0.9%

- Taiwan’s TAIEX plunged 2.3% as TSMC shares pressured the broader electronics sector lower following U.S. tech weakness and uncertainty over potential Trump administration stake

- The JAKOTA Blue Chip 150 Index fell 2.4% with Taiwanese cloud infrastructure company Wiwynn emerging as the worst performer despite recent strong earnings

Japan

Japan’s stock market retreated this week, with the Nikkei 225 falling 1.7% as investors pulled back from risk assets amid a broader global selloff. The decline mirrored weakness in U.S. mega cap tech stocks, where growing doubts about the sustainability of the AI driven rally weighed on sentiment.

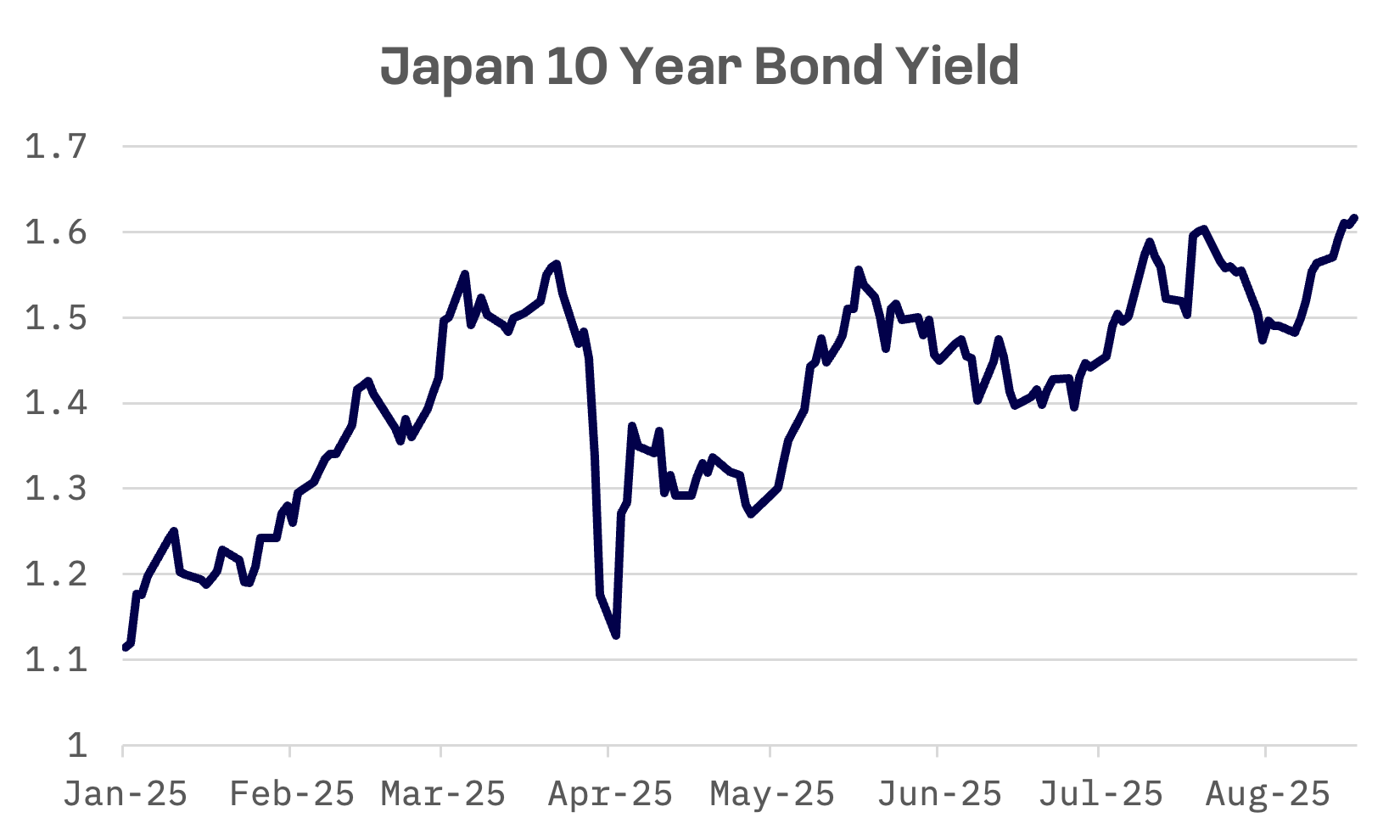

The yield on Japan’s 10 year government bond (JGB) rose to 1.61% from 1.56% at the end of last week, hovering near its highest level since 2008.

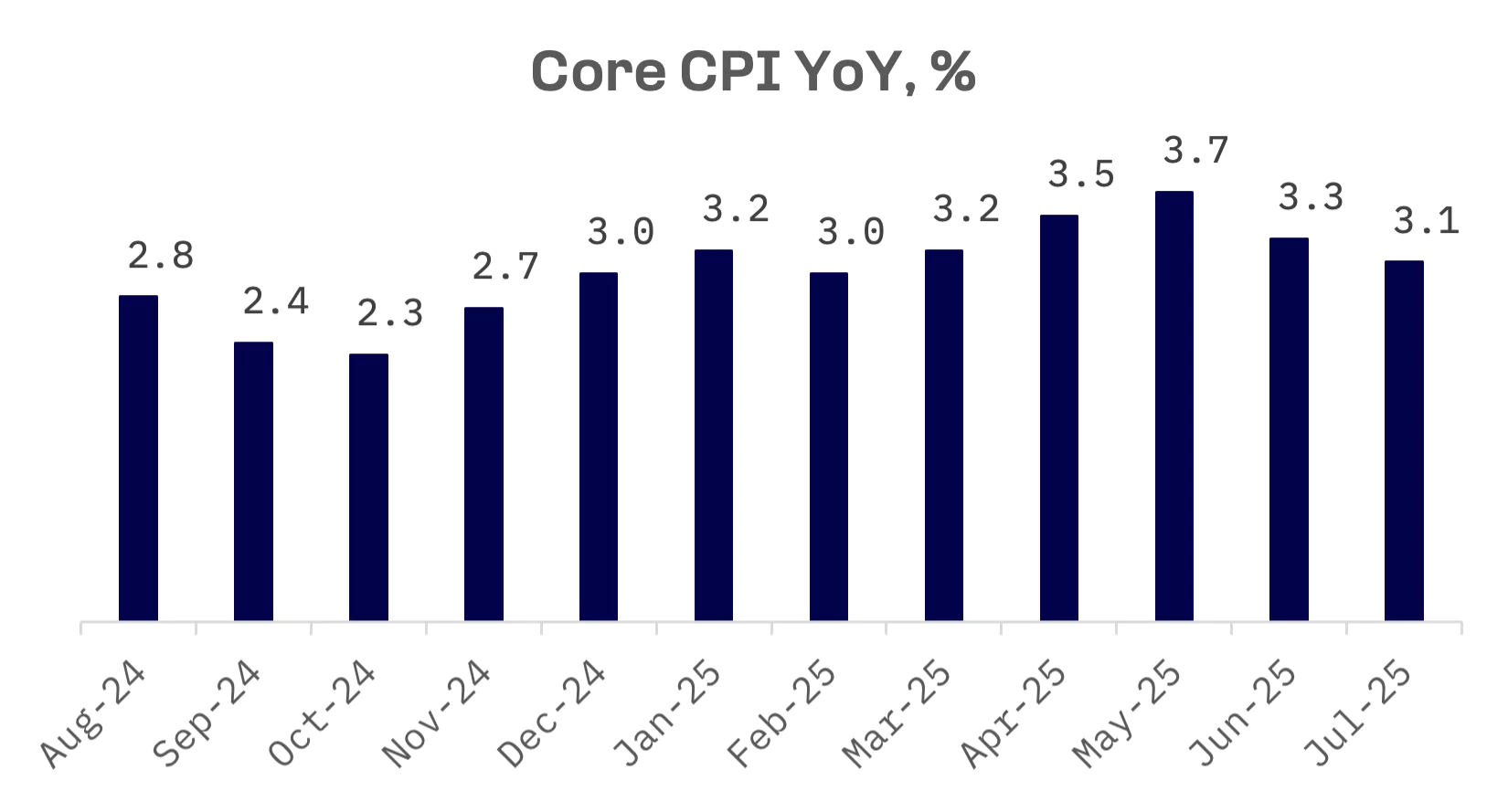

Hotter than expected inflation data reinforced market expectations that the Bank of Japan (BoJ) could tighten monetary policy again this year, potentially as early as October. Japan’s core consumer price index (CPI) climbed 3.1% year-over-year in July, slightly above the anticipated 3% but down from June’s 3.3%. While inflation remains well above the BoJ’s 2% target, the central bank has maintained that an accommodative stance remains necessary, arguing that underlying price pressures still fall short of target levels.

Meanwhile, Japanese exports declined 2.6% year-over-year in July, pressured by U.S. tariffs that dampened overseas demand. The drop exceeded forecasts for a 2.1% decline and followed a 0.5% fall in June, with weaker shipments of automobiles, auto parts and semiconductors to the U.S. weighing on the overall trade picture.

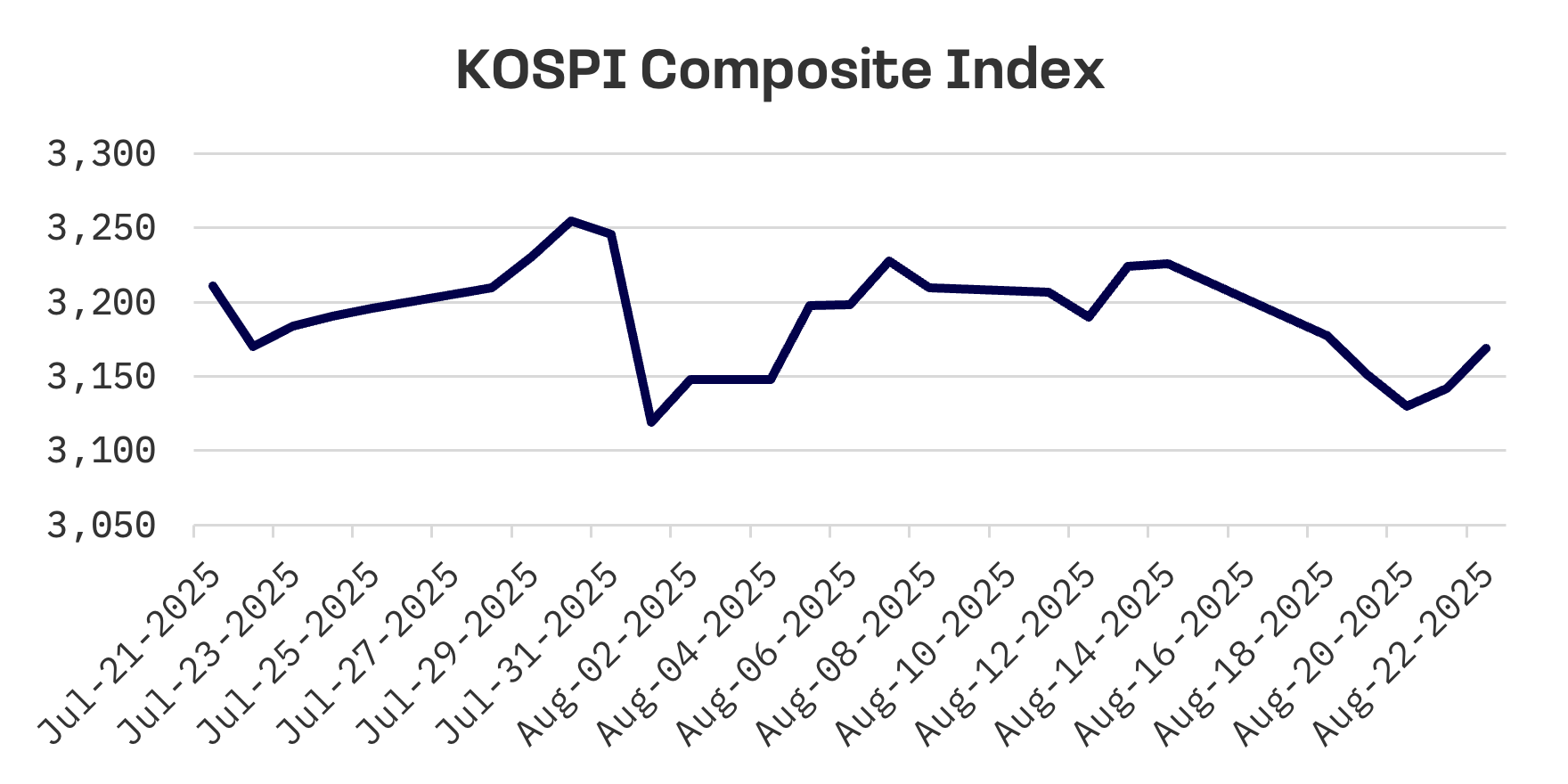

South Korea

South Korean stocks fell this week, with the KOSPI Index declining 0.3% amid persistent global uncertainties and mounting concerns over a potential bubble in the AI sector.

The South Korean government sharply cut its 2025 economic growth forecast in half, projecting just 0.9% expansion despite tens of billions of dollars in additional government spending and interest rate cuts. Officials cited a construction slump and trade headwinds that have offset stimulus measures.

The revised outlook, released on Friday by the Ministry of Economy and Finance, represents the weakest growth projection since 2020, when the economy contracted 0.7% during the pandemic. The forecast falls well short of the 1.8% estimate outlined in the government’s policy plan earlier this year.

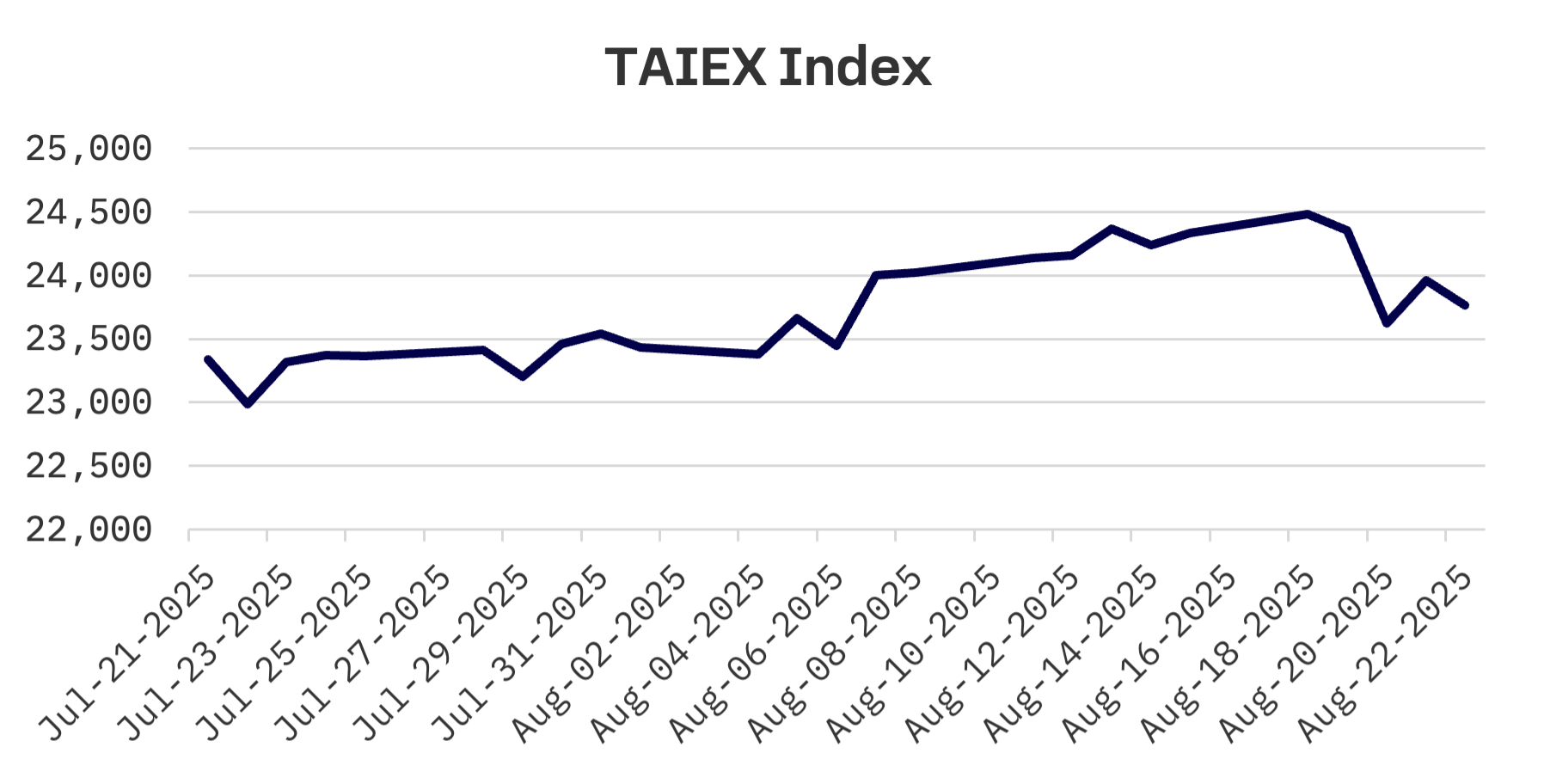

Taiwan

Taiwan’s stock market tumbled this week, with the TAIEX losing 2.3%, as Taiwan Semiconductor (TSMC) came under heavy pressure. The chip giant dragged the broader electronics sector lower following declines in U.S. tech stocks amid renewed doubts over the sustainability of massive AI related infrastructure spending.

Beyond profit taking, TSMC shares fell amid uncertainty over reports that the Trump administration is considering taking a stake in the company. The U.S. government is seeking equity stakes in chipmakers receiving CHIPS Act funding to build domestic factories, with TSMC among the potential targets.

JAKOTA Blue Chip 150 Index

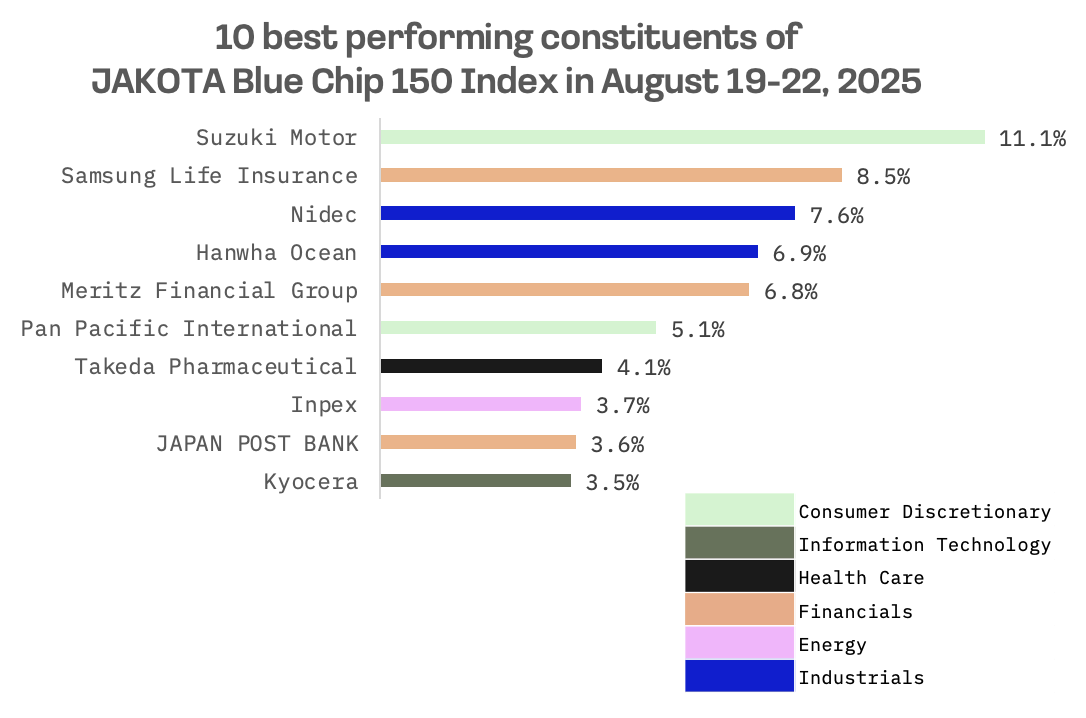

The JAKOTA Blue Chip 150 Index declined 2.4% this week. Of the 150 constituents, 67 stocks posted gains.

Suzuki Motor emerged as the top performer on the JAKOTA Blue Chip 150 Index, with shares jumping more than 11% after the Japanese automaker beat profit expectations in first quarter results announced on Tuesday.

Suzuki posted first quarter operating profit of ¥142 billion, surpassing analyst estimates by 9% to 12%, while net profit reached ¥102 billion, 11% to 21% above forecasts.

Global vehicle sales fell 4% year-over-year to 754,000 units. Indian sales dropped 6% to 402,000 units, while European sales slid 27% to 48,000 units, mainly due to the discontinuation of the Ignis and Jimny models. Japanese sales grew 4% to 176,000 units, supported by strong demand for registered models such as the Solio and Fronx.

Suzuki attributed its strong operating profit performance to unrealised gains, lower quality related costs and limited impact from U.S. tariffs. Higher than expected finance income also helped boost net profit.

Looking ahead, Suzuki expects the Indian market to strengthen in the second half, supported by policy rate cuts, tax reductions and the launch of its new SUV, the e-Vitara.

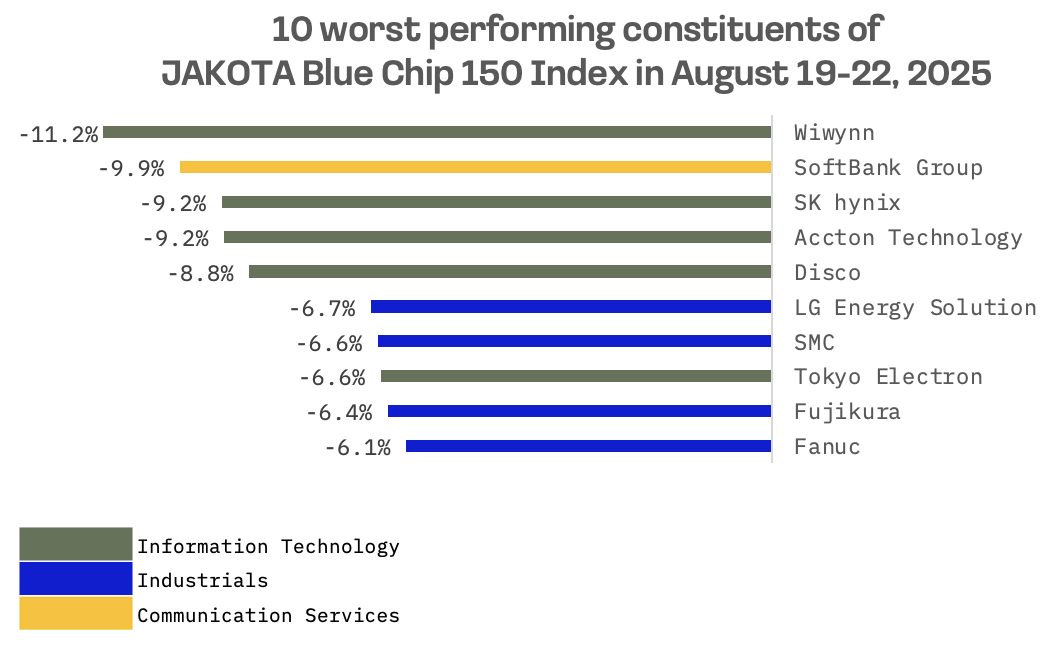

Companies in the electronics sector dominated the top 10 worst performing constituents of the JAKOTA Blue Chip 150 Index this week. Wiwynn, a Taiwanese company specialising in the design, manufacturing and delivery of cloud infrastructure products, emerged as the worst performer. The company’s share price decline largely reflects investor skepticism over its future revenue growth prospects, despite recent strong earnings performance.