Last week’s Jakota markets:

- Japan’s Nikkei 225 slipped 0.6% as trade war fears drove financial stocks lower, while the yen strengthened sharply to the upper ¥142 range against the dollar

- South Korea’s KOSPI fell 1.3% through a roller coaster week, prompting Seoul to unveil a ₩9 trillion rescue package to shield domestic exporters from U.S. tariffs

- Taiwan’s TAIEX suffered an 8.3% weekly decline after plummeting 18.3% in three sessions, leading regulators to extend short selling curbs as markets caught up after the previous week’s public holidays

- The JAKOTA Blue Chip 150 Index gained a modest 0.6%, with Korean shipbuilders benefiting from potential U.S. vessel purchases and Renesas Electronics plummeting 26%

Japan

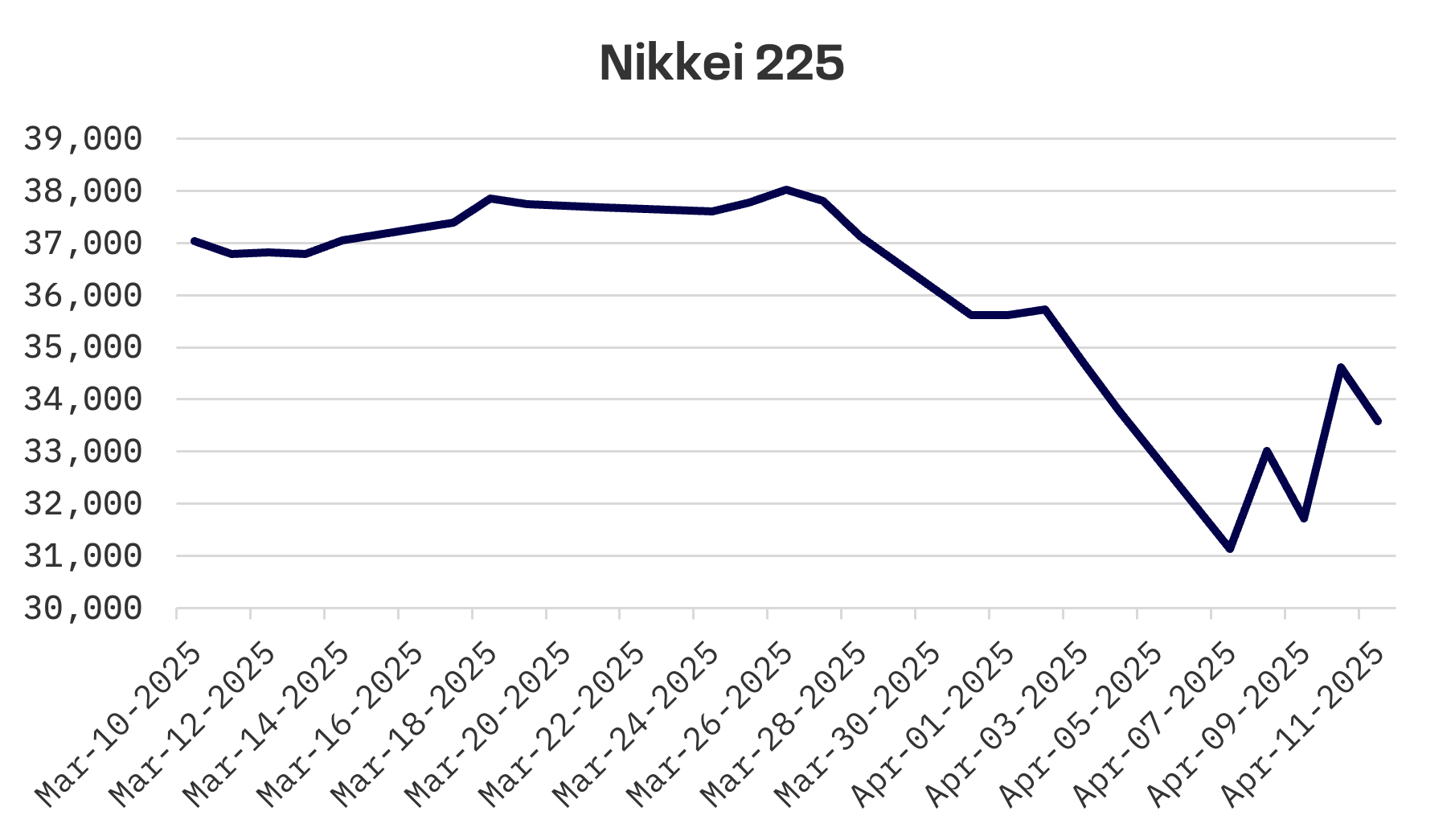

Japan’s stock market retreated over the week, with the Nikkei 225 slipping 0.6% following a volatile period marked by persistent trade concerns that dampened investor sentiment.

The Japanese benchmark took its hardest hit on Monday when investors, rattled by Washington’s aggressive tariff posture, sent financial shares tumbling amid mounting fears of a global trade war. A midweek recovery materialised after U.S. officials extended an olive branch, signalling openness to bilateral trade discussions. Market sentiment brightened further on news that the White House would dial back proposed tariff rates to 10% for most trading partners during a 90 day evaluation period – considerably less punitive than the 24% initially slated for Japanese imports. The reprieve proved partial, however, as the 25% duty on Japanese automotive exports remained firmly in place.

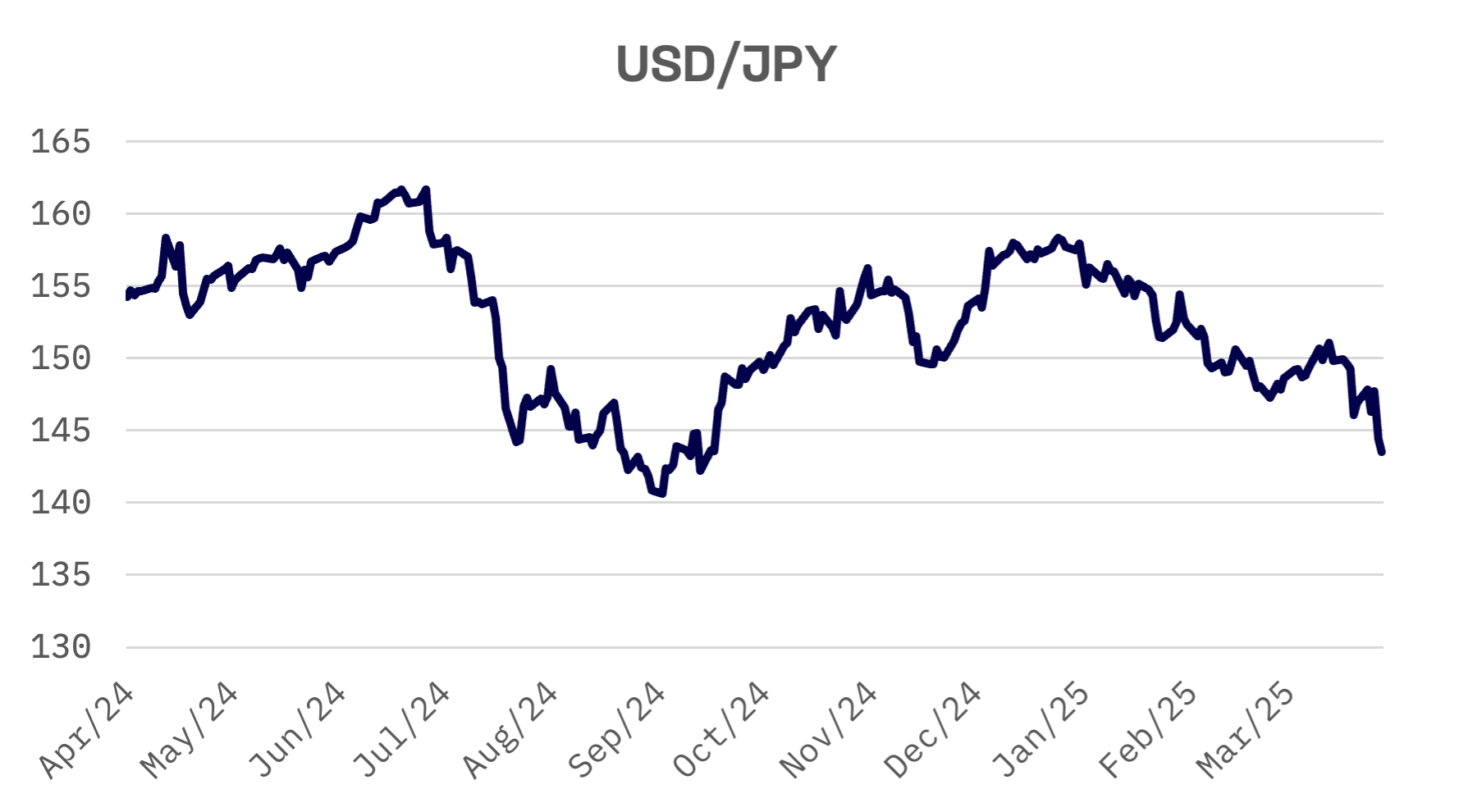

Meanwhile, the yen surged against the dollar as recession anxiety globally prompted a flight to safety and a widespread selloff in U.S. Treasuries. The Japanese currency strengthened to the upper ¥142 range against the greenback, a significant move from around ¥147 just a week earlier. The sharp appreciation prompted Japanese officials to voice concerns about excessive market volatility and call for coordinated international efforts to buffer the impact of trade barriers.

In the debt markets, yields on benchmark 10 year Japanese government bonds (JGB) climbed to 1.36% from 1.18% a week prior, reflecting growing confidence that the Bank of Japan (BoJ) would stay the course on normalising monetary policy despite trade related uncertainties. Persistent wage growth and services inflation continued to underpin the case for further tightening, though BoJ Governor Kazuo Ueda emphasised that policy decisions would remain contingent on incoming economic data, particularly given the fluid situation surrounding tariff measures.

South Korea

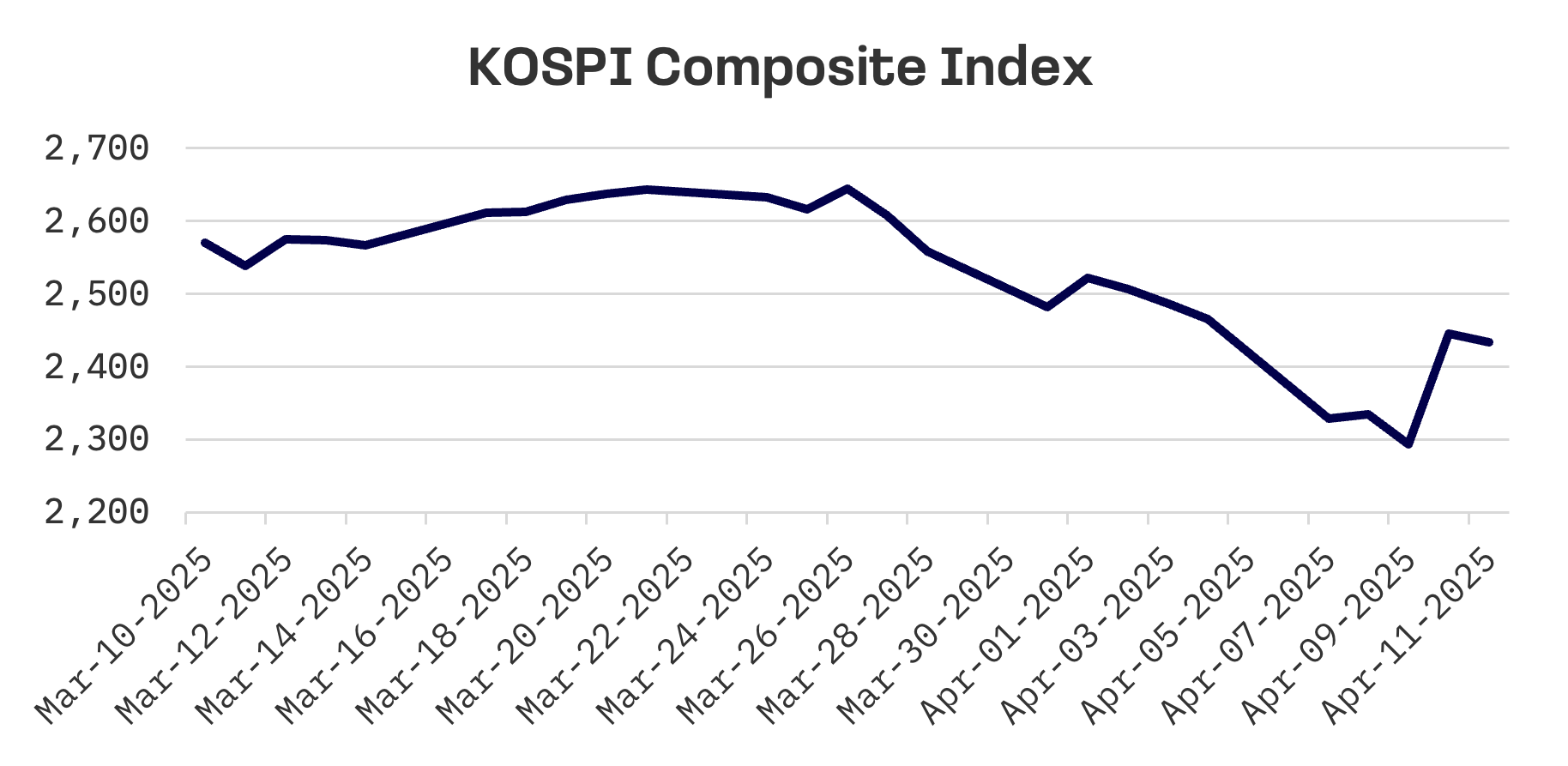

South Korean equities weathered a turbulent week as the KOSPI finished down 1.3%, with traders struggling to find steady footing amid escalating global trade frictions.

Monday’s session delivered a brutal blow to the index, which plunged more than 5.5% as investors grappled with fallout from Washington’s latest round of retaliatory tariffs. A modest reprieve came Tuesday when technology and defence shares pulled the market higher, temporarily snapping its downward trajectory. The respite proved short lived, however, as the KOSPI tumbled nearly 2% on Wednesday to its lowest close in 17 months amid renewed fears of an intensifying U.S.-China trade confrontation. The won’s slide continued unabated, touching its weakest level against the dollar in 16 years.

The market’s fortunes reversed dramatically on Thursday when stocks surged 6.6% after Washington announced it would temporarily suspend new reciprocal tariffs. Yet even this powerful rally couldn’t hold through to the end of the week, as Friday’s session saw equities retreat once more on fresh concerns about deteriorating U.S.-China relations.

Against this volatile backdrop, Seoul moved decisively to shore up its export sector. The government on Friday unveiled a ₩9 trillion ($6.6 billion) financing package designed to safeguard domestic exporters affected by mounting trade headwinds and the wave of new U.S. tariffs.

The comprehensive program includes a ₩3 trillion “crisis response” initiative offering low interest loans targeted at small and mid sized enterprises struggling with tariff pressures. An additional ₩2 trillion will flow to major exporters, while ₩3 trillion will be directed toward policy funds fostering collaboration between large corporations and their smaller supply chain partners. Another ₩1 trillion will fund a new financing mechanism aimed at helping businesses diversify and develop alternative export markets.

Taiwan

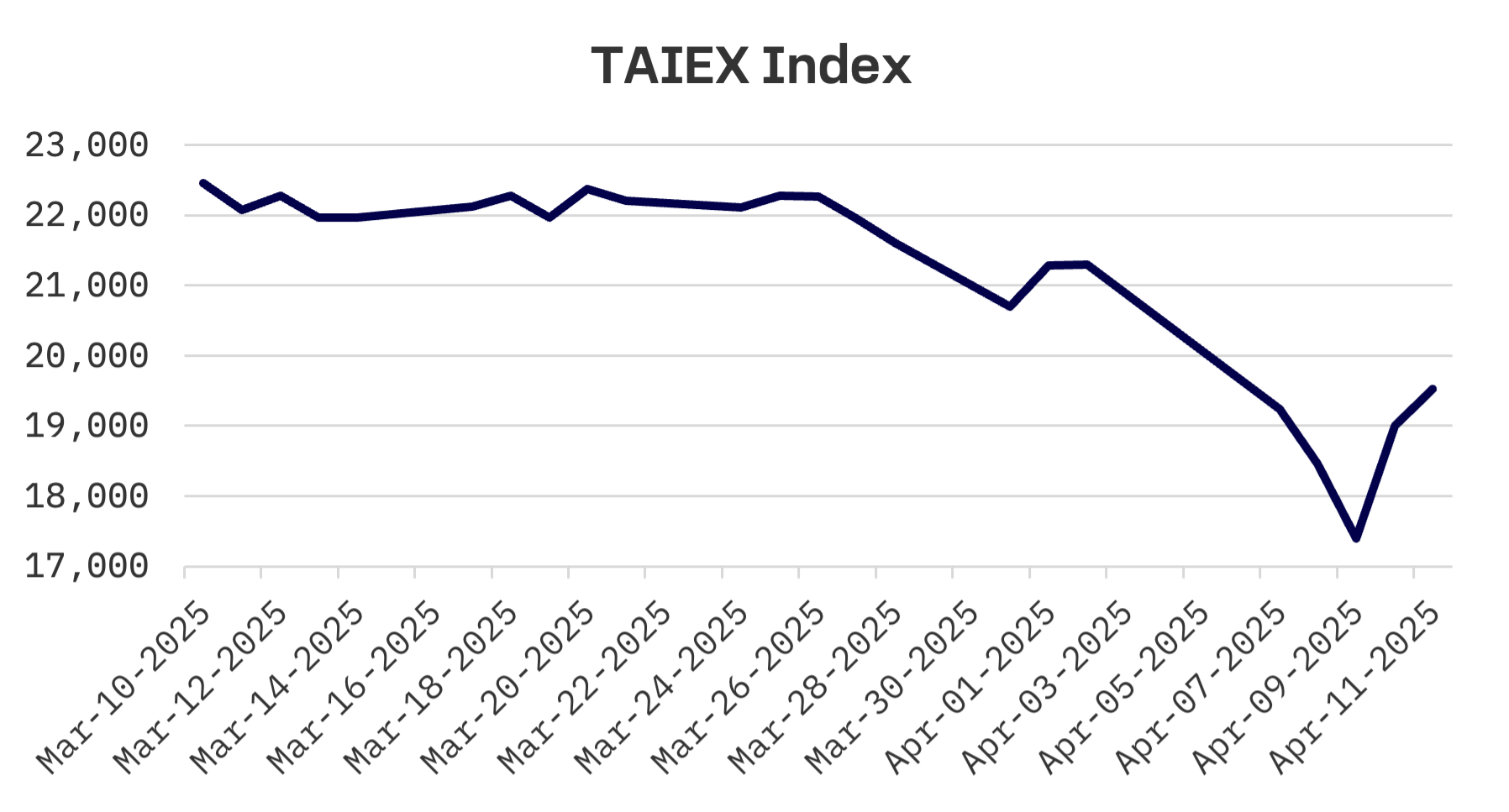

Taiwan’s stock market endured a punishing week as investors returning from a holiday break rushed to price in the impact of Washington’s reciprocal tariff announcement. With markets closed the previous Thursday and Friday for Children’s Day and Tomb Sweeping Day, Taiwanese investors faced a delayed reckoning with the trade developments that had already roiled global markets.

The catchup trading proved brutal. The TAIEX index plummeted 18.3% across the first three trading sessions. A late week recovery emerged after the U.S. announced it would pause the proposed tariffs for 90 days, though the index still finished the week down 8.3% as investor confidence remained severely shaken.

In response to the extreme volatility, Taiwan’s Financial Supervisory Commission announced on Saturday it would prolong emergency restrictions on short selling for an additional week. The protective measures, originally implemented from April 7 to 11 following President Trump’s announcement of broad reciprocal tariffs, aim to stabilise markets amid heightened investor anxiety.

The extended regulations drastically reduce the intraday limit on borrowed share sell orders by slashing it from 30% to merely 3% of a stock’s average 30 day trading volume. Regulators designed the aggressive curbs to dampen speculative trading at a moment of acute market vulnerability stemming from the Trump administration’s trade offensive.

Despite the market turbulence, Taiwan’s export machine showed remarkable resilience. The Ministry of Finance reported that March exports surged more than 18% compared to the previous year, extending the island’s streak of annual export growth to 17 consecutive months. Officials attributed part of the jump to manufacturers accelerating shipments in anticipation of potential U.S. tariff actions.

JAKOTA Blue Chip 150 Index

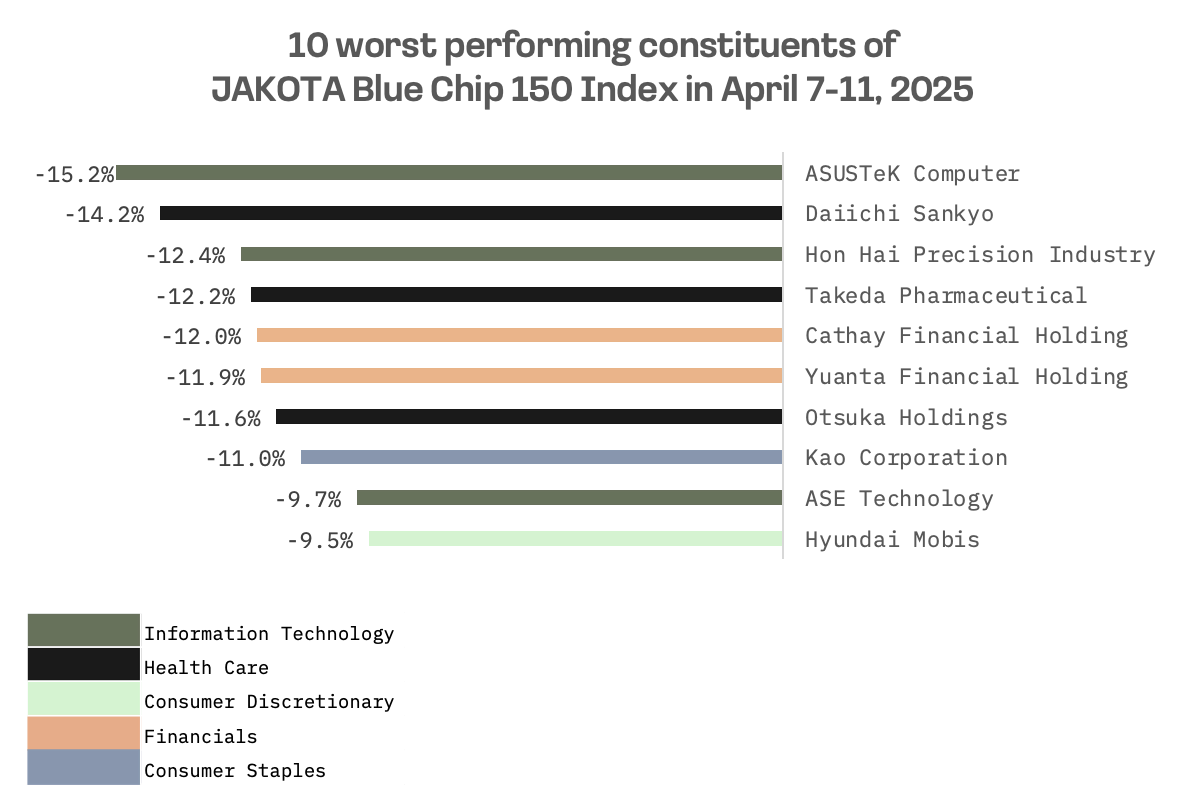

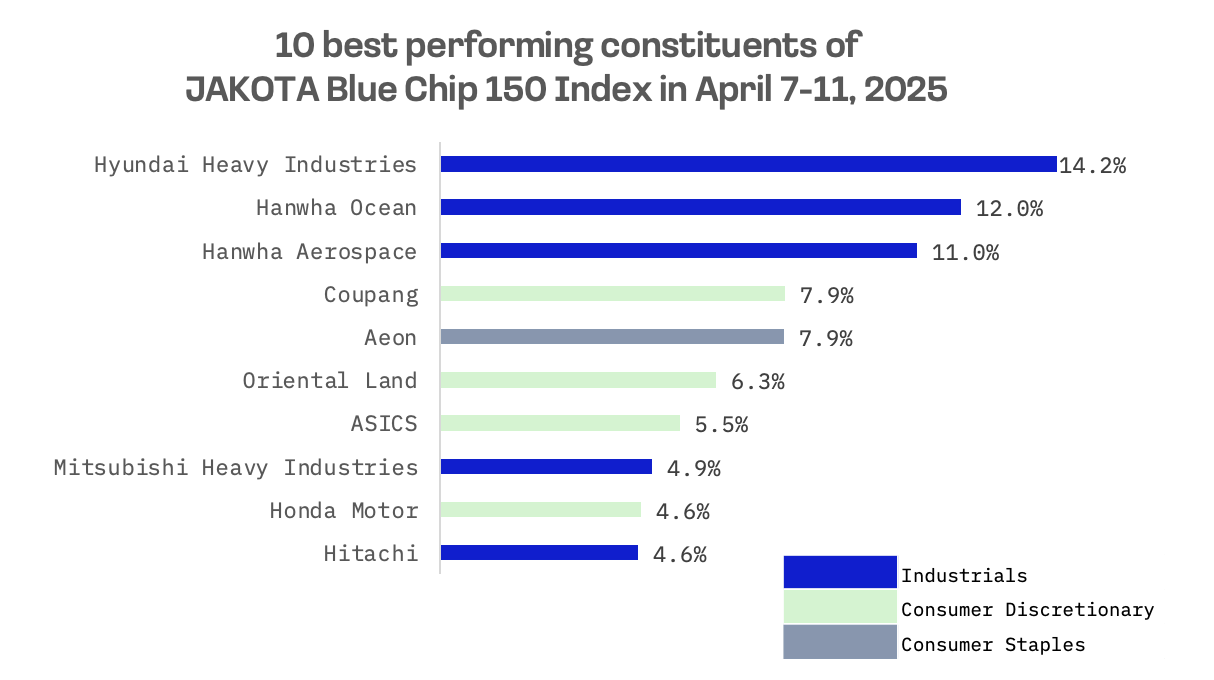

The JAKOTA Blue Chip 150 Index eked out a 0.6% gain for the week, though the modest advance stemmed largely from yen appreciation rather than underlying stock strength.

Korean top shipbuilders emerged as unexpected winners amid the broader market turmoil. Shares of HD Hyundai Heavy Industries and Hanwha Ocean surged after President Trump indicated potential U.S. purchases of advanced vessels from allied shipyards as part of his administration’s broader initiative to reinvigorate America’s maritime sector.

By contrast, Japanese financial stocks faced significant headwinds as government bond yields tumbled. However, the steepest decline among the index constituents came from Japanese semiconductor manufacturer Renesas Electronics, which saw its share price plummet 26% during the week.

Taiwanese electronics firms ranked prominently among the week’s laggards. ASUSTeK Computer, a major producer of computer and phone hardware, and Hon Hai Precision Industry, known for iPhone assembly and AI server manufacturing, both suffered substantial losses.

Japanese pharmaceutical companies Daiichi Sankyo and Takeda Pharmaceutical likewise saw their shares under considerable pressure after President Trump doubled down on plans to impose “major” tariffs on pharmaceuticals entering the U.S. market.