Last week’s JAKOTA markets:

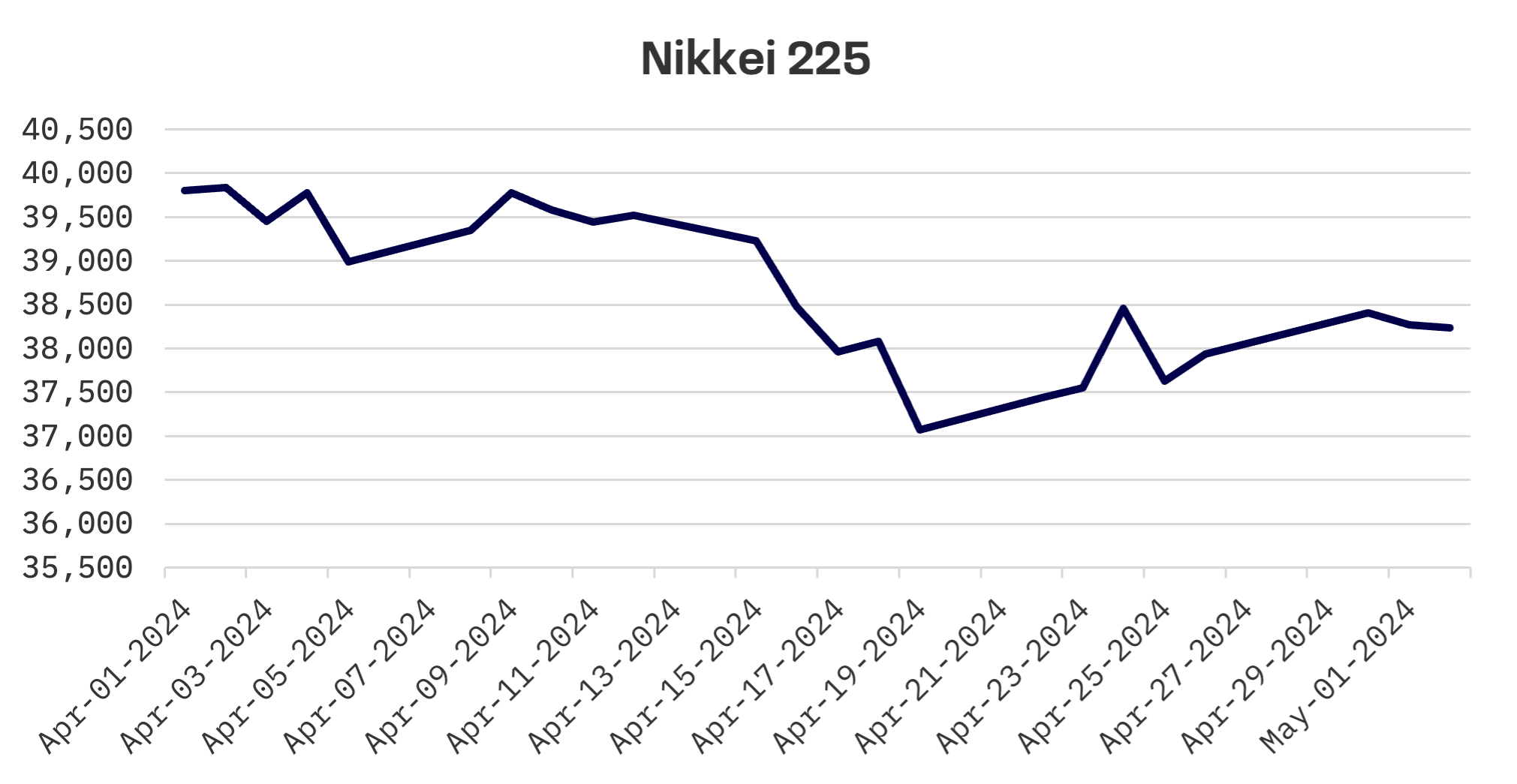

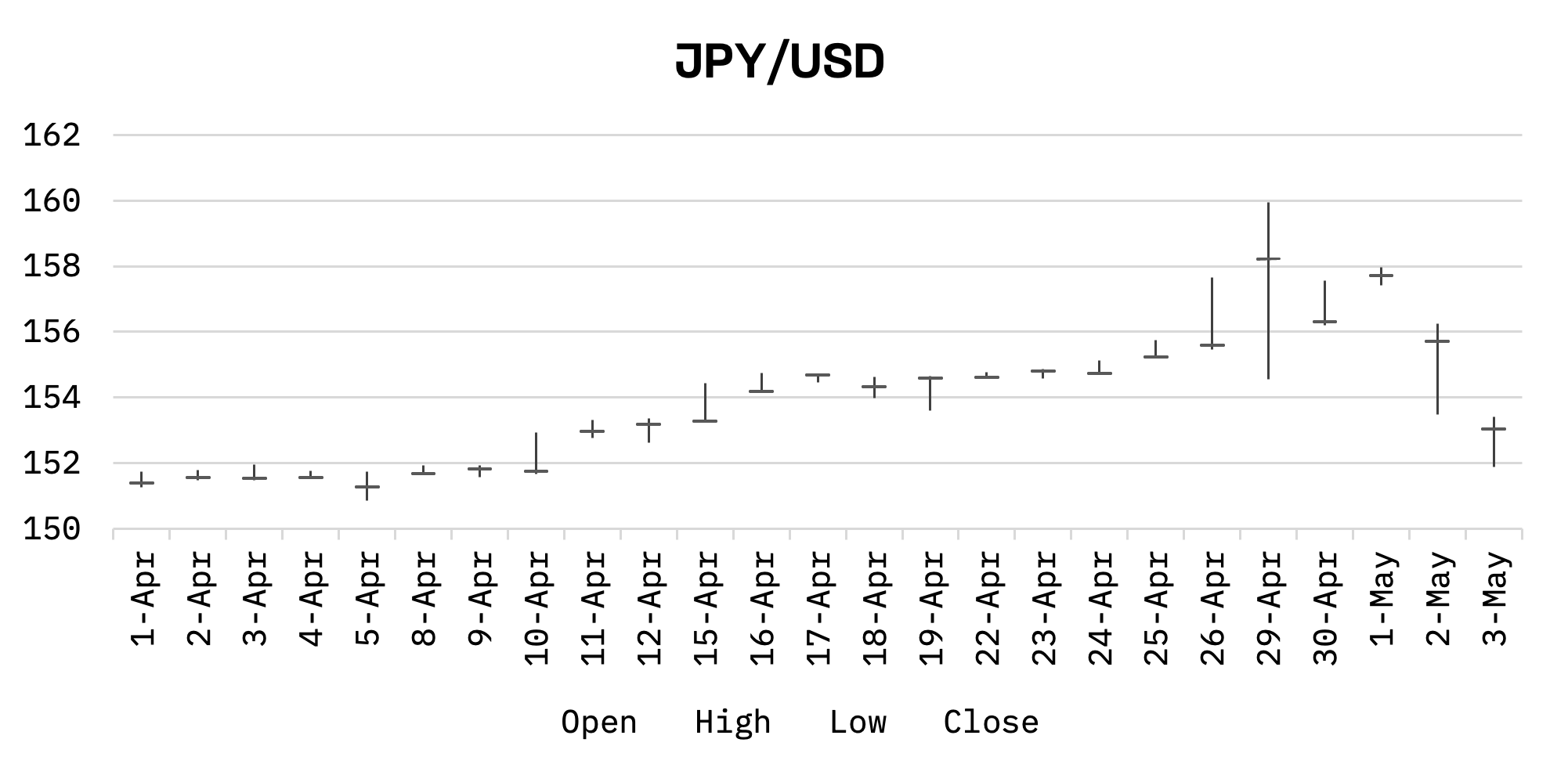

- Japan’s Nikkei 225 Index climbed 0.8%, boosted by strong corporate earnings and speculative central bank interventions to stabilise the yen

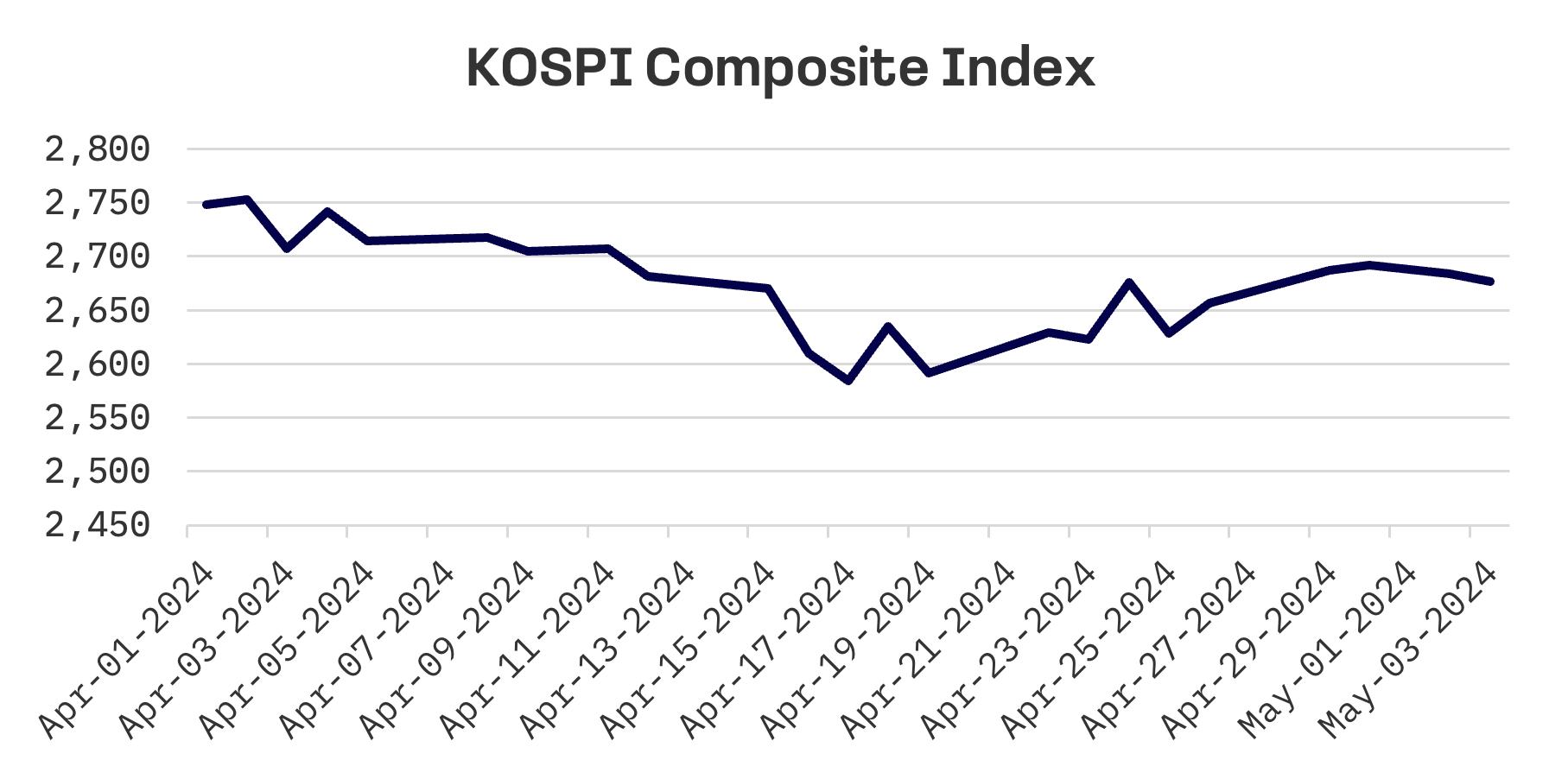

- South Korea’s KOSPI extended its gains by 0.8%, driven by robust corporate performance early in the week, though tempered later by the Federal Reserve’s rate decision

- Taiwan’s TAIEX gained 1%, reflecting an initial surge that tapered off due to global rate decisions impacting the tech sector

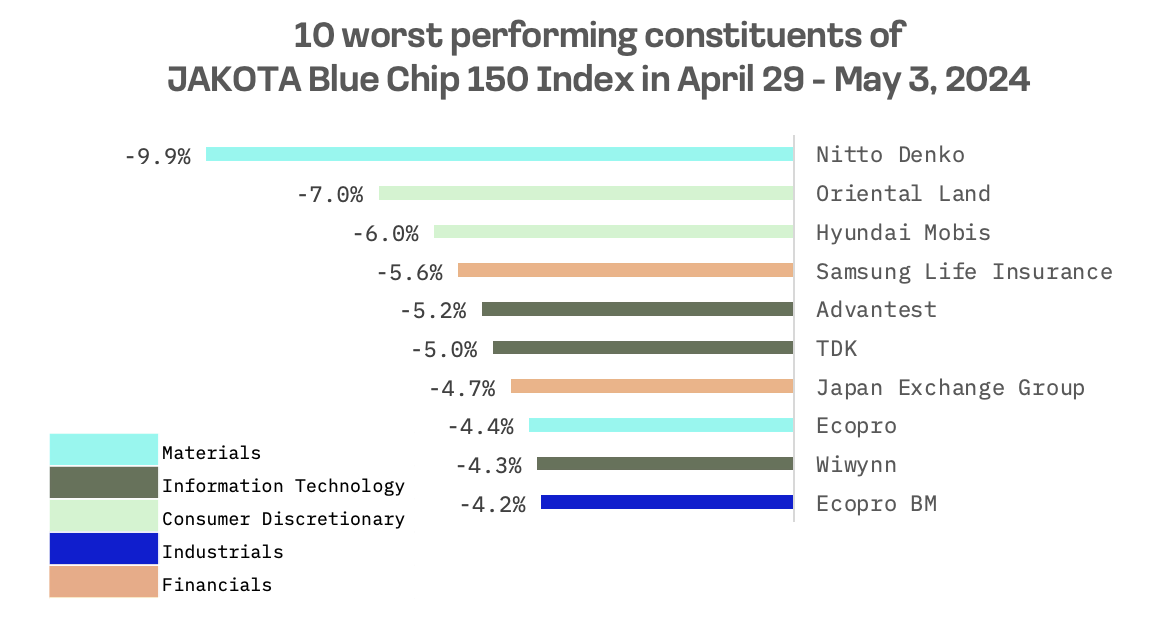

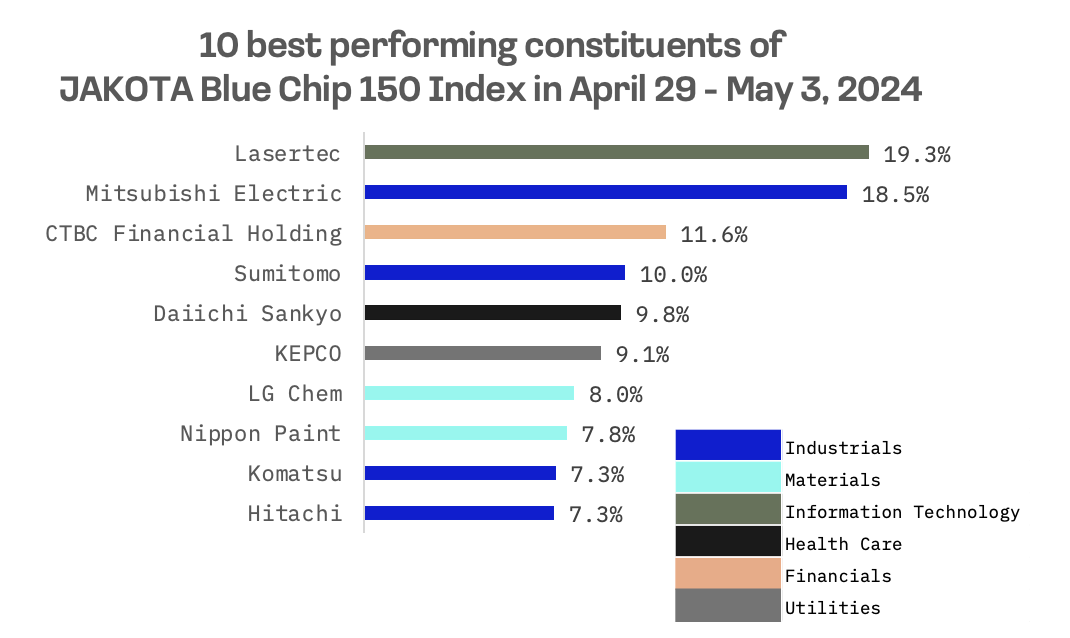

- The JAKOTA Blue Chip 150 Index enjoyed a 2.9% gain, with Lasertec leading the way with significant gains, contrasting with Nitto Denko’s decline following disappointing financial results

Japan

This week, the Japanese stock market showed positive performance, with the Nikkei 225 Index increasing by 0.8%. This rise was propelled by strong corporate earnings and market speculation that Japanese authorities had intervened twice in the foreign exchange market to support the yen.

Although direct confirmation from authorities was not provided, shifts in the Bank of Japan’s accounts hinted at such interventions. Consequently, the yen strengthened to approximately JPY 153 against the USD, up from JPY 158 at the previous week’s close.

During the recent earnings season, about 70% of Japan’s large publicly traded companies reported increased profits, according to analysis by the Nikkei. Factors contributing to this improvement included the devaluation of the yen, price adjustments and a resurgence in inbound tourism. Many companies also benefitted from advancements in generative AI.

However, certain firms faced challenges such as increased competition, particularly from China, and the adverse impacts of currency devaluation, which tempered their overall performance.

South Korea

The Korean stock market continued its upward trajectory for the second consecutive week, with the KOSPI index rising by 0.8%. Market momentum in the first half of the week was driven by strong earnings from large-cap companies, notably Samsung Electronics. Nonetheless, market sentiment shifted later in the week following the Federal Reserve’s decision to maintain its key interest rate, coupled with hints at possible future rate reductions due to concerns over volatile inflation.

Economic data from South Korea showed that headline inflation fell below 3% for the first time in three months. April’s consumer prices rose by 2.9% year-on-year, a 0.2% decrease from March, as reported by Statistics Korea. Despite this, sustained high prices for agricultural products and volatile international oil prices have increased the likelihood that policy rates will remain unchanged for an extended period.

Additionally, April marked the seventh consecutive month of growth in exports, which surged by 13.8% year-on-year, fuelled by strong demand for chips and a record high in automobile shipments, according to the Ministry of Trade, Industry and Energy.

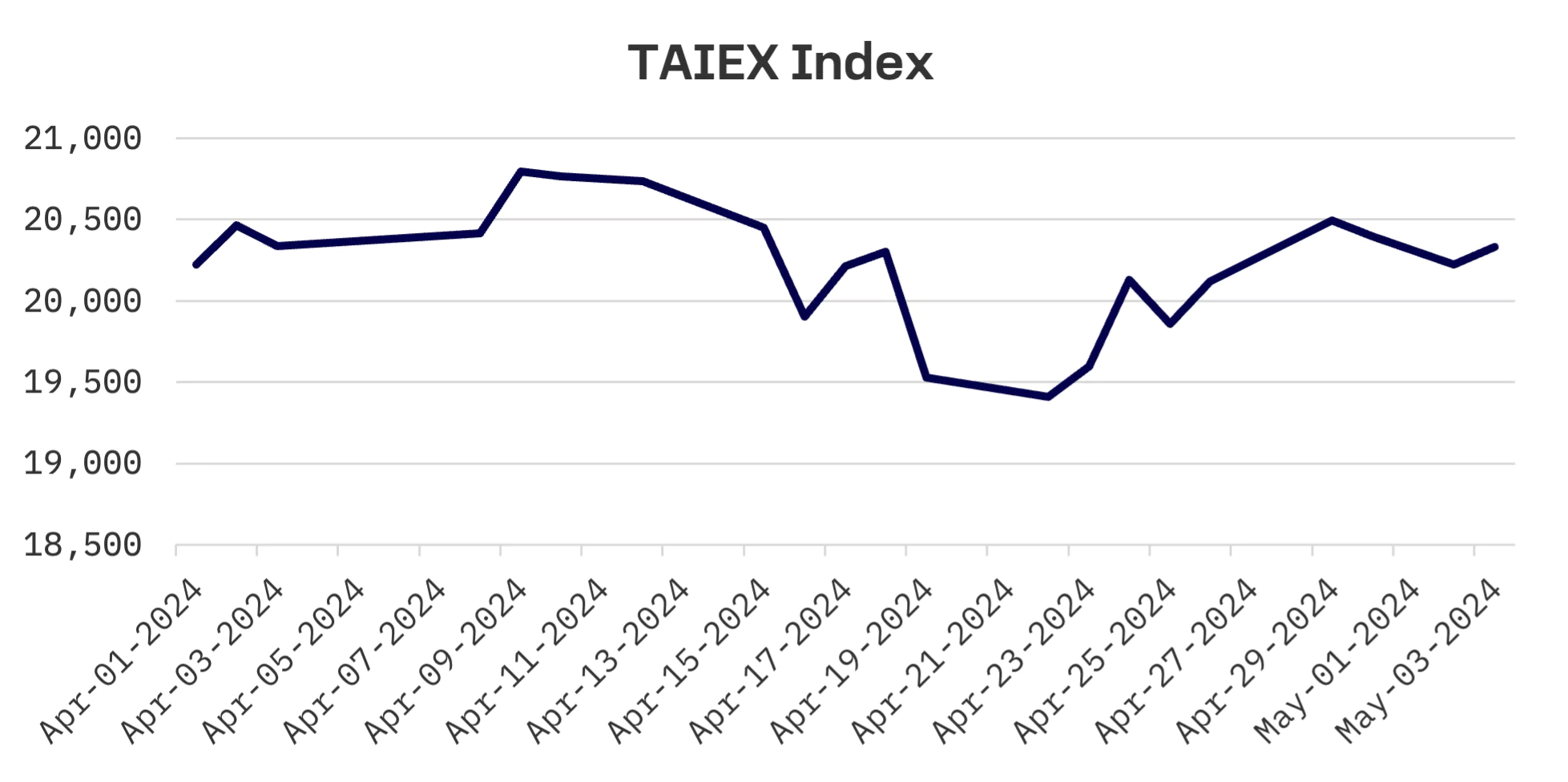

Taiwan

Like other JAKOTA markets, Taiwan’s stock market had a positive week, with the TAIEX index increasing by 1%. Market dynamics mirrored those elsewhere, showing growth initially, followed by a slowdown after the Federal Reserve’s decision to maintain current interest rates. On Thursday, the electronics sector drove a market downturn in Taiwan, reacting to significant overnight losses in U.S. technology stocks.

Taiwan’s GDP grew by 6.51% year-on-year in the first quarter, exceeding the earlier forecast of 5.92%. This growth was largely driven by stronger than expected export performance, as highlighted by the Directorate General of Budget, Accounting and Statistics (DGBAS).

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index saw a substantial increase of 2.9% this week, supported by overall positive performance across large-cap stocks. Of the 150 constituents, 106 exhibited positive price trends.

Lasertec, a Japanese manufacturer specialising in inspection and measurement equipment, emerged as the top performer with a 19% gain. The company announced robust consolidated financial results for the third quarter of the fiscal year ending June 2024 (July 2023 to March 2024), with sales reaching ¥157 billion, a 97.9% increase from the previous year, and net income surging to ¥41.5 billion, double that of the same period last year.

Conversely, Nitto Denko, a Japanese manufacturer of tapes, vinyl, LCDs and insulation, experienced a significant 9.9% decline in its shares after announcing disappointing financial results. The company’s consolidated final profit for the fiscal year ended March 2024 was ¥102.6 billion, down 5.9% from the previous year.