Last week’s JAKOTA markets:

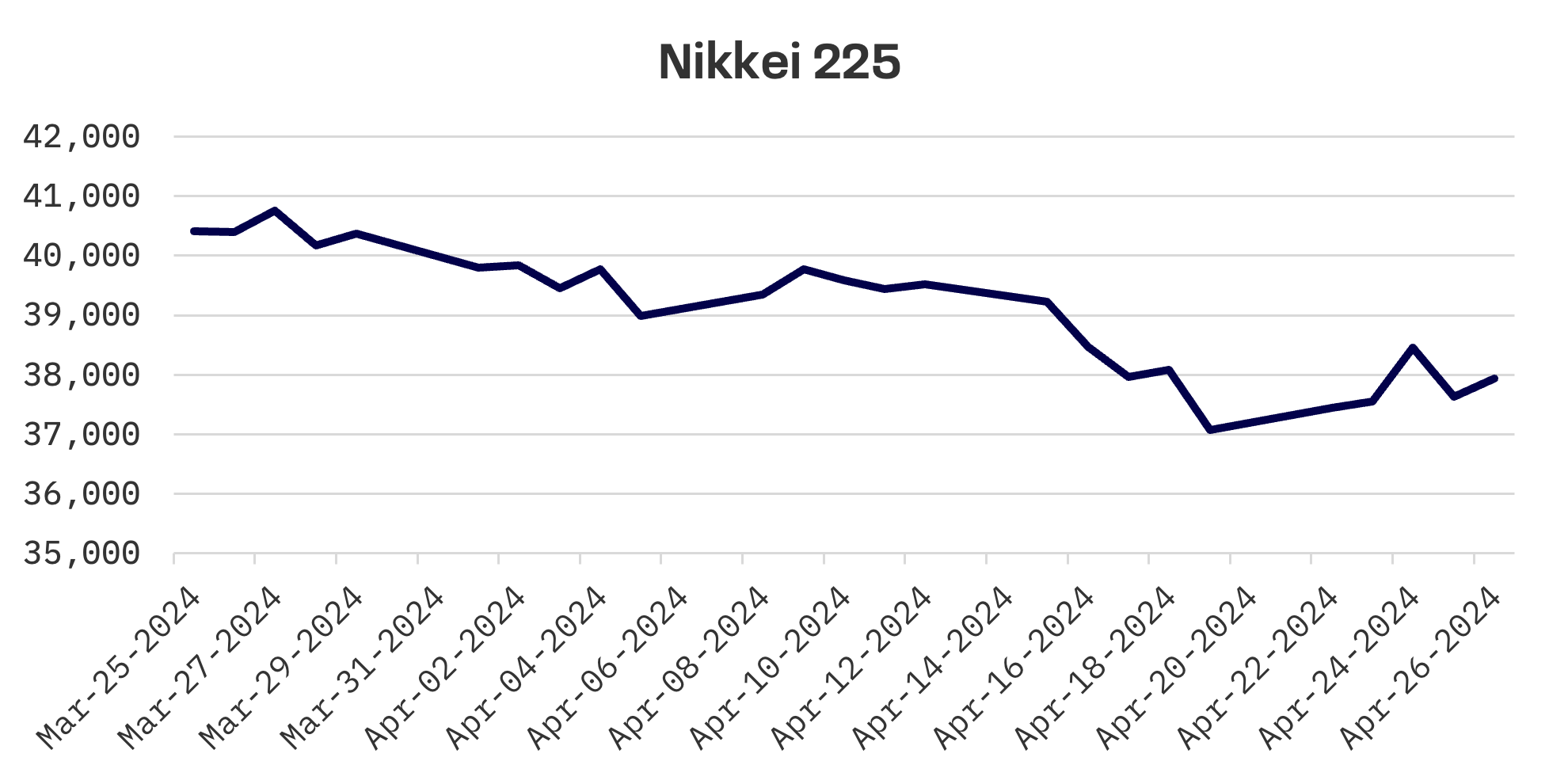

- The Nikkei 225 advanced by 2.3% as Japan faced currency challenges but received support from a dovish central bank outlook

- The KOSPI ended four weeks of losses with a 2.5% gain, spurred by legislative discussions and strong export figures, particularly in semiconductors

- The TAIEX recovered by 3.0%, lifted by easing concerns over tensions in the Middle East and anticipation of favorable U.S. monetary policy adjustments

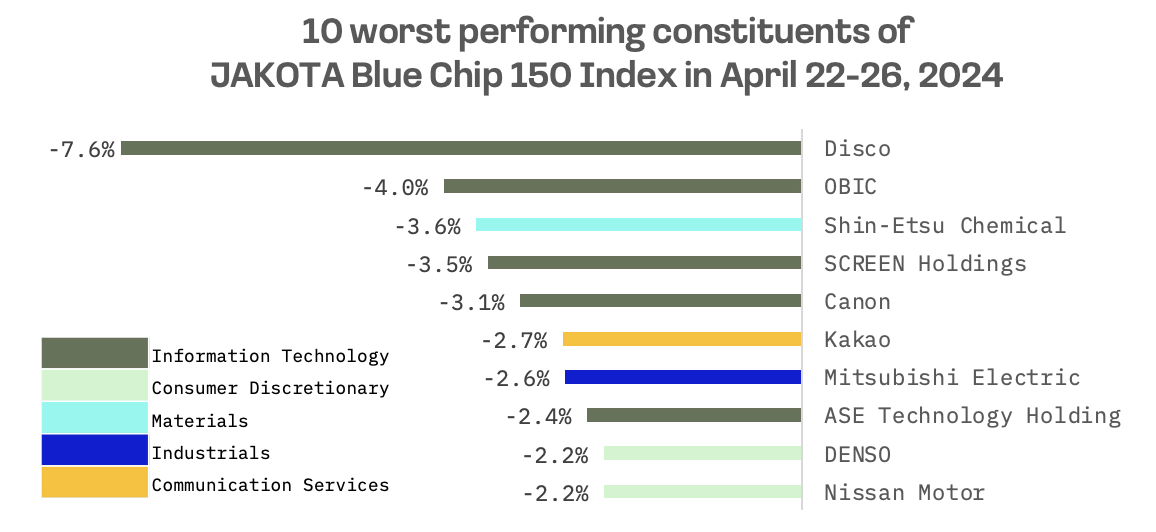

- The JAKOTA Blue Chip 150 Index gained 1.7%, with 120 stocks showing positive trends; highlights included a surge in KB Financial Group’s shares, offset by a notable decline in DISCO Corporation’s stock despite reporting a consecutive year of record profits

Japan

This week, the Japanese stock market recorded substantial gains, with the Nikkei 225 Index advancing by 2.3%. The Bank of Japan (BoJ) held steady on its monetary policy at its April meeting, a move investors deemed dovish. BoJ Governor Kazuo Ueda hinted at a growing likelihood of interest rate hikes later this year.

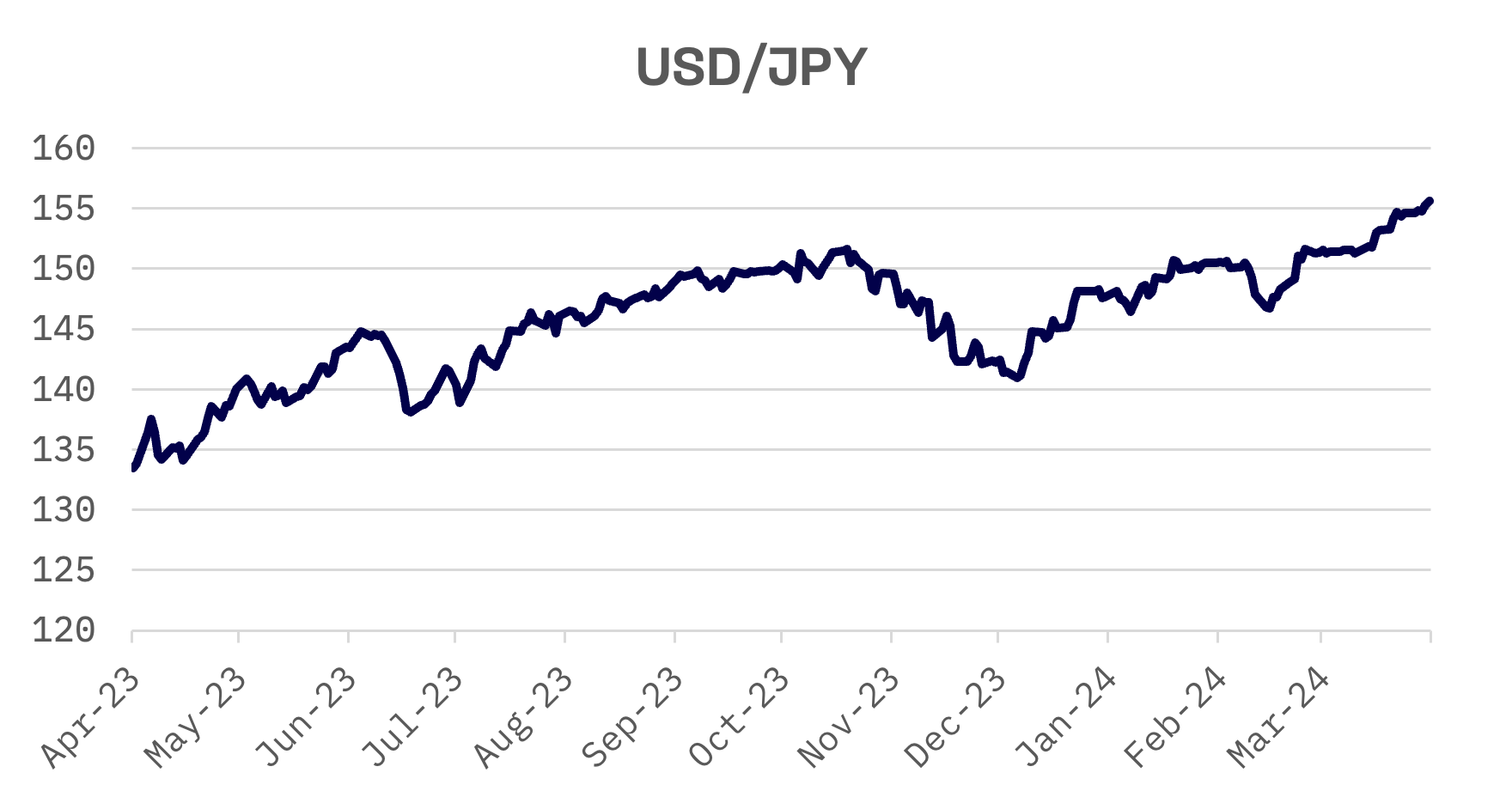

Despite ongoing speculation about potential interventions to support the historically weak yen, Japanese authorities did not take action. The yen depreciated to approximately JPY 156.8 against the USD, down from about 154.6 at the close of the previous week. Governor Ueda expressed concern about the prolonged weakness of the yen and reaffirmed the central bank’s commitment to monitoring the forex markets and assessing their impact on the economy.

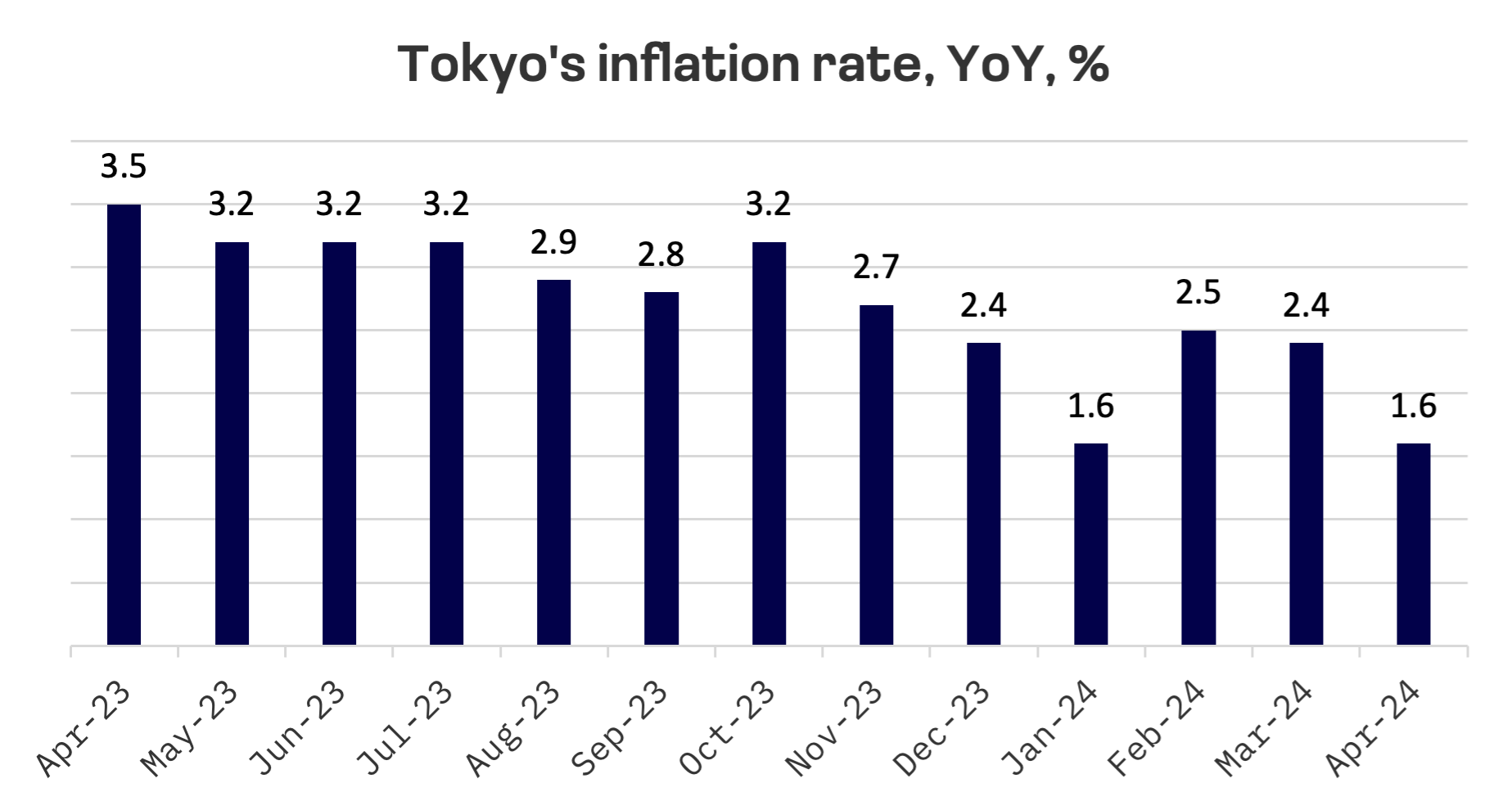

Economic indicators showed a moderation in inflationary pressures. The Tokyo-area core consumer price index (CPI) rose by 1.6% year-on-year in April, falling short of consensus projections and the BoJ’s 2% target. Tokyo’s CPI is often viewed as a precursor to national inflation trends.

The preliminary April purchasing managers’ index (PMI) from au Jibun Bank suggested that Japan’s manufacturing sector is stabilizing. The composite PMI increased to 52.6, up from 51.7 in March, with private sector hiring accelerating amid positive business sentiment, signaling sustained momentum ahead.

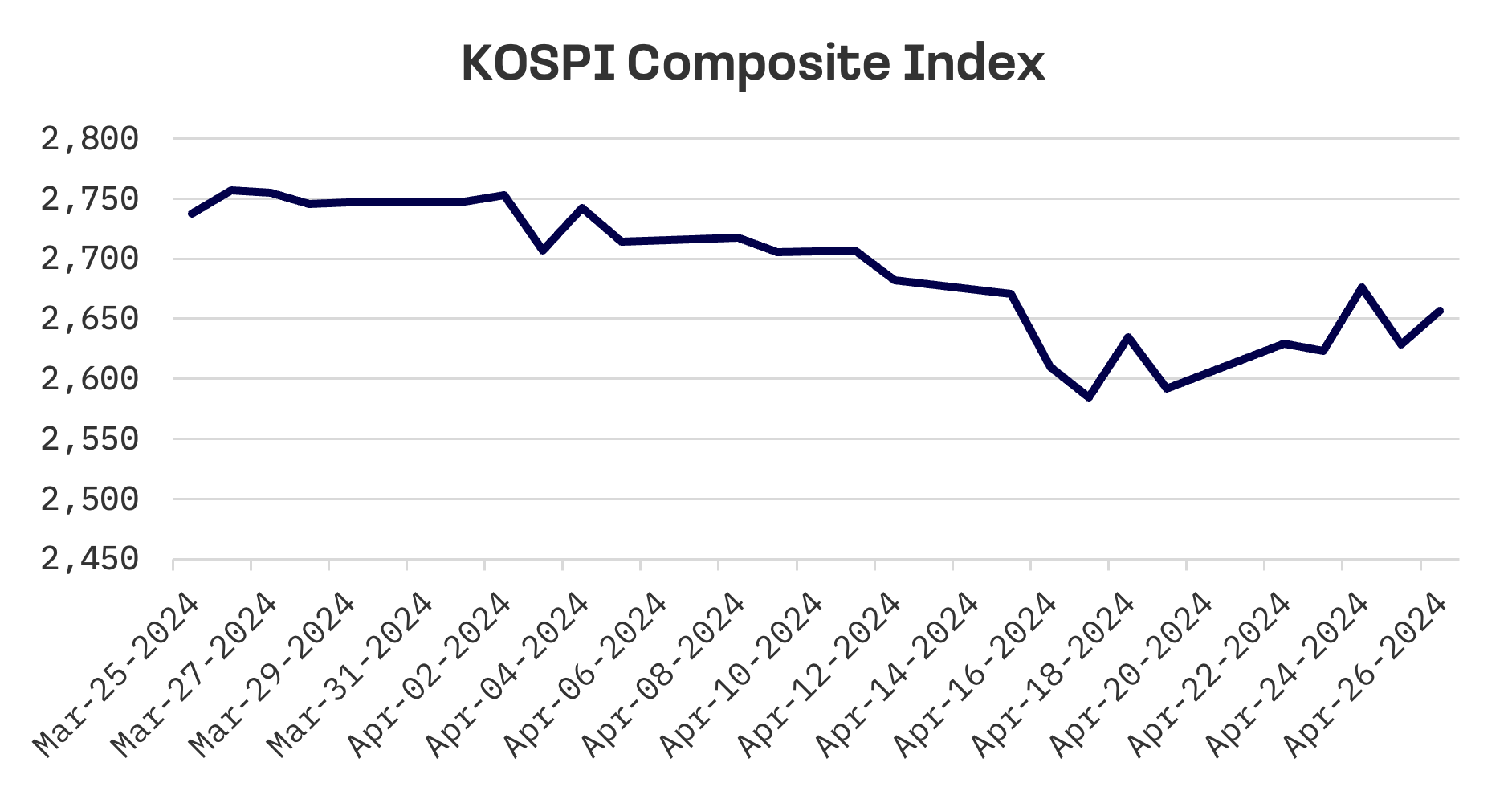

South Korea

The Korean stock market rebounded from four consecutive weeks of losses, with the KOSPI index surging 2.5%. Investor confidence was bolstered by easing Middle East tensions and a weakening Korean won against the dollar, spurring purchases in tech and financial sectors.

The rise in the KOSPI index was also supported by discussions in the National Assembly about potentially deferring the implementation of financial investment income taxes for two years.

Market analysts are increasingly skeptical of a near-term rate cut by the Bank of Korea, amid volatile global commodity prices and the sharp depreciation of the Korean currency.

On the economic front, Korea’s exports during the first 20 days of April surged by 11.1% year-on-year, fuelled by strong semiconductor sales amid robust global demand.

Korea’s economy expanded at its fastest rate in more than two years during the first quarter, propelled by a recovery in exports and increased construction investment. According to the Bank of Korea, preliminary figures showed a 1.3% quarter-over-quarter increase in real GDP for the January-March period, surpassing expectations.

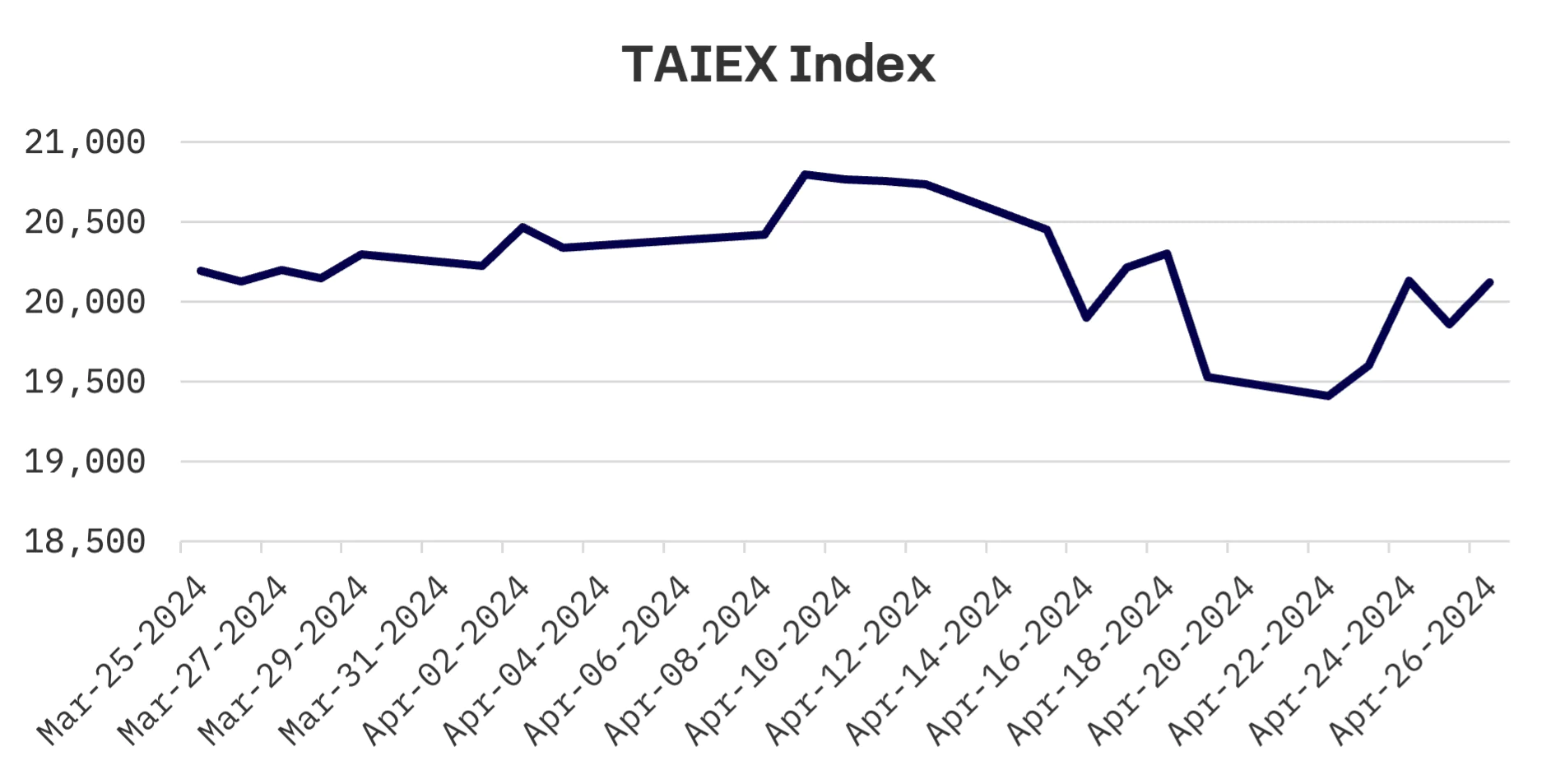

Taiwan

Following a downturn last week, Taiwan’s stock market rebounded, with the TAIEX index rising 3.0%. The market was lifted by reduced tensions in the Middle East and optimism about a potential U.S. Federal Reserve rate cut after new data showed a slowdown in U.S. manufacturing activity. The electronics sector, in particular, saw increased buying activity.

The Taiwan Institute of Economic Research (TIER) revised its 2024 GDP growth forecast for Taiwan upwards to 3.29% from an earlier estimate of 3.15%, made in January. The revision reflects a global surge in demand for AI technologies, significantly benefiting Taiwan’s export performance.

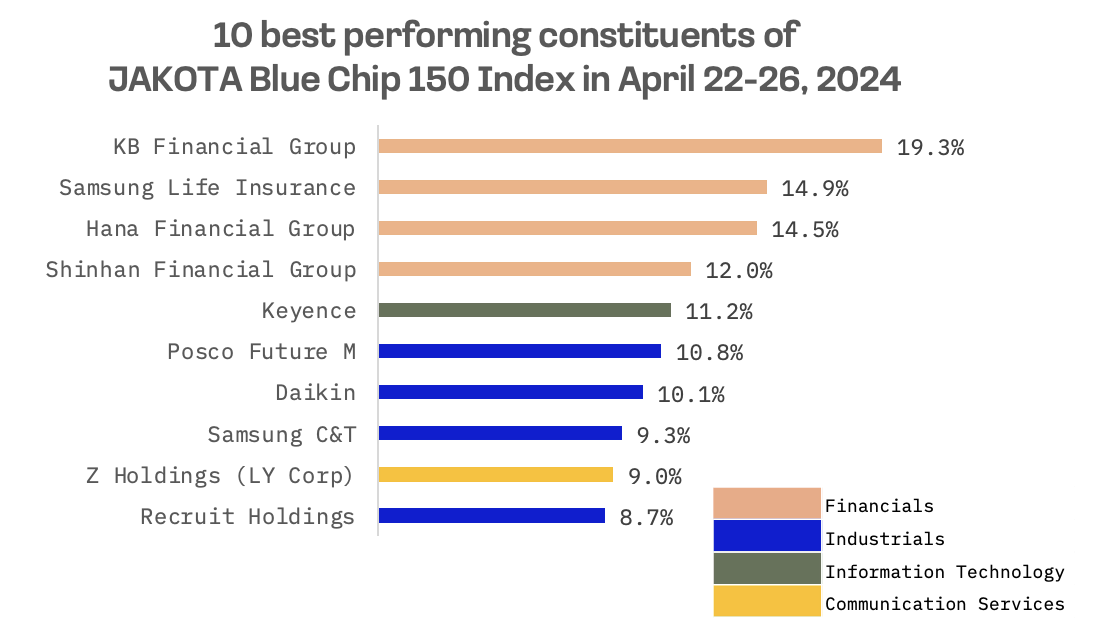

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index increased by 1.7% this week. Out of its 150 constituents, 120 stocks showed positive trends.

Korean financial stocks performed exceptionally well, led by KB Financial Group, which saw its share price surge over 19% following a strong first-quarter earnings report and an enhanced shareholder return program.

On the other hand, DISCO Corporation, a Japanese manufacturer specializing in precision processing equipment and tooling, experienced a significant 7.6% decline in its share price this week. This downturn occurred despite the company announcing favorable financial results after the market closed on April 25th, which were initially well-received by investors.

Notably, DISCO reported a 9.0% increase in consolidated ordinary income for the fiscal year ending March 31, 2024, marking the fourth consecutive year of record-high profits. However, in the days following the announcement, several market securities firms lowered their target price for DISCO, contributing to the decline in its stock price.