Last week’s JAKOTA markets:

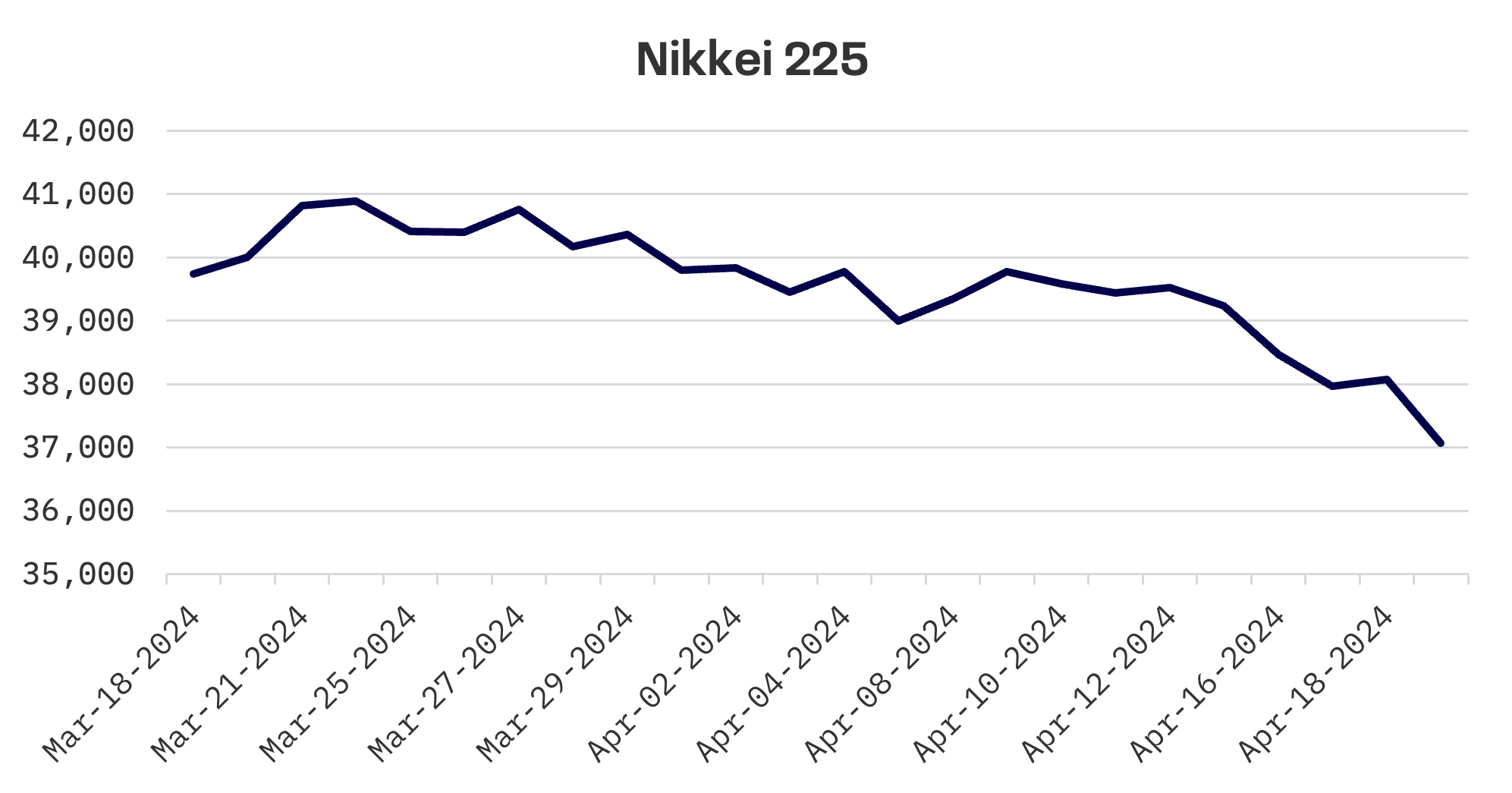

- In Japan, the Nikkei 225 tumbled 6.2% due to increasing Middle East tensions and slowing demand in the AI industry, reflecting its worst week since March 2020

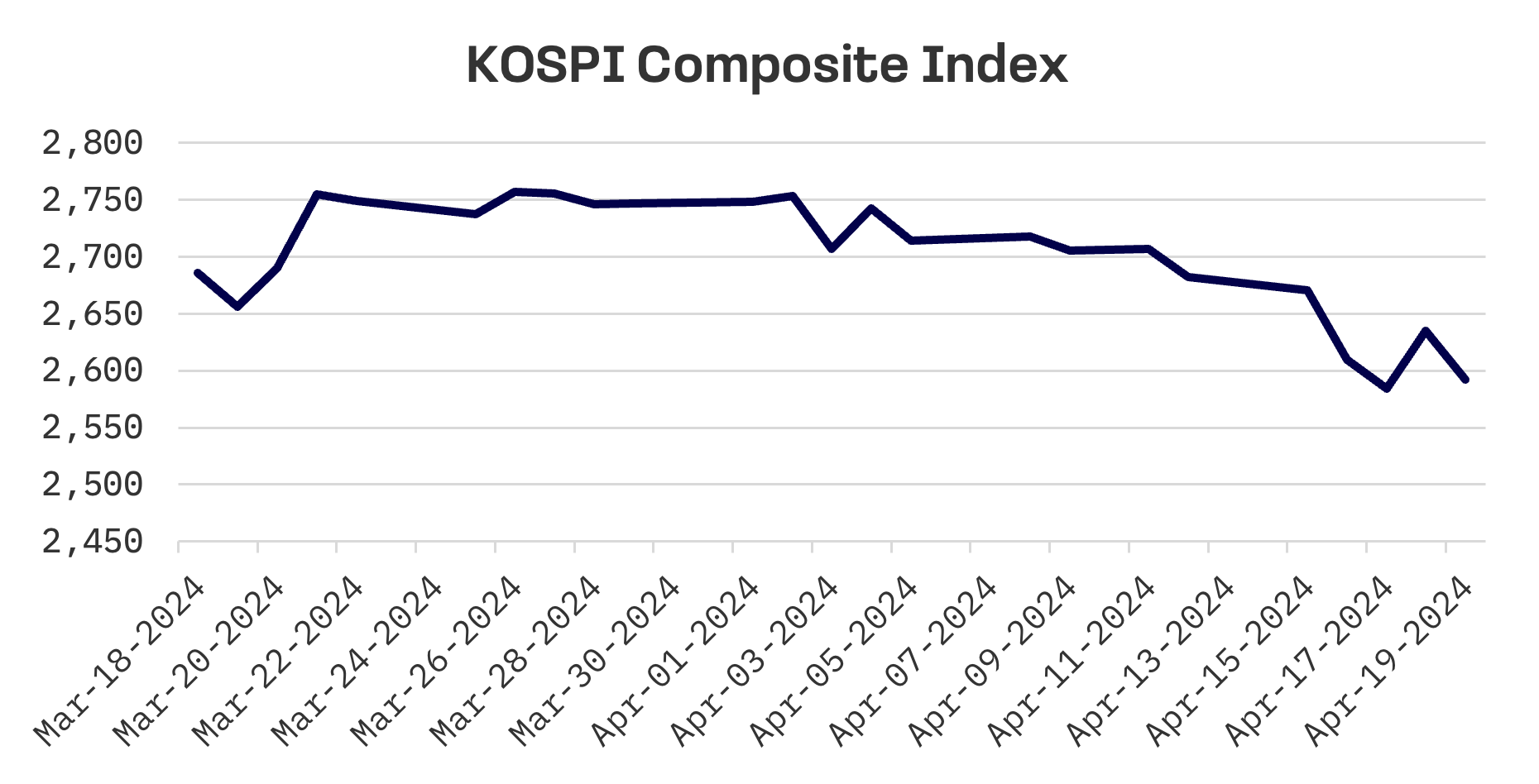

- The KOSPI index fell by 3.4%, continuing a four-week downward trend, influenced by geopolitical concerns and cautious expectations for U.S. rate cuts

- Taiwan’s TAIEX suffered a 5.8% loss, mirroring declines across the region, despite a brief uplift from TSMC’s strong quarterly performance

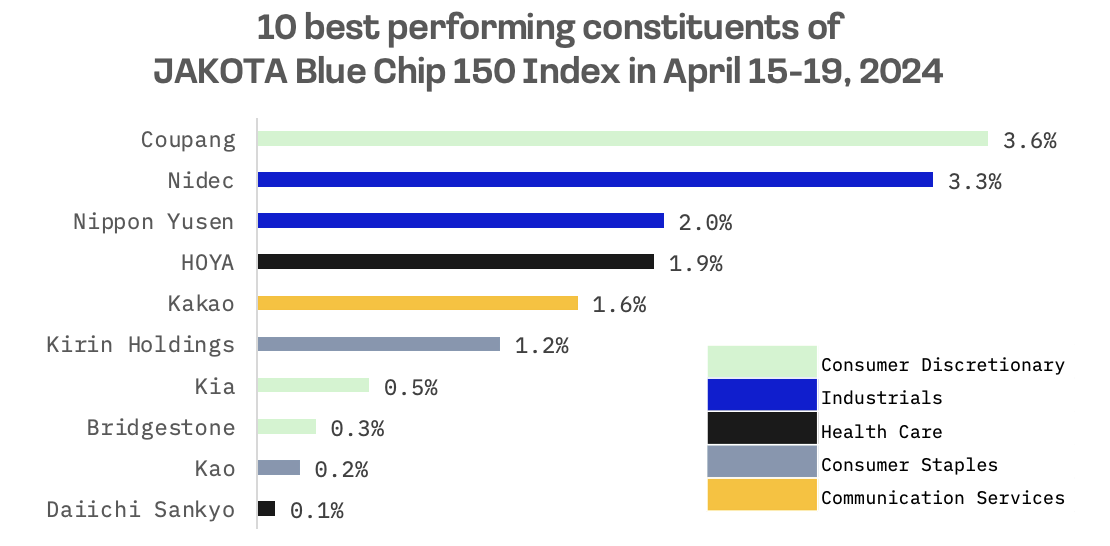

- The JAKOTA Blue Chip 150 Index plummeted by 6%, with an overwhelming majority of stocks facing losses, despite a standout performance from Coupang due to a strategic pricing move

Japan

This week, the Japanese stock market experienced a significant downturn, with the Nikkei 225 Index falling 6.2%, marking its largest one-week drop since the week ending March 13, 2020. This steep decline was driven by escalating tensions in the Middle East and concerns over waning demand in the AI sector.

Although traditionally seen as a safe haven during geopolitical unrest, the yen only strengthened on the final trading day of the week. It remained near its 34-year lows, closing around the mid-JPY 154 range against the U.S. dollar, a slight recovery from the previous week’s lows in the low-JPY 153 range.

While there was speculation about potential intervention by Japanese authorities to support the yen, no such action was taken. However, leaders from the U.S., Japan and South Korea did convene to address the sharp depreciation of the yen and the South Korean won in the forex markets.

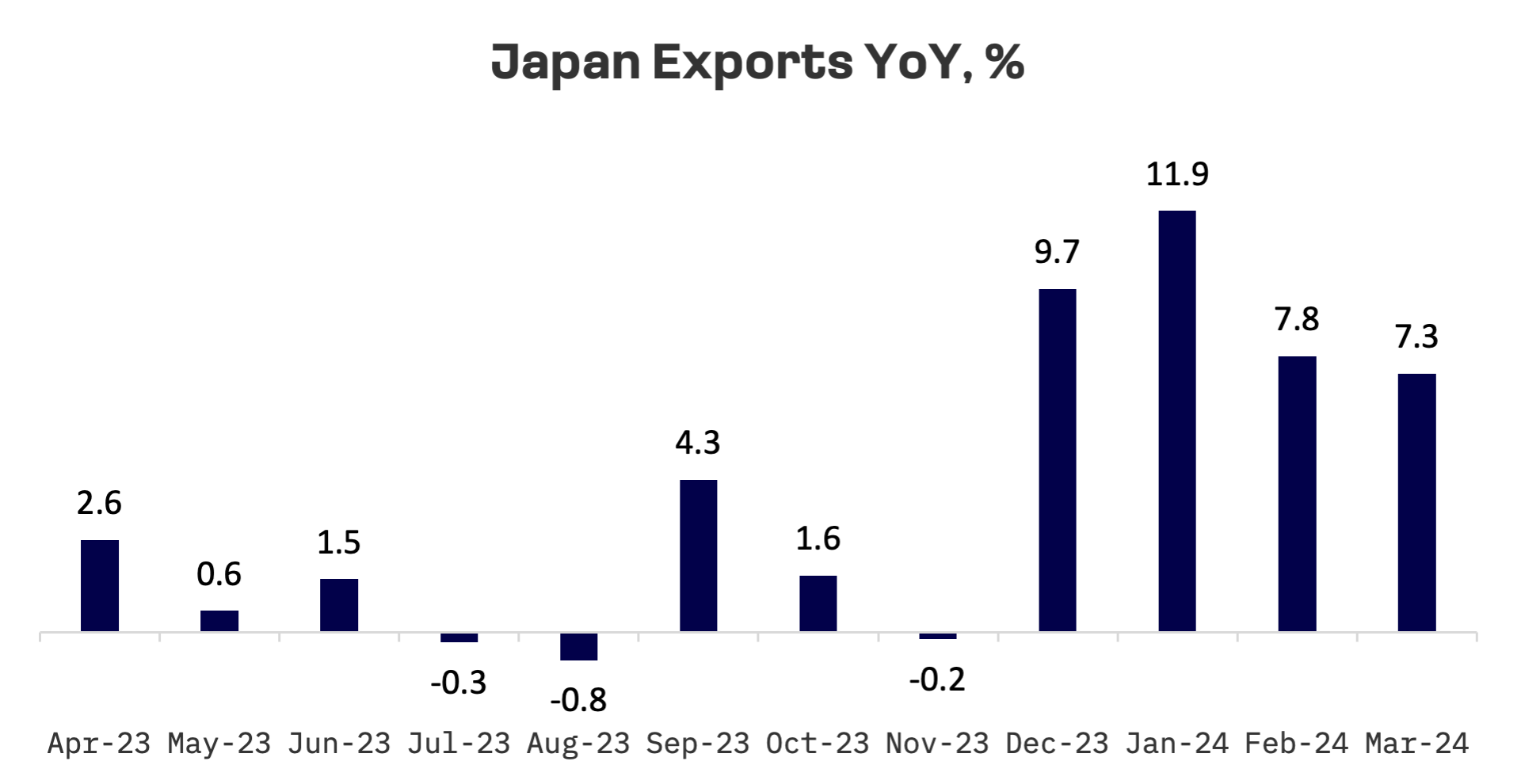

On the economic front, Japan’s exports rose 7.3% year-on-year in March, a slight slowdown from February’s 7.8% increase. This growth, driven by a weaker yen and increased demand from China, marked the fourth consecutive month of rising exports.

The core consumer price index (CPI) increased by 2.6% year-on-year in March, slightly below expectations and down from February’s revised figure of 2.8%. Although this suggests some easing of price pressures, the significant expansion in Japan’s inbound tourism, particularly from South Korea and China, is expected to continue supporting services inflation.

South Korea

The Korean stock market recorded its fourth consecutive week of declines, with the KOSPI index dropping 3.4%. The market’s downturn was exacerbated by growing concerns over a potential escalation in Middle East conflicts and slower-than-expected U.S. interest rate reductions.

The South Korean won reached a 17-month low, briefly surpassing the critical 1,400 per dollar threshold as foreign investors withdrew from the market. On Friday, Governor Rhee Chang-yong of South Korea’s central bank suggested that the won-dollar exchange rate might stabilize if Middle East tensions do not worsen, although he acknowledged “numerous uncertainties” in the region.

Finance Minister Choi Sang-mok emphasized the importance of enhancing the emergency response system to mitigate the potential economic and market impacts of increased Middle East tensions. He affirmed the government’s readiness to deploy swift measures, with $68 billion in market stabilization funds at its disposal to counter excessive foreign exchange market volatility.

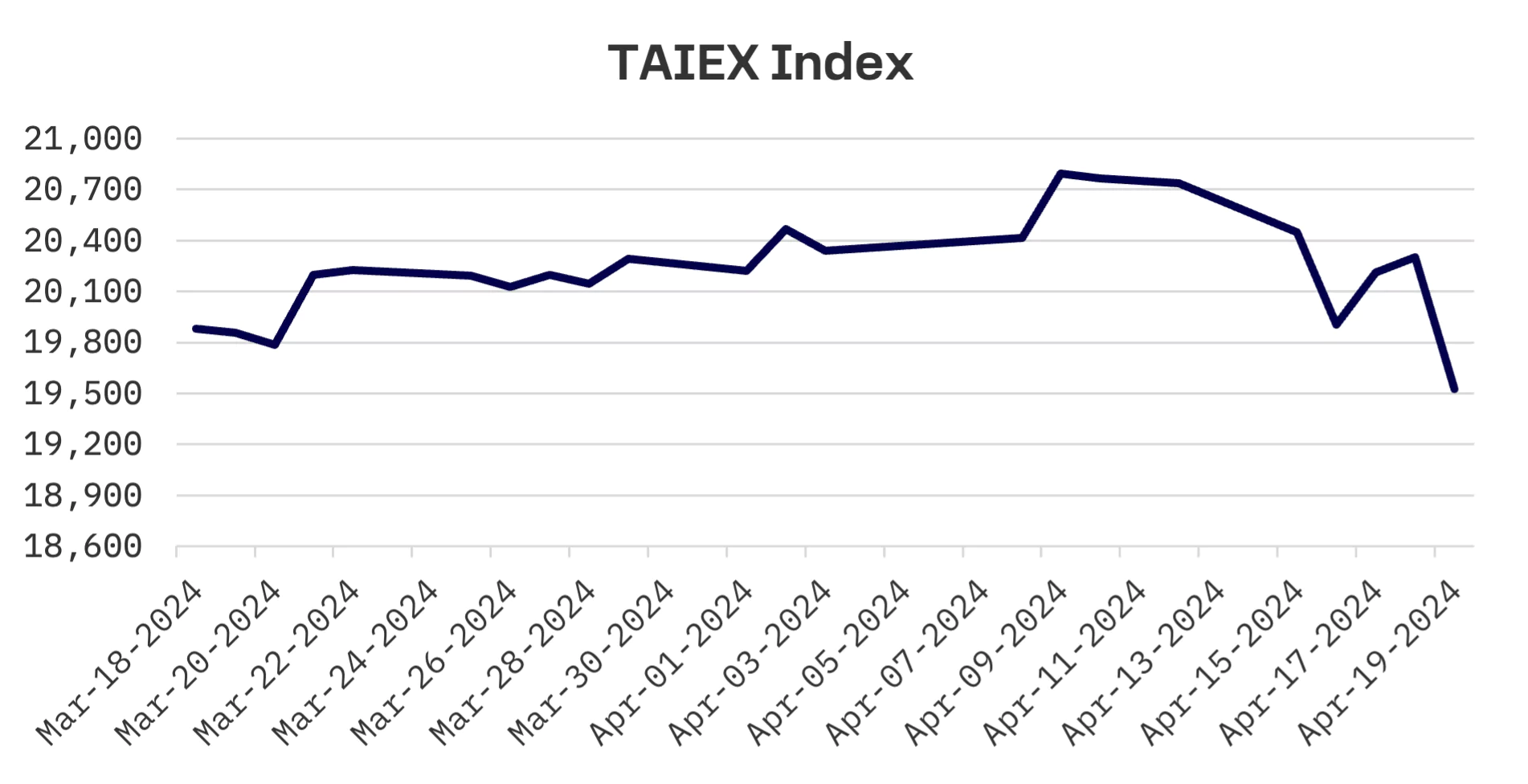

Taiwan

Taiwan’s stock market also saw significant losses this week, with the TAIEX index dropping 5.8%. The sell-off was fuelled by the same concerns affecting other JAKOTA markets: heightened Middle East tensions and ongoing inflation pressures that might delay U.S. interest rate cuts.

On a brighter note, Taiwan Semiconductor (TSMC) reported a nearly 9% increase in net profit for the first quarter year-over-year, thanks to record-breaking sales. This positive development led to a brief market rebound on Thursday. However, the market’s initial gains were lost, culminating in a record single-day drop on Friday.

JAKOTA Blue Chip 150 Index

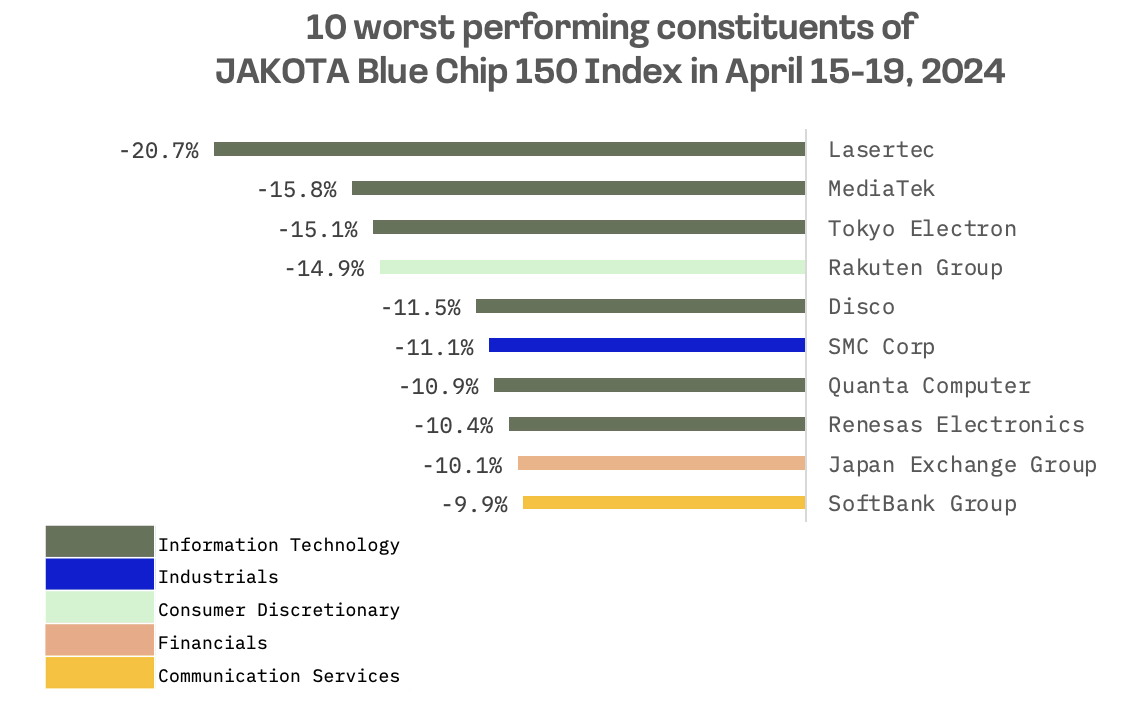

Not surprisingly, the JAKOTA Blue Chip 150 Index suffered a sharp 6% decline over the week. Of its 150 constituents, an unprecedented 138 stocks showed negative price trends.

Coupang, a South Korean e-commerce company, remained the top performer in the index for the second consecutive week, with its stock price rising by 3.6%. This increase was supported by the announcement of a price hike for its Wow paid membership service, which continued to drive positive momentum. Coupang is unique among the JAKOTA Blue Chip companies with its primary listing outside Japan, South Korea or Taiwan.

Semiconductor leaders Lasertec, MediaTek and Tokyo Electron were among the week’s weakest performers, impacted by diminishing demand in the AI sector and a general market sell-off.