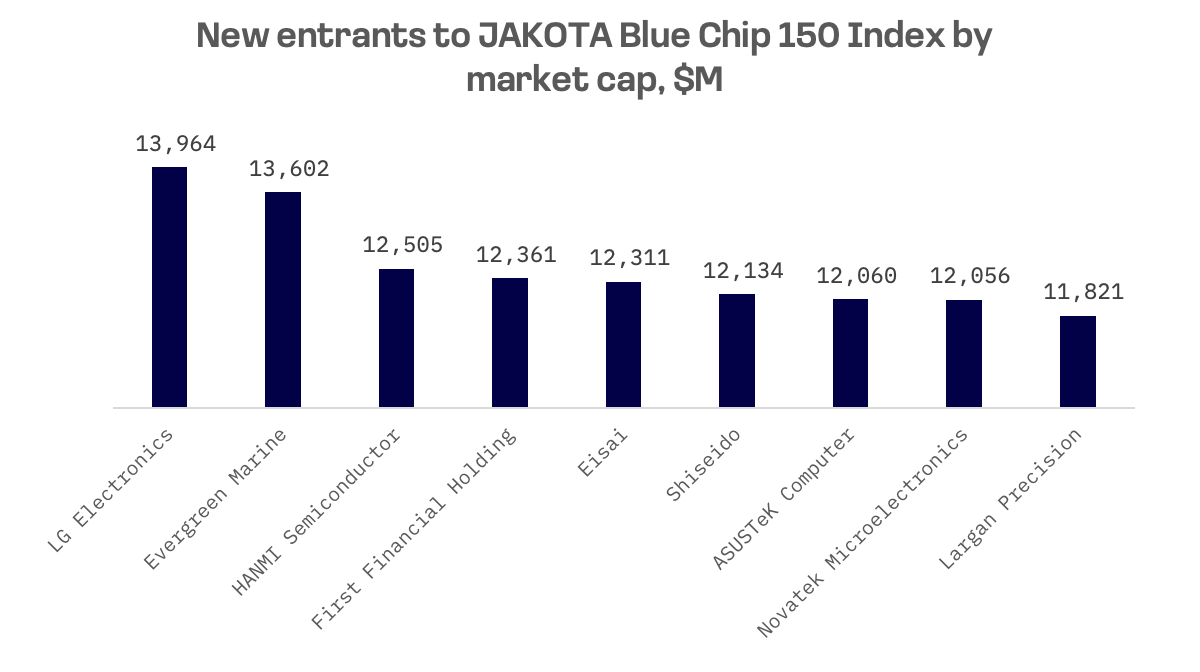

| Entrants | Leavers | ||

| LG Electronics | Shionogi | ||

| Evergreen Marine | Formosa Plastics | ||

| HANMI Semiconductor | Nitto Denko | ||

| First Financial Holding | Kirin Holdings | ||

| Eisai | Ecopro | ||

| Shiseido | SCREEN Holdings | ||

| ASUSTeK Computer | Kikkoman | ||

| Novatek Microelectronics | Rakuten Group | ||

| Largan Precision | China Steel |

Six of these firms are returning after exiting in the previous quarter:

- Eisai (4523.TSE), a Japanese pharmaceutical company focused on prescription medicines.

- LG Electronics (066570.KO), a South Korean multinational major appliance and consumer electronics corporation.

- Largan Precision (3008.TW), a Taiwan-based company principally engaged in design and production of various types of optical lens modules and optoelectronic components.

- Shiseido (4911.TSE), a Japanese pharmaceutical company, which develops cosmetics and health care products.

- ASUSTeK Computer (2357.TW), a Taiwanese manufacturer of computer hardware and electronics products.

- First Financial Holding (2892.TW), a Taiwan-based holding company, offering a range of financial services including banking, bancassurance, securities, asset management, venture capital, and financial consulting.

Three newcomers complete the list:

- HANMI Semiconductor (042700.KO), a South Korean manufacturer of chip-cutting and inspection equipment.

- Evergreen Marine (2603.TW), a Taiwanese container shipping company.

- Novatek Microelectronics (3034.TW), a Taiwan-based manufacturer of electronic components with focus on flat-panel display drive wafers and system-on-chip (SOC) wafers.

Taiwan dominates the new entries with five companies, reflecting the strong performance of its stock market in early 2024. In terms of sector distribution, the semiconductor industry is well-represented, buoyed by growing demand from AI expansion.

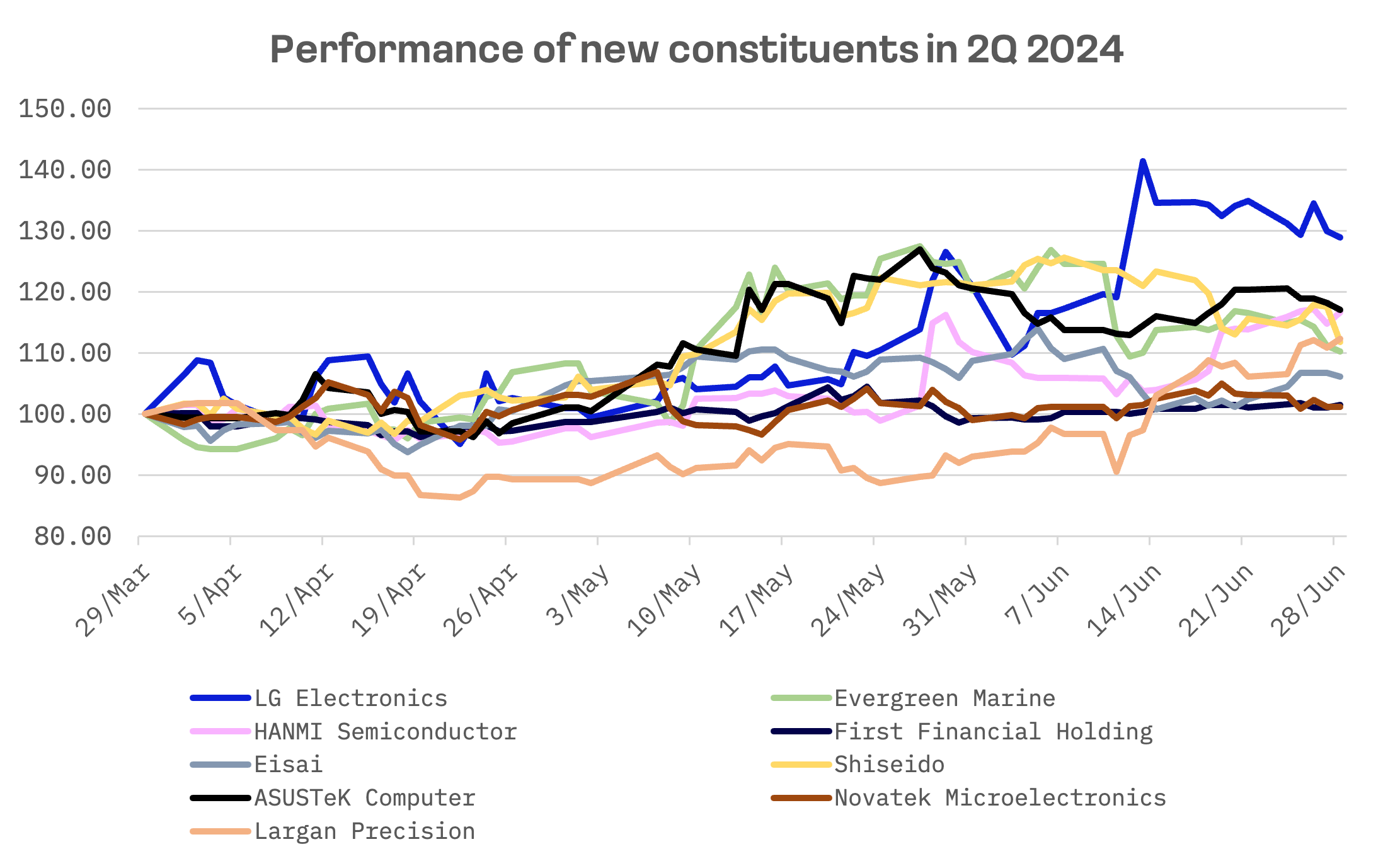

New index constituents saw an average share price growth of 12% in the second quarter. LG Electronics stood out with a 29% increase as it expands into AI markets. Foreign ownership of LG Electronics exceeded 31% in May, a level not seen in nearly three years.

HANMI Semiconductor emerged as the priciest stock among the new entrants, bolstered by strong demand for its AI-related chipmaking equipment and stock purchases by its CEO.

| Company | EV/Total Revenues | EV/EBITDA | P/E |

| LG Electronics | 0.3x | 4.38x | 27.00x |

| Evergreen Marine | 1.21x | 3.28x | 8.62x |

| HANMI Semiconductor | 76.03x | 59.15x | 79.24x |

| First Financial Holding | 7.27x | N/A | 16.93x |

| Eisai | 2.34x | 16.74x | 44.37x |

| Shiseido | 2.12x | 20.99x | 189.42x |

| ASUSTeK Computer | 0.61x | 8.78x | 15.51x |

| Novatek Microelectronics | 2.88x | 10.78x | 8.63x |

| Largan Precision | 4.50x | 7.37x | 17.36x |

| MEAN | 10.81x | 16.43x | 45.23x |

| MEDIAN | 2.34x | 9.78x | 17.36x |