This report expands on last year’s publication, tracking foreign investment trends across Jakota stock markets.

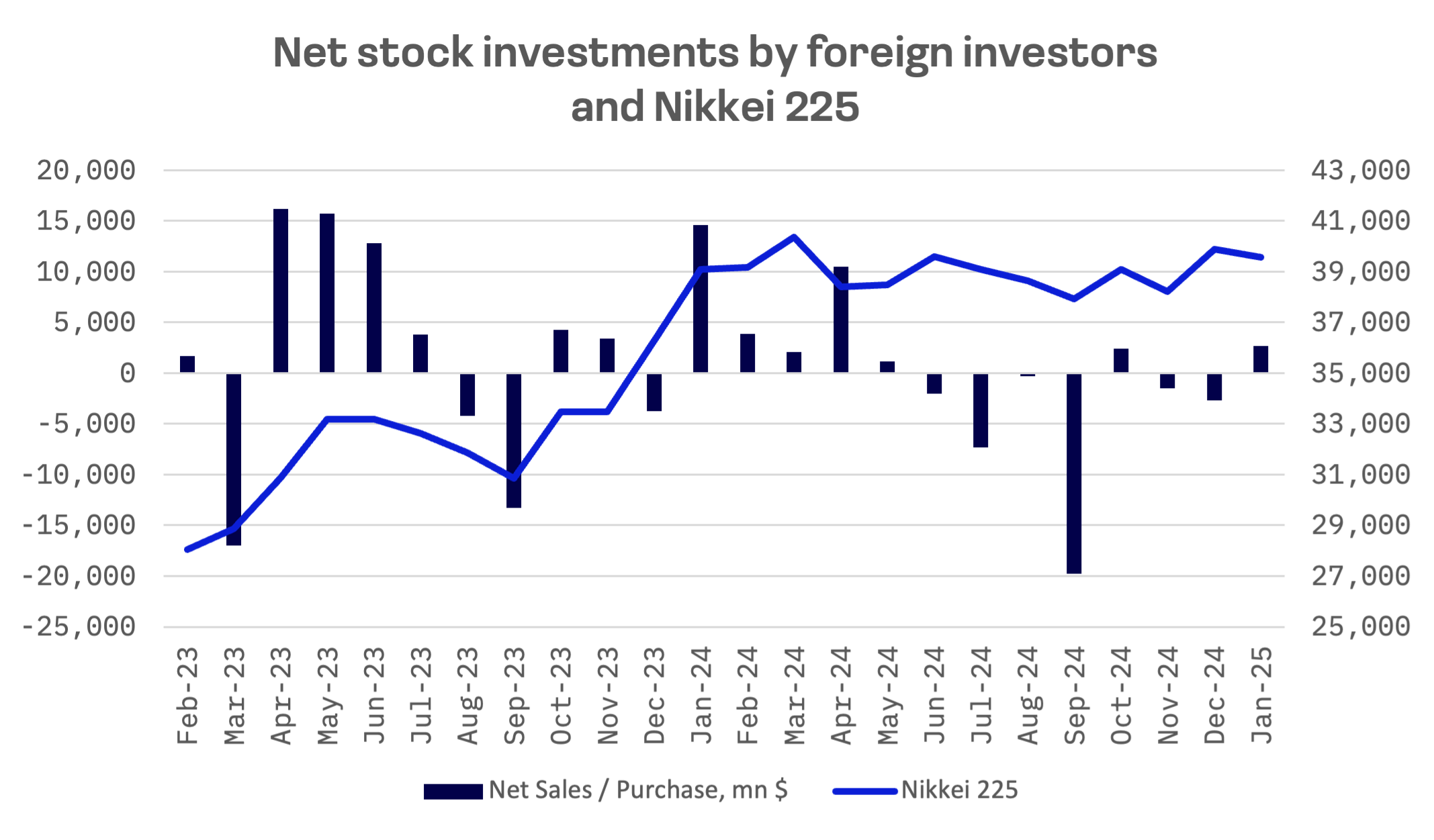

Japan

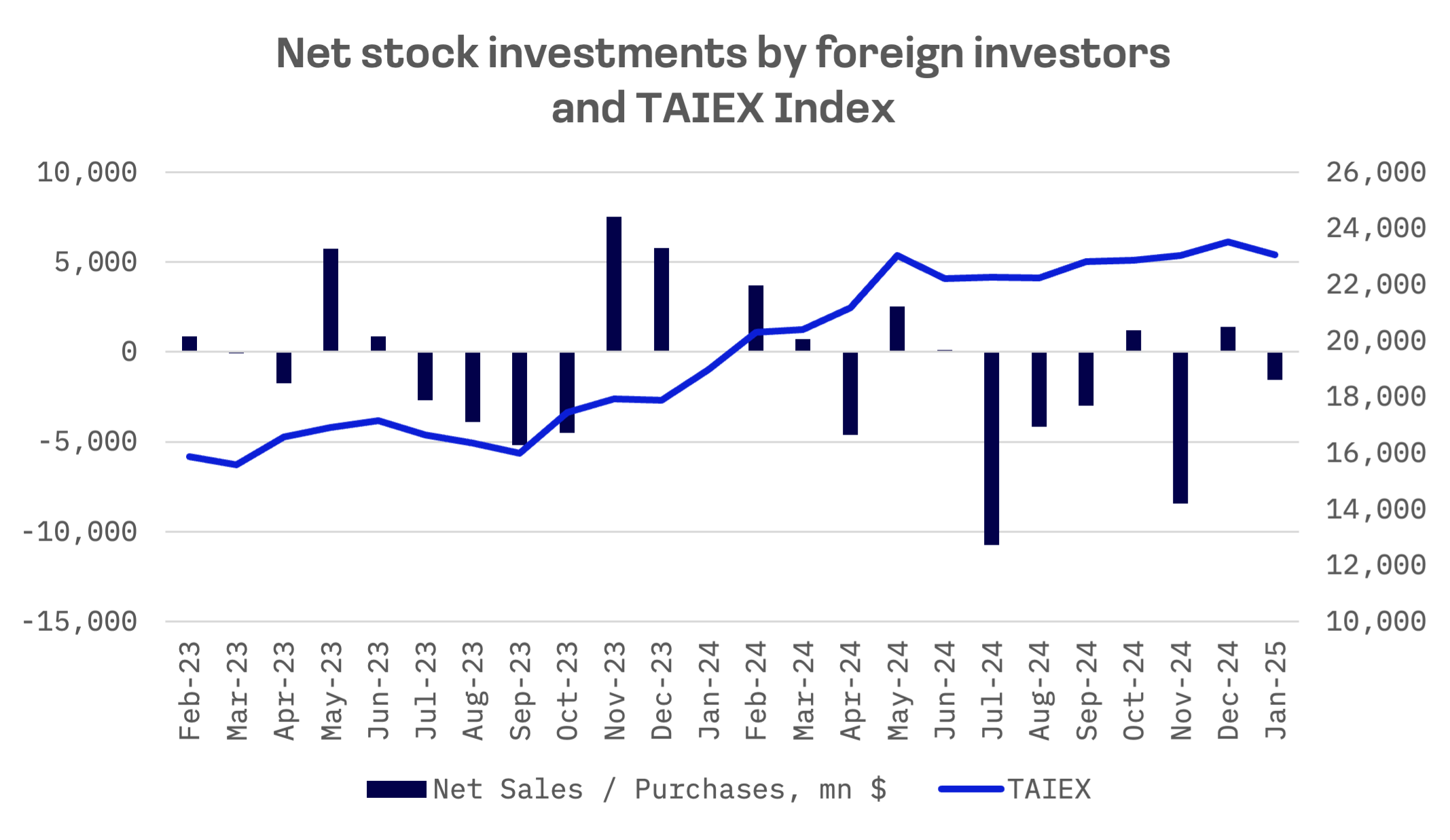

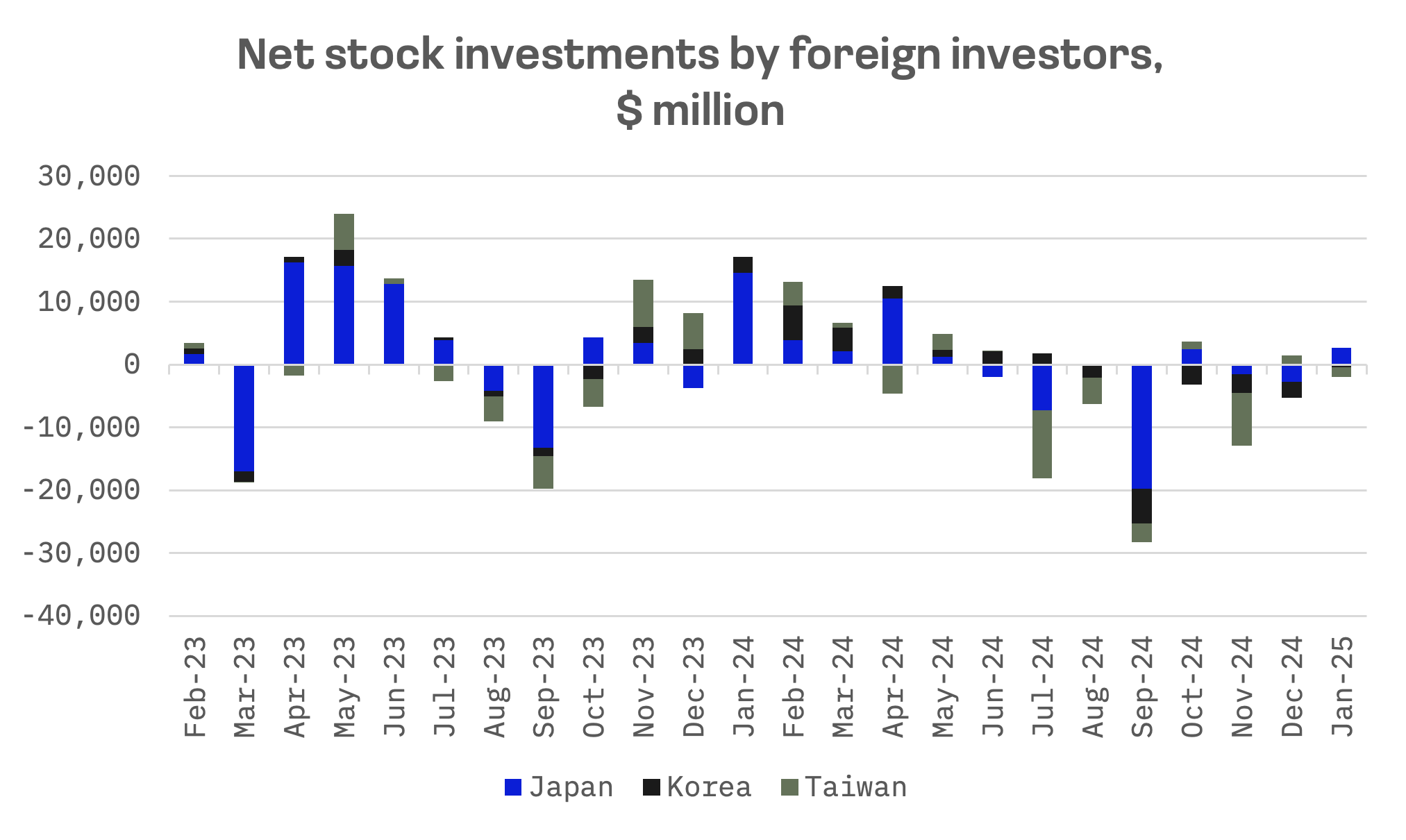

Foreign investment in Japan has dramatically reversed course: between February 2024 and January 2025, net sales have nearly reached $11 billion, a sharp reversal from the previous period, when net purchases of Japanese shares exceeded $34 billion.

September 2024 saw particularly aggressive selling as investors grew anxious ahead of the Bank of Japan (BoJ)’s monetary policy announcements.

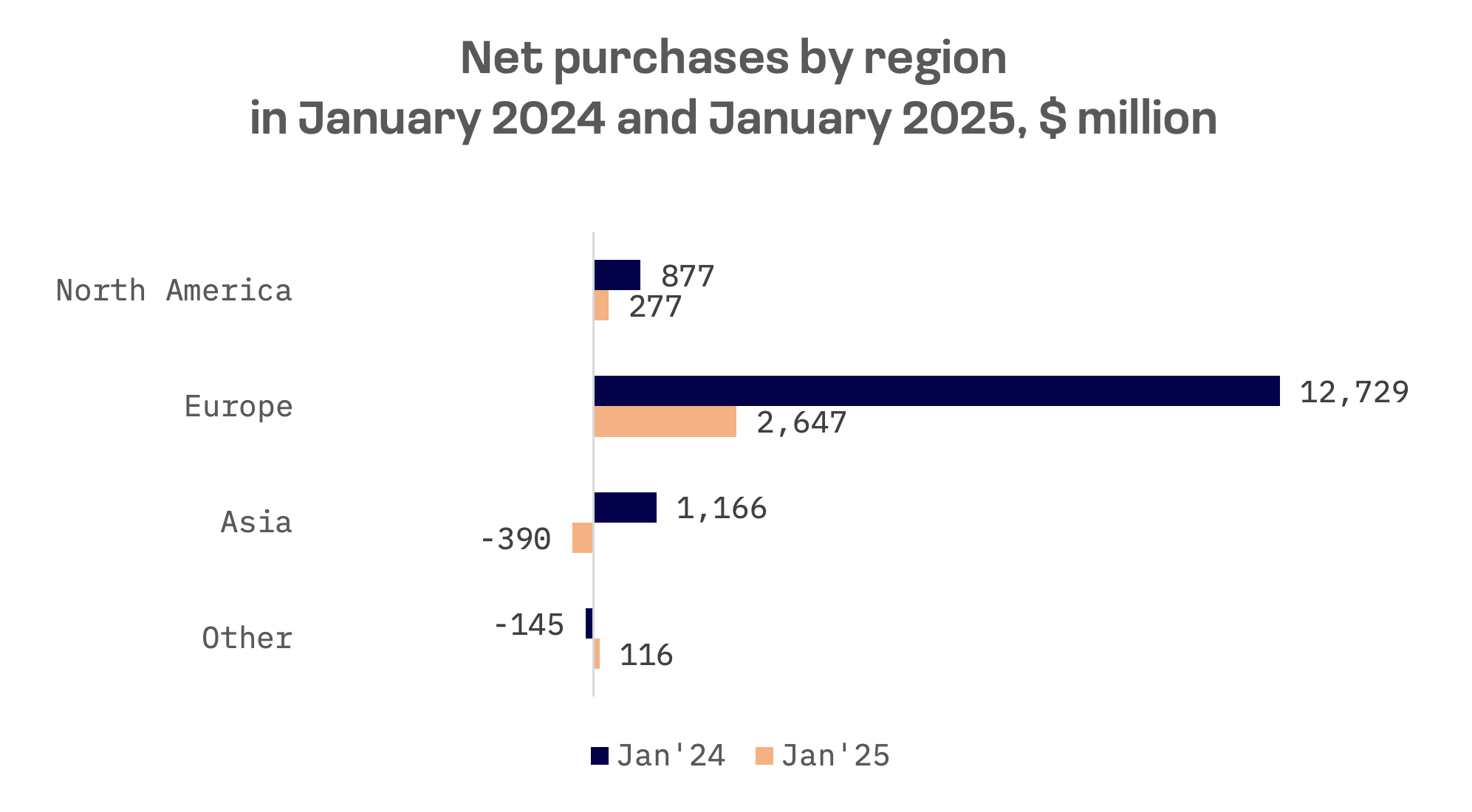

Europe had the largest net purchases in both years but saw a substantial decline, alongside North America and Asia, which even turned into net sales.

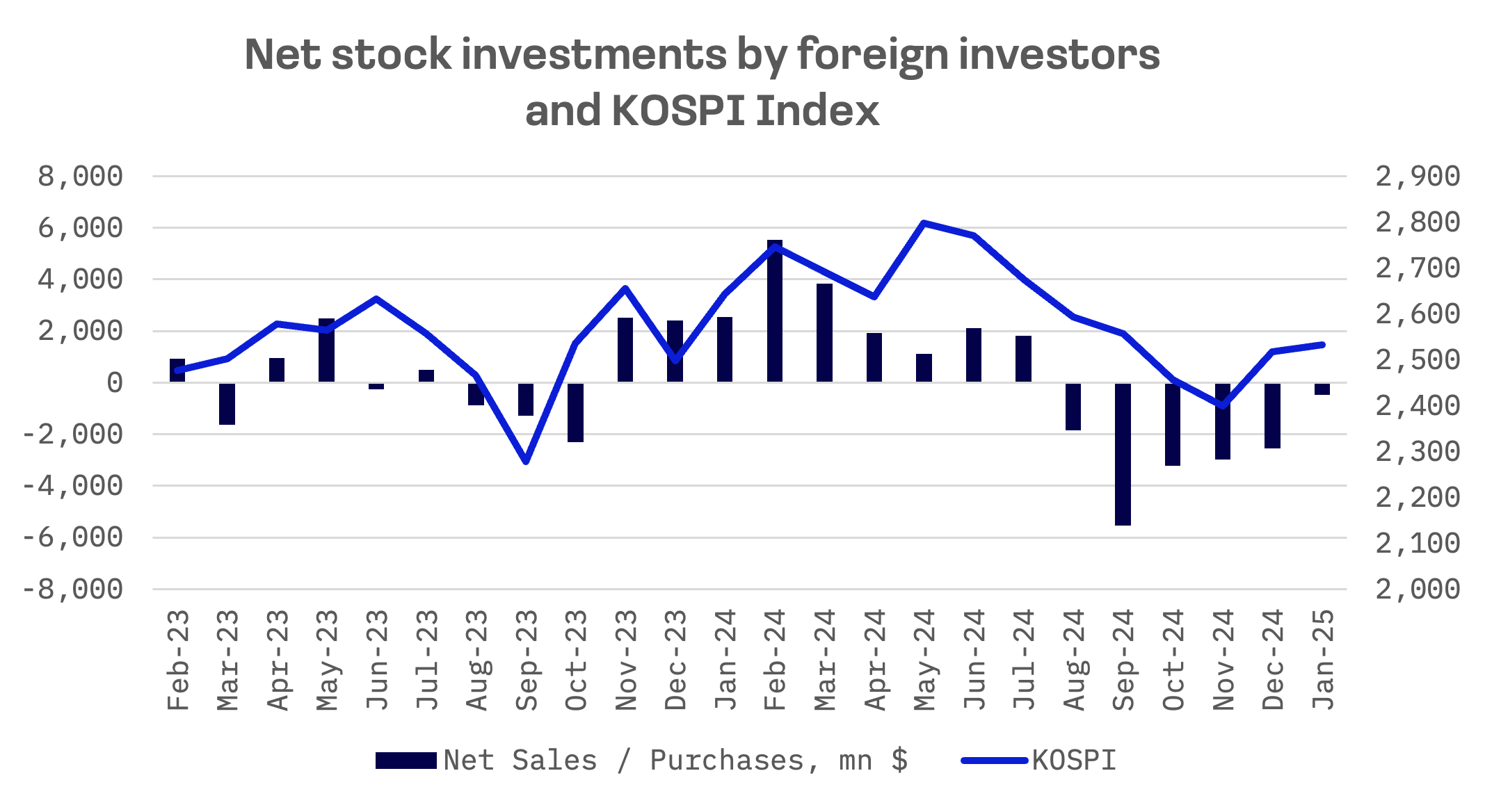

South Korea

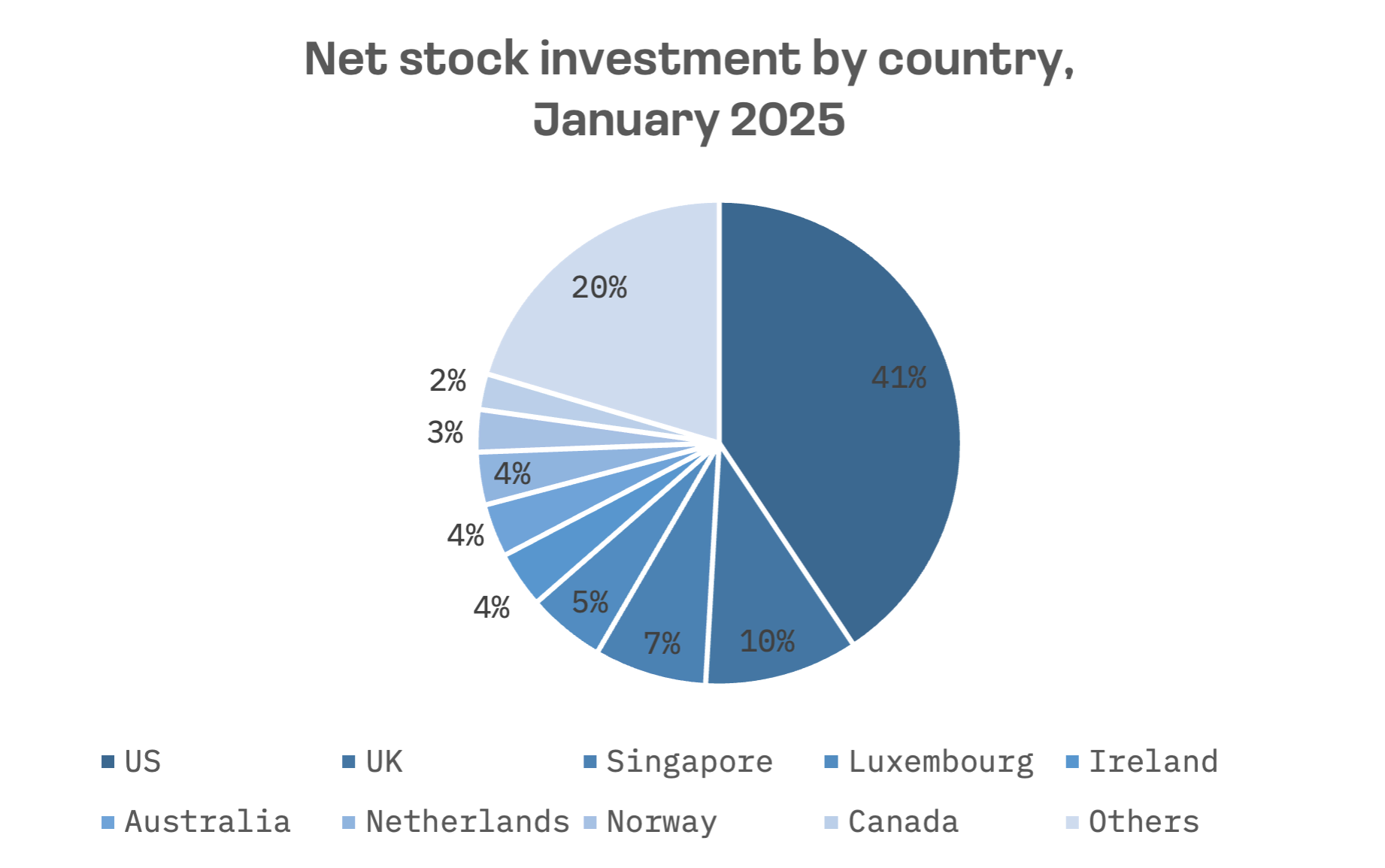

Foreign investors withdrew $0.7 billion from South Korean equities between February 2024 and January 2025, marking a stark turnaround from the $6 billion in net purchases during the previous 12 month period. The selloff has persisted since August 2024, driven by a combination of global economic uncertainties, interest rate fluctuations and geopolitical tensions.

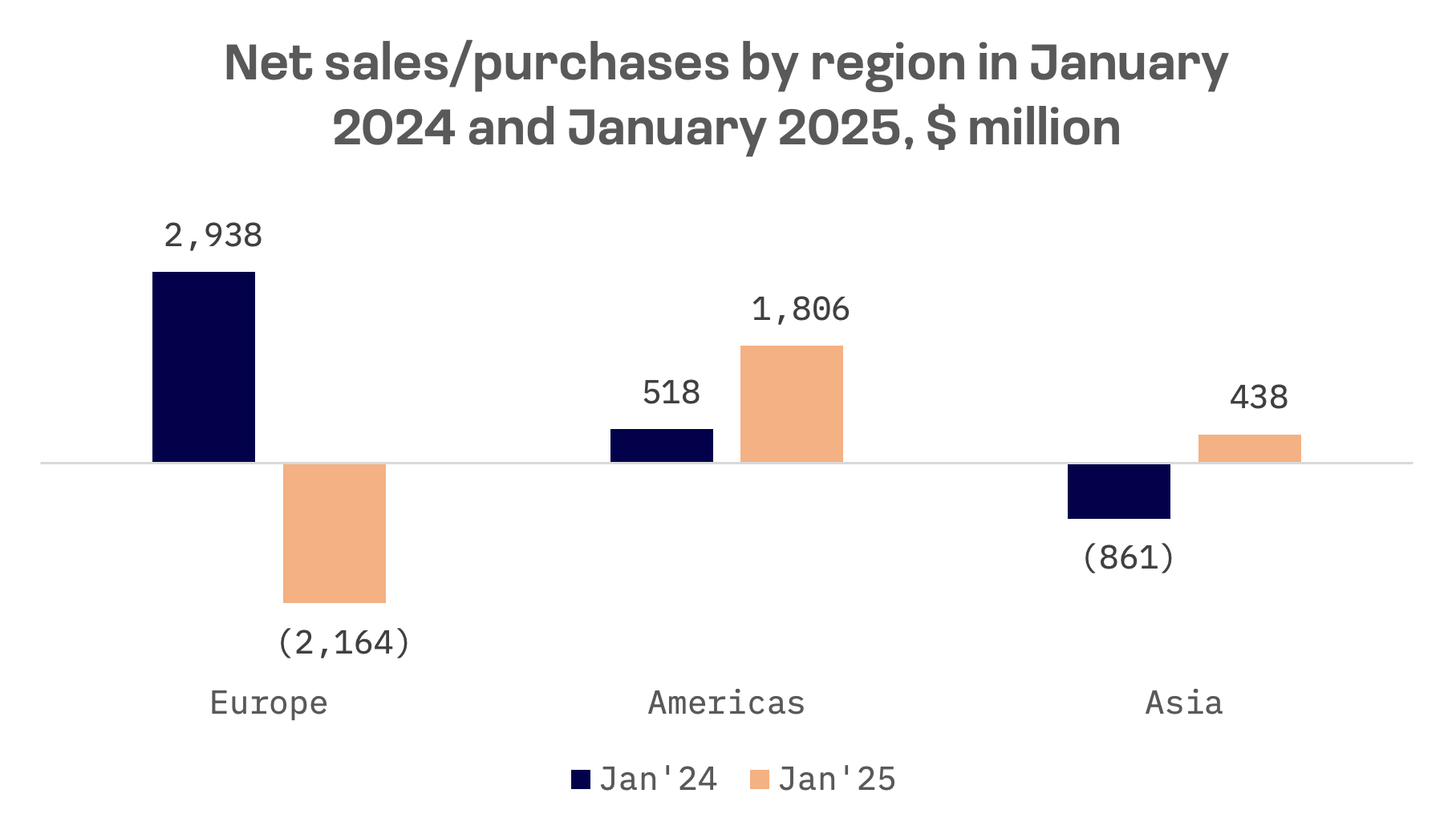

Though U.S. investors continue to dominate Korean equity holdings, January 2025 revealed pronounced shifts in regional investment patterns compared with the previous year. European investors executed a notable reversal, moving from net purchases of $2.94 billion in January 2024 to net sales of $2.16 billion in January 2025. Simultaneously, net purchases from the Americas more than tripled year-over-year.

Taiwan

Taiwan experienced the most substantial outflows, with foreign investors divesting $22.8 billion worth of Taiwanese shares over the 12 months ending January 2025 – a figure exceeding the combined net sales in Japan and South Korea. This represents a complete turnaround from the $2.6 billion in net purchases recorded during the preceding 12 month period.

Market Drivers

Foreign investors withdrew capital from all Jakota markets from February 2024 to January 2025, influenced by currency considerations, geopolitical developments and sector specific challenges.

Japan:

- Yen Appreciation Concerns: Investors worry that a strengthening yen will diminish returns upon repatriation.

South Korea:

- Higher U.S. Yields: The increasing attractiveness of U.S. Treasury yields has undermined the appeal of Korean equities.

- Political Uncertainty: South Korea weathered political instability in December 2024 when President Yoon Suk Yeol declared, then swiftly rescinded, martial law.

Taiwan:

- Tech Sector Volatility: Taiwan’s equity market, heavily concentrated in technology, suffered substantial outflows amid a global tech selloff.