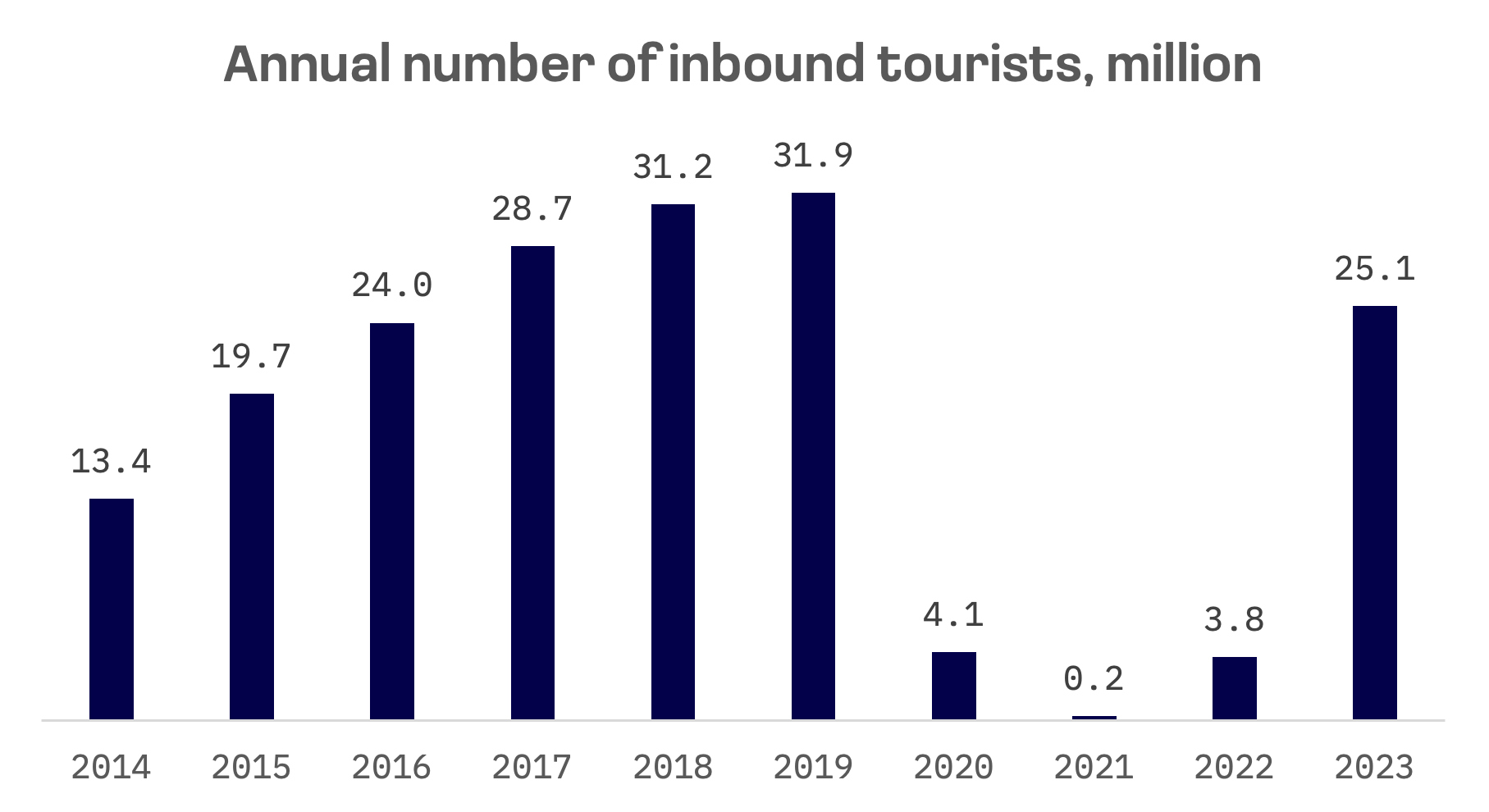

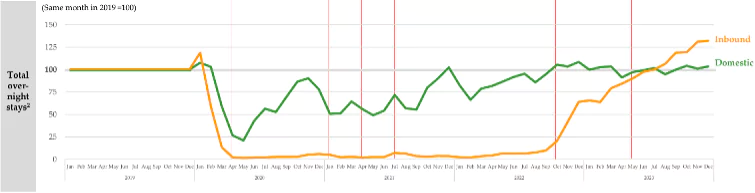

In 2023, Japan welcomed a record 25 million visitors, marking the highest tourism influx since 2019. This surge was largely fuelled by the yen’s depreciation, which significantly bolstered the nation’s economy by making it a more appealing destination for post-pandemic travelers.

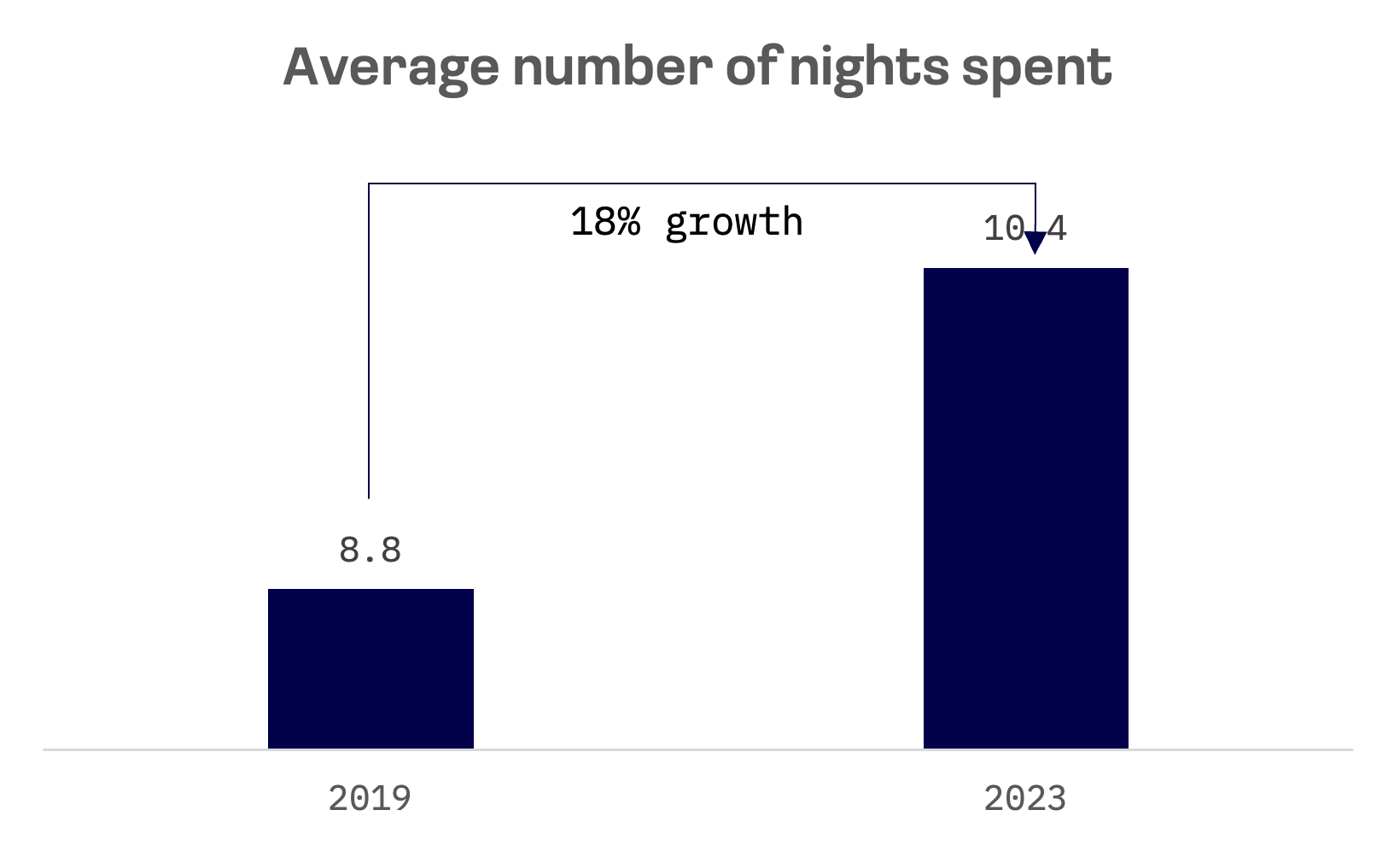

The duration of stays also saw an increase, with the average number of nights rising 18% from 2019 to 10.4 nights.

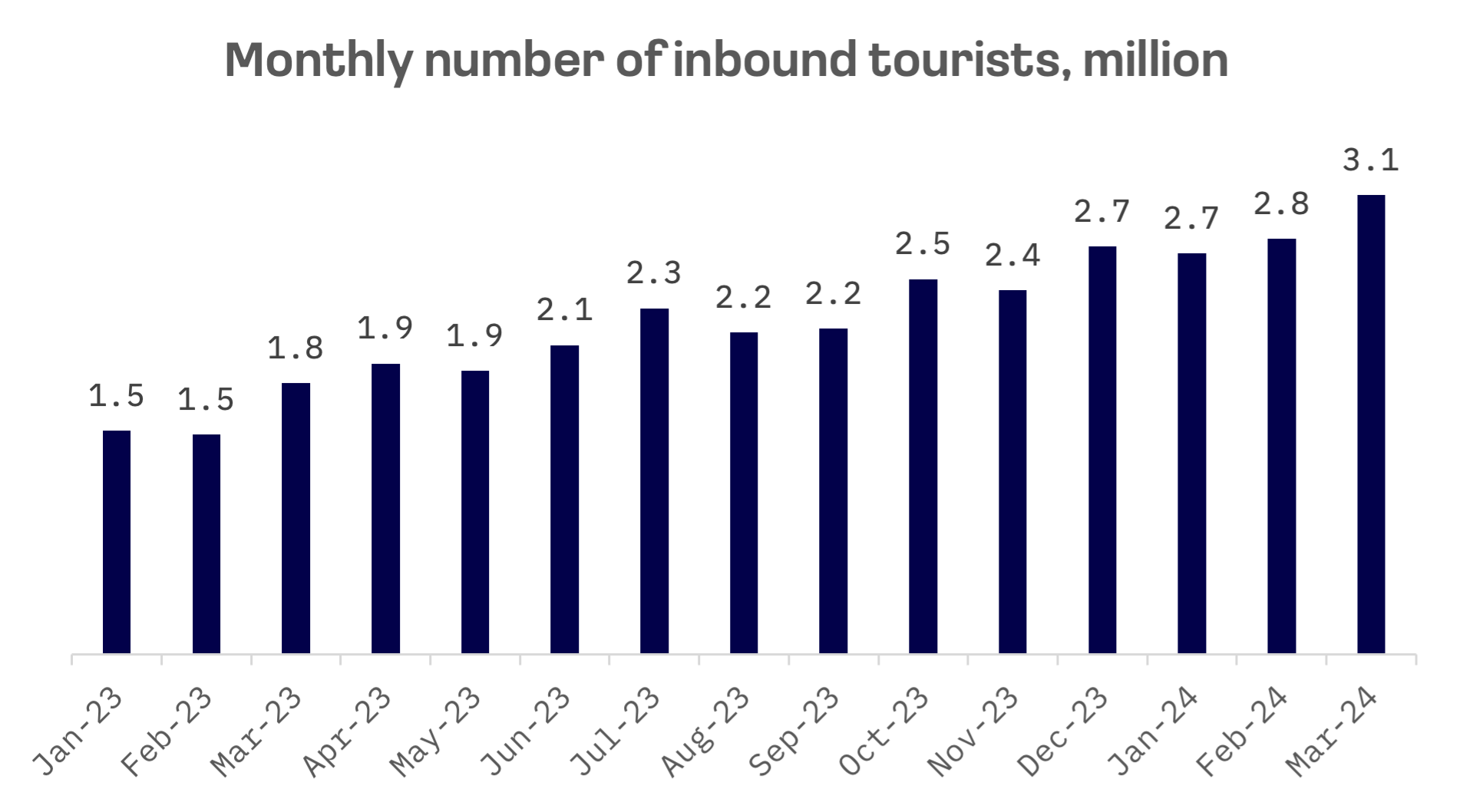

March 2024 set a historic milestone by exceeding three million foreign visitors in a single month — a first for Japan.

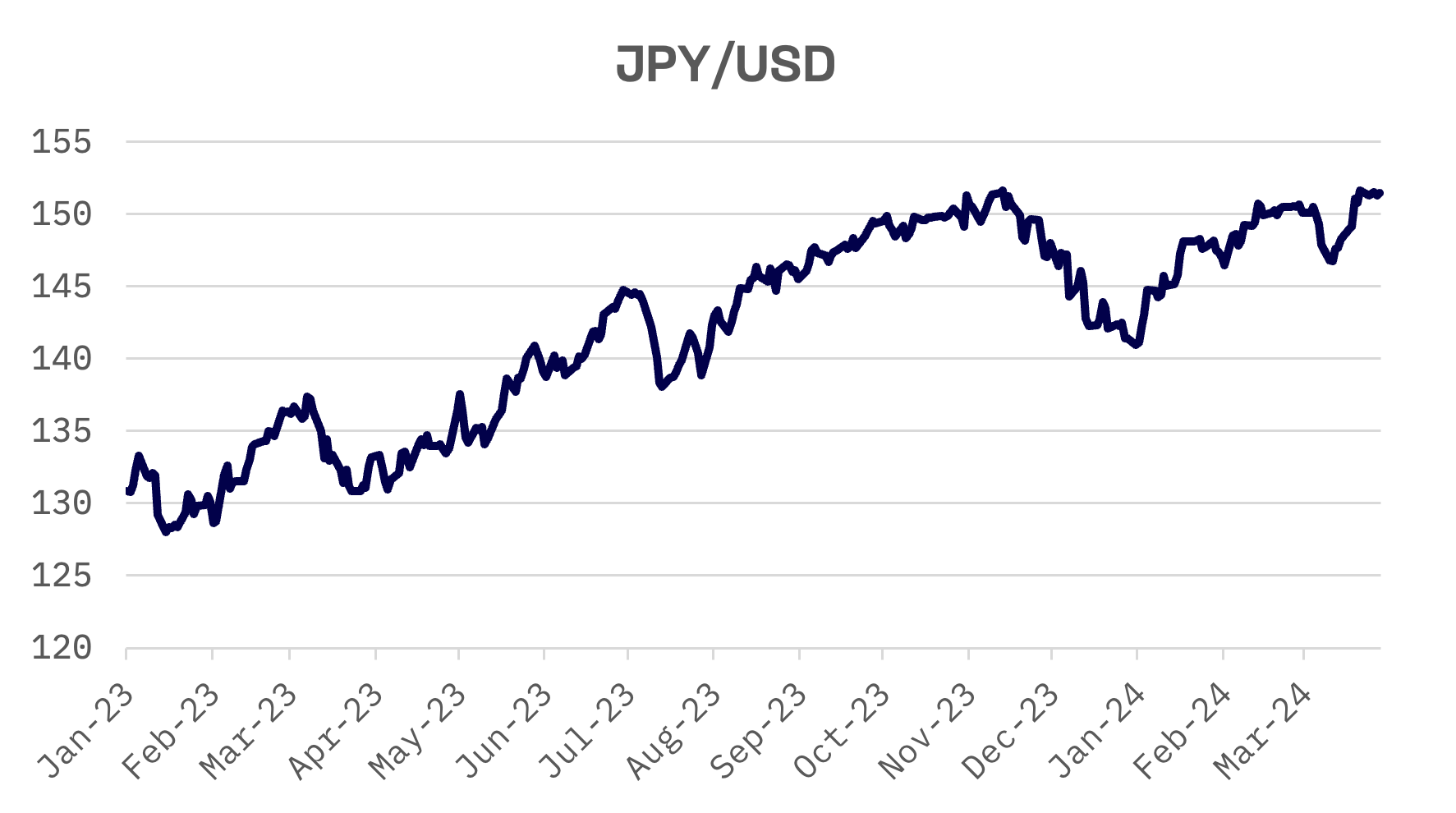

The weaker yen, averaging about ¥140.5 against the dollar last year, has substantially enhanced tourists’ purchasing power.

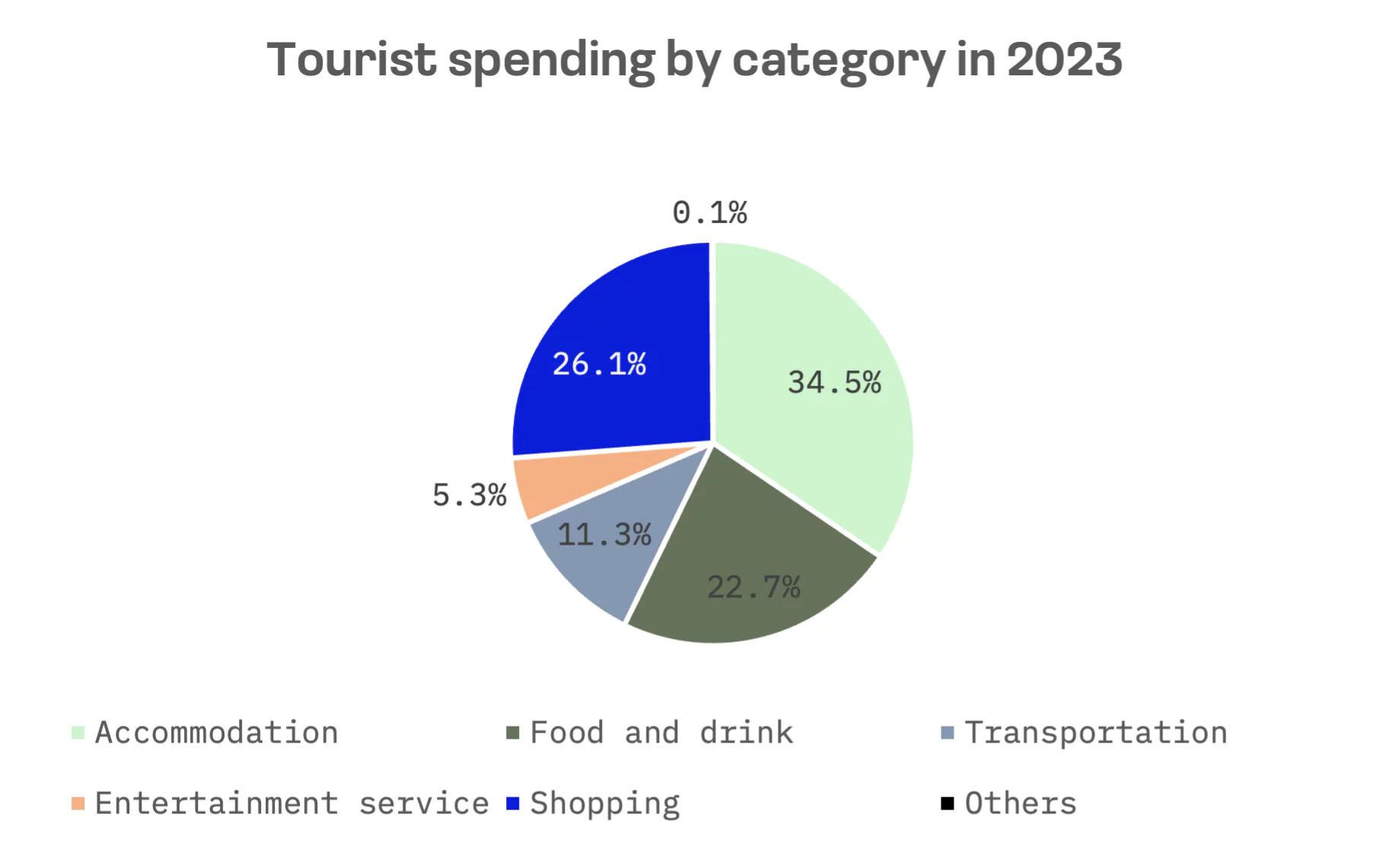

In 2023, spending by visitors skyrocketed to a record ¥5.3 trillion ($35.9 billion), up nearly 10% from pre-pandemic levels in 2019. Per capita spending also surged by almost 34% to ¥212,000, according to the Japan Tourism Agency. The fourth quarter of 2023 alone witnessed a 21% increase in visitor spending from the preceding quarter, underscoring a robust contribution to the economy, particularly as domestic demand waned due to elevated prices.

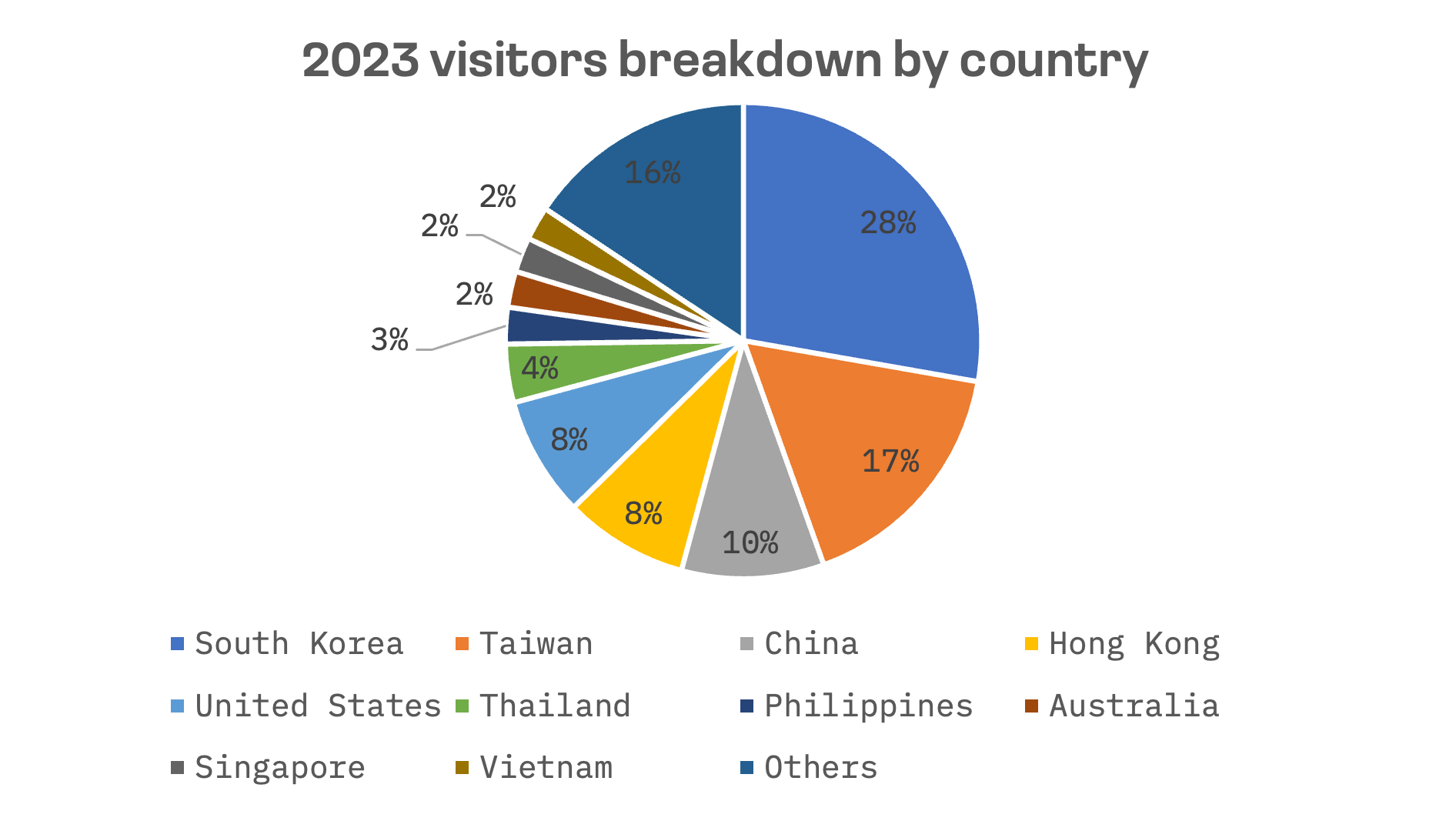

However, the total annual number of visitors still trails the 32 million recorded in 2019. The rebound in tourists from China — formerly the largest and most lavish spending group — remains subdued, with only 2.4 million visitors compared to 9.6 million in 2019, despite the lifting of Beijing’s ban on tour groups to Japan.

South Korea and Taiwan led in tourist numbers in 2023, contributing 7 million and 4 million visitors, respectively. Additionally, the number of tourists from Singapore and the United States exceeded pre-pandemic levels

Projections by the Japan Tourism Agency anticipate 2024 will surpass 2019’s visitor counts. Furthermore, a July 2023 survey by the Development Bank of Japan and Japan Travel Bureau Foundation found Japan to be the most favored upcoming travel destination among residents of Asia, Europe, the U.S. and Australia. Reflecting this optimism, the Japanese government targets attracting 60 million visitors by 2030, aiming for ¥15 trillion in tourist spending, according to the Ministry of Economy, Trade and Industry. In 2023, travel spending reached ¥5.3 trillion.

Tourists primarily spend on accommodation, which accounts for nearly 35% of their total expenditures, while food and drink, combined with lodging, account for 57.2%.

Japan’s tourism boom has notably benefited the hospitality sector, particularly visible among the leading public companies in the Japanese hotel industry. The market features a limited number of large players, with only two companies boasting a market capitalization exceeding $2 billion:

- Invincible Investment, a real estate investment trust (REIT) that focuses primarily on hotel assets, has 134 properties, including 92 hotels.

- Japan Hotel REIT Investment (JHR) also specializes in hotels with a total of 47 properties.

| Company Name | Ticker | Market Cap, USD | JAKOTA Index |

| Invincible Investment | 8963.TSE | 3.1B | n/a |

| Japan Hotel REIT Investment | 8985.TSE | 2.5B | n/a |

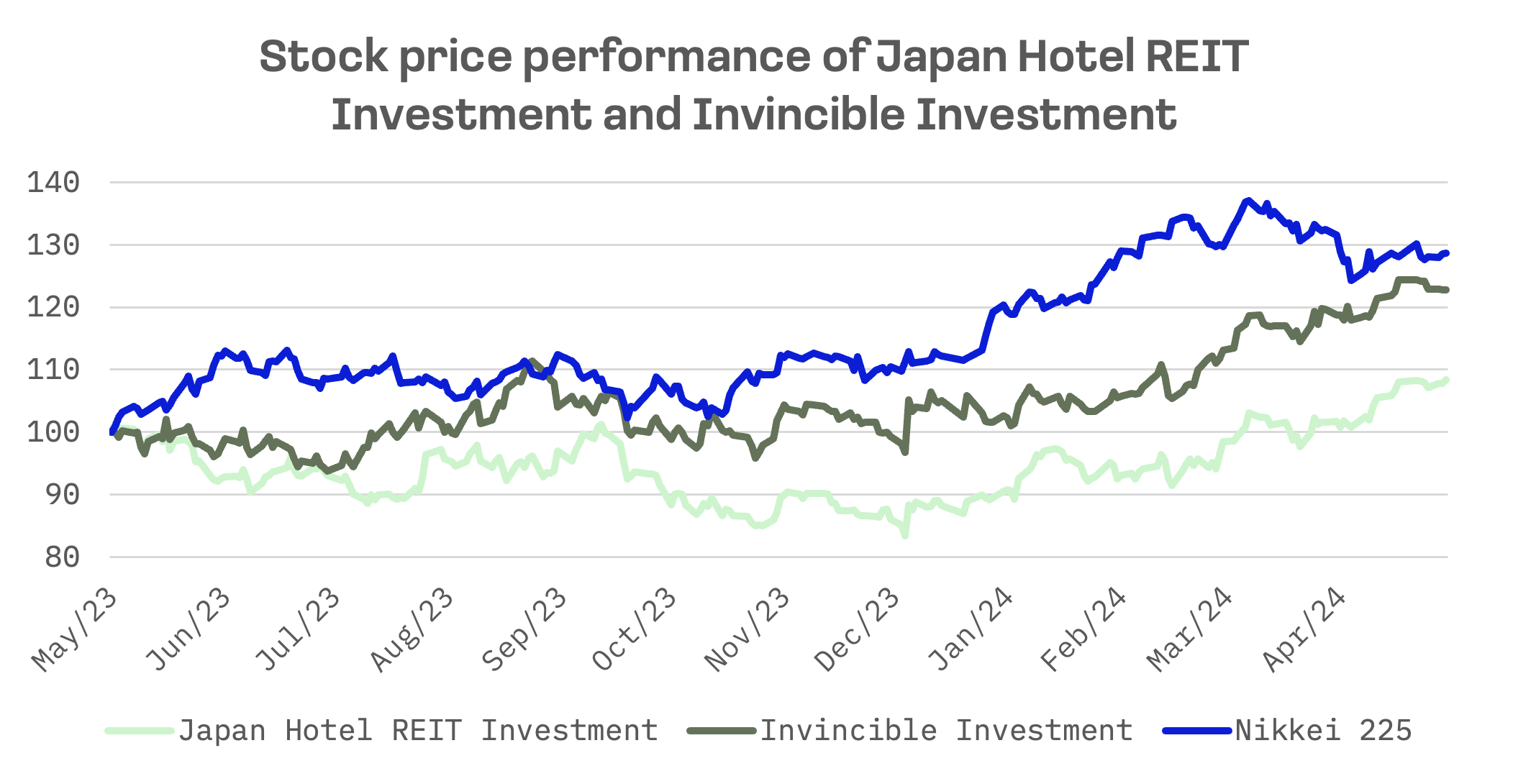

Despite positive stock performance over the past 12 months, neither company has managed to outperform the Nikkei 225 index.

Based on the EV/Sales and EV/EBITDA ratios, Invincible Investment is valued substantially higher than Japan Hotel REIT Investment.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Invincible Investment | 34.4x | 50.8x | 23.0x |

| Japan Hotel REIT Investment | 20.4x | 36.2x | 29.8x |

Over the past year, shares of Invincible Investment have risen nearly 23%. The company has seen a marked recovery in the number of inbound overnight stays, which had previously stagnated due to the pandemic. According to the company’s statement, by December 2023, the number of overnight stays had increased by 32% compared to December 2019. This rebound was largely facilitated by the easing of border controls and boosted by the yen’s depreciation, among other factors.

In August 2023, Invincible Investment acquired six hotels for a total of ¥57.2 billion ($400 million) from affiliates of the trust’s sponsor, US asset manager Fortress Investment Group. The largest of the six properties, Fusaki Beach Resort Hotel & Villas, is located on Okinawa’s Ishigaki Island, while the rest are in Nagano, Okayama, Aomori, Chiba and Akita on the main island of Honshu. Acquired six domestic hotels achieved a simulated 6.0% NOI yield.

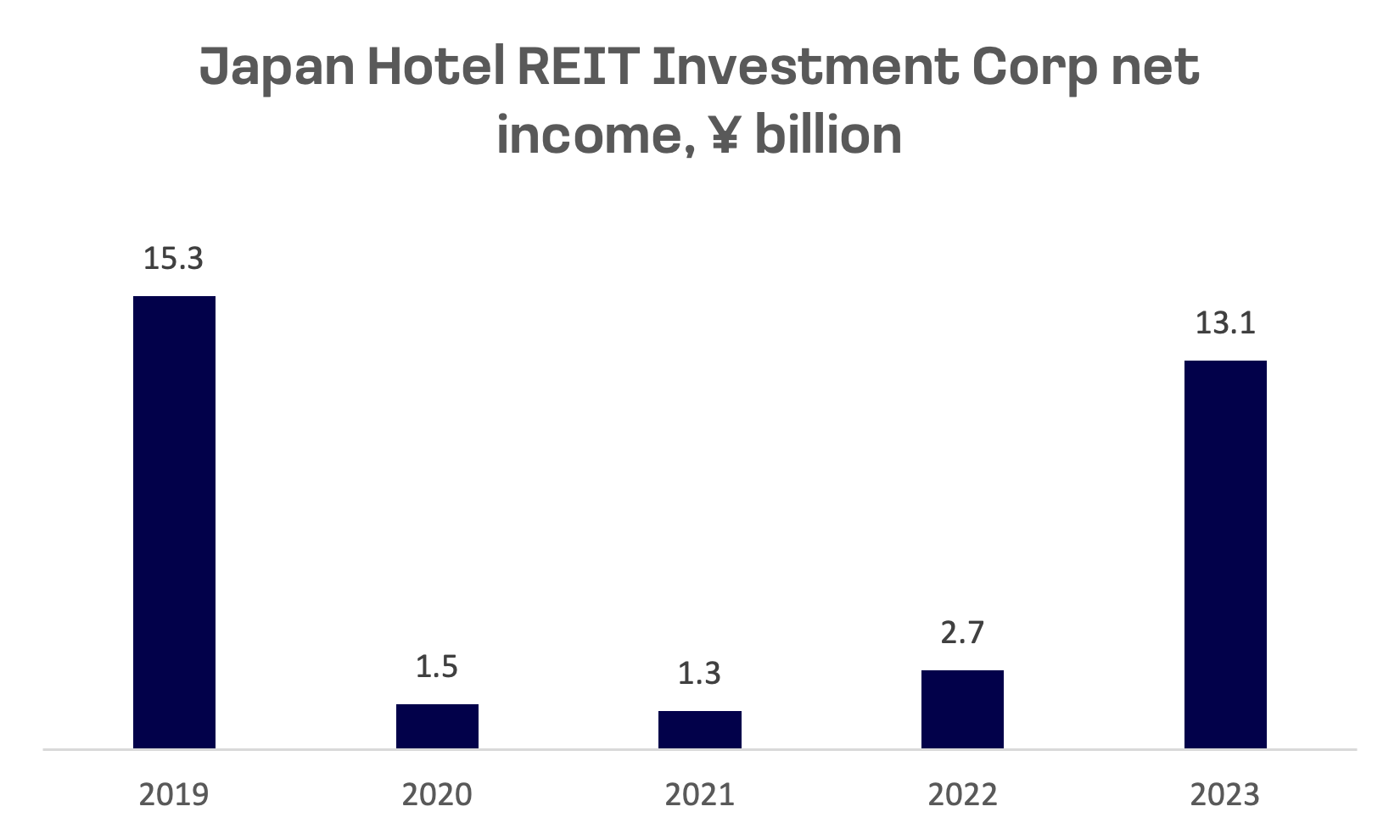

Japan Hotel REIT Investment Corp also had a prosperous 2023, with operating revenues increasing to ¥26.6 billion from ¥14.9 billion, and net income rising nearly fivefold.

In 2023, as demand in the hospitality sector began to recover, Japan Hotel REIT Investment Corporation was notably active in the M&A market. In mid-2023, the company acquired three properties across Japan for ¥18.9 billion: La’gent Stay Sapporo Odori, Oriental Hotel Kyoto Rokujo and Hotel Oriental Express Fukuoka. Further expanding its portfolio, in December 2023, Japan Hotel REIT also completed the acquisition of a 170-room property in central Yokohama for ¥4 billion.

With strong inbound tourism forecasts for 2024 and encouraging early visitor statistics, both companies are positioned for robust financial results this year.