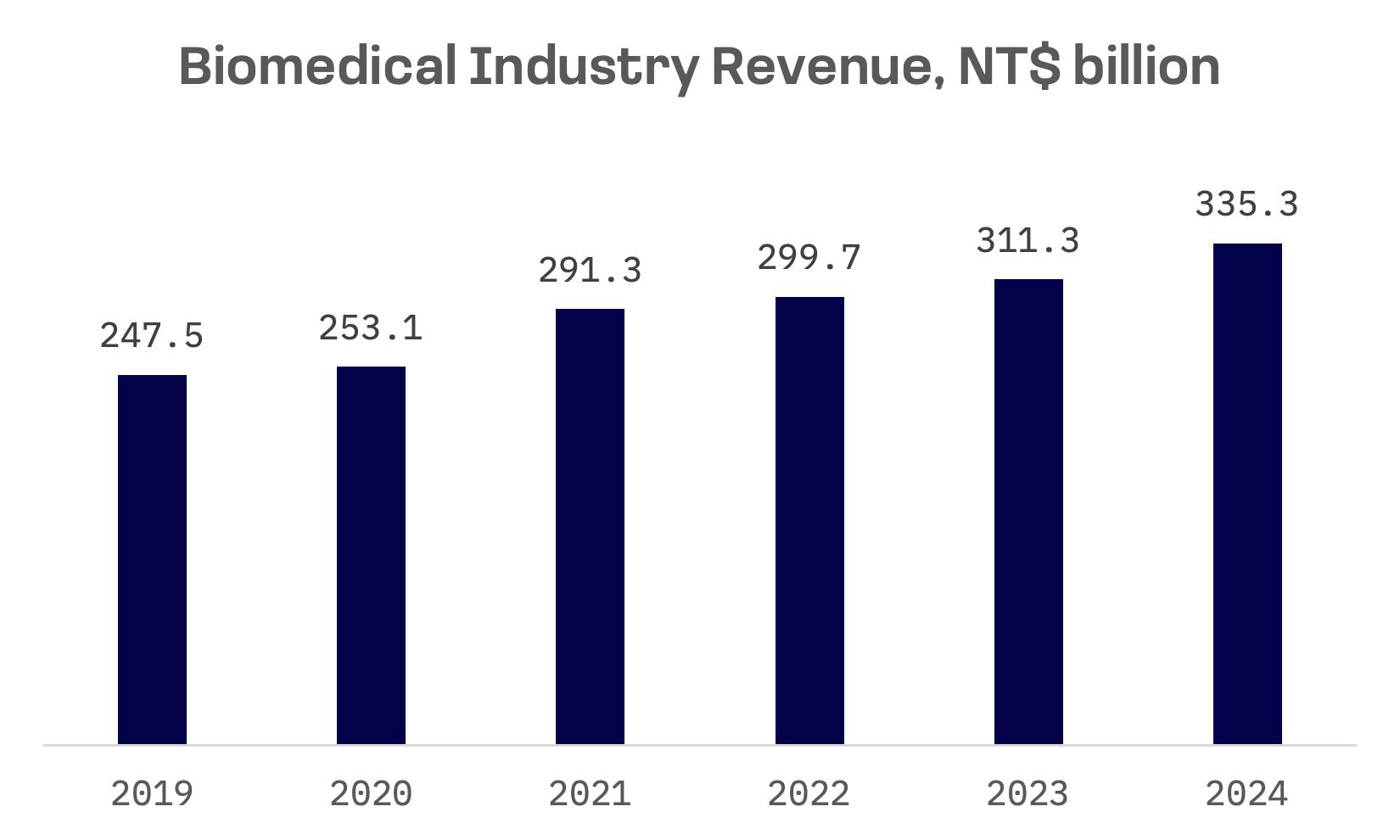

Taiwan’s biomedical sector has sustained steady growth since 2018, according to data from the Institute for Biotechnology and Medicine Industry (IBMI). The sector continued its upward trajectory in 2024, with total revenue reaching NT$335 billion ($10.8 billion), a 7.7% increase from the previous year. The number of listed companies in Taiwan’s biotech and medical sectors rose to 236 in 2024, up by 12 from the previous year.

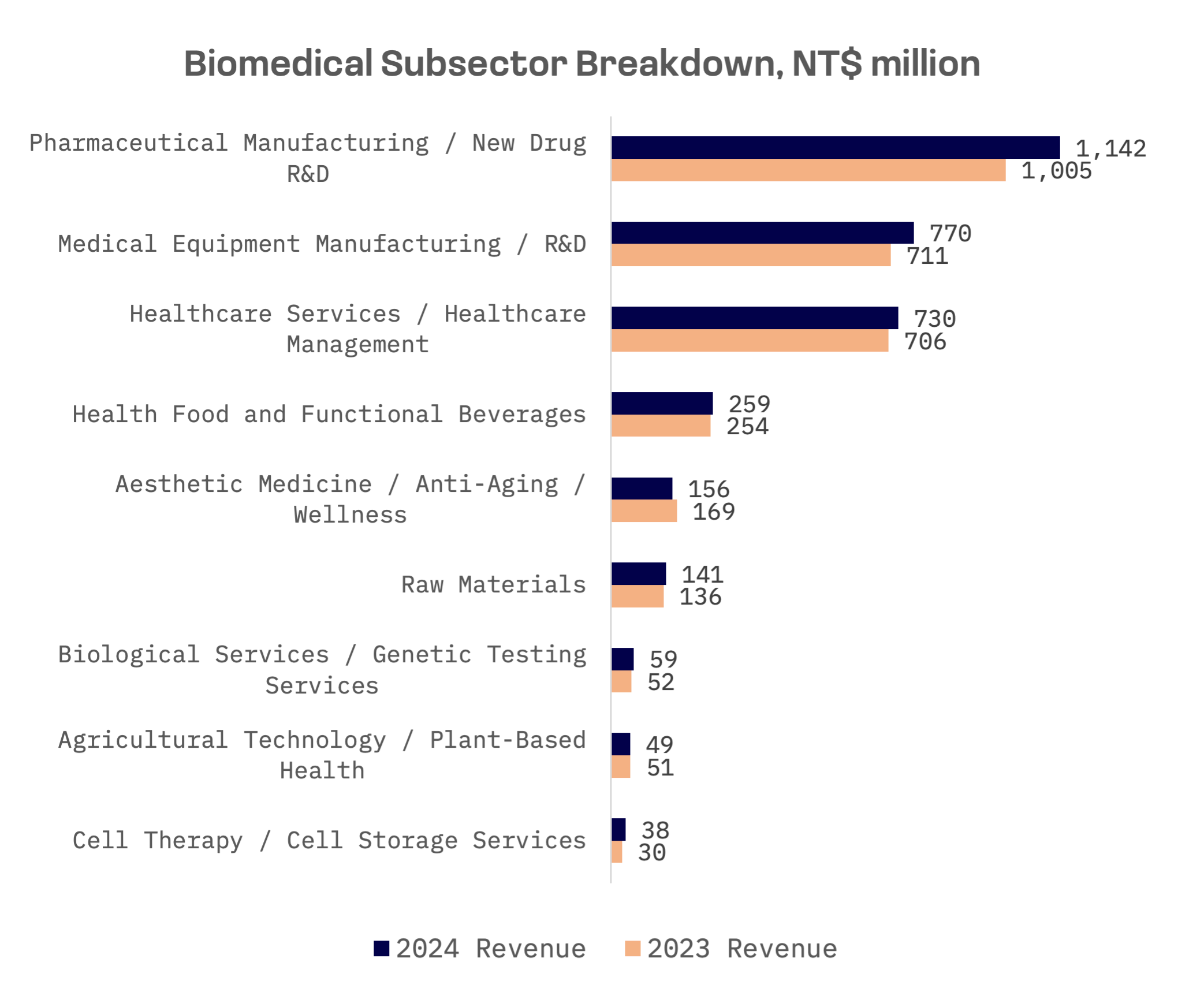

The industry’s expansion was fuelled by solid performances across key subsectors, notably pharmaceuticals and medical devices. A record 32 publicly listed biotech companies reported all time high revenues in 2024.

Taiwan’s biomedical sector is being driven by demographic shifts, deeper integration into global supply chains and regulatory reforms. Taiwan’s aging population represents a central force behind long term healthcare demand. The number of elderly citizens doubled between 2002 and 2023, significantly increasing demand for chronic disease management, regenerative therapies and advanced diagnostics. The demographic shift supports stable demand and provides predictable revenue streams for industry players.

At the same time, the industry is transitioning from generic drug manufacturing to innovation focused R&D. Taiwanese firms are increasingly pursuing novel drug development and biologics, responding to global demand for differentiated therapeutics and higher margin products. While development risk remains high, several companies have adopted licensing models to monetise innovation through partnerships with global pharmaceutical giants.

Taiwan is rapidly becoming a key node in the global pharmaceutical supply chain, with contract development and manufacturing organisations (CDMOs) gaining prominence. The rise of CDMOs aligns with a global trend towards outsourcing complex drug manufacturing to enhance supply chain resilience.

Looking ahead, mergers and acquisitions, faster drug approvals and strategic global partnerships are expected to fuel further growth. With its innovation pivot, regulatory reforms and demographic tailwinds, Taiwan’s life sciences sector is positioned to deliver resilient, long term value.

The National Health Insurance Administration (NHIA) significantly broadened reimbursement in 2024, covering new and existing cancer and rare disease treatments, including next generation sequencing diagnostics. A new Cancer Drug Fund and a two year provisional reimbursement framework for therapies addressing unmet medical needs were introduced to accelerate patient access. The implementation of a parallel review process is expected to streamline both regulatory approval and reimbursement, shortening time-to-market for new drugs.

Taiwan continues to manage healthcare expenditures through its Drug Expenditure Target (DET) system. Annual caps on NHI spending are enforced via pricing adjustments, with the latest round of drug price cuts in April 2025 affecting a wide range of therapies. As in prior years, the revisions prompted pharmacies to reduce inventories in anticipation of lower reimbursements.

Among more than 200 publicly listed companies in Taiwan’s biotech and medical sector, five have a market capitalisation exceeding $1 billion. All five are constituents of the JAKOTA Mid and Small Cap 2000 Index:

| Company Name | Ticker | Primary Business Focus | JAKOTA Index | Market Cap, USD |

| PharmaEssentia | 6446.TW | Biopharmaceutical innovation (hematology, oncology, immunology) | Mid and Small Cap 2000 | 6.36B |

| Bora Pharmaceuticals | 6472.TW | Generic, brand & OTC drugs, CDMO services, consumer healthcare | Mid and Small Cap 2000 | 2.80B |

| Caliway Biopharmaceuticals | 6919.TWO | Clinical stage new drug R&D (aesthetic medicine, chronic inflammation) | Mid and Small Cap 2000 | 2.47B |

| Lotus Pharmaceutical | 1795.TW | Generic drugs, R&D, licensing, specialty pharma | Mid and Small Cap 2000 | 1.95B |

| Oneness Biotech | 4743.TWO | New drug R&D (diabetic foot ulcers, oncology), health products | Mid and Small Cap 2000 | 1.06B |

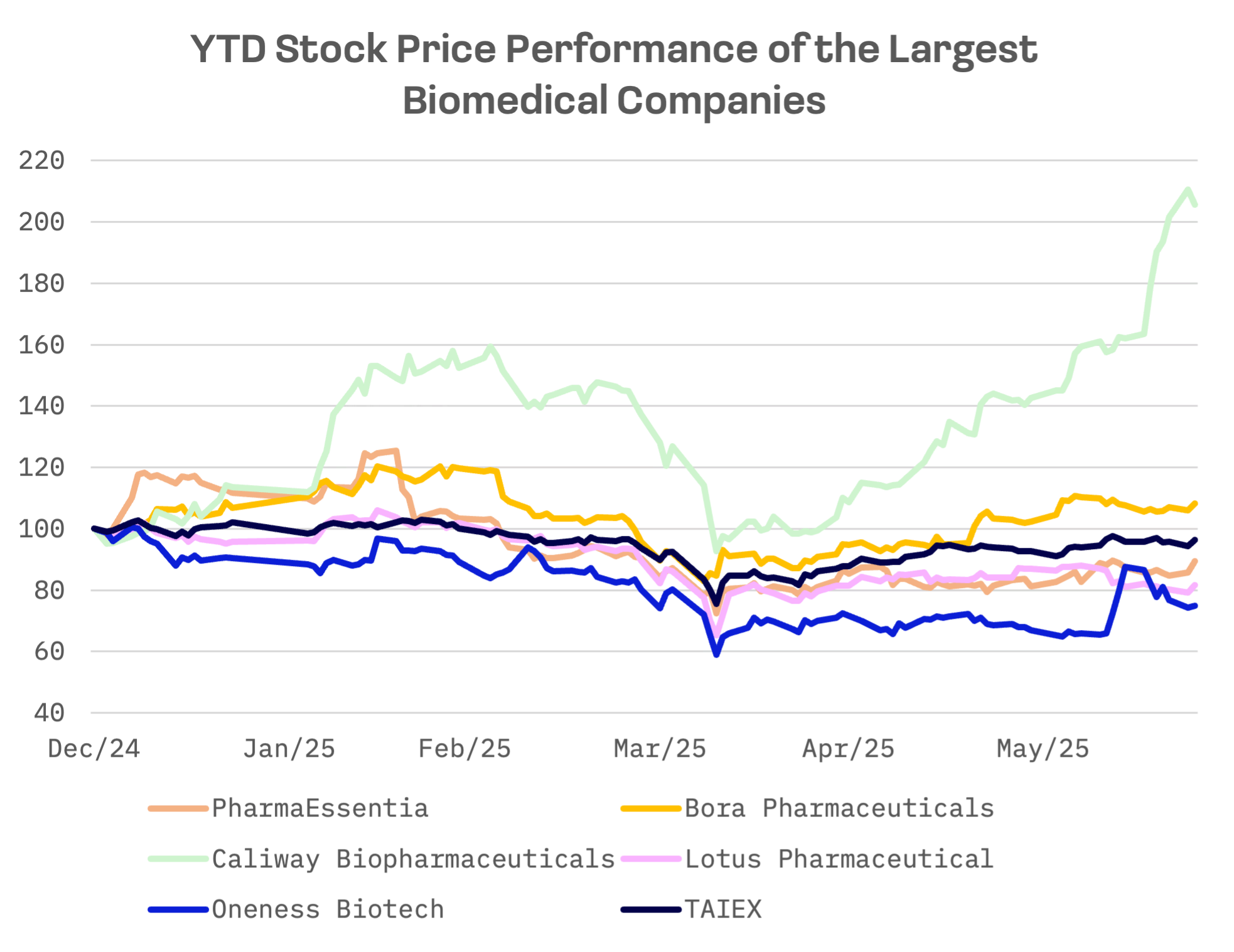

Year-to-date, only Bora Pharmaceuticals and Caliway Biopharmaceuticals, whose shares have more than doubled, have outperformed the TAIEX Index with positive returns. The remaining three companies’ shares declined.

Caliway Biopharmaceuticals and Oneness Biotech, both focused on new drug R&D, generate minimal revenue, making valuation multiples less relevant. Among the remaining three – PharmaEssentia, Bora Pharmaceuticals and Lotus Pharmaceutical – PharmaEssentia is the most expensive across all valuation multiples:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| PharmaEssentia | 13.64x | 34.21x | 44.64x |

| Bora Pharmaceuticals | 4.56x | 10.96x | 14.93x |

| Lotus Pharmaceutical | 3.28x | 7.23x | 10.61x |

| AVERAGE | 7.16x | 17.47x | 23.39x |

| MEDIAN | 4.56x | 10.96x | 14.93x |

Caliway Biopharmaceuticals

Caliway Biopharmaceuticals, a clinical stage biotech founded in 2012, focuses on small molecule therapies for aesthetic medicine and chronic inflammation. Its lead candidate, CBL-514, is being developed for nonsurgical fat reduction, cellulite and GLP-1 weight rebound management – a novel and high growth segment. The recent rally reflects strong investor enthusiasm for the company’s pipeline, particularly CBL-514, amid growing demand in aesthetic and metabolic medicine.

At BIO 2025, Caliway unveiled preclinical data showing that CBL-514 significantly mitigates GLP-1 post treatment weight regain, setting the stage for a U.S. FDA Phase 2 investigational new drug (IND) filing in the fourth quarter of 2025.

CBL-514 also met key endpoints in Phase 2b trials for cellulite and localised fat reduction, with data selected for presentation at AMWC and IMCAS 2025. Caliway was recently added to the MSCI World Small Cap Index, which further boosted investor sentiment.

Bora Pharmaceuticals

Bora Pharmaceuticals is a full service global CDMO specialising in the development and manufacturing of complex pharmaceutical products for clinical and commercial uses.

The company reported exceptionally strong first quarter 2025 earnings driven significantly by its CDMO business and a large nonoperating gain from a strategic investment, with EPS for the quarter hitting NT$13.55. Net income surged to NT$1.399 billion, up 131% quarter-over-quarter and 95.3% year-over-year.

Bora Pharmaceuticals has been strategically expanding its global footprint, especially in North America, through a series of acquisitions and investments:

- The acquisition of Tanvex to expand BioManufacturing services in August 2024

- The acquisition of a U.S. Sterile Fill/Finish facility from Emergent in August 2024

- A multiphase capital investment plan at its Maple Grove facility in Minnesota to expand oral solid dosage (OSD) and sterile injectable production capacity

Bora Pharmaceuticals: Key Financial Indicators, NT$ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 4.48 | 56.77% |

| EBITDA | 0.93 | -11.12% |

| Net income | 1.4 | 95.39% |

PharmaEssentia

PharmaEssentia is the largest biopharmaceutical company in Taiwan by market capitalisation, with a strategic focus on hematology, oncology and immunology. The company is actively involved in the research, development, production and sale of new drugs. Its flagship product, BESREMi (ropeginterferon alfa-2b-njft), is approved for polycythemia vera (PV) and has secured regulatory approvals in more than 40 countries, including the U.S., European Union and Japan.

At the 2025 American Society of Clinical Oncology (ASCO) Annual Meeting, PharmaEssentia presented positive Phase 3 SURPASS-ET data for BESREMi in essential thrombocythemia (ET), showing superior durable clinical response rates versus anagrelide. This raises the potential for a label expansion, positioning BESREMi as a broader therapeutic platform and strengthening the company’s long term growth potential.

PharmaEssentia’s 97% year-over-year revenue growth in the first quarter of 2025 highlights the successful commercialisation of BESREMi.

PharmaEssentia: Key Financial Indicators, NT$ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 3.26 | 97% |

| EBITDA | 1.14 | 282.45% |

| Net income | 1.26 | 2,453% |