This initiative aims to enhance the valuation of undervalued local markets and mitigate the ‘Korea discount’ phenomenon.

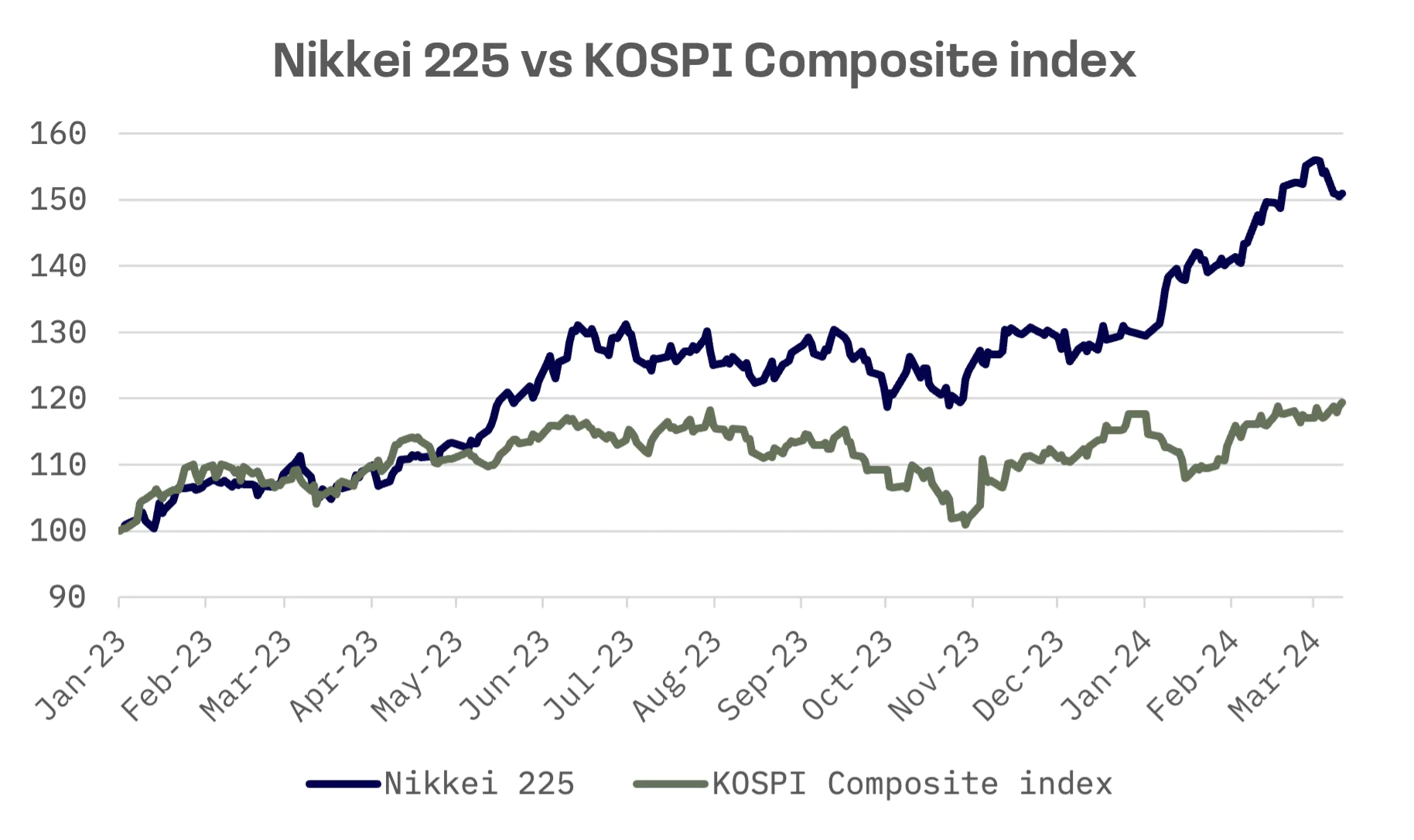

While acknowledging the similarity to Japan’s approach, which has contributed to the Nikkei 225 achieving new heights beyond its 1989 record, the FSC pointed out several distinct features of the Korean program. Notably, it includes bold incentives such as tax benefits, awards and management consulting support for exceptional businesses.

FSC Chairman Kim Joo-hyun articulated the government’s reform agenda, designed to catalyze fundamental shifts within the capital markets, including:

- establishing a fair and transparent market order;

- enhancing capital market accessibility;

- reinforcing protection for general shareholders.

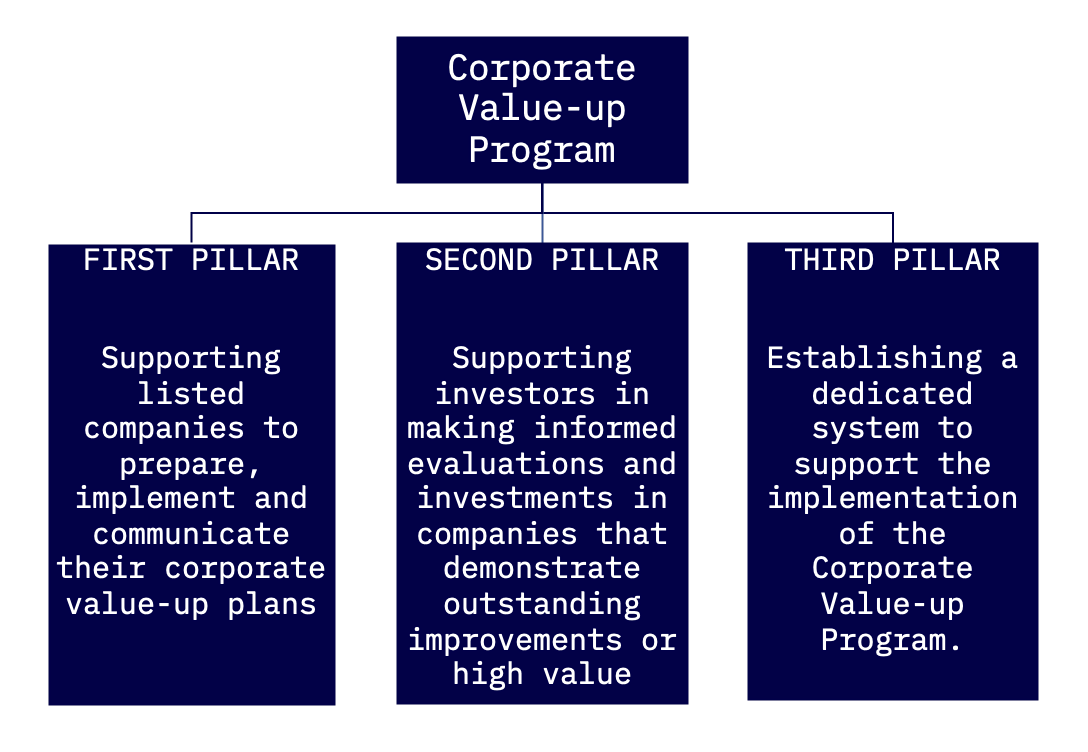

The Corporate Value-up Program aims to prioritize shareholder returns by offering incentives like tax benefits and encouraging listed companies to voluntarily establish and disclose plans for enhancing valuation. The initiative is structured around three pillars.

Voluntary Disclosure of Corporate Value-up Plans

The first pillar emphasizes the importance of listed companies voluntarily disclosing their plans for enhancing corporate value over the medium to long term. Under the program’s guidelines, companies are advised to:

- annually formulate their corporate value-up plans with a focus on medium- to long-term growth, ensuring the board of directors plays a pivotal role in the development and execution of these plans;

- publish these plans on their websites;

- proceed with a voluntary disclosure of these plans to the Korea Exchange (KRX).

To further incentivize companies to enhance their corporate value and increase shareholder returns, the government is exploring additional measures such as tax incentives and benefits. Companies demonstrating high corporate value or significant improvements may be eligible for awards and preferential treatment under the revised tax policies.

Assisting Investor Evaluation through the Korea Value-up Index

The second pillar focuses on aiding investors in assessing companies’ efforts and performances in enhancing corporate value.

The FSC will introduce the ‘Korea Value-up Index,’ which will feature companies recognized for their best practices, demonstrated profitability, or potential for corporate value enhancement. This index will serve as a benchmark for institutional investors, including pension funds, enabling them to refine their investment strategies with a well-informed perspective. Furthermore, Exchange-Traded Funds (ETFs) tracking the Korea Value-up Index will be listed, facilitating retail investors’ access to these companies.

Establishing a Dedicated Support System for Implementation

The third pillar involves the establishment of a dedicated support system to implement the Corporate Value-up Program as a mid- to long-term agenda. A specialized department will be established within the Korea Exchange (KRX).

Additionally, KRX will introduce a web portal to enhance investor engagement by providing easy access to various types of information related to the program, including the disclosure status of companies regarding their corporate value-up plans.

Market experts have generally viewed the program’s direction positively but have called for more details on how corporations will increase dividend payout ratios and conduct stock buybacks. Further efforts are considered necessary to fully achieve the program’s objectives.

The FSC announced that detailed guidelines will be finalized and a dedicated web portal established by June. Companies prepared to disclose their “value-up” plans will have the opportunity to do so in the second half of 2024.