Last year, on November 5, South Korea’s Financial Services Commission (FSC) announced an unexpected ban on short-selling in Seoul’s stock markets, excluding market makers and liquidity providers, effective the following day until the end of June 2024.

Short-selling involves selling borrowed stocks from a broker for a fee, based on the assumption that their price will decline. The borrower sells the shares before they fall, buys them back at the lower price, and returns them to the lender, pocketing the difference. Although risky for the borrower, short-selling is considered beneficial for targeting overvalued stocks and maintaining overall market health. This move was celebrated by retail investors who argue that institutional short-selling unfairly depresses stock prices.

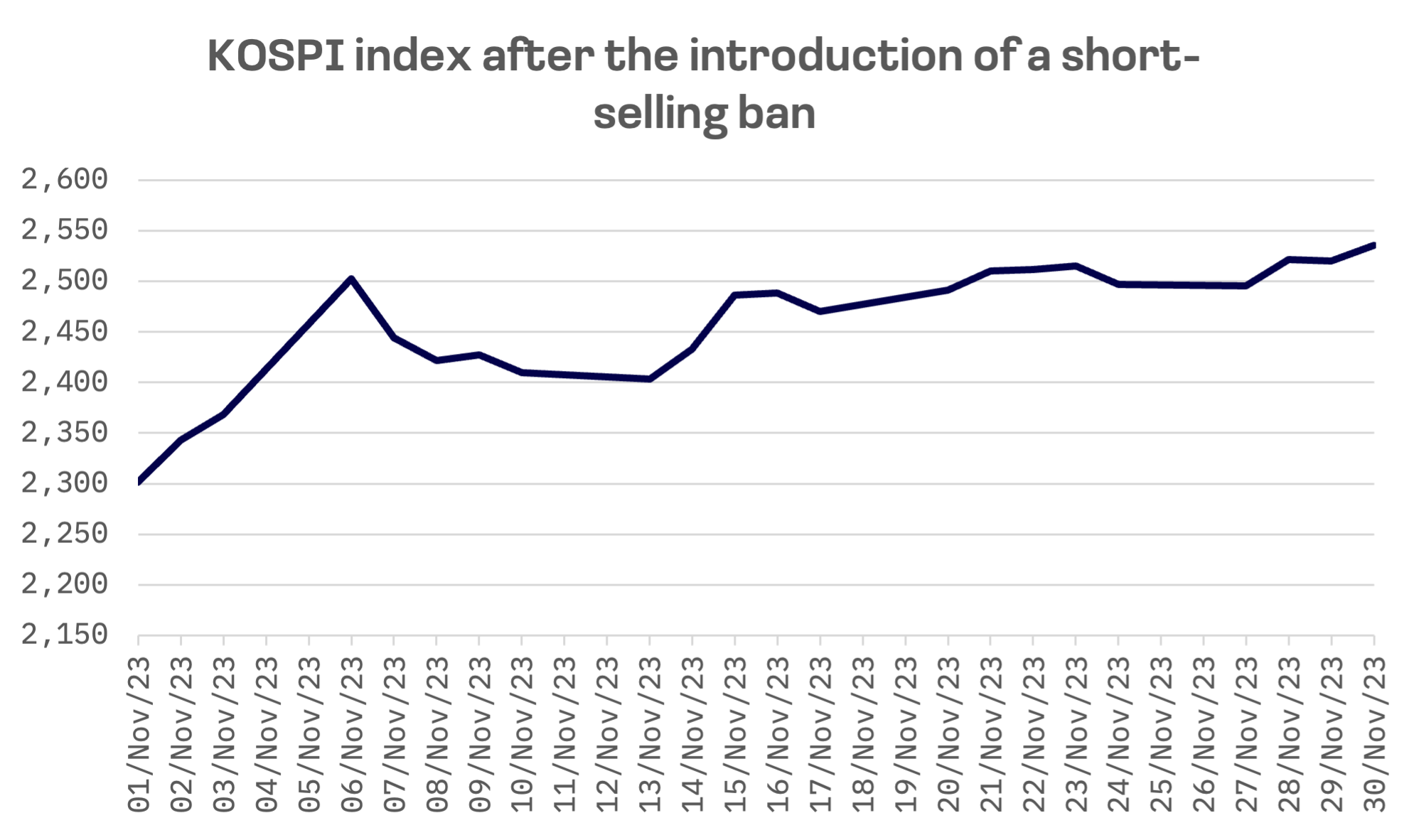

Following the announcement, the KOSPI index surged by 5.7% on November 6 — the first trading day post-announcement. This marked the largest daily increase in three and a half years. However, it dipped by 2.3% the subsequent day, with an overall three-week gain of 5.4%.

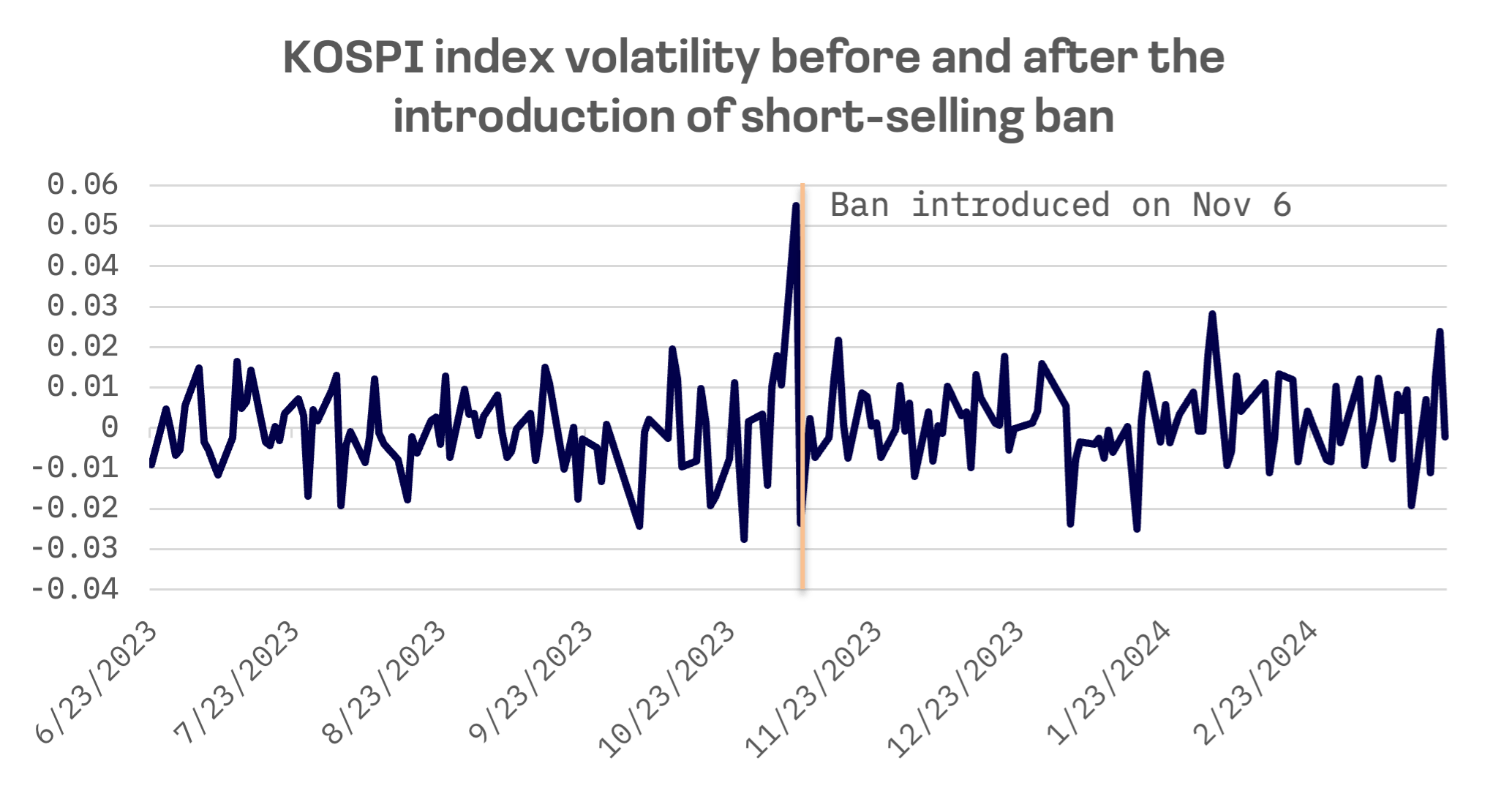

Analysts have voiced concerns that the prohibition might increase market volatility by hampering the ability to correct overvalued stocks. Despite these warnings, data shows that volatility levels before and after the ban’s implementation remained stable, around 15.3%.

This isn’t the first instance of a short-selling ban in South Korea. In March 2020, the FSC imposed a similar ban in response to market turmoil triggered by the onset of the COVID-19 pandemic. The FSC argues that the current ban ensures equity among institutional and retail investors, though there is no immediate market crisis necessitating such measures. Speculations suggest the FSC may have capitulated to pressures from President Yoon Suk Yeol’s administration and the People Power Party, as retail investors form a significant electoral group.

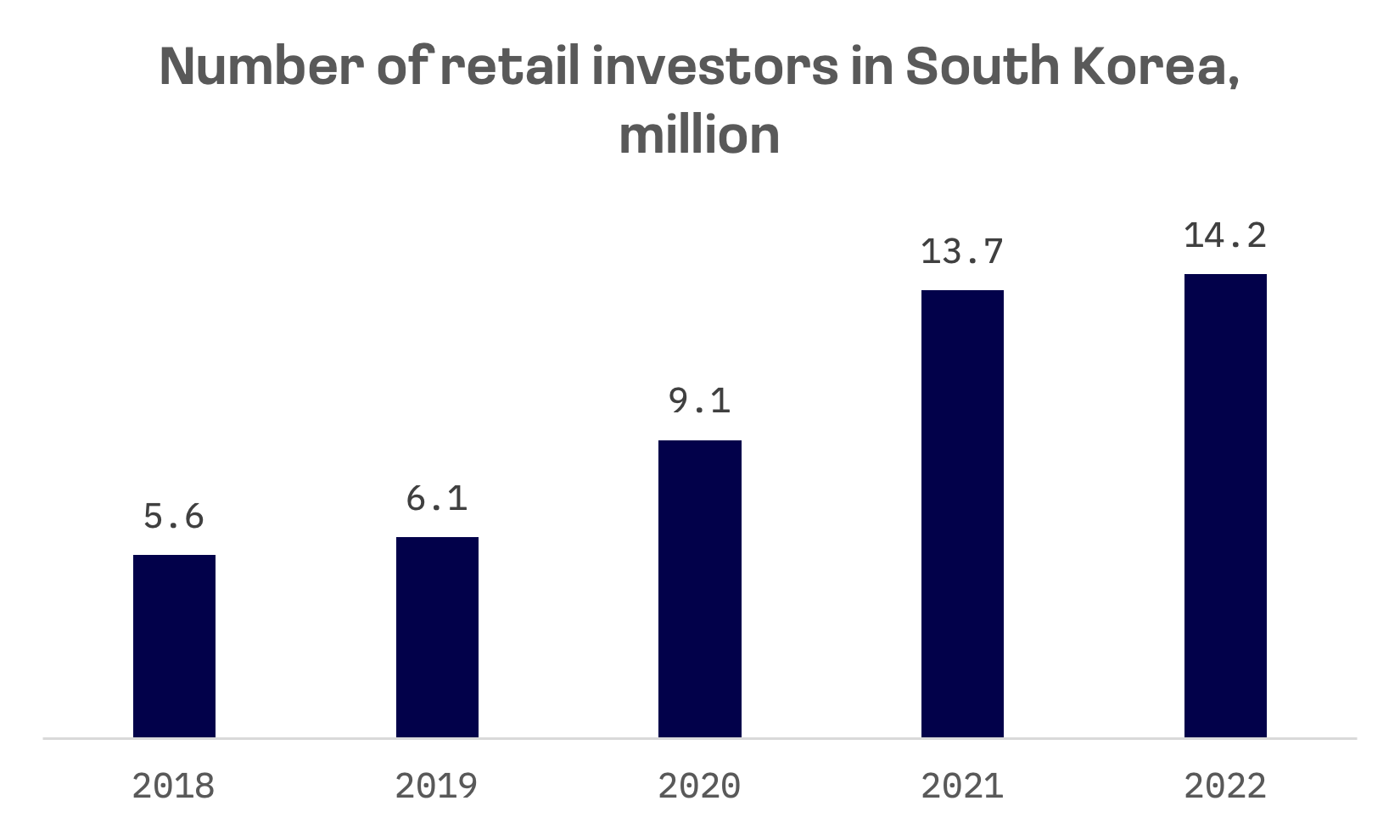

By December 2022, the number of retail investors in South Korea had escalated to 14.2 million, making up 27.5% of the nation’s 51.6 million inhabitants. This marked a nearly threefold increase in the retail investor base over the past five years.

A study conducted by the Korea Securities Depository (KSD) revealed that retail investors accounted for 64% of annual transactions on South Korean stock markets in 2022, marking the highest ratio of any stock market in the world. This percentage is more than double the figure observed on similar markets in the US and Japan.

South Korea has a vibrant protest culture, and retail investors are no exception, often demonstrating against the FSC. A group known as the KSA, consisting of 58,000 retail investors, made headlines a few years ago when they hired a large bus and painted a slogan on it reading, “I hate short-selling.”

In a cabinet meeting on November 14, South Korean President Yoon affirmed, “We will ban short-selling until we have substantial solutions,” citing protection for retail investors from potential losses.

As the June 2024 deadline for the current ban approaches, speculation about its future intensifies.

On May 16, Lee Bok-hyun, governor of the Financial Supervisory Service (FSS), said that “We’re reviewing measures to allow for the resumption of short selling through an enforcement ordinance before revising the law”.

Later, he said at a press conference in New York City on the sidelines of the Invest K-Finance, “I hope and plan to allow for the partial resumption of short selling from June.”

Lee added that technical issues and the absence of relevant systems could potentially delay the schedule, as efforts are underway to develop systems for monitoring short selling more effectively.

To facilitate lifting the ban in July, the FSS is pushing for legislative changes to the Capital Markets Act that would require institutional investors to report their short-selling balances to the Korea Exchange and financial regulators. The amendment is currently pending in Parliament.

Meanwhile, on May 22, Bloomberg reported that the presidential office’s stance is not to resume short selling until there is a platform to eliminate naked short sales, according to a source.

Earlier this month, it was announced that the Financial Supervisory Service (FSS) uncovered ₩211.2 billion worth of naked short sales in the country by Credit Suisse, Nomura Securities and seven other global banks between 2021 and 2023. The regulatory body has imposed fines amounting to ₩54.0 billion on Credit Suisse and Nomura Securities.

Amid these regulatory adjustments, South Korea’s integration into MSCI’s developed markets indexes necessitates the resumption of short-selling. Even though the vice regulator chief stated in December last year that achieving a developed-market status in global index provider MSCI Inc.’s indexes is not the government’s primary goal. Instead, the focus is on eliminating illegal practices in short-selling. As a long-term goal to make the Korean stock market more attractive to foreign investors and to eliminate the so-called “Korean discount,” lifting the ban could be an important action.