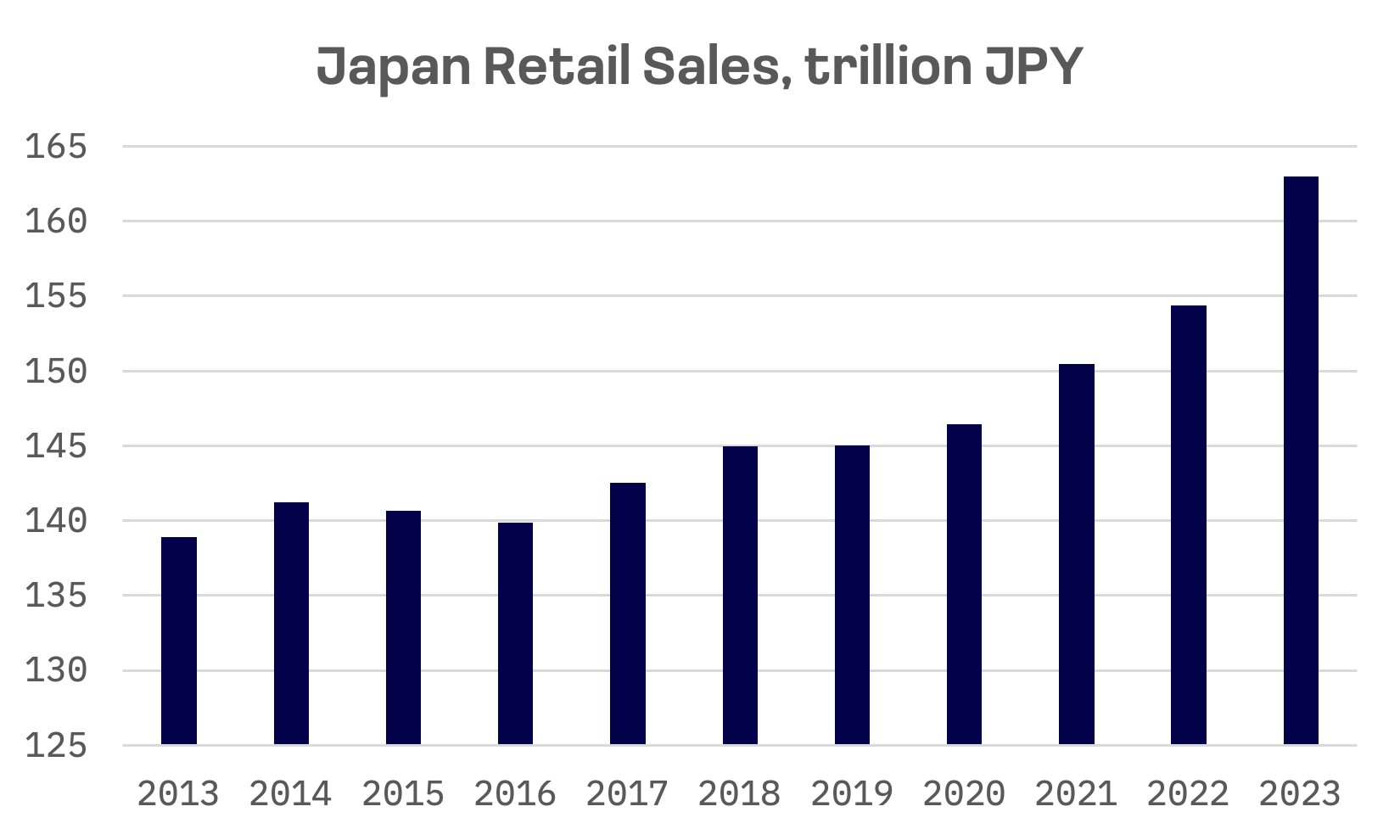

Retail and wholesale trade, pillars of Japan’s economy, consistently contribute more than 10% to the nation’s GDP. While the wholesale sector has faced stagnation, retail sales have been on an upward trajectory, driven by expanding supply chains, evolving store formats and adoption of cutting-edge technologies.

Japan’s retail sector reached a milestone in 2023, with sales hitting a record high. Domestic consumption is expected to strengthen further, buoyed by robust wage growth. Popular tourist destinations are emerging as clear winners, thanks to a surge in inbound visitors. This trend is evidenced by the growing number of shops catering to foreign clientele.

The Japanese retail market, known for its unique blend of traditional and modern shopping experiences, can be broadly divided into four main categories:

1. Department Stores and Shopping Streets

Despite the rise of online shopping, these remain popular in major cities like Tokyo, Osaka and Kyoto. They offer a mix of luxury brands, local boutiques and specialty goods, providing a unique shopping experience.

2. Konbini (Convenience Stores)

These ubiquitous stores offer a wide range of products, including ready-to-eat meals and groceries, as well as services like bill payment and ticketing. Their accessibility and convenience make them a significant part of Japanese daily life.

3. Specialty Stores

Focused on specific product categories such as electronics, fashion or cosmetics, these stores cater to niche markets with specialized offerings.

4. E-commerce and Online Retail

This sector has been growing steadily, with platforms like Rakuten, Amazon Japan and Yahoo! Shopping dominating the space.

The retail landscape faces multifaceted challenges, including changing consumer behaviors, intense competition from e-commerce giants and the need to embrace emerging technologies. The COVID-19 pandemic has accelerated the shift towards online shopping, compelling retailers to bolster their digital presence and logistical frameworks. Despite these hurdles, Japan’s retail sector persists in its momentum.

This report will further focus exclusively on the largest retail companies by market capitalization that are part of the JAKOTA Blue Chip 150 Index:

- Fast Retailing: Parent company of Uniqlo, operates globally in apparel design and retail. The company’s four segments – UNIQLO Japan, UNIQLO International, GU and Global Brands – manufacture and retail clothing for all ages under brands including UNIQLO, GU, PLST, Theory, COMPTOIR DES COTONNIERS, J Brand and PRINCESSE TAM.TAM.

- Seven & i Holdings: A diversified retail conglomerate operating convenience stores, superstores, department stores, supermarkets and specialty stores. Its six segments span Domestic Convenience Store Operations, Overseas Convenience Store Operations, Superstore Operations, Department and Specialty Store Operations, Financial Services and Others.

- Aeon: Manages diverse retail operations across Japan, China, ASEAN countries and internationally. It operates through General Merchandise Store (GMS) Business, Discount Store Business, Supermarket (SM) Business, Health and Wellness Business, Financial Services Business, Shopping Center Development Business, Services and Specialty Store Business, International Business and Other Business segments.

- Nitori Holdings: Specializes in furniture and interior products, focusing primarily on the Japanese market.

- Pan Pacific: Operates retail stores through three main segments: Discount Store Business, General Merchandise Store (GMS) Business and Rent Business. Its well known brands include “Don Quijote” and “Apita”, among others.

Fast Retailing stands out among its peers in market capitalization, partly due to its integrated business model that extends beyond retail:

| Company Name | Ticker | Subsector | Market Cap, USD |

| Fast Retailing | 9983.TSE | Apparel Retail | 82.2B |

| Seven & i Holdings | 3382.TSE | Food Retail | 30.0B |

| Aeon | 8267.TSE | Merchandise Retail | 18.8B |

| Pan Pacific | 7532.TSE | Broadline Retail | 15.2B |

| Nitori Holdings | 9843.TSE | Homefurnishing Retail | 13.1B |

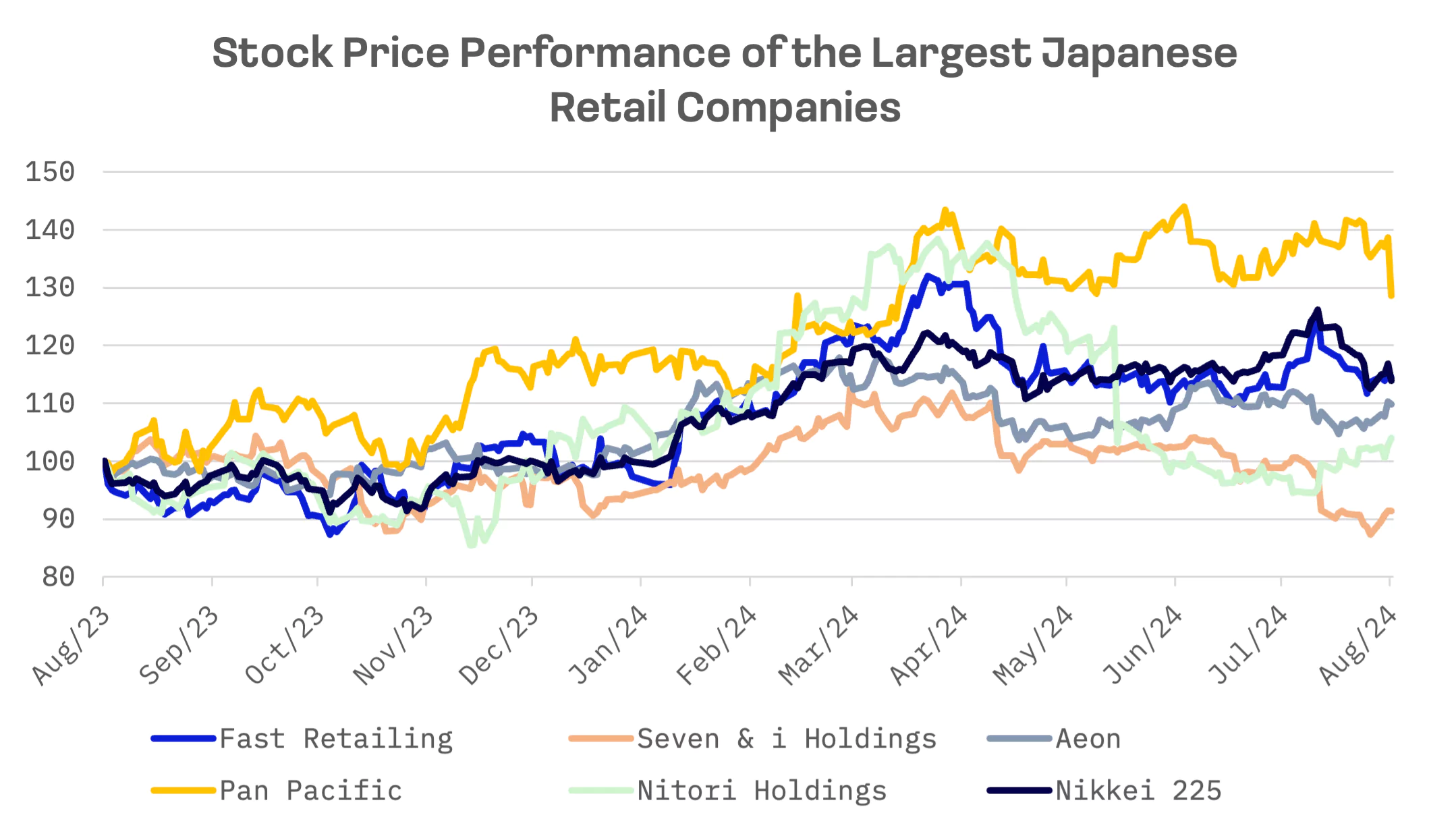

Over the past 12 months, only Pan Pacific and Fast Retailing stocks have outperformed the Nikkei 225. Aeon and Nitori Holdings saw modest share price increases, while Seven & i Holdings shares fell by 8.6%.

Being not a pure retailer company, Fast Retailing is the most expensive among its peers across most valuation multiples:

| Company Name | EV/Sales | EV/EBITDA | P/E | Forward P/E |

| Fast Retailing | 4.07x | 16.67x | 33.90x | 39.06x |

| Seven & i Holdings | 0.65x | 8.89x | 22.42x | 17.42x |

| Aeon | 0.50x | 8.41x | 88.50x | N/A |

| Pan Pacific | 1.35x | 16.06x | 26.53x | 28.33x |

| Nitori Holdings | 3.20x | 20.87x | 23.15x | 20.28x |

| AVERAGE | 1.95x | 14.18x | 38.90x | 26.27x |

| MEDIAN | 1.35x | 16.06x | 26.53x | 24.31x |

Fast Retailing’s expansion into the U.S. and Europe is yielding results, with strong performances in those markets compensating for a sharp slowdown in China. The company raised its full year operating income forecast to ¥475 billion from ¥450 billion. For the quarter ended May, operating income reached ¥145 billion, surpassing analysts’ average estimate of ¥124 billion.

Last Quarterly Results of Fast Retailing:

| Quarterly results for the period ended May 31, 2024 | YoY Change | |

| Total Revenue | ¥767.5B | 13.51% |

| EBITDA | ¥196.1B | 25.84% |

| Net Income | ¥116.9B | 20.97% |

Fast Retailing has been accelerating its overseas expansion beyond Japan and China, aiming to establish itself as a global apparel retailer. Uniqlo reported significant revenue and profit gains in North America and Europe, while business in Southeast Asia, India, Australia and South Korea continues to improve. Strong performance in Japan also contributed to profit growth in the latest period.

Pan Pacific has benefitted from a recovery in spending by foreign tourists visiting Japan, further accelerated by the depreciation of the yen. This helped boost net profit and increased its share price by 29% over the last 12 months.

Last Quarterly Results of Pan Pacific:

| Quarterly results for the period ended May 31, 2024 | YoY Change | |

| Total Revenue | ¥519.8B | 8.6% |

| EBITDA | ¥46.4B | 33.56% |

| Net Income | ¥23.9B | 62.23% |

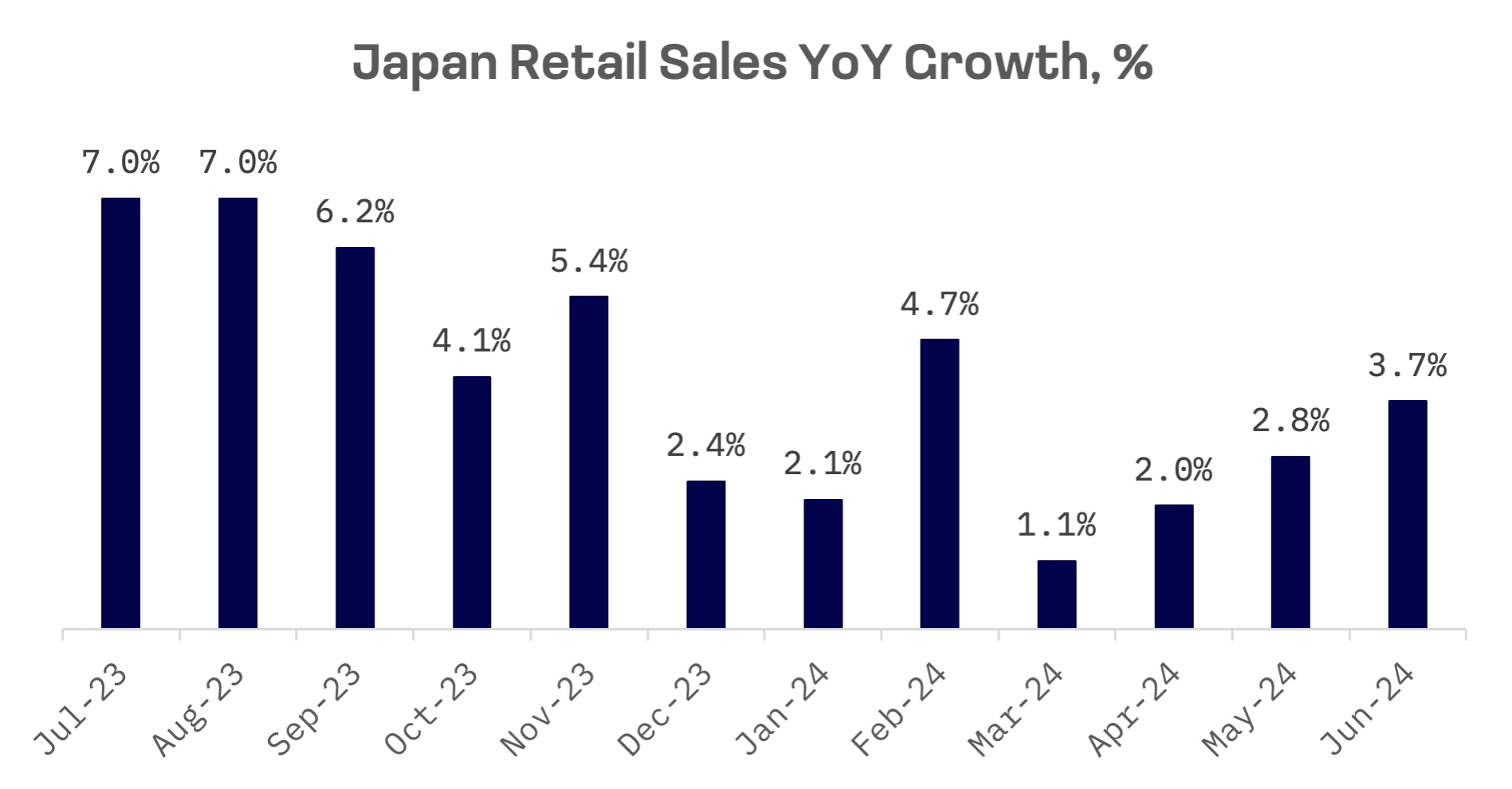

Retail sales in Japan surged by 3.7% year-over-year in June 2024, outpacing the anticipated 3.3% rise and marking the strongest performance in four months. This growth highlights the resilience of consumer spending despite economic uncertainties, attributed to a rebound in consumer confidence, yen depreciation and an increase in inbound tourism.

However, long-term challenges persist, including a declining population and global supply chain disruptions. As Japan’s retail market evolves, companies that can adapt to changing consumer preferences and leverage technology are likely to lead the pack in this dynamic and competitive landscape.