Japan

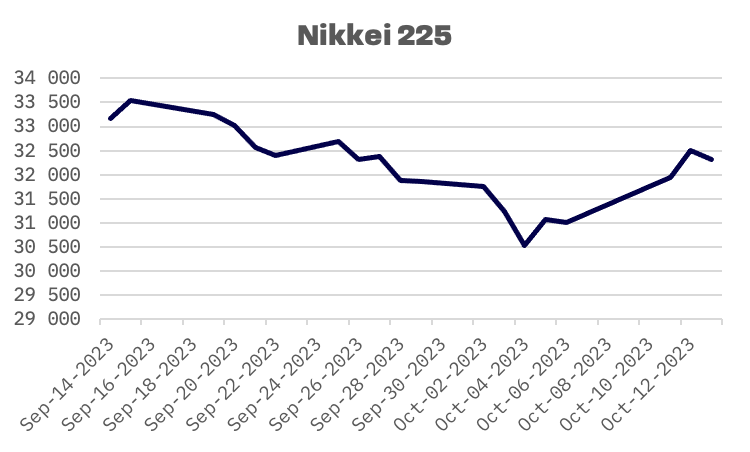

Japan’s stock markets posted gains over the week, propelled by a 4.3% surge in the Nikkei 225 Index. This marks the most substantial one-week point and percentage gain since the period ending June 16, 2023, and snaps a three-week losing streak. Market analysts suggest that Japanese shares may have been oversold until the prior week. Furthermore, the alleviation of U.S. Treasury yields served as an additional positive factor.

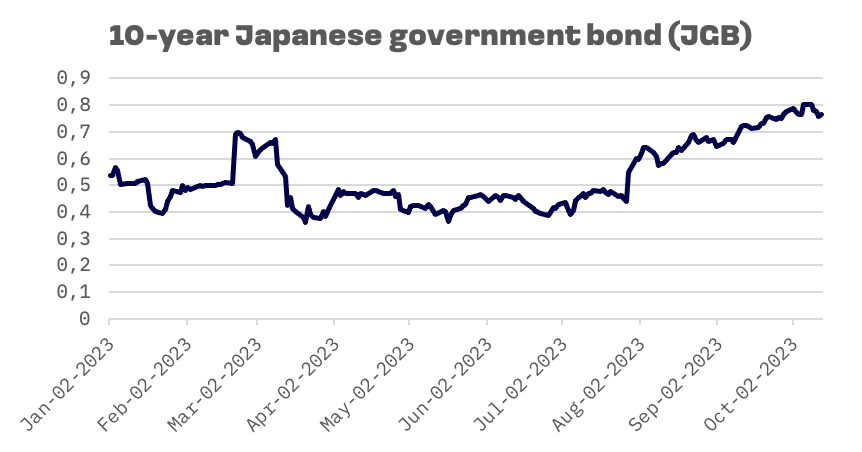

The yield on the 10-year Japanese government bond (JGB) declined to 0.76%, down from 0.80% at the close of the preceding week. Ongoing speculation focused on the potential timing for the Bank of Japan (BoJ) to further normalize its monetary policy. In July, the BoJ adjusted its approach to yield curve control (YCC), allowing yields more latitude to increase while capping them at 1.0%. Asahi Noguchi, a member of the BoJ’s Board, indicated that the central bank still has room for maneuvering before the JGB yield reaches its upper limit, and emphasized that there is currently no urgent necessity to modify its YCC policy.

Amidst a backdrop of positive market sentiment this week, a notable development emerged as the International Monetary Fund (IMF) revised its outlook for Japan’s growth trajectory. According to the October release of the World Economic Outlook, the IMF upgraded its projection for Japan’s 2023 growth from 1.4% to 2.0% . The organization anticipates a confluence of factors, including pent-up consumer demand, a resurgence in inbound tourism, accommodative monetary policy, and ameliorating supply chain constraints, to drive this expansion.

Additionally, the IMF raised its forecast for Japan’s price gains, foreseeing a 3.2% uptick in consumer inflation for the year, up from the previously expected 2.7% increase. This shift is attributed to a broader-than-expected surge in prices, along with heightened crude oil costs and yen depreciation, all of which have exerted upward pressure on overall price levels. Consequently, it is anticipated that the Bank of Japan (BoJ) will revise its own inflation projections in October, reflecting these influential factors.

South Korea

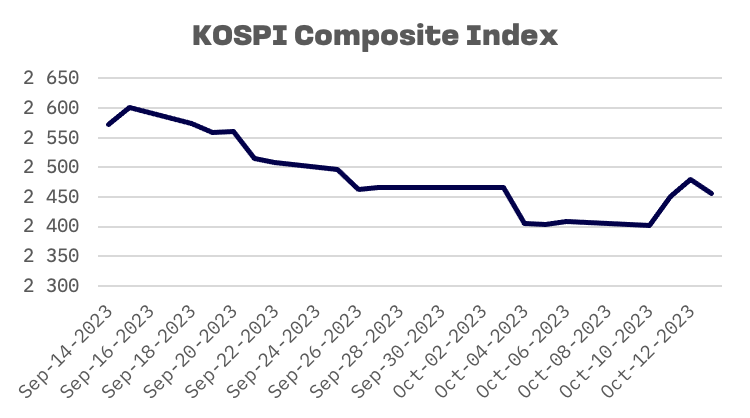

South Korea’s stock markets gained over the week, with the KOSPI Composite Index up 2.0% helping to snap a three-week losing streak.

Nevertheless, market sentiment did not lean favorably towards growth. Recent data reveals a prolonged trend of foreign investors consistently divesting from South Korean equities over a span of 15 consecutive trading days. This marks the lengthiest such streak since 2020. According to the Korea Exchange, foreigners offloaded a net total of 2.5 trillion won (equivalent to approximately $1.8 billion) from the benchmark Korea Composite Stock Price Index between September 18 and the conclusion of the previous week.

The prior record for the most prolonged streak of selloffs in the Kospi market, attributed to foreign investors, was established at 30 consecutive trading days, spanning from March 5 to April 16 in 2020. During this recent 15-day divestment period, foreign investors predominantly offloaded shares of Samsung Electronics (JAKOTA Blue Chip 150 Index), the preeminent global memory chip manufacturer, amassing a total value of 751.4 billion won ($0.56 billion).

Taiwan

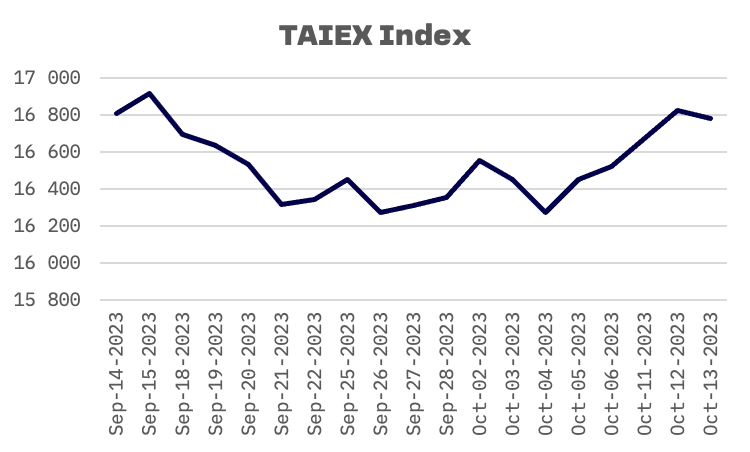

This week was reduced trading week due to the prolonged October 10 National Day holiday. The first trading day commenced on Wednesday, October 11. Consequently, with a 1.6% increase, the TAIEX showed the most modest growth this week when compared to the Nikkei 225 and KOSPI indices.

On October 11, the Ministry of Finance announced positive data on Taiwan’s exports which surged by over 3 percent in September compared to the previous year, breaking a 12-month year-on-year falling streak. This shift was attributed to a notable improvement in the electronics component industry, which serves as the linchpin of the country’s outbound sales.

However, during the final trading session of the week, shares in Taiwan experienced a downturn, with market sentiment dampened by the higher-than-anticipated consumer price index data for the United States in September.

JAKOTA Blue Chip 150 Index

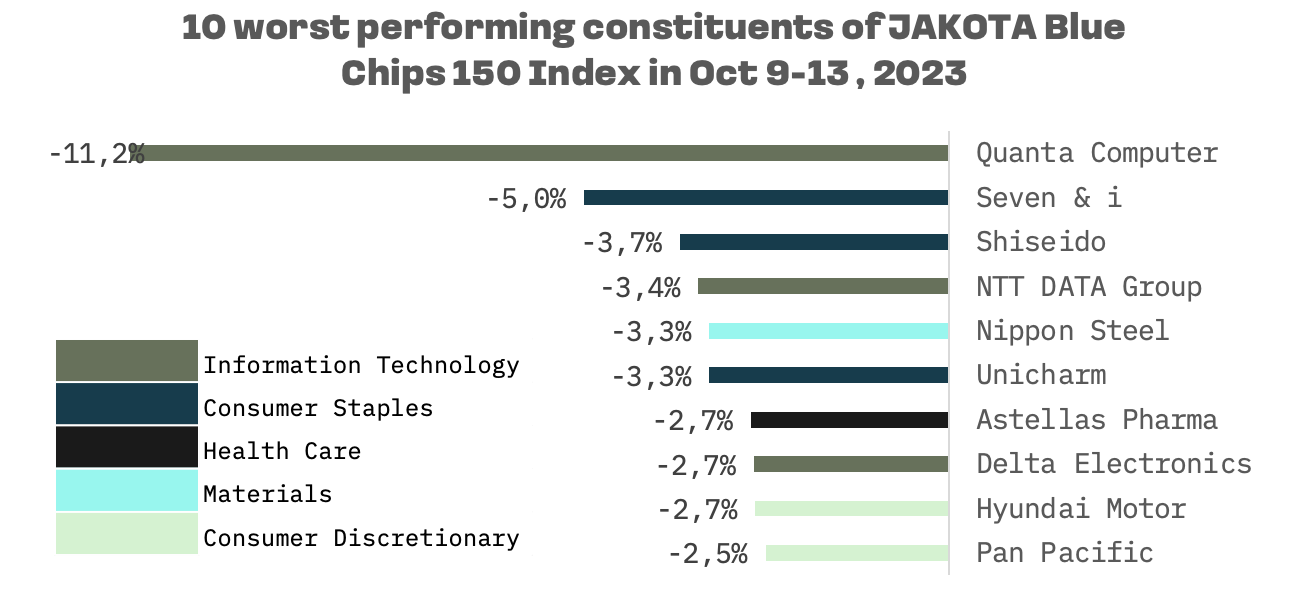

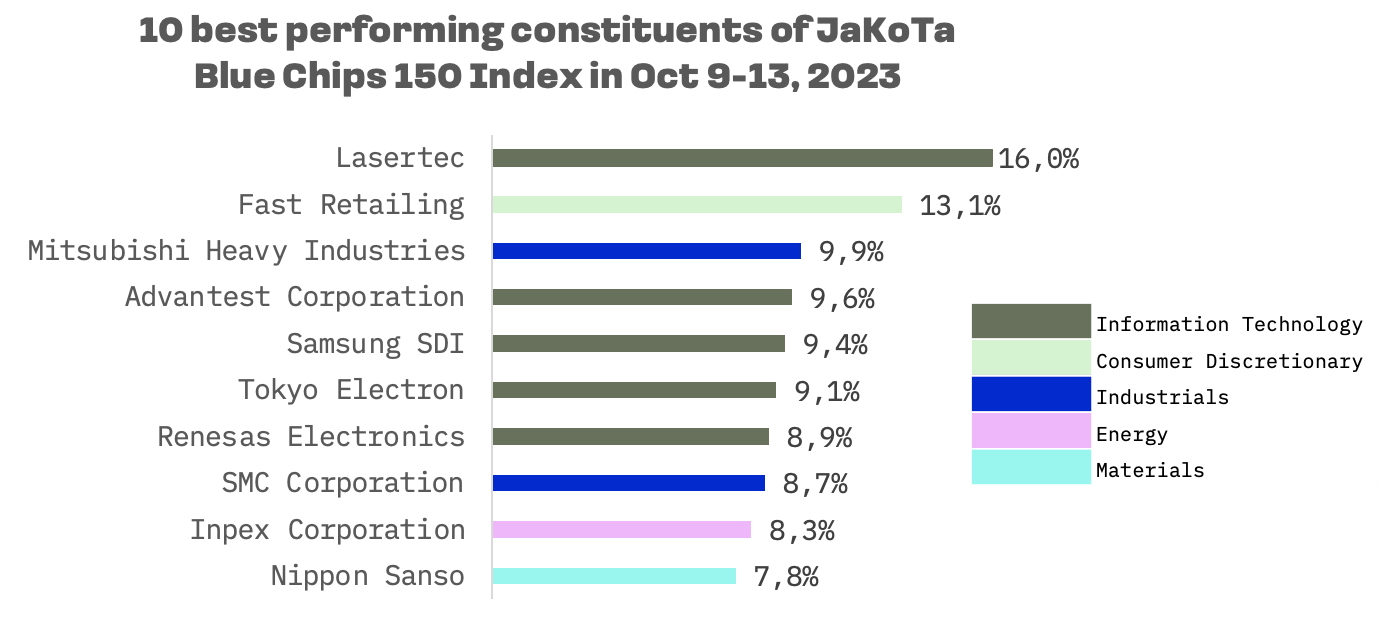

Out of a pool of 150 constituents, 117 demonstrated positive share price trends this week.

The best-performing stock this week is Lasertec, which has notably benefited from its inclusion in the Nikkei 225 Index on October 2.

Quanta Computer, which had previously been a leader in terms of growth last week, saw a stark reversal in fortunes, emerging as the worst-performing stock this week with a notable decline of 11.2%.