Japan

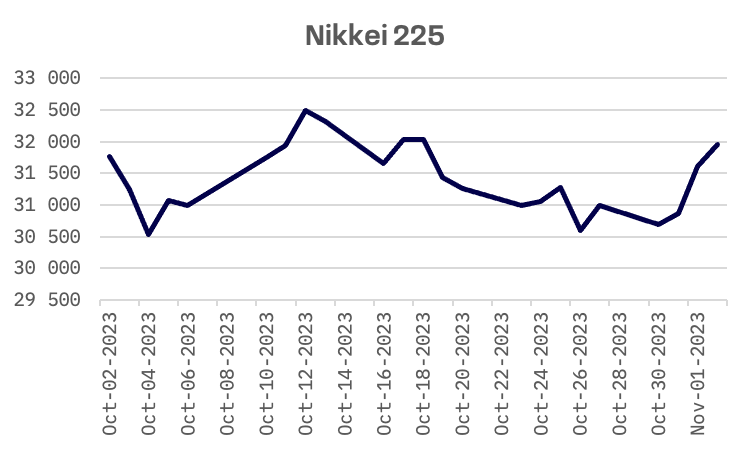

The Japanese stock market ended the week on a high note, with the Nikkei 225 Index climbing by 3%. This advance came even as the Bank of Japan (BoJ) fine-tuned its yield curve control policy, reinforcing its commitment to economic support through a continued dovish monetary policy approach.

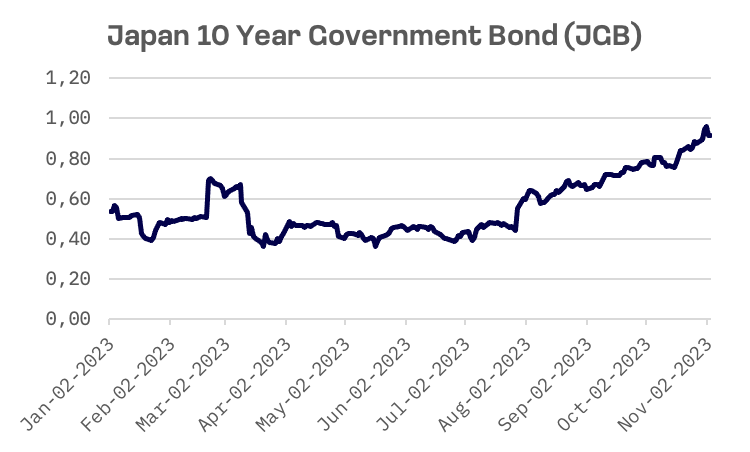

During its October meeting, the BoJ reaffirmed its ultra-accommodative stance, with short-term interest rates remaining at -0.1%. The central bank’s decision to allow a more flexible upward movement for the 10-year JGB yields above the informal 1% ceiling underscores its responsive approach to global yield dynamics.

This sustained easing has exerted downward pressure on the yen, which briefly dipped below 151 against the dollar amid a significant interest rate differential with the U.S.

By the week’s close, the 10-year JGB yield had retreated slightly to around 0.92%, after earlier touching a decade-plus high of 0.96%.

The BoJ’s Outlook for Economic Activity and Prices report adjusted inflation forecasts upward for fiscal years 2023 and 2024 to 2.8% year-on-year, citing variable factors like oil prices and domestic fiscal measures.

On the fiscal front, Japan’s government passed a 17 trillion yen ($112 billion) stimulus package aimed at spurring economic growth and mitigating the impact of soaring living costs. Key elements of the package include tax cuts and extended subsidies for energy costs, set to be implemented as early as June 2024.

South Korea

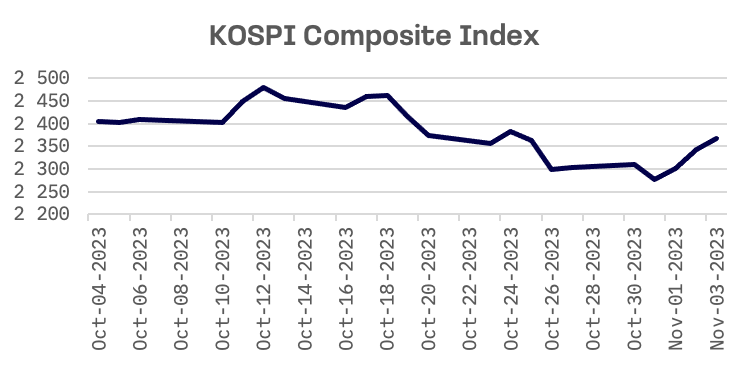

The KOSPI Composite Index broke a two-week decline, advancing 2.85% this week — its best performance since mid-July 2023 — buoyed by the U.S. Federal Reserve holding interest rates steady.

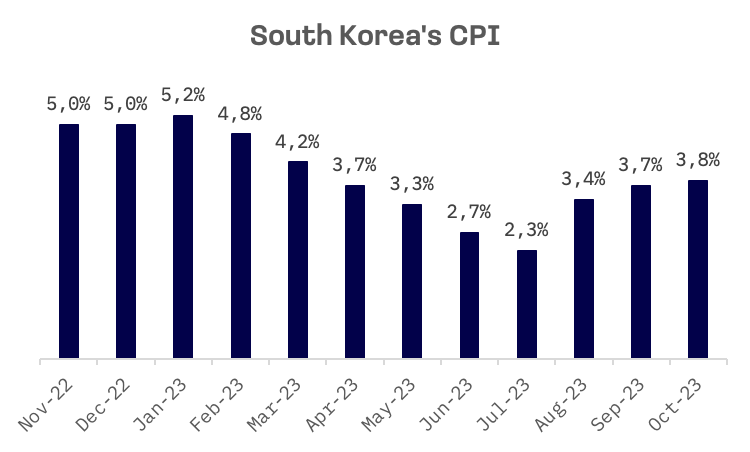

Contrasting this growth, South Korea’s consumer prices accelerated for the third month in succession, with a 3.8% year-on-year rise in October, surpassing economist expectations.

The nation’s foreign exchange reserves fell by $1.24 billion in October, marking the third consecutive drop to the lowest level since June 2020, amid the authorities’ dollar-selling efforts to stabilize the won.

Commencing on November 5, 2023, South Korea will enforce a reinstated prohibition on short-selling shares, a measure anticipated to extend at least through June. The Financial Supervisory Service (FSS) articulated this directive aims to ‘level the playing field’ for retail and institutional investors alike.

The Financial Supervisory Service also announced a probe into illicit naked short-selling by major foreign banks, aiming to safeguard the local market’s integrity.

Taiwan

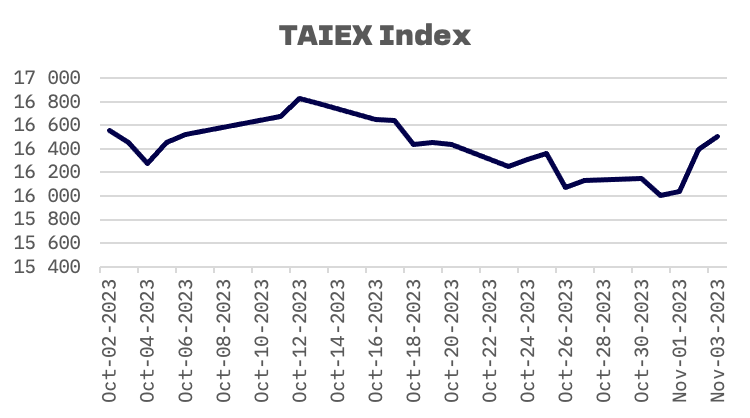

The Taiwanese equity market saw a 2.3% lift in the TAIEX index over the week, bolstered by investor speculation that the Federal Reserve may have paused its rate hikes. Despite the general market upturn, key “Apple concept stocks” faced declines. Notably, shares of Foxconn (Hon Hai Precision Industry), Pegatron, and Quanta Computer, all suppliers to the U.S. tech behemoth, retreated on Friday amidst a backdrop of the American company’s four straight quarters of falling sales.

Throughout the week, a few important macroeconomic indicators were disseminated.

Taiwan’s manufacturing sector remained under pressure, contracting for the eighth straight month as the Purchasing Managers’ Index (PMI) dipped to 47.1 — a marginal decrease of 1.1 points from the previous month, as reported by the Chung-Hua Institution for Economic Research (CIER) on Wednesday. This sustained contraction underscores the challenges facing the industry.

In response to these economic pressures, Taiwan’s central bank has been proactive in managing the local currency’s value. October marked the third consecutive month of decline in foreign exchange reserves, which fell by approximately $2.93 billion to $561.08 billion, signaling continued intervention to curb the Taiwan dollar’s depreciation.

JAKOTA Blue Chip 150 Index

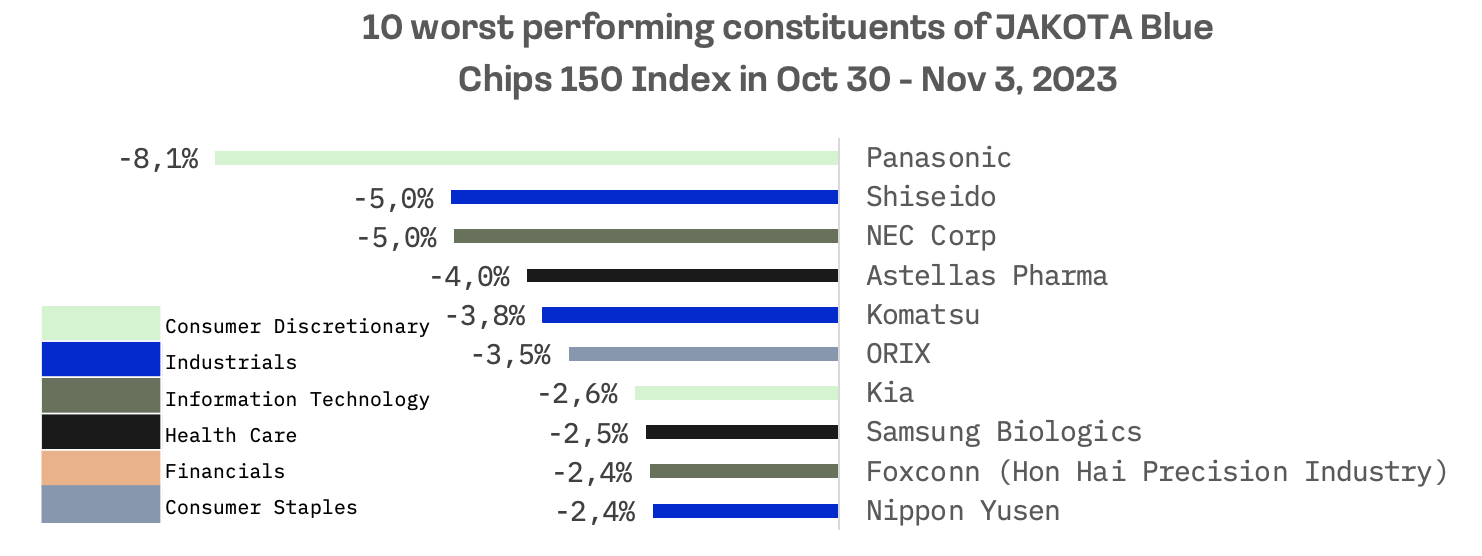

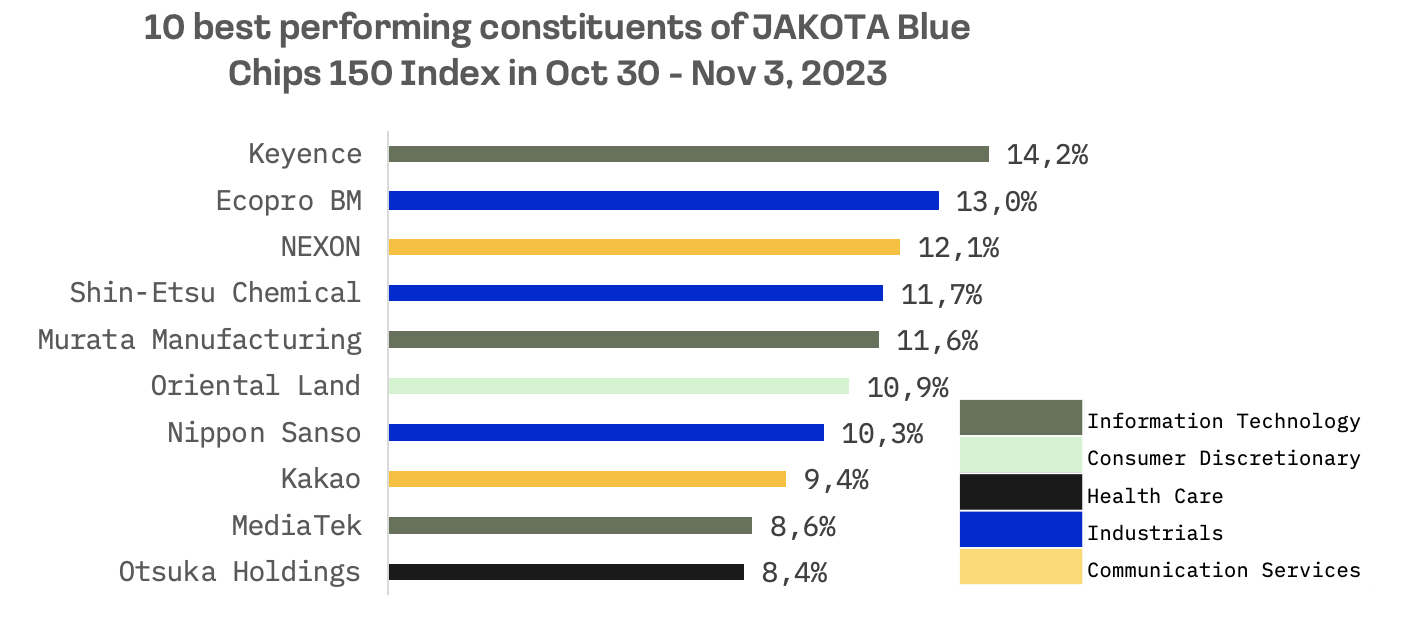

Within the JAKOTA Blue Chip 150 Index, a significant majority of shares – 122 out of 150 – ended the week on a positive note. Leading the gains, Keyence, a major electronic equipment manufacturer, stood out as the week’s top performer. The company’s financial results for the quarter ending September 20, 2023, released post-trading on October 27, outstripped consensus estimates, reflecting a bullish sentiment among investors.

Conversely, Panasonic presented a stark contrast within the index. On October 30, 2023, alongside its quarterly earnings disclosure, Panasonic announced a cutback in its Japanese automotive battery production, precipitating a downward revision of its annual profit forecast by 15%. This development underscores the broader slowdown affecting the global electric vehicle (EV) market.