Japan

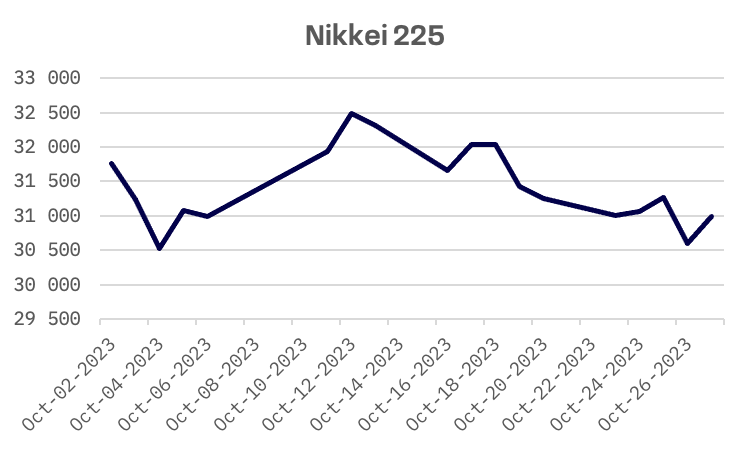

Japan’s stock markets experienced a slight decline over the past week, with the Nikkei 225 Index down by 0.86%. Market sentiment was initially dampened by increasing bond yields and geopolitical tensions at the beginning of the week. However, a resurgence in technology stocks and a new round of economic stimulus from China helped stock markets recover from their earlier losses.

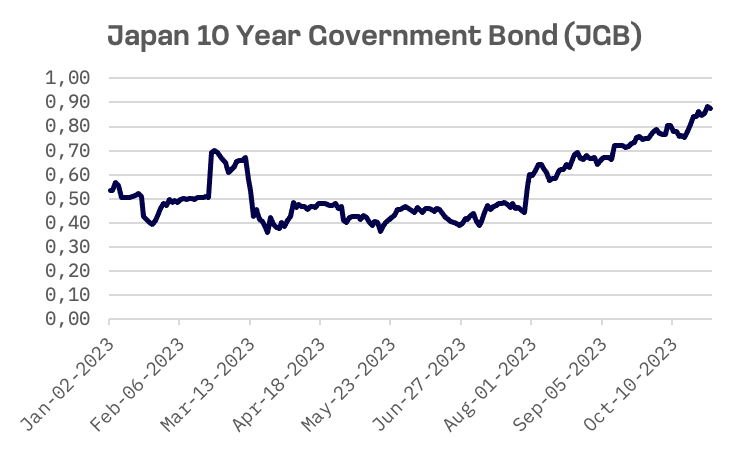

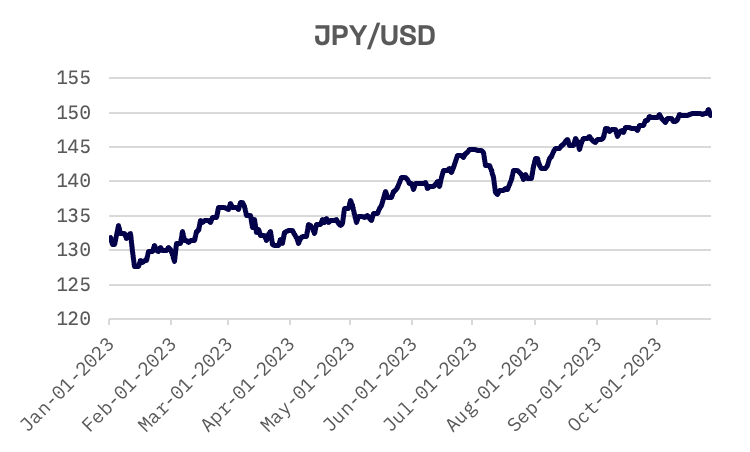

The weakness of the yen and further increasing bond yields, along with an uptick in inflation, have sparked heightened speculation regarding potential intervention by authorities and a potential adjustment to the yield curve control policy by the Bank of Japan (BOJ) in its upcoming meeting.

At the beginning of the week, the yield of the 10-year Japanese government bond surged to a 10-year peak of 0.87%, nearing the central bank’s upper limit of 1.0%. This raised concerns about borrowing costs for the government and potential implications for the broader economy.

In response, the Bank of Japan (BOJ) conducted an unscheduled bond-purchase operation, aiming to temper the ascent of sovereign debt yields. This action involved the buying of bonds ranging from five to ten years, as well as 10- to 25-year notes, marking the fifth unscheduled operation since July.

The yen experienced a decline beyond the significant threshold of 150 against the U.S. dollar, prompting concerns over potential intervention by governing authorities. Finance Minister Shunichi Suzuki cautioned speculators, affirming that officials would persist in addressing the currency market ‘with a strong sense of urgency.’ This decline is notable as it can affect Japan’s export competitiveness and may have broader implications for trade.

In October, Tokyo’s core inflation rate, considered a leading indicator of nationwide trends, accelerated to 2.7%, surpassing consensus expectations and marking the initial uptick in four months. This unexpected acceleration signals a broadening of price pressures and could sustain anticipations of an imminent shift away from ultra-low interest rates.

Additionally, the au Jibun Bank of Japan Composite PMI registered a decline from 52.1 in September to 49.9 (a PMI figure below 50 denotes a contraction in output) in October, attributed to fragility in the manufacturing sector. While the services sector continued its expansion for the fourteenth consecutive month, the pace of growth moderated.

South Korea

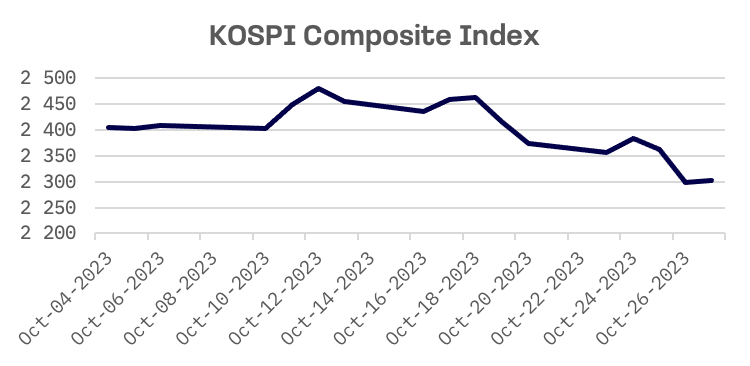

The KOSPI Composite Index experienced a decline of 72.19 points or 3.04% over the course of the week, closing at 2302.81. This marks the second consecutive week of losses for the index. Following a substantial sell-off on Thursday, South Korea’s KOSPI experienced a sharp decline of 2.7%, reaching a 10-month nadir. Persistent concerns among investors regarding the potential preemptive action by the US Federal Reserve to raise its key interest rate, coupled with mounting investor pressure, contributed to the market downturn. This week, data about South Korea’s producer price index, a significant gauge of consumer inflation, was published. In September, producer prices saw a month-on-month increase of 0.4%, primarily driven by higher global oil prices.

Nevertheless, this week saw the release of relatively positive macroeconomic data. South Korea’s economy demonstrated resilience in the third quarter, recording a GDP growth of 0.6% compared to the preceding quarter. This marks the third consecutive quarter of expansion, driven by a resurgence in exports and robust domestic consumption. Nevertheless, there remains substantial uncertainty regarding whether South Korea’s economy will meet the central bank’s projected 1.4% growth for the year. Lingering inflationary pressures, coupled with escalating external geopolitical risks, present formidable challenges.

Taiwan

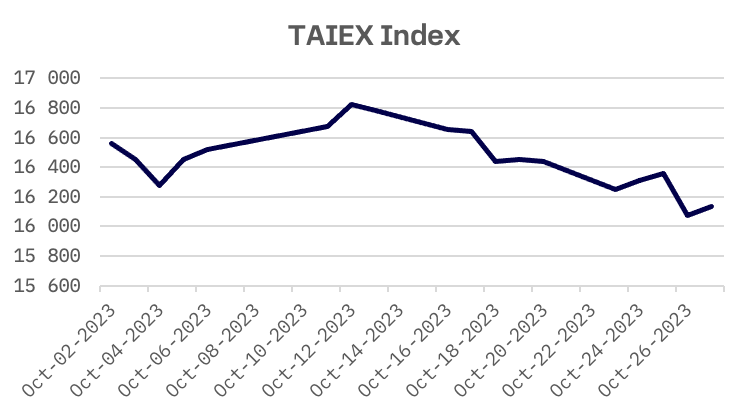

In line with trends observed in other Asian stock markets, Taiwan’s stock exchanges experienced a decline over the course of the week, with the TAIEX index registering a 1.9% decrease. The electronics sector, serving as a key indicator, exerted downward pressure on prices, notably affecting major players like chipmaker Taiwan Semiconductor Manufacturing (JAKOTA Blue Chip 150 Index). This decline was attributed to the increase in Treasury yields, which rendered tech stocks, with their comparatively lower dividends, less appealing to investors.

This week witnessed the release of two significant sets of macroeconomic data which failed to instill positive market sentiments among investors.

On Monday, the Ministry of Economic Affairs (MOEA) released data about Taiwan’s industrial production index, which registered a year-on-year decrease of 6.72% to 89.60 in September. Additionally, the manufacturing sector sub-index, which accounts for over 90% of total industrial production, recorded a 7.01% decline from the previous year, settling at 88.81. This prolonged downturn in industrial production underscores the ongoing impact of global demand weakness for electronic goods on Taiwan’s export-driven economy. The MOEA noted that this prolonged downturn in both the industrial index and the manufacturing sub-index constitutes the lengthiest period of weakness in these indices in Taiwan’s history.

The National Development Council (NDC) reported on Friday that the composite index of economic indicators increased by two points compared to the previous month, reaching a total of 17. However, the leading indicators, which provide insight into the economic outlook for the next three to six months, continued their downward trend, falling by 0.77 percent from the previous month to 97.88. This marks the sixth consecutive monthly decline, as per the NDC’s findings.

JAKOTA Blue Chip 150 Index

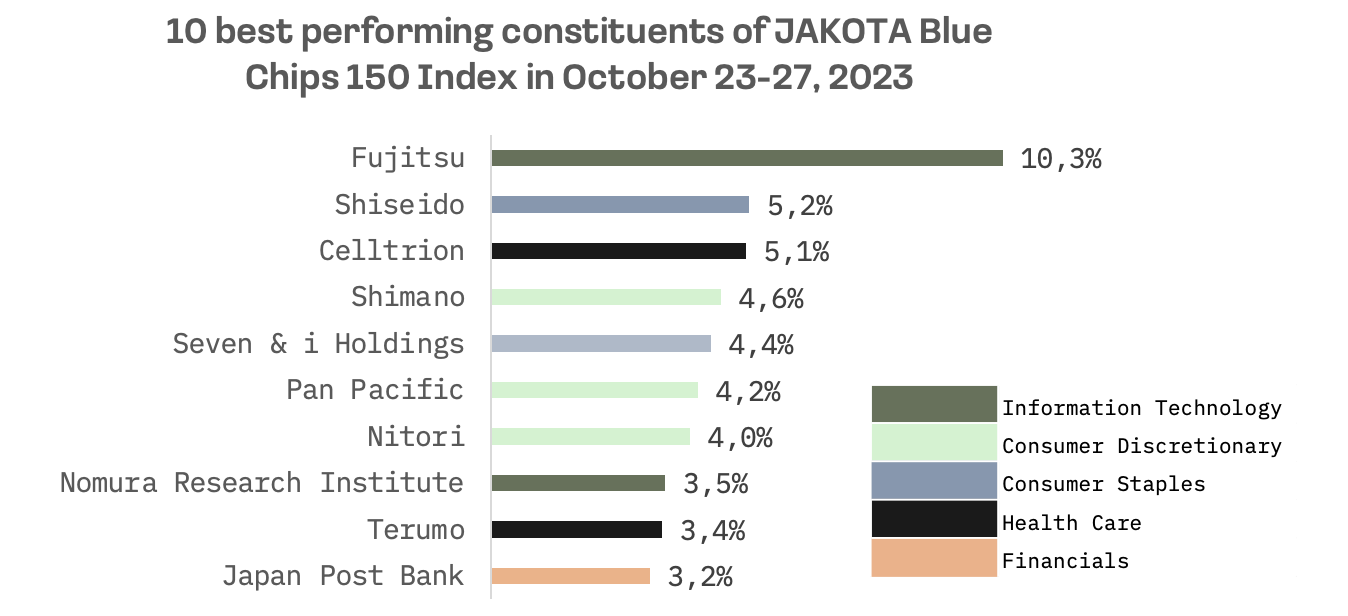

Out of a pool of 150 constituents, 62 shares demonstrated positive price trends this week.

The top-performing stock this week is Fujitsu. On October 26, the corporation unveiled its consolidated financial results for the second quarter of the ongoing fiscal year concluding in March 2024 (April to September 2023). The company cut its full-year forecasts for sales and operating profit. Nevertheless, the IT services division, a cornerstone of the company’s operations, demonstrated robust performance, marked by substantial upticks in sales and profits during the second quarter (July-September 2023) as opposed to the preceding quarter (April-June 2023).

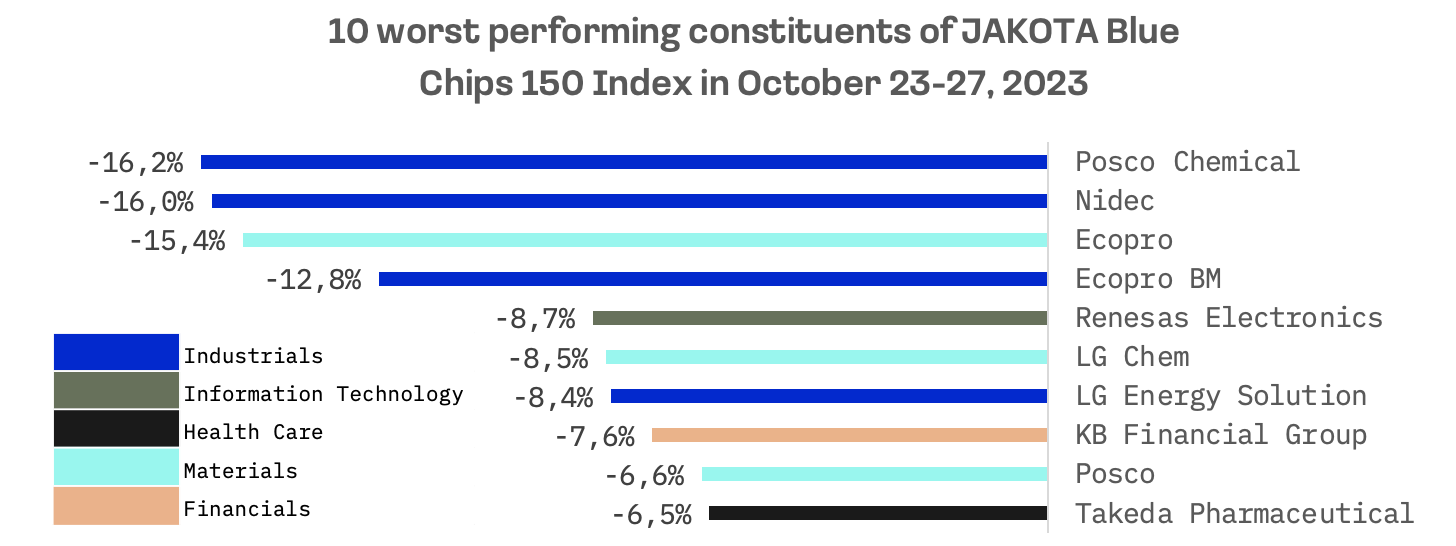

Alongside POSCO Chemical and POSCO, both of which have consistently ranked among the 10 poorest performers in the JAKOTA Blue Chip 150 Index for the second consecutive week, Nidec also witnessed a significant decline in its share value. This decline reflects growing apprehensions among investors regarding the company’s outlook within the fiercely competitive Chinese electric vehicle market. The dip in profitability within Nidec’s EV sector in China underscores the challenges encountered by component manufacturers in the world’s largest automotive market. Automakers are increasingly exerting pressure on suppliers to streamline expenses amidst a backdrop of waning growth in electric vehicle demand and aggressive price competition.