Japan

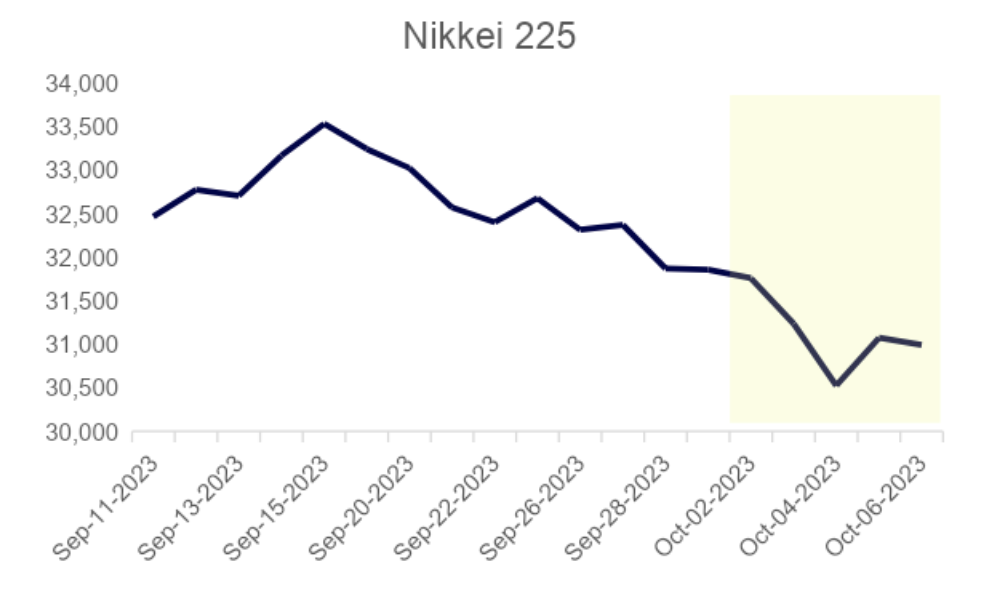

Stock markets in Japan experienced a downturn throughout the week, with the Nikkei 225 Index witnessing a decline of 2.7%. The downward trend can be attributed to mounting concerns over escalating U.S. bond yields, coupled with concerns regarding prolonged hawkishness from central banks.

Recent economic indicators unveiled during the first week of October have further dampened market sentiment:

- Real wages dropped for the 17th straight month, with average earnings declining 2.5% in August from a year earlier.

- In August, household spending witnessed a 2.5% decline compared to the previous year, marking the sixth consecutive month of contraction.

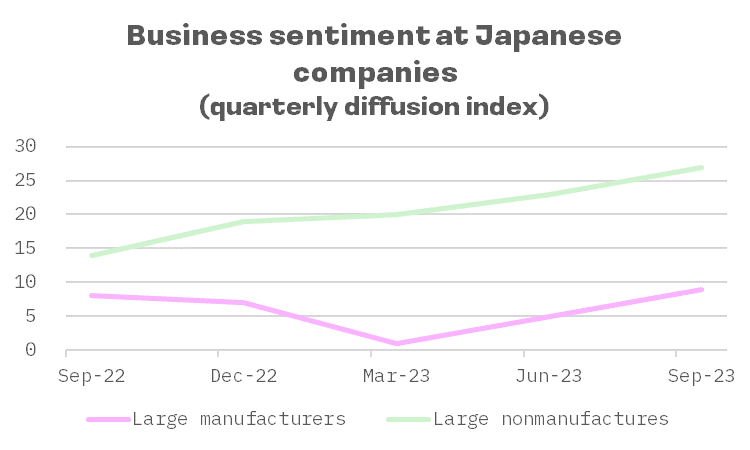

The Bank of Japan’s (BoJ) most recent quarterly Tankan survey (Short-Term Economic Survey of Enterprises in Japan) indicated that a weakened yen has bolstered business confidence among Japanese enterprises, providing some support to the market. This uptick in sentiment is also attributed to a more advantageous supply chain and an influx of international tourists. The diffusion index for large manufacturers, a metric closely monitored by market observers, exhibited a notable uptick of 4 points from the previous survey in June, reaching a total of 9. This sentiment boost was particularly pronounced within the automotive sector.

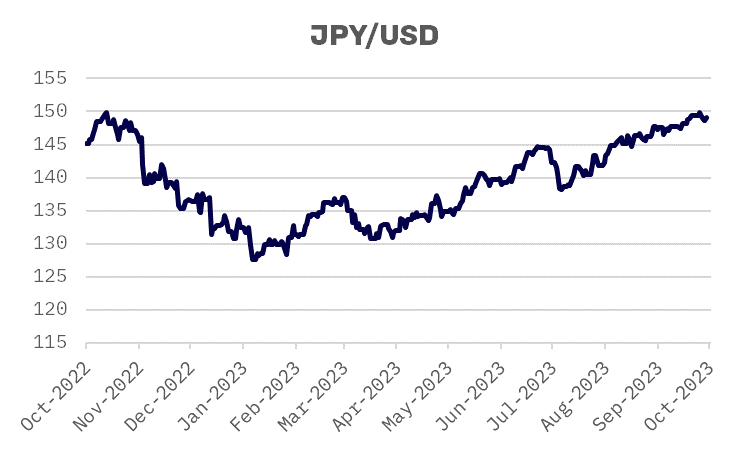

Market speculation was rife regarding the intervention of Japan’s Ministry of Finance in the foreign exchange market, aiming to stem the yen’s descent. This move followed a rapid surge of the currency, briefly breaching the JPY 150 threshold against the U.S. dollar, an event widely anticipated as a potential trigger for regulatory intervention. While Japan’s Ministry of Finance officials refrained from explicit confirmation or denial of their involvement, however they emphasized their commitment to curbing excessive volatility. As the week concluded, the yen demonstrated resilience, stabilizing around JPY 149 against the U.S. dollar.

The yield on the 10-year Japanese government bond (JGB) surged to 0.80%, a 10-year high. This upward trajectory occurred despite the Bank of Japan unscheduled purchases of JGBs at maturities between five and 10 years. The ascent in yields was propelled by a pronounced selloff in U.S. Treasuries and a mounting consensus that the BoJ may expedite its course toward monetary policy normalization in the near term.

South Korea

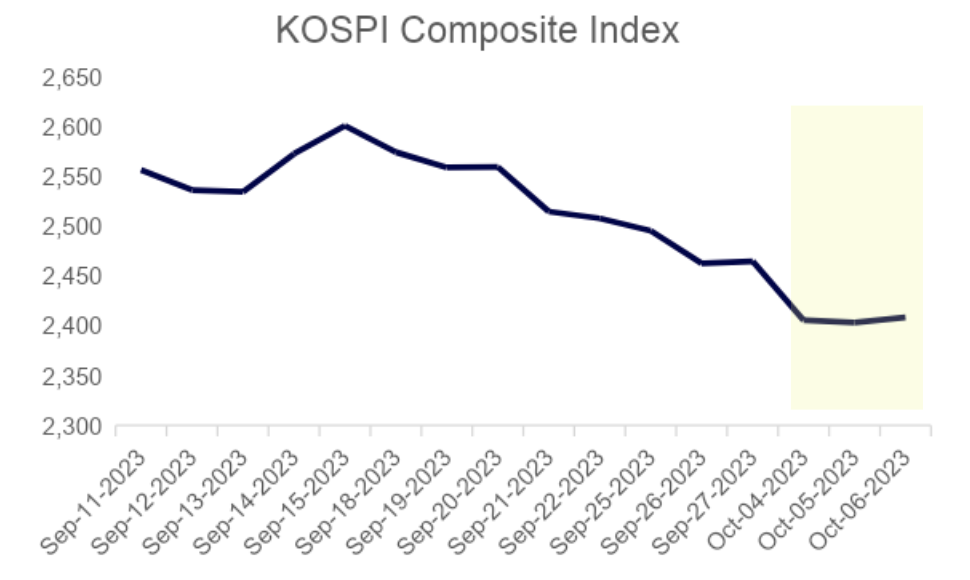

The week encompassed only three trading sessions (from Wednesday to Friday), owing to the closure of the stock markets during the extended fall harvest holiday.

On Wednesday, October 4, South Korean stocks tumbled to their lowest point in six months, a downturn primarily driven by a steep decline in major-cap tech shares. This decline has been exacerbated by growing concerns that the Federal Reserve will maintain higher interest rates for an extended period.

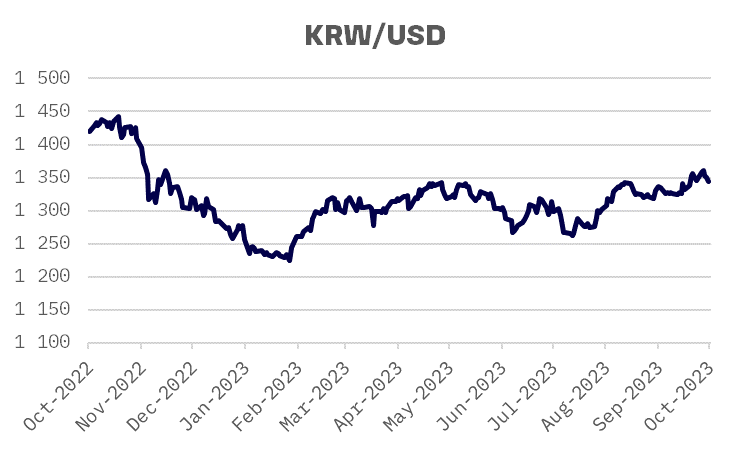

Simultaneously, the local currency experienced a notable depreciation against the U.S. dollar, reaching an 11-month low.

Inflation data published on Thursday failed to instill optimism. South Korea witnessed a second consecutive month of accelerated consumer inflation in September, surpassing market projections. This supports prospects of the central bank maintaining its restrictive policy in the foreseeable future.

In specifics, the consumer price index registered a 3.7% year-on-year surge in September. Economists participating in a Reuters survey had anticipated the figure to stay unchanged.

Trading activity on Friday was slim as South Korean stock markets will be closed till Tuesday (October 10). Next Monday is the Hangeul Day holiday, commemorating the proclamation of the Korean alphabet.

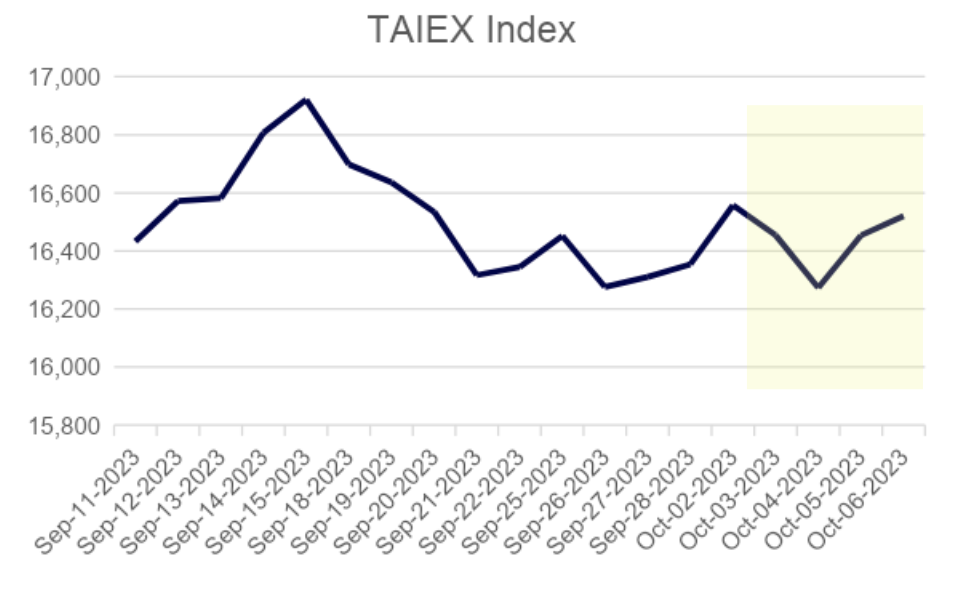

Taiwan

Midweek, the Taiwanese stock market, in tandem with its Asian counterparts, faced renewed pressure due to renewed fears over a hawkish U.S. Federal Reserve in the wake of a spike in American treasury yields, pointing to higher interest rates.

Comments made by Yang Chin-long, the governor of Taiwan’s central bank, on Wednesday, did not engender optimism among investors. Yang said that the bank prioritizes combating inflation over stimulating economic growth when contemplating adjustments to monetary policy. Despite the pause in the bank’s rate hike in September, Yang stated after the meeting that the local central bank’s endeavors to tighten monetary policy might extend further.

On Thursday, the Taiwanese stock market experienced a rebound, prompted by a recovery in the U.S. market. Furthermore, on Thursday the Financial Supervisory Commission (FSC) published a press release detailing the Status of Foreign Portfolio Investment. compiled by the FSC revealed that foreign institutional investors, including Chinese investors, collectively divested a net NT$77.03 billion worth of shares across both the local main board and the OTC market over the January-September period. The substantial net sell-off by foreign institutional investors primarily stemmed from a surge in U.S. treasury yields, and the desire of foreign institutional investors to allocate their capital towards U.S. dollar-denominated assets.

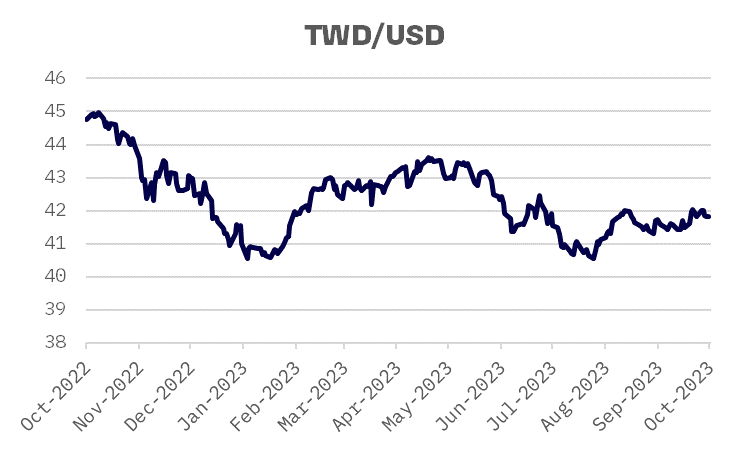

Besides, Taiwan’s foreign exchange reserves at the conclusion of September recorded a second consecutive month-over-month dip, a result of the local central bank’s efforts to fortify the Taiwan dollar and curb the ascendancy of the U.S. dollar.

Statistics released by the central bank indicated that the nation’s forex reserves as of September’s end amounted to US$564.01 billion, marking a decrease of US$1.46 billion compared to the preceding month. This trend follows a decrease in August, signifying the first decline in Taiwan’s forex reserves in 11 months, attributable to similar market intervention by the central bank.

JAKOTA Blue Chip 150 Index

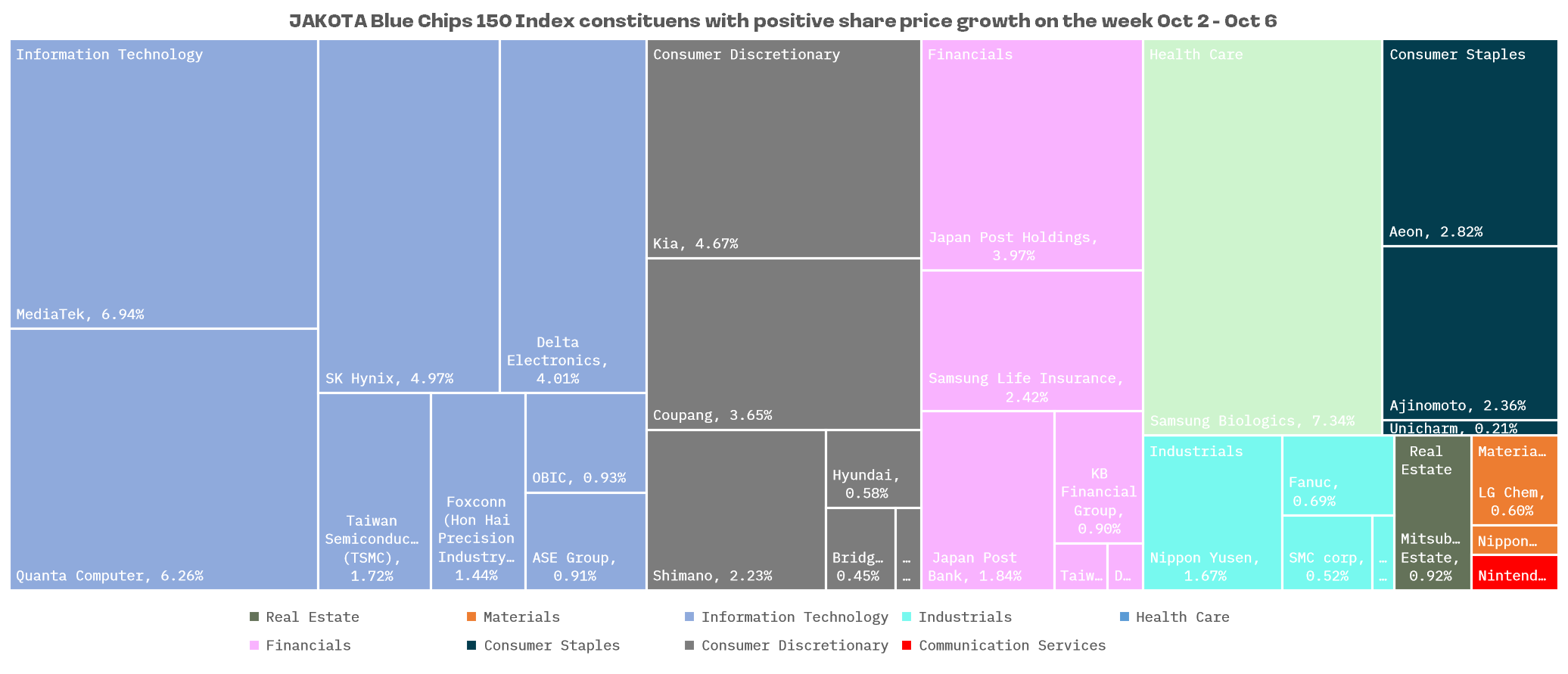

Out of a pool of 150 constituents, only 32 exhibited favorable share price trends in the past week. Notably, most of these companies are affiliated with the Information Technology and Consumer Discretionary sectors.

Refiner Inpex (1605.TSE) was the worst performing JaKoTa Blue Chip 150 Index stock, witnessing a substantial 15% decline in its stock value last week driven by a significant drop in oil prices.

Among growth leaders there were shares of:

Samsung BioLogics (207940.KO) declared in a public statement on October 4th that it is revising upwards its annual sales forecast for 2023. The initial projection, which ranged from 15-20%, has now been elevated to over 20%

MediaTek (2454.TW) and Quanta Computer (2382.TW) shares demonstrated growth amidst the positive trends observed in shares of large-cap semiconductor companies in the American market.

| Company Name | Exchange: Ticker | Market Cap as of Oct-6, 2023, USD million |

| Giant Manufacturing Co., Ltd. | TWSE:9921 | 2,183.7 |

| Merida Industry Co., Ltd. | TWSE:9914 | 1,651.9 |

| Yusin Holding Corp. | TWSE:4557 | 152.8 |

| Lee Chi Enterprises Company Ltd. | TWSE:1517 | 104.6 |

| Ideal Bike Corporation | TPEX:8933 | 96.7 |

| Axman Enterprise Co., Ltd. | TPEX:6804 | 67.3 |

| Sun Race Sturmey-Archer Corporation | TWSE:1526 | 64.8 |

| Joy Industrial Co., Ltd. | TPEX:4559 | 20.3 |