Japan

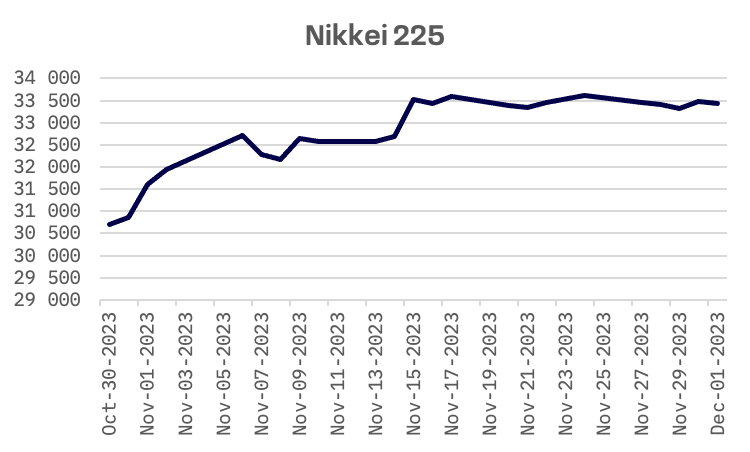

Japan’s stock market experienced a modest downturn this week, with the Nikkei 225 Index declining by 0.6%. This pullback followed a robust surge in November, buoyed by expectations that U.S. interest rates might have peaked, strong corporate earnings, and the yen’s weakening aiding manufacturers.

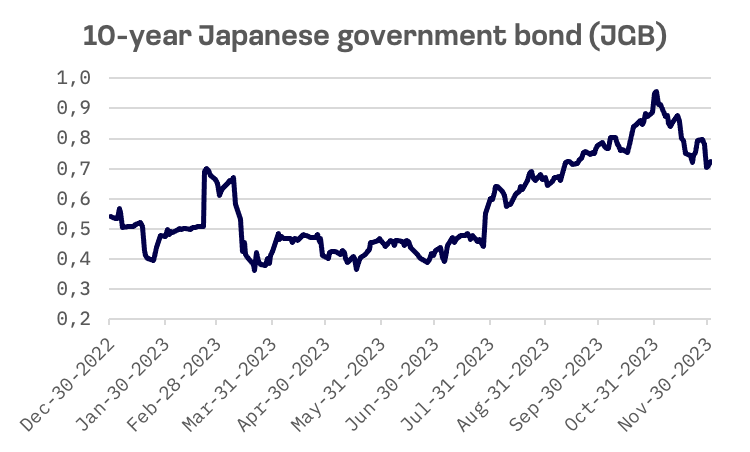

The yield on 10-year Japanese government bonds dropped to 0.71% from 0.77%, reflecting the impact of dovish remarks by the Federal Reserve on U.S. bond yields.

The Bank of Japan (BoJ) reported significant unrealized losses of 10.5 trillion yen ($71.2 billion) on its Japanese government bond holdings as of September’s end, as revealed in its latest financial statements. These losses, the most substantial since the adoption of its current valuation method in 2004, were primarily due to rising yields adversely impacting bond prices. Notably, this marks the third consecutive semiannual period of such paper losses for the central bank.

As the BoJ contemplates an exit from its extensive monetary easing program, these ongoing losses are drawing increased scrutiny from legislators. Concerns are mounting that a gradual policy shift could lead to elevated interest rates, potentially increasing the central bank’s interest payments to financial institutions beyond its interest income. To mitigate this risk, the BoJ has maintained a reserve, totaling 537.4 billion yen for the six months through September, as a buffer against the growing financial pressures.

Amidst ongoing economic challenges, Japan’s Prime Minister Fumio Kishida has reiterated the government’s commitment to implementing comprehensive measures to counter the adverse effects of recent price hikes. In early November, his administration unveiled a substantial economic stimulus package, exceeding USD 110 billion, aimed at stimulating growth and easing the financial burden on households struggling with the rising cost of living. This package includes targeted initiatives such as reductions in income and residential taxes, as well as direct cash assistance for low-income earners. Further bolstering these efforts, Japan’s parliament, during the week, approved an additional budget for the ongoing business year, which concludes in March 2024. This move facilitates the allocation of funds necessary for these fiscal stimulus measures, underscoring the government’s proactive stance in addressing these economic challenges.

South Korea

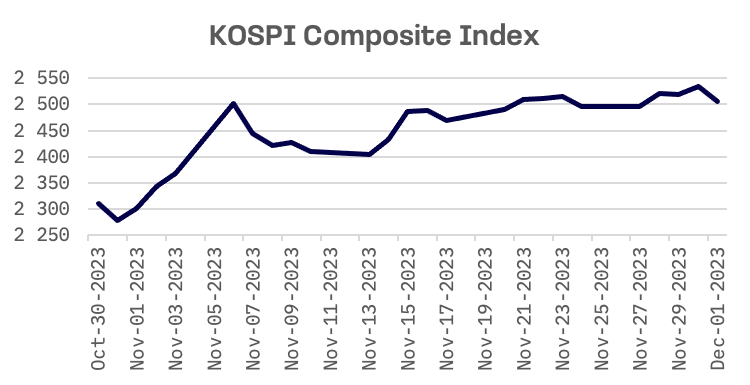

The KOSPI Composite Index in South Korea advanced by 0.34% this week, continuing its upward trajectory for the fifth consecutive week. This sustained growth was partly influenced by the November surge in U.S. stocks, fueled by optimism around the Federal Reserve potentially moving away from its hawkish stance. Notably, the S&P 500 Index and the Nasdaq Composite concluded Thursday with their most significant monthly gains since July 2020, recording increases of 8.9% and 10.7%, respectively.

Despite recent statements from the head of the central bank stressing the need for continued high interest rates and hinting at possible additional rate hikes, the South Korean market’s sentiment has remained relatively buoyant. This resilience may be attributed to investor expectations aligning with the Bank of Korea’s recent decisions to hold interest rates steady and revise its growth forecast downward, in line with actions by international bodies like the IMF and World Bank.

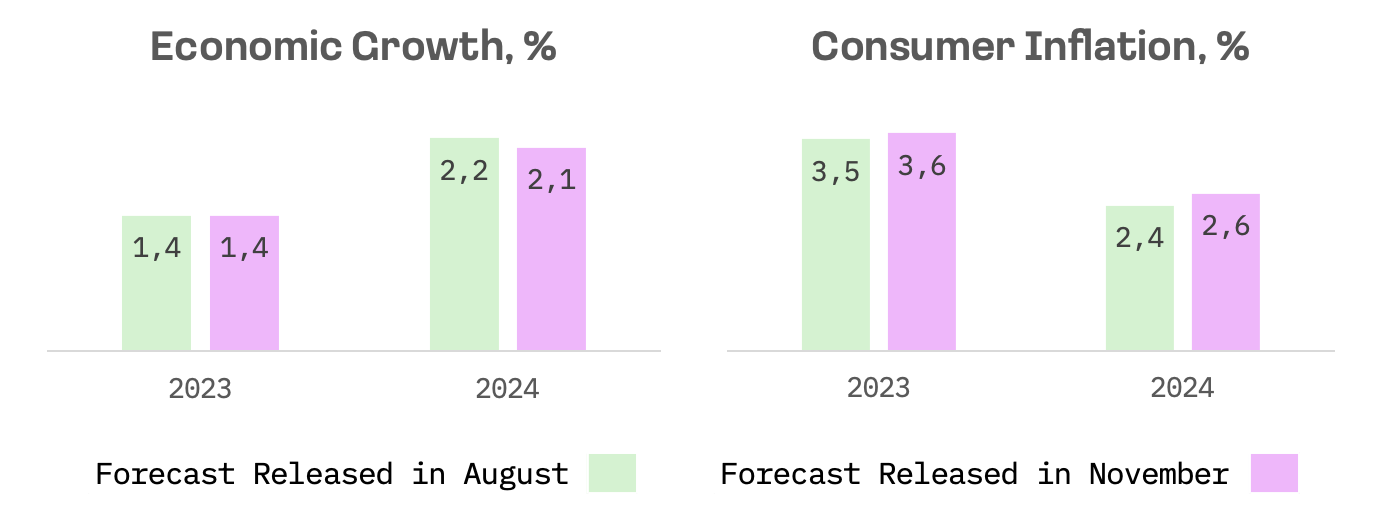

In a move that was widely expected, the Bank of Korea (BOK) decided to maintain its policy interest rate at 3.5% for the seventh consecutive meeting, a unanimous decision reflecting continuity in its monetary policy stance. The BOK revised its consumer inflation outlook, raising its forecasts to 3.6% for 2023 and 2.6% for 2024. These adjustments represent slight increases of 0.1 and 0.2 percentage points, respectively, from the forecasts set in August. Concurrently, the BOK moderated its economic growth expectation for 2024, reducing it to 2.1% from the previously projected 2.2%, while maintaining the current year’s growth prediction at 1.4%.

In a significant development for the country’s economy, the Ministry of Trade, Industry, and Energy reported a notable increase in chip exports. November saw a 12.9% year-on-year growth in outbound chip shipments, amounting to $9.5 billion. This growth marks the end of a 15-month declining trend and signals a potential resurgence in the global semiconductor industry.

Taiwan

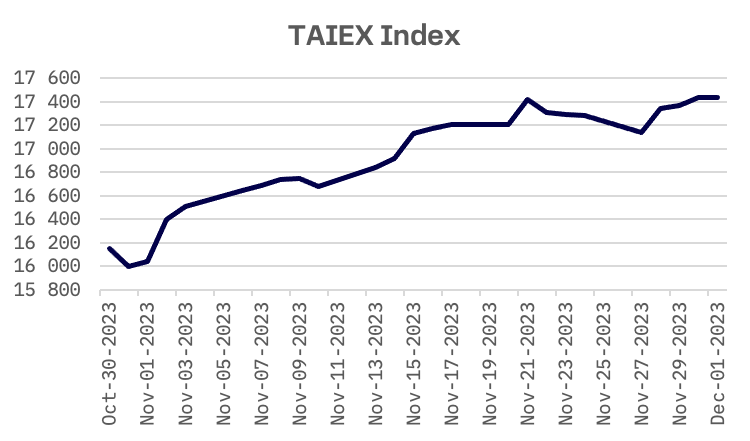

Taiwan’s TAIEX index recorded a 0.9% gain, overcoming an initial decline driven by selling in tech stocks related to the U.S. ban on chip sales to China. The semiconductor sector, a critical driver of Taiwan’s economy, experienced volatility following reports of potential price cuts by Taiwan Semiconductor Manufacturing Co. (TSMC). However, the market rebounded from Tuesday, achieving levels not seen since April 2022.

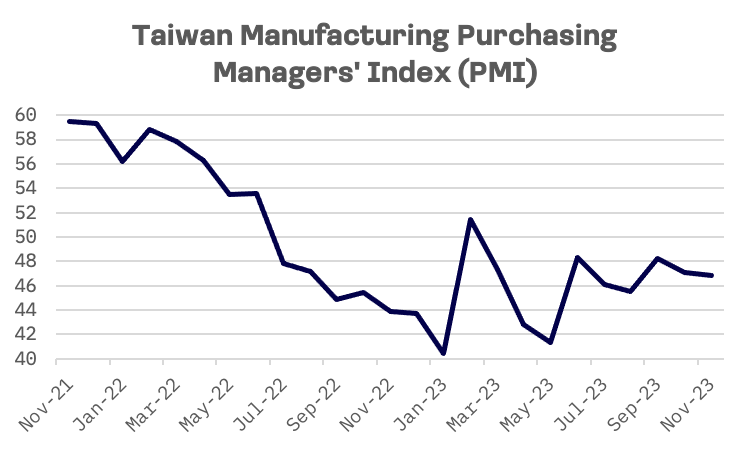

In Taiwan, manufacturing activity continued to demonstrate signs of weakening, as reported by the Chung-Hua Institution for Economic Research (CIER). The purchasing managers’ index (PMI) for November decreased slightly by 0.3 points from the previous month, registering at 46.8. This decline in the PMI was primarily driven by notable drops in specific sub-indexes. The production sub-index fell by 1.2 points to 48.2, and the employment sub-index decreased by 0.7 points to 47.9, compared to their levels a month earlier. Furthermore, the inventories sub-index also experienced a marginal decline of 0.1, settling at 42.7.

JAKOTA Blue Chip 150 Index

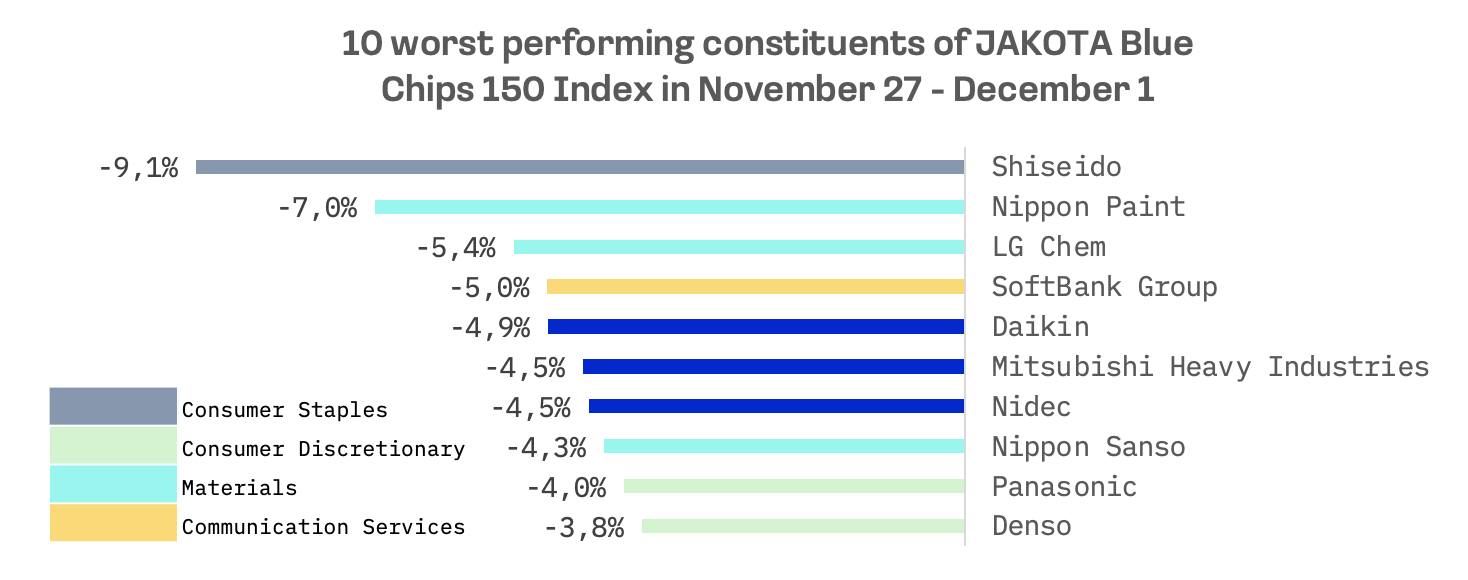

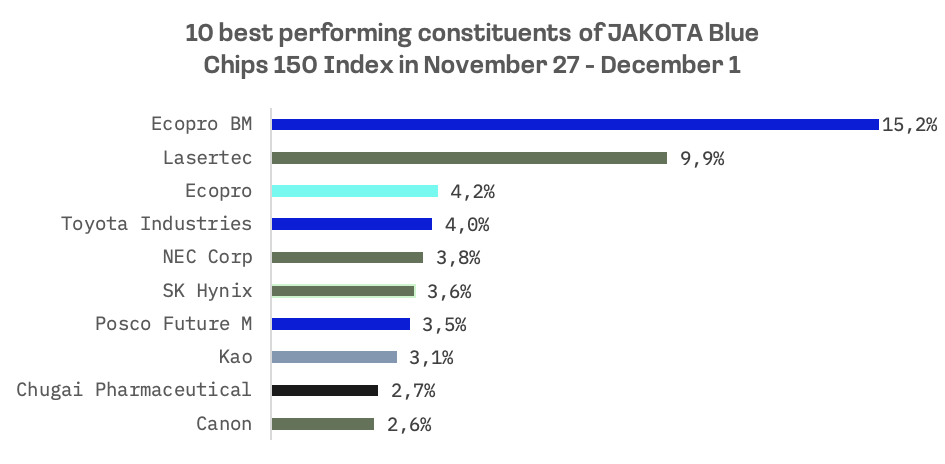

The JAKOTA Blue Chip 150 Index saw a 0.7% rise, with only 62 of its 150 constituents showing positive trends.

Ecopro BM, a manufacturer specializing in cathode materials, stood out as one of the top-performing stocks this week. The company’s stock experienced a significant surge following the announcement of securing a pivotal cathode material supply contract with Samsung SDI, a major player in the industry.

Lasertec, known for its inspection and measurement solutions in the semiconductor and flat panel display industries, also saw a noteworthy uptick in its stock performance. The company rebounded technically after a period of underperformance in the previous week. This positive shift was further supported on November 30 when Iwai Cosmo Securities reaffirmed its investment rating for Lasertec at “A”, simultaneously raising the target price for the stock from 34,000 yen to 40,000 yen. Additionally, Lasertec’s recent unveiling of the ACTIS “A300” photomask defect inspection system, which integrates advanced EUV (extreme ultraviolet) light technology, may have contributed to the renewed investor confidence in the company.

Shiseido, a prominent cosmetics company, faced challenges this week, emerging as the worst-performing stock in the JAKOTA Blue Chip 150 Index. Notably, this represents the second time in recent weeks that Shiseido has found itself at the bottom of the index, having previously shown the weakest stock performance just two weeks prior. The company’s stocks have been under pressure primarily due to a strategic revision in its operations within the China market.