Japan

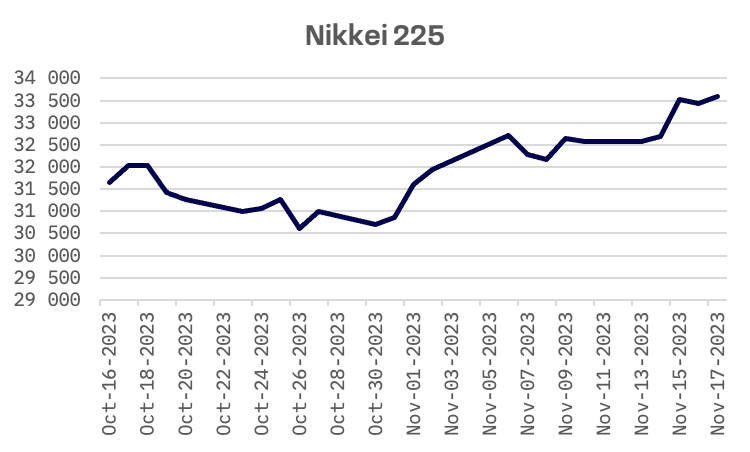

This week, Japan’s Nikkei 225 Index recorded a robust 3.1% gain, reflecting a positive shift in investor sentiment. This upbeat market mood was further bolstered by better-than-expected corporate earnings and a surge in risk appetite, fueled by recent U.S. inflation data that fell below expectations. This data suggested a potential impending economic soft landing, boosting hopes that interest rates might have peaked, thereby enhancing investor optimism.

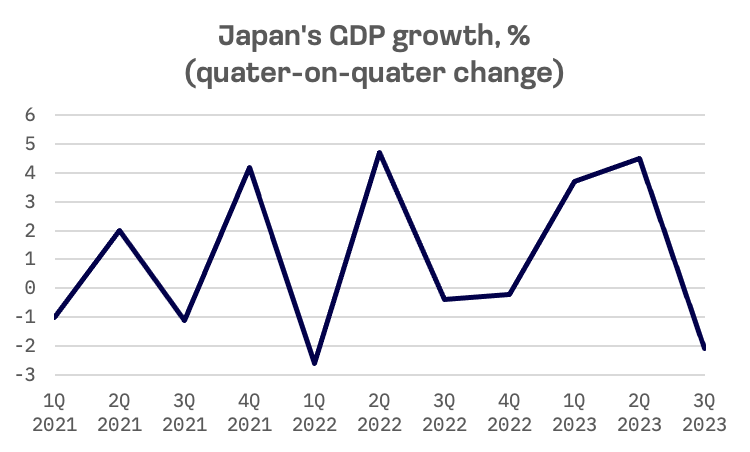

Japan’s economic challenges, however, were underscored by its third-quarter GDP figures. The economy contracted at an annualized rate of 2.1% in the July-September period, sharply exceeding the forecasted 0.6% decline. This downturn, following two consecutive quarters of positive growth, highlights the unpredictability and fragility of Japan’s economic recovery. The primary factors behind this contraction were a significant slump in private inventories, compounded by persistent challenges such as subdued private consumption, which was impacted by inflation and yen depreciation, as well as lackluster export performance in the face of global demand headwinds.

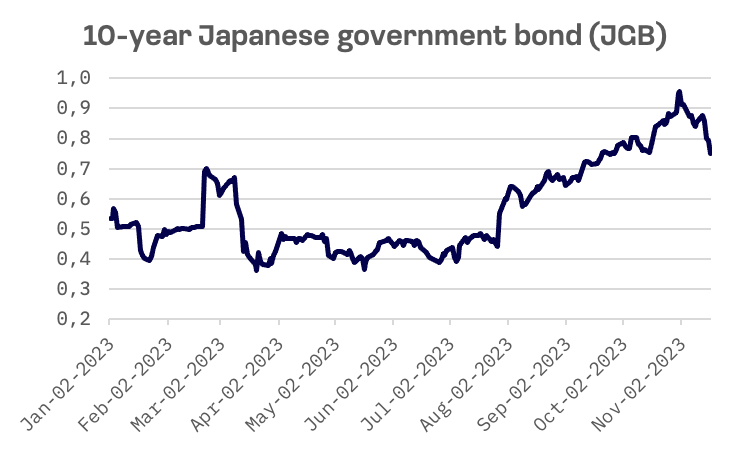

In the bond market, the yield on 10-year Japanese government bonds fell from 0.85% to 0.72%, mirroring declines in U.S. bond yields. The Bank of Japan responded by reducing the amount of JGBs offered for purchase, aiming to mitigate yield volatility.

The deceleration in October’s corporate goods price index, which rose by just 0.8% year-over-year, was largely attributed to a decline in global commodity prices, marking a notable slowdown from September’s 2.2% increase. This suggests signs of easing inflation in Japan, a positive shift in the economic landscape.

The yen strengthened to JPY 149 against the USD, yet remains near a 33-year low. The Japanese government has reiterated its commitment to taking all necessary measures to address foreign exchange market volatility. BoJ Governor Kazuo Ueda underscored the dual impact of the yen’s valuation, noting that while it aids in boosting exports and enhancing global firms’ profits, it also contributes to elevated import prices.

South Korea

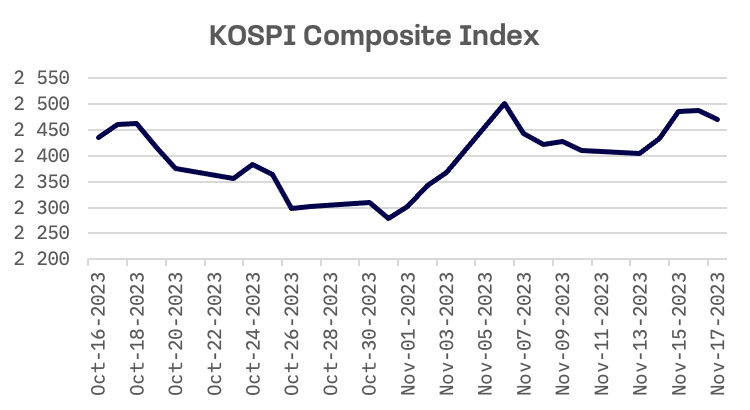

In South Korea, the KOSPI Composite Index climbed 2.5%, marking its third consecutive week of gains. The upward movement in the Korean stock market was propelled by signs of easing U.S. inflation and improvements in the country’s factory output and chip exports. Early data indicated a 3.2% increase in the country’s exports during the initial 10 days of the month, driven by a 1.3% uptick in semiconductor exports – the first positive movement since August 2022. Following this report, the market continued its upward trajectory, influenced by speculation about the Federal Reserve’s potential conclusion of rate hikes.

In its monthly economic assessment report, Korea’s Ministry of Economy and Finance remarked, “We’ve observed indications of a gradual economic recovery propelled by a resurgence in factory output and chip exports. This positive trend is complemented by sustained improvements in the service sector and employment.”

Taiwan

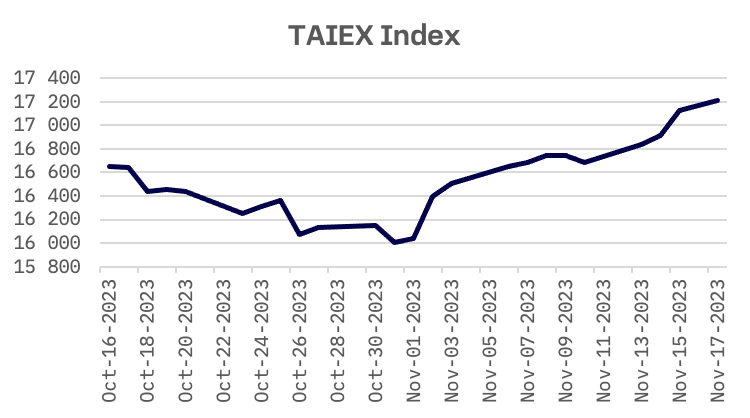

Alongside other JAKOTA markets, Taiwan’s TAIEX index experienced a notable upward trajectory this week. The TAIEX index registered a significant 3.2% gain, achieving a milestone on Wednesday by surpassing the crucial 17,000 level. This gain was largely attributed to diminishing concerns regarding additional interest rate hikes by the United States Federal Reserve, following a lower than anticipated increase in the U.S. inflation rate.

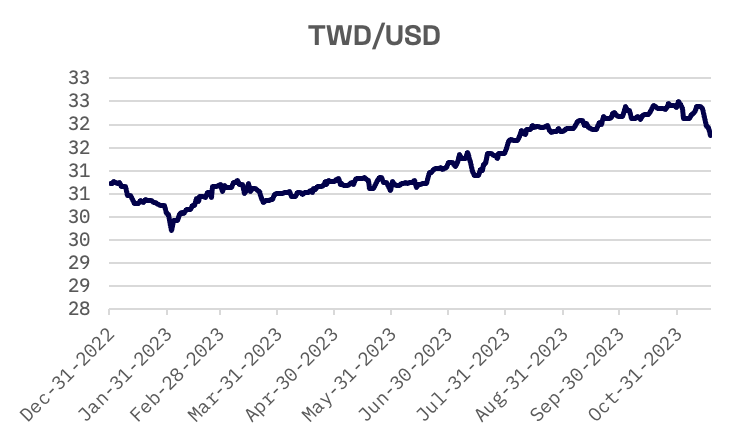

The TAIEX’s upward trajectory was accompanied by a strengthening local dollar, buoyed by the news of a unified candidate from opposition parties – the Kuomintang and Taiwan People’s Party. This political development provided reassurance to those concerned about potential strain between Taipei and Beijing, particularly if Vice President Lai Ching-te of the ruling Democratic Progressive Party, a consistent leader in opinion polls, were to emerge victorious.

JAKOTA Blue Chip 150 Index

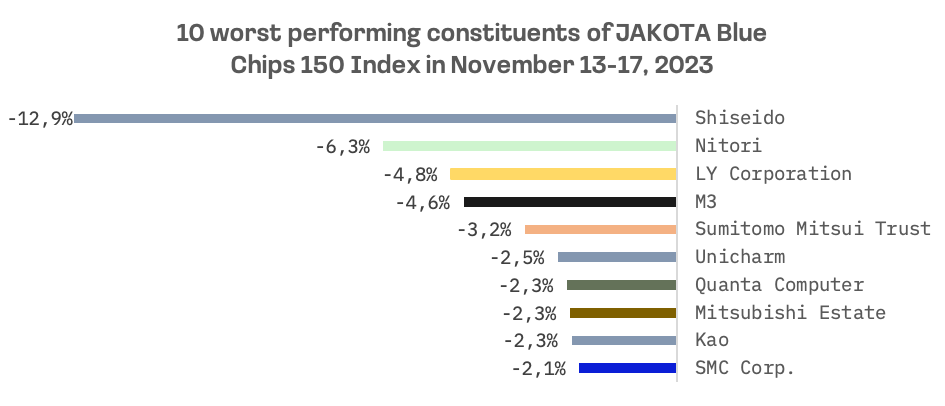

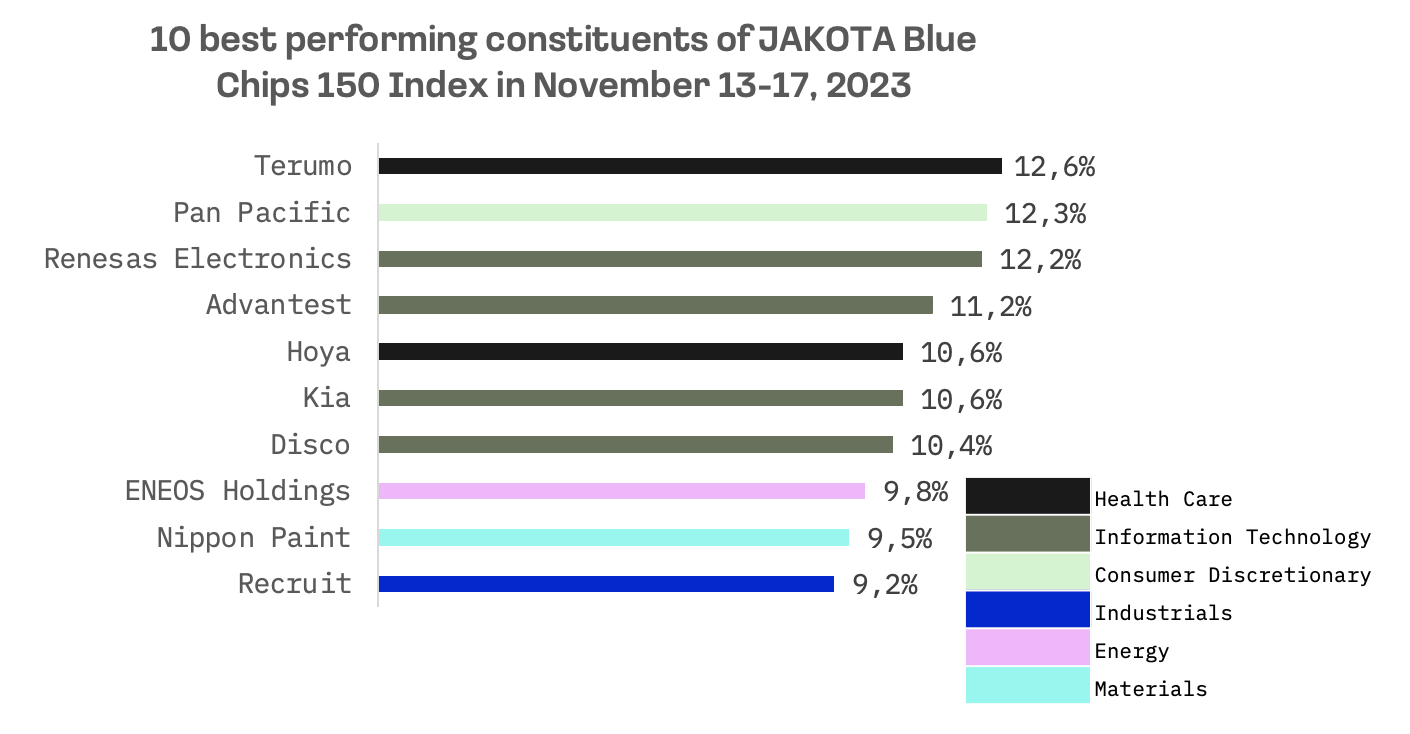

The JAKOTA Blue Chip 150 Index surged 4.5%, with investors reassessing future rate hike likelihoods and favoring large-cap stocks. Among its 150 constituents, 119 stocks showed positive trends.

Top performers this week included Terumo, a medical equipment manufacturer, whose shares soared on November 15, reaching their highest valuation in about five months, following the release of impressive quarterly financial results. This surge was driven by robust international sales of catheters, particularly for cardiovascular treatments, and record-breaking consolidated net profit for the April-September period.

Pan Pacific, an operator of discount stores, also saw its shares rise, driven by financial results released after market close on November 10. The company reported a notable 33.3% year-on-year increase in net income for the first quarter, totaling 24.6 billion yen.

Renesas Electronics, a semiconductor manufacturer, experienced a surge in its shares following the announcement by INCJ, a government-backed fund, of the completion of its divestment of all shares in Renesas. This move was significant given INCJ’s crucial role in rescuing Renesas with approximately 140 billion yen in 2013, after financial challenges post the 2011 Tōhoku earthquake and tsunami.

Conversely, Shiseido, a cosmetics company, emerged as the worst-performing constituent of the JAKOTA Blue Chip 150 Index this week. The company revised its earnings forecast downward for the fiscal year ending December 31, 2023. Shiseido now anticipates net sales of JPY 980,000 million, core operating profit of JPY 35,000 million, and basic earnings per share of JPY 45.04, a significant deviation from its prior forecast.