Last week’s JAKOTA markets:

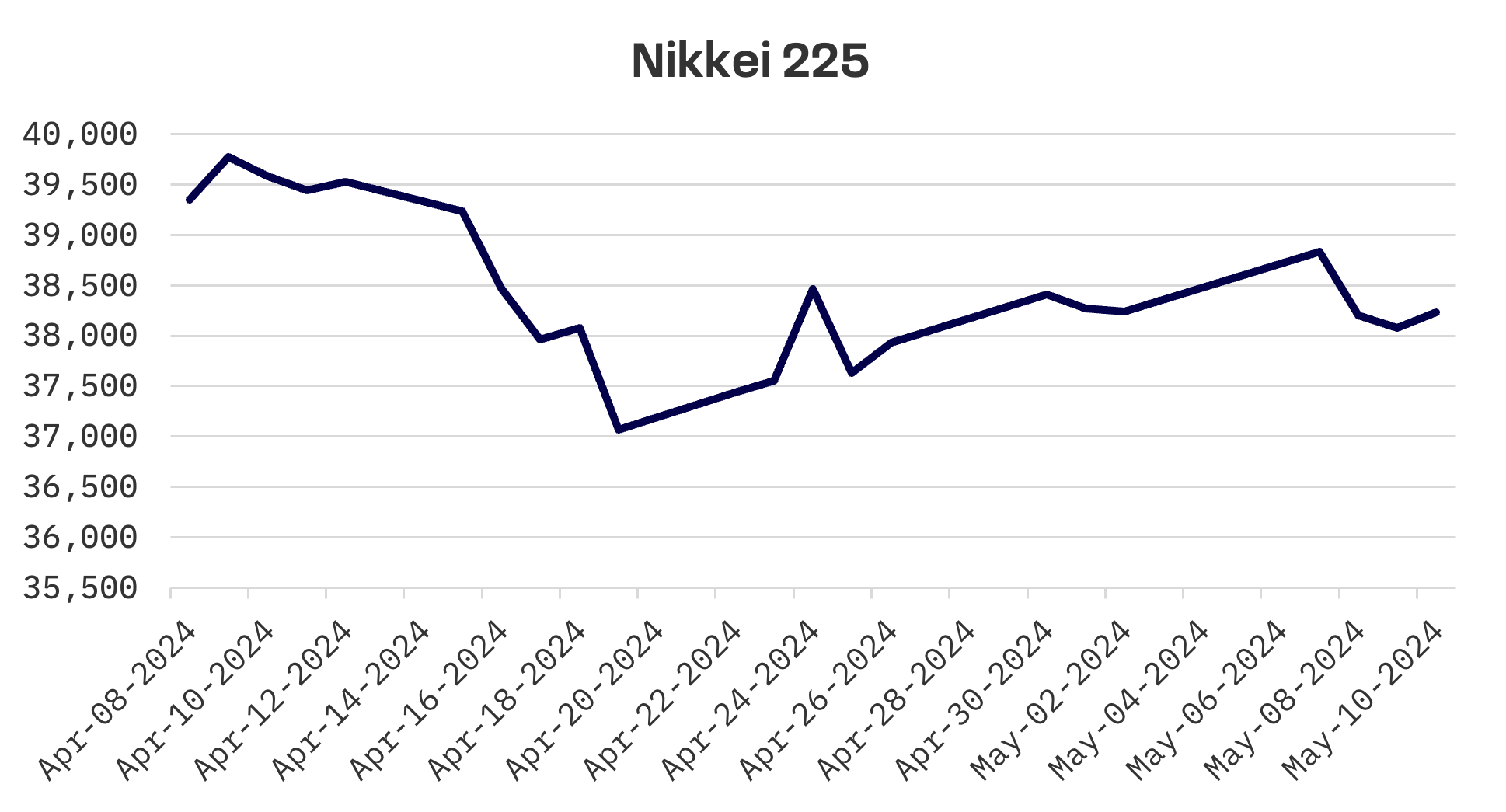

- Japan’s Nikkei 225 index remained flat as BoJ Governor Ueda hinted at potential early rate hikes amid weak economic data

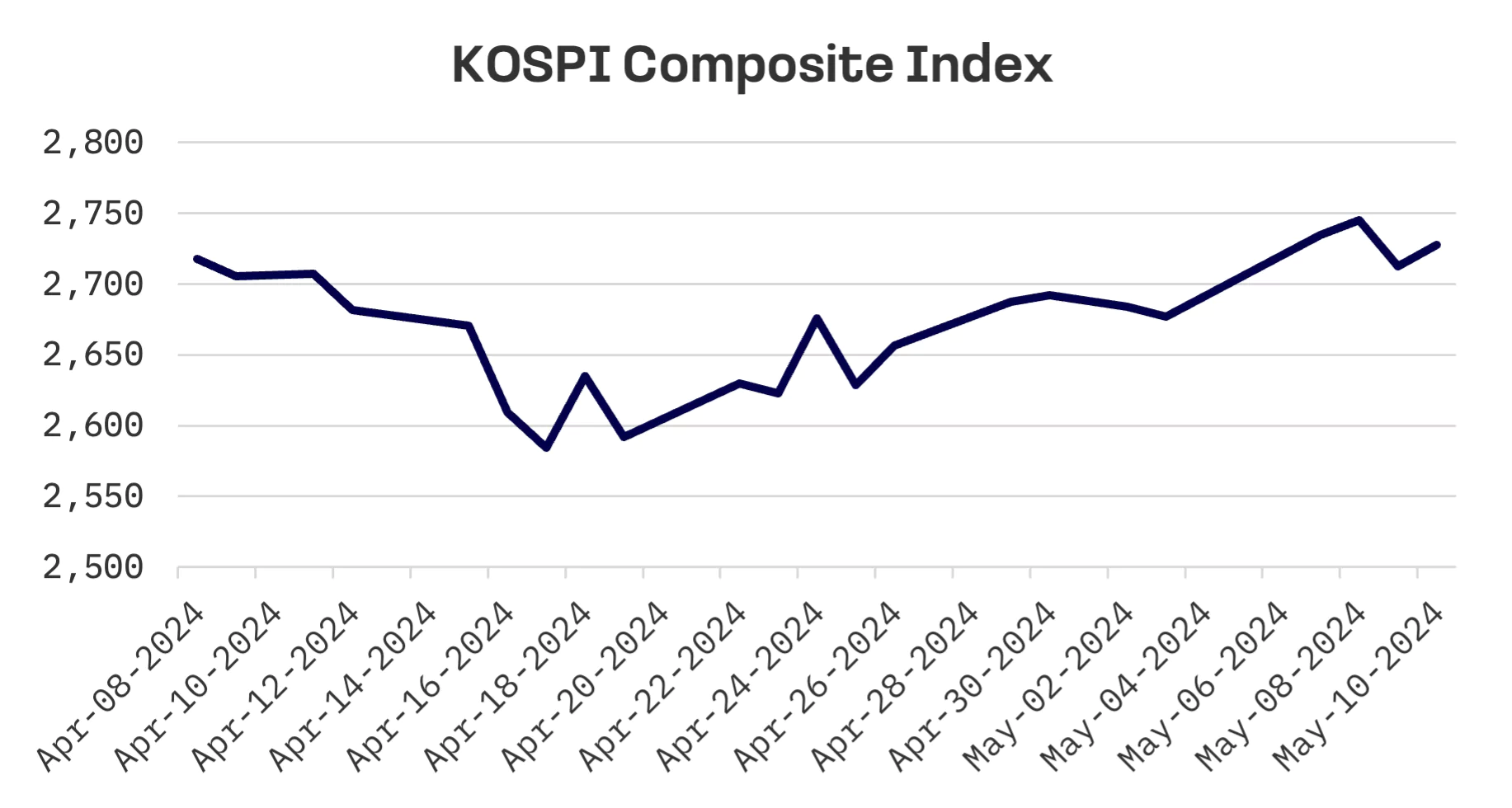

- South Korea’s KOSPI rose 1.9%, buoyed by optimism over Federal Reserve rate cuts and speculation about extending the short-selling ban

- Taiwan’s TAIEX climbed 1.9%, driven by strong performance from TSMC and hopes for a U.S. rate cut cycle

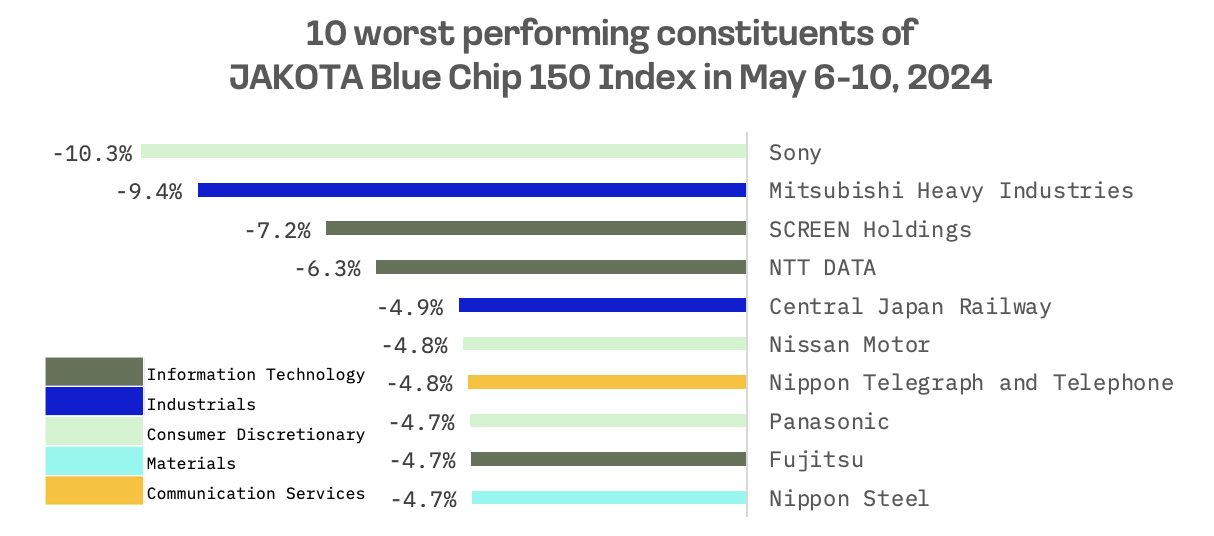

- The JAKOTA Blue Chip 150 Index edged down 0.5%, with Daikin Industries posting gains and Sony Group facing declines over acquisition financing concerns

Japan

The Nikkei 225 index showed little change this week compared to its close on the previous Friday, May 3. Stability in the market comes amid signals from Bank of Japan (BoJ) Governor Kazuo Ueda that the central bank might consider an early interest rate hike in response to potential upside risks to the inflation outlook, influenced by the yen’s weakness.

At the April BoJ meeting, a summary of opinions revealed a notable shift towards a hawkish stance among participants. One member suggested the possibility of an expedited pace of monetary policy normalisation, signalling a proactive approach. Another member expressed the view that the trajectory for interest rates could surpass current market expectations. Notably, many market participants are factoring in the likelihood of two rate hikes within a year, reflecting growing anticipation of policy adjustments.

The prevailing high differentials in interest rates between the United States and Japan have led some analysts to speculate that another interest rate increase might not necessarily bolster sustainable yen appreciation. Throughout the week, the yen experienced depreciation, reaching the upper range of JPY 157 against the USD, a shift from approximately 153. Surprisingly, this movement occurred despite market consensus suggesting that authorities had intervened in the foreign exchange markets twice recently to bolster the yen, supported by accounts from the BoJ.

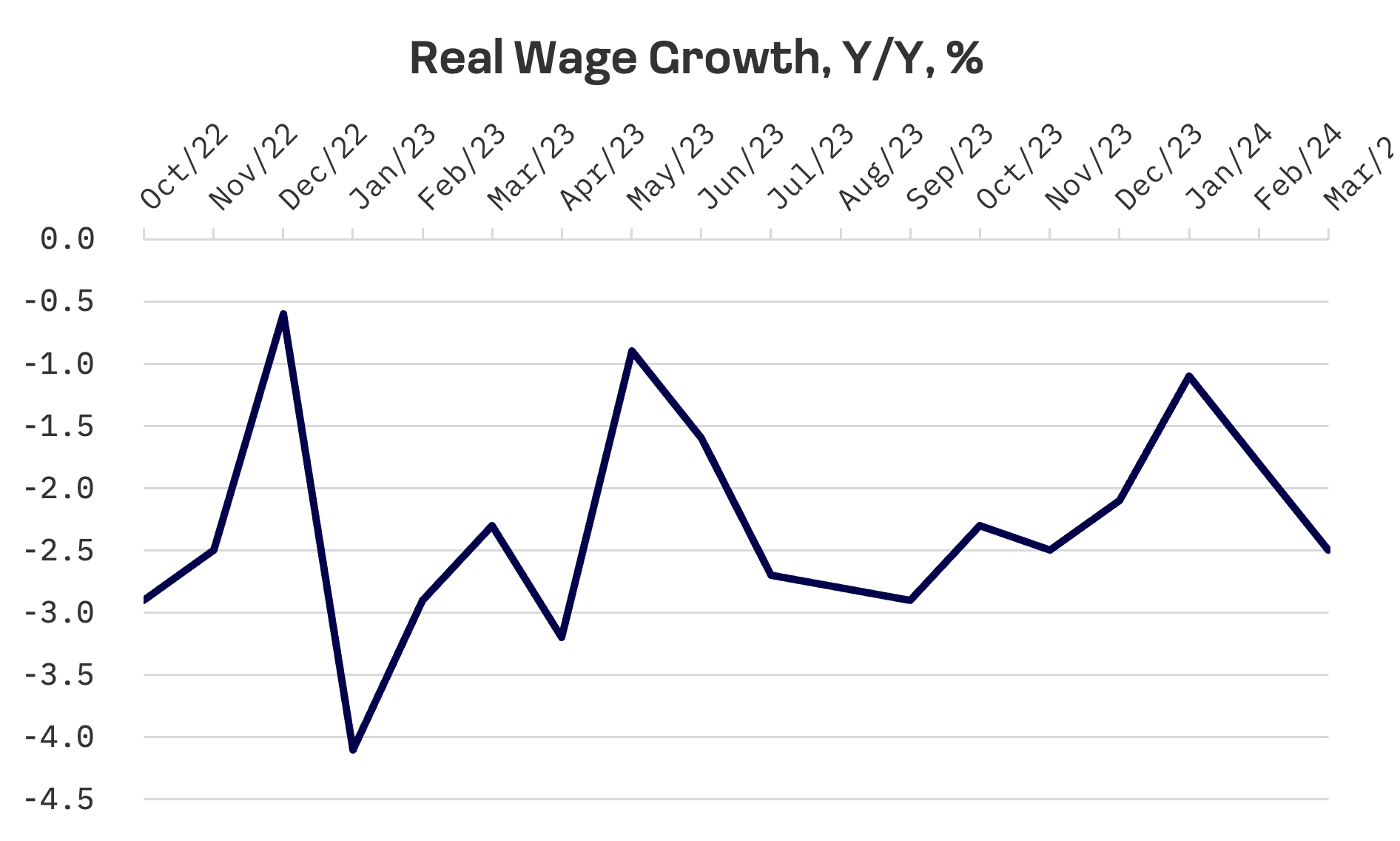

On the economic data front, indications of weakness in key metrics may potentially defer the BoJ’s plans for a rate hike. Notably, real wages, adjusted for inflation, experienced a substantial decline of 2.5% in March compared to the previous year, worsening from the previous month’s 1.8% decrease.

The BoJ consistently emphasises the necessity of a “virtuous cycle” wherein price growth reaches its 2% target alongside wage inflation, deeming it a prerequisite for any further normalisation of monetary policy. While the central bank has terminated its negative interest rate policy, its overall monetary policy stance remains one of the most accommodative globally.

South Korea

The Korean stock market sustained its upward trajectory for the third consecutive week, with the KOSPI index increasing by 1.9%. Investor sentiment received a boost from two key developments: renewed optimism surrounding the possibility of Federal Reserve rate cuts, coupled with rumors of an extension to the short selling ban in Korea.

Experts indicated on Wednesday that the government’s ban on short selling is likely to be extended until the following year, potentially setting a record as the longest such restriction in history. The pledge by authorities to reintroduce short selling by July appears increasingly improbable amid an investigation into global investment banks, revealing a string of infractions. Furthermore, the launch of a computerised system designed to prevent illegal short selling practices is not expected until at least the first half of next year.

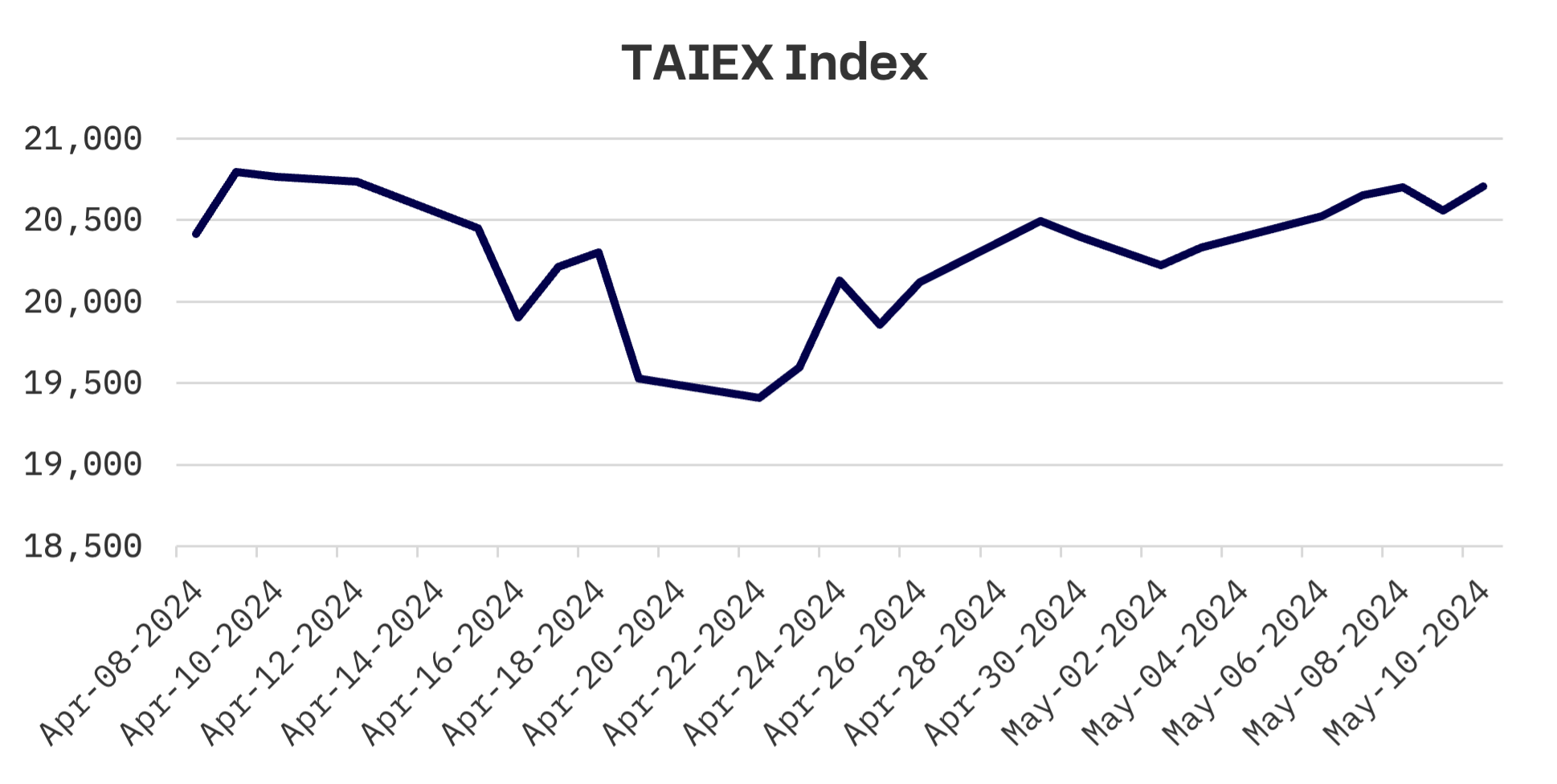

Taiwan

Taiwan’s stock market demonstrated positive performance as well, with the TAIEX index rising by 1.9%. Market sentiment experienced an uplift as investors embraced high hopes over the possibility of a rate cut cycle by the U.S. Federal Reserve, particularly following the release of weaker than expected job data for April. Additionally, April sales data from Taiwan Semiconductor (TSMC), which recorded the second highest monthly level in the company’s history, further lifted market spirits.

On the economic data front, Taiwan’s Ministry of Finance announced on Wednesday that the country’s exports surged over 4% from the previous year in April, marking the sixth consecutive monthly year-on-year increase. This growth was propelled by robust global demand for emerging technologies, particularly artificial intelligence applications and high-performance computing devices. Despite slower demand in traditional industries, outbound sales escalated by 4.3% year-on-year to reach $37.48 billion, following an impressive 18.9% year-on-year surge in March.

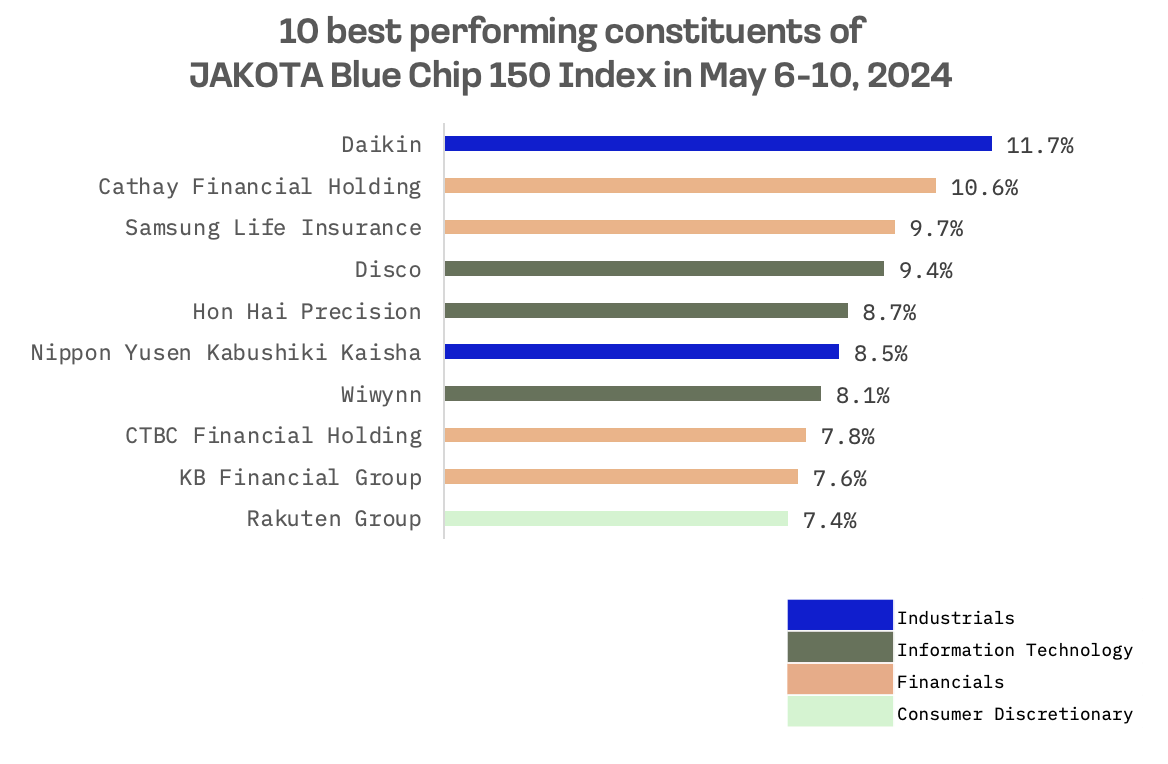

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index saw a slight decline of 0.5% this week. Out of 150 constituents, 85 stocks exhibited positive price trends.

Daikin Industries, a Japanese manufacturer of air conditioners, ventilation systems, heat pumps, hot water preparation and refrigeration solutions, emerged as the top performing stock this week, boasting a gain of almost 12%. The surge followed the company’s announcement of impressive sales figures, totaling ¥4,395.3 billion ($28 billion) for the fiscal year ending March 31, marking a substantial 10% increase compared to the previous year.

Conversely, Sony Group saw a significant drop of 10.3% over the course of the week, following concerns raised over financing related to its proposal to acquire Paramount Global.