Last week’s Jakota markets:

- Japan’s Nikkei 225 sank 9% as investors recoiled from steep U.S. reciprocal tariffs, sending government bond yields sharply lower and the yen to strengthen to the ¥146 range

- South Korea’s KOSPI slid 3.6% amid U.S. reciprocal tariffs, the lifting of a short selling ban and political turmoil following President Yoon Suk Yeol’s removal from office

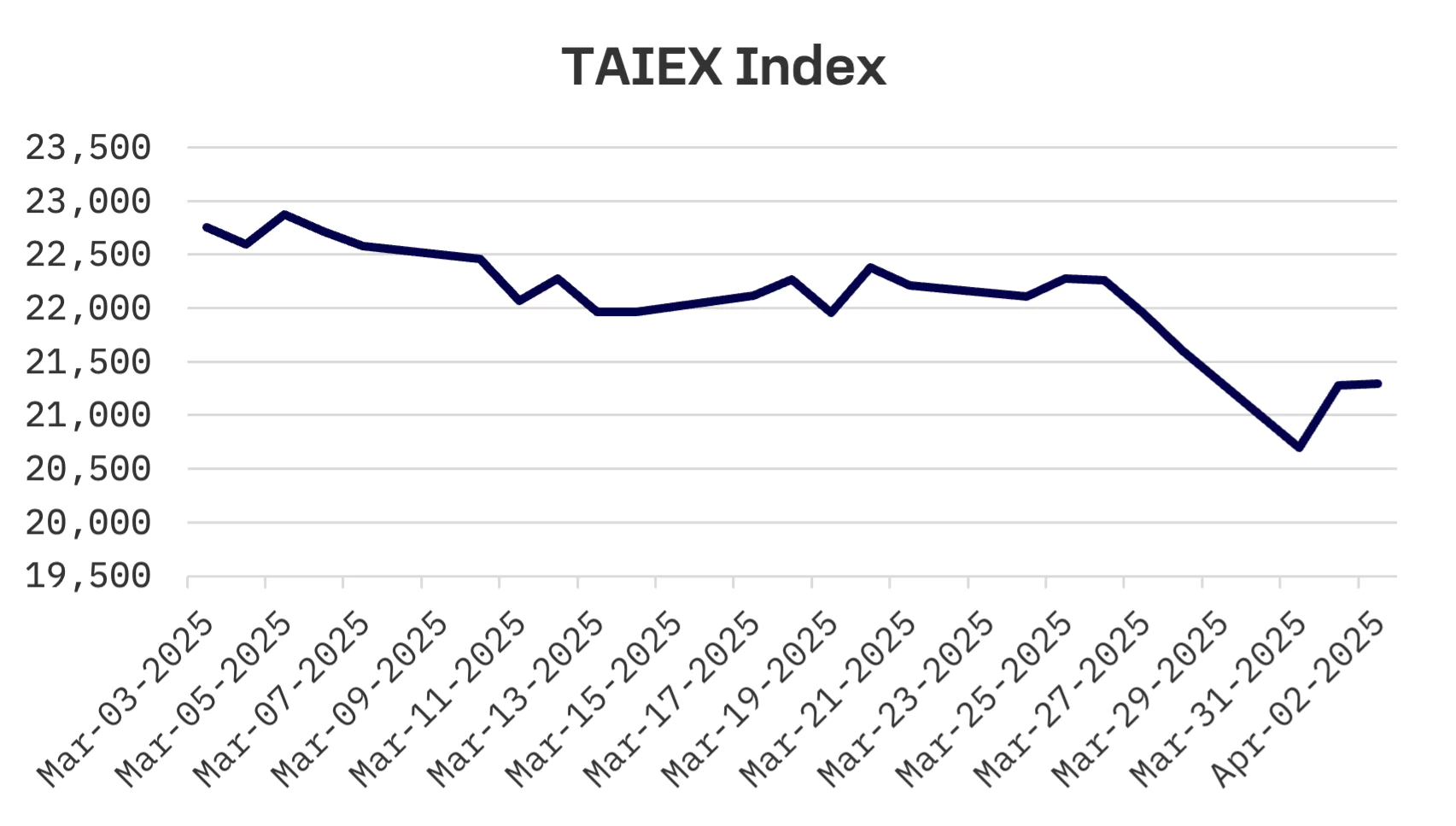

- Taiwan’s TAIEX dropped 1.4% in a shortened trading week, as markets digested news of 32% U.S. reciprocal tariffs on Taiwanese imports

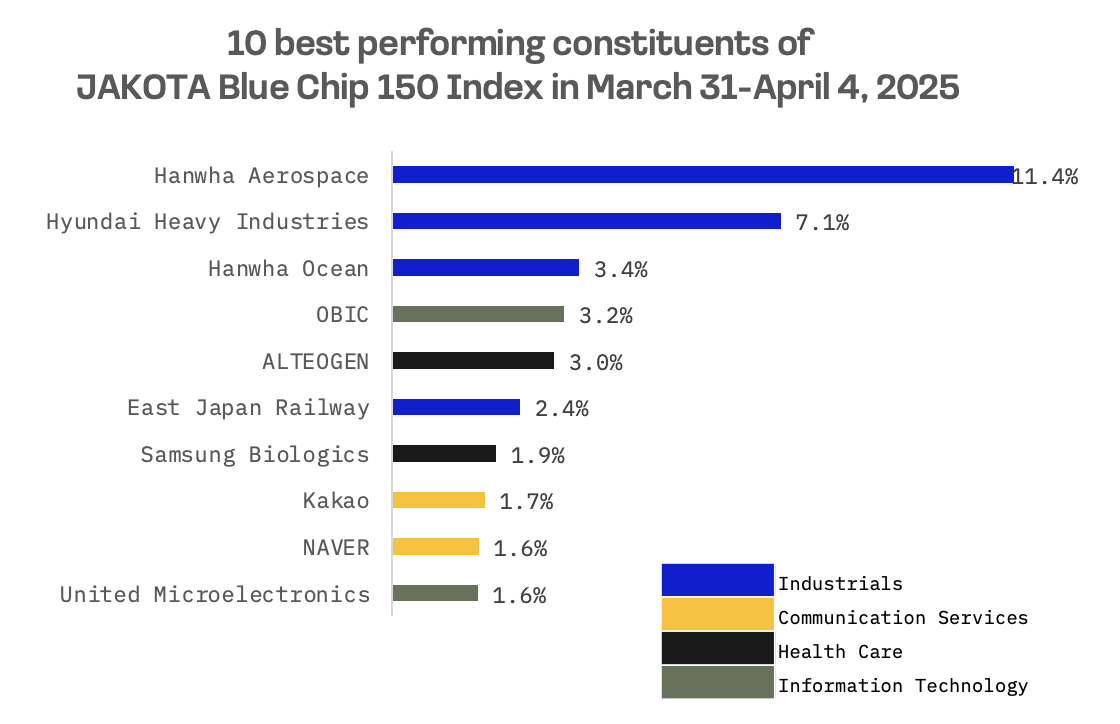

- The JAKOTA Blue Chip 150 Index suffered a 5.1% decline, with defense contractor Hanwha Aerospace emerging as a rare bright spot amid widespread semiconductor sector weakness

Japan

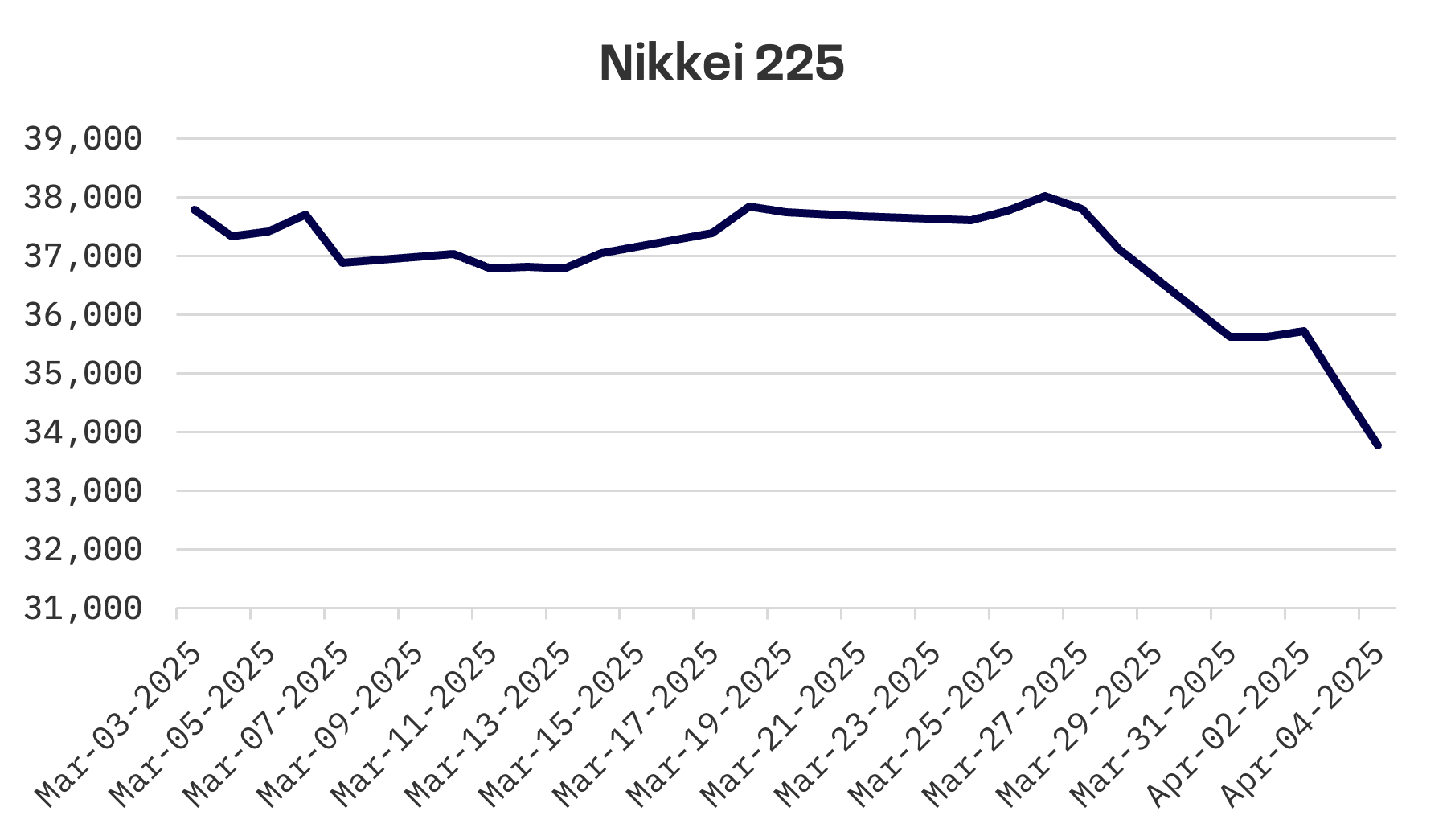

Japan’s stock market tumbled this week, with the Nikkei 225 plunging 9% after the Trump administration unexpectedly imposed a 10% blanket tariff on U.S. imports alongside a steeper than anticipated 24% reciprocal tariff targeting Japanese goods. The trade measures stoked fears of a broader economic slowdown, sending investors scrambling to position for renewed inflation pressures and heightened recession risks.

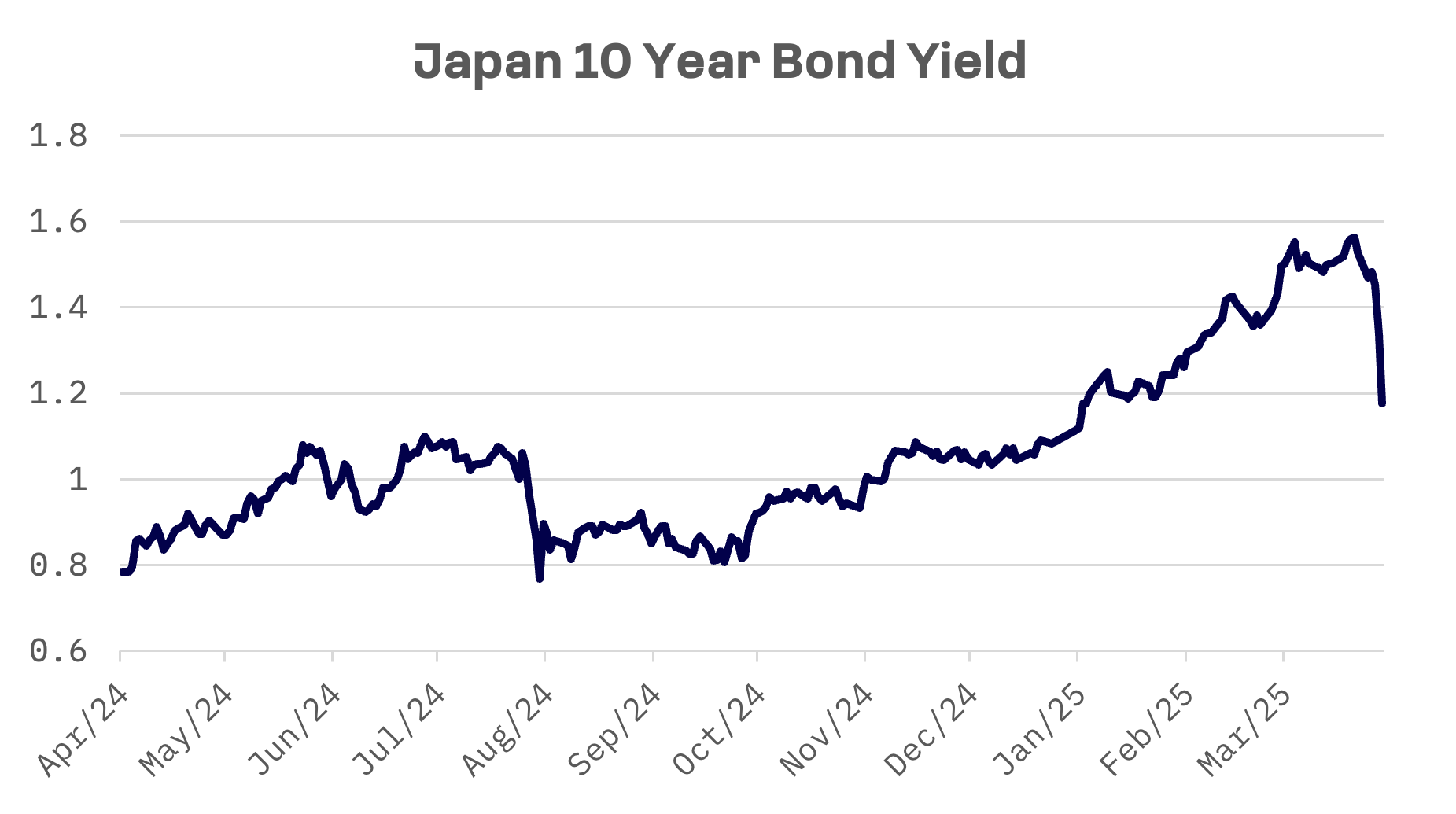

Rate sensitive Japanese banks led the market’s retreat as government bond yields sharply contracted. The benchmark 10 year JGB yield fell to 1.18% from 1.56% a week earlier.

The nation’s automakers continued their downward slide, still reeling from the previously announced 25% U.S. auto tariffs, measures from which Tokyo continues to seek exemptions.

Adding to exporters’ woes, the yen strengthened to the low ¥146 range against the dollar, up from ¥150 the previous week, as investors sought safety amid global market turbulence.

Market watchers increasingly speculate that the Bank of Japan (BoJ) might postpone its next rate increase while it assesses the full impact of U.S. tariffs on global and domestic economic conditions. Governor Kazuo Ueda cautioned that the new levies could hamper growth and increase market uncertainty, while noting their inflationary impact remains unclear — economic slowdown could suppress prices, but supply chain disruptions might push them higher.

Ueda indicated the BoJ would vigilantly monitor developments and incorporate them into policy decisions. Though the central bank maintains its baseline trajectory toward another rate hike based on economic and inflation projections, it has flagged mounting downside risks stemming from escalating trade frictions.

South Korea

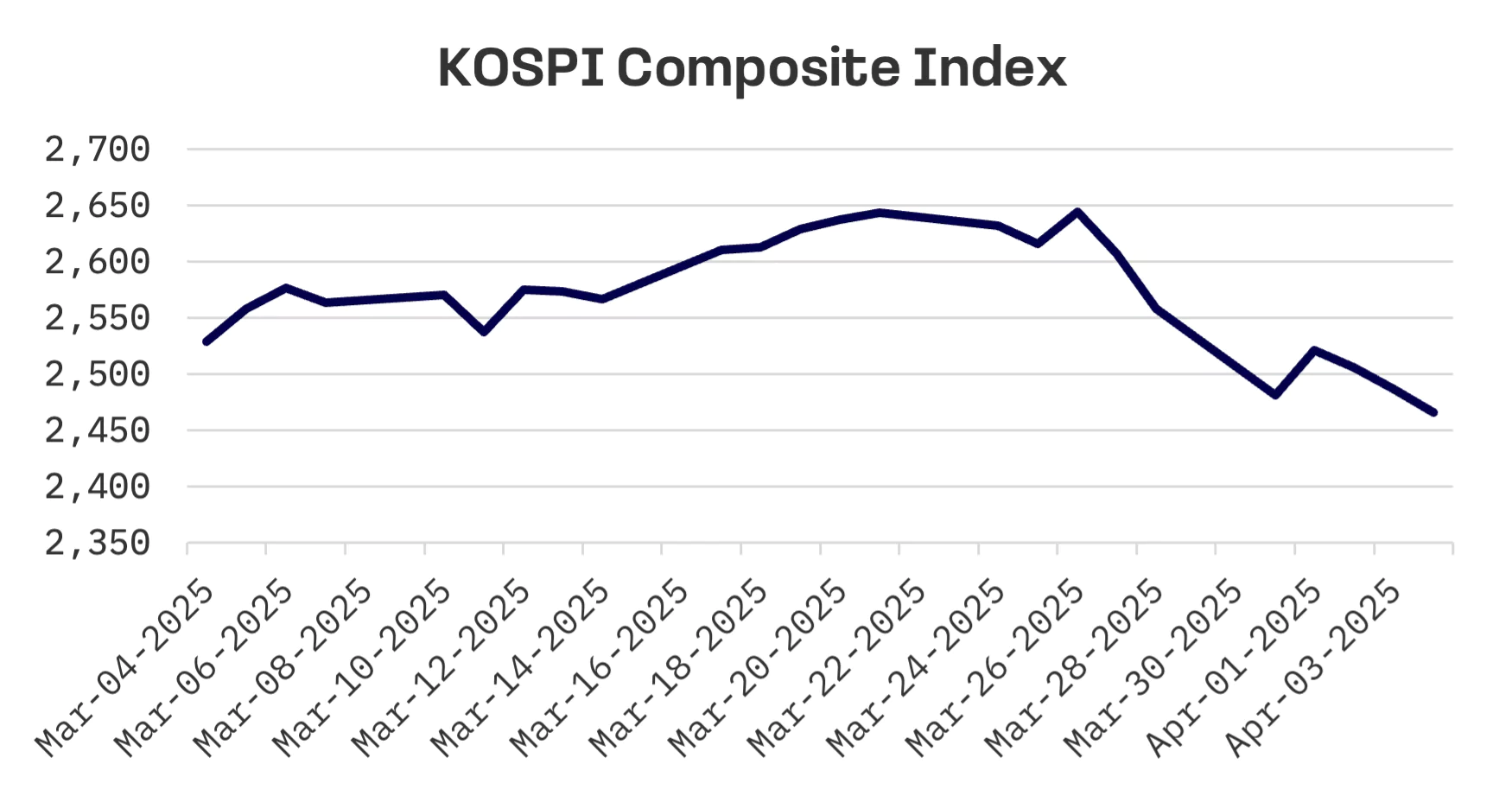

South Korea’s stock market took a beating this week, with the KOSPI tumbling 3.6% amid a perfect storm of challenges: heightened trade tensions following the imposition of 25% U.S. reciprocal tariffs, the recent removal of a short selling ban and unprecedented political upheaval after the Constitutional Court’s landmark decision to remove President Yoon Suk Yeol from office.

In currency markets, the South Korean won staged its most dramatic rally in over two and a half years against the dollar on Friday, buoyed by optimism that the Constitutional Court’s decision to oust President Yoon might bring political stability. The won strengthened to ₩1,434.1 per dollar, climbing ₩32.9 from the previous session’s close of a ₩1,467.

Short selling activity surged to ₩6.4 trillion (US$4.38 billion) during the first week following the lifting of restrictions that had been in place for more than a year. Foreign investors dominated the short selling landscape, accounting for 90% of KOSPI short positions, while institutional investors represented another 9%.

Taiwan

Taiwan’s equity market echoed the broader retreat across its Jakota peers, with the TAIEX shedding 1.4% during an abbreviated trading week. Markets remained closed on Thursday and Friday for Children’s Day and Tomb Sweeping Day, limiting investors’ ability to fully process the implications of newly imposed U.S. reciprocal tariffs, set at a substantial 32% for Taiwanese imports.

JAKOTA Blue Chip 150 Index

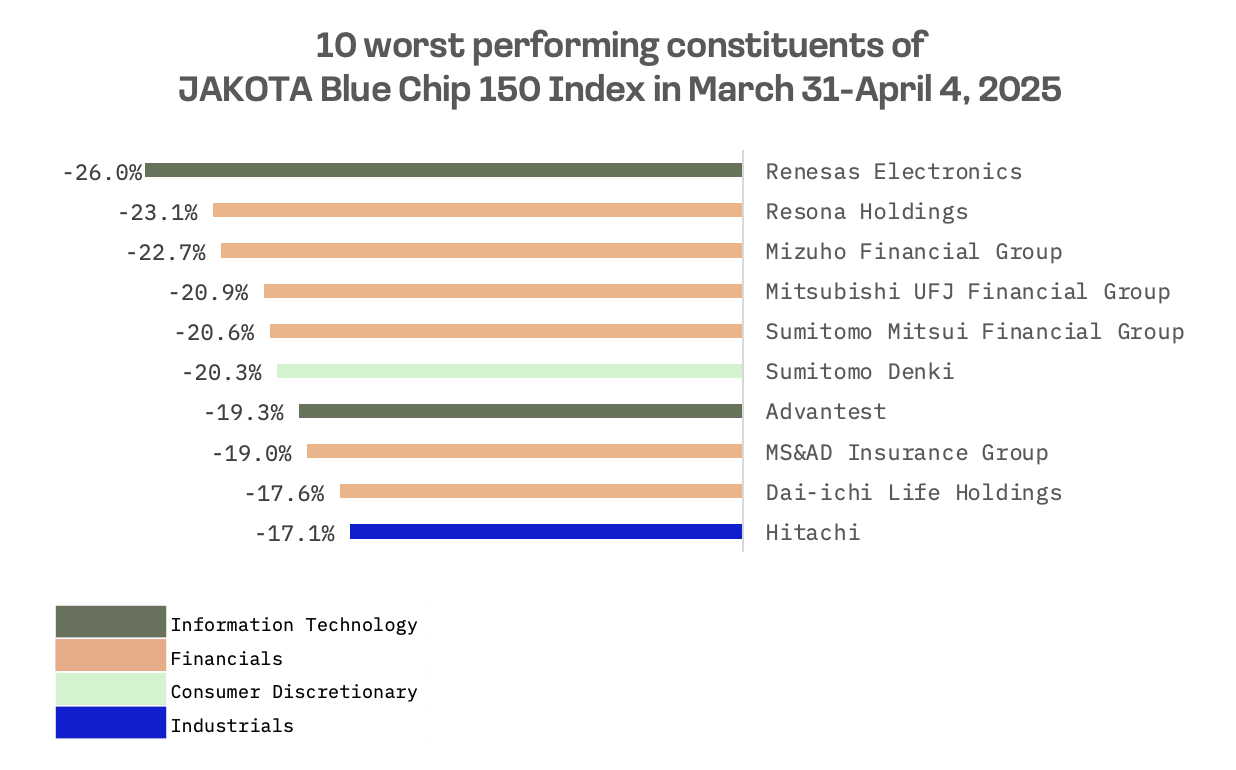

The JAKOTA Blue Chip 150 Index nosedived 5.1% this week. In a telling sign of market distress, merely 15 stocks – a record low – managed to post gains among the index’s 150 constituents.

Hanwha Aerospace Co., a leading South Korean defence contractor recently added to the JAKOTA Blue Chip 150 Index in last quarter’s rebalancing, emerged as the standout performer. The company clinched a $254 million (₩370 billion) contract to supply K9 self propelled howitzers to India, representing the Indian Army’s second major acquisition of these weapons systems.

The firm has also formed a strategic partnership with U.S. based General Atomics Aeronautical Systems Inc. (GA-ASI) to jointly develop and manufacture unmanned aerial vehicles (UAVs).

At the other end of the spectrum, Advantest, Japan’s premier manufacturer of automatic test equipment (ATE) for the semiconductor industry, posted the steepest losses among JAKOTA Blue Chip 150 constituents. The decline came amid a broader semiconductor sector selloff, which saw industry heavyweight Nvidia drop 5.7%. Advantest, a key supplier of testing systems for Nvidia’s GPUs, suffered collateral damage. Nvidia’s retreat followed the U.S. government’s decision to place several Chinese firms on a national security export blacklist, requiring U.S. companies to secure governmental approval before selling chips to these entities.

Japanese financial stocks ranked among the hardest hit sectors, dragged down by rapidly declining government bond yields. However, Renesas Electronics, a Japanese semiconductor producer, recorded the most precipitous fall among JAKOTA Blue Chip 150 components, with shares plummeting 26% this week.

The company’s dramatic decline largely reflected the broader Japanese market downturn, particularly in the Nikkei 225, triggered by Washington’s announcement of reciprocal tariffs. The resulting negative sentiment weighed heavily on the semiconductor sector, with Renesas’s key competitors also experiencing significant share price erosion. While Renesas issued no specific negative news this week, concerns regarding its recent earnings trajectory likely amplified market reaction to the macroeconomic headwinds.