Last week’s JAKOTA markets:

- Amidst a depreciating yen, Japan’s Nikkei 225 index fell by 1.3%, signalling concerns that may prompt governmental intervention in currency markets

- South Korea’s KOSPI index dipped slightly by 0.1%, as investors processed positive manufacturing output against a backdrop of ongoing inflation pressures

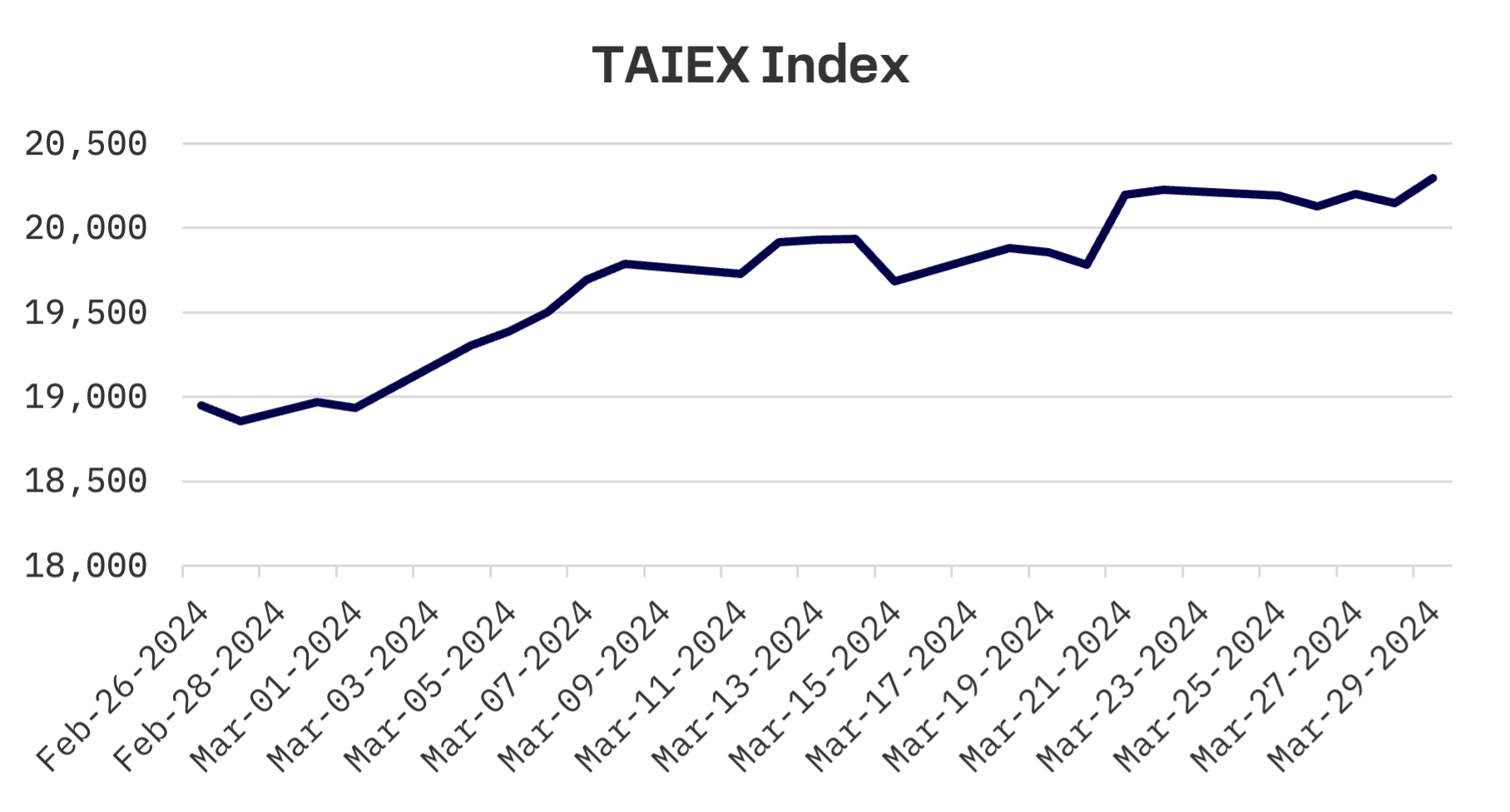

- In Taiwan, the TAIEX index experienced growth of 0.3%, led by investor enthusiasm in the tech sector, with AI-related stocks making notable gains

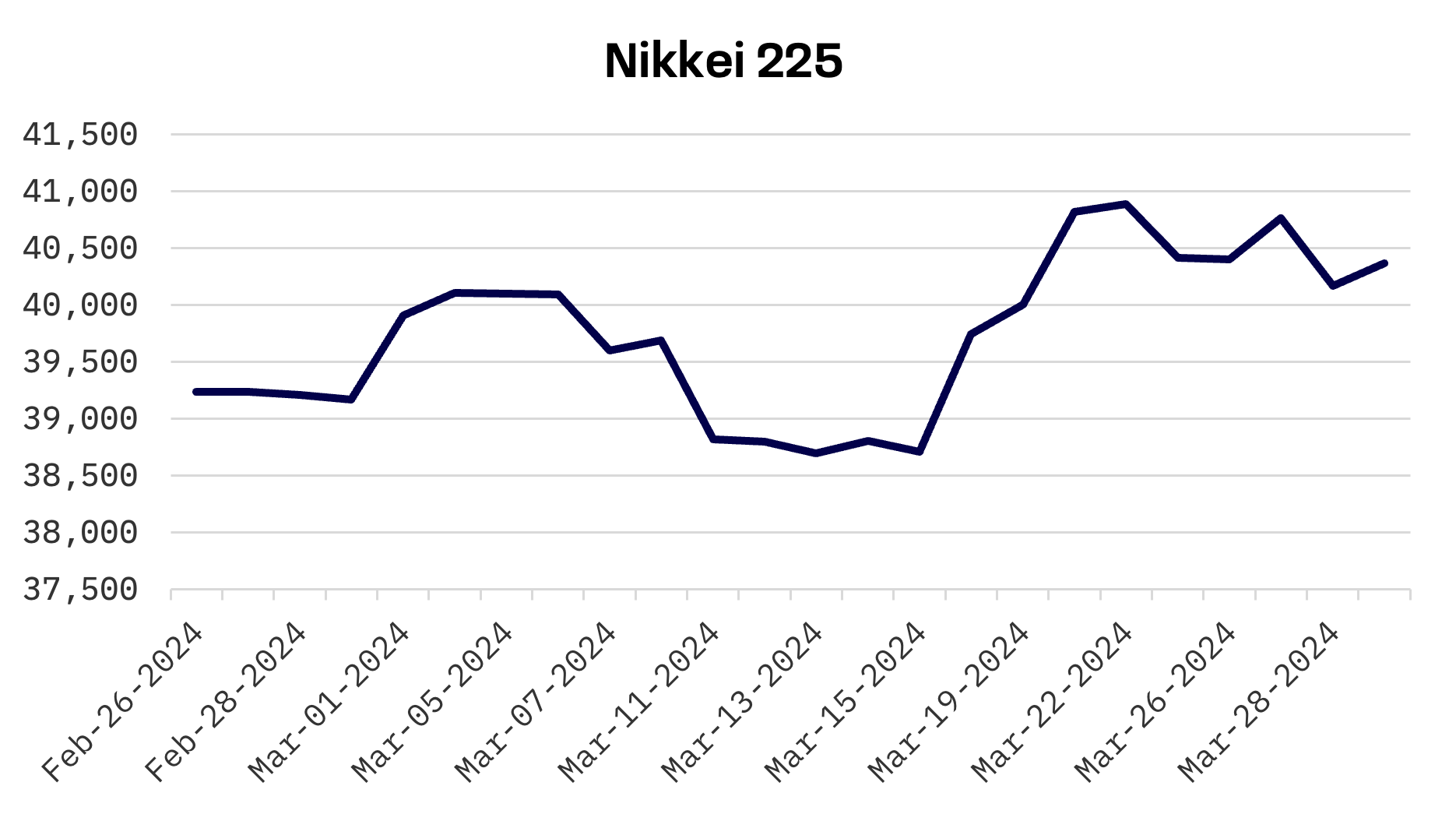

Japan

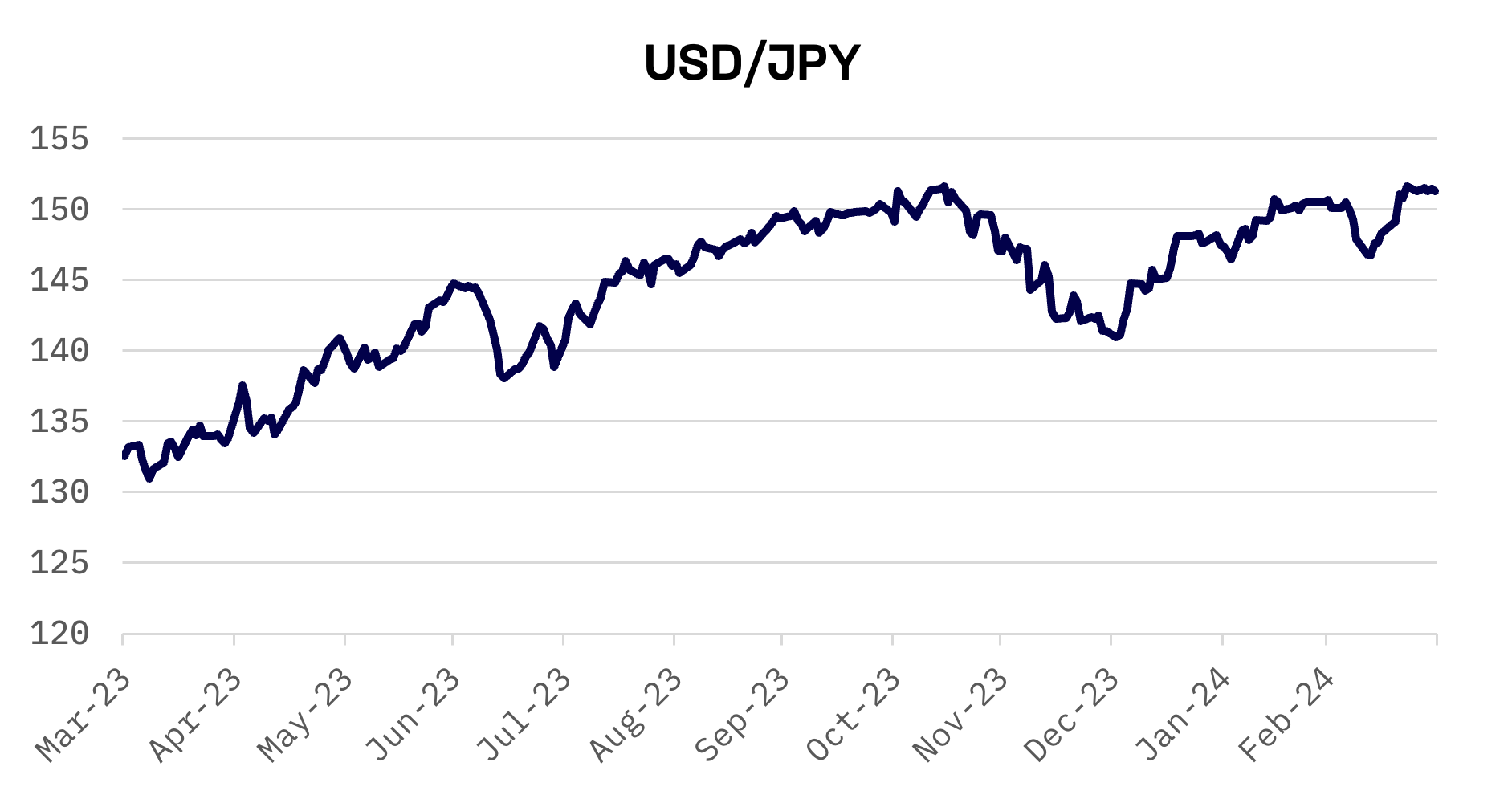

This week, Japan’s stock markets witnessed a downturn, with the Nikkei 225 index falling by 1.3%. This decrease is primarily attributed to the sharply depreciating yen, which approached JPY 152 against the U.S. dollar — a level that is widely regarded as a potential trigger for authorities to intervene in the foreign exchange markets to bolster the Japanese currency.

Following a meeting on Wednesday, Japan’s three principal monetary authorities — the Bank of Japan (BOJ), the Finance Ministry and the Financial Services Agency — suggested the possibility of such intervention. This marks the most explicit indication to date, especially noteworthy given the yen’s dive to a 34-year nadir.

Notwithstanding concerns about the yen’s depreciation, Japan’s large-cap exporters have seen considerable benefits from this trend, as a significant portion of their earnings are derived from overseas operations.

Further, a Bank of Japan Board member this week posited that ending the central bank’s negative interest rates policy signifies a preliminary move towards the normalization of monetary policy. This adjustment is a response to observable increases in wages alongside prices, a crucial condition for the BOJ to amend its policy stance. Despite these changes, Japan’s monetary policy continues to be one of the most accommodating globally, with expectations for the financial environment to remain supportive in the foreseeable future.

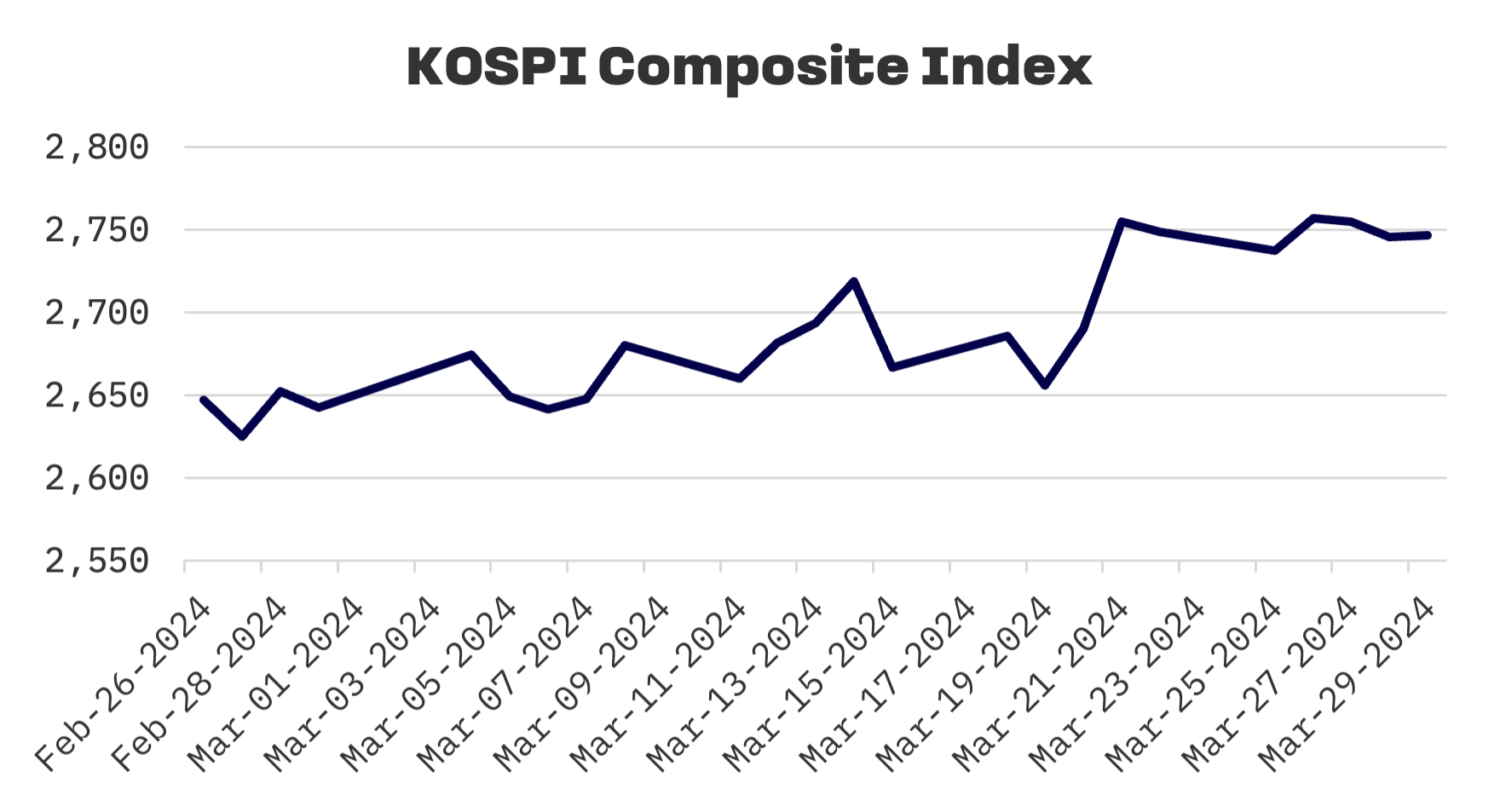

South Korea

The Korean stock market exhibited minimal movement this week, with the KOSPI index slightly down by 0.1%. Investors seem to be capitalizing on recent gains, following the KOSPI’s upward trend in March, albeit with recent minor corrections.

Economically, South Korea showed resilience with seasonally adjusted mining and manufacturing output in February increasing by 3.1% from the previous month, marking the first gain since a rise of 1.6% in November last year.

The surge was led primarily by a 3.4% increase in manufacturing output, with significant contributions from microchips and machinery production — staples of Korea’s export sector. Yet, consumer spending remained muted, pressured by ongoing inflationary challenges.

Taiwan

Contrasting with other JAKOTA markets, Taiwan’s stock market demonstrated modest growth this week. The TAIEX index rose by 0.3%, achieving a new record high on Friday, buoyed by strong purchasing in the electronics sector. Taiwan Semiconductor (TSMC) and other AI-related stocks gained momentum, predominantly driven by local, both institutional and retail, investors.

According to data released by the Ministry of Economic Affairs, Taiwan’s industrial production index fell by 1.1% year-on-year in February, settling at 78.48. This decline is attributed largely to the reduced number of working days due to the Lunar New Year holiday.

Additionally, the Taiwan Institute of Economic Research (TIER) reported a slowdown in the manufacturing sector for February, a pivot from January’s stability. This contraction, influenced significantly by seasonal factors, was reflected in TIER’s composite index dropping to 11.82 in February from 15.84 in January, indicating a shift from a “green” to a “yellow-blue” light in the sector’s fundamentals.

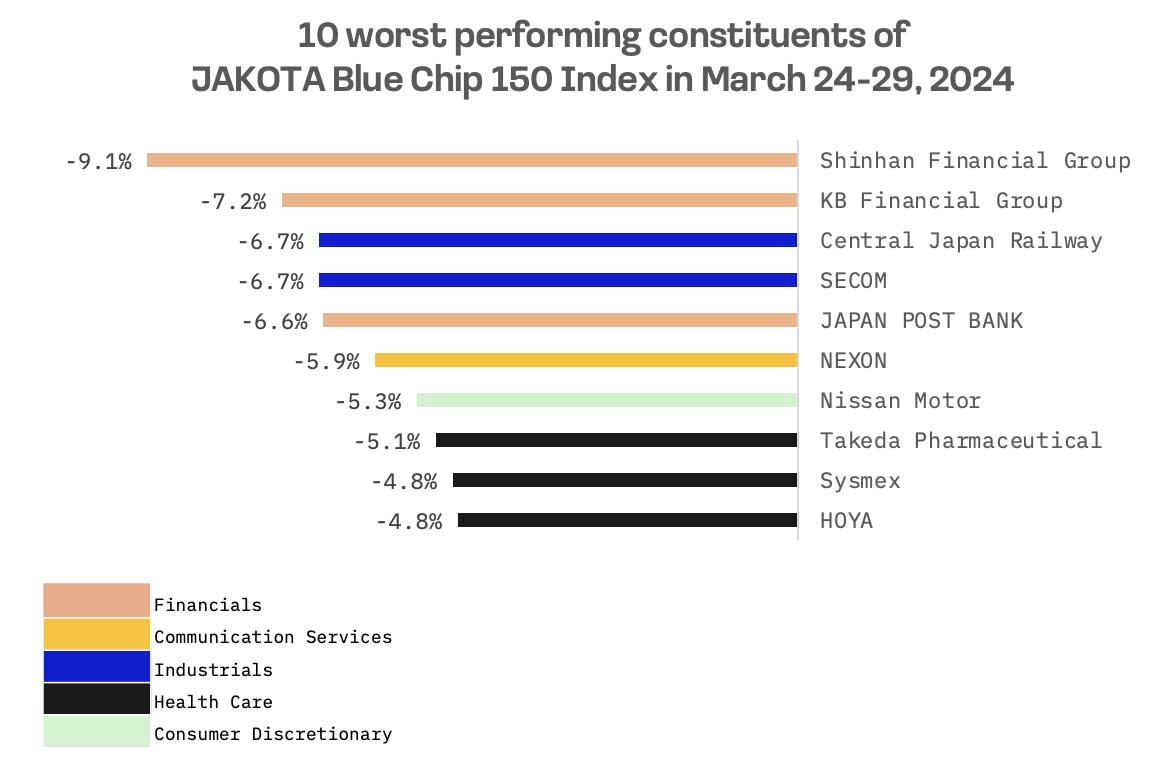

JAKOTA Blue Chip 150 Index

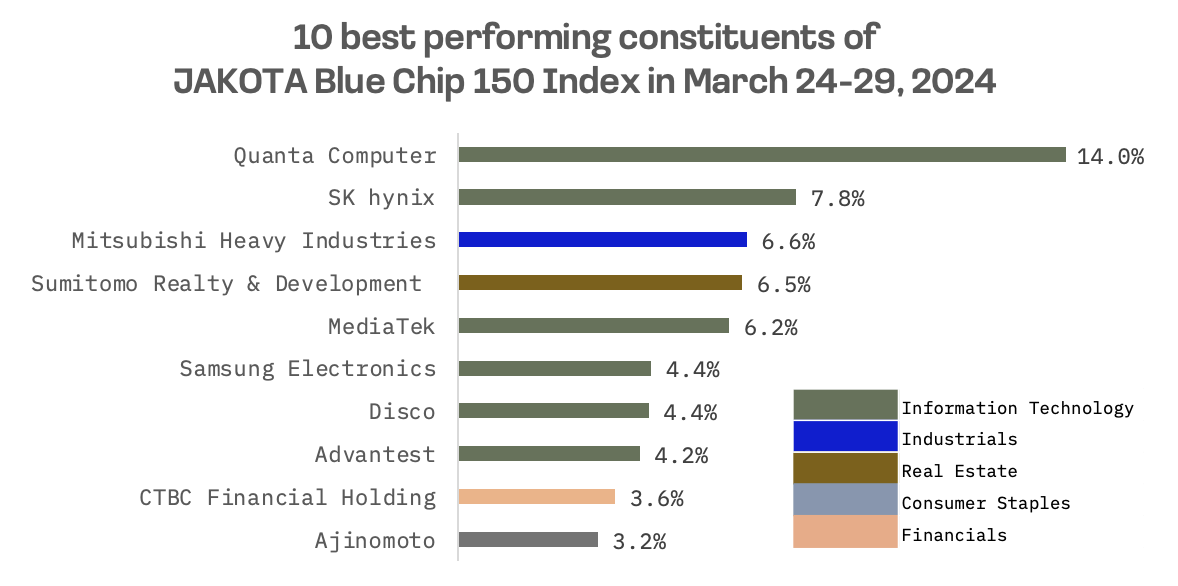

The JAKOTA Blue Chip 150 Index saw a 0.3% decline this week, with only 47 out of its 150 constituents posting positive price trends.

Quanta Computer emerged as a standout, leading the best-performing stocks within the JAKOTA Blue Chip 150. The company, a key player in AI server manufacturing, saw a 14% increase this week, benefiting from a broader resurgence in semiconductor and AI-related stocks after recent market consolidation.

Conversely, Shinhan Financial Group was identified as the week’s least successful stock within the index, plummeting by 9.1% following BNP Paribas’s announcement of seeking buyers for its shares in Shinhan through a block trade. Holding a 3.6% stake, BNP Paribas’s decision is viewed as an attempt to exit its investment in Shinhan Financial, following the termination of their cooperation three years ago.