Last week’s Jakota markets:

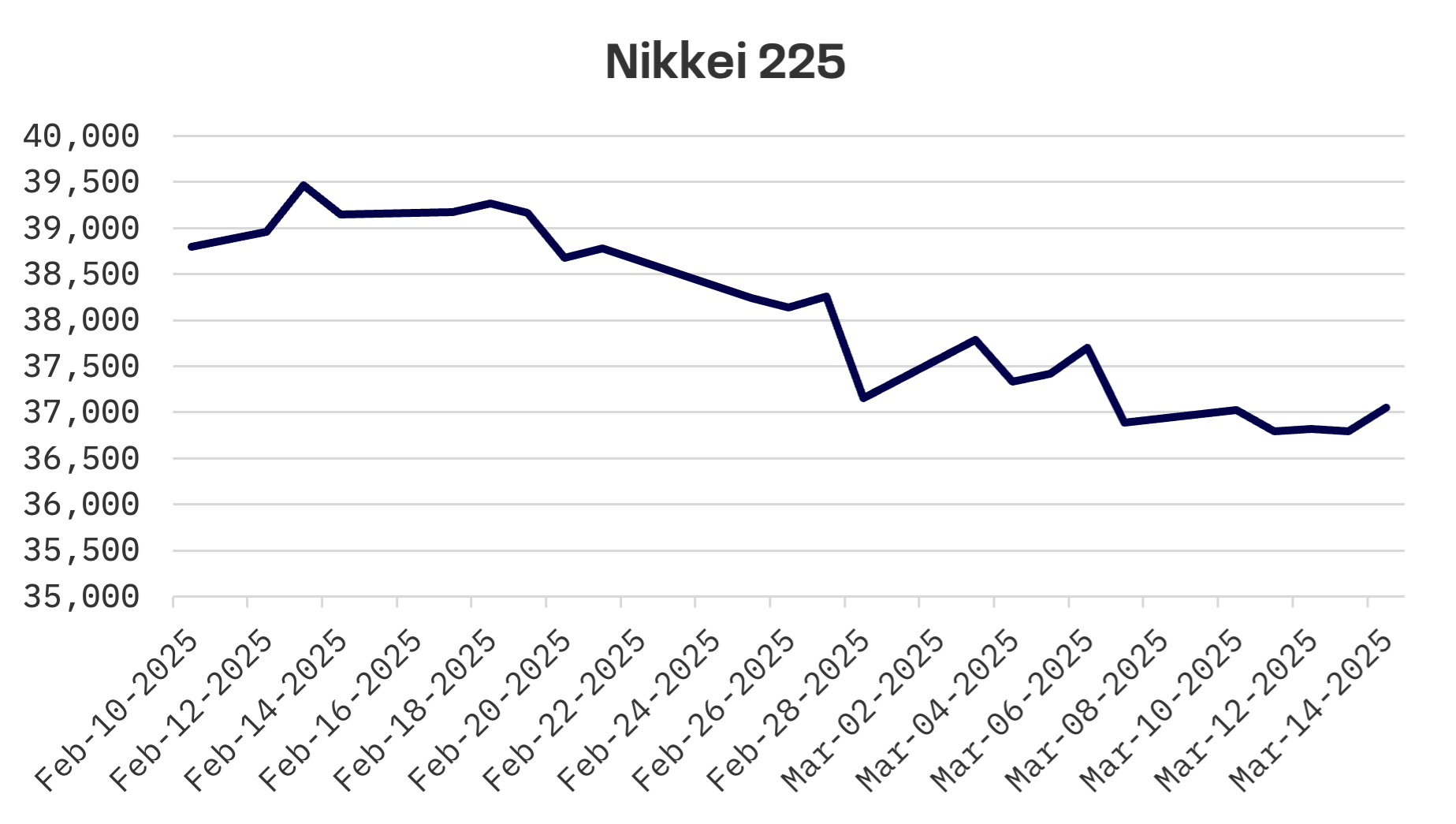

- Japan’s Nikkei 225 rose 0.45% as 10 year JGB yields approached post 2008 highs amid expectations of further BoJ tightening

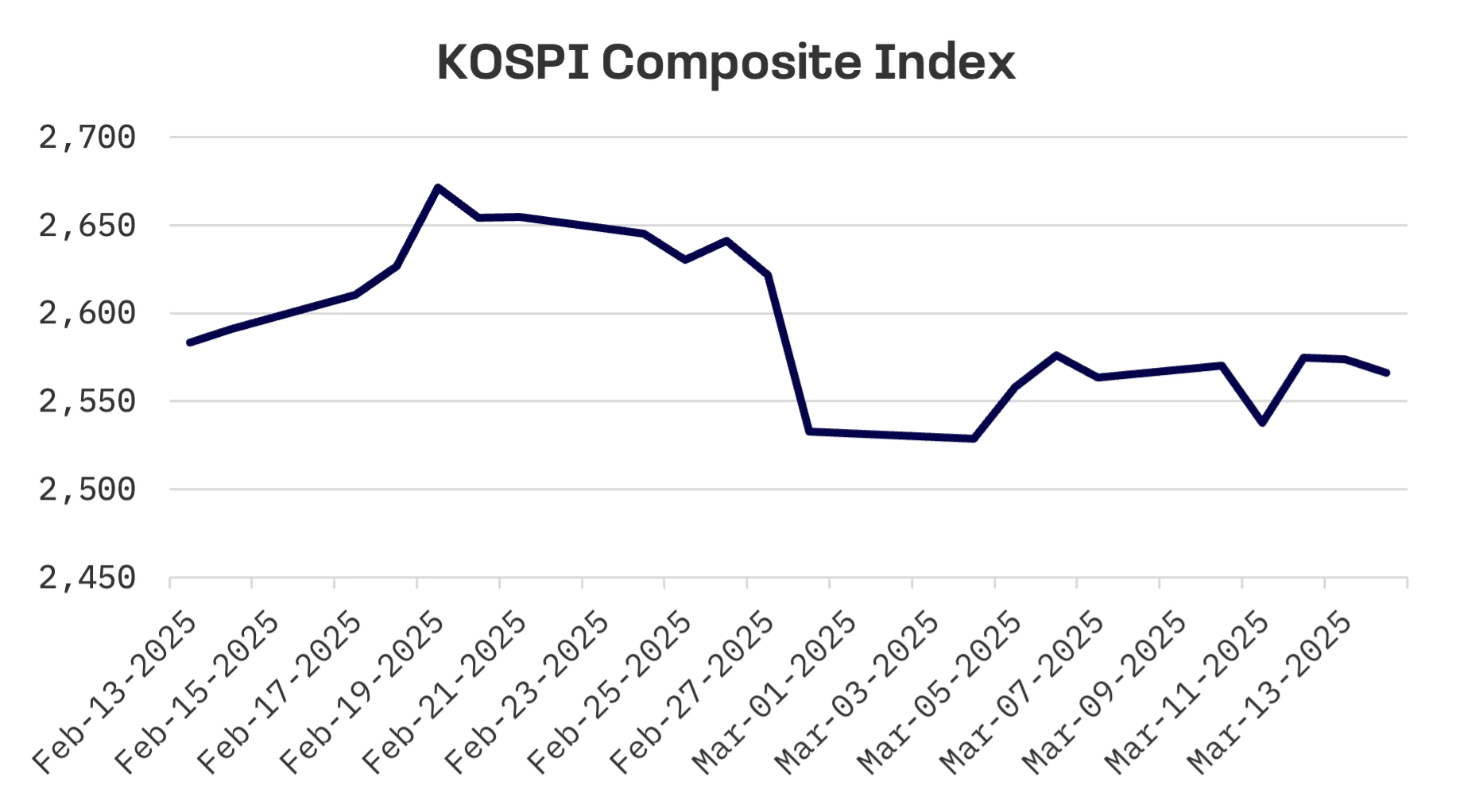

- South Korea’s KOSPI edged down 0.2% as Trump reaffirmed controversial tariff policies, while the BOK signalled potential for two additional rate cuts this year

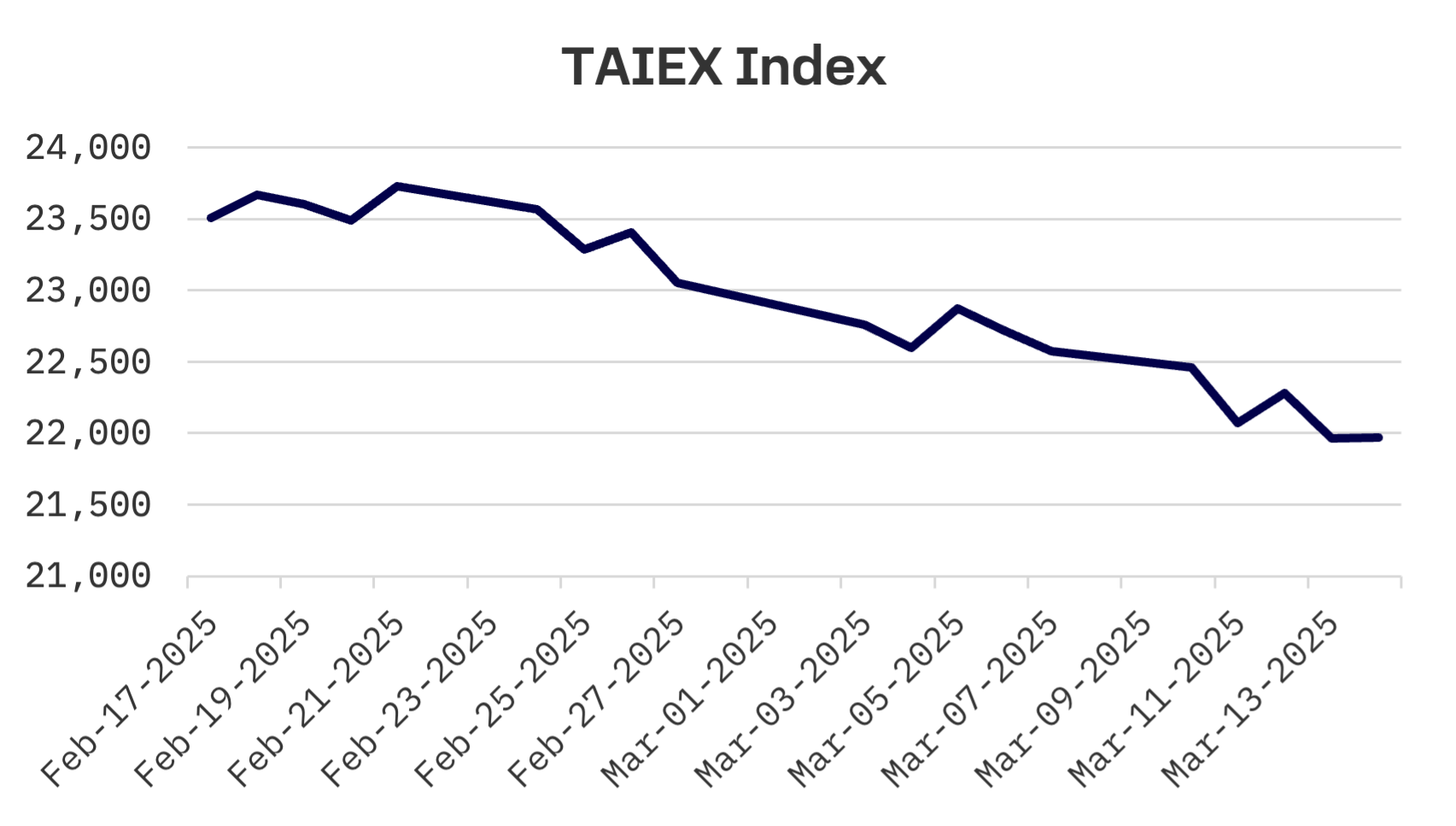

- Taiwan’s TAIEX continued its losing streak, falling 2.7% for a third consecutive week despite TSMC’s record February sales

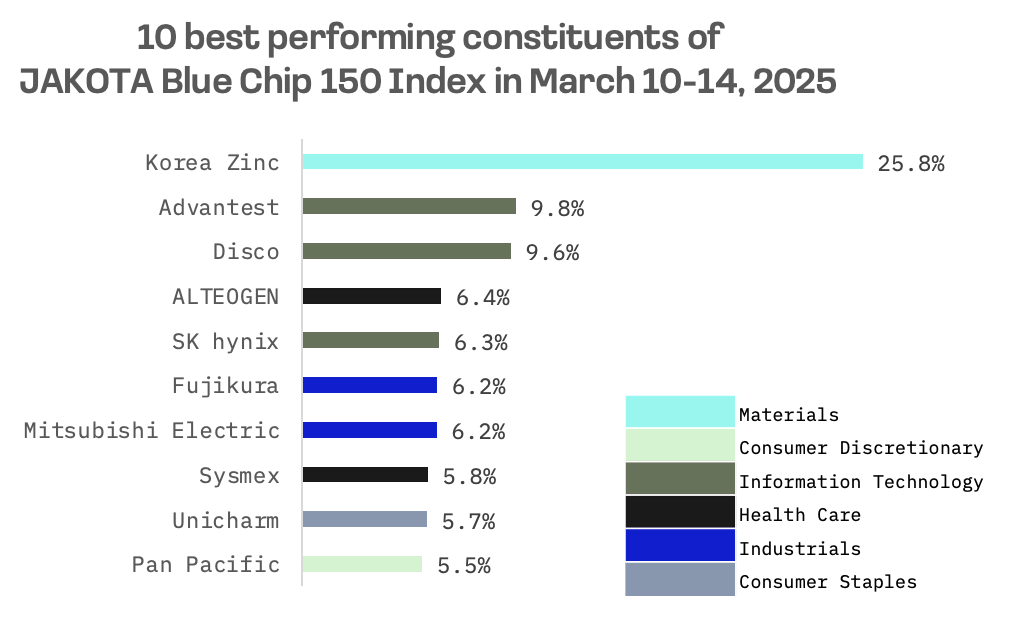

- The JAKOTA Blue Chip 150 Index fell 1.1%, though nearly half of constituents posted gains, led by Korea Zinc’s 26% rally amid a corporate control battle

Japan

Japan’s stock market edged higher this week, with the Nikkei 225 gaining 0.45%, though advances were limited by uncertainty surrounding the Trump administration’s proposed 25% tariffs on imported automobiles – a sector accounting for roughly a third of Japan’s exports to the U.S.

Investor attention centered on Japan’s annual “shunto” wage negotiations, which yielded the largest pay increases in more than 30 years, confirming a persistent upward trend in compensation across the economy, including at smaller companies. The talks have now produced significant raises for three straight years. The Bank of Japan (BoJ) continues to monitor wage growth as a crucial factor in its monetary policy decisions, watching whether higher pay translates into broader inflationary pressures. Market expectations for another rate hike this year are firmly in place.

Yields on 10 year Japanese government bonds (JGB) approached their highest levels since the 2008 financial crisis as investors positioned for additional monetary tightening. BoJ Governor Kazuo Ueda described rising JGB yields as a natural response to economic conditions, inflation expectations and global interest rate movements. He emphasised that bond yields should fluctuate freely, noting the central bank would intervene only if increases deviated markedly from market norms.

South Korea

South Korea’s stock market retreated slightly this week, with the KOSPI declining 0.2% as U.S. President Donald Trump reasserted his commitment to controversial tariff policies.

Trump confirmed his intention to impose tariffs on steel, aluminum and automobiles, despite his administration’s recent modifications to duties on Canadian and Mexican products that sparked concerns about policy consistency. Although South Korea’s equity market has shown resilience amid U.S. market fluctuations, investors remain wary of escalating political risks. Trump’s broad tariff measures threaten to further constrain South Korea’s economic growth and exacerbate inflation pressures.

The Bank of Korea (BOK) indicated it might implement up to two more rate reductions this year to stimulate economic growth. In its monetary policy report released this week, the central bank stressed its priority of mitigating downside risks while preserving price stability. This guidance follows February’s quarter percentage point rate cut to 2.75%, marking the third reduction since the BOK pivoted toward monetary easing in October.

Taiwan

Taiwan’s stock market continued its downward trajectory for a third consecutive week, with the TAIEX falling 2.7% as ongoing tariff uncertainties undermined investor confidence.

Taiwan Semiconductor (TSMC), the index’s most heavily weighted component, faced selling pressure despite posting record February sales, as fears of a potential U.S. economic downturn intensified. Market sentiment deteriorated further following reports that TSMC had proposed forming a joint venture with Nvidia, AMD and Broadcom to operate Intel’s manufacturing facilities, stirring concerns about potential technology leaks.

Taiwan’s central bank will likely maintain current interest rates at its quarterly policy meeting next week, according to Governor Yang Chin-long, contradicting speculation about a rate reduction amid growing economic uncertainties.

JAKOTA Blue Chip 150 Index

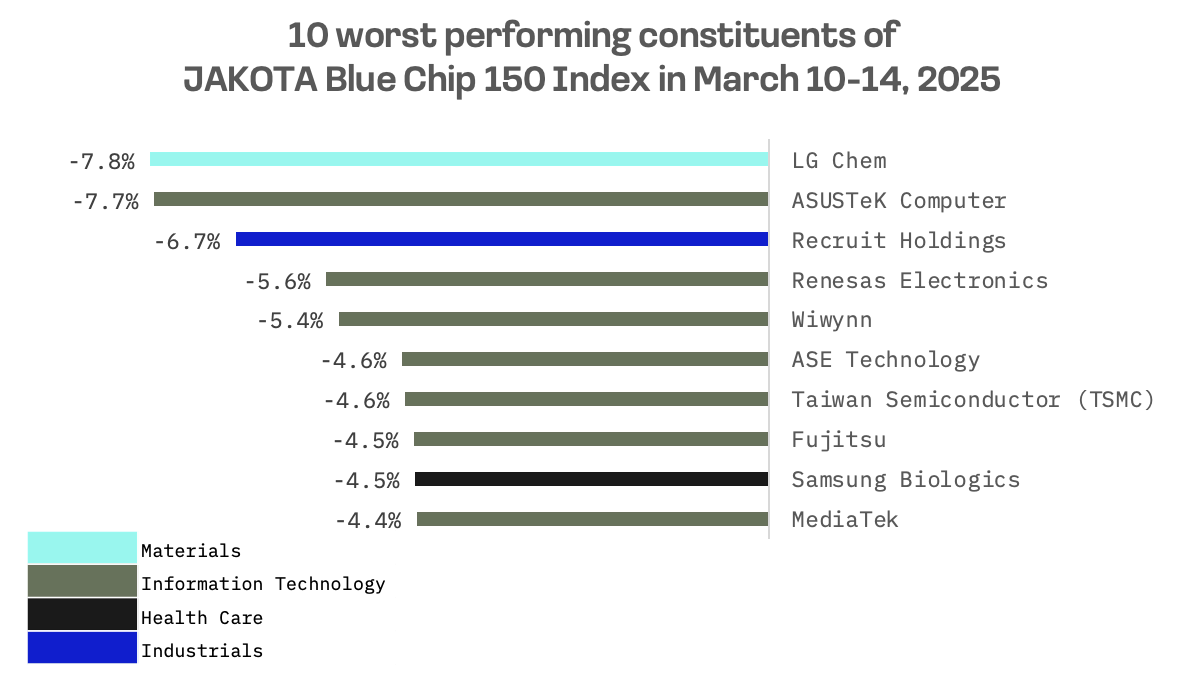

The JAKOTA Blue Chip 150 Index lost 1.1% this week, though 70 of its 150 constituents recorded gains.

Korea Zinc, the world’s largest supplier of non ferrous metals, led the index’s performers with a nearly 26% surge after a Seoul court overturned key decisions from the company’s January shareholder meeting, including board appointments, renewing a protracted control struggle. The court ruled in favour of majority shareholder Young Poong Corp., issuing an injunction that effectively removed seven Korea Zinc nominated directors. The decision determined that Korea Zinc’s last minute restrictions on Young Poong’s voting rights were improper, escalating the ongoing control dispute.

Semiconductor and electronics stocks across Japan and Taiwan remained weak as worries about a potential U.S. recession continued to dampen market sentiment.