Last week’s Jakota markets:

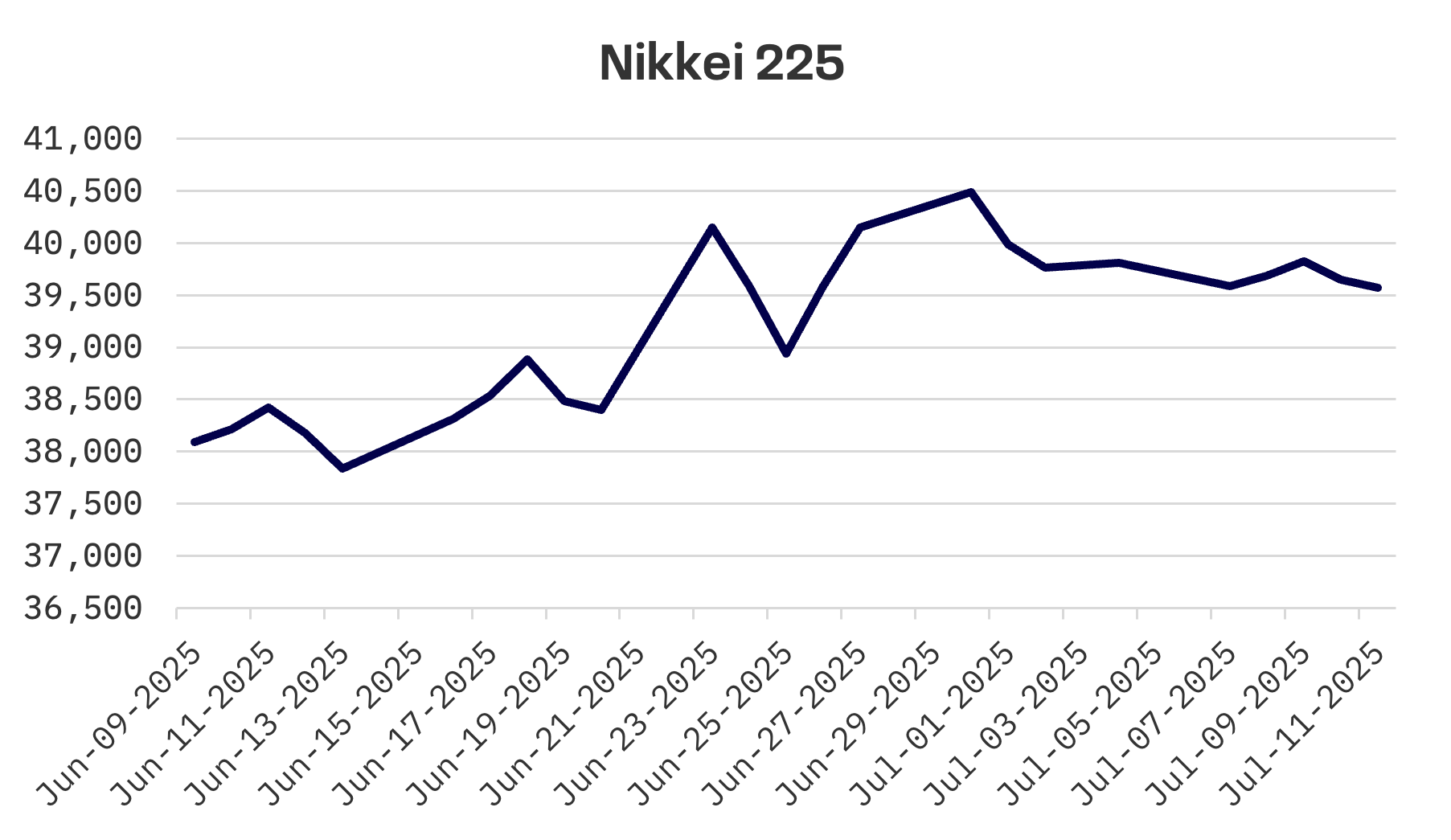

- Japan’s Nikkei 225 Index fell 0.61% as escalating U.S. trade tensions and disappointing wage growth data reinforced expectations that the BoJ will delay rate hikes until 2026

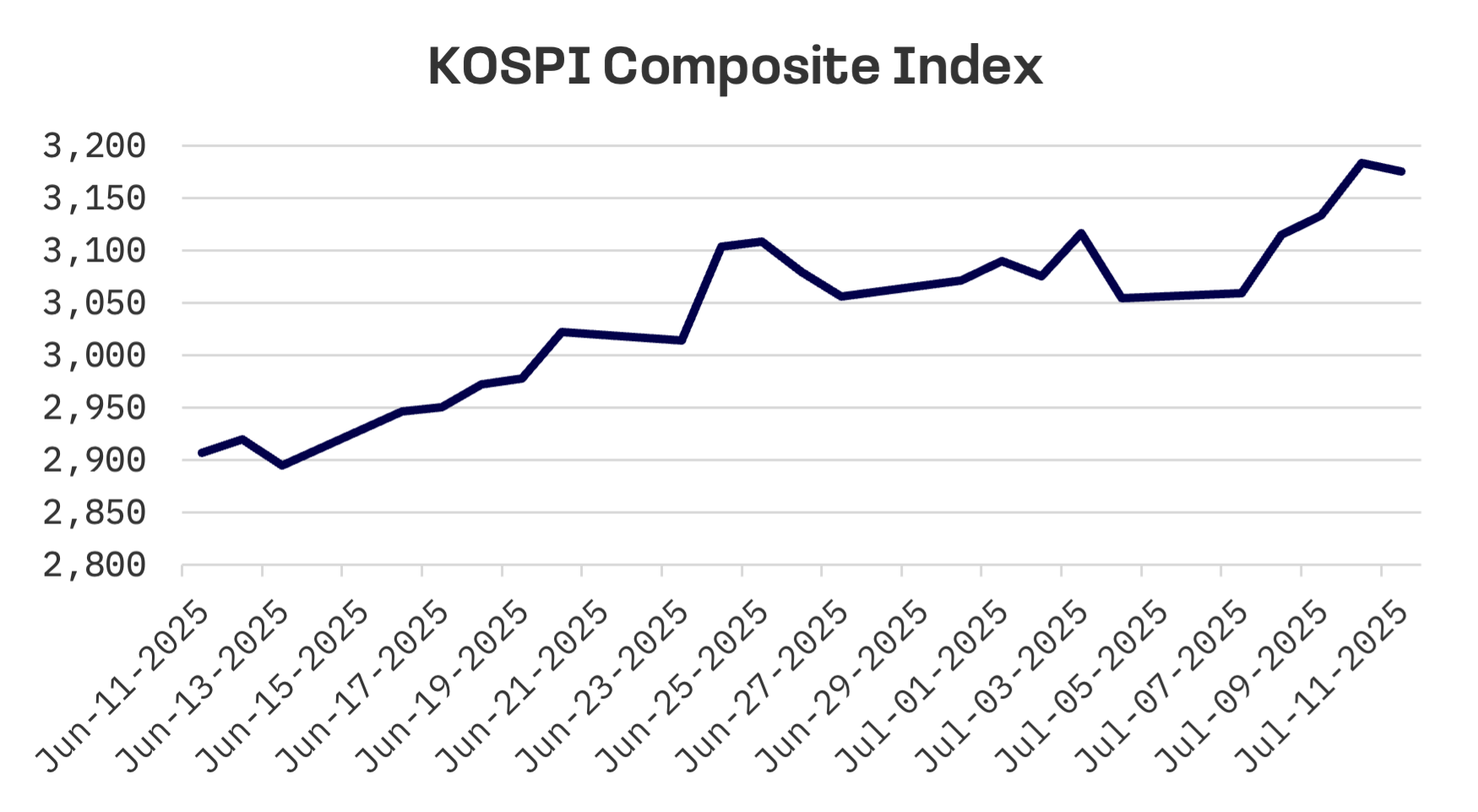

- South Korea’s KOSPI surged 4% to nearly four year highs, buoyed by investor optimism over ongoing trade negotiations despite President Trump’s fresh 25% tariff threats

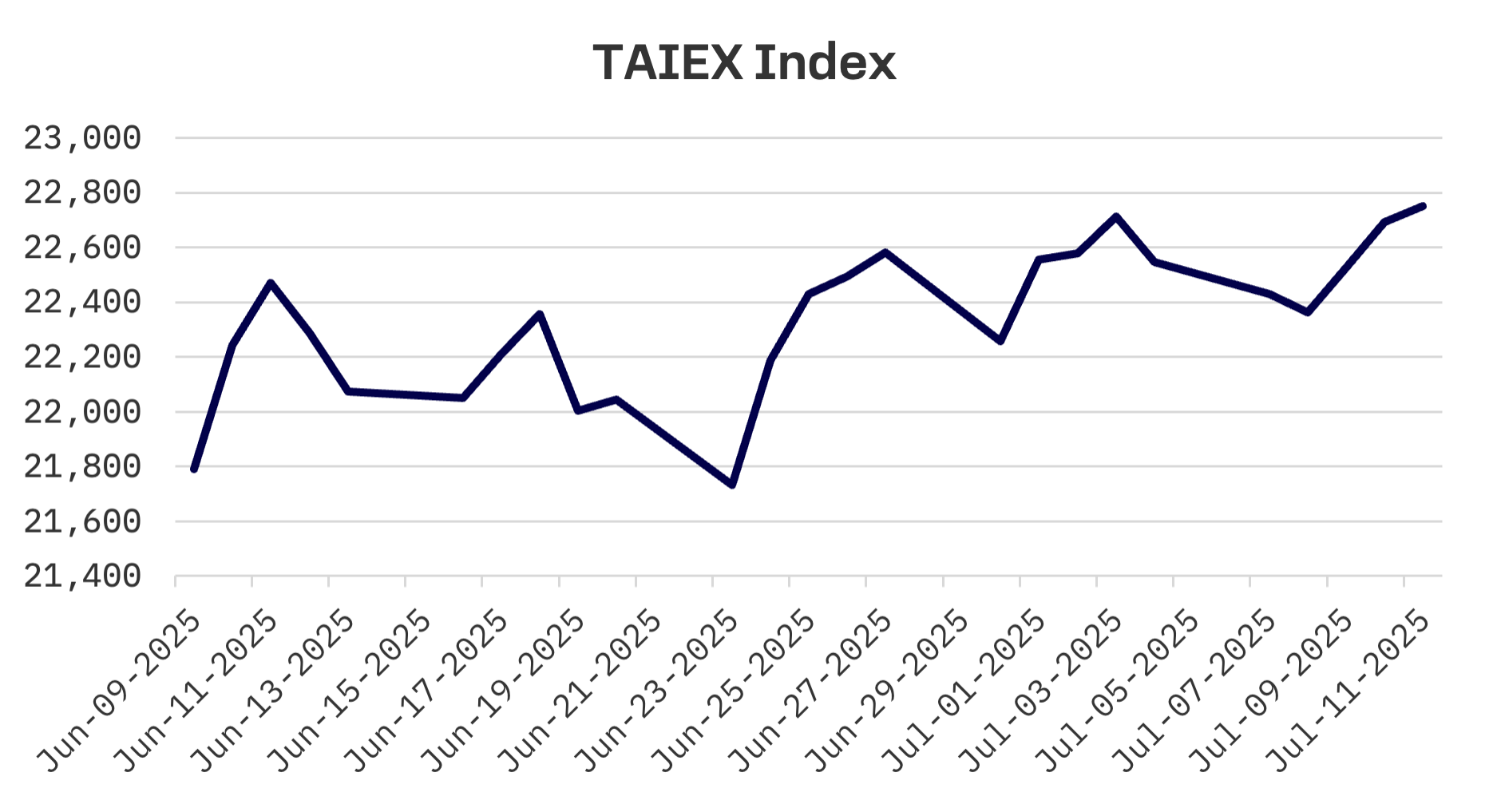

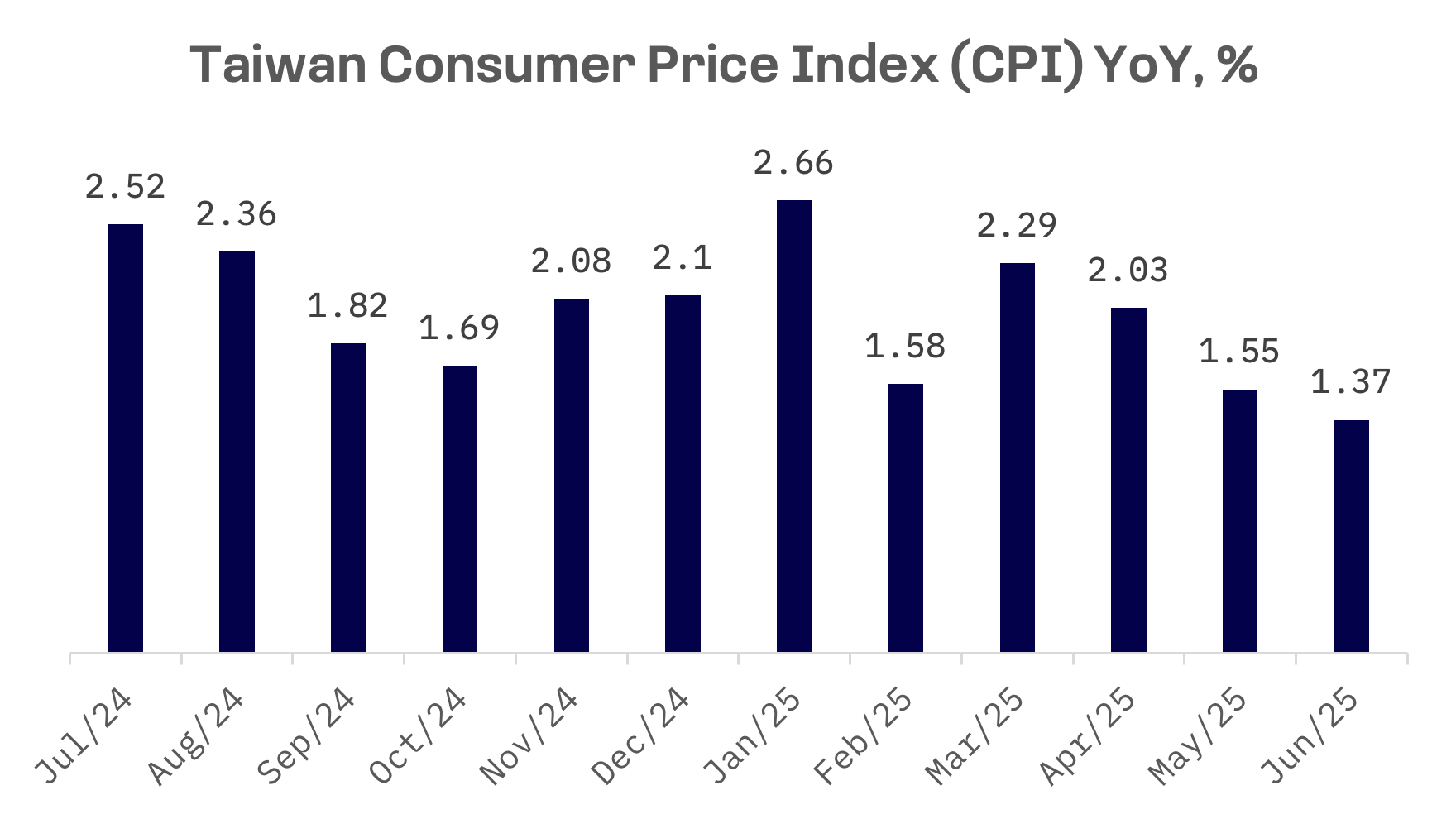

- Taiwan’s TAIEX gained 0.9% on continued trade discussions with Washington and moderating inflation, though concerns persisted over the looming 32% reciprocal tariff deadline

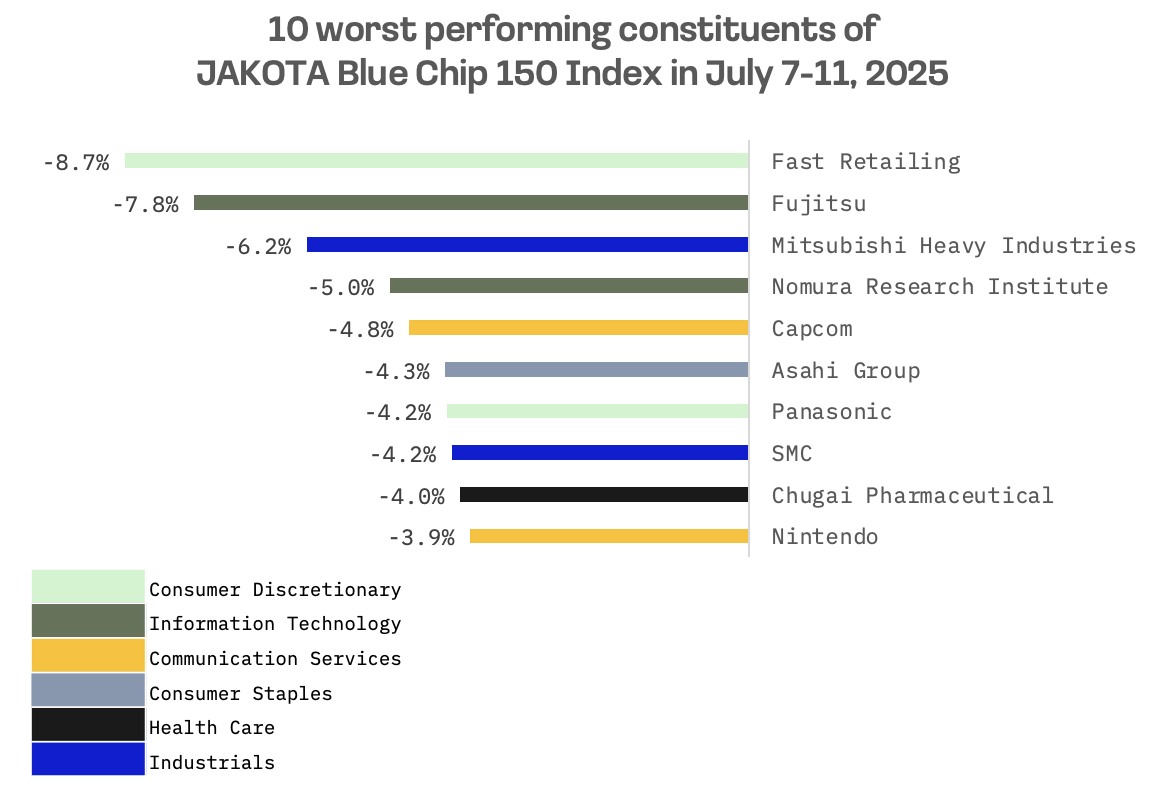

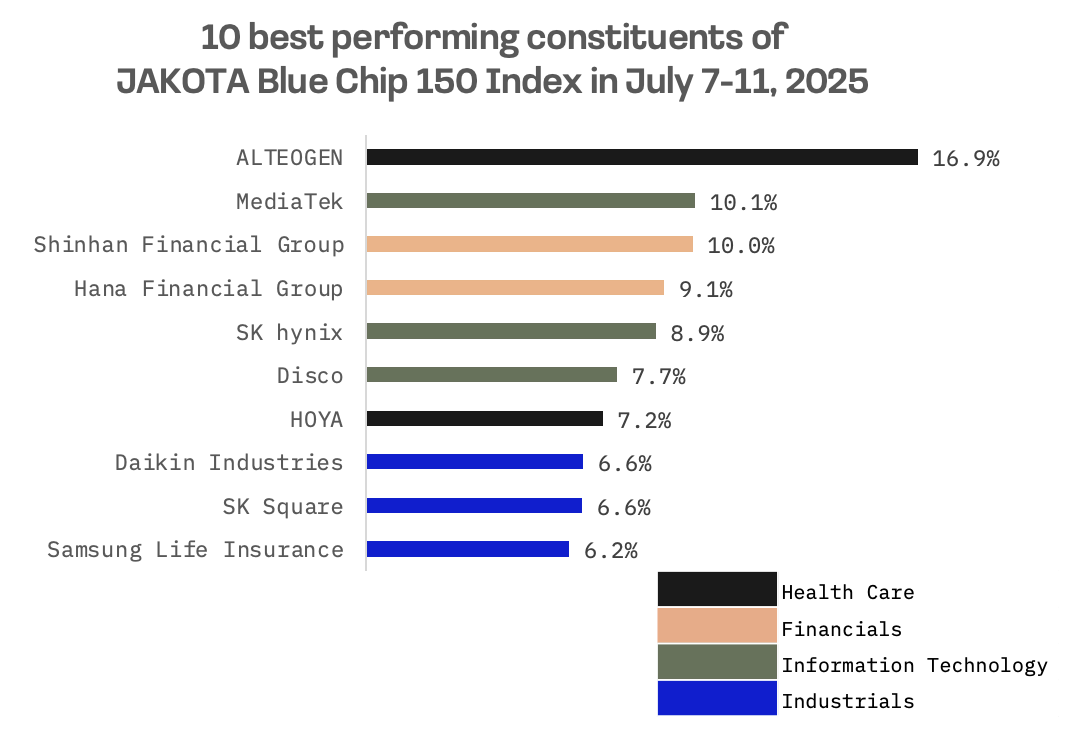

- The JAKOTA Blue Chip 150 Index slipped 1.1%, with Alteogen leading gains on biosimilar partnership news and Fast Retailing tumbling 8.7% on tariff impact warnings

Japan

Japan’s stock market retreated this week as trade tensions with the U.S. intensified and economic data pointed to a slowing recovery. The Nikkei 225 fell 0.61%, weighed down by investor concerns over escalating tariff disputes and weakening domestic fundamentals.

The U.S. announced plans to increase tariffs on Japanese imports to 25% from the current 24% rate implemented in early April. While markets found some relief in the delayed implementation date of August 1, 2025 – viewing it as an opportunity for continued negotiations – attention has turned to Japan’s July 20 Upper House election, where Prime Minister Shigeru Ishiba’s ruling coalition is expected to lose seats, adding to political uncertainty.

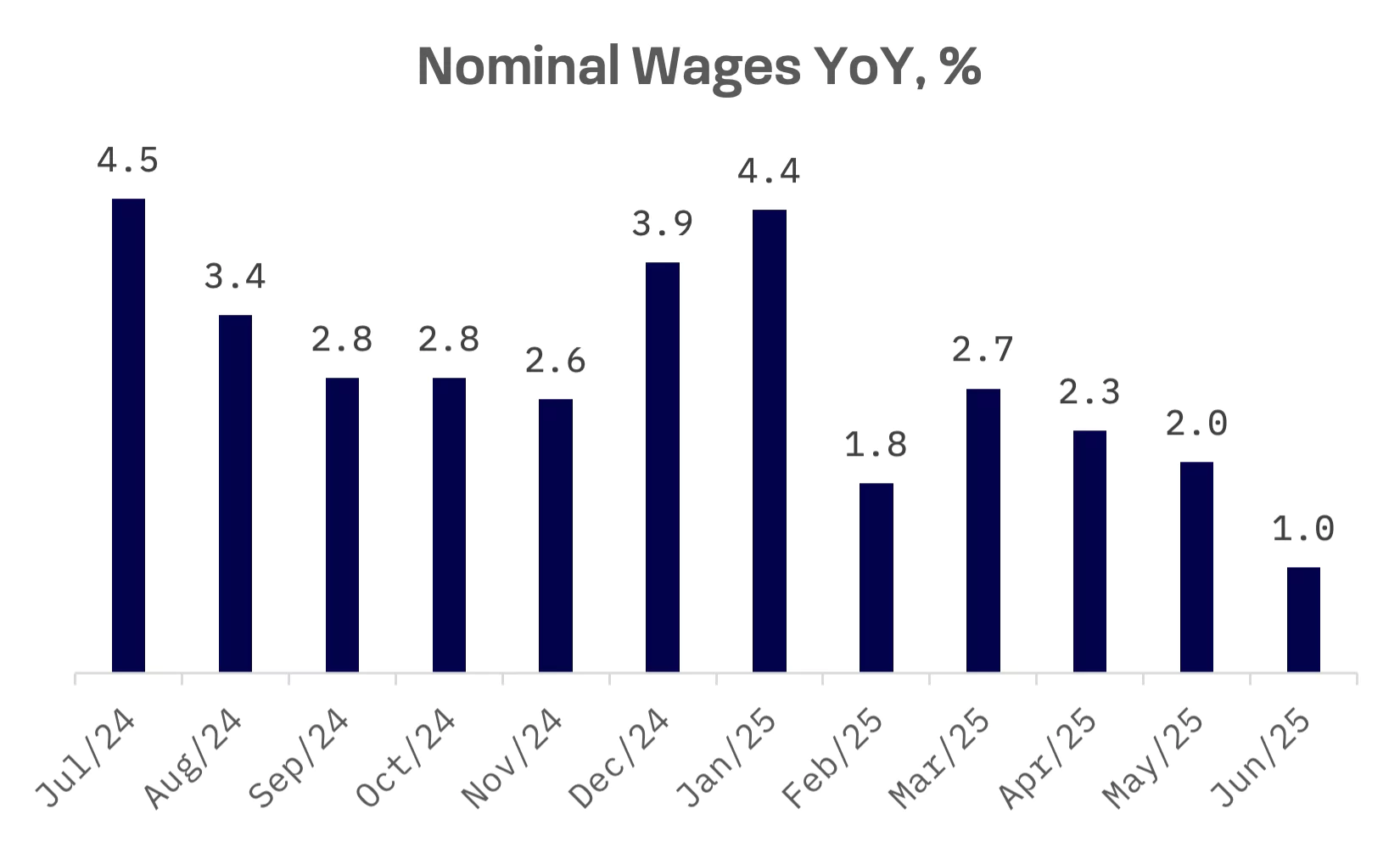

Economic data further dampened investor sentiment, with Japanese wage growth showing a sharp deceleration that has raised questions about the strength of the country’s economic recovery. The disappointing figures have reinforced expectations that the Bank of Japan (BoJ) will postpone its next interest rate increase until 2026.

Nominal wages rose just 1% year-over-year in May, falling well short of the 2.4% forecast and down from April’s 2% increase. Real wages, adjusted for inflation, declined 2.9%, a steeper drop than the expected 1.7% decline and worse than the previous month’s 1.8% fall.

South Korea

South Korean stocks surged this week, with the KOSPI Index climbing 4% as investors expressed optimism about ongoing U.S. led trade negotiations. The KOSPI reached its highest level in nearly four years on Wednesday, despite fresh tariff threats from Washington.

President Donald Trump announced on Monday a 25% tariff on nearly all South Korean goods, scheduled to take effect August 1 unless a deal is reached within a 90 day negotiating window. The measure builds on earlier levies imposed in April, including 25% tariffs on vehicles and auto parts and 50% duties on steel and aluminium.

In a letter to President Lee Jae-myung, Trump emphasised the urgency of reaching a new trade agreement. Seoul responded by saying senior officials from both countries are exploring approaches to negotiations that would strengthen the bilateral alliance.

Meanwhile, Bank of Korea (BOK) Governor Rhee Chang-yong warned on Thursday that rising household debt is constraining private consumption and threatening broader economic growth. Citing a sharp increase in Seoul area home prices and robust mortgage lending, Rhee said these risks contributed to the central bank’s unanimous decision to maintain its benchmark rate at 2.5% for a second consecutive month in July.

Taiwan

Taiwan’s stock market advanced this week, with the TAIEX gaining 0.9%, supported by ongoing trade discussions with Washington and moderating inflation data.

However, pressure persists as concerns remain over the absence of a finalised agreement with the U.S. to reduce the 32% “reciprocal tariff” announced by President Donald Trump on April 2. The tariff is scheduled to take effect after the 90 day pause ends on July 9, unless both sides reach an agreement, officials said. As of July 11, no announcement has been made regarding Taiwan’s tariff rate.

On the economic front, Taiwan’s consumer inflation continued to moderate for a third straight month in June, with the headline CPI rising just 1.37% from a year earlier – the weakest pace in more than four years, according to data released on Tuesday by the Directorate General of Budget, Accounting and Statistics (DGBAS).

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index declined 1.1% this week, though 89 of the 150 constituent stocks posted gains.

Alteogen, a South Korean biopharmaceutical company, emerged as the top performer on the JAKOTA Blue Chip 150 Index this week after Sandoz announced a biosimilar pipeline incorporating the South Korean biotech firm’s subcutaneous (SC) delivery technology.

The rally followed news of a technology transfer agreement between the two companies, boosting investor optimism about future revenue streams. Sandoz had previously highlighted two biosimilar candidates using Alteogen’s SC platform during an investor presentation.

Benchmark biosimilar products targeted by the pipeline generated more than ₩10 trillion in sales last year. If commercialisation proves successful, Alteogen stands to earn not only milestone payments from the deal but also significant royalty income tied to intellectual property rights.

Japan’s Fast Retailing, owner of the Uniqlo clothing brand, tumbled 8.7% this week – the steepest decline among JAKOTA Blue Chip 150 constituents – after the company announced that higher U.S. tariffs would begin significantly affecting its U.S. operations later this year and that it plans to raise prices to offset the impact.